Color Sorter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432656 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Color Sorter Market Size

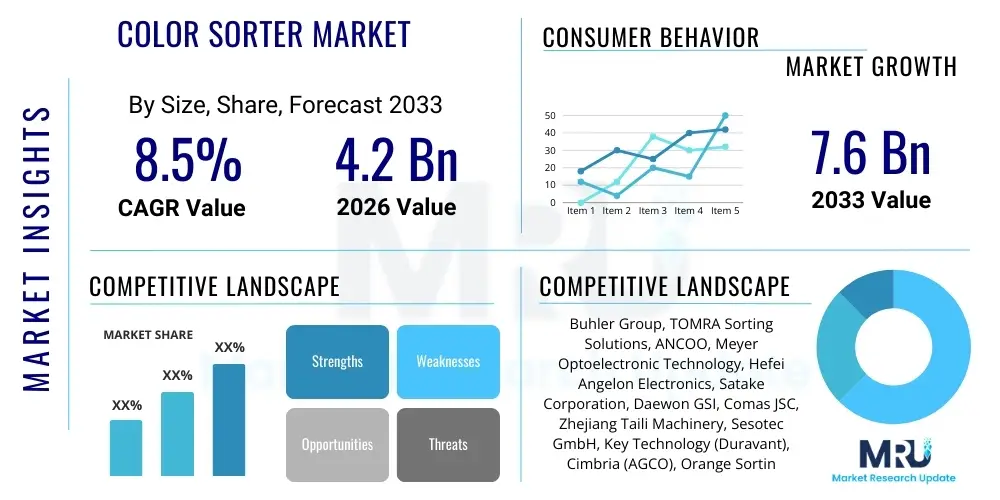

The Color Sorter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 4.2 Billion in 2026 and is projected to reach USD 7.6 Billion by the end of the forecast period in 2033. This substantial expansion is primarily fueled by rising global demand for high-quality processed agricultural products, increasingly stringent regulatory standards for food safety, and continuous technological advancements integrating Artificial Intelligence and high-resolution optical sensors into sorting machinery. The market trajectory reflects a crucial shift from traditional manual sorting methods towards highly efficient, automated optical inspection systems capable of rapid defect detection and separation across various industrial applications, guaranteeing optimal product purity and consistency for end-users worldwide.

Color Sorter Market introduction

The Color Sorter Market encompasses the manufacture, distribution, and utilization of sophisticated automated equipment designed to inspect materials and separate them based on color, shape, size, and composition defects using advanced optical sensors and ejector mechanisms. These machines are vital across numerous industries, ensuring high-quality output and minimizing waste. The primary function involves high-speed analysis of bulk material streams, comparing each item against pre-set acceptance parameters, and swiftly ejecting substandard materials through pressurized air jets. Key applications span grain and seed processing, rice milling, plastics recycling, mineral extraction, and nut and dried fruit processing. These systems significantly enhance operational efficiency, reduce labor costs, and, most importantly, uphold rigorous standards of food and material safety, making them indispensable tools in modern manufacturing and agricultural supply chains.

Product descriptions typically highlight features such as multi-spectral imaging (visible light, NIR, InGaAs), high-capacity throughput, and user-friendly interfaces allowing for customized sorting profiles. Major applications include sorting impurities from rice, coffee beans, wheat, plastics (PET, HDPE), and various industrial minerals. The chief benefits derived from utilizing color sorters include improved yield, superior product quality consistency, compliance with stringent international quality regulations, and significant labor displacement savings. Furthermore, these machines are integral in sustainability initiatives, particularly in the recycling sector, where efficient material separation is critical for closing the loop on valuable resources. The integration of advanced computational vision and machine learning algorithms continues to redefine the capabilities of these systems, pushing the boundaries of precision and speed.

Driving factors propelling market growth include rapid industrialization in developing economies, increasing global population necessitating higher food production efficiencies, and the burgeoning demand for processed foods that adhere to strict quality controls. Moreover, the increasing adoption of recycling technologies globally, particularly in Asia Pacific and Europe, is fueling the demand for specialized color sorters capable of distinguishing complex polymers and colors in mixed waste streams. Regulatory pressure from organizations like the FDA and EFSA, emphasizing zero-tolerance for contaminants in food products, mandates the use of highly accurate sorting equipment. The continuous refinement of sensor technology, moving toward higher resolution and broader spectral analysis, further acts as a significant market accelerant.

Color Sorter Market Executive Summary

The global Color Sorter Market is witnessing robust growth, driven primarily by technological convergence and increased regulatory stringency across food and non-food industries. Current business trends indicate a strong move toward systems leveraging Artificial Intelligence (AI) for enhanced defect detection and self-optimization, enabling higher throughput and reduced false rejects. Strategic partnerships focusing on integrating Internet of Things (IoT) capabilities are also prevalent, allowing for remote diagnostics, predictive maintenance, and seamless integration into smart factory ecosystems. Companies are investing heavily in hyperspectral imaging technology to detect impurities invisible to the human eye, solidifying the industry's commitment to delivering unparalleled product purity. Furthermore, the market structure is moderately fragmented, with intense competition among established global players and niche regional specialists focusing on cost-effective, application-specific solutions, particularly for smaller agricultural enterprises.

Regionally, Asia Pacific (APAC) currently dominates the market share due to its massive agricultural output (especially rice, grains, and tea) and rapidly expanding plastics recycling infrastructure, notably in China, India, and Southeast Asian nations. This dominance is reinforced by government initiatives promoting automation in farming and processing sectors to meet domestic and export demands efficiently. North America and Europe, while representing mature markets, exhibit high adoption rates of advanced, premium sorting equipment focused on high-specification applications, such as specialized seed sorting and complex polymer recycling, reflecting stringent safety standards and high labor costs. Latin America and the Middle East & Africa (MEA) are emerging as high-growth regions, spurred by investments in modernizing agricultural practices and developing domestic food security infrastructure, necessitating automated sorting solutions to improve post-harvest management and reduce spoilage.

Segment trends highlight the dominance of the CCD camera-based sorter segment, though the adoption rate of specialized sensor technologies like NIR and InGaAs is accelerating rapidly due to their superior performance in challenging applications such as mineral sorting and detecting foreign materials (e.g., glass, stones) in processed food. Application-wise, the food segment, particularly grain sorting, remains the largest revenue contributor. However, the non-food segment, propelled by the growth of plastic recycling and the need for higher purity metallic scrap, is projected to record the highest CAGR during the forecast period. End-user preference is shifting toward modular systems that offer flexibility and easy upgrades, allowing processors to adapt quickly to changing commodity types and quality requirements without significant capital expenditure, promoting higher market penetration across diverse operational scales.

AI Impact Analysis on Color Sorter Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) fundamentally transform the accuracy and efficiency of existing color sorting technologies. Common questions revolve around AI’s ability to detect subtle defects previously missed by traditional algorithms, the feasibility of real-time self-calibration, and the integration costs associated with retrofitting older machines with AI modules. Key user concerns center on the reliability of AI algorithms across diverse and unpredictable material inputs (e.g., varying humidity, different crop strains) and the training data requirements needed to achieve optimal sorting profiles. The overarching expectation is that AI will move color sorters beyond mere color differentiation to complex, feature-based sorting, reducing dependence on manual parameter setting and significantly lowering false reject rates, thereby maximizing yield and reducing operational overheads for processors globally. AI integration is viewed as the necessary evolution to handle increasing complexity in both raw materials and stringent regulatory demands.

The impact of AI is multidimensional, enhancing every aspect of the sorting process, from initial image acquisition to final product ejection. AI algorithms, particularly deep learning models, excel at processing massive datasets generated by high-resolution cameras, enabling the identification of microscopic blemishes, subtle texture differences, and foreign materials that are difficult for traditional software to classify. This capability allows sorters to distinguish between items based on complex criteria, such as the maturity of a fruit or the precise type of contaminant plastic, vastly improving purity levels. Furthermore, AI facilitates predictive modeling for maintenance, optimizing machine performance and minimizing downtime, which is critical in high-throughput environments where continuous operation is essential for profitability. The shift toward AI-driven decision-making represents a paradigm leap in sorting precision.

The integration of AI is not limited to defect classification; it also plays a crucial role in operational optimization. AI-powered sorters can dynamically adjust sensitivity and ejector timing in real time based on fluctuations in input material flow and environmental conditions, ensuring consistent sorting quality without human intervention. This self-learning capability reduces the need for constant operator adjustments and specialized training, democratizing access to high-precision sorting technology. The resulting improvements in efficiency and yield solidify AI’s position as a core competitive differentiator, prompting manufacturers to prioritize AI/ML integration in their new product development cycles to meet the evolving demands for high-purity processed goods in the food, recycling, and mining sectors.

- Enhanced Defect Recognition: AI uses deep learning to identify subtle, complex, or previously unseen defects and contaminants.

- Real-time Self-Calibration: Algorithms optimize sorting parameters dynamically based on continuous material input analysis.

- Reduced False Rejects: Machine Learning models minimize the rejection of good products, maximizing yield efficiency.

- Predictive Maintenance: AI analyzes sensor data to forecast potential component failures, reducing unscheduled downtime.

- Feature-Based Sorting: Moving beyond color, AI enables sorting based on complex features like texture, density, or moisture content.

- Improved Throughput Consistency: Automated optimization ensures stable performance regardless of fluctuating material quality or flow rates.

- Lower Operational Complexity: Simplified user interfaces driven by automated learning reduce reliance on highly skilled operators.

DRO & Impact Forces Of Color Sorter Market

The Color Sorter Market is powerfully influenced by key drivers, significant restraints, and promising opportunities, collectively shaping its trajectory and competitive landscape. The primary drivers include escalating global demand for food safety and quality compliance, driven by consumer awareness and stringent governmental regulations (e.g., HACCP, FSMA). Additionally, high labor costs and the scarcity of manual labor in agricultural and processing sectors necessitate automation, making color sorters an economically viable long-term investment. Conversely, the market faces significant restraints, chiefly the high initial capital investment required for advanced optical sorting equipment, which poses a barrier to entry for Small and Medium-sized Enterprises (SMEs), particularly in developing regions. Furthermore, the specialized technical expertise required for maintenance and optimization of these sophisticated machines sometimes limits widespread adoption.

However, the market is rife with opportunities stemming from emerging technologies and developing markets. The development of cost-effective, modular, and customizable sorting solutions designed specifically for smaller-scale operations presents a significant avenue for market expansion. The largest opportunity lies in the rapid growth of the global recycling industry, where color sorters are crucial for efficient separation of polymers, glass, and metals to achieve high-purity recovered materials. Technological opportunities, such as the refinement of hyperspectral imaging and AI integration, promise to unlock new application areas, particularly in complex domains like seed analysis, pharmaceutical inspection, and high-pgrade mineral beneficiation. Tapping into these non-traditional applications will diversify revenue streams and stabilize market growth against commodity price fluctuations.

The impact forces exerted on the market emphasize the shift towards automation and precision. Regulatory pressures force processors to adopt the best available technology (BAT), thus accelerating market penetration of high-end sorters. Competitive intensity among manufacturers drives innovation, pushing down the cost-to-performance ratio over time, making these systems more accessible. Simultaneously, the environmental impact force, demanding sustainable resource management and waste reduction, positions color sorters as essential tools for achieving circular economy goals in recycling and reducing post-harvest losses in agriculture. These impact forces ensure that while initial capital outlay remains a constraint, the long-term economic and compliance benefits overwhelmingly favor the adoption of advanced automated sorting solutions globally, guaranteeing continued market buoyancy over the forecast period.

Segmentation Analysis

The Color Sorter Market is meticulously segmented based on camera type, sorting mechanism, application, and end-user, allowing for precise market targeting and strategic decision-making. The segmentation reflects the diverse operational requirements across different industries, ranging from the high-volume, low-margin demands of staple food processing to the specialized, high-precision needs of seed production or critical metal recycling. Analyzing these segments helps stakeholders understand where specific technological innovations, such as InGaAs sensors or advanced ejection systems, are gaining the highest traction and delivering the most compelling return on investment. The complexity of materials handled dictates the required sorting mechanism, driving market differentiation between chute-type, belt-type, and specialized free-fall sorters, each optimized for specific material characteristics like fragility, density, and flow rate.

The application segment analysis reveals that the food sector, encompassing grains, pulses, seeds, and nuts, constitutes the largest segment, driven by persistent demand for food safety and export quality maintenance. However, the non-food sector, powered by plastics recycling and mining/mineral processing, is exhibiting superior growth dynamics due to global commitments to sustainability and the necessity to recover high-purity secondary raw materials efficiently. Geographically, segmentation highlights the regional disparities in technology adoption, with APAC driving volume demand for staple food sorting, while North America and Europe focus on value-added, high-specification sorting solutions across food and recycling applications. These distinct regional profiles guide manufacturers in tailoring product specifications and pricing strategies to maximize market penetration across different economic landscapes.

- By Type of Camera:

- CCD (Charged-Coupled Device) Camera Sorters

- CMOS (Complementary Metal-Oxide-Semiconductor) Camera Sorters

- Infrared (IR) Sorters (NIR/InGaAs)

- Hyperspectral Imaging Sorters

- By Sorting Mechanism:

- Chute-Type Color Sorters

- Belt-Type Color Sorters

- Free-Fall Sorters

- By Application:

- Food & Agriculture: Rice, Grains & Pulses, Seeds, Coffee & Tea, Nuts & Spices, Fruits & Vegetables

- Non-Food: Plastics Recycling (PET, HDPE, PVC), Mineral & Mining, Industrial Products (Glass, Metals)

- By End-User:

- Processing Plants (Large-scale)

- Farm & Field Operations (Small to Medium-scale)

- Recycling Facilities

- Mining & Quarrying Operations

Value Chain Analysis For Color Sorter Market

The value chain of the Color Sorter Market is a complex structure involving highly specialized technology providers and sophisticated distribution networks, beginning with upstream component manufacturing. Upstream analysis focuses heavily on key raw material suppliers, predominantly high-resolution camera and sensor manufacturers (CCD, CMOS, NIR, InGaAs), specialized pneumatic ejector system developers, and advanced computational hardware providers (GPUs and CPUs essential for AI processing). The quality and cost of these core components directly influence the final performance and price of the sorting machine. Manufacturers form strategic, long-term partnerships with these specialized component suppliers to ensure supply chain reliability, technological integration superiority, and maintain a competitive edge, emphasizing component miniaturization and enhanced sensor longevity.

The core manufacturing stage involves the assembly, integration of software (including proprietary AI algorithms and optics management systems), rigorous testing, and quality control of the finished sorting machine. The downstream value chain primarily revolves around distribution, installation, and critical after-sales services, which are crucial due to the highly technical nature of the equipment. Distribution channels are varied, involving direct sales teams for large processing plants that require highly customized installations and regional distributors or agents who manage sales, inventory, and local technical support for smaller enterprises. The efficacy of the downstream network, particularly in providing rapid maintenance and specialized training, significantly influences customer satisfaction and repeat business, especially in regions with limited local expertise.

The reliance on both direct and indirect channels is balanced strategically. Direct channels are utilized for key accounts, ensuring deep client relationships and effective negotiation on complex customized solutions. Indirect channels, through specialized distributors, allow manufacturers to achieve broader geographical reach, particularly in fragmented markets like Asia Pacific, where localized support infrastructure is paramount. Furthermore, the role of value-added resellers (VARs) who integrate color sorters into complete processing lines (e.g., rice milling or plastic washing lines) is increasingly important. This comprehensive value chain ensures that the cutting-edge technology developed upstream is effectively delivered, installed, maintained, and optimized downstream to meet the specific purity and throughput requirements of diverse end-users across agriculture, food processing, and the industrial sectors.

Color Sorter Market Potential Customers

Potential customers for color sorter equipment span a broad spectrum of industries, fundamentally categorized by the need for high-speed, high-precision material separation and quality control. The primary end-users are large-scale agricultural processors, including rice millers, grain handlers, seed producers, and nut and dried fruit processors, all striving to meet stringent consumer and export quality standards while maximizing commodity value. These entities require high-capacity, reliable machines capable of sorting vast quantities of product quickly and accurately, often demanding sophisticated systems that can detect aflatoxins or microscopic foreign materials. For these customers, the primary purchasing drivers are yield improvement, regulatory compliance, and reduction in manual labor costs, viewing the sorter as a critical capital investment in operational scalability.

Beyond the food sector, the rapidly expanding recycling industry represents a massive potential customer base, particularly facilities handling Municipal Solid Waste (MSW) or specialized industrial waste. Plastics recyclers, glass cullet producers, and scrap metal yards use color sorters to separate polymers (like PET from PVC) or different colored glass fractions, which is crucial for producing high-purity, marketable secondary raw materials required by manufacturers committed to using recycled content. These non-food customers prioritize spectral detection capabilities (e.g., NIR for plastics) and robust machinery designs that can withstand harsh industrial environments, focusing on the machine's ability to create high-value homogenous streams from heterogeneous waste inputs.

Additionally, niche end-users, such as specialized seed banks, pharmaceutical ingredient manufacturers, and advanced mineral processing operations (e.g., diamond or precious metal extraction), constitute high-value customers. These buyers require ultra-high precision, often purchasing belt-type sorters or specialized optical systems capable of single-seed or single-particle inspection. In these sectors, the cost of error is significantly higher, leading to a focus on customized software, sophisticated algorithms, and advanced multi-spectral analysis capabilities rather than merely high throughput. The market strategy must therefore be bifurcated, addressing both the volume demands of large-scale commodity processors and the extreme precision needs of specialized industrial customers to capture the full market potential.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.2 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Buhler Group, TOMRA Sorting Solutions, ANCOO, Meyer Optoelectronic Technology, Hefei Angelon Electronics, Satake Corporation, Daewon GSI, Comas JSC, Zhejiang Taili Machinery, Sesotec GmbH, Key Technology (Duravant), Cimbria (AGCO), Orange Sorting Machine, Hefei Guangzhong, AMD Manufacturing |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Color Sorter Market Key Technology Landscape

The technology landscape of the Color Sorter Market is defined by a rapid evolution in optical sensing, image processing, and intelligent control systems, making the current generation of sorters significantly more capable than their predecessors. The transition from basic monochromatic cameras to high-resolution CCD and CMOS full-color cameras (RGB) marked the first major leap, enabling detection based on subtle color variations. However, the modern technological forefront is dominated by the integration of multi-spectral and hyperspectral imaging. Near-Infrared (NIR) and Indium Gallium Arsenide (InGaAs) sensors are critical, allowing sorters to "see" internal chemical properties, moisture content, and foreign material composition invisible to the human eye, vital for detecting toxic contaminants like aflatoxins in nuts and grains or identifying different polymer types in recycling applications. This shift towards spectral analysis fundamentally broadens the application scope and elevates the purity achievable by sorting equipment across all end-user sectors.

The second critical technological pillar is the adoption of advanced computational hardware and Artificial Intelligence (AI). High-speed graphics processing units (GPUs) are now standard, providing the necessary computing power to run complex deep learning algorithms in real-time as material streams pass through the inspection zone at high velocity. AI enhances the machine's decision-making process, allowing it to move beyond simple threshold comparisons to complex feature classification based on texture, shape anomalies, and subtle discoloration patterns. This significantly reduces false reject rates and enables the machine to handle much more complex sorting tasks, such as differentiating between various types of plastics that appear identical in visible light but have distinct spectral signatures. Manufacturers are continuously refining these algorithms to enable self-learning and predictive performance optimization based on historical data and real-time operational feedback, ensuring the sorters operate at peak efficiency with minimal human intervention.

Furthermore, the mechanical and pneumatic systems have seen significant improvements focused on enhancing speed, reliability, and precision. Ejector systems have evolved from large, slow nozzles to high-speed, miniaturized air valves capable of thousands of actuations per second, ensuring precise rejection of individual faulty items without disrupting the flow of adjacent good material. Belt-type sorters, favored for delicate or complex materials like frozen foods and sticky items, utilize controlled conveyance systems to stabilize material flow, maximizing inspection accuracy and minimizing product damage. The trend is moving towards modular, IoT-enabled designs, facilitating easier integration into existing processing lines, enabling remote diagnostics, and allowing for rapid field upgrades of software and specialized sensors. This interconnected technological ecosystem ensures longevity and adaptability of color sorting investments in an environment of continually rising quality expectations.

Regional Highlights

- Asia Pacific (APAC) Dominance: APAC maintains its position as the largest market region, primarily driven by massive agricultural economies (China, India, Thailand, Vietnam) heavily reliant on rice, grain, and seed processing. Government mandates focusing on food security, reducing post-harvest losses, and improving export quality standards necessitate the widespread adoption of high-capacity color sorters. Furthermore, the region is experiencing exponential growth in manufacturing and plastics recycling, particularly due to stringent import bans on waste by some nations, compelling the establishment of advanced domestic recycling infrastructures. This high volume of demand across both food and non-food sectors ensures APAC's continued market leadership and high growth potential for cost-effective, high-throughput chute-type sorters.

- North America (NA) Advanced Adoption: North America represents a mature, high-value market characterized by early adoption of the latest AI and hyperspectral technologies. The region’s focus is on premium, high-specification sorting applications in specialized crops, certified seed production, and complex food safety applications (e.g., micro-defect detection, foreign material analysis). High labor costs are a fundamental driver, making automation essential across the food processing and recycling sectors. Investment in belt-type sorters for delicate products and high-tech plastic sorting (utilizing NIR and advanced AI) is particularly strong, reflecting the industry's focus on maximizing efficiency and achieving the highest possible purity levels demanded by regulatory bodies like the FDA.

- Europe (EU) Regulatory and Recycling Focus: Europe is characterized by extremely stringent food safety regulations and robust commitments to the circular economy. This drives consistent demand for high-end color sorters. The massive investment in recycling infrastructure, particularly for glass, polymers, and electronic waste, makes the non-food segment exceptionally strong. European processors demand high energy efficiency, modular designs, and sophisticated sensor technology capable of complex material identification to meet ambitious EU recycling targets. Germany, Italy, and the UK are key markets, focusing on continuous technological upgrades and advanced integration into automated processing lines to sustain competitive manufacturing advantages.

- Latin America (LATAM) Emerging Growth: Latin America is rapidly emerging as a significant growth hub, fueled by the modernization of agricultural practices, particularly in Brazil, Argentina, and Mexico (major exporters of coffee, sugar, and grains). Increasing focus on export quality maintenance requires processors to upgrade from manual to automated sorting systems to comply with international trade standards. Market penetration is accelerating, presenting significant opportunities for manufacturers offering robust, reliable, and regionally supported sorting solutions, often targeting mid-range capacity machines suitable for regional processing facilities that are currently automating their post-harvest operations.

- Middle East & Africa (MEA) Infrastructure Development: The MEA region is expected to demonstrate accelerating growth, driven by large-scale government investments in agricultural modernization and food security initiatives. Countries in the Middle East are investing heavily in establishing advanced food processing capabilities, reducing reliance on imports. In Africa, the need to reduce massive post-harvest losses and improve commodity quality for global trade is the main driver. This necessitates the implementation of entry-level to mid-range color sorters, focusing on staple grains and nuts. Market expansion relies heavily on establishing effective local service networks and offering scalable technology tailored to developing infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Color Sorter Market.- Buhler Group

- TOMRA Sorting Solutions

- Satake Corporation

- Meyer Optoelectronic Technology Inc.

- Key Technology (Duravant)

- Sesotec GmbH

- Hefei Angelon Electronics Co., Ltd.

- ANCOO

- Daewon GSI Co., Ltd.

- Comas JSC

- Zhejiang Taili Machinery Co., Ltd.

- Cimbria (AGCO Corporation)

- Orange Sorting Machine

- AMD Manufacturing

- Hefei Guangzhong Technology Co., Ltd.

- NRT (National Recovery Technologies)

- Sea-Lion Technology

- Changsha Rongsheng Technology

- Jingcheng Machinery

- TAIHO Intelligent

Frequently Asked Questions

Analyze common user questions about the Color Sorter market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of color sorters globally?

The primary driver is the stringent global enforcement of food safety regulations and quality standards (e.g., for toxins, foreign materials), coupled with the necessity to reduce manual labor costs and maximize yield efficiency in processing operations across agriculture and recycling sectors.

How does AI improve the performance and accuracy of modern color sorters?

AI utilizes deep learning algorithms to analyze complex material characteristics (texture, shape, subtle defects) in real-time, enabling higher precision defect detection, self-calibration, and significantly reducing the false reject rate compared to traditional fixed-parameter sorting systems.

Which type of sensor technology is currently experiencing the fastest growth in the market?

Near-Infrared (NIR) and Hyperspectral Imaging (InGaAs) sensors are experiencing the fastest growth. These technologies allow the detection of chemical composition and internal properties invisible to visible light cameras, crucial for advanced sorting in recycling and high-value food safety applications.

Is the high initial cost of color sorters justified for smaller processing facilities?

While the initial cost is high, manufacturers are increasingly offering modular and smaller-capacity chute-type sorters. The justification lies in long-term savings through reduced labor costs, increased product yield, and improved consistency, leading to a strong Return on Investment (ROI) over the machine's lifecycle.

Which geographical region holds the largest market share for color sorters?

Asia Pacific (APAC) holds the largest market share due to its vast agricultural processing industry (rice and grains) and rapid industrialization, which fuels high-volume demand for both food and plastics sorting equipment across key economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Plastics Color Sorter Market Statistics 2025 Analysis By Application (PVC Recycling, PET Recycling, HDPE Recycling, Other), By Type (Plastic Bottle Sorting Equipment, Plastic Flake Sorting Equipment), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Color Sorter for Recycling Market Statistics 2025 Analysis By Application (Plastic, Glass), By Type (Chute-Type, Belt-Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager