Cold Rolled Steel Coil Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432440 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cold Rolled Steel Coil Market Size

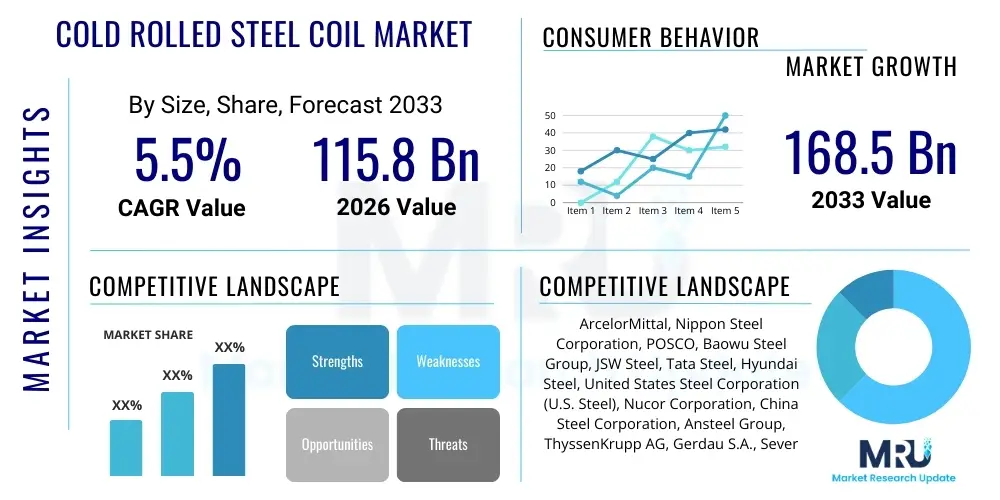

The Cold Rolled Steel Coil Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at $115.8 Billion USD in 2026 and is projected to reach $168.5 Billion USD by the end of the forecast period in 2033.

Cold Rolled Steel Coil Market introduction

The Cold Rolled Steel Coil Market encompasses the production and distribution of steel coils that have undergone a cold rolling process, resulting in superior surface finish, tighter thickness tolerances, and enhanced mechanical properties compared to hot rolled steel. Cold rolling involves reducing the thickness of hot rolled steel at room temperature (or slightly above) using a series of rollers. This mechanical working significantly increases the material's strength and hardness while providing a smooth, non-porous surface, making it ideal for applications requiring precision and aesthetic appeal. Key products include full hard coils, skin-passed coils, and annealed coils, each tailored to specific end-use requirements such as deep drawing or structural integrity.

Major applications driving the demand for cold rolled steel coils span several critical industrial sectors, most notably automotive, construction, and durable goods manufacturing. In the automotive industry, cold rolled steel is indispensable for producing body panels, structural components, and parts requiring high dimensional accuracy and paintability. The construction sector utilizes it for metal roofing, framing, and HVAC systems. Furthermore, its application in consumer appliances like refrigerators, washing machines, and electrical enclosures underscores its versatility and crucial role in modern manufacturing supply chains. The rigorous demand for lightweight, fuel-efficient vehicles and the global push for infrastructure development serve as primary market catalysts.

The principal benefits derived from using cold rolled steel coils include improved yield strength, excellent formability after annealing, and significantly better flatness and surface quality, which reduces subsequent finishing costs for manufacturers. Driving factors accelerating market expansion include the rapid industrialization across Asia Pacific, particularly in China and India, coupled with stringent quality requirements in high-end manufacturing. Technological advancements in cold rolling mills, such as continuous annealing lines and sophisticated gauge control systems, are further enabling producers to meet the evolving demands for high-strength, low-alloy (HSLA) steel grades, thereby sustaining market growth and competitive advantage globally.

Cold Rolled Steel Coil Market Executive Summary

The Cold Rolled Steel Coil Market is characterized by intense price volatility driven by raw material costs (iron ore and coking coal) and capacity utilization rates across major steel-producing nations. Business trends indicate a strong move toward specialization, with manufacturers focusing on advanced high-strength steels (AHSS) and ultra-high-strength steels (UHSS) to cater to the demanding requirements of the electric vehicle (EV) and lightweight construction segments. Strategic mergers and acquisitions are shaping the competitive landscape, aimed at consolidating regional market share and achieving economies of scale in high-volume production. Furthermore, sustainability initiatives, including the adoption of electric arc furnaces (EAFs) over traditional blast furnaces (BFs), are influencing production methods and supply chain decisions, albeit cold rolling remains energy-intensive, pushing companies towards optimized energy management systems.

Regionally, Asia Pacific maintains its dominance, primarily due to the massive consumption in the Chinese manufacturing hub and expanding infrastructure projects across Southeast Asia. North America and Europe demonstrate mature market characteristics, focusing on technological upgrades, recycling capabilities, and producing niche, high-value cold rolled products for sophisticated end-use applications like medical devices and aerospace components. Developing regions, including Latin America and the Middle East & Africa, show substantial potential, stimulated by urbanization and growing domestic automotive assembly plants. Geopolitical stability and trade tariffs, particularly regarding imported steel, exert significant influence on regional pricing strategies and supply route diversification, necessitating agile operational strategies for global market players.

Segmentation trends highlight the increasing prominence of high-strength steel grades (HSLA and AHSS) driven by vehicle lightweighting mandates, shifting market emphasis away from traditional commercial-grade cold rolled coils. By end-use, the automotive segment remains the largest consumer, but the construction and mechanical equipment sectors are exhibiting robust growth. In terms of processing, full hard cold rolled coils, often used for galvanizing or subsequent processing, hold a substantial share, while specialized products like electro-galvanized coils are growing due to their superior corrosion resistance required in demanding outdoor applications. This shift necessitates continuous investment in research and development to optimize the cold rolling process for harder, more complex alloy compositions without compromising surface finish or flatness standards.

AI Impact Analysis on Cold Rolled Steel Coil Market

Common user questions regarding AI's impact on the Cold Rolled Steel Coil Market often revolve around operational efficiency, quality control, predictive maintenance implementation, and the potential for autonomous mill operation. Users are primarily concerned with how AI can mitigate the high cost and complexity associated with defects (such as strip breakage, coil defects, or gauge variations) that plague traditional cold rolling processes. There is significant interest in using machine learning models to predict raw material quality impact on the final coil finish, optimize annealing cycles to save energy, and enhance overall throughput while maintaining strict tolerance levels. The core expectation is that AI will move the industry toward 'smart factories,' drastically reducing waste and maximizing yield, thereby increasing the competitiveness of domestic steel producers against global rivals.

- AI optimizes mill scheduling and resource allocation, minimizing idle time and maximizing throughput efficiency.

- Machine learning algorithms predict potential equipment failures in rolling mills (e.g., roller wear, bearing faults), enabling proactive maintenance and reducing costly unplanned downtime.

- Computer vision systems monitor strip surface quality in real-time, instantly identifying defects (pinholes, scratches, scale) that are undetectable by human operators.

- AI models analyze data from chemical composition and temperature sensors to optimize the annealing process, ensuring desired mechanical properties (ductility, hardness) while conserving energy.

- Predictive analytics assists in forecasting demand and pricing fluctuations, allowing steel producers to optimize inventory management and procurement strategies for raw materials.

- Reinforcement learning is employed to fine-tune complex control systems in cold rolling stands, achieving superior gauge and flatness control under high-speed operation.

- AI enhances supply chain traceability and logistics, managing complex global distribution networks for finished coils from mill to end-user.

- Natural Language Processing (NLP) is increasingly used in market intelligence gathering to quickly analyze global trade policy changes and commodity market sentiment impacting steel prices.

DRO & Impact Forces Of Cold Rolled Steel Coil Market

The Cold Rolled Steel Coil Market is strongly driven by global trends favoring lightweighting in the automotive industry and relentless expansion in residential and commercial construction, particularly in emerging economies. However, market growth is consistently restrained by volatile raw material costs, the high capital expenditure required for modern cold rolling facilities, and ongoing global overcapacity issues in primary steel production, which depress selling prices. Significant opportunities lie in the development and proliferation of specialized, coated cold rolled coils (e.g., galvannealed, electro-galvanized) and advanced high-strength variants crucial for safety and efficiency standards in modern manufacturing. These factors collectively create a dynamic competitive environment where technological adoption and supply chain resilience are key determinants of market success and long-term viability.

Segmentation Analysis

The Cold Rolled Steel Coil Market is systematically segmented based on various technical and commercial parameters, including material type, product form, thickness, application, and geography, to provide a detailed understanding of market dynamics. Segmentation by material type distinguishes between carbon steel, alloy steel, and stainless steel cold rolled products, each serving distinct industrial needs based on required strength and corrosion resistance. Product segmentation typically includes full hard, annealed, and skin-passed coils, which dictates the downstream processing and final mechanical properties. Understanding these segment dynamics is crucial for manufacturers to align their production capacity and technological investment with high-growth end-use sectors like automotive structural components and high-precision appliance casing.

- By Type:

- Full Hard Cold Rolled Coil

- Cold Rolled Annealed Coil (CRA)

- Cold Rolled Skin-Passed Coil (SPCC)

- Others (e.g., Electro-Galvanized, Aluminized)

- By Material:

- Carbon Steel (Low, Medium, High Carbon)

- Alloy Steel

- Stainless Steel (300 series, 400 series)

- Advanced High-Strength Steel (AHSS)

- By Thickness:

- Below 0.5 mm

- 0.5 mm to 1.5 mm

- Above 1.5 mm

- By Application/End-Use Industry:

- Automotive (Body panels, chassis, structural parts)

- Construction (Roofing, cladding, framing)

- Home Appliances (Refrigerators, washing machines, dryers)

- Electrical & Electronics (Casings, motor parts, transformers)

- Machinery & Equipment

- Others (Packaging, Furniture)

- By Geography:

- North America (US, Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (Saudi Arabia, UAE, South Africa)

Value Chain Analysis For Cold Rolled Steel Coil Market

The value chain for Cold Rolled Steel Coil begins with the highly capital-intensive upstream segment, dominated by iron ore mining and coking coal production, followed by primary steelmaking (Blast Furnace/Basic Oxygen Furnace or Electric Arc Furnace processes) to produce crude steel. This crude steel is then cast into slabs or billets. These intermediate products are subsequently hot rolled into Hot Rolled Coil (HRC), which serves as the essential raw material input for the cold rolling stage. The pricing and availability of HRC are the most significant cost drivers in the entire cold rolling value chain, heavily influencing the profitability margins of cold rolling operations which are largely considered secondary processing units.

The cold rolling process itself constitutes the core transformation stage, involving acid pickling, cold reduction (rolling), cleaning, annealing, and potentially temper rolling or skin passing to achieve desired mechanical properties and surface finish. Distribution channels for the finished cold rolled coils are highly complex, involving a mix of direct sales to large, captive end-users (like major automotive OEMs) and indirect distribution through extensive networks of service centers, distributors, and traders. Service centers play a critical role, offering value-added services such as slitting, cutting-to-length, and customized packaging, enabling smaller manufacturers to purchase tailored quantities.

Downstream analysis focuses on the application industries, where the coils are further processed through stamping, forming, welding, and painting into final goods. The efficiency and quality demands of these downstream users, particularly in the automotive and appliance sectors, dictate the required specifications (gauge tolerance, flatness, ductility) for cold rolled coils. The direct distribution model ensures high technical support and quality control for premium products, while indirect channels provide market reach and inventory flexibility, crucial for balancing supply and demand fluctuations across diverse geographical markets.

Cold Rolled Steel Coil Market Potential Customers

The primary consumers of Cold Rolled Steel Coils are large industrial manufacturers seeking materials with high surface quality, precise dimensions, and specific mechanical properties required for deep drawing, stamping, or coating. The automotive manufacturing sector is arguably the largest and most demanding customer segment, utilizing CRC for exposed body panels, internal structural components, and high-precision parts where weight reduction and aesthetic finish are paramount. The shift towards electric vehicle production has intensified the demand for AHSS cold rolled products, driving procurement specifications toward lighter and stronger materials capable of ensuring battery protection and overall vehicle integrity.

Another major buying group consists of manufacturers in the Heating, Ventilation, and Air Conditioning (HVAC) and general construction industries. These end-users rely on cold rolled steel for ductwork, metal roofing, framing components, and various construction fasteners, where durability and rust resistance (often achieved through subsequent galvanization of the cold rolled base) are key purchasing criteria. Similarly, the consumer durable goods sector, encompassing appliance manufacturers, is a consistent and high-volume buyer, requiring cold rolled coils with excellent flatness and paintability for producing aesthetically pleasing and reliable refrigerators, ovens, washing machines, and electronic enclosures.

In addition to these major sectors, the packaging industry (specifically for specialized containers and drums), the furniture industry (metal office furniture and shelving), and general engineering sectors (metal fabrication and machinery production) represent significant customer bases. Procurement decisions among these buyers are heavily influenced by factors such as coil cost stability, lead times, consistency of batch quality, and the availability of pre-processed (slit or cut) materials from local steel service centers. Long-term supplier relationships, often secured via volume contracts, are typical for securing consistent supply of specialized cold rolled grades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115.8 Billion USD |

| Market Forecast in 2033 | $168.5 Billion USD |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ArcelorMittal, Nippon Steel Corporation, POSCO, Baowu Steel Group, JSW Steel, Tata Steel, Hyundai Steel, United States Steel Corporation (U.S. Steel), Nucor Corporation, China Steel Corporation, Ansteel Group, ThyssenKrupp AG, Gerdau S.A., Severstal, Shougang Group, BlueScope Steel, Voestalpine AG, Essar Steel, Emirates Steel, Novolipetsk Steel (NLMK) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Rolled Steel Coil Market Key Technology Landscape

The technological landscape of the Cold Rolled Steel Coil Market is dominated by advancements aimed at increasing productivity, improving surface quality, and enabling the production of increasingly complex and high-strength steel grades. A primary technological focus is on Continuous Pickling and Cold Rolling Mills (CPCM), which integrate the traditionally separate pickling process (removing surface scale) and cold rolling into one seamless operation. This integration significantly reduces processing time, minimizes handling damages, and ensures a more uniform product quality entering the subsequent annealing stage. Modern CPCMs utilize advanced tension leveling systems and computerized gauge control (using X-ray or isotope measurements) to maintain stringent thickness tolerances across the entire coil length, a critical requirement for high-speed stamping operations in automotive manufacturing.

Another crucial area of innovation is in thermal processing, specifically Continuous Annealing Lines (CALs). Unlike batch annealing, which is slow and less uniform, CALs rapidly heat and cool the steel strip, achieving precise control over the microstructural properties, thereby dictating the final ductility and strength of the coil. The adoption of advanced gas jet cooling and specialized furnace atmospheres in CALs is essential for producing sophisticated AHSS and UHSS grades without compromising the desirable clean, bright surface finish characteristic of cold rolled products. Furthermore, advancements in specialized coatings, such as continuous galvanizing lines (CGL) integrated with skin passing, allow manufacturers to offer enhanced corrosion resistance directly within the cold rolling facility, increasing the value proposition of the finished coil.

Digitalization and automation are also transforming the market. The implementation of Level 2 and Level 3 automation systems, leveraging advanced sensors, real-time data analytics, and machine learning, allows for predictive maintenance and closed-loop control over critical parameters like rolling force, strip temperature, and flatness. These technologies not only reduce operational variability and scrap rates but also enable faster grade changes, enhancing the mill's flexibility to cater to diverse customer orders. The development of specialized lubricants and rolling fluids that reduce friction and improve the longevity of work rolls further contributes to efficiency and the maintenance of superior surface quality, cementing the technological push for high-precision, low-defect cold rolled products.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC remains the undisputed global leader in both production and consumption of cold rolled steel coils, driven primarily by China's extensive manufacturing base and large-scale infrastructure and residential construction activity. Countries like India, Vietnam, and Indonesia are experiencing rapid urbanization and industrial growth, fueling high demand, particularly from the automotive and consumer electronics industries. Regional governments often support domestic steel production, leading to continuous capacity expansion and intense competition.

- North America Market Maturity and Specialization: The North American market, characterized by stringent quality standards, is focused on high-value, niche cold rolled products, specifically AHSS and UHSS grades required by major automotive original equipment manufacturers (OEMs). The region places a strong emphasis on domestic sourcing and high recycling rates, utilizing advanced cold rolling technologies to achieve superior flatness and strength for applications in lightweighting vehicles and high-rise construction.

- Europe's Emphasis on Sustainability and Quality: European consumption is driven by the highly advanced German automotive sector and widespread use in the sophisticated machinery and equipment industry. European manufacturers face strict environmental regulations, pushing the industry toward cleaner production methods and the development of specialized, energy-efficient cold rolled products. The focus is heavily on high-specification, low-tolerance coils for premium applications.

- Latin America's Emerging Automotive Hub: Latin America, particularly Brazil and Mexico, presents significant growth opportunities, largely tied to expanding regional automotive assembly plants and growing domestic demand for construction materials and appliances. Market growth is sensitive to commodity price fluctuations and regional economic stability, but increasing foreign investment in local manufacturing capabilities supports sustained demand for locally processed cold rolled coils.

- Middle East & Africa (MEA) Infrastructure Boom: The MEA region shows robust demand, predominantly linked to massive infrastructure projects (e.g., in Saudi Arabia, UAE) and the expansion of oil and gas related construction. While local production capacity is growing (e.g., Emirates Steel), the region relies significantly on imports of high-quality cold rolled products to meet diverse architectural and industrial specifications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Rolled Steel Coil Market.- ArcelorMittal

- Nippon Steel Corporation

- POSCO

- Baowu Steel Group

- JSW Steel

- Tata Steel

- Hyundai Steel

- United States Steel Corporation (U.S. Steel)

- Nucor Corporation

- China Steel Corporation

- Ansteel Group

- ThyssenKrupp AG

- Gerdau S.A.

- Severstal

- Shougang Group

- BlueScope Steel

- Voestalpine AG

- Essar Steel

- Emirates Steel

- Novolipetsk Steel (NLMK)

- Shandong Iron and Steel Group

- HBIS Group

- Jindal Steel and Power Limited

- Cleveland-Cliffs Inc.

- AK Steel Corporation

Frequently Asked Questions

Analyze common user questions about the Cold Rolled Steel Coil market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between hot rolled and cold rolled steel coils?

The primary difference is the temperature at which the steel is processed. Hot rolled steel is processed above its recrystallization temperature, resulting in softer, less precise material, while cold rolled steel is processed at or near room temperature, yielding tighter dimensional tolerances, superior surface finish, and higher strength due to work hardening.

Which application segment drives the highest demand for Cold Rolled Steel Coil?

The automotive industry currently drives the highest demand for Cold Rolled Steel Coil, particularly for use in body panels, structural components, and parts requiring precision fit and excellent surface quality for painting and corrosion resistance. The shift toward lightweight AHSS in EVs is sustaining this high demand.

What technological advancements are key to increasing the efficiency of cold rolling mills?

Key technological advancements include the integration of Continuous Pickling and Cold Rolling Mills (CPCM), the use of sophisticated Continuous Annealing Lines (CALs) for microstructure control, and advanced automation systems (Level 2/3) utilizing AI for real-time gauge control and predictive maintenance, enhancing throughput and reducing defects.

How do volatile raw material prices affect the Cold Rolled Steel Coil Market?

Volatility in raw material prices, primarily iron ore and coking coal, directly impacts the cost of Hot Rolled Coil (HRC), the main input for cold rolling. This volatility compresses the profit margins of cold rolling producers and necessitates hedging strategies and flexible pricing models to manage supply chain risks effectively.

Which geographical region exhibits the fastest growth rate in the Cold Rolled Steel Coil Market?

The Asia Pacific (APAC) region, specifically emerging economies like India and Southeast Asia, exhibits the fastest growth rate, fueled by rapid industrialization, large-scale infrastructure projects, and increasing consumer spending on durable goods and automotive production.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager