Colistin Sulfate Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437002 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Colistin Sulfate Market Size

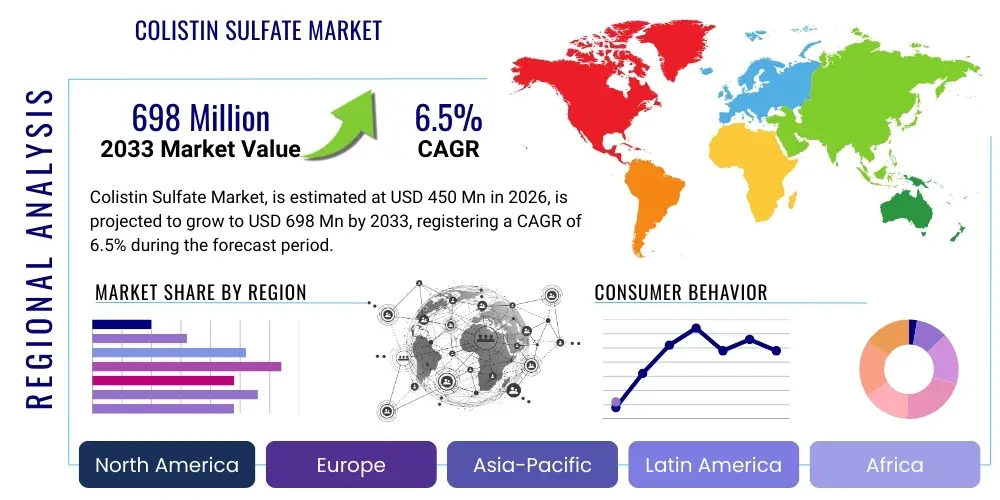

The Colistin Sulfate Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 698 Million by the end of the forecast period in 2033.

Colistin Sulfate Market introduction

The Colistin Sulfate Market is defined by the production, distribution, and utilization of Colistin Sulfate, a polymyxin antibiotic primarily used as a last-resort treatment for severe infections caused by multi-drug resistant (MDR) Gram-negative bacteria, particularly those belonging to the Enterobacteriaceae family, such as Klebsiella pneumoniae and Acinetobacter baumannii. Colistin Sulfate, also known as polymyxin E, functions by disrupting the permeability of the bacterial cell membrane, leading to leakage of essential cell components and subsequent bacterial death. Its resurgence in clinical use is directly tied to the global crisis of antimicrobial resistance (AMR), where older, previously abandoned antibiotics are being revisited due to their efficacy against highly resistant pathogens. The pharmaceutical grade of colistin sulfate is rigorously controlled to ensure safety and potency, reflecting its critical role in human and veterinary medicine.

The primary applications of Colistin Sulfate span across human health and veterinary medicine. In human clinical settings, it is predominantly administered intravenously for systemic infections, although ophthalmic and topical formulations are also available. Its efficacy against difficult-to-treat hospital-acquired infections (HAIs) drives significant demand, especially in intensive care units (ICUs) worldwide. Conversely, in the agricultural sector, Colistin Sulfate has historically been used extensively as a growth promoter and for the prophylaxis and treatment of enteric infections in livestock, particularly swine and poultry. However, due to increasing regulatory pressure focused on curbing antimicrobial resistance transmission from animals to humans, many regions are phasing out or strictly limiting its non-therapeutic use, shifting the market focus predominantly toward critical human medical applications and regulated veterinary therapeutic use.

Market growth is significantly propelled by the escalating global prevalence of carbapenem-resistant Enterobacteriaceae (CRE) and other critical antibiotic-resistant strains, necessitating effective fallback treatment options. Furthermore, substantial investment in research and development aimed at creating safer, less nephrotoxic derivatives of colistin, coupled with improvements in diagnostic testing that confirm the need for this specific antibiotic, contribute positively to its demand. Despite challenges related to known side effects, such as dose-dependent nephrotoxicity and neurotoxicity, the lack of viable alternatives for MDR infections maintains Colistin Sulfate’s vital position in the infectious disease treatment paradigm. Regulatory bodies are continuously monitoring its usage to balance the need for effective treatment against the risks associated with its adverse reaction profile and the potential for inducing further bacterial resistance.

Colistin Sulfate Market Executive Summary

The Colistin Sulfate Market exhibits robust growth driven primarily by the global antimicrobial resistance crisis, positioning it as a critical component in the armamentarium against multi-drug resistant Gram-negative bacterial infections. Business trends indicate a strategic pivot by pharmaceutical manufacturers towards developing liposomal formulations and improved delivery systems to mitigate the drug's inherent nephrotoxicity, thereby broadening its clinical applicability and patient tolerance. Furthermore, increased collaborative research between public health organizations and private entities focusing on surveillance of resistance patterns and standardization of dosing protocols is shaping market dynamics. The regulatory landscape, marked by stringent controls on non-therapeutic veterinary use, is redirecting market revenue streams predominantly towards prescription-based human therapeutic applications, encouraging manufacturers to enhance quality assurance and compliance standards, particularly across emerging economies where antibiotic misuse has historically been rampant.

Regional trends highlight the Asia Pacific (APAC) region as the dominant market, characterized by high rates of infectious diseases, large patient populations, and, critically, a high burden of antimicrobial resistance, particularly in countries like India and China, fueling acute demand for last-resort antibiotics. North America and Europe, while exhibiting slower volume growth due to sophisticated infection control protocols, demonstrate higher value growth, driven by premium pricing for specialized formulations and comprehensive healthcare spending on complex cases. Segment trends reveal that the human usage segment is poised for faster growth than the veterinary segment, reflecting global efforts to restrict the use of critically important antimicrobials in food production animals. Within formulations, the injectable segment remains the largest due to the severity of infections treated, but R&D into inhalation and oral delivery methods for targeted applications is gaining traction, signaling future segmentation shifts.

Overall, the market is characterized by a high degree of necessity-driven demand coupled with significant supply chain complexity, given that colistin is derived through fermentation processes. Key stakeholders are focusing on establishing secure, stable supply lines and investing heavily in clinical trials to reaffirm the efficacy and safety profile of colistin in various patient subsets, including pediatrics and those with renal impairment. The strategic emphasis on stewardship programs, which promote rational antibiotic use, while potentially limiting immediate volume growth, is viewed positively as it sustains the long-term effectiveness of the drug, ensuring its availability when critically needed. This delicate balance between meeting urgent medical needs and preserving the drug's utility against rising resistance defines the market’s trajectory through the forecast period, making policy adherence and advanced formulation crucial competitive factors.

AI Impact Analysis on Colistin Sulfate Market

User queries regarding AI's impact on the Colistin Sulfate market primarily revolve around three central themes: AI's ability to accelerate the discovery of novel antibiotic alternatives, its role in accurately predicting and managing Colistin resistance (MCR-1 gene spread), and its potential to optimize personalized dosing to minimize nephrotoxicity. Users are particularly concerned about whether AI-driven drug discovery pipelines will eventually render Colistin obsolete by providing safer alternatives, or if AI will be utilized instead to extend the lifespan of Colistin by refining its clinical application. The core expectation is that AI algorithms, leveraging vast databases of clinical, microbiological, and chemical data, will revolutionize the stewardship of this critical drug, enabling clinicians to make rapid, data-informed decisions regarding treatment initiation, combination therapies, and precise dosage adjustments tailored to individual patient pharmacokinetics and renal function, thereby directly addressing the primary safety concern associated with Colistin therapy.

- AI accelerates target identification for new compounds replacing Colistin.

- Predictive modeling tracks the geographical spread and mutation rate of Colistin resistance mechanisms (e.g., MCR-1).

- Machine learning algorithms optimize personalized dosing of Colistin Sulfate, reducing nephrotoxicity risk in high-risk patients.

- AI enhances clinical trial design for next-generation Colistin derivatives, improving efficiency and reducing time-to-market.

- Natural Language Processing (NLP) tools analyze real-world clinical data (EHRs) for better antimicrobial stewardship and monitoring Colistin outcomes.

- Automated diagnostics, utilizing AI, rapidly identify MDR pathogens necessitating Colistin use, shortening treatment initiation time.

DRO & Impact Forces Of Colistin Sulfate Market

The market for Colistin Sulfate is fundamentally driven by the severe public health threat posed by multi-drug resistant (MDR) Gram-negative bacterial infections, particularly those resistant to carbapenems, positioning Colistin as an indispensable last-line therapeutic option. However, the market faces significant constraints primarily due to the drug's pronounced dose-dependent nephrotoxicity, which mandates careful patient monitoring and limits its long-term use, alongside the escalating global detection and transmission of plasmid-mediated Colistin resistance (MCR-1 gene), threatening the drug's viability. Opportunities lie in the development of safer, next-generation formulations, such as inhaled or liposomal preparations, and in expanded therapeutic applications outside of critical care, coupled with robust antibiotic stewardship programs that ensure its appropriate use. These forces—the overwhelming necessity driven by AMR, the constraints of toxicity and resistance, and the opportunities arising from formulation science—create a high-impact, volatile market where regulatory decisions and clinical research advancements exert powerful influence on adoption rates and perceived therapeutic lifespan.

Key drivers include the high mortality rates associated with MDR bacterial infections, compelling healthcare systems to adopt any effective treatment, irrespective of toxicity concerns, especially in critical care environments where swift intervention is paramount. Furthermore, the limited pipeline of genuinely novel antibiotics active against Gram-negative pathogens means that Colistin is likely to retain its status as a cornerstone agent for the foreseeable future. The primary restraints are the significant logistical and economic challenges associated with monitoring and treating Colistin-induced acute kidney injury (AKI), increasing the overall cost of care. Additionally, restrictive regulatory measures, particularly in developed regions limiting its veterinary application, although promoting human health, constrain the overall market volume. The identification of widespread resistance mechanisms, especially MCR-1, is perhaps the most critical restraint, forcing pharmaceutical companies and public health organizations to rapidly invest in combination therapies or alternative strategies to protect the drug's efficacy.

Opportunities for market expansion center around innovative drug delivery technologies that promise to reduce systemic toxicity while maintaining high local concentrations at the site of infection, such as targeted drug delivery systems. There is also a substantial opportunity in developing rigorous pharmacokinetic/pharmacodynamic (PK/PD) models integrated with clinical decision support systems to facilitate precise, individualized dosing, maximizing efficacy while minimizing risk. Impact forces governing the market include the regulatory response to antimicrobial resistance (e.g., EU restrictions on veterinary use, US FDA oversight), the pace of competitor introduction (specifically new anti-Gram-negative agents), and public health initiatives focused on infection control and surveillance. These forces collectively dictate the speed of adoption, pricing dynamics, and the geographic utilization patterns of Colistin Sulfate, emphasizing that market success is deeply intertwined with global public health policy and the effectiveness of resistance mitigation strategies.

Segmentation Analysis

The Colistin Sulfate market is comprehensively segmented based on its application, formulation type, and end-user, reflecting the diverse clinical and veterinary needs across different geographical regions. The application segmentation differentiates between human use, which addresses critical, life-threatening multi-drug resistant infections, and veterinary use, historically focused on prophylactic and therapeutic treatment of enteric diseases in livestock, though this segment is rapidly evolving due to regulatory tightening. Formulation segmentation is crucial as it addresses the route of administration and bioavailability concerns, distinguishing between injectable preparations necessary for systemic treatment of severe sepsis, and oral/topical formulations used for localized infections. End-user segmentation recognizes the primary consumers, notably hospitals and specialized critical care centers that utilize the drug for acute human infections, and veterinary clinics or farms, which manage livestock health. This multi-faceted segmentation helps manufacturers tailor their production, distribution, and marketing strategies to meet the specific requirements and regulatory hurdles associated with each category, optimizing market penetration and regulatory compliance across the global health spectrum.

- By Application:

- Human Use

- Veterinary Use

- By Formulation:

- Injectable Solutions (IV Administration)

- Oral Suspensions/Powders

- Topical and Ophthalmic Formulations

- By End User:

- Hospitals and Clinics (Critical Care Units)

- Veterinary Clinics and Pharmacies

- Research and Academic Institutions

- By Region:

- North America (U.S., Canada)

- Europe (Germany, UK, France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Mexico)

- Middle East and Africa (MEA)

Value Chain Analysis For Colistin Sulfate Market

The value chain for Colistin Sulfate begins with upstream activities dominated by the fermentation process necessary for producing the raw polymyxin E base, involving specialized microbial strains and rigorous quality control to achieve pharmaceutical grade purity. Key upstream components include specialized fermentation equipment, sourcing of media components, and highly skilled biological process engineering. Because Colistin is a natural product, variations in yield and purity are inherent challenges that necessitate sophisticated purification and extraction techniques, heavily influencing the cost of the active pharmaceutical ingredient (API). Robust partnerships between API manufacturers and suppliers of biological media are critical to ensuring supply stability and cost efficiency, especially given the global urgency for this last-resort antibiotic. Any disruption in the supply of critical raw materials or issues with fermentation scalability directly impacts the downstream availability and pricing of the final drug product, creating significant supply chain risks.

The midstream activities involve the conversion of Colistin Sulfate API into various finished dosage forms, including sterile injectable powders (the most complex due to stringent aseptic requirements), oral granules, and specialized topical preparations. This manufacturing stage requires high capital investment in Good Manufacturing Practice (GMP) certified facilities, especially for lyophilization (freeze-drying) processes required for stable injectable products. Downstream activities encompass distribution, which is bifurcated into direct channels, often involving contracts with large hospital groups and governmental health agencies for emergency stockpile provision, and indirect channels relying on pharmaceutical wholesalers, distributors, and specialized cold-chain logistics providers. The distribution complexity is heightened by the drug's critical nature and the need for rapid deployment in response to infectious disease outbreaks or resistant pathogen surges, necessitating streamlined global logistics networks compliant with local pharmaceutical regulations.

The ultimate stage involves reaching the end-users: hospitals, critical care centers, and veterinary facilities. Direct sales channels, facilitated by pharmaceutical company representatives, are essential for conveying the latest clinical data, dosing guidelines, and specialized stewardship information directly to infectious disease specialists and critical care physicians. Indirect channels ensure broad market coverage, particularly reaching smaller clinics and rural veterinary practices. Due to the high risk of resistance and toxicity, robust post-market surveillance and pharmacovigilance programs form an integral part of the downstream value chain, requiring coordination between manufacturers, distributors, and regulatory bodies. The efficiency of the distribution channel, particularly for a drug used in life-or-death situations, is paramount, making reliable warehousing, temperature control, and minimized lead times critical components for maintaining market integrity and supporting clinical needs across all geographic domains.

Colistin Sulfate Market Potential Customers

The primary consumers and end-users of Colistin Sulfate are institutions and individuals engaged in the critical management of severe, multidrug-resistant bacterial infections, spanning both human and animal health sectors. In the human health segment, the dominant potential customers are tertiary care hospitals and specialized critical care units, particularly Intensive Care Units (ICUs) and oncology wards, where patients are highly susceptible to nosocomial infections caused by Colistin-sensitive Gram-negative superbugs like CRE and MDR Acinetobacter. These institutional buyers prioritize drug efficacy, formulation stability (especially injectables), and reliable supply chain logistics, often procuring through large, negotiated contracts or national procurement tenders, making institutional purchasing power a significant demand driver. Furthermore, governmental public health agencies and national defense organizations are potential customers, maintaining strategic stockpiles of Colistin Sulfate for use in biodefense scenarios or large-scale public health emergencies where resistant strains may proliferate rapidly.

The secondary, yet historically significant, customer base resides within the veterinary and agricultural sectors. Large-scale industrial livestock operations, particularly swine and poultry farms, along with associated veterinary practices, purchase Colistin Sulfate formulations (primarily oral) for the treatment and metaphylaxis of enteric infections, such as those caused by E. coli. However, due to stringent global regulations focused on limiting the use of critically important antimicrobials in food-producing animals to combat antimicrobial resistance, this customer segment is undergoing rapid contraction, shifting focus towards regulated therapeutic use only, rather than prophylaxis or growth promotion. This customer group increasingly demands transparency in manufacturing and adherence to withdrawal periods. Research and development institutions, including university medical centers and contract research organizations (CROs), also represent a niche but essential customer base, utilizing Colistin Sulfate for ongoing drug resistance studies, pharmacokinetic research, and the development of combination therapies aimed at preserving its effectiveness against emerging resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 698 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Xellia Pharmaceuticals, Fresenius Kabi, Pfizer Inc., Merck & Co., Inc., Cipla Ltd., Abbott Laboratories, Takeda Pharmaceutical Company Limited, Hikma Pharmaceuticals, Mylan N.V. (now Viatris), Teva Pharmaceutical Industries Ltd., Alkem Laboratories, Lupin Limited, Sun Pharmaceutical Industries Ltd., Sandoz (Novartis division), Aurobindo Pharma. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Colistin Sulfate Market Key Technology Landscape

The technological landscape surrounding the Colistin Sulfate market is not focused on fundamentally altering the core chemical structure, which has remained largely constant since its discovery, but rather on innovating drug delivery systems and pharmaceutical manufacturing processes to enhance safety and efficacy. A significant technological focus is placed on advanced formulation techniques, specifically lyophilization technology, which ensures the stability and sterility of the injectable powder form, critical for administration in acute care settings. Furthermore, micronization technology is being employed to create optimal particle sizes for inhaled Colistin formulations, allowing the drug to reach the lungs effectively for treating ventilator-associated pneumonia and cystic fibrosis-related infections, thus circumventing systemic toxicity associated with intravenous administration while achieving high local drug concentrations at the infection site. This targeted delivery approach represents a significant technological leap in utilizing the drug more effectively and safely.

Another crucial area of technological advancement involves liposomal encapsulation and advanced polymer chemistry. Liposomal formulations are designed to encapsulate the Colistin molecule, gradually releasing the drug and potentially reducing its direct interaction with renal cells, which is the primary cause of nephrotoxicity. This technology aims to improve the therapeutic index of Colistin, making it safer for patients requiring prolonged or high-dose therapy. Concurrently, manufacturing technologies related to fermentation and purification have seen incremental improvements, utilizing bioprocess optimization tools and analytical technology like High-Performance Liquid Chromatography (HPLC) to ensure consistent, high-purity API production. These improvements are vital for maintaining compliance with rigorous pharmaceutical standards globally, particularly as regulatory scrutiny of last-resort antibiotics intensifies, requiring unparalleled consistency in product quality across all batches.

Beyond drug formulation, the technological landscape includes ancillary technologies essential for the responsible clinical use of Colistin Sulfate. This encompasses rapid diagnostic testing platforms, including Polymerase Chain Reaction (PCR) and next-generation sequencing, which quickly identify MDR organisms and, critically, detect resistance genes like MCR-1, guiding timely therapeutic decisions. Furthermore, sophisticated pharmacokinetic/pharmacodynamic (PK/PD) modeling software and therapeutic drug monitoring (TDM) systems represent a technological layer enabling personalized medicine. These tools utilize patient-specific data (e.g., renal function, weight) to calculate optimal loading and maintenance doses of Colistin, minimizing the risk of adverse events while maximizing bacterial killing, thereby leveraging computational technology to mitigate the inherent risks of this potent antibiotic. The integration of these diagnostic and dosing technologies is rapidly becoming the standard of care in high-resource settings to safeguard both patient safety and the long-term effectiveness of Colistin.

Regional Highlights

Geographic market dynamics for Colistin Sulfate are heterogeneous, reflecting regional variations in antimicrobial resistance burdens, regulatory frameworks concerning veterinary use, and healthcare expenditure capabilities, leading to distinct growth trajectories and competitive environments across the globe.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market due to the extremely high prevalence of MDR Gram-negative infections, particularly in countries like India, China, and Southeast Asia, where high population density and historically less regulated antibiotic use have exacerbated resistance. The region faces a critical need for last-resort antibiotics like Colistin, driving high volume consumption in the human health sector. However, price sensitivity and the need for scalable, affordable formulations are key characteristics of this market, compelling domestic manufacturers to compete aggressively on cost while ramping up production capacity to meet the substantial demand from burgeoning public and private healthcare infrastructures.

- North America: This region is characterized by high-value growth, driven by premium pricing, advanced healthcare infrastructure, and stringent infection control protocols. While overall volume usage may be lower compared to APAC due to robust antibiotic stewardship programs, the utilization of Colistin is highly specialized, reserved strictly for confirmed MDR infections. The market is also a leader in adopting innovative formulations, such as inhaled Colistin, and advanced PK/PD monitoring technologies to maximize patient safety. Regulatory bodies, especially the FDA, play a significant role in influencing market dynamics through oversight of new formulation approvals and adherence to clinical trial safety standards.

- Europe: The European market demonstrates a mature and highly regulated environment. A key differentiator here is the strict enforcement of regulations limiting veterinary use of Colistin (driven by EU mandates), which significantly constrains the veterinary segment but reinforces the drug's importance for human critical care. Demand is stable, centered in major markets like Germany, UK, and France, often driven by tenders and hospital group purchasing organizations. European manufacturers are focused heavily on quality compliance and developing robust surveillance systems to track resistance, ensuring the drug’s utility is preserved through strong stewardship and prudent clinical use.

- Latin America (LATAM): The LATAM market, including Brazil and Mexico, presents a high-growth opportunity due to rapidly developing healthcare systems and a growing, yet often less monitored, burden of AMR. The region is transitioning from historical reliance on bulk generic supplies toward demanding higher quality, standardized formulations. Challenges include economic instability and varied regulatory enforcement across countries, affecting drug availability and pricing. The market requires investment in local manufacturing or secure import channels to stabilize the supply chain for hospitals treating complex infections.

- Middle East and Africa (MEA): This region exhibits significant disparity, with Gulf Cooperation Council (GCC) countries showing high investment in specialized critical care and utilizing premium formulations, whereas broader African nations face severe resource limitations and high rates of infectious disease. Demand for Colistin is high due to prevalent bacterial infections, but procurement is often reliant on global aid organizations and public sector funding. The regulatory focus is strongly centered on ensuring access while combating substandard medications and monitoring emerging resistance patterns in environments where healthcare infrastructure is often challenged.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Colistin Sulfate Market.- Xellia Pharmaceuticals

- Fresenius Kabi

- Pfizer Inc.

- Merck & Co., Inc.

- Cipla Ltd.

- Abbott Laboratories

- Takeda Pharmaceutical Company Limited

- Hikma Pharmaceuticals

- Mylan N.V. (now Viatris)

- Teva Pharmaceutical Industries Ltd.

- Alkem Laboratories

- Lupin Limited

- Sun Pharmaceutical Industries Ltd.

- Sandoz (Novartis division)

- Aurobindo Pharma

- F. Hoffmann-La Roche Ltd.

- Sanofi S.A.

- Melinta Therapeutics

- Bayer AG

- Zydus Lifesciences Ltd.

Frequently Asked Questions

Analyze common user questions about the Colistin Sulfate market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and major application of Colistin Sulfate?

Colistin Sulfate is a critical, last-resort polymyxin antibiotic used primarily to treat severe systemic infections caused by multi-drug resistant (MDR) Gram-negative bacteria, such as carbapenem-resistant Enterobacteriaceae (CRE) and MDR Acinetobacter baumannii. Its major application is in human critical care settings where alternative antibiotics are ineffective, though historical use included veterinary medicine for enteric infections.

What are the key safety concerns associated with Colistin use?

The primary safety concern surrounding Colistin Sulfate therapy is dose-dependent nephrotoxicity (acute kidney injury), which requires rigorous therapeutic drug monitoring (TDM) and dosage adjustment based on patient renal function. Other concerns include neurotoxicity, which manifests as muscle weakness or paresthesia, requiring careful assessment, particularly in susceptible patient populations.

How is the spread of Colistin resistance impacting the market?

The emergence and global spread of plasmid-mediated resistance genes, notably MCR-1, represent the most significant restraint on the Colistin Sulfate market. This resistance threatens the drug's viability as a last-resort option, driving research into combination therapies and stricter antibiotic stewardship policies to preserve its efficacy and extend its therapeutic lifespan against susceptible strains.

Which geographic region dominates the demand for Colistin Sulfate?

The Asia Pacific (APAC) region currently dominates the volume demand for Colistin Sulfate due to the exceptionally high burden of infectious diseases and high prevalence of multi-drug resistant Gram-negative organisms. Factors such as large population density and extensive past antibiotic usage contribute to the acute need for this last-line antibiotic in major APAC economies.

What technological innovations are being pursued to improve Colistin therapy?

Technological innovations are focused primarily on improving safety and targeted delivery. Key advancements include the development of liposomal formulations to mitigate systemic toxicity (nephrotoxicity), high-purity injectable formulations utilizing advanced lyophilization, and micronized inhaled solutions designed for localized treatment of lung infections, enhancing efficacy while reducing overall patient risk.

Detailed Market Dynamics and Competitive Landscape Analysis

The Colistin Sulfate market is a fascinating domain where public health urgency intersects with complex pharmaceutical chemistry and stringent regulatory control. The competitive landscape is characterized by a mix of established multinational pharmaceutical companies and regional generic manufacturers, all vying for market share in a segment driven less by elective demand and more by critical medical necessity. Price competition is intense, particularly in emerging markets where generic versions proliferate, but premiumization occurs in developed markets for specialized, low-toxicity formulations. Companies that can demonstrate superior API purity, stable supply chains, and investment in clinical data supporting optimal dosing protocols often gain a competitive edge. Moreover, success is increasingly tied to effective lobbying and collaboration with government agencies to influence antibiotic stewardship guidelines and procurement policies, ensuring their product is listed on essential medicines lists worldwide.

A major dynamic driving strategic alliances is the push towards combination therapies. Recognizing the limitations of Colistin monotherapy in the face of rising resistance, manufacturers are increasingly collaborating with developers of other anti-Gram-negative agents to conduct trials proving the synergy between Colistin and newer antibiotics (e.g., Carbapenems or novel beta-lactamase inhibitors) in high-resistance settings. These combinations aim to restore susceptibility and improve patient outcomes, indirectly bolstering the demand for Colistin as a co-therapeutic agent. Furthermore, the expiration of key patents allows many generic players to enter the market rapidly, particularly those specializing in sterile injectables. This influx often drives down pricing, creating challenges for branded manufacturers who must rely on their reputation for quality, consistency, and investment in next-generation delivery systems to maintain their price point and market relevance in critical care environments.

The regulatory environment acts as a powerful market dynamic, distinctly shaping regional market potential. For instance, the European Union's move to virtually eliminate Colistin use in prophylactic veterinary applications has led to a significant redirection of supply and strategic focus towards human therapeutic needs globally. Conversely, regions with less restrictive veterinary policies, despite facing pressure from international health organizations, still maintain a sizable, albeit challenged, agricultural segment. Strategic forecasting must heavily account for potential future tightening of these regulations worldwide, necessitating adaptive business models that pivot seamlessly towards highly regulated human health markets. The ongoing research into resistance mechanisms, such as MCR-1, also generates significant volatility; any breakthrough discovery that nullifies Colistin's utility would cause an immediate market contraction, reinforcing the need for continuous research and diversification of the drug development pipeline among key players.

Future Outlook and Emerging Trends

The future outlook for the Colistin Sulfate market is one of cautious growth, primarily fueled by the continued failure of the novel antibiotic pipeline to keep pace with evolving Gram-negative resistance. The market will see a steady transition towards highly specialized and quality-controlled usage, moving away from historical bulk application. Key emerging trends include the rise of personalized medicine approaches, specifically the integration of advanced pharmacokinetics (PK) data with Artificial Intelligence (AI) to develop precision dosing software. This technology will become indispensable in critical care units, standardizing the administration of Colistin to minimize the risk of Acute Kidney Injury (AKI), thereby making the drug safer and expanding its potential patient pool to include more vulnerable populations who were previously excluded due to toxicity concerns.

Another significant trend is the increasing dominance of specialized formulations. Liposomal Colistin and highly stable inhaled Colistin formulations are expected to capture a growing share of the injectable segment, offering superior risk-benefit profiles. This shift requires substantial capital investment in R&D and advanced manufacturing capabilities, creating higher barriers to entry for smaller generic manufacturers. Furthermore, global public health initiatives, often funded by organizations like the WHO and CEPI, will increasingly focus on establishing global stewardship programs and resistance surveillance networks. These initiatives, while potentially limiting volume growth by preventing misuse, will solidify Colistin's status as a critical reserve antibiotic, guaranteeing sustained, high-value demand for ethical and necessary therapeutic use. The focus will move from mass treatment to targeted, life-saving interventions.

Geographically, while established markets in North America and Europe will drive formulation innovation and premium pricing, the long-term volume growth engine will remain the rapidly industrializing economies of Asia Pacific and Latin America, where the fight against AMR is most intense. Successful market players will need dual strategies: maintaining efficient, low-cost API production for price-sensitive bulk markets while simultaneously investing heavily in sophisticated delivery systems for high-value segments. Ultimately, the market trajectory is intrinsically linked to global efforts to combat antimicrobial resistance. If widespread, effective alternatives emerge, Colistin's dominance will wane; however, in the absence of such alternatives, targeted utilization and advanced safety technologies will ensure Colistin Sulfate remains a vital, high-impact pharmaceutical product throughout the forecast period, positioning it as a strategic asset in global healthcare security.

The development of novel diagnostic technologies also plays a pivotal role in shaping the demand structure. Technologies that allow for rapid detection of Colistin-sensitive bacterial strains, especially in emergency settings, ensure that the drug is used only when clinically appropriate, conserving its efficacy. This shift from empirical prescribing to targeted prescribing, facilitated by technological advancements, means that while the frequency of prescribing might be reduced through stewardship, the clinical value and perceived necessity of each prescribed dose are significantly heightened. Manufacturers are consequently investing in strategic partnerships with diagnostic companies to integrate rapid testing solutions into their commercial offerings, creating a comprehensive solution package rather than merely supplying the drug itself. This move towards integrated care solutions, encompassing diagnostics, therapeutics, and TDM, defines the strategic trajectory of the key market players seeking to optimize resource utilization and patient safety in critical care environments.

Regulatory harmonization efforts across different international blocs are another critical area impacting the market. As organizations like the EMA and FDA continuously update their guidance on Colistin dosing (e.g., dosage conversion between Colistimethate Sodium (CMS) and Colistin Sulfate base units), manufacturers must quickly adapt labeling and clinical education materials. Non-compliance or delay in updating these materials can lead to market withdrawals or restricted access, especially in highly regulated markets. Furthermore, patent landscapes, particularly around formulation improvements and delivery systems, are becoming increasingly complex and contested, serving as a key competitive battleground. Intellectual property protection over improved formulations or manufacturing processes is vital for maintaining margins and justifying the high investment in safety-enhancing technologies, differentiating branded products from commodity generics. The interplay between stringent regulatory requirements, the necessity of therapeutic efficacy preservation, and the drive for safer administration methods defines the current innovation focus within the Colistin Sulfate market ecosystem.

This market analysis strongly suggests that survival and growth within the Colistin Sulfate sector depend heavily on proactive engagement with global public health goals, particularly in antimicrobial stewardship. Companies must position themselves not merely as suppliers of an antibiotic, but as integral partners in the global fight against superbugs. This involves funding educational programs for clinicians on appropriate usage, supporting pharmacovigilance studies, and transparently tracking manufacturing quality. The long-term viability of the product hinges on preventing resistance and mitigating toxicity, two factors directly influenced by technological and clinical strategic decisions made today. The emphasis on quality over quantity will define market success in the coming years, shifting value towards specialized expertise and high-assurance supply chains rather than simple low-cost production. The critical nature of Colistin ensures that, despite its challenges, it will remain a cornerstone of infectious disease management until genuinely novel, safer alternatives are readily available across the globe.

In conclusion, the Colistin Sulfate market is poised for expansion driven by necessity, moderated by safety concerns, and shaped fundamentally by technological innovation in delivery and dosing. The demand structure is inelastic in critical care settings, providing resilience against economic downturns, but is highly sensitive to regulatory changes concerning resistance management and veterinary use. The regional divergence highlights the global disparity in healthcare resources and the varied response to the AMR crisis, with APAC demanding high volumes and Western markets driving specialized value. Strategic growth necessitates focused investment in PK/PD modeling, liposomal technology, and robust quality control, ensuring that Colistin remains an effective and safe option for patients facing life-threatening multi-drug resistant bacterial infections in all parts of the world. The overall market narrative is a testament to the complex, challenging, and critically important role of last-resort antibiotics in modern medicine.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager