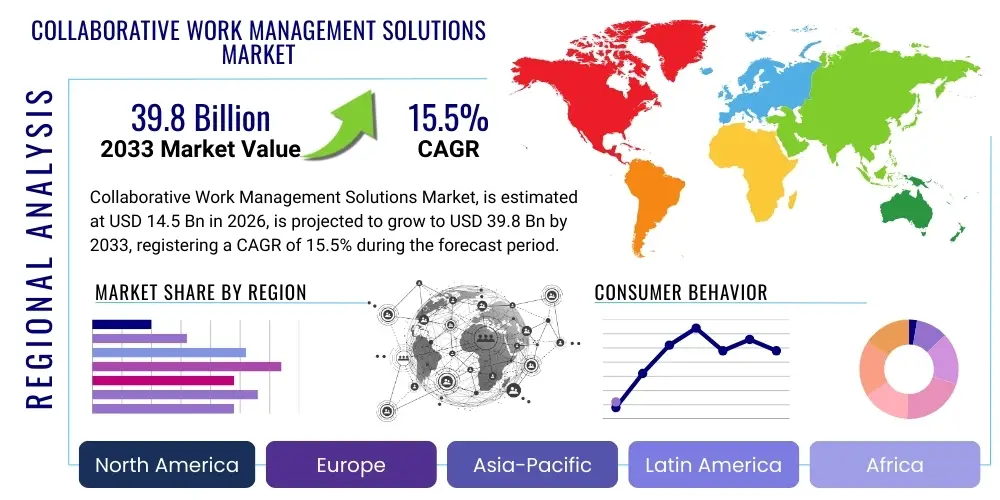

Collaborative Work Management Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439091 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Collaborative Work Management Solutions Market Size

The Collaborative Work Management Solutions Market is experiencing robust expansion driven by the global shift towards hybrid work models, the increasing complexity of cross-functional projects, and the necessity for centralized digital platforms to maintain organizational alignment and productivity. This strategic market segment, which encompasses tools for task management, resource allocation, real-time communication, and project oversight, is crucial for enterprises seeking efficiency gains in decentralized environments. The heightened demand for seamless integration capabilities with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems further catalyzes market valuation, particularly as organizations prioritize unified digital workspaces. Investment in agile methodologies and digital transformation initiatives across sectors such as IT, media, and professional services reinforces the sustained upward trajectory of market growth, making it a critical area for technology vendors.

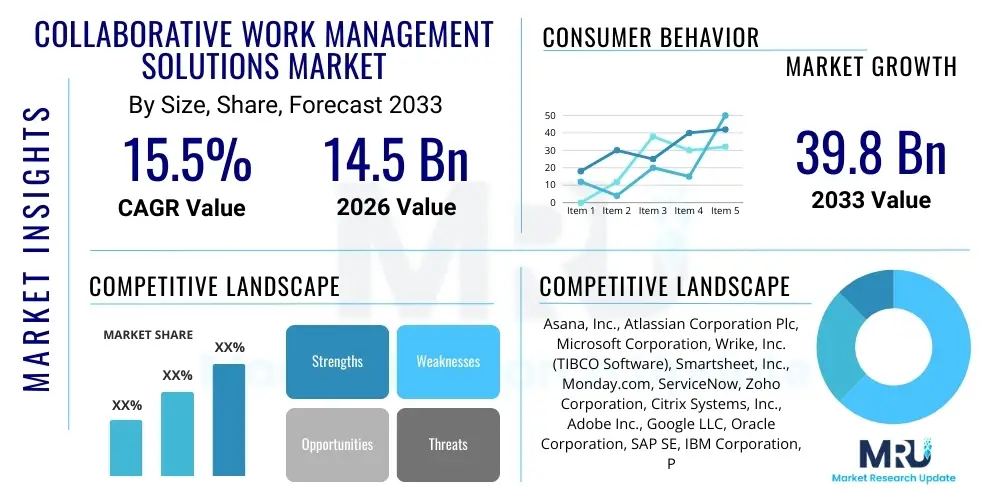

The Collaborative Work Management Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $39.8 Billion by the end of the forecast period in 2033. This substantial growth is primarily attributable to the accelerating adoption of cloud-based CWM platforms, which offer enhanced scalability, accessibility, and security compared to on-premise deployments. Furthermore, the integration of advanced features such as predictive analytics, automated workflows, and artificial intelligence into CWM platforms is boosting their utility and justifying higher subscription costs, thereby inflating the overall market size. Regional macroeconomic factors, including robust technological infrastructure development in North America and rapid digital penetration in the Asia Pacific region, are major contributors to this projected financial expansion.

Collaborative Work Management Solutions Market introduction

The Collaborative Work Management (CWM) Solutions Market provides centralized software platforms designed to optimize how teams coordinate tasks, manage resources, and track project progress effectively, moving beyond rudimentary email and spreadsheets. These solutions fundamentally address the inefficiencies inherent in disparate workflows by offering features like dynamic task assignment, shared document repositories, integrated communication channels, and real-time status dashboards. The modern CWM platform is critical in fostering transparency and accountability across organizational boundaries, particularly within multinational corporations and project-intensive industries like construction, engineering, and software development. The core product description centers on delivering a unified digital environment that supports agile, waterfall, or hybrid project methodologies, ensuring that all stakeholders have access to accurate, timely project data regardless of their geographic location or functional role.

Major applications of Collaborative Work Management Solutions span across nearly every business function, including marketing campaign execution, product development lifecycle management, IT service management (ITSM), and human resources onboarding processes. In the marketing sphere, CWM tools facilitate content calendar planning, asset creation tracking, and performance measurement against key objectives. For product teams, they are essential for managing backlogs, sprint planning, and coordinating releases. The overarching benefit derived from these solutions is a significant uplift in operational efficiency, characterized by reduced manual effort, minimized communication gaps, and improved adherence to deadlines. Furthermore, CWM platforms provide robust reporting and analytics capabilities, allowing senior management to gain granular visibility into resource utilization and project profitability, thereby enabling data-driven strategic decision-making. These platforms transform reactive project management into proactive workflow optimization.

The driving factors propelling the Collaborative Work Management Solutions Market growth are multifaceted and rooted in current global business trends. The exponential rise in remote and hybrid work structures following recent global events necessitates robust digital infrastructure capable of maintaining team cohesion and oversight without physical proximity. Secondly, the increasing complexity of global supply chains and cross-departmental initiatives demands sophisticated tools to manage dependencies and risks effectively. Thirdly, vendors are continuously enhancing platform capabilities through investment in user experience (UX) and advanced functionalities, making these solutions indispensable for competitive organizations. Finally, the growing regulatory environment often requires meticulous documentation and audit trails, which CWM systems inherently provide through centralized project history and activity logs, making compliance easier and more manageable across regulated industries.

Collaborative Work Management Solutions Market Executive Summary

The Collaborative Work Management Solutions Market Executive Summary reveals a dynamic landscape characterized by high levels of innovation and strategic consolidation among key vendors. Current business trends indicate a strong move toward platform specialization, where vendors differentiate themselves not just through features, but through deep integration capabilities tailored for specific enterprise ecosystems (e.g., Salesforce, Microsoft 365). The market is seeing increased adoption of vertical-specific CWM solutions addressing unique requirements in sectors like healthcare project tracking or financial regulatory compliance, moving away from generic, horizontal tools. Financial strategies emphasize subscription models and usage-based pricing, promoting scalability and long-term customer retention. Furthermore, merger and acquisition activities are focused on acquiring niche AI capabilities or enhancing existing platforms with complementary communication or automation tools, aiming to offer an end-to-end operational operating system for modern business.

Regional trends significantly influence market momentum, with North America maintaining its dominance due to early adoption of digital transformation technologies, the presence of major CWM solution providers, and a highly competitive corporate environment necessitating efficiency tools. Europe follows closely, driven by regulatory demands (e.g., GDPR compliance affecting data handling within CWM) and strong adoption in professional services and manufacturing sectors focusing on lean operations. The Asia Pacific (APAC) region is poised for the highest growth rate, fueled by the rapid digital transformation of small and medium-sized enterprises (SMEs), particularly in China, India, and Southeast Asia, where cloud adoption is accelerating. These emerging markets prioritize mobile-first CWM solutions due to the prevalence of mobile workforces, creating unique regional demands that vendors must address through tailored offerings.

Analysis of segment trends highlights the strong performance of the cloud deployment model, which is rapidly replacing on-premise installations across all enterprise sizes due to reduced overhead costs and faster feature updates. By application, IT & Telecommunication remains the largest segment, using CWM extensively for DevOps and service delivery, but the Marketing & Sales segment is exhibiting the fastest growth as organizations seek to formalize and track campaign execution processes. Enterprise size segmentation shows that Large Enterprises constitute the largest revenue source due to their extensive user bases and complex project structures, requiring premium features like advanced governance and security controls. However, the SME segment is becoming increasingly vital, driven by the availability of scalable, affordable, and easy-to-implement SaaS CWM solutions, ensuring continued market diversification and expansion across all organizational sizes.

AI Impact Analysis on Collaborative Work Management Solutions Market

User queries regarding AI's influence on Collaborative Work Management Solutions often center on efficiency gains, predictive capabilities, and data security concerns. Common questions revolve around how AI can automate routine task management, optimize resource allocation across complex portfolios, and proactively identify potential project bottlenecks before they cause delays. Users are keenly interested in the potential for Generative AI to assist in project documentation, drafting status updates, and automatically creating structured reports from unstructured communication data. Key thematic expectations include the transition from reactive tracking to predictive guidance, enabling project managers to focus on strategic execution rather than administrative overhead. Conversely, concerns frequently arise regarding the accuracy of AI-driven recommendations, data privacy when feeding sensitive project data into machine learning models, and the necessary skill shift required for employees to effectively manage and utilize AI-enhanced CWM platforms. The overarching user expectation is that AI will move CWM solutions beyond mere tracking tools into intelligent operational assistants.

The integration of artificial intelligence (AI) and machine learning (ML) is fundamentally transforming the CWM landscape, shifting the focus from simple organizational structure to intelligent, proactive workflow optimization. AI algorithms are increasingly deployed to analyze historical project data, identifying patterns in resource depletion, task duration, and collaboration effectiveness. This analysis enables systems to provide highly accurate effort estimations for future projects, significantly improving the budgeting and scheduling phases. Furthermore, intelligent prioritization engines use real-time data input (e.g., communication volume, dependency mapping) to dynamically adjust task priority lists for individual team members, ensuring that high-impact activities are addressed first, thereby accelerating project delivery cycles and minimizing the potential for expensive scope creep.

This technological evolution directly impacts solution providers, requiring massive investment in data science capabilities and cloud infrastructure capable of handling large-scale data processing necessary for effective ML training. For end-users, the immediate benefit lies in advanced features like automated risk detection, where the system flags projects nearing critical thresholds based on anomalies in progress tracking or resource burnout indicators. AI also powers automated workflow creation, learning from successful past projects to suggest optimal process flows for new initiatives, drastically reducing the setup time for complex projects. Consequently, vendors who successfully embed robust, ethical, and transparent AI functionality into their CWM platforms are expected to gain a significant competitive advantage and capture higher market share within the forecast period, driving market value upward.

- AI enhances task prioritization and intelligent workload balancing based on historical efficiency data.

- Machine learning models enable predictive risk assessment, identifying projects likely to miss deadlines or exceed budget.

- Generative AI assists in automated documentation, drafting meeting summaries, and generating preliminary project reports.

- AI facilitates automated resource optimization by suggesting skill-based team assignments and balancing allocation.

- Natural Language Processing (NLP) improves search functionality and allows CWM platforms to extract key decisions from communication transcripts.

DRO & Impact Forces Of Collaborative Work Management Solutions Market

The dynamics of the Collaborative Work Management Solutions Market are fundamentally shaped by a powerful interplay of Drivers, Restraints, Opportunities, and broader Impact Forces. The primary Driver is the overwhelming business need for operational transparency and agility, particularly given the global shift toward decentralized, cross-border team structures that necessitate centralized digital coordination. This is strongly supported by the Opportunity created through pervasive cloud computing infrastructure and the maturation of SaaS models, lowering the barrier to entry for deployment across SMEs. Conversely, a significant Restraint involves data security and compliance concerns, especially in highly regulated sectors like finance and government, alongside the inherent complexity of integrating new CWM platforms with legacy enterprise systems. The resulting Impact Forces mandate innovation in security protocols, integration APIs, and user change management strategies to ensure successful market penetration and long-term customer value realization.

Specific market Drivers include the increasing adoption of Agile and DevOps methodologies, which are inherently dependent on real-time tracking and collaboration tools to manage iterative development cycles effectively. Furthermore, the rapid expansion of digital communication channels (e.g., Slack, Teams) creates a massive volume of unstructured data that CWM solutions are necessary to structure and convert into actionable project insights. Strategic Opportunities are emerging in the sphere of low-code/no-code CWM customization, allowing business users to tailor workflows without reliance on IT specialists, thereby democratizing sophisticated project management capabilities. Geographically, untapped potential in emerging markets, driven by mass mobile internet penetration, presents a key area for high-volume, affordable CWM solution deployment, leveraging mobile-first application strategies to capture new user segments.

Key Restraints, beyond security, encompass the challenge of user adoption resistance, especially in organizations accustomed to traditional management practices; the investment required for training and ongoing platform maintenance can sometimes deter mid-sized companies. The Impact Forces generated by these elements pressure vendors to develop highly intuitive user interfaces (UI) and comprehensive training resources to mitigate user friction. Competitive intensity is another significant force, leading to constant pressure on pricing and feature proliferation, pushing vendors to invest heavily in differentiation through specialized AI features and superior customer support. Overall, the market remains highly attractive, but success is contingent upon addressing integration hurdles and convincingly demonstrating a clear return on investment (ROI) to potential enterprise clients.

Segmentation Analysis

The Collaborative Work Management Solutions Market is extensively segmented based on criteria such as Component, Deployment Model, Enterprise Size, Application, and Industry Vertical, reflecting the diverse needs of the global business community. This granular segmentation allows vendors to tailor their offerings—ranging from lightweight task management apps for SMEs to highly complex portfolio management solutions for large corporations—and define precise go-to-market strategies. Understanding these segments is crucial for strategic planning, as distinct purchasing behaviors and feature preferences exist across different deployment types and end-user industries. For instance, highly regulated sectors prioritize on-premise solutions or specialized private cloud CWM platforms for data sovereignty, while creative agencies may prioritize highly flexible, intuitive SaaS platforms focused on visual workflow management and external client collaboration capabilities.

The primary segmentation breakdown highlights the current market shift toward cloud-based subscriptions (Deployment Model) due to accessibility and ease of maintenance. The Component segmentation emphasizes the growing importance of integrated services (e.g., consulting, training) alongside the core software offering, reflecting the complex implementation required for enterprise-wide adoption. Furthermore, the segmentation by Application underscores the market’s utility beyond traditional IT project management, showcasing strong growth in functional areas such as Human Resources, Marketing, and Operations. This diversification indicates that CWM platforms are evolving into essential business process management tools rather than specialized project tools, solidifying their long-term position within the enterprise software ecosystem and supporting the overall market expansion outlined in the growth projections.

- By Component:

- Solutions (Software/Platform)

- Services (Implementation, Training, Consulting, Support)

- By Deployment Model:

- Cloud (SaaS)

- On-Premise

- Hybrid

- By Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Application:

- Project Management and Portfolio Management

- Document and Content Management

- Resource Management

- Task Management and Scheduling

- Communication and Collaboration

- By Industry Vertical:

- IT and Telecommunication

- Banking, Financial Services, and Insurance (BFSI)

- Media and Entertainment

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing and Automotive

- Government and Public Sector

- Professional Services

Value Chain Analysis For Collaborative Work Management Solutions Market

The Value Chain for Collaborative Work Management Solutions begins with the Upstream activities, focused primarily on research and development (R&D), technological innovation, and platform security architecture design. This phase involves substantial investment in developing core algorithms for features like resource allocation optimization, integrating advanced AI/ML capabilities, and ensuring compliance with global data protection standards (e.g., ISO 27001, SOC 2). Key upstream providers include cloud infrastructure services (AWS, Azure, Google Cloud), which host the majority of CWM platforms, and specialized third-party component developers contributing advanced features like embedded video conferencing or sophisticated visualization tools. The quality and security of the upstream software stack directly determine the reliability and market readiness of the final CWM product.

Midstream activities revolve around the actual development, customization, testing, and deployment of the CWM software. This phase includes continuous integration/continuous delivery (CI/CD) practices common in SaaS development, ensuring rapid feature iteration and bug fixes. The distribution channel plays a critical role here, often involving a direct sales model for large enterprise contracts, supplemented by indirect channels through global Value-Added Resellers (VARs) and Managed Service Providers (MSPs). These indirect partners specialize in regional implementation, integration with legacy systems, and providing localized support, essential for complex, multinational deployments. Successful midstream execution depends heavily on efficient sales enablement and partner training programs.

The Downstream phase focuses on post-sale activities: customer support, professional services, training, and ongoing platform maintenance. Direct distribution benefits from immediate feedback loops, allowing providers to rapidly iterate based on customer usage data and support tickets. Indirect distribution, leveraging MSPs, is vital for reaching SMEs that require turnkey solutions and outsourced management of the platform. Potential customers evaluate the CWM offering not just on features but also on the robustness of the downstream support infrastructure and the quality of the implementation services provided, emphasizing that the long-term perceived value of the solution is heavily influenced by the service component of the value chain. This end-stage interaction is crucial for reducing churn and driving renewal rates.

Collaborative Work Management Solutions Market Potential Customers

Potential customers for Collaborative Work Management Solutions encompass a vast spectrum of organizations, defined primarily as any entity requiring structured coordination among multiple team members or departments to achieve a defined outcome. The core End-Users/Buyers of these products are typically Project Management Offices (PMOs), IT Department Heads, Marketing Leadership, and functional Team Managers who are tasked with overseeing budgets, timelines, and personnel resources across complex initiatives. These decision-makers prioritize solutions that offer superior integration capabilities with existing enterprise software (e.g., CRM, HRIS) and robust governance features necessary for audit trails and regulatory compliance. Large multinational corporations represent high-value customers, requiring tiered licenses, advanced security features, and customization options to fit diverse internal methodologies and regional data requirements, making them the primary target for premium CWM offerings.

The segmentation of potential customers by industry vertical reveals specialized needs. For example, the Banking, Financial Services, and Insurance (BFSI) sector utilizes CWM platforms extensively for regulatory reporting projects, compliance adherence tracking, and managing the rollout of new digital banking services, demanding rigorous security and access controls. Conversely, the Media and Entertainment vertical uses CWM primarily for creative asset pipelines, content production scheduling, and campaign management, prioritizing visual workflow tools and seamless file sharing capabilities. Understanding these sector-specific priorities enables vendors to develop targeted feature sets and industry-specific templates, increasing the relevance and adoption rates of their solutions across diverse economic activities. Consequently, the sales strategy must be highly tailored to address the unique pain points of each vertical.

Furthermore, Small and Medium Enterprises (SMEs) represent a rapidly expanding customer base, drawn to CWM solutions primarily through accessible, subscription-based SaaS models that require minimal upfront capital investment and provide immediate scalability. These customers generally favor platforms that are intuitive, require limited training, and provide essential functionality like task tracking and simple resource allocation without overly complex enterprise features. Their purchasing decision is heavily influenced by cost-effectiveness, positive peer reviews, and the ease of immediate deployment. As the digital maturity of SMEs increases globally, this segment is expected to drive significant volume growth in the Collaborative Work Management Solutions Market, complementing the high-revenue contracts derived from large enterprises that focus on complex portfolio management capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $39.8 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Asana, Inc., Atlassian Corporation Plc, Microsoft Corporation, Wrike, Inc. (TIBCO Software), Smartsheet, Inc., Monday.com, ServiceNow, Zoho Corporation, Citrix Systems, Inc., Adobe Inc., Google LLC, Oracle Corporation, SAP SE, IBM Corporation, Planview, Inc., Celoxis Technologies Pvt. Ltd., Workfront, Inc. (Adobe), Teamwork.com, Basecamp, Trello (Atlassian) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Collaborative Work Management Solutions Market Key Technology Landscape

The technological landscape of the Collaborative Work Management Solutions Market is rapidly evolving, driven primarily by the need for seamless integration, advanced automation, and superior data security. Cloud computing, specifically multi-tenant Software as a Service (SaaS) architecture, remains the foundational technology, providing the necessary scalability, continuous updates, and immediate accessibility required by globally dispersed teams. Modern CWM platforms leverage microservices architecture to enhance modularity, allowing vendors to integrate third-party tools and specialized features (like advanced charting or time tracking) without compromising core system stability. Furthermore, the reliance on robust Application Programming Interfaces (APIs) for deep integration with hundreds of complementary business applications (e.g., Salesforce, Slack, GitHub) is a non-negotiable requirement, making open and well-documented API ecosystems a key technological differentiator for leading providers in the market.

Artificial Intelligence (AI) and Machine Learning (ML) are the most significant emerging technologies shaping the future of CWM. These technologies are utilized not only for simple task automation but for complex, predictive capabilities such as forecasting project timelines based on real-time task completion data, intelligent resource scheduling that accounts for employee skill sets and availability, and automated risk scoring for projects showing early signs of difficulty. Another critical technology is advanced data visualization and business intelligence (BI) integration. CWM dashboards are moving beyond static reports to offer dynamic, interactive data analysis using embedded BI tools, allowing project stakeholders to drill down into key performance indicators (KPIs) immediately, facilitating faster corrective actions and enhancing accountability across the portfolio.

Security technologies, including Zero Trust architecture models and advanced encryption standards (both in transit and at rest), are paramount, particularly as CWM platforms handle sensitive organizational data. Blockchain technology, although still nascent in this sector, is being explored by some specialized vendors for enhancing immutable audit trails and validating document versioning in highly regulated environments. The continuous focus on improving mobile application technology is also critical, ensuring that the full suite of collaborative features is available and highly functional on smartphones and tablets, catering to the needs of field-based workers and executives who require on-the-go oversight. The convergence of these technological elements defines the competitive advantage and ultimate utility of any modern Collaborative Work Management Solution.

Regional Highlights

North America holds the undisputed leadership position in the Collaborative Work Management Solutions Market, primarily due to the region's early and aggressive adoption of cloud technologies, high penetration of digital workplace solutions, and the presence of the majority of global market leaders (e.g., Atlassian, Smartsheet, Asana). The region’s sophisticated IT infrastructure and competitive business environment necessitate continuous optimization of workflow efficiency, driving high demand, particularly among large enterprises in the IT, financial services, and professional consulting sectors. The U.S. market, in particular, demonstrates a strong willingness to invest in premium CWM platforms that offer advanced features like embedded AI and portfolio management capabilities, leading to high average revenue per user (ARPU) compared to other regions. Regulatory frameworks, while demanding, also encourage investment in robust, compliant CWM solutions that provide detailed data governance and reporting functionality.

Europe constitutes the second-largest market, exhibiting strong and consistent growth driven by digital transformation mandates across the European Union and the widespread shift towards agile methodologies in manufacturing and automotive industries. Market growth is bifurcated, with Western European countries (Germany, UK, France) showing high maturity and steady adoption rates, focusing on integrating CWM with established ERP systems (like SAP). Central and Eastern Europe are experiencing faster adoption rates, capitalizing on SaaS solutions to modernize outdated legacy processes. Strict data privacy regulations, particularly GDPR, have significantly impacted CWM product development in the region, forcing vendors to prioritize data residency options and strong privacy controls, often favoring hybrid deployment models to meet specific national compliance requirements for data handling.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This explosive growth is attributed to rapid urbanization, increasing foreign investment leading to complex cross-border projects, and aggressive digital policy initiatives adopted by governments in countries like India, China, and Southeast Asian nations. The massive population of Small and Medium Enterprises (SMEs) in APAC are rapidly migrating away from manual processes to affordable, scalable cloud-based CWM solutions. Demand here is characterized by a strong preference for mobile-optimized platforms, multi-lingual support, and solutions capable of handling extremely large, distributed teams across vastly different time zones and regulatory landscapes. Investment by vendors in establishing local data centers and offering regionalized support is crucial for capturing this high-potential market segment.

Latin America (LATAM) and Middle East & Africa (MEA) represent emerging but highly valuable markets. Growth in LATAM is driven by increasing investment in IT and technology startups and the need for better project governance amidst macroeconomic volatility. In the MEA region, particularly the Gulf Cooperation Council (GCC) countries, large-scale infrastructure projects (e.g., Vision 2030 initiatives) are fueling demand for sophisticated CWM solutions capable of handling massive resource allocation, detailed construction timelines, and complex multi-stakeholder collaboration. While these regions currently contribute a smaller share to the global revenue, their high projected CAGR underscores significant future opportunities, conditional upon continuous improvement in digital infrastructure and increased business investment.

- North America (NA): Market leader due to high digital maturity, headquarters of key vendors, and strong enterprise adoption of advanced portfolio management features.

- Europe: Second largest market, driven by GDPR compliance needs, strong adoption in manufacturing, and mandated digital transformation across major economies.

- Asia Pacific (APAC): Highest projected CAGR, fueled by rapid SME digitalization, mobile-first adoption strategies, and major government digital initiatives in emerging economies.

- Latin America (LATAM): Emerging market focused on enhancing organizational efficiency and supporting a growing base of tech startups and digital service providers.

- Middle East & Africa (MEA): Growth centered on massive infrastructure and government-backed projects demanding stringent resource and timeline tracking capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Collaborative Work Management Solutions Market.- Asana, Inc.

- Atlassian Corporation Plc

- Microsoft Corporation

- Wrike, Inc. (TIBCO Software)

- Smartsheet, Inc.

- Monday.com

- ServiceNow

- Zoho Corporation

- Citrix Systems, Inc.

- Adobe Inc. (Workfront)

- Google LLC

- Oracle Corporation

- SAP SE

- IBM Corporation

- Planview, Inc.

- Celoxis Technologies Pvt. Ltd.

- Teamwork.com

- Basecamp

- Freshworks Inc.

- Aha!

Frequently Asked Questions

Analyze common user questions about the Collaborative Work Management Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Collaborative Work Management (CWM) and traditional Project Management (PM) software?

CWM solutions differ from traditional PM software by placing a greater emphasis on cross-functional teamwork, communication fluidity, and workflow automation, rather than just strict Gantt charts and deadlines. CWM is designed for ongoing, dynamic collaboration across the entire organization, supporting diverse work methodologies, while traditional PM software often focuses rigidly on single, fixed-scope projects and is typically utilized primarily by certified project managers.

How is Artificial Intelligence (AI) being integrated into CWM platforms?

AI integration in CWM is focused on enhancing predictive capabilities and automation. This includes using machine learning to forecast project risk, automatically prioritize tasks based on organizational objectives, optimize resource allocation across competing projects, and generate automated project status reports and documentation summaries, ultimately reducing administrative burden.

Which deployment model is dominating the Collaborative Work Management Solutions Market?

The Cloud (SaaS) deployment model significantly dominates the CWM market. Its supremacy is driven by lower implementation costs, rapid scalability, continuous feature updates, and the necessary accessibility required to support globally distributed, remote, and hybrid workforces. On-premise solutions remain relevant mainly for highly regulated sectors requiring stringent data sovereignty controls.

What are the key security concerns associated with adopting CWM solutions?

Primary security concerns involve data privacy, ensuring compliance with global regulations (like GDPR and CCPA), and managing access control across large enterprise systems. Users are concerned about the security of sensitive corporate intellectual property and financial data handled within the collaborative environment. Vendors address this through advanced encryption, multi-factor authentication, and specialized data residency options.

Which industry vertical is showing the fastest growth rate in CWM adoption?

While the IT and Telecommunication sector remains the largest consumer by volume, the Professional Services and Marketing & Sales verticals are exhibiting the fastest growth rates. This acceleration is driven by the need to streamline client delivery projects, manage complex marketing campaigns, and rapidly onboard new clients using standardized, measurable workflows provided by CWM platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager