Cold-chain Temperature and Humidity Control Products Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434045 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cold-chain Temperature and Humidity Control Products Market Size

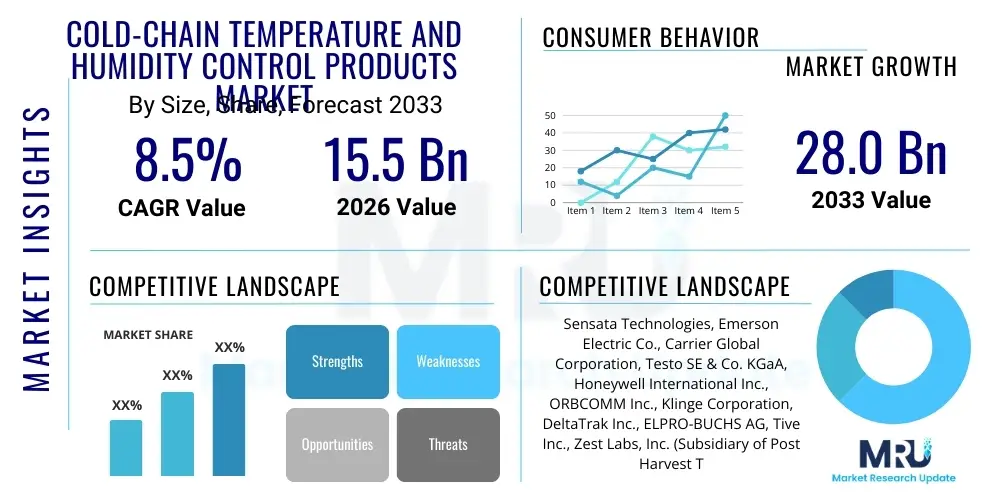

The Cold-chain Temperature and Humidity Control Products Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 28.0 Billion by the end of the forecast period in 2033.

Cold-chain Temperature and Humidity Control Products Market introduction

The Cold-chain Temperature and Humidity Control Products Market encompasses a wide range of specialized equipment, systems, and services designed to maintain optimal environmental conditions, primarily temperature and relative humidity, for temperature-sensitive goods throughout the supply chain. These products are crucial for preserving the efficacy, quality, and safety of perishable items, particularly in the pharmaceutical, food and beverage, and chemical industries. Products include sophisticated data loggers, real-time monitoring sensors (both wired and wireless), advanced telemetry systems, and integrated software platforms for data analysis and reporting.

The core objective of these control products is to ensure compliance with strict regulatory standards—such as those set by the FDA and WHO—which mandate unbroken temperature traceability. The increasing complexity of global supply chains, coupled with the rapid growth in the production of highly sensitive biologics and specialized vaccines (like mRNA vaccines), necessitates robust and reliable cold-chain infrastructure. These systems provide benefits such as reducing product spoilage, minimizing financial losses due to temperature excursions, and guaranteeing end-user safety. Furthermore, modern control systems offer predictive analytics capabilities, allowing supply chain managers to preemptively address potential risks before they lead to product loss.

Major applications span storage facilities (warehouses, distribution centers), transportation logistics (air, sea, road freight), and final-mile delivery. Key driving factors accelerating market expansion include stringent government regulations concerning food safety and pharmaceutical integrity, the globalization of trade leading to longer transit times, and technological advancements such as the integration of IoT, cloud computing, and Machine Learning (ML) for enhanced real-time visibility and automated compliance reporting. The shift towards higher-value, temperature-critical goods is solidifying the market's trajectory towards digitalization and preventative monitoring solutions.

Cold-chain Temperature and Humidity Control Products Market Executive Summary

The Cold-chain Temperature and Humidity Control Products Market is undergoing significant digitalization, characterized by a fundamental shift from reactive manual monitoring toward proactive, real-time, automated monitoring systems leveraging IoT and cloud platforms. Business trends show a strong emphasis on interoperability and end-to-end visibility, driven by pharmaceutical companies seeking validated supply chain integrity for complex biological drugs. Strategic mergers, acquisitions, and partnerships focusing on software integration and global service delivery are common as key players strive to offer comprehensive solutions rather than isolated hardware components. Furthermore, sustainability is becoming a critical business imperative, driving demand for energy-efficient cooling and monitoring solutions that reduce overall operational footprints.

Regionally, North America and Europe maintain dominance, primarily due to well-established regulatory frameworks and high pharmaceutical R&D expenditure, creating persistent demand for high-precision monitoring tools. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding healthcare infrastructure, rising middle-class consumption of processed foods, and significant governmental investment in developing efficient supply chains, particularly in China and India. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by rapid urbanization and increasing international trade, necessitating immediate investments in foundational cold-chain logistics to support incoming foreign direct investment and trade agreements.

Segment trends highlight the wireless sensors and data loggers segment as the fastest growing product category, attributed to their ease of deployment, scalability, and ability to transmit data instantly to cloud dashboards. Among applications, pharmaceutical transportation and storage remain the highest revenue generators, given the extremely high value and sensitivity of medical products, which demand tight tolerance monitoring. Conversely, the growth in e-commerce and home delivery models is boosting demand for specialized, smaller-form-factor monitoring devices suitable for final-mile logistics, creating new opportunities for disposable and low-cost sensor solutions integrated into smart packaging.

AI Impact Analysis on Cold-chain Temperature and Humidity Control Products Market

User inquiries regarding AI's impact on the cold chain primarily center on how artificial intelligence can move beyond simple data logging to provide predictive and prescriptive insights, thereby optimizing operational efficiency and mitigating risk. Key user concerns revolve around the accuracy of AI models in predicting micro-climate temperature excursions, the integration challenge of AI software with legacy monitoring hardware, and the return on investment (ROI) derived from implementing complex machine learning algorithms for route and inventory optimization. Users are highly interested in AI’s capability to automate compliance reporting and reduce human intervention, ensuring continuous regulatory adherence with minimal overhead. The analysis shows a clear expectation that AI will transform the cold chain from a reactive storage and transport function into an intelligent, self-optimizing logistical network.

- AI enables sophisticated predictive maintenance for refrigeration units, forecasting equipment failure based on historical performance data.

- Machine learning algorithms optimize transportation routes dynamically, accounting for real-time weather, traffic, and risk factors to minimize temperature excursions.

- AI facilitates anomaly detection, instantly identifying unusual temperature or humidity fluctuations that standard threshold alarms might miss.

- Generative models assist in optimizing packaging design by simulating various environmental stress tests and identifying the most efficient insulation materials required for specific transit lanes.

- Automated compliance reporting and auditing are streamlined through natural language processing (NLP) and rule-based AI systems, reducing manual regulatory burdens.

- Improved inventory management based on predicted expiration dates and shelf-life analysis under different environmental conditions.

- Enhanced energy consumption efficiency in cold storage facilities through AI-driven load balancing and temperature setpoint adjustments.

DRO & Impact Forces Of Cold-chain Temperature and Humidity Control Products Market

The market is significantly propelled by regulatory requirements and the inherent risk associated with high-value, temperature-sensitive products, primarily in the pharmaceutical sector. Strict adherence to Good Distribution Practice (GDP) standards globally acts as a powerful driver, mandating the adoption of validated monitoring systems capable of providing comprehensive data traceability throughout the supply chain. Simultaneously, the increasing global demand for fresh and frozen foods, alongside growing consumer awareness regarding food safety, fuels the need for dependable temperature and humidity control during transport and storage, pushing retailers and logistics providers toward advanced tracking solutions.

However, the market faces constraints related to the high initial investment costs required for implementing integrated cold-chain monitoring infrastructure, especially the sophisticated wireless sensor networks and cloud-based analytical platforms. Furthermore, challenges arise from the lack of standardized global protocols for data exchange and system interoperability, which hinders seamless tracking across multiple borders and different logistics partners. The technical complexity of integrating new IoT devices with existing, often older, refrigeration infrastructure in developing economies also serves as a restraint to broader market penetration.

Opportunities are abundant in emerging economies where cold-chain infrastructure development is nascent, offering fertile ground for mobile and low-power wireless solutions. The expansion of personalized medicine and the rise of cell and gene therapies, which require ultra-low temperature maintenance (cryogenic storage), create niche, high-value opportunities for specialized monitoring and handling products. The pervasive need for end-to-end transparency, intensified by the growth of direct-to-consumer delivery models, makes investment in cloud-native monitoring solutions and blockchain-enabled traceability mechanisms highly lucrative, representing a major impact force pushing technological evolution.

Segmentation Analysis

The Cold-chain Temperature and Humidity Control Products Market is systematically segmented based on the type of product, the application area, the technology employed, and the specific end-user industry, allowing for targeted market analysis and strategic development. The segmentation reflects the diverse needs of different industries—ranging from the high-precision requirements of pharmaceutical companies to the large volume and cost-sensitivity challenges faced by the food and beverage industry. Analyzing these segments provides critical insights into market drivers, growth pockets, and competitive landscapes across the value chain, demonstrating a clear market shift towards integrated, software-as-a-service (SaaS) models built around hardware ecosystems.

- By Product Type:

- Hardware (Sensors, Data Loggers, Monitoring Devices, RFID Tags, GPS Trackers)

- Software (Cloud-based Monitoring Platforms, Data Analytics Software, Telemetry Solutions)

- Services (Installation, Calibration, Maintenance, Consulting, Data Management)

- By Application:

- Storage (Warehouses, Distribution Centers, Cold Rooms)

- Transportation (Air Freight, Sea Freight, Road Freight, Rail Transport)

- Packaging (Insulated Containers, Thermal Blankets, Phase Change Materials (PCMs) integrated with monitoring)

- Last-mile Delivery

- By Technology:

- Wired Systems

- Wireless Systems (Wi-Fi, Bluetooth, ZigBee, Cellular/GSM, Satellite)

- RFID and NFC Technology

- Cloud and IoT Integration

- By End-use Industry:

- Pharmaceutical and Healthcare (Biologics, Vaccines, Clinical Trials, Blood Products)

- Food and Beverage (Frozen Foods, Dairy, Fresh Produce, Meat and Seafood)

- Chemicals and Petrochemicals

- Life Sciences (Research Samples, Biorepositories)

Value Chain Analysis For Cold-chain Temperature and Humidity Control Products Market

The value chain begins with upstream activities involving the design, manufacturing, and sourcing of critical components, specifically high-precision sensors, microprocessors, and battery technology. Key players in this stage focus heavily on R&D to ensure accuracy, miniaturization, long battery life, and durability under extreme temperatures. Calibration and validation services are also crucial upstream inputs, ensuring that all monitoring hardware meets global regulatory standards such as NIST traceability. Competition at this stage centers on cost-effective component sourcing and the development of proprietary, high-reliability sensor technology tailored for harsh cold-chain environments.

Midstream activities involve the integration of hardware and software components into complete monitoring systems, followed by distribution through specialized logistics technology providers and third-party logistics (3PLs) companies. Direct sales channels are often employed for major pharmaceutical clients requiring custom-validated systems, while indirect distribution leverages regional distributors for smaller food and beverage clients. The distribution channel is specialized, requiring expertise not only in logistics but also in regulatory compliance and sensor calibration, establishing a barrier to entry for non-specialized distributors. The ability to provide integrated installation and maintenance services often determines the competitive advantage.

Downstream analysis focuses on the end-users—pharmaceutical manufacturers, food processors, and cold-chain logistics operators—who rely on these products for compliance and risk management. The efficiency of the monitoring system is measured by its impact on reducing product loss and improving supply chain visibility. Direct interaction occurs between solution providers and large corporations seeking enterprise-wide monitoring dashboards, while smaller users often purchase off-the-shelf data loggers through indirect retail channels. The final stage involves data analysis and secure storage (often cloud-based), providing audit trails necessary for regulatory submissions, thereby completing the cycle of continuous monitoring and compliance assurance.

Cold-chain Temperature and Humidity Control Products Market Potential Customers

Potential customers for cold-chain temperature and humidity control products are defined by their critical need to maintain product integrity and adhere to strict governmental mandates regarding perishable goods handling. The primary buyers are large pharmaceutical manufacturers, who require high-accuracy, GxP-compliant monitoring solutions for vaccines, biologics, and clinical trial materials, often operating in ultra-low temperature ranges. These entities prioritize data integrity, system validation, and global service support, driving demand for high-end, real-time monitoring platforms integrated with ERP systems. Cold-chain specialized 3PL and 4PL providers represent another major customer segment, purchasing large volumes of data loggers and tracking devices to service their diverse clientele, focusing on durability, ease of use, and cost efficiency across multiple transport modes.

The food and beverage industry, including large supermarket chains, food processors, and fast-food distributors, represents a substantial customer base, primarily driven by mass volume requirements and regulatory pressure regarding foodborne illness prevention. While generally more cost-sensitive than pharmaceuticals, this sector is increasingly adopting wireless monitoring for continuous environmental safety tracking in storage and transit. Lastly, specialized scientific organizations such as national blood banks, forensic laboratories, and research institutions constitute crucial buyers, demanding highly specialized, often bespoke, monitoring solutions for sensitive biological samples and chemical reagents, prioritizing precision and redundant data backup features.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 28.0 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sensata Technologies, Emerson Electric Co., Carrier Global Corporation, Testo SE & Co. KGaA, Honeywell International Inc., ORBCOMM Inc., Klinge Corporation, DeltaTrak Inc., ELPRO-BUCHS AG, Tive Inc., Zest Labs, Inc. (Subsidiary of Post Harvest Technologies), Berlinger & Co. AG, Monnit Corporation, NXP Semiconductors N.V., Oceasoft (Vaisala), Cold Chain Technologies, Inc., Tempmate, Controlant, SpotSee, LogTag. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold-chain Temperature and Humidity Control Products Market Key Technology Landscape

The technological landscape of the cold chain is rapidly evolving, moving decisively towards digitalization and pervasive connectivity, driven primarily by the need for greater data granularity and real-time intervention capability. Wireless Sensor Networks (WSN) form the backbone of modern monitoring, utilizing technologies such as Bluetooth Low Energy (BLE), ZigBee, and LoRaWAN to provide scalable, low-power monitoring solutions capable of covering large storage areas or extensive transit routes without the constraints of wired installations. This shift significantly reduces installation costs and allows for flexible deployment, supporting the increasing use of disposable, low-cost sensors for single-trip monitoring, especially relevant in last-mile logistics and clinical trial distribution where asset retrieval is impractical.

Crucially, the integration of the Internet of Things (IoT) and Cloud Computing provides the platform for seamless data aggregation, storage, and visualization. IoT-enabled devices continuously feed data into centralized cloud platforms, allowing users to access real-time status updates and historical reports from any location, fulfilling the demand for global visibility. Furthermore, advanced identification and tracking technologies like Radio Frequency Identification (RFID) and Near Field Communication (NFC) are increasingly embedded into cold-chain packaging, enabling automated temperature checks and inventory management without direct line-of-sight, streamlining the transfer process at distribution hubs and minimizing manual data entry errors.

The future of the technology landscape is centered on predictive and prescriptive analytics capabilities, often powered by AI and Machine Learning. These advanced software solutions analyze vast datasets collected by sensors (temperature, humidity, pressure, location) to not only report current conditions but also predict future temperature deviations, thereby enabling preventative actions like rerouting shipments or adjusting refrigeration settings before product safety is compromised. Blockchain technology is emerging as a critical tool for enhancing data security and traceability, providing an immutable record of environmental conditions across multiple stakeholders, thereby building trust and simplifying the audit process, especially for cross-border pharmaceutical shipments.

Regional Highlights

- North America: This region maintains a dominant market share driven by the presence of major pharmaceutical manufacturers, stringent FDA regulations (especially regarding drug serialization and traceability), and robust investment in advanced logistics infrastructure. The U.S. leads the adoption of high-precision, IoT-integrated monitoring solutions due to the complexity and high value of its domestic biologics market. Demand focuses on system validation and compliance services.

- Europe: Characterized by mandatory adherence to EU Good Distribution Practices (GDP), Europe is a mature market prioritizing regulatory compliance and standardized monitoring protocols across member states. High growth is observed in the adoption of reusable wireless data loggers and comprehensive temperature mapping services for large-scale cold storage facilities, particularly in Germany, France, and the UK.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, propelled by rapidly expanding healthcare expenditure, increasing consumption of frozen and processed foods, and significant government initiatives to modernize inadequate logistics networks in countries like China, India, and Japan. This region shows high demand for scalable, cost-effective monitoring solutions, often involving mobile and satellite-based tracking for long-distance, intra-regional transport.

- Latin America: This emerging market segment is focused on infrastructure development, driven by foreign trade partnerships and the need to improve food safety standards. Brazil and Mexico are key markets, seeing increased adoption of cold-chain technology to support agricultural exports and pharmaceutical distribution, relying on hybrid solutions that balance cost with required monitoring accuracy.

- Middle East and Africa (MEA): Growth in MEA is driven by the necessity to transport temperature-sensitive goods, including vaccines and perishable foods, across vast distances and extreme climates. Investment is concentrated in developing centralized cold storage hubs (e.g., in the UAE and Saudi Arabia) and utilizing robust cellular and satellite tracking technologies to overcome infrastructure limitations, particularly for humanitarian aid and large vaccine programs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold-chain Temperature and Humidity Control Products Market.- Sensata Technologies

- Emerson Electric Co.

- Carrier Global Corporation

- Testo SE & Co. KGaA

- Honeywell International Inc.

- ORBCOMM Inc.

- Klinge Corporation

- DeltaTrak Inc.

- ELPRO-BUCHS AG

- Tive Inc.

- Zest Labs, Inc. (Subsidiary of Post Harvest Technologies)

- Berlinger & Co. AG

- Monnit Corporation

- NXP Semiconductors N.V.

- Oceasoft (Vaisala)

- Cold Chain Technologies, Inc.

- Tempmate

- Controlant

- SpotSee

- LogTag

Frequently Asked Questions

Analyze common user questions about the Cold-chain Temperature and Humidity Control Products market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory standards driving the adoption of cold-chain monitoring products?

The primary regulatory standards include the FDA's Current Good Manufacturing Practice (cGMP) and Good Distribution Practice (GDP), specifically mandated by agencies like the European Medicines Agency (EMA) and the World Health Organization (WHO). These standards require traceable, validated records of temperature and humidity conditions for all pharmaceutical products to ensure efficacy and patient safety.

How does IoT technology specifically enhance cold-chain visibility and compliance?

IoT technology enhances visibility by utilizing interconnected wireless sensors and GPS trackers to provide real-time location and environmental data to a cloud-based dashboard. This allows stakeholders to monitor conditions remotely, receive instant alerts for deviations, and automate the creation of audit-ready compliance reports, significantly reducing reaction time to temperature excursions.

What is the difference between disposable data loggers and reusable monitoring systems?

Disposable data loggers are cost-effective, single-use devices, often used for last-mile or short-duration shipments, providing a temperature record for one trip. Reusable monitoring systems are higher-value assets, typically employed for long-term monitoring in warehouses or expensive logistics routes, featuring advanced communication capabilities (GSM/satellite) and requiring calibration and regular maintenance.

Which end-use industry is the largest consumer of cold-chain temperature and humidity control products?

The Pharmaceutical and Healthcare industry is the largest consumer, driven by the need to protect high-value, temperature-sensitive products such as biologics, vaccines, and specialized clinical trial materials. The stringent regulatory environment and the severe consequences of product spoilage necessitate the highest levels of monitoring precision and system validation.

How are AI and predictive analytics being utilized in the modern cold chain?

AI and predictive analytics are used to shift the cold chain from reactive alarming to proactive risk mitigation. This involves machine learning algorithms analyzing historical and real-time data (weather, traffic, equipment performance) to predict potential temperature deviations, optimize transportation routes dynamically, and schedule proactive maintenance for refrigeration equipment before failures occur.

The continuous growth trajectory of the cold-chain temperature and humidity control products market is intrinsically linked to global population health trends and the increasing complexity of international trade. As advanced therapies, such as cell and gene therapy, gain commercial viability, the demand for ultra-low temperature monitoring solutions will intensify, necessitating further innovation in sensor durability and accuracy in cryogenic environments. The primary competitive differentiator moving forward will be the ability of vendors to successfully integrate hardware systems with powerful, yet user-friendly, cloud-based software platforms that offer superior analytical capabilities and streamlined regulatory compliance features. This focus on integrated solutions, rather than disparate components, will define market leadership over the forecast period. Furthermore, sustainability pressures will increasingly require vendors to develop energy-efficient monitoring devices and cooling technologies, aligning with corporate social responsibility goals of major pharmaceutical and food processing clients. The evolution of 5G networks is also poised to revolutionize real-time data transmission capabilities, especially in previously underserved remote areas, guaranteeing complete end-to-end traceability that satisfies the exacting requirements of global regulators and consumers alike.

In summary, while technological advancements like IoT and AI are providing critical solutions for monitoring precision, the underlying market growth remains fundamentally tied to regulatory strictness and the inherent economic value of the products being preserved. The Asia Pacific region stands out as the major growth engine, requiring substantial investment in infrastructure, which simultaneously presents massive opportunities for international solution providers. Successful market penetration requires a dual approach: high-precision, validated solutions for the pharmaceutical sector, and scalable, cost-efficient, ruggedized systems for the high-volume, global food and beverage supply chain. The convergence of hardware development, secure cloud infrastructure, and sophisticated data analytics is the defining trend shaping the future competitive environment of this critical market.

Detailed analysis of the competitive landscape reveals that key market participants are strategically investing in vertical integration—expanding from manufacturing simple data loggers to offering full-suite software platforms, including data hosting and managed service contracts. This strategic shift is aimed at capturing recurring revenue streams and establishing long-term relationships with large enterprise clients who require continuous support and system maintenance to uphold compliance integrity. Furthermore, smaller, innovative technology firms specializing in sensor miniaturization, battery optimization, and blockchain integration are frequently targeted for acquisition by larger established players seeking to quickly incorporate cutting-edge digital capabilities. This dynamic merger and acquisition activity underscores the market's rapid transition towards a software-driven ecosystem where data security and analytical superiority are paramount over hardware commoditization. The market is thus characterized by a strong push for unified systems capable of communicating seamlessly across different global logistics providers, ultimately aiming for a truly ‘unbroken’ chain of custody.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager