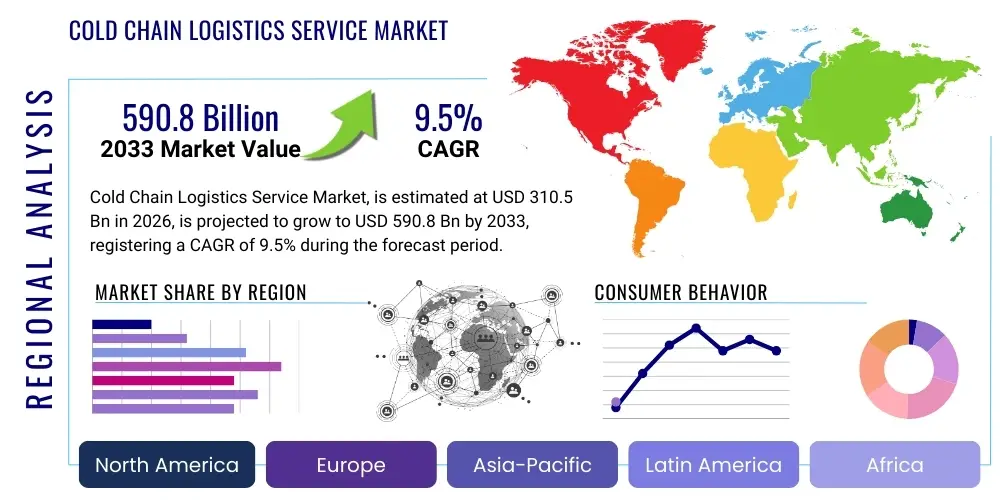

Cold Chain Logistics Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438948 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Cold Chain Logistics Service Market Size

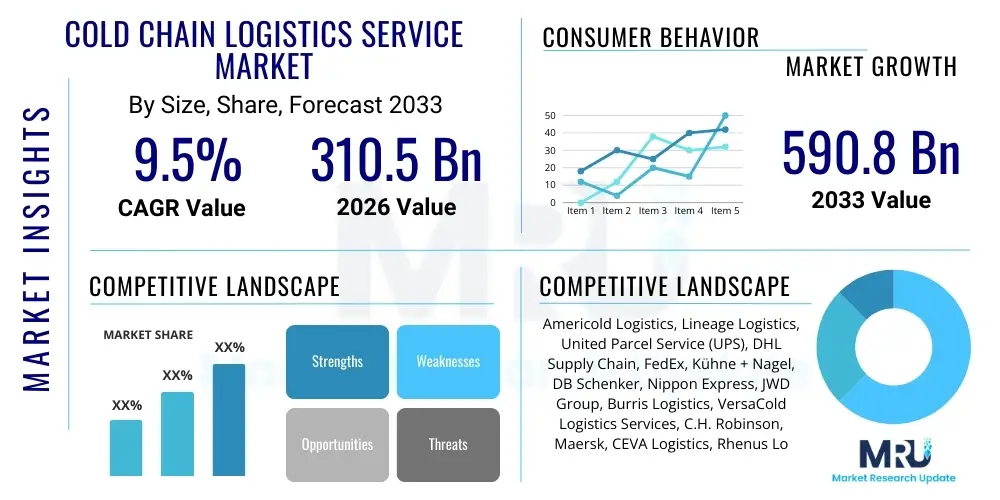

The Cold Chain Logistics Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 310.5 Billion in 2026 and is projected to reach USD 590.8 Billion by the end of the forecast period in 2033.

Cold Chain Logistics Service Market introduction

The Cold Chain Logistics Service Market encompasses the processes, infrastructure, and technology required to maintain a specific temperature range for temperature-sensitive products, primarily spanning across the food and beverage (F&B), pharmaceutical, and chemical sectors. This specialized logistics network includes temperature-controlled warehousing, refrigerated transportation (refrigerated trucks, railcars, air freight, and sea containers), and continuous monitoring solutions. The primary objective is to preserve product efficacy, integrity, and shelf life, minimizing spoilage and ensuring compliance with stringent regulatory standards, particularly for biologics and perishable food items.

The core value proposition of cold chain services lies in mitigating risks associated with temperature excursions, which can render pharmaceuticals ineffective or food products unsafe. Key applications range from distributing deep-frozen vaccines globally to transporting fresh produce across continents. Recent innovations focus on enhancing end-to-end visibility and operational efficiency through digitalization and predictive analytics, moving the industry beyond traditional cold storage toward fully integrated, smart logistics ecosystems. This integration is crucial for addressing the growing complexity of global supply chains and the increasing demand for high-value, temperature-sensitive goods.

Major driving factors include the booming global trade in perishable goods, the rapid expansion of the pharmaceutical and biotechnology sectors (especially driven by novel mRNA vaccines and complex biologics requiring ultracold storage), and the increasing penetration of organized retail and e-commerce platforms requiring rapid, temperature-controlled delivery. Furthermore, stricter governmental regulations concerning food safety and drug integrity in developed and developing economies necessitate robust cold chain infrastructure, fueling market expansion.

Cold Chain Logistics Service Market Executive Summary

The Cold Chain Logistics Service Market is experiencing transformative growth, driven by fundamental shifts in global consumption patterns and pharmaceutical innovation. Business trends indicate a strong move towards asset-light models, strategic partnerships, and end-to-end integrated service offerings, where large logistics providers are acquiring specialized cold storage and technology firms to offer comprehensive, global coverage. Technology integration, particularly IoT sensors, telematics, and cloud-based monitoring systems, is no longer a differentiator but a mandatory requirement for maintaining high-service quality and achieving compliance. The market exhibits intense competition, focusing on optimizing the "last mile" delivery for e-commerce and pharmaceutical distribution, demanding flexibility and scalability in temperature management.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive population growth, increasing disposable incomes, and significant infrastructure investments in countries like China and India, particularly in establishing robust domestic cold storage networks to support booming fresh food and vaccine demand. North America and Europe maintain dominance in terms of technological maturity and regulatory compliance, particularly in managing high-value biopharma logistics, while simultaneously focusing heavily on sustainable cooling solutions and reducing carbon footprints associated with refrigerated transport. Latin America and the Middle East and Africa (MEA) are emerging markets, characterized by rapid urbanization and rising adoption of modern retail formats, necessitating foundational investments in core cold chain infrastructure.

Segment trends highlight the overwhelming dominance of the pharmaceutical application segment, propelled by the complex distribution requirements of advanced therapies and vaccines. In terms of temperature type, the demand for chilled storage (2°C to 8°C) remains high due to its wide applicability in both F&B and healthcare, although the ultracold segment (below -60°C) is gaining prominence due to the proliferation of specialized biotech products. Services show a critical shift: while transportation remains the largest revenue generator, value-added services such as continuous real-time monitoring, inventory management, and cross-docking services are seeing the fastest growth, indicating a market preference for integrated, consultative partnerships over basic logistics outsourcing.

AI Impact Analysis on Cold Chain Logistics Service Market

User inquiries regarding the impact of Artificial Intelligence (AI) on cold chain logistics center primarily on three key themes: predictive maintenance and risk mitigation, optimization of complex, high-variability routes, and ensuring data integrity and compliance. Users frequently ask how AI can move the industry beyond reactive monitoring to proactive risk management—specifically, predicting temperature excursions before they occur or identifying potential equipment failures in refrigeration units. Another core concern is utilizing AI to dynamically optimize routing and scheduling in real-time, accounting for fluctuating ambient temperatures, traffic congestion, and delivery time windows, which is crucial for maintaining end-to-end temperature stability. Furthermore, stakeholders seek assurance that AI-driven data processing remains compliant with stringent pharmaceutical regulations (like GDP), ensuring audit trails are immutable and traceable, leading to questions about AI integration with blockchain technologies.

AI's primary influence is establishing "smart cold chains" capable of self-correction and continuous improvement. By processing massive datasets generated by IoT sensors (temperature, humidity, vibration, location), AI algorithms create high-fidelity predictive models. These models are essential for sophisticated demand forecasting, preventing the overstocking or understocking of temperature-sensitive goods, thereby reducing waste and operational costs. Furthermore, AI contributes significantly to energy efficiency; algorithms can autonomously manage and fine-tune refrigeration cycles in warehouses and containers based on internal load and external weather forecasts, leading to substantial reductions in the high energy consumption traditionally associated with cold storage, addressing both cost restraints and sustainability goals.

The deployment of Machine Learning (ML) models is particularly vital in quality control and regulatory adherence. ML can rapidly analyze data streams to detect subtle anomalies that human operators might miss, such as micro-fluctuations in temperature indicating sensor drift or potential door seal failures. This capability enhances regulatory reporting and speeds up root cause analysis during compliance audits. Ultimately, AI transforms the cold chain from a sequential series of processes into an intelligent, adaptive network, guaranteeing superior product safety and integrity, which is paramount for high-stakes applications like biopharma distribution.

- AI-driven Predictive Maintenance: Forecasts refrigeration unit failures and sensor malfunctions, drastically reducing unexpected temperature breaches.

- Dynamic Route Optimization (DRO): Utilizes real-time data to adjust transport routes based on weather patterns, traffic, and thermal inertia calculations.

- Demand and Capacity Forecasting: Improves inventory management and warehousing space utilization for perishable goods, minimizing spoilage.

- Anomaly Detection: Identifies subtle, non-compliant temperature fluctuations instantly, enhancing quality assurance and audit readiness.

- Energy Consumption Management: Optimizes cooling cycles in warehouses and reefer containers based on load, achieving significant energy savings.

DRO & Impact Forces Of Cold Chain Logistics Service Market

The Cold Chain Logistics Service Market is powerfully driven by three major forces: the globalization of pharmaceutical supply chains, escalating consumer demand for fresh and frozen foods via organized retail and e-commerce, and increasing regulatory scrutiny across all geographies mandating strict temperature control. Key restraints include the high capital expenditure required for specialized refrigerated infrastructure and continuous monitoring systems, significant energy consumption leading to high operational costs and environmental concerns, and the complexity of managing last-mile cold delivery logistics in dense urban environments. Opportunities are abundant in the integration of advanced technologies like IoT and Blockchain for enhanced transparency, expanding into emerging markets with rapidly developing cold chain needs, and the burgeoning specialized logistics required for highly sensitive biological products like gene therapies and personalized medicine. These dynamics collectively create a complex operating environment where technology adoption and strategic partnerships dictate competitive success.

The primary driver remains the biopharma sector, where high-value, temperature-sensitive products such as vaccines, biologics, and specialized clinical trial materials require precise, uncompromised temperature fidelity from manufacturing to administration. The success of large-scale public health initiatives, such as global immunization programs, is directly dependent on the reliability of the cold chain. Concurrently, the proliferation of global food trade, driven by consumer desires for year-round exotic produce and processed frozen foods, exerts constant pressure on logistics providers to expand capacity and improve temperature consistency across long distances. This demand, coupled with increasing population awareness regarding foodborne illnesses, amplifies the regulatory impact force, compelling companies to invest in certified and reliable cold chain solutions.

Despite these favorable drivers, significant challenges persist. The initial investment in refrigerated warehouses, specialized fleet vehicles, and IT infrastructure capable of handling large data volumes is prohibitive, particularly for smaller market participants. Furthermore, maintaining temperature integrity over long, multimodal journeys—transitioning goods smoothly between air, sea, and land transport—presents operational hurdles. However, these restraints catalyze opportunities for technology innovation. The move toward modular, energy-efficient cooling units, the standardization of IoT tracking protocols, and the development of sustainable refrigerants present significant market potential for companies that can effectively address both cost reduction and environmental compliance, transforming high operational costs into competitive advantages through efficiency gains.

Segmentation Analysis

The Cold Chain Logistics Service Market is primarily segmented based on Temperature Type, Service offering, and Application, each reflecting distinct operational complexities and demand characteristics. Understanding these segments is crucial for strategizing investments, as the requirements for ultracold storage supporting biologics differ vastly from the requirements for chilled storage used in dairy or fresh produce. The segmentation reflects the diverse clientele, ranging from global pharmaceutical manufacturers requiring highly regulated, secure logistics to large-scale food distributors focused on high volume and speed to market. This structural diversification ensures that specialized providers can meet precise industry needs while integrated logistics firms focus on offering versatile, multi-temperature services across the entire spectrum.

- By Temperature Type:

- Chilled (2°C to 8°C)

- Frozen (0°C to -25°C)

- Deep/Ultra-cold (Below -25°C)

- By Service:

- Storage (Warehousing and Cold Storage Facilities)

- Transportation (Air Freight, Sea Freight, Road Freight, Rail Freight)

- Value-Added Services (Inventory Management, Custom Clearance, Packaging, Labeling, Monitoring)

- By Application:

- Food and Beverages (Meat, Seafood, Dairy, Fruits & Vegetables, Confectionery)

- Pharmaceuticals and Healthcare (Vaccines, Biologics, Clinical Trials Materials, APIs)

- Chemicals and Fertilizers

- Others (e.g., Floral, Cosmetics)

Value Chain Analysis For Cold Chain Logistics Service Market

The cold chain value chain begins upstream with specialized equipment manufacturers and technology providers. This includes suppliers of advanced refrigeration units (reefers), insulated packaging materials, high-precision temperature monitoring sensors (IoT devices), and sophisticated Warehouse Management Systems (WMS). Upstream efficiency is paramount; providers rely heavily on energy-efficient cooling technologies and reliable hardware to minimize operational downtime and energy consumption, which are major cost drivers in this industry. Strategic alliances at this stage, particularly with technology firms specializing in real-time telemetry and cloud data management, determine the overall quality and compliance potential of the services offered downstream.

The midstream focuses on core logistics operations: handling, storage, and long-haul transportation. This involves operating extensive networks of temperature-controlled warehouses (cold storage facilities), managing inventory specialized for diverse temperature requirements (e.g., blast freezing), and executing multimodal transportation strategies. The distribution channel is heavily reliant on integrated carriers and specialized third-party logistics (3PL) providers capable of maintaining stringent temperature protocols across varied geographical and regulatory landscapes. Direct distribution often occurs for high-volume, domestic movements (like distributing fresh produce to major retail hubs), while indirect distribution leverages specialized freight forwarders for complex, international lanes, especially for biopharma products requiring intricate customs and regulatory clearance.

Downstream, the value chain centers on last-mile delivery and customer fulfillment. This segment is characterized by specialized distribution to end-users such as hospitals, pharmacies, clinical research organizations (CROs), and major retail chains. The interaction involves not just delivery but often value-added services like cross-docking, customized labeling, and proof-of-delivery with integrated temperature logs. The critical factor downstream is visibility and transparency; end-users require immediate access to immutable temperature data records to ensure product viability and satisfy regulatory requirements. The relationship here is consultative, focusing on optimizing the final leg of the journey, which is often the most vulnerable point in the cold chain.

Cold Chain Logistics Service Market Potential Customers

Potential customers for cold chain logistics services are diverse but are predominantly concentrated in industries where product integrity is directly tied to temperature stability and regulatory compliance. The largest and most demanding segment includes global pharmaceutical and biotechnology companies that rely on cold chains for the storage and distribution of highly valuable and sensitive products such as vaccines, insulin, complex protein-based drugs, and gene therapies. These customers prioritize quality assurance, validation protocols, and comprehensive risk mitigation strategies over cost, demanding 24/7 monitoring and audit-ready data trails.

The second major group comprises the vast Food and Beverage sector, including agricultural producers, large-scale processors, distributors, and major retail chains. These buyers are highly sensitive to market fluctuations and spoilage rates, focusing on maintaining optimal freshness and minimizing waste across high-volume shipments. Specific demands include efficient handling of perishable goods (like meat, dairy, and fresh produce), rapid turnaround times, and scalability to meet seasonal demands. E-commerce platforms specializing in groceries also represent a rapidly growing sub-segment requiring complex, localized cold storage and delivery capabilities.

Furthermore, chemical and specialty industrial manufacturers constitute a significant niche. These buyers often require controlled temperature environments for hazardous materials, polymers, and certain chemical precursors, where temperature excursions could lead to safety hazards or product degradation. Clinical research organizations (CROs) are also crucial potential customers, utilizing cold chain services to manage highly sensitive clinical trial materials and biological samples, often requiring specialized ultracold capabilities and highly flexible, time-critical logistics support globally.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 310.5 Billion |

| Market Forecast in 2033 | USD 590.8 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Americold Logistics, Lineage Logistics, United Parcel Service (UPS), DHL Supply Chain, FedEx, Kühne + Nagel, DB Schenker, Nippon Express, JWD Group, Burris Logistics, VersaCold Logistics Services, C.H. Robinson, Maersk, CEVA Logistics, Rhenus Logistics, A.P. Moller – Maersk, GAC Group, XPO Logistics, Congebec, AGRO Merchants Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Chain Logistics Service Market Key Technology Landscape

The foundation of the modern cold chain relies heavily on sophisticated monitoring and control technologies, collectively known as Telematics and the Internet of Things (IoT). IoT sensors, deployed within containers and warehouses, continuously capture high-resolution data points on temperature, humidity, light exposure, and physical shock. This data is transmitted in real-time via telematics systems to cloud-based platforms, providing logistics operators and end-users with unparalleled visibility into product conditions throughout the entire journey. This real-time visibility is critical not only for maintaining operational control but also for generating compliant documentation, a core requirement for pharmaceutical clients, minimizing the risk of costly spoilage and litigation arising from temperature breaches.

Beyond basic monitoring, the cold chain market is increasingly integrating advanced technologies for predictive optimization and security. Artificial Intelligence (AI) and Machine Learning (ML) algorithms analyze the historical and real-time sensor data to predict potential cold chain failures, enabling proactive intervention, such as rerouting shipments or dispatching maintenance teams before equipment fails. Furthermore, Blockchain technology is gaining traction to establish a secure, decentralized, and immutable ledger for all temperature records and transactional data. This addresses the high demand for verifiable audit trails, enhancing transparency and reducing disputes over product integrity, especially across multiple jurisdictional handoffs and complex international supply chains.

The future technology landscape is centered on sustainability and automation. Innovations in phase-change materials (PCMs) and vacuum insulated panels (VIPs) are improving passive packaging solutions, offering longer thermal hold times without mechanical refrigeration. Concurrently, the industry is witnessing increased automation in cold storage facilities, utilizing robotic handling systems and automated storage and retrieval systems (AS/RS) that operate efficiently at sub-zero temperatures, reducing human exposure and labor costs while dramatically increasing throughput and accuracy. Furthermore, the mandatory phase-out of high-Global Warming Potential (GWP) refrigerants is driving significant research and development into natural refrigerants (like CO2 and ammonia) and magnetocaloric cooling systems, aiming to decarbonize refrigerated transportation and storage assets.

Regional Highlights

- Asia Pacific (APAC): Positioned as the fastest-growing region, driven by explosive domestic demand for fresh food and the establishment of robust cold chains to support vaccine manufacturing and distribution in populous nations like India, China, and Southeast Asia. Significant government investment in infrastructure and the rising middle class seeking organized retail contribute to market acceleration.

- North America: Characterized by high technological maturity, stringent FDA regulations, and dominance in the high-value biopharma cold chain segment. The market focuses heavily on automation, AI-driven predictive logistics, and sophisticated last-mile solutions for complex metropolitan areas, maintaining a leading position in expenditure on ultra-cold logistics capacity.

- Europe: Defined by strong cross-border trade, adherence to strict EU regulations (Good Distribution Practice - GDP), and a high focus on sustainability. The region leads in the adoption of electric and hydrogen-powered refrigerated transport and the use of natural refrigerants, driven by ambitious environmental targets and consumer preference for sustainably sourced goods.

- Latin America: An emerging market experiencing rapid development, largely fueled by increasing urbanization and the expansion of modern grocery retail chains. Investments are primarily focused on building foundational cold storage capacity and improving road network connectivity to reduce post-harvest losses and ensure pharmaceutical integrity.

- Middle East and Africa (MEA): Growth is tied to diversification away from oil economies, expansion of logistics hubs (like the UAE and Saudi Arabia), and climatic challenges requiring robust temperature control. Focus is on establishing efficient multimodal hubs connecting sea and air freight, particularly to support pharmaceutical imports and large-scale food security initiatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Chain Logistics Service Market.- Americold Logistics

- Lineage Logistics

- United Parcel Service (UPS)

- DHL Supply Chain

- FedEx

- Kühne + Nagel

- DB Schenker

- Nippon Express

- JWD Group

- Burris Logistics

- VersaCold Logistics Services

- C.H. Robinson

- Maersk

- CEVA Logistics

- Rhenus Logistics

- A.P. Moller – Maersk

- GAC Group

- XPO Logistics

- Congebec

- AGRO Merchants Group

Frequently Asked Questions

Analyze common user questions about the Cold Chain Logistics Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Cold Chain Logistics Market?

The growth is primarily driven by the increasing global demand for complex biological drugs (vaccines and specialized pharmaceuticals), the expansion of e-commerce for perishable food items, and stricter global regulations mandating verifiable temperature control throughout the supply chain.

How does the Deep/Ultra-cold segment differ from standard cold chain logistics?

The Deep/Ultra-cold segment involves maintaining temperatures below -25°C, sometimes reaching as low as -80°C (e.g., for mRNA vaccines). It requires specialized handling equipment, cryogenic freezers, and dry ice logistics, demanding significantly higher capital investment and operational complexity than standard chilled (2°C to 8°C) chains.

What role does IoT technology play in enhancing cold chain integrity?

IoT sensors provide real-time, continuous monitoring of critical parameters like temperature and humidity within containers and warehouses. This data enables immediate alerts for potential breaches, facilitates proactive risk management, and ensures the generation of compliant, audit-ready temperature logs for regulatory purposes, significantly improving overall integrity and visibility.

What are the key operational challenges facing cold chain service providers?

Key challenges include managing the substantial capital expenditure for refrigerated infrastructure, mitigating high operational costs associated with energy consumption, maintaining seamless temperature consistency across multimodal transport transitions, and navigating the complexities of the last-mile delivery, especially in densely populated areas.

Which application segment holds the largest market share and why?

The Food and Beverages segment currently holds the largest volume share due to the sheer scale and frequency of perishable goods movement globally (meat, dairy, produce). However, the Pharmaceuticals and Healthcare segment often contributes the highest revenue growth and requires the most technologically advanced and high-margin services due to the high value and regulatory sensitivity of the products transported.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager