Cold Seal Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437161 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Cold Seal Packaging Market Size

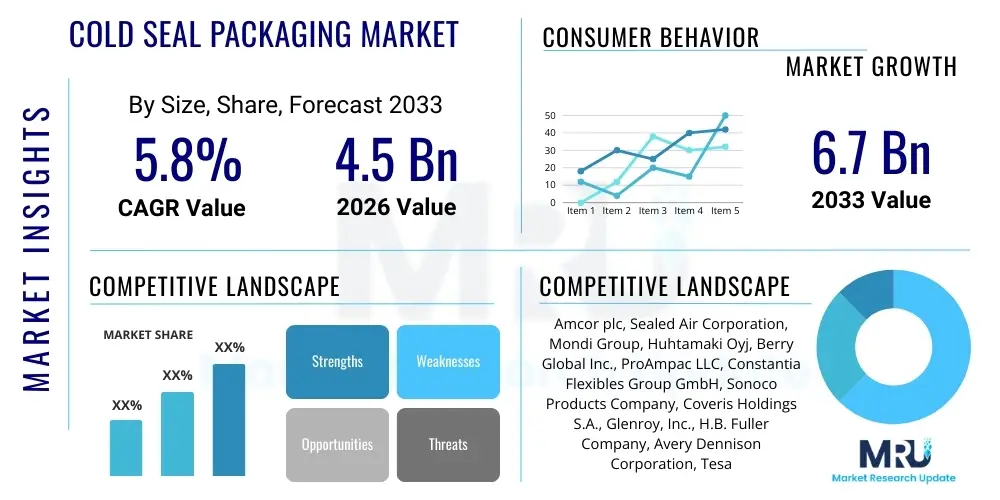

The Cold Seal Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.5 billion in 2026 and is projected to reach USD 6.7 billion by the end of the forecast period in 2033.

Cold Seal Packaging Market introduction

The Cold Seal Packaging Market encompasses packaging solutions that utilize self-adhesive coatings, such as latex or cohesive materials, applied to substrates like paper, film, or foil. These coatings adhere only to themselves under pressure, eliminating the need for heat, solvent, or extensive drying time during the packaging process. This heatless sealing mechanism is crucial for protecting heat-sensitive products, including confectionery, frozen goods, baked items, pharmaceuticals, and medical devices. The primary product descriptions include cold seal wraps, laminates, and pouches, often tailored for high-speed automated packaging lines where efficiency and product integrity are paramount.

Major applications for cold seal technology span the food and beverage industry, particularly in chocolate and candy bar wrapping, snack foods, and individual serving packs, where the aesthetic quality and quick turnaround are vital. In the healthcare sector, cold seal packaging ensures sterility for single-use medical kits, devices, and diagnostic products, benefiting from the reduced risk of product deformation caused by heat. The inherent benefits include superior product protection against moisture and contaminants, faster production cycles, reduced energy consumption compared to traditional heat-sealing methods, and enhanced sustainability credentials due to material versatility and lighter weight.

Key driving factors propelling the expansion of the Cold Seal Packaging Market include the escalating demand for convenient, on-the-go snack packaging, stringent regulatory requirements in the pharmaceutical and medical device sectors demanding secure and sterile seals, and the growing focus among manufacturers on minimizing environmental impact and operational costs. Furthermore, rapid urbanization and increasing disposable income in emerging economies are bolstering the consumption of packaged food items, directly translating to higher demand for specialized sealing solutions like cold seals.

Cold Seal Packaging Market Executive Summary

The Cold Seal Packaging Market is poised for significant expansion, driven by robust demand from the confectionery and medical sectors globally. Key business trends indicate a strong industry focus on developing cohesive materials with enhanced barrier properties, particularly against oxygen and moisture, to extend product shelf life. There is also a notable shift towards sustainable and recyclable cold seal substrates, responding directly to consumer and regulatory pressure for environmentally friendly packaging solutions. Automation in packaging lines continues to be a central investment theme, requiring cohesive materials optimized for ultra-high-speed sealing applications, thus elevating efficiency and reducing material waste.

Regionally, North America and Europe currently dominate the market due to established pharmaceutical and food processing infrastructures and high adoption rates of advanced packaging technologies. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by expanding population bases, burgeoning middle classes increasing consumption of packaged snacks, and substantial investments in the regional manufacturing sectors. Specific regional trends include China's focus on domestic cold chain infrastructure improvement and India’s growing pharmaceutical manufacturing hub, both accelerating the need for reliable, temperature-agnostic sealing solutions.

Segment-wise, the market is primarily segmented by material type (films, paper, foil), application (food, medical, industrial), and end-use industry. The film segment, especially flexible packaging films incorporating cohesive latex, maintains the largest market share owing to its versatility and superior barrier performance required for food preservation. The confectionery segment remains the dominant application, though the medical segment, driven by strict standards for sterile barrier systems (SBS), exhibits the fastest growth trajectory, demanding specialized materials that ensure peel strength and integrity without compromising the sterile environment.

AI Impact Analysis on Cold Seal Packaging Market

Common user inquiries regarding AI's influence on the Cold Seal Packaging Market frequently center on themes of operational efficiency, quality control, predictive maintenance, and personalized packaging design. Users are concerned with how AI can optimize high-speed cold seal machinery settings to minimize defects and material scrap, ensuring consistent seal integrity across millions of units. There is also significant interest in using machine learning algorithms to analyze real-time production data, predict material cohesive failures, and automate inventory management based on fluctuating supply chain dynamics. Furthermore, the role of generative AI in designing complex, multi-layered cold seal structures tailored for specific product requirements or optimizing supply chain logistics is a prominent area of user expectation and analysis.

- AI-Powered Quality Control: Implementing computer vision and machine learning (ML) algorithms to inspect cold seals in real-time, instantly identifying micro-leaks or inconsistencies that are invisible to the human eye, leading to near-zero defect rates in sterile packaging.

- Predictive Maintenance: Utilization of sensor data and AI models to predict potential mechanical failures in cold seal applicators or cutting systems, scheduling proactive maintenance to minimize unplanned downtime crucial for high-volume candy and medical packaging operations.

- Supply Chain Optimization: AI-driven logistics platforms optimizing the sourcing and delivery of specialized cohesive materials (latex/non-latex), managing variable lead times, and reducing warehousing costs for converters and end-users.

- Formulation and Material Science: Machine learning accelerating the R&D cycle for new, sustainable, bio-based cold seal formulations by simulating cohesive performance, barrier properties, and peelability characteristics under various environmental conditions.

- Process Parameter Optimization: Using reinforcement learning to autonomously adjust packaging machine parameters (pressure, speed, tension) in dynamic environments to maintain optimal sealing performance regardless of minor material variations or ambient temperature shifts.

The integration of artificial intelligence is fundamentally transforming packaging line management from reactive failure correction to proactive operational optimization. For cold seal technologies, where sealing integrity is paramount but relies solely on controlled pressure application, AI provides the necessary precision to manage complex variables such as substrate thickness uniformity, cohesive coating weight, and environmental humidity. This increased control not only minimizes waste but also enhances the reliability of the packaging, which is non-negotiable for sectors like pharmaceuticals. AI systems monitor the complex interplay of hundreds of variables simultaneously, surpassing the capability of traditional Statistical Process Control (SPC) methods.

Moreover, AI is playing a critical role in the sustainability agenda of the Cold Seal Packaging Market. By optimizing material utilization and minimizing defective output, AI directly contributes to reducing the overall carbon footprint of packaging operations. Furthermore, AI tools are helping designers simulate the recyclability and compostability of new flexible packaging materials before large-scale production, accelerating the shift towards mono-material structures that still require reliable, non-heat-activated sealing mechanisms. This confluence of operational efficiency and sustainability focus solidifies AI as a major enabling technology for future cold seal advancements.

DRO & Impact Forces Of Cold Seal Packaging Market

The Cold Seal Packaging Market is influenced by a dynamic interplay of factors. Key drivers include the accelerated adoption of flexible packaging across high-speed consumer goods sectors, coupled with the critical need for non-heat-sealing methods for sensitive products like diagnostic strips and premium confectionery. Restraints primarily involve the relatively higher cost of specialized cohesive materials (latex or non-latex alternatives) compared to standard heat-seal polymers, alongside technical challenges related to maintaining long-term shelf-life barrier properties in specific laminated cold seal structures. Opportunities abound in developing bio-based and highly recyclable cohesive materials, expanding applications in e-commerce protective packaging, and penetrating fast-growing medical and nutraceutical markets that require tamper-evident, sterile packaging. Impact forces are derived from rigorous governmental regulations on food contact safety and pharmaceutical packaging standards, compelling manufacturers toward secure and verifiable sealing technologies, thus favoring cold seal solutions over less reliable alternatives.

Segmentation Analysis

The Cold Seal Packaging Market is intricately segmented based on material, end-use application, and packaging format, enabling suppliers to cater precisely to diverse industry needs. Material segmentation, covering films, paper, and foil, dictates barrier properties and required sustainability features, with polymer films dominating due to their versatility and customizable performance characteristics. End-use application partitioning highlights the market's reliance on the high-volume confectionery and bakery sectors, contrasted with the high-value medical and pharmaceutical applications which demand absolute sealing reliability. Furthermore, the segmentation by format—such as rolls, pouches, and wrappers—reflects the deployment modality across different automated packaging machines globally.

- By Material Type:

- Paper & Paperboard

- Films (Polypropylene (PP), Polyethylene (PE), Polyethylene Terephthalate (PET), BOPP)

- Foil

- Others (Non-woven materials)

- By Application:

- Food & Beverages (Confectionery, Bakery, Dairy, Frozen Foods)

- Pharmaceuticals & Medical (Medical Devices, Diagnostic Kits, Over-the-counter drugs)

- Industrial (Electronics, Component Kits)

- Cosmetics & Personal Care

- By Packaging Format:

- Rolls & Wraps (Used primarily for high-speed horizontal form-fill-seal machines in confectionery)

- Pouches & Bags (Used for smaller runs or specialized medical applications)

Understanding these segmentations is vital for strategic market planning. For instance, the demand for cold seal paper is strongly tied to sustainability initiatives, offering a fiber-based, readily recyclable alternative to plastic films, particularly favored by premium food brands seeking eco-friendly labeling. Conversely, the film segment is experiencing rapid innovation, focusing on multi-layer laminates that integrate advanced barrier layers (like EVOH or metallic coatings) to preserve oxygen-sensitive products, necessitating highly stable cohesive coatings that function optimally under varying processing pressures and environments.

The distinction between the food and medical application segments determines compliance requirements and material selection. In the food sector, the emphasis is often on cost-effectiveness and high-speed throughput, while the medical segment focuses entirely on compliance with ISO 11607 (packaging for terminally sterilized medical devices), requiring peelable, particulate-free seals, which cold seal technology is uniquely positioned to deliver without affecting device function or material integrity. This inherent benefit makes cold seal solutions indispensable for complex medical assemblies and sterilization processes where heat exposure is prohibitive.

Value Chain Analysis For Cold Seal Packaging Market

The value chain for the Cold Seal Packaging Market begins with upstream activities involving raw material suppliers, predominantly chemical manufacturers providing specialized cohesive agents (synthetic latex or silicone-based alternatives) and substrate producers (polymer resin manufacturers, paper mills, and foil converters). These raw materials are processed by converting companies, who apply the cohesive coating, print graphics, and laminate multiple layers to create the final flexible packaging material. These converters play a critical role, as the precision of cohesive application directly impacts the final product's sealing strength and peel characteristics. Innovation upstream focuses on developing bio-based or non-latex cohesive materials to address allergic concerns and environmental pressures, driving significant R&D investments among chemical suppliers.

The mid-stream encompasses the packaging manufacturers (converters) who transform raw films, papers, and foils into finished cold seal rolls, wrappers, and pre-formed pouches. They employ specialized coating and slitting machinery. The distribution channel is segmented into direct sales (large converters dealing directly with major multinational CPG or pharmaceutical companies) and indirect sales (distribution networks catering to smaller enterprises and regional manufacturers). The choice of distribution model is often governed by the volume and technical complexity of the required packaging material, with direct channels dominating specialized, high-barrier medical packaging.

Downstream activities include the end-users—specifically CPG companies, confectioners, and medical device manufacturers—who utilize high-speed automated packaging machines (Horizontal Form-Fill-Seal, or HFFS) to apply the cold seal materials to their products. The efficiency of the cold seal material directly influences the end-user's operational costs and production speed. Therefore, strong collaboration between converters and end-users on machine compatibility and material runnability is critical. The final stage involves the consumer and subsequent waste management processes, where the recyclability or compostability of the cold seal structure impacts the material's total life cycle value and market acceptance.

Cold Seal Packaging Market Potential Customers

Potential customers and end-users of Cold Seal Packaging solutions span a wide range of industries, driven primarily by the need for rapid, low-temperature sealing of sensitive or perishable goods. The largest segment remains the food industry, specifically large-scale confectionery manufacturers and bakery operations that require high-speed wrapping for items like chocolate bars, granola bars, and cookies, where heat would melt or damage the product. These customers seek materials that offer excellent grease resistance, moisture protection, and high machinability to maintain operational throughput while ensuring product integrity and aesthetic appeal.

The pharmaceutical and medical device sectors represent another critical potential customer base. Manufacturers of diagnostic test kits, medical swabs, surgical gloves, and sensitive electronic medical components rely heavily on cold seal technology to create sterile barrier systems (SBS) that can withstand gamma irradiation or E-beam sterilization without seal degradation. For these buyers, regulatory compliance, validated seal strength, peel consistency (clean, particulate-free peel), and tamper-evidence features are non-negotiable purchasing criteria. The shift toward smaller, personalized medical kits further drives demand for customized cold seal pouches.

Furthermore, e-commerce and industrial customers are increasingly adopting cold seal solutions for protective and secure packaging of electronic components, spare parts, and retail fulfillment items. The immediate, tape-free closure capability of cohesive materials makes them ideal for manual or semi-automated packing stations, reducing labor costs and improving package security during transit. These diverse customer demands necessitate that converters offer a wide portfolio of cold seal materials, ranging from basic paper-based wraps for food to highly engineered multilayer films for critical medical applications, ensuring market resilience across varied economic cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 billion |

| Market Forecast in 2033 | USD 6.7 billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor plc, Sealed Air Corporation, Mondi Group, Huhtamaki Oyj, Berry Global Inc., ProAmpac LLC, Constantia Flexibles Group GmbH, Sonoco Products Company, Coveris Holdings S.A., Glenroy, Inc., H.B. Fuller Company, Avery Dennison Corporation, Tesa SE, Tekni-Plex, Inc., UPM Raflatac, Interflex Group, Specialty Tapes Manufacturing, Pregis LLC, Flexi-Seal Packaging, Printpack Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Seal Packaging Market Key Technology Landscape

The Cold Seal Packaging Market relies on sophisticated coating and lamination technologies to achieve reliable self-sealing functionality. The fundamental technology involves the precision application of cohesive materials, primarily solvent-based, water-based, or solvent-less synthetic latex or non-latex silicone polymers, onto a substrate. Advanced coating techniques, such as gravure coating and flexographic printing, are utilized to ensure uniform weight and pattern of the cohesive layer, which is critical for consistent seal strength and controlled peelability. Recent technological evolution focuses heavily on developing pressure-sensitive cohesive agents that retain their efficacy across a wider range of temperatures and humidity levels, mitigating environmental variations commonly found on high-speed packaging lines.

A significant area of innovation is in non-latex cohesive formulations. Driven by concerns over latex allergies, especially in the medical device sector, manufacturers are investing in synthetic alternatives that offer comparable, or superior, seal strength and clean-peel performance. This technological shift requires precise control over polymer chemistry and particle size distribution to ensure effective self-adhesion under minimal pressure. Furthermore, the integration of peel-strength monitoring and validation systems into the coating process allows converters to certify the integrity of the cold seal material before it reaches the end-user, adhering to strict quality standards demanded by pharmaceutical clients.

Another crucial technological development involves creating multi-layer cold seal laminates with advanced barrier technologies. This involves co-extrusion and adhesive lamination techniques to combine barrier films (like metallized PET or nylon) with the cohesive substrate, all while ensuring the cohesive layer remains uncontaminated and functional. These sophisticated structures aim to extend the shelf life of highly sensitive food items without resorting to heat sealing. The trend towards mono-material flexible structures for enhanced recyclability necessitates technological breakthroughs that allow the cohesive agent to function effectively on typically challenging substrates, demanding high performance from the sealing machinery (the HFFS or VFFS equipment) which must apply the precise pressure required for bonding.

Regional Highlights

Geographical market dynamics reveal varying adoption rates and technological maturity for cold seal packaging across the globe, heavily influenced by regional manufacturing hubs and consumer behavior. North America commands a substantial share of the market, driven by the presence of large multinational pharmaceutical companies requiring compliant sterile packaging and a mature, demanding consumer packaged goods (CPG) sector that favors innovative and convenient snacking formats. The region benefits from early adoption of high-speed automation and stringent regulatory environments that favor secure, tamper-evident seals.

Europe represents another cornerstone of the cold seal market, particularly due to its robust confectionery sector and leading position in sustainability initiatives. European regulations encourage the use of recyclable and mono-material packaging, spurring innovation in paper-based cold seal solutions and non-latex cohesives. Germany and the UK are key contributors, hosting major pharmaceutical and food manufacturers who rely on quick, efficient packaging lines. The shift towards sustainable materials often leads to higher R&D expenditure in the European market compared to other regions, focusing on performance-grade, biodegradable cold seal agents.

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR during the projection period. This rapid growth is attributable to massive industrialization, soaring populations, rising disposable incomes, and the consequent expansion of packaged food consumption, particularly in China and India. While cold seal adoption was initially slower than traditional heat sealing, the increasing penetration of automated packaging machinery and the establishment of local medical device manufacturing hubs are accelerating demand. Latin America and the Middle East & Africa (MEA) are emerging markets, primarily driven by investments in food processing infrastructure and gradual urbanization, presenting opportunities for cost-effective, high-speed cold seal solutions in basic food wrapping applications.

- North America: Market leader due to large pharmaceutical and snack food industries; strong emphasis on compliance and high-speed automation; focus on medical device sterile barrier systems.

- Europe: Second largest market; driven by strict sustainability mandates and a sophisticated confectionery market; high demand for paper-based and bio-based cold seal materials.

- Asia Pacific (APAC): Fastest growing region; massive volume potential fueled by rising packaged food consumption in China and India; increasing investment in domestic medical manufacturing requiring sterile packaging.

- Latin America (LATAM): Emerging market characterized by increasing foreign investment in food processing; demand focused on efficient, durable wrapping solutions for consumer goods.

- Middle East & Africa (MEA): Growth driven by expanding retail sector and infrastructure development; initial focus on basic food packaging and localized manufacturing needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Seal Packaging Market.- Amcor plc

- Sealed Air Corporation

- Mondi Group

- Huhtamaki Oyj

- Berry Global Inc.

- ProAmpac LLC

- Constantia Flexibles Group GmbH

- Sonoco Products Company

- Coveris Holdings S.A.

- Glenroy, Inc.

- H.B. Fuller Company

- Avery Dennison Corporation

- Tesa SE

- Tekni-Plex, Inc.

- UPM Raflatac

- Interflex Group

- Specialty Tapes Manufacturing

- Pregis LLC

- Flexi-Seal Packaging

- Printpack Inc.

Frequently Asked Questions

Analyze common user questions about the Cold Seal Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of cold seal packaging over traditional heat sealing?

Cold seal packaging utilizes pressure-sensitive cohesive coatings that bond without the application of heat, which is essential for protecting heat-sensitive products like chocolates, frozen goods, and certain medical devices from damage or degradation. It also results in significantly faster packaging line speeds and reduces energy consumption, leading to lower operational costs.

Is cold seal packaging suitable for medical and pharmaceutical applications?

Yes, cold seal packaging is highly suitable and widely used in the medical sector. It is crucial for creating sterile barrier systems (SBS) for diagnostic kits and devices, as the heatless process ensures product integrity and allows for a clean, particulate-free peel. Compliance with ISO 11607 standards often favors validated cold seal processes.

Are there sustainable and recyclable options available for cold seal materials?

The industry is rapidly developing sustainable cold seal options, including structures utilizing paper substrates and mono-material films (e.g., all-PE or all-PP) that are easier to recycle than traditional multi-layer laminates. Furthermore, bio-based and non-latex cohesive agents are being introduced to enhance the overall environmental profile of the packaging.

What is the role of cohesive materials (latex vs. non-latex) in cold seal technology?

Cohesive materials are the specialized coatings that allow the packaging material to stick only to itself under pressure. Latex-based cohesives are common but non-latex alternatives (synthetic polymers, silicones) are gaining significant traction, particularly in applications like medical device packaging and sensitive food items, to mitigate allergen risks while ensuring strong, reliable sealing performance.

Which end-use industry drives the largest demand for cold seal solutions?

The confectionery sector, including manufacturers of chocolate, candy, and nutritional bars, represents the largest and most established end-use industry for cold seal packaging. The high-speed requirements and the need to protect products from melting or deformation during the sealing process make cold seal technology indispensable for these high-volume operations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cold Seal Packaging in Food Market Statistics 2025 Analysis By Application (Chocolates Packaging, Bakery Goods Packaging, Nutritional Bars Packaging, Ice Creams Packaging, Others), By Type (Polypaper, Film, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cold Seal Packaging Machines Market Statistics 2025 Analysis By Application (Food Industry, Pharmaceuticals, Others), By Type (Semi-automatic, Full-automatic), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cold Seal Packaging Market Statistics 2025 Analysis By Application (Food Industry, Pharmaceuticals, Others), By Type (Polypaper, Film, Others), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager