Cold Rolled Low Carbon Steel Drum Barrel Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433093 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cold Rolled Low Carbon Steel Drum Barrel Market Size

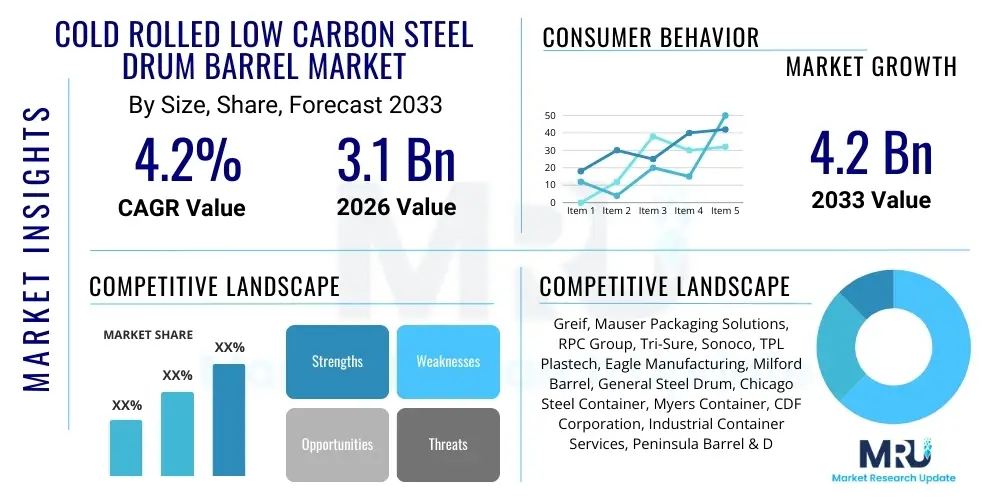

The Cold Rolled Low Carbon Steel Drum Barrel Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.2% between 2026 and 2033. The market is estimated at USD 3.1 Billion in 2026 and is projected to reach USD 4.2 Billion by the end of the forecast period in 2033.

Cold Rolled Low Carbon Steel Drum Barrel Market introduction

The Cold Rolled Low Carbon Steel Drum Barrel Market encompasses the manufacturing, distribution, and utilization of industrial containers fabricated from cold-rolled steel sheets. Cold rolling imparts superior surface finish, enhanced dimensional tolerance, and increased mechanical strength compared to hot-rolled steel, making it ideal for deep drawing and high-quality barrel production required for sensitive materials. These characteristics ensure the structural integrity and leak-proof performance essential for storing and transporting hazardous and non-hazardous liquids and solids, including chemicals, refined petroleum products, pharmaceuticals, and specialized food ingredients.

Product description centers on standardized volumes, predominantly the 55-gallon (200-liter) drum, often featuring tight-head or open-head configurations depending on the application. Low carbon content ensures excellent weldability and malleability, crucial for automated manufacturing processes and compliance with international transport regulations like UN/DOT standards. Major applications span critical industrial sectors, acting as essential packaging for bulk intermediates and finished goods, providing reliable containment and minimizing environmental risks associated with leakage.

The market is primarily driven by sustained global industrial output, particularly in the chemicals and petrochemicals sectors, which rely heavily on durable steel packaging for long-distance logistics. Furthermore, the inherent benefits of steel drums, such as high recyclability (supporting circular economy goals) and superior barrier properties (protecting contents from oxidation and contamination), continue to underpin demand, even amid competition from plastic intermediate bulk containers (IBCs) and plastic drums. Technological advancements in coatings and lining materials further extend the range of products that can be safely packaged in cold-rolled steel drums.

Cold Rolled Low Carbon Steel Drum Barrel Market Executive Summary

The Cold Rolled Low Carbon Steel Drum Barrel Market demonstrates stable growth driven by recovering industrial production and increased international trade volume, particularly across Asia Pacific and North America. Current business trends indicate a strong focus on sustainable manufacturing practices, with key players investing in high-efficiency welding techniques and advanced internal coatings that extend drum longevity and expand compatibility with complex chemical formulations. Furthermore, digitalization of the supply chain, incorporating IoT sensors for tracking and inventory management, is becoming a differentiating factor among premium drum suppliers, enhancing logistics efficiency for end-users.

Regional trends highlight the dominance of the Asia Pacific market, fueled by robust infrastructural development and the expansion of the chemical processing and refining industries in China, India, and Southeast Asian nations. North America and Europe, while mature markets, are experiencing demand shifts towards reconditioned and recycled drums, driven by stringent environmental, social, and governance (ESG) mandates and cost-efficiency measures. This regional divergence necessitates customized market strategies, focusing on capacity expansion in APAC and specialization in high-performance, sustainability-focused products in Western economies.

Segment trends show the 55-gallon capacity segment maintaining its market share leadership due to its standardization in bulk logistics. However, the specialized smaller capacity segment (30-gallon and below) is exhibiting faster growth, fueled by demand from the flavor and fragrance, and specialized additives industries which require precise batch sizes. The Chemicals and Petroleum segments remain the principal revenue generators, though the Food and Beverages sector is increasingly adopting lined steel drums for high-value products like edible oils and flavor concentrates where barrier protection is critical, thereby contributing significantly to future segmentation growth.

AI Impact Analysis on Cold Rolled Low Carbon Steel Drum Barrel Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cold Rolled Low Carbon Steel Drum Barrel Market predominantly center on operational efficiency, predictive maintenance for manufacturing equipment, and optimized supply chain logistics. Consumers, particularly large industrial buyers, seek to understand how AI can reduce variability in drum manufacturing quality, predict raw material price fluctuations (especially cold-rolled steel coil costs), and enhance the traceability of drums through the entire lifecycle, supporting refill and recycling programs. Key concerns include the initial capital investment required for implementing AI-driven automation and ensuring data security across interconnected manufacturing environments.

The core themes emerging from user analysis suggest expectations that AI will revolutionize drum fabrication by enabling real-time quality control checks on welding seams and coating thickness, far surpassing human inspection capabilities. Furthermore, AI-powered demand forecasting is expected to allow drum manufacturers to optimize inventory levels for various gauges and capacities, minimizing scrap rates and avoiding costly rush orders for high-demand segments. The integration of Machine Learning (ML) models into factory floor operations promises substantial gains in overall equipment effectiveness (OEE) by predicting component failure, leading to minimized downtime.

Ultimately, the consensus is that AI will not fundamentally change the physical product—the steel drum—but will drastically transform the economics and speed of its production and deployment. Enhanced efficiency through AI implementation will be crucial for maintaining competitive pricing against alternative packaging solutions and for adhering to the increasingly complex logistical demands of global chemical and pharmaceutical supply chains. Early adopters leveraging AI for proactive maintenance and dynamic pricing models are positioned to gain a significant competitive advantage.

- AI enhances predictive maintenance of high-speed welding and coating machinery, minimizing unexpected downtime.

- Machine Learning optimizes raw material inventory management, forecasting optimal cold-rolled steel coil procurement times based on global commodity indices.

- Computer Vision systems conduct real-time quality inspection of seam welds and internal linings, ensuring defect rates near zero.

- AI-driven supply chain platforms optimize routing and fleet management for drum deliveries and collection, lowering transportation costs.

- Generative design tools assist in optimizing drum structural integrity using less material while maintaining regulatory compliance.

DRO & Impact Forces Of Cold Rolled Low Carbon Steel Drum Barrel Market

The dynamics of the Cold Rolled Low Carbon Steel Drum Barrel Market are dictated by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form significant Impact Forces shaping investment decisions and strategic planning. A primary driver is the unwavering demand from the chemical, petrochemical, and refining industries, which require non-permeable, robust packaging that only steel can consistently provide for high-hazard or high-value materials. This is coupled with regulatory mandates in certain jurisdictions that specify steel as the preferred packaging for UN Group I hazardous substances, providing a foundational demand floor. Restraints largely revolve around the volatility of cold-rolled steel prices, which are deeply tied to iron ore and energy markets, making cost management challenging for manufacturers, alongside escalating competition from high-density polyethylene (HDPE) drums and flexible Intermediate Bulk Containers (FIBCs).

Opportunities for market growth are primarily concentrated in sustainability and technological advancement. The opportunity to increase the utilization of reconditioned and recycled steel drums (the circular economy model) offers a significant avenue for manufacturers to meet ESG targets and provide cost-effective options to clients. Furthermore, the development and adoption of high-performance internal linings, such as specialized epoxies and phenolic coatings, allow steel drums to safely package corrosive or sensitive products previously restricted to stainless steel or advanced plastics, thereby expanding the addressable market. These factors create an environment where operational efficiency and sustainable practices are crucial for profitability.

The Impact Forces are heavily skewed towards material availability and stringent logistics regulations. The ability to secure stable, high-quality cold-rolled low-carbon steel feedstock at competitive prices remains the single most powerful factor influencing market stability and profitability. Additionally, the increasing complexity of international shipping regulations requires manufacturers to invest continuously in certification, testing, and traceability systems, which acts as a barrier to entry for smaller players but ensures product reliability across the industry. Infrastructure spending, particularly in developing economies, further amplifies demand for lubricants, asphalt, and construction chemicals, subsequently driving the need for corresponding steel packaging.

Segmentation Analysis

The Cold Rolled Low Carbon Steel Drum Barrel Market is segmented based on critical operational parameters including the drum capacity, the material gauge utilized, the type of closure mechanism, and the specific end-use industry. This segmentation reflects the varied requirements across the global logistics chain, ranging from bulk storage of petroleum products to specialized transport of fine chemicals. Capacity segmentation, such as the differentiation between standard 55-gallon drums and specialized 30-gallon drums, dictates manufacturing scale and pricing structures, while gauge segmentation addresses the required level of protection and regulatory compliance for hazardous goods transport.

End-use industry segmentation provides the clearest insight into demand drivers, with the Chemical and Petrochemical sectors dominating due to the necessity for robust, impermeable barriers for corrosive and volatile materials. However, the Food & Beverage and Pharmaceutical sectors, although smaller in volume, are high-value segments demanding specialized linings and ultra-clean manufacturing environments to prevent contamination, driving innovation in coating technology. The closure type, whether tight-head (non-removable top, used for liquids) or open-head (removable top, used for solids or viscous materials), determines the functionality and ease of dispensing the packaged contents.

Analyzing these segments reveals that growth is heterogeneous; while the volume of standard 55-gallon drums tied to industrial output expands steadily, the specialized coating and smaller capacity segments, driven by niche chemical and high-purity pharmaceutical applications, exhibit superior growth rates and margin potential. Manufacturers are increasingly focusing on vertical integration and offering customized lining solutions to capture this high-margin specialized demand, ensuring their steel drums meet highly specific customer requirements beyond basic containment.

- By Capacity:

- 55 Gallon (200 Liters)

- 30 Gallon (110 Liters)

- Smaller Capacities (10-20 Gallons)

- Custom Volumes

- By Material Gauge:

- 18 Gauge and Thicker (Heavy Duty)

- 20 Gauge

- 22 Gauge and Thinner (Light Duty)

- By Closure Type:

- Tight-Head Drums

- Open-Head Drums

- By End-Use Industry:

- Chemicals and Fertilizers

- Petroleum and Lubricants

- Food and Beverages (Edible Oils, Syrups)

- Pharmaceuticals and Cosmetics

- Paints, Inks, and Coatings

- Others (Waste Management, Construction)

Value Chain Analysis For Cold Rolled Low Carbon Steel Drum Barrel Market

The value chain for the Cold Rolled Low Carbon Steel Drum Barrel Market begins with the upstream procurement of raw materials, primarily steel coils, sourced from integrated steel mills or mini-mills. This crucial stage involves the cold-rolling process, which transforms hot-rolled steel into sheets with precise gauge, superior surface finish, and enhanced mechanical properties required for drum manufacturing. Upstream analysis focuses on managing volatility in iron ore, coking coal, and energy prices, as these factors directly dictate the cost of the finished steel coil, which constitutes the largest portion of the final drum cost.

Midstream activities involve the drum fabrication process, including cutting, welding, rolling, flanging, seaming, and the application of internal linings and external coatings. Manufacturers operate sophisticated, high-speed assembly lines, where efficiency and quality control (especially welding integrity) are paramount. The choice of coating—ranging from rust inhibitors to specialized phenolic or epoxy linings—adds significant value and differentiates the product for specific applications (e.g., highly corrosive chemicals). Distribution channels are highly developed, encompassing both direct sales to major industrial end-users (especially chemical giants) and indirect sales through large industrial packaging distributors and reconditioners.

Downstream analysis centers on the diverse end-user sectors, including bulk buyers in the chemical, petroleum, and food processing industries. The life cycle of the drum extends beyond the first use, integrating a highly organized reconditioning and recycling segment, especially in mature markets like North America and Europe. Direct sales ensure tight quality assurance and tailored logistics for specialized customers, while indirect channels provide market breadth and supply chain flexibility for smaller or intermittent buyers. The robust recycling infrastructure ensures the steel drums maintain a positive environmental profile compared to single-use alternatives.

Cold Rolled Low Carbon Steel Drum Barrel Market Potential Customers

The potential customers for Cold Rolled Low Carbon Steel Drum Barrels are diverse, spanning virtually all heavy and intermediate industrial sectors requiring secure, bulk, non-reactive packaging for liquid and solid goods. The primary buyers are large multinational chemical producers that utilize drums for intermediate products, finished industrial chemicals, and agricultural inputs such as fertilizers and pesticides. These customers demand highly reliable, certified drums compliant with global transportation standards (e.g., DOT, UN, ADR, RID) and often require specialized internal coatings tailored to their specific chemical compositions to prevent degradation or contamination.

Another significant customer base lies within the petroleum and lubricants industry, including major oil companies, independent lubricant blenders, and asphalt manufacturers. For lubricants, the 55-gallon drum is the standard unit of bulk sale for distribution to industrial workshops, automotive service centers, and mining operations. These buyers prioritize drum robustness, ease of handling, and external coating durability to withstand harsh storage and transit conditions. The Food & Beverage sector represents a high-growth segment, particularly for edible oils, flavor concentrates, and high-purity food-grade syrups, where potential customers mandate specific food-safe linings (often NSF approved) and stringent cleanliness protocols throughout the manufacturing process.

Finally, the pharmaceutical and specialty chemicals sectors represent high-value potential customers. While their volume demand is lower, they require the highest quality drums, often utilizing stainless steel drums for sensitive powders and high-purity materials, but cold-rolled low-carbon steel drums, when appropriately lined, serve effectively for solvents, non-sterile intermediates, and specialized excipients. These customers prioritize supplier reliability, quality consistency, detailed batch traceability, and adherence to Good Manufacturing Practices (GMP), making long-term contractual relationships with certified drum manufacturers highly common.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 4.2 Billion |

| Growth Rate | 4.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Greif, Mauser Packaging Solutions, RPC Group, Tri-Sure, Sonoco, TPL Plastech, Eagle Manufacturing, Milford Barrel, General Steel Drum, Chicago Steel Container, Myers Container, CDF Corporation, Industrial Container Services, Peninsula Barrel & Drum, Metal Drum Company, Skolnik Industries, Time Steel Drum, Cleveland Steel Container, Container Solutions International, Drumco. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Rolled Low Carbon Steel Drum Barrel Market Key Technology Landscape

The technological landscape for cold rolled low carbon steel drum barrels is characterized by continuous refinement aimed at improving efficiency, product integrity, and environmental performance. Core technological advancements focus on high-speed automated welding systems, particularly resistance welding and laser welding techniques, which ensure a hermetic seal and high uniformity across the longitudinal and chime seams, crucial for UN certification. These advanced welding methods minimize heat-affected zones, preserving the structural integrity of the low-carbon steel and allowing for faster production cycles. Furthermore, robotic automation is heavily utilized throughout the fabrication process, from sheet handling and stamping to the final painting and palletizing stages, thereby reducing labor costs and enhancing dimensional accuracy.

A second major technological area involves coating and lining systems, which are essential for expanding the applicability of standard steel drums to aggressive or contamination-sensitive products. Innovations include specialized thin-film epoxy-phenolic coatings that offer superior chemical resistance and flexibility, preventing cracking during handling. Furthermore, the development of internal surface preparation techniques, such as phosphating and specialized washing protocols, ensures optimal adhesion of these linings, guaranteeing product purity for food-grade and pharmaceutical applications. Non-contact thickness measurement systems, often integrated with AI, monitor coating consistency in real time, minimizing material waste and enhancing quality assurance.

Finally, the implementation of traceability technologies is becoming standard practice. This includes robust labeling systems, laser etching for permanent identification codes, and, increasingly, the integration of RFID tags or IoT sensors. These technologies enable precise tracking of the drum's location, condition, and usage history through the supply chain, which is vital for compliance, inventory management, and maximizing the lifetime utilization of drums in refill programs. These integrated systems facilitate efficient reconditioning processes and provide end-users with critical logistical data, adding significant value beyond mere packaging containment.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to maintain the largest market share and the highest growth rate, driven by significant capital expenditure in chemical processing, oil refining, and industrial manufacturing sectors, particularly in China, India, and Southeast Asia. Rapid urbanization and infrastructure projects spur demand for construction chemicals and lubricants, necessitating bulk steel packaging. Government incentives supporting manufacturing and exports further accelerate the region's dominance.

- North America: Characterized by stringent environmental and safety regulations, the North American market exhibits high demand for UN-certified drums and sophisticated reconditioning services. While industrial output is stable, market growth is increasingly linked to the circular economy, focusing on high-quality reconditioned drums and specialized coatings for the complex specialty chemical and pharmaceutical industries.

- Europe: The European market emphasizes sustainability, characterized by early adoption of circular economy models and high recycling rates for steel packaging. Growth is moderate, driven by replacement demand and the high-value food and flavorings segment. Regulatory pressures regarding chemical transport safety (REACH compliance) necessitate premium, high-integrity steel drums, supporting premium pricing.

- Latin America: Growth in this region is volatile but promising, tied closely to commodity exports and the development of the petrochemical industry in nations like Brazil and Mexico. Demand is concentrated in the agricultural chemicals and mining sectors. Market players focus on establishing localized manufacturing bases to mitigate high import costs and logistical complexities.

- Middle East and Africa (MEA): Demand is intrinsically linked to the oil and gas sector, with significant usage of steel drums for crude oil derivatives, lubricants, and specialized drilling fluids. Infrastructure expansion in the Middle East and industrialization efforts across Africa are driving stable long-term growth for bulk packaging, although political instability can occasionally impact raw material access.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Rolled Low Carbon Steel Drum Barrel Market.- Greif

- Mauser Packaging Solutions

- RPC Group

- Tri-Sure

- Sonoco

- TPL Plastech

- Eagle Manufacturing

- Milford Barrel

- General Steel Drum

- Chicago Steel Container

- Myers Container

- CDF Corporation

- Industrial Container Services

- Peninsula Barrel & Drum

- Metal Drum Company

- Skolnik Industries

- Time Steel Drum

- Cleveland Steel Container

- Container Solutions International

- Drumco

Frequently Asked Questions

Analyze common user questions about the Cold Rolled Low Carbon Steel Drum Barrel market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of cold-rolled steel drums over hot-rolled steel drums?

Cold-rolled low carbon steel offers superior surface finish, tighter dimensional tolerances, and enhanced strength compared to hot-rolled steel. This quality allows for improved paint adhesion, better welding integrity, and suitability for complex deep drawing processes required for high-performance, standardized drum manufacturing.

How significant is the role of specialized internal coatings in the drum market?

Internal coatings, such as epoxy or phenolic resins, are critical as they enable cold-rolled steel drums to safely store corrosive chemicals, sensitive food ingredients, and pharmaceuticals by preventing chemical interaction and contamination, thereby significantly expanding the drum's applicability beyond general industrial use.

Which end-use industry drives the highest demand for cold-rolled low carbon steel drums globally?

The Chemicals and Petrochemicals industry consistently represents the largest end-use segment. This sector demands high volumes of robust, UN-certified steel drums for the secure transportation and storage of hazardous liquids, refined fuels, and bulk chemical intermediates worldwide.

What is the market's current stance on sustainability and recycling for steel drums?

Steel drums boast exceptional sustainability credentials, with high recyclability rates (often over 90%). The market actively promotes the reconditioning and re-use of drums, aligning with global circular economy goals and providing a cost-effective, environmentally sound option compared to single-use packaging alternatives.

How does raw material price volatility affect the profitability of drum manufacturers?

Volatility in cold-rolled steel coil prices is the primary financial risk for manufacturers, directly impacting production costs and margins. Manufacturers mitigate this through hedging strategies, long-term procurement contracts, and implementing highly efficient manufacturing processes to minimize material waste.

The pervasive necessity of safe, standardized industrial packaging across crucial sectors globally ensures the sustained relevance and moderate growth trajectory of the Cold Rolled Low Carbon Steel Drum Barrel Market. Manufacturers are strategically adapting by integrating automation, investing in advanced coating technologies, and prioritizing sustainability to maintain competitiveness against alternative packaging solutions. The future market success hinges on operational efficiency and robust supply chain management, particularly concerning volatile steel pricing and complex international logistics regulations.

Technological advancement, especially the integration of AI for predictive quality assurance and demand planning, represents a significant opportunity for key players to differentiate their offerings and achieve economies of scale. Regional growth will be disproportionately driven by industrial expansion in Asia Pacific, while mature markets in Europe and North America will focus intensely on specialized, high-performance products and extending the lifecycle of existing drum assets through efficient reconditioning networks. The continuous evolution of transport standards mandates persistent innovation in drum design and certification processes.

The market structure remains consolidated at the top tier, dominated by global packaging giants who benefit from vast distribution networks and integrated steel supply chains. However, niche players specializing in custom gauges, specific internal coatings, or regional reconditioning services continue to carve out profitable segments. Overall, the market for cold-rolled low carbon steel drums is characterized by stability, essentiality in industrial logistics, and an increasing commitment to sustainable manufacturing and material utilization practices.

The primary challenge remains balancing the cost pressures associated with steel procurement against the requirement for stringent quality and regulatory compliance. As industrial processes become more specialized, the demand for drums tailored for extreme conditions, such as high heat resistance or specialized corrosion protection, will intensify, necessitating further R&D in lining materials and fabrication precision. This focus on premium, engineered solutions will be critical for maintaining high profitability in the coming forecast period.

Furthermore, geopolitical factors and trade agreements significantly influence the flow of cold-rolled steel coils, impacting regional market dynamics. Manufacturers must maintain diversified sourcing strategies and flexible production capabilities to navigate trade barriers and tariffs effectively. The emphasis on local or regionalized production within major consumption areas like the USMCA zone or the European Union is a growing trend aimed at achieving supply chain resilience and reducing lead times for bulk orders.

The Cold Rolled Low Carbon Steel Drum Barrel Market is not merely a commodity business but an integral part of the hazardous materials handling infrastructure, placing immense importance on quality control and regulatory expertise. The ongoing integration of digital tracking technologies (IoT/RFID) promises to transform drum management from a passive packaging function into an active data asset for end-users, further enhancing the value proposition of modern steel drums.

In summary, while the physical product has been a mainstay of industry for decades, the associated manufacturing processes, materials science (coatings), and supply chain management are evolving rapidly. This evolution ensures that cold-rolled steel drums will continue to be the container of choice for essential industrial bulk logistics, underpinned by their unmatched strength, durability, and superior environmental profile derived from their near-100% recyclability.

The investment outlook for the market remains positive, specifically favoring companies that can demonstrate both cost leadership through advanced automation and product differentiation through specialized certification and sustainable practices. Mergers and acquisitions are likely to continue as key players seek to consolidate regional market shares and acquire specialized coating or reconditioning capabilities to offer comprehensive lifecycle solutions to major clients.

Future research efforts will likely focus on developing lighter-gauge steel drums that maintain equivalent strength, reducing material costs while adhering to load-bearing standards. This drive for efficiency, combined with leveraging predictive analytics to optimize factory throughput, defines the trajectory of manufacturing excellence in the cold-rolled steel drum sector.

The demand for smaller capacity drums (e.g., 30-gallon) is expected to accelerate disproportionately as modern manufacturing shifts toward just-in-time inventory management and smaller batch production for high-value specialty chemicals. This shift requires suppliers to adapt their production lines to handle a greater variety of drum specifications efficiently.

The robust infrastructure supporting drum reconditioning in developed economies plays a crucial role in stabilizing market demand and reducing the overall environmental footprint of the industry. Partnerships between original equipment manufacturers (OEMs) and certified reconditioners are becoming tighter, ensuring quality and compliance standards are maintained throughout the drum's multi-year service life.

Geographically, investment flow is heavily favoring emerging manufacturing hubs. While Europe and North America focus on technological upgrades and maintaining quality standards, regions like India, Vietnam, and Indonesia are witnessing greenfield investments aimed at establishing large-scale drum fabrication facilities to meet domestic and regional export demands.

The implementation of stricter international maritime organization (IMO) regulations concerning freight and packaging integrity also mandates continuous investment in drum testing and certification. This regulatory environment favors large, established manufacturers with the resources and expertise to ensure continuous compliance across all product lines, further increasing barriers to entry for new competitors.

Considering the essentiality of steel drums for transporting critical industrial inputs, supply chain disruptions, such as those experienced during global health crises or geopolitical conflicts, highlight the strategic importance of resilient domestic or regional manufacturing capacity for cold-rolled steel drums, compelling end-users to secure diverse supply sources.

The adoption of advanced material handling systems by end-users, including automated drum filling and palletizing systems, necessitates strict adherence to dimensional consistency from drum manufacturers. Cold-rolled steel's inherent precision makes it the preferred material in highly automated facilities, reinforcing its market position.

Finally, the growing global population and rising middle-class consumption across developing markets drive incremental demand for products packaged in steel drums, including lubricants for new vehicles, chemicals for consumer goods production, and edible oils, securing a foundational level of growth for the foreseeable future.

The convergence of material science, digital technology, and stricter regulatory oversight is propelling the Cold Rolled Low Carbon Steel Drum Barrel Market into a phase defined by precision manufacturing and comprehensive lifecycle management, ensuring its vital role in the global industrial economy.

Further growth in the pharmaceuticals sector is anticipated, particularly as stringent global quality standards necessitate packaging that offers ultimate protection against oxygen and moisture ingress, a characteristic that well-sealed steel drums, especially those with specialized internal lacquer finishes, provide reliably.

The competitive landscape is characterized by strategic pricing and differentiation based on value-added services such as personalized logistics, vendor-managed inventory programs, and specialized coating applications rather than just bulk volume discounts. This shift highlights the maturing nature of the market.

Investments in sustainable manufacturing processes, such as reducing energy consumption in welding and painting operations, are becoming non-negotiable for large market players seeking alignment with corporate sustainability mandates issued by major industrial customers. This creates a feedback loop where ethical sourcing and production become competitive necessities.

In conclusion, the cold-rolled low carbon steel drum barrel market remains robust, resilient, and continuously optimizing, positioned to capture growth from essential global industrial activities while adapting to stringent safety and environmental mandates.

The increasing complexity of hazardous material transport requires manufacturers to not only adhere to existing UN requirements but also anticipate and comply with forthcoming global transport protocols, further emphasizing the need for robust quality assurance frameworks and continuous investment in advanced testing infrastructure. This proactive approach ensures market leadership and client confidence in handling sensitive cargo.

The specialized sub-segment of composite drums, which often utilize a cold-rolled steel outer shell combined with an inner plastic liner, is also seeing growth. This hybrid design caters to materials requiring the strength of steel combined with the chemical inertness of plastics, demonstrating market flexibility and innovation in addressing complex packaging needs.

Digital transformation extends to the sales and ordering process, with sophisticated B2B platforms allowing large customers to seamlessly track custom specifications, order history, and reconditioning status, minimizing administrative friction and strengthening supplier-customer relationships.

The development of innovative coatings for external applications also plays a role, with new anti-corrosion paints and powder coatings enhancing the longevity and aesthetic presentation of drums, particularly important for materials stored outdoors or for brand visibility in supply chains.

In essence, the market’s stability is derived from the non-substitutable nature of steel for certain applications where safety, durability, and high recyclability are paramount, solidifying its essential role in chemical, petroleum, and high-value commodity logistics for the foreseeable future.

The ongoing global focus on infrastructure development, especially in emerging economies, will continue to provide a baseline demand for steel drums used to package construction materials, asphalt, and machinery lubricants, providing a broad economic foundation for market expansion.

Lastly, labor challenges and the rising cost of skilled welding technicians are prompting manufacturers to accelerate the deployment of fully automated robotic welding cells, which not only address labor shortages but also deliver superior, consistent weld quality essential for UN compliance.

This comprehensive synthesis confirms that the Cold Rolled Low Carbon Steel Drum Barrel Market is characterized by mature technology, high barriers to entry related to capital expenditure and regulation, and steady, industrially driven demand, making it a reliable segment of the global industrial packaging market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager