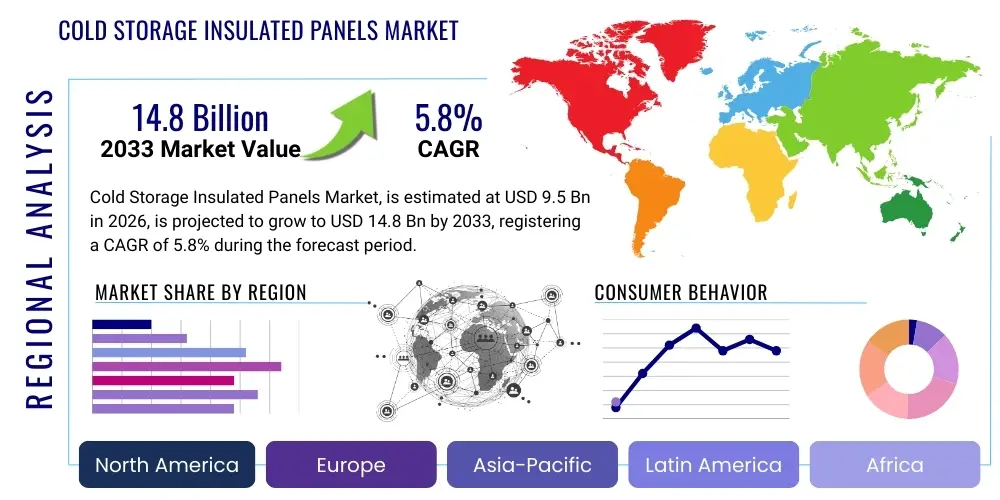

Cold Storage Insulated Panels Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439048 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cold Storage Insulated Panels Market Size

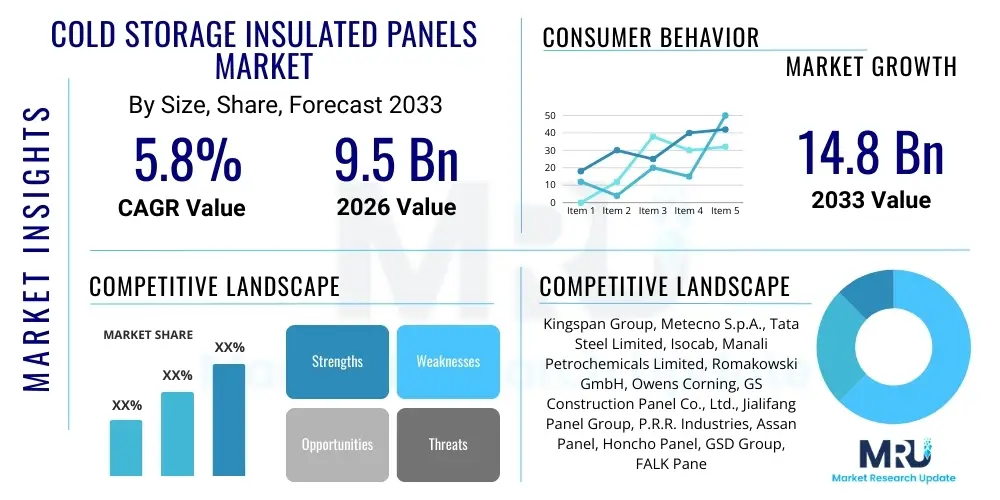

The Cold Storage Insulated Panels Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 9.5 Billion in 2026 and is projected to reach USD 14.8 Billion by the end of the forecast period in 2033.

Cold Storage Insulated Panels Market introduction

The Cold Storage Insulated Panels Market encompasses the design, manufacture, and deployment of structural insulating panels specifically engineered to maintain precise temperature control within cold chain infrastructure. These panels are foundational components for constructing refrigerated warehouses, distribution centers, processing plants, and various commercial cold rooms. They are crucial for minimizing thermal transfer, thereby ensuring energy efficiency and compliance with stringent food safety and pharmaceutical storage regulations across the globe. The panels typically consist of a core insulating material, such as Polyurethane (PU), Polyisocyanurate (PIR), or Expanded Polystyrene (EPS), sandwiched between two structural facings, often pre-painted galvanized iron (PPGI) or stainless steel, selected for durability and hygiene.

The primary application areas for these high-performance panels span the entire cold chain ecosystem, including food and beverage processing, deep-freeze storage, temperature-controlled logistics, and pharmaceutical manufacturing and distribution. Their critical benefit lies in providing superior thermal resistance compared to traditional building materials, significantly reducing the operational costs associated with refrigeration while maintaining product integrity over extended periods. Furthermore, the modular nature of insulated panels allows for rapid construction and scalability, addressing the urgent demand for expanded cold storage capacity driven by global shifts in consumer spending habits and the increasing complexity of international trade.

Major driving factors fueling the expansion of this market include the relentless globalization of the perishable goods trade, the necessity for robust cold chain logistics in emerging economies, and heightened regulatory standards demanding better control over temperature-sensitive products. The pharmaceutical industry’s increased reliance on biologics and vaccines, which require ultra-low temperatures, has further cemented the demand for advanced panel technologies offering enhanced R-values and structural longevity. Continuous innovation in core materials, focusing on fire resistance (PIR) and sustainability, continues to shape the competitive landscape and drive market adoption globally, positioning cold storage insulated panels as indispensable assets in modern infrastructure development.

Cold Storage Insulated Panels Market Executive Summary

The Cold Storage Insulated Panels Market is currently experiencing robust growth, primarily propelled by systemic shifts in global supply chains and accelerated investments in temperature-controlled logistics infrastructure. Key business trends indicate a strong move toward high-performance materials, particularly PIR panels, which offer superior fire resistance and energy efficiency compared to traditional PU panels, appealing directly to large-scale industrial and pharmaceutical clients seeking compliance and reduced insurance premiums. Furthermore, consolidation among panel manufacturers and cold chain logistics providers is leading to integrated solutions that encompass design, construction, and monitoring, optimizing project timelines and overall facility performance.

Regionally, the Asia Pacific (APAC) market, spearheaded by countries like China and India, is registering the fastest expansion due to massive infrastructure development, rapid urbanization, and significant government initiatives aimed at reducing post-harvest food losses. North America and Europe, while mature, remain crucial markets, driven primarily by technological upgrades, replacement cycles, and stringent energy efficiency mandates, leading to high adoption rates of advanced composite materials and phase-change materials integrated into panel systems. The Middle East and Africa (MEA) are also emerging as high-potential regions, leveraging insulated panel technology to establish reliable cold chains in challenging climates, especially concerning meat and fresh produce imports.

Segment-wise, the Polyurethane (PU) and Polyisocyanurate (PIR) segments dominate the market share, with PIR witnessing faster growth due to its superior thermal performance and fire safety attributes crucial for regulatory compliance in major economies. Application trends show the highest consumption occurring within the food and beverage industry, particularly in meat, dairy, and frozen food processing and distribution centers. However, the pharmaceutical and healthcare segment is demonstrating the most significant CAGR, driven by the increasing complexity of pharmaceutical cold chains, which require highly reliable, specialized panel solutions for validation and maintenance of ultra-low temperatures necessary for sensitive biological products.

AI Impact Analysis on Cold Storage Insulated Panels Market

User inquiries regarding AI's influence in the cold storage panel market frequently revolve around predictive maintenance, optimization of panel deployment, and enhancing the energy efficiency of the total cold storage envelope. Users are keen to understand how AI-driven analytics can move beyond general facility management to specifically monitor the structural integrity and thermal performance of insulated panels over time, identifying potential failures such as air leaks, moisture ingress, or thermal bridging before they compromise the cold chain. Key concerns also focus on integrating AI feedback loops into panel manufacturing processes to improve quality control and material usage, ensuring that manufactured panels meet specified R-values consistently. Expectations are high that AI will transform the traditionally reactive maintenance model into a proactive, data-informed system, extending the operational lifespan of cold storage facilities and drastically reducing power consumption.

The immediate impact of AI is centered on optimizing the energy consumption of refrigeration systems, where sensor data collected from or near the panels (monitoring surface temperature, humidity, and pressure differentials) feeds into machine learning algorithms. These algorithms predict the optimal time and duration for cooling cycles, directly minimizing the heat load that the panels must resist, thereby enhancing their perceived efficiency. Furthermore, AI is being utilized in the design phase, employing generative design tools that test thousands of panel configurations and material combinations based on specific regional climate data, insulation requirements, and structural loads, resulting in custom-optimized panel structures that maximize performance per unit cost.

Looking ahead, AI integration is expected to revolutionize cold storage asset management. By analyzing patterns of stress, vibration, and thermal fluctuations detected by embedded IoT sensors within the panel structure, AI models will provide real-time condition monitoring. This capability is paramount for validating compliance in pharmaceutical storage, where temperature excursions can result in millions of dollars in losses. The integration of AI also aids in supply chain efficiency for panel manufacturers, predicting raw material demands and optimizing production schedules based on regional construction forecasts and specific project requirements, ensuring timely delivery of complex, custom-sized panel systems.

- AI algorithms optimize refrigeration cycles based on real-time panel performance data.

- Predictive maintenance identifies panel degradation (e.g., thermal breaches, moisture) before failure occurs.

- Generative design utilizes AI to optimize panel geometry and material mix for maximal R-value.

- Enhanced quality control during manufacturing via machine vision systems linked to AI for defect detection.

- AI supports dynamic load management, extending panel lifespan and reducing structural stress.

- Integration of deep learning models for comprehensive cold chain temperature validation and compliance reporting.

DRO & Impact Forces Of Cold Storage Insulated Panels Market

The Cold Storage Insulated Panels Market is characterized by strong fundamental drivers centered on global food security and pharmaceutical necessity, though it faces constraints related to material costs and environmental regulations. The overarching market dynamic is shaped by the relentless expansion of the organized retail sector and the booming e-commerce penetration into fresh and frozen goods, requiring massive build-outs of localized and centralized cold chain hubs. Opportunities are highly concentrated in sustainable innovation, particularly the development of high-efficiency, non-ODS (Ozone-Depleting Substances) blowing agents and bio-based panel materials, attracting significant investment. The confluence of these factors, alongside external geopolitical and supply chain disruptions, results in complex impact forces influencing pricing, adoption rates, and technological standards.

Key drivers include the imperative to reduce global food waste, which mandates robust cold chain infrastructure, especially in developing economies where loss rates are highest. Furthermore, the specialized storage needs associated with advanced healthcare products, notably mRNA vaccines and biologics, necessitates ultra-low temperature panels that are structurally and thermally superior. Conversely, the market is restrained by the high initial capital expenditure required for cold storage facility construction compared to ambient storage. Additionally, the fluctuating costs of petrochemical-derived raw materials, such as MDI and Polyol used in PU/PIR foams, introduce significant volatility into the manufacturing cost structure. Stringent fire safety regulations, while driving adoption of PIR, also increase overall complexity and manufacturing costs.

Major opportunities are found in the modernization of aging cold storage facilities in established markets (replacement cycles) and the integration of smart technologies. The development of advanced vacuum insulated panels (VIPs) and hybrid panel systems offers a niche opportunity for ultra-efficient, space-saving solutions. Impact forces primarily manifest through regulatory shifts—specifically, global movements towards phasing out high Global Warming Potential (GWP) blowing agents, forcing manufacturers to invest heavily in next-generation foam technology. Additionally, increasing scrutiny on construction sustainability (green building certifications) elevates the market advantage for panels manufactured using recycled or sustainable input materials, demanding greater transparency in the value chain and influencing procurement decisions by large-scale logistics operators and retailers.

Segmentation Analysis

The Cold Storage Insulated Panels market is segmented comprehensively based on core material type, panel thickness, end-user application, and foaming agent used. This multi-dimensional segmentation allows for precise market targeting, reflecting the varied requirements across industries, from deep-freeze logistics (requiring thick, high R-value panels) to standard refrigerated environments (utilizing more cost-effective materials). Understanding these segments is crucial as technological differentiation, pricing strategies, and regional demand dynamics are fundamentally driven by material composition, particularly the insulating core and the protective facing chosen for specific environmental challenges and regulatory mandates.

Core material type represents the most influential segment, determining performance attributes such as thermal conductivity, fire safety rating, and structural load-bearing capacity. Polyisocyanurate (PIR) and Polyurethane (PU) panels hold the dominant market share, valued for their excellent thermal properties and cost-effectiveness, respectively. Expanded Polystyrene (EPS), while offering lower initial costs, sees substantial use in less demanding or temporary cold storage applications. End-user segmentation highlights the market's dependence on the food supply chain, encompassing fisheries, meat, dairy, and horticulture, alongside the high-growth pharmaceutical sector, which demands premium-grade, validated panels.

- By Core Material: Polyurethane (PU), Polyisocyanurate (PIR), Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Mineral Wool, Others (e.g., Vacuum Insulated Panels).

- By Thickness: Below 80 mm, 80 mm – 120 mm, Above 120 mm.

- By End-User: Food & Beverage (Meat & Poultry, Dairy & Ice Cream, Fruits & Vegetables, Seafood, Others), Pharmaceuticals & Healthcare, Chemicals, Logistics & Distribution.

- By Application: Walls, Roofs, Floors.

- By Foaming Agent: Non-ODS Hydrocarbons, Hydrofluorocarbons (HFCs), Hydrofluoroolefins (HFOs).

Value Chain Analysis For Cold Storage Insulated Panels Market

The value chain for Cold Storage Insulated Panels begins with the upstream sourcing of crucial raw materials, primarily petrochemical derivatives. This involves securing isocyanates (MDI), polyols, blowing agents (HFCs, HFOs), and facing materials (steel coils, aluminum). Price volatility in these chemical commodities significantly influences the profitability and cost structure of panel manufacturers. Key upstream strategic activities include negotiating long-term contracts and establishing backward integration capabilities to mitigate supply risk and manage material consistency, which is vital for maintaining high product quality standards (e.g., thermal resistance and dimensional stability).

The midstream focuses on the manufacturing process itself, involving continuous lamination lines where the foaming process is precisely controlled, followed by cutting and packaging the customized panel sections. Direct distribution channels are typically employed for large, complex cold storage projects, where panel manufacturers interact directly with specialized cold chain construction contractors and design engineers, offering technical consultation and customized panel sizing. Conversely, indirect distribution utilizes wholesalers and distributors for smaller, prefabricated cold rooms or replacement projects, allowing for wider geographic reach and localized inventory management, serving smaller enterprises.

Downstream activities center on installation, commissioning, and subsequent maintenance. Installation requires specialized expertise to ensure airtight seals and thermal bridging avoidance, which is critical for the panel's long-term performance and energy efficiency. End-users, who are primarily logistics firms, pharmaceutical companies, and major food processors, focus heavily on the panel's performance metrics, longevity, and adherence to specific regulatory standards (e.g., FDA, HACCP). The market success hinges not only on the panel's intrinsic quality but also on the efficiency and reliability of the installation and the post-sale services provided, including thermal integrity audits and panel repair programs.

Cold Storage Insulated Panels Market Potential Customers

The primary consumers and end-users of cold storage insulated panels are entities that require stringent temperature management for product preservation, safety, and compliance. This spans large multinational companies engaged in global food production and distribution, national governments investing in strategic food reserves, and specialized logistics providers that manage the last-mile delivery of temperature-sensitive goods. These buyers prioritize panels based on performance criteria such as superior R-value, fire resistance ratings (FM approval), and hygiene certifications, often requiring tailored panel specifications to meet unique facility designs and operational temperature ranges, from chilled environments (0°C to 10°C) to ultra-low freezers (-60°C and below).

A rapidly expanding customer base resides within the pharmaceutical and biotech industries. These buyers, including vaccine manufacturers, clinical trial logistics companies, and regional hospital networks, demand the highest quality panels due to the catastrophic financial and public health consequences of temperature excursions. Their purchasing decisions are heavily influenced by the ability of the panel system to integrate seamlessly with monitoring technology, provide verifiable temperature stability for regulatory audits, and comply with standards for cleanroom environments. For this segment, panel suppliers must offer comprehensive documentation and robust technical support for validation processes, establishing partnerships rather than transactional relationships.

Additionally, the burgeoning quick service restaurant (QSR) and e-commerce grocery sectors are major volume buyers. These customers typically require modular, rapidly deployable cold rooms for localized distribution centers and dark stores, often prioritizing speed of installation and scalability over ultra-premium features. Their demand drives the market for standardized, highly efficient PU and PIR panels with easy-to-assemble interlocking mechanisms. The potential for repeat business and long-term contracts makes these high-volume commercial buyers a significant focus area for market penetration strategies, emphasizing efficiency, cost-effectiveness, and the durability required for high-traffic environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 9.5 Billion |

| Market Forecast in 2033 | USD 14.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kingspan Group, Metecno S.p.A., Tata Steel Limited, Isocab, Manali Petrochemicals Limited, Romakowski GmbH, Owens Corning, GS Construction Panel Co., Ltd., Jialifang Panel Group, P.R.R. Industries, Assan Panel, Honcho Panel, GSD Group, FALK Panel, Danpal, Panel Systems Ltd., Zamil Industrial Investment Co., Hemsec, R&D Cold Storage Solutions, Eurobond Doors & Panels. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cold Storage Insulated Panels Market Key Technology Landscape

The technological evolution in the Cold Storage Insulated Panels market is characterized by advancements in core material chemistry and integration with smart digital infrastructure. A pivotal area of focus is the development and commercial adoption of high-performance foam materials, particularly rigid polyurethane (PU) and polyisocyanurate (PIR) foams utilizing low Global Warming Potential (GWP) blowing agents, such as Hydrofluoroolefins (HFOs). This transition is mandated by international environmental treaties and domestic regulations aiming to phase out traditional high-GWP agents, forcing manufacturers to innovate mixtures that maintain or improve the crucial thermal resistance (R-value) while meeting sustainability goals. Furthermore, the push for enhanced fire safety has led to the widespread adoption of PIR panels, engineered with flame-retardant additives to achieve higher fire classifications necessary for large industrial buildings.

Another significant technological advancement involves the structural design of the panels, focusing on optimizing joint and connection systems to minimize thermal bridging. Advanced tongue-and-groove or cam-lock systems utilize sophisticated sealing techniques and specialized gaskets to create an airtight, vapor-proof envelope, which is fundamental to energy efficiency and preventing condensation within the panel core. In niche applications, technologies like Vacuum Insulated Panels (VIPs) are emerging, offering dramatically superior insulation performance in ultra-thin profiles, though their higher cost and susceptibility to vacuum loss restrict their application mainly to highly demanding environments, such as ultra-low temperature freezers and specific cold chain transportation solutions where space is at a premium.

Crucially, the market is undergoing digitization through the integration of embedded IoT sensors and passive RFID tags directly into the panel structure. These technologies enable real-time monitoring of internal temperature gradients, moisture levels, and even structural strain, providing critical data back to building management systems (BMS) and predictive maintenance platforms. This technological capability allows operators to continuously validate the thermal performance of the facility, ensuring compliance and proactively identifying potential insulation failures. This convergence of high-performance materials science with digital monitoring represents the future direction of the market, moving beyond passive insulation components to active, data-generating cold chain assets, thereby enhancing the overall resilience and efficiency of the cold storage infrastructure.

Regional Highlights

- Asia Pacific (APAC): APAC represents the fastest-growing and largest regional market, driven by unparalleled levels of urbanization, massive government investment in modern agricultural supply chains (particularly in China and India), and the expansion of the organized food retail sector. Countries like Vietnam, Indonesia, and Thailand are rapidly constructing cold chain infrastructure to support growing exports of seafood and processed foods. The high demand is fueled by the necessity to reduce substantial post-harvest losses and meet the surging domestic consumer base for frozen and chilled products. The market here is characterized by intense competition and a growing preference for PIR panels over cheaper alternatives due to increasing focus on large, long-term investments and international regulatory standards.

- North America (NA): North America holds a substantial market share, defined primarily by technological maturity, stringent energy conservation codes (like ASHRAE 90.1), and continuous replacement cycles for aging cold storage infrastructure. The US is a major consumer, propelled by advanced pharmaceutical logistics, large-scale food processing facilities, and the rapid deployment of regional distribution hubs by major e-commerce grocery platforms. Demand centers around premium, highly certified panels (FM approved), systems that integrate smart monitoring capabilities, and a strong preference for HFO-blown foams to meet environmental compliance. Investment is highly focused on automation and efficiency in mega-sized cold warehouses.

- Europe: The European market is characterized by high regulatory standards concerning environmental sustainability (EU F-Gas Regulation) and strict requirements for food safety and hygiene (HACCP). This drives consistent demand for high-quality PIR panels and low-GWP foam solutions. Western European countries lead in terms of technological adoption and sustainability, focusing on zero-energy cold storage designs. Eastern Europe offers significant growth opportunities as infrastructure modernization continues, particularly in food processing and logistics sectors that are upgrading facilities to meet EU compliance requirements. The strong emphasis on reducing carbon footprints impacts material selection and manufacturing processes.

- Latin America (LA): The Latin American market exhibits steady growth, largely driven by increasing regional trade (especially meat and agricultural exports) and improving economic conditions that foster greater consumption of frozen and chilled products. Key markets such as Brazil, Mexico, and Argentina are investing in expanded cold chain capacities to support both domestic consumption and international exports. Challenges include localized energy cost variations and infrastructural deficits, which simultaneously act as a driver for highly efficient, well-insulated panel systems that can operate reliably under fluctuating power conditions. The need for basic cold storage is gradually transitioning towards modern logistics standards.

- Middle East and Africa (MEA): This region is an emerging high-growth market, primarily due to the necessity of establishing reliable cold chains in extreme climatic conditions. The reliance on imported perishable goods across the Gulf Cooperation Council (GCC) states necessitates advanced, high-thickness insulated panels capable of maintaining temperature integrity against severe external heat load. Major construction projects, including massive food storage complexes and pharmaceutical hubs (e.g., in the UAE and Saudi Arabia), are fueling demand. Africa's long-term potential is immense, driven by rapidly expanding population centers and international efforts to formalize agricultural cold chains, though initial investment costs remain a significant barrier requiring modular, scalable panel solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cold Storage Insulated Panels Market.- Kingspan Group

- Metecno S.p.A.

- Tata Steel Limited

- Isocab

- Manali Petrochemicals Limited

- Romakowski GmbH

- Owens Corning

- GS Construction Panel Co., Ltd.

- Jialifang Panel Group

- P.R.R. Industries

- Assan Panel

- Honcho Panel

- GSD Group

- FALK Panel

- Danpal

- Panel Systems Ltd.

- Zamil Industrial Investment Co.

- Hemsec

- R&D Cold Storage Solutions

- Eurobond Doors & Panels

- Trimo Group

- NCI Building Systems

Frequently Asked Questions

Analyze common user questions about the Cold Storage Insulated Panels market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for PIR panels over PU panels?

The primary driver for Polyisocyanurate (PIR) panels is their superior fire resistance rating and lower smoke emission characteristics, which are mandated by increasingly stringent building codes and insurance requirements, especially for large-scale industrial and pharmaceutical cold storage facilities, offering enhanced safety compliance and reduced operational risk.

How does the cold storage insulated panels market address global sustainability requirements?

The market addresses sustainability by phasing out high Global Warming Potential (GWP) foaming agents, adopting low-GWP alternatives like Hydrofluoroolefins (HFOs). Furthermore, manufacturers are focusing on improving the thermal efficiency (R-value) of panels to minimize the energy consumption of refrigeration units, thereby reducing the overall carbon footprint of cold chain logistics operations globally.

Which end-user segment is projected to show the highest growth rate?

The Pharmaceuticals & Healthcare end-user segment is projected to exhibit the highest growth rate. This is fueled by the increasing production and distribution of temperature-sensitive biologics, vaccines, and specialized medicines, demanding reliable ultra-low temperature storage solutions and high standards of temperature validation that only premium insulated panels can reliably provide.

What are the main restraints impacting the growth of the market?

The main restraints include the volatility and high cost of petrochemical-derived raw materials (like MDI and Polyol) used in foam production, which impacts manufacturer margins and final pricing. Additionally, the significant upfront capital expenditure required for cold storage construction acts as a barrier to entry, particularly for smaller businesses.

How do smart panels improve the efficiency of cold storage operations?

Smart panels utilize embedded IoT sensors to monitor thermal performance, moisture ingress, and structural integrity in real-time. This data feeds into predictive maintenance systems, allowing facility managers to proactively identify thermal leaks or failures, optimize refrigeration cycles, and ensure continuous temperature stability, leading to substantial energy savings and reduced product loss risk.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager