Cold Forging Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433058 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cold Forging Machine Market Size

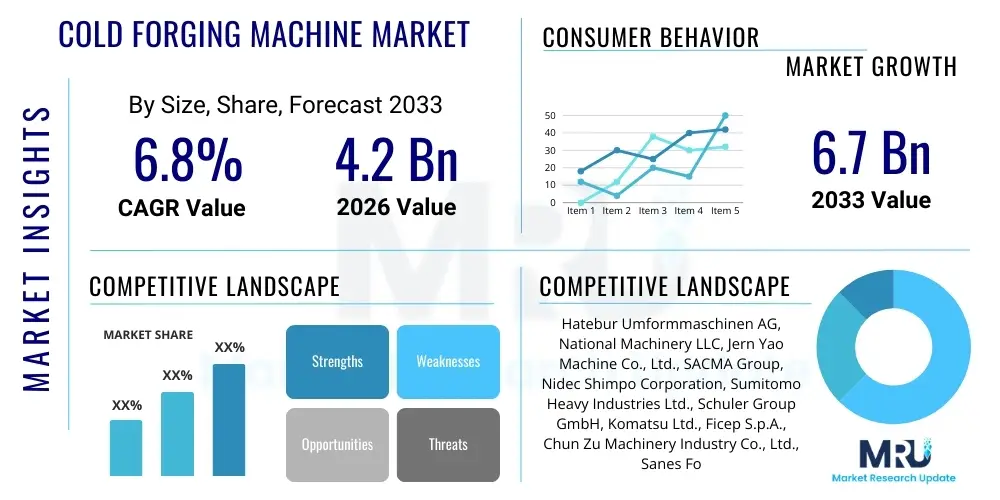

The Cold Forging Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 6.7 Billion by the end of the forecast period in 2033.

Cold Forging Machine Market introduction

The Cold Forging Machine Market encompasses specialized heavy machinery used to shape metals below their recrystallization temperature, typically at or near room temperature. This manufacturing process, central to producing high-strength, precision components, involves severe plastic deformation of the metal blank using dies and punches. Products manufactured using cold forging include high-tolerance fasteners, intricate gears, spline shafts, and various automotive transmission components. The inherent ability of cold forging to produce near-net-shape components minimizes material waste and subsequent machining requirements, offering significant cost advantages over traditional hot forging or machining processes.

These sophisticated machines utilize mechanical or hydraulic actuation systems to deliver substantial forming forces, ensuring excellent surface finish and enhanced mechanical properties duetaining the metal's grain structure. The core benefits derived from cold forging technology include superior dimensional accuracy, increased material strength due to work hardening, improved fatigue resistance, and high production efficiency suitable for mass production lines. Furthermore, cold forging is highly favored in sectors requiring robust, lightweight solutions, directly supporting the increasing demand for fuel efficiency and stringent safety standards in the automotive and aerospace industries.

The market is primarily driven by the expanding global automotive sector, particularly the rapid transition toward electric vehicles (EVs), which necessitates lightweight yet high-integrity components such as internal shafts, motor components, and battery housings. Coupled with the rising industrialization across Asia Pacific and technological advancements such as high-speed servo-driven machines, the cold forging sector continues its trajectory toward greater efficiency and complexity in component manufacturing. These factors collectively solidify the cold forging machine market's position as an indispensable segment of the global precision manufacturing landscape.

Cold Forging Machine Market Executive Summary

The Cold Forging Machine Market is characterized by strong foundational demand driven by the stringent quality requirements of the automotive and industrial machinery sectors. Business trends indicate a marked shift towards automated and multi-station forging presses capable of handling complex parts with minimal human intervention. Key market stakeholders are increasingly focusing on developing integrated forging solutions that incorporate real-time monitoring, intelligent die management, and rapid tool change systems to maximize uptime and operational flexibility. Furthermore, sustainability is emerging as a critical business imperative, driving the adoption of energy-efficient, servo-driven machines that reduce overall energy consumption compared to traditional mechanical presses, thus lowering the total cost of ownership (TCO) for end-users globally.

Regionally, Asia Pacific (APAC) stands as the undisputed market leader, propelled by the massive manufacturing output in China, India, and South Korea, particularly within their burgeoning electric vehicle and electronics supply chains. While North America and Europe maintain stable markets focused on high-precision and customized components for aerospace and high-end automotive applications, APAC’s sheer volume of production and continuous infrastructure investment provide the primary growth impetus. European manufacturers, however, lead in technological innovation, emphasizing the integration of Industry 4.0 principles, including predictive maintenance frameworks and sophisticated quality control systems, setting global benchmarks for operational excellence.

Segment trends reveal that multi-station cold forging machines dominate the market owing to their superior capability to perform sequential forming operations, leading to highly complex components in a single setup, which is essential for high-volume automotive production. The application segment focused on electric vehicle components, such as transmission parts and motor shafts, is projected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the global regulatory push for decarbonization and electrification. The shift in demand structure favors machines with higher tonnage capacity, reflecting the trend toward manufacturing larger, monolithic parts required for heavy industrial machinery and advanced vehicle platforms, thus sustaining market expansion.

AI Impact Analysis on Cold Forging Machine Market

Common user questions regarding AI’s impact on the Cold Forging Machine Market frequently revolve around topics such as real-time defect detection, maximizing machine uptime, and optimizing complex forming processes. Users are concerned with how Artificial Intelligence can mitigate tooling wear, which represents a major operational cost, and whether machine learning algorithms can accurately predict material flow behavior under high stress. There is a strong expectation that AI will transition forging operations from reactive maintenance models to highly proactive, predictive environments, significantly improving component quality consistency and reducing scrap rates. Users also inquire about the practicality and return on investment (ROI) associated with integrating sophisticated AI vision systems for automated quality verification in high-speed production lines, seeking confirmation that AI can enhance precision beyond conventional sensor-based monitoring.

- AI-Powered Predictive Maintenance: Utilizing machine learning algorithms to analyze vibration, temperature, and current data from machine sensors to predict component failure (e.g., bearings or hydraulic systems) days or weeks in advance, drastically reducing unplanned downtime.

- Intelligent Process Optimization: Employing neural networks to fine-tune forming parameters (stroke speed, pressure curves, cooling rates) based on input material properties and ambient conditions, ensuring optimal component geometry and mechanical strength.

- Real-Time Quality Control (QC): Integrating AI-driven vision systems and deep learning models to inspect every forged part immediately for surface defects, dimensional inconsistencies, or micro-cracks, ensuring 100% compliance with stringent tolerance requirements.

- Automated Die and Tooling Management: AI predicting the remaining useful life (RUL) of forging dies based on usage patterns and stress profiles, scheduling maintenance proactively, and optimizing tooling replacement cycles to extend life and minimize sudden failure.

- Simulation and Design Enhancement: Using AI to accelerate finite element analysis (FEA) simulations, exploring thousands of design iterations virtually to achieve optimal component geometry and material savings before physical prototyping begins.

- Energy Consumption Reduction: Implementing AI controls to modulate servo motor energy usage based on real-time load requirements, achieving significant efficiency gains during non-forming stages of the cycle.

DRO & Impact Forces Of Cold Forging Machine Market

The dynamics of the Cold Forging Machine Market are fundamentally shaped by a robust set of driving forces centered on industrial precision and material optimization, balanced by significant operational and capital constraints. The overarching driver is the global emphasis on vehicle lightweighting and improved fuel efficiency, necessitating high-strength, complex components achievable only through cold forging, particularly in the expanding electric vehicle battery and motor systems. Opportunities are significantly catalyzed by the continuous development of advanced alloys suitable for cold forming, allowing manufacturers to push the boundaries of component complexity and material performance. Restraints largely center on the prohibitively high initial capital expenditure required for purchasing and installing these massive, high-precision machines, alongside the specialized skill set required for die design and operational maintenance, creating formidable barriers to entry for smaller enterprises.

Key drivers include the massive expansion of the automotive sector in emerging economies, notably India and Southeast Asia, where rising disposable incomes fuel vehicle ownership and consequently demand for highly reliable engine and chassis components. The superior mechanical properties conferred by the cold forging process, such as excellent tensile strength and fatigue resistance, make it indispensable for critical safety components like steering knuckles and suspension arms, providing continuous market traction. Furthermore, the adoption of Industry 4.0 methodologies compels machine manufacturers to incorporate advanced features like IoT connectivity and sophisticated diagnostics, enhancing operational transparency and efficiency, which serves as a powerful market accelerator for modernization.

However, the market faces significant hurdles stemming from the intensive need for high-quality, defect-free raw materials, as minor inconsistencies can lead to catastrophic tool failure under the immense pressure involved in cold forging. The cyclical volatility of the global steel and aluminum markets directly impacts operational costs and investment stability. Impact forces, therefore, lean heavily towards technological evolution, where the ability to manage tooling wear effectively through specialized coatings and intelligent monitoring systems acts as a critical differentiator. The imperative for noise reduction and energy recovery in manufacturing environments also exerts pressure on manufacturers to innovate press designs, ensuring that environmental and occupational safety regulations are met, influencing the long-term investment priorities of major end-users.

Segmentation Analysis

The Cold Forging Machine Market is comprehensively segmented based on machine type, tonnage capacity, application sector, and end-user profile, allowing for granular analysis of market demand patterns and technological niches. Segmentation by machine type clearly delineates between single-station, multi-station, and transfer machines, reflecting the required complexity and volume of production, with multi-station presses dominating for complex automotive parts. Analyzing the market based on tonnage provides insight into the size and robustness of components produced, ranging from small fasteners (low tonnage) to large axle shafts (high tonnage), directly correlating with industrial needs across different sectors.

The most lucrative segmentation remains the application segment, particularly the automotive industry, which dictates demand for standardized, high-volume production machinery suitable for manufacturing bolts, nuts, engine components, and sophisticated transmission systems. The rising importance of non-automotive sectors, such as aerospace and construction, while smaller in volume, drives demand for highly specialized, high-precision equipment capable of processing difficult-to-form materials like titanium and high-nickel alloys. This diversification ensures market stability, mitigating risks associated with single-industry dependence.

Overall market trajectory suggests increasing convergence in machine capabilities, blurring the lines between traditional single-hit and multi-stage processes through modular and flexible design architectures. Furthermore, the geographical distribution of manufacturing capacity dictates machine sales, with APAC favoring high-speed, high-volume machines, while North America and Europe often prioritize machines offering flexibility for shorter production runs and higher value-added components. Understanding these segmentation nuances is crucial for manufacturers to tailor their product development and market penetration strategies effectively.

- By Type: Multi-station Cold Forging Machines, Single-station Cold Forging Machines, High-speed Cold Forging Machines, Horizontal Forging Machines, Vertical Forging Machines.

- By Application: Automotive Components (Bolts, Nuts, Gears, Shafts, Axles, Transmission Components), Industrial Machinery Components, Aerospace Fasteners and Structural Parts, Construction and Infrastructure Components, Consumer Goods and Electronics.

- By Tonnage/Force: Less than 500 Tons, 500 Tons to 1500 Tons, Above 1500 Tons.

- By End-User: Original Equipment Manufacturers (OEMs), Tier 1 Automotive Suppliers, Independent Forging Job Shops, Aftermarket Suppliers.

Value Chain Analysis For Cold Forging Machine Market

The value chain for the Cold Forging Machine Market begins with the upstream sourcing of high-grade raw materials, primarily specialized steel alloys (carbon steel, alloy steel, stainless steel) required for machine construction, precision components, and tooling. Specialized raw material suppliers provide the foundational inputs, including wire rod and billets, which are essential for the forging process itself. Machine manufacturers then engage in complex design, engineering, and assembly, requiring expertise in mechanical engineering, hydraulics, electrical control systems, and software integration (PLCs, HMI). This stage involves high intellectual property investment in developing proprietary press mechanisms and control algorithms to ensure high tonnage, speed, and accuracy.

Midstream activities focus on the actual manufacturing and distribution of the forging equipment. Machine builders employ highly skilled labor for fabrication and stringent quality control processes to meet international safety and performance standards. Distribution channels are typically specialized and involve a mix of direct sales teams for major, highly customized orders, and established local distributors or agents who handle sales, installation, and essential after-sales support, particularly in geographically diverse markets. Given the scale and cost of the equipment, technical service and training constitute a crucial part of the offering, bridging the gap between machine deployment and optimal operational performance.

Downstream activities involve the extensive network of end-users, predominantly Tier 1 and Tier 2 automotive suppliers, who utilize these machines to produce components that are then integrated into final products by OEMs. The demand profile of the downstream market is highly sensitive to automotive production cycles and regulatory changes concerning vehicle safety and emissions. Direct sales often characterize highly customized, large-tonnage machine purchases, whereas indirect channels (distributors) are essential for penetrating small to medium-sized job shops globally, providing localized maintenance and spare parts supply, which significantly impacts overall customer lifetime value and brand loyalty within this capital-intensive industry.

Cold Forging Machine Market Potential Customers

The primary and most significant segment of potential customers for Cold Forging Machines is the expansive global automotive manufacturing ecosystem. This includes both Original Equipment Manufacturers (OEMs) who are increasingly integrating forging capabilities in-house for critical components, and, more commonly, Tier 1 and Tier 2 suppliers who specialize in the mass production of high-volume, safety-critical parts. These components range from engine valves, connecting rods, and transmission shafts to specialized fasteners and chassis components, all requiring the superior strength and precision afforded by cold forging. The rapid growth of Electric Vehicle (EV) manufacturing is creating a new wave of demand for specialized machines capable of forging lightweight aluminum and copper alloy components required for battery packs, motor assemblies, and high-performance reduction gears.

Beyond the automotive sector, substantial potential exists within the general industrial machinery and heavy equipment manufacturing domains. Customers in this category require cold-forged components such as large bolts, bushings, and linkages for construction machinery (e.g., excavators, cranes), agricultural equipment, and mining apparatus, where resilience and fatigue strength under heavy load conditions are paramount. These buyers typically focus on large-tonnage machines and robust, reliable equipment designed for continuous, severe duty cycles.

Furthermore, the aerospace industry represents a high-value niche market. While the volume is lower compared to automotive, aerospace customers, including major aircraft component suppliers, demand exceptionally high precision and impeccable material integrity for mission-critical parts like airframe fasteners, landing gear components, and specialized engine components. These buyers prioritize sophisticated multi-stage presses capable of handling complex, high-nickel alloys and titanium, where stringent certifications and quality traceability requirements elevate the machine specifications and overall capital investment significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 6.7 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hatebur Umformmaschinen AG, National Machinery LLC, Jern Yao Machine Co., Ltd., SACMA Group, Nidec Shimpo Corporation, Sumitomo Heavy Industries Ltd., Schuler Group GmbH, Komatsu Ltd., Ficep S.p.A., Chun Zu Machinery Industry Co., Ltd., Sanes Forging, Wafios AG, Lasco Umformtechnik GmbH, Stamtec Inc., Formtek Group, Buffalo Machinery, IHI Corporation, Qingdao Huada Heavy Industry Machinery Co., Ltd., JINAN YIDU MACHINERY CO., LTD., Shanghai Wuxing Machinery Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Forging Machine Market Key Technology Landscape

The technology landscape of the Cold Forging Machine Market is rapidly evolving, driven by the shift towards precision control, higher speeds, and greater energy efficiency. A pivotal technological advancement is the widespread adoption of servo-motor driven presses, replacing traditional mechanical flywheel systems. Servo technology allows for unparalleled control over the ram's stroke curve, speed, and position during the forging cycle. This precision control minimizes shock loading, extends tool life, and enables the forging of more complex geometries with greater repeatability. Furthermore, servo systems offer significant energy savings by only consuming power when the ram is actively working, contrasting sharply with the continuous power draw of mechanical systems, aligning with global sustainability initiatives and reducing operational expenses for end-users.

Another critical area of innovation involves the integration of advanced monitoring and sensor technology, forming the foundation for Industry 4.0 compatibility. Modern cold forging machines are equipped with sophisticated arrays of sensors to measure parameters such as vibration, acoustic emissions, temperature profiles, and instantaneous load applied at various points of the die. This deluge of operational data is processed through integrated machine control units and increasingly, cloud-based analytics platforms. The goal is to facilitate real-time condition monitoring, anomaly detection, and the implementation of predictive maintenance protocols, thereby maximizing Overall Equipment Effectiveness (OEE) and preventing costly catastrophic failures.

Furthermore, significant technological efforts are focused on improving the durability and rapid interchangeability of tooling systems. Quick Die Change (QDC) systems, utilizing automated clamping mechanisms and robotic tool handling, dramatically reduce setup and changeover times, enhancing production flexibility, especially important for job shops handling diverse component portfolios. Concurrently, material science innovation in die coatings (e.g., PVD and CVD coatings) and advanced tooling materials is improving resistance to wear and thermal fatigue, directly addressing the primary constraint of tooling lifespan in high-pressure cold forging operations. This continuous cycle of improvement in machine mechanics, digitalization, and tooling robustness defines the competitive advantage in the modern cold forging sector.

Regional Highlights

- Asia Pacific (APAC) dominates the global Cold Forging Machine Market, primarily due to the concentration of high-volume automotive production, particularly in China, Japan, and South Korea, which are major manufacturing hubs for conventional and electric vehicles. The region benefits from substantial government investments in manufacturing infrastructure, competitive labor costs, and a massive domestic demand for consumer electronics and industrial machinery components, driving the need for continuous deployment of high-speed, multi-station forging equipment.

- North America is characterized by a mature market emphasizing high-precision and customized forging solutions, particularly for the aerospace and high-end automotive sectors. The regional focus is less on sheer volume and more on technological integration, with significant adoption of automated and digitized forging cells. Demand is increasingly driven by the revitalization of domestic supply chains and the push toward domestic production of EV components, requiring advanced machines capable of handling specialty alloys with strict quality controls.

- Europe represents a key market segment, leading in technological innovation and adherence to stringent environmental and worker safety regulations. Countries like Germany, Italy, and Switzerland house leading manufacturers of cold forging equipment, focusing on developing energy-efficient servo technology and integrated Industry 4.0 features like cloud-based diagnostics and cyber-physical systems. The demand here is stable, rooted in the high-quality requirements of the region's premium automotive and industrial machinery manufacturers.

- Latin America and the Middle East & Africa (MEA) currently hold smaller market shares but present significant growth opportunities. Market expansion in Latin America is tied closely to local automotive manufacturing and commodity production cycles, while the MEA region sees demand linked to infrastructure projects, oil and gas, and developing domestic industrialization strategies, often relying on imported, reliable forging machinery from established global vendors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Forging Machine Market.- Hatebur Umformmaschinen AG

- National Machinery LLC

- Jern Yao Machine Co., Ltd.

- SACMA Group

- Nidec Shimpo Corporation

- Sumitomo Heavy Industries Ltd.

- Schuler Group GmbH

- Komatsu Ltd.

- Ficep S.p.A.

- Chun Zu Machinery Industry Co., Ltd.

- Sanes Forging

- Wafios AG

- Lasco Umformtechnik GmbH

- Stamtec Inc.

- Formtek Group

- Buffalo Machinery

- IHI Corporation

- Qingdao Huada Heavy Industry Machinery Co., Ltd.

- JINAN YIDU MACHINERY CO., LTD.

- Shanghai Wuxing Machinery Co., Ltd.

- Hengda Forging Machinery Co., Ltd.

- Dongguan King-Mazon Machinery Co., Ltd.

- Taiwan Formosa Heavy Industry Co., Ltd.

- Aida Engineering Ltd.

- Minster Machine Company (Nidec Press & Automation)

Frequently Asked Questions

Analyze common user questions about the Cold Forging Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of cold forging over hot forging processes?

Cold forging yields superior mechanical properties, including enhanced tensile strength and fatigue resistance, due to work hardening and precise control over grain structure. It also achieves significantly better surface finishes and tighter dimensional tolerances, often eliminating the need for subsequent machining, thereby saving material and reducing production costs significantly.

How does the shift to electric vehicles (EVs) impact the demand for cold forging machines?

The EV transition is a major growth driver, necessitating high volumes of high-precision, lightweight components such as motor shafts, differential gears, and specialized fasteners made from lightweight alloys (e.g., aluminum). Cold forging machines are essential for producing these high-integrity parts with minimal material waste required for efficient EV powertrain systems.

Which regional market holds the largest share for cold forging machine sales?

Asia Pacific (APAC) currently dominates the market share due to its vast automotive manufacturing base, particularly in China and India, and high investment in industrial infrastructure. This region drives global demand for high-speed, multi-station forging presses used in mass production.

What is the role of servo technology in modern cold forging equipment?

Servo technology provides precise control over ram speed, position, and forming energy, which is crucial for complex parts and difficult materials. It enhances process repeatability, reduces noise, extends tool life, and significantly improves energy efficiency compared to traditional mechanical and hydraulic presses, aligning with sustainability and cost optimization goals.

What are the key financial restraints affecting the adoption of cold forging machines?

The primary restraint is the extremely high initial capital expenditure (CapEx) required for sophisticated, high-tonnage cold forging equipment. Additionally, the recurring costs associated with specialized die design, complex tooling, and the need for high-quality, pre-treated raw materials contribute significantly to the total cost of ownership (TCO).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager