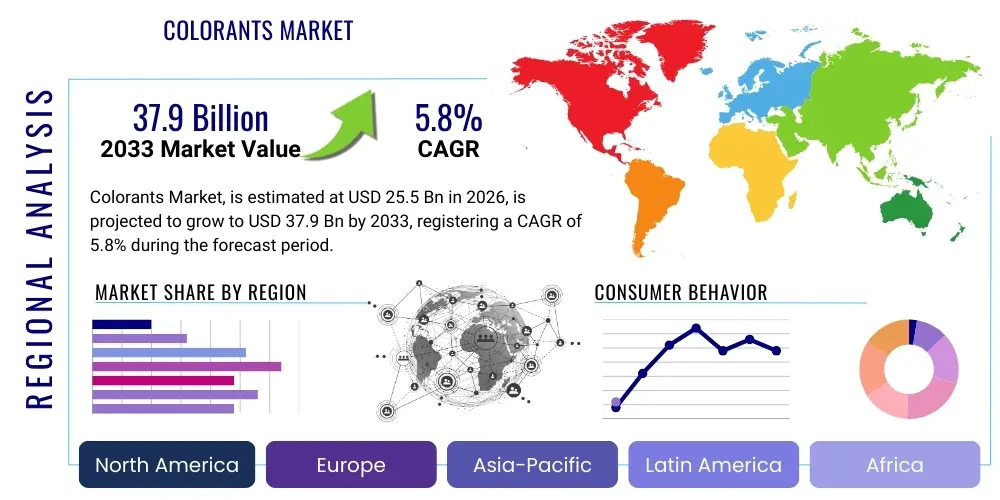

Colorants Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437530 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Colorants Market Size

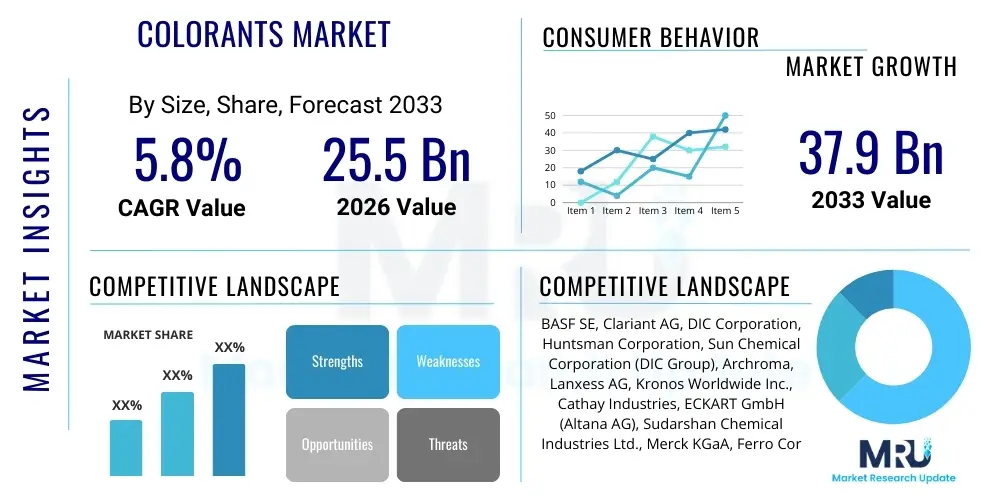

The Colorants Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 37.9 Billion by the end of the forecast period in 2033.

Colorants Market introduction

The Colorants Market encompasses a vast array of substances—primarily dyes and pigments—used to impart color to various materials and substrates. These substances are crucial components in nearly every manufacturing sector, providing aesthetic appeal, identification, and functional properties such as UV resistance or heat stability. The product range is extensive, spanning synthetic organic colorants, inorganic pigments (like titanium dioxide and carbon black), and natural dyes, each offering unique performance characteristics tailored to specific industrial requirements.

Major applications of colorants include the coating industry (automotive, architectural, industrial), plastics manufacturing (packaging, consumer goods, construction materials), textiles, printing inks, and cosmetics. The primary benefit derived from colorants is enhanced product differentiation and consumer appeal, directly impacting purchasing decisions. Functionally, colorants ensure consistency and durability in end-use products. The versatility of modern colorant technologies allows manufacturers to achieve specific hues, saturation levels, and operational efficiencies, particularly through highly concentrated pigment dispersions and advanced dyeing techniques.

Key driving factors accelerating market expansion include the burgeoning growth of the packaging industry, increased demand for high-performance coatings in the automotive and construction sectors, and the rapid shift towards digital printing technologies which utilize specialized colorants (inks). Furthermore, the rising consumer preference for sustainable and bio-based colorants, driven by stringent environmental regulations, is compelling manufacturers to invest heavily in green chemistry R&D, thereby opening new avenues for specialized product categories and market growth across diverse geographic regions.

Colorants Market Executive Summary

The Colorants Market is currently experiencing robust growth underpinned by strong consumption in emerging economies and persistent innovation focused on environmental compliance and high-performance attributes. Business trends emphasize strategic mergers and acquisitions aimed at consolidating market share and gaining control over specialized pigment technologies, particularly in the digital ink and effect pigments segments. Companies are increasingly adopting vertical integration strategies to manage supply chain volatility associated with key raw materials like crude oil derivatives and heavy metals. Furthermore, significant capital expenditure is being directed toward enhancing production efficiency and scaling up capacity for sustainable, heavy-metal-free, and low volatile organic compound (VOC) colorant formulations to meet evolving global standards.

Regionally, the Asia Pacific (APAC) continues to dominate the global market, driven by massive manufacturing bases in China and India across the textile, automotive, and construction industries. This region exhibits the highest growth trajectory due to rapid urbanization and infrastructural development, leading to surging demand for architectural and protective coatings. North America and Europe, while mature markets, are leading the charge in adopting sophisticated, regulatory-compliant colorants, focusing heavily on sustainability trends such as bio-based pigments and recyclable packaging compatibility. Regulatory frameworks, such as REACH in Europe and similar initiatives globally, significantly shape regional consumption patterns, favoring specialized, traceable, and eco-friendly products.

Segmentation trends indicate a strong shift toward high-performance organic pigments, which offer superior color strength, durability, and chemical resistance compared to traditional inorganic counterparts, particularly in automotive and specialized plastics applications. The application segment shows robust expansion in printing inks, fueled by the e-commerce boom necessitating high-quality packaging and labeling, and the textile sector, which is increasingly adopting reactive and disperse dyes suitable for synthetic and natural fibers. Technological advancements in inkjet and digital printing colorants are poised to revolutionize the printing industry, offering greater customization and shorter production cycles, which further drives the market toward concentrated liquid dispersions and precise color matching solutions.

AI Impact Analysis on Colorants Market

Common user questions regarding AI's impact on the Colorants Market frequently revolve around topics such as the potential for AI-driven color formulation optimization, its role in predicting market demand fluctuations, and its ability to enhance quality control and regulatory compliance checks. Users are keen to understand how AI can reduce the time and cost associated with developing new colors, which historically relies on laborious trial-and-error processes. Key themes emerging from these queries include the expectation that AI will standardize color matching across different substrates and batches, improve supply chain resilience through predictive maintenance and inventory management, and facilitate the transition towards sustainable formulations by identifying optimal non-toxic alternatives rapidly. There is a palpable concern, however, regarding the initial investment cost for implementing AI infrastructure and the need for specialized data scientists within traditionally chemistry-focused organizations.

AI and machine learning (ML) are fundamentally transforming the R&D and manufacturing workflows within the colorants industry. In R&D, AI algorithms analyze vast datasets comprising chemical structures, performance attributes (such as light fastness and thermal stability), and spectral data to predict the optimal combination of raw materials needed to achieve a target color under specific application conditions. This predictive modeling drastically cuts down the laboratory time required for formulating new products, moving from months of experimental work to near-instantaneous theoretical predictions. Furthermore, AI tools are essential in optimizing dispersion techniques, ensuring particle size homogeneity, which is critical for the performance and consistency of pigments used in high-end applications like automotive coatings and digital inks. The utilization of neural networks in analyzing complex molecular interactions helps accelerate the discovery of novel, environmentally compliant color chemistries.

Within manufacturing and supply chain operations, AI enhances operational efficiency and product quality. Predictive analytics models, trained on historical sales data, seasonal variations, and external macroeconomic indicators, provide highly accurate demand forecasts, allowing colorant manufacturers to optimize production scheduling and minimize waste and excess inventory. Machine vision systems powered by AI are deployed on production lines for real-time, high-speed quality control, detecting subtle color deviations or contamination that might be missed by human inspection. This rigorous control is particularly vital for industries with strict specifications, such as pharmaceuticals and automotive topcoats. Moreover, AI assists in automating compliance reporting by cross-referencing formulations against global regulatory databases (e.g., TSCA, REACH), ensuring that every batch manufactured adheres to the latest complex legal requirements efficiently and mitigating costly compliance failures.

- AI-Driven Formulation Optimization: Machine learning algorithms accelerate the creation of new color recipes by predicting material interaction and performance metrics, significantly reducing R&D cycle times and costs.

- Enhanced Quality Control (QC): AI-powered spectral analysis and machine vision systems ensure real-time color consistency, detecting minute batch-to-batch variations essential for sensitive applications.

- Predictive Maintenance: AI algorithms analyze sensor data from manufacturing equipment to forecast potential failures, minimizing downtime and ensuring continuous, optimized production throughput.

- Supply Chain Forecasting: Advanced analytics predict raw material demand and finished product consumption patterns, enabling manufacturers to optimize inventory levels and hedge against supply disruptions.

- Sustainable Material Discovery: AI accelerates the identification and synthesis of non-toxic, bio-degradable, or heavy-metal-free alternative colorants, aiding the industry's shift toward green chemistry principles.

- Regulatory Compliance Automation: Automated systems audit colorant formulations against global environmental and safety standards instantaneously, reducing human error and ensuring rapid market entry compliance.

DRO & Impact Forces Of Colorants Market

The Colorants Market is primarily driven by expanding end-use sectors, notably packaging, construction, and automotive industries, coupled with a pervasive global trend towards aesthetic customization and product premiumization. The restraint landscape is dominated by increasingly stringent environmental regulations, particularly concerning VOC emissions and the use of heavy metal-based pigments, which necessitates costly reformulations and compliance procedures. Opportunities arise significantly from technological advancements in digital printing, which demands specialized high-chroma inks, and the burgeoning consumer preference for bio-based and sustainable colorants. These market forces, when combined, create a dynamic environment where investment in R&D for compliant and high-performance products becomes the dominant success factor, shifting competitive focus from simple cost reduction to specialized product offerings and supply chain resilience.

Drivers: The global proliferation of e-commerce has led to a sustained surge in demand for specialized packaging and labeling inks, requiring rapid drying times and excellent adhesion to diverse substrates. Furthermore, the construction industry’s need for durable, weather-resistant architectural coatings, often requiring high-performance pigments for UV stability and color longevity, remains a critical driver, particularly in fast-developing urban centers. The automotive sector's increasing focus on vibrant, durable, and sophisticated effect colorants (such as metallic and pearlescent pigments) to enhance vehicle aesthetics and durability is also significantly boosting the demand for specialized, high-cost pigment technologies. The inherent need across almost all manufacturing sectors to differentiate products through color ensures a continuous, non-cyclical baseline demand for colorants.

Restraints: Raw material price volatility poses a substantial challenge, as key intermediates for organic pigments (like crude oil derivatives) and inorganic pigments (such as titanium dioxide) are subject to global commodity market fluctuations and geopolitical instability. More critically, the implementation of strict regulations, notably in developed economies (e.g., REACH in the EU, California Proposition 65 in the US), mandates the phase-out of certain traditional, cost-effective pigments containing substances of concern like cadmium and lead. This forces manufacturers to absorb the high costs associated with developing and testing safer alternatives, sometimes leading to market disruptions when widely used substances are restricted. The capital intensity required for regulatory compliance and advanced manufacturing equipment acts as a barrier to entry for smaller players.

Opportunity and Impact Forces: The most significant opportunity lies in capitalizing on the shift toward sustainability. Developing and commercializing bio-based colorants derived from natural sources, utilizing advanced fermentation techniques, presents a high-growth niche. The rapid penetration of digital textile and industrial printing technologies creates massive demand for sophisticated liquid colorant dispersions and inkjet formulations optimized for performance and lower environmental footprint. Impact forces are currently centered around circular economy initiatives, pushing colorant manufacturers to create products that are easily de-inkable or compatible with recycling processes, thereby linking product design inherently with end-of-life management. Geopolitical factors affecting oil prices and trade tariffs also exert high impact forces on the profitability and sourcing strategies of global colorant suppliers.

Segmentation Analysis

The Colorants Market is comprehensively segmented based on its fundamental material types, the specific technology used for application, and the diverse end-use industries it serves. Understanding these segments is crucial for strategic market positioning, as each category possesses unique growth drivers, regulatory challenges, and competitive dynamics. The dominant segmentation by type includes pigments (inorganic and organic) and dyes, with pigments holding a larger market share due to their superior stability and widespread use in coatings and plastics. The application spectrum is broad, spanning high-volume sectors like textiles and packaging to highly specialized areas such as advanced digital printing and medical device coatings, requiring tailored colorant solutions. This diverse segmentation reflects the chemical complexity and industrial necessity of colorants across the modern economy.

Segmentation based on chemistry allows manufacturers to target specific performance requirements. Inorganic pigments, such as iron oxides and titanium dioxide, are favored for their opacity, heat stability, and cost-effectiveness, dominating applications in construction and protective coatings. Conversely, organic pigments provide high color strength and chroma, essential for automotive finishes, high-definition printing, and specialized plastics. Dyes, characterized by their solubility and ability to chemically bind to substrates, remain indispensable in the textile and paper industries. The competitive landscape within each segment is heavily influenced by intellectual property rights related to novel molecules and efficient production processes, making innovation in dispersion and formulation technologies a key differentiator.

Analyzing the market through the lens of end-use applications reveals where the highest value creation occurs. The packaging industry, driven by global consumption patterns, provides continuous volume growth, demanding efficient, food-contact compliant inks and plastics colorants. The automotive coating segment, requiring precise color matching and extreme durability against environmental exposure, is a high-value, albeit volume-sensitive, sector. The ongoing technological migration towards solvent-free, water-borne, and powder-based colorant systems across all applications further refines the market segmentation, reflecting the industry's commitment to mitigating environmental impact while enhancing product functionality and extending lifespan.

- By Type:

- Pigments

- Inorganic Pigments (Titanium Dioxide, Iron Oxide, Carbon Black, Chrome-based)

- Organic Pigments (Azo, Phthalocyanine, High-Performance Pigments (HPPs))

- Dyes

- Disperse Dyes

- Reactive Dyes

- Acid Dyes

- Direct Dyes

- Color Concentrates & Masterbatches

- Pigments

- By Application:

- Coatings (Architectural, Automotive, Industrial, Powder)

- Plastics (Packaging, Consumer Goods, Construction)

- Printing Inks (Digital, Flexographic, Gravure, Offset)

- Textiles

- Building and Construction

- Paper

- Cosmetics and Personal Care

- By End-Use Industry:

- Automotive

- Construction

- Packaging

- Consumer Goods

- Electronics

Value Chain Analysis For Colorants Market

The value chain of the Colorants Market is complex, spanning from the extraction and processing of raw petrochemicals and minerals to the final distribution and integration into end-user products. The upstream segment involves the synthesis of chemical intermediates, such as naphthalene, benzene derivatives, and metallic ores, which are critical precursors for both organic dyes and inorganic pigments. This stage is highly capital-intensive and often concentrated among large chemical manufacturers, characterized by reliance on consistent and competitive supply of primary raw materials. Volatility in crude oil prices significantly impacts the cost structure at the upstream level, directly influencing the final price of synthetic organic colorants, creating leverage for firms with robust backward integration capabilities.

The midstream process involves the actual manufacturing, purification, and formulation of colorants into marketable forms like powders, pastes, or liquid dispersions. This stage requires specialized chemical processing expertise, stringent quality control for particle size and color consistency, and significant R&D investment to comply with performance specifications and regulatory mandates. Formulation into specialized products such as masterbatches for plastics or pre-dispersed inks for digital printing adds considerable value. Competitive advantage at this stage hinges on process efficiency, proprietary synthesis routes, and the ability to customize products rapidly for niche application requirements.

Downstream analysis focuses on the distribution channels and the final end-users. Distribution is multifaceted, involving direct sales to large, strategic customers (e.g., major automotive coaters or large textile mills) and indirect distribution through specialized chemical distributors and agents for smaller customers or geographically distant markets. Distributors play a crucial role in providing logistical support, smaller batch sizes, technical service, and localized inventory management. The final consumption is dictated by sectors like coatings, plastics, and textiles, where the colorant is integrated into the final product. The shift toward direct engagement with key end-users allows colorant manufacturers to provide application-specific technical support and co-develop customized color solutions, solidifying long-term supplier relationships.

Colorants Market Potential Customers

Potential customers for the Colorants Market are extremely diverse, representing the vast spectrum of manufacturing and processing industries worldwide that rely on visual appeal, product identification, and material protection. The largest categories of end-users include major coating producers, who serve the architectural, protective, and OEM (Original Equipment Manufacturer) automotive sectors, requiring large volumes of standardized inorganic and highly specialized organic pigments. Secondly, plastic processors and packaging manufacturers represent a massive customer base, demanding tailor-made color concentrates (masterbatches) that ensure easy incorporation into polymers while maintaining heat stability and food contact safety standards, essential for fast-moving consumer goods (FMCG) and industrial packaging.

Another significant customer cohort is the global textile industry, ranging from large-scale apparel manufacturers and fiber producers to specialized technical textile firms. These customers utilize various dye types (reactive, disperse, acid) selected based on the fiber substrate (cotton, polyester, nylon) and the required fastness properties. The printing and graphics industry, encompassing traditional print houses and rapidly growing digital printing service providers, forms a critical consumer segment for performance inks, demanding high purity, narrow particle distribution, and specific viscosity characteristics for modern printing equipment. The cosmetic and personal care industry represents a high-value niche, requiring FDA/EU compliant, non-toxic, and often natural-sourced colorants for lipsticks, makeup, and topical products.

Emerging and specialized customer segments include manufacturers in the electronics and medical device fields. Electronics manufacturers require highly specialized, conductive, or thermally stable pigments and dyes for screens, casings, and internal components. The medical sector demands ultra-pure, certified, traceable colorants for pharmaceutical tablet coatings, medical plastics, and diagnostic test kits where bio-compatibility and lack of leachability are paramount concerns. These sectors prioritize performance, quality validation, and regulatory adherence above initial cost, presenting lucrative opportunities for suppliers specializing in high-specification colorant technologies and providing extensive documentation and regulatory support.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 37.9 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Clariant AG, DIC Corporation, Huntsman Corporation, Sun Chemical Corporation (DIC Group), Archroma, Lanxess AG, Kronos Worldwide Inc., Cathay Industries, ECKART GmbH (Altana AG), Sudarshan Chemical Industries Ltd., Merck KGaA, Ferro Corporation, Heubach GmbH, Rockwood Pigments, Pidilite Industries, Kiri Industries, Dainichiseika Color & Chemicals Mfg. Co. Ltd., Atul Ltd., Penn Color Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Colorants Market Key Technology Landscape

The technological landscape of the Colorants Market is undergoing rapid evolution, primarily driven by the imperative to enhance functional performance, minimize environmental footprint, and facilitate digital integration. A major focus is on advanced dispersion and milling techniques, such as micro- and nano-pigment technology, which enable the production of ultra-fine pigment particles. These specialized pigments offer superior color strength, opacity, and gloss, while also ensuring stability and consistent flow properties necessary for high-speed digital inkjet printing applications. Achieving precise particle size distribution is critical for preventing nozzle clogging and maximizing efficiency in modern printing and coating systems, making controlled synthesis and stabilization technologies highly valued intellectual property.

Another crucial technological development involves the widespread adoption of specialized masterbatches and concentrates. These highly loaded colorant systems allow plastics manufacturers to introduce color efficiently and cleanly, eliminating the need to handle raw pigment powders. Recent innovations focus on developing universal carrier systems compatible with a wide range of polymers and biodegradable masterbatches that align with circular economy objectives in the packaging sector. Furthermore, the shift from solvent-borne to water-borne and powder coating colorant formulations represents a mature but continuously evolving technology, aimed at complying with VOC emission regulations while maintaining or exceeding the durability and performance of traditional solvent-based systems, especially in automotive and industrial protective coatings.

The future of colorant technology is increasingly being shaped by sophisticated analytical and computational tools. Digital color management systems (CCMS) utilize spectrophotometers and specialized software to ensure perfect color reproducibility across different materials, batches, and geographic locations, minimizing waste and formulation errors. Coupled with this, ongoing research into bio-sourced and sustainable colorants—including those derived from microbial fermentation, plant extracts, or waste streams—is a high-growth area. These sustainable technologies aim to replace synthetic counterparts, offering a pathway for the industry to achieve compliance with stringent 'Green' product certifications, which is a major driver for innovation in organic and natural colorant synthesis and stabilization techniques.

Regional Highlights

The Colorants Market exhibits distinct growth trajectories and competitive environments across major geographical regions, influenced by localized manufacturing capacities, regulatory standards, and end-user market maturity.

- Asia Pacific (APAC): APAC stands as the undisputed market leader in terms of volume and consumption growth, predominantly fueled by China, India, and Southeast Asian nations. This region benefits from being the world’s manufacturing hub for textiles, consumer electronics, and automotive components, which translates directly into high demand for dyes, pigments, and printing inks. The architectural and construction segments are booming due to rapid urbanization and infrastructure projects, driving significant uptake of high-opacity inorganic pigments like titanium dioxide and iron oxides for protective and decorative coatings. While growth is vigorous, regulatory enforcement related to heavy metals and environmental pollutants is intensifying, pushing manufacturers toward adopting cleaner, albeit more costly, western standards for colorant production and usage. The competitive landscape is fragmented, featuring a mix of large global players and highly competitive local manufacturers.

- Europe: Europe represents a technologically advanced but highly mature market, characterized by strict environmental regulations, especially the Registration, Evaluation, Authorization and Restriction of Chemicals (REACH) framework. This stringent regulatory environment acts as a driver for innovation, compelling companies to pioneer and adopt sustainable, low-VOC, and bio-based colorant alternatives. The regional market growth, while steady, is primarily driven by high-value, specialty segments such as high-performance organic pigments for the premium automotive sector and specialized inkjet inks for industrial applications.

The European market places a high premium on sustainability and circular economy principles. This has led to strong demand for colorants compatible with plastic recycling processes (de-inkability) and those certified as ecologically friendly. Germany, France, and Italy are key centers for automotive and industrial manufacturing, creating a consistent need for durable and sophisticated coating colorants. Manufacturers in Europe focus heavily on integrating digital technologies into their production and color management systems to ensure traceability, compliance, and precise color reproduction, serving niche markets such as high-end cosmetics and specialty food packaging with extremely rigorous quality specifications.

The competitive structure in Europe is dominated by well-established multinational chemical giants that possess robust R&D capabilities and a deep understanding of complex regulatory requirements. Market growth relies heavily on technological differentiation, premiumization of products, and the ability to offer comprehensive technical services alongside the product itself. The market is witnessing a steady shift toward powder coatings and water-borne systems in the industrial segment, reflecting a commitment to sustainable manufacturing practices mandated by both government policy and strong consumer preference for ecological products.

- North America: The North American market is characterized by high consumption of specialty colorants and a rapid transition towards sustainable and performance-driven solutions, largely driven by regulatory pushes and consumer awareness in the United States and Canada. The automotive refinish market and the residential construction sector are significant end-users, requiring durable, fade-resistant pigments for exterior use. A key driver here is the rapid adoption of digital printing technologies, particularly in textile and commercial graphics, necessitating high volumes of compatible, high-chroma inkjet formulations.

Regulatory frameworks, such as varying state-level restrictions on VOCs and chemical usage, create complexity but also propel innovation. Manufacturers strategically locate production facilities and distribution hubs close to major industrial consumers to enhance supply chain responsiveness. The plastics market, especially in advanced packaging and durable goods, is a major consumer of color concentrates, where the focus is on achieving custom effects and ensuring regulatory compliance for food contact materials. Furthermore, there is strong R&D activity focused on developing advanced color measurement and management tools to cater to the exacting specifications of the consumer goods and aerospace industries.

The competitive environment is mature, featuring both large global players and specialized niche producers. Success in North America often relies on providing customized technical solutions and ensuring fast time-to-market for new color trends, particularly in fast-fashion textiles and consumer packaging. The market shows a high preference for value-added services, including customized color matching and inventory management programs, minimizing complexity for end-users and building strong supplier partnerships based on reliability and technical competence.

- Latin America (LATAM): LATAM is an emerging market with significant growth potential, driven primarily by expanding industrial activity, urbanization, and rising middle-class consumption across countries like Brazil, Mexico, and Argentina. The construction and general industrial coatings sectors are the primary consumers of both inorganic and basic organic pigments. Market dynamics are heavily influenced by macroeconomic stability and local currency fluctuations, making price competitiveness a critical factor for market penetration.

While the adoption of high-performance colorants is increasing, particularly in branded consumer goods and automotive manufacturing, the market remains price-sensitive, often relying on cost-effective, high-volume standard colorant grades. However, global standards are slowly penetrating the region through multinational companies operating local subsidiaries, leading to a gradual shift toward more compliant and sustainable colorant systems. Distribution often involves local agents and specialized logistics networks due to challenging infrastructural conditions in some areas. Manufacturing capacity is generally centralized around major economic hubs, serving local demand and increasingly focusing on regional export opportunities.

Key growth areas include the plastics packaging market, tied to population growth and retail expansion, and the decorative coatings segment. Investment focuses on improving local formulation capabilities and technical service to support end-users who are beginning to require more sophisticated color palettes and enhanced product stability. International suppliers compete by offering standardized products complemented by localized technical expertise and flexible supply agreements adapted to the region's specific commercial realities.

- Middle East and Africa (MEA): The MEA market for colorants is heterogeneous, driven mainly by large-scale infrastructure projects, expansion in the oil and gas sector (requiring anti-corrosive and protective coatings), and rapid development of consumer product manufacturing in specific nations like Saudi Arabia, UAE, and South Africa. The demand for industrial and protective coatings dominates the high-value segment due to harsh climate conditions and the need for durable materials in petrochemical facilities and construction.

Market expansion is also linked to the burgeoning textile industry in North Africa and the growing plastics manufacturing sector in the Gulf Cooperation Council (GCC) countries. Supply chains are often characterized by reliance on imports from Asia and Europe, making logistics and geopolitical stability crucial factors influencing market accessibility and pricing. Regulatory standards are evolving, often aligning with international best practices due to the strong presence of international EPC (Engineering, Procurement, and Construction) firms demanding certified materials.

The demand for specialized, high-heat stability pigments for plastics used in demanding external applications is strong. Companies operating in MEA must prioritize reliability and offer robust technical support to address the unique performance challenges posed by extreme temperatures and UV exposure prevalent in the region. Long-term market potential remains high, contingent upon sustained infrastructural investment and diversified industrialization efforts beyond the traditional energy sector.

The Chinese market, in particular, is undergoing a substantial quality transformation, moving away from low-cost, low-quality products toward high-performance, specialized colorants required for advanced applications such as electric vehicle battery coatings and specialized food packaging. India is witnessing a high growth rate in its textile and packaging sectors, creating persistent demand for basic and reactive dyes. Investment in advanced polymer and colorant manufacturing facilities across the region, particularly focusing on digital inkjet ink production, is a primary strategic focus for international companies looking to capture future growth in high-value segments.

Strategic efforts in APAC involve developing region-specific color palettes and ensuring compliance with local environmental protection laws, which are becoming increasingly strict. The strong presence of indigenous chemical suppliers often results in highly competitive pricing, compelling multinational corporations to differentiate themselves through superior technical support, supply chain reliability, and high-performance product features rather than simply price competition. The proliferation of local R&D centers dedicated to tailoring colorant solutions for Asian climates and application methods is a major trend influencing regional market dynamics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Colorants Market.- BASF SE

- Clariant AG

- DIC Corporation

- Huntsman Corporation

- Sun Chemical Corporation (DIC Group)

- Archroma

- Lanxess AG

- Kronos Worldwide Inc.

- Cathay Industries

- ECKART GmbH (Altana AG)

- Sudarshan Chemical Industries Ltd.

- Merck KGaA

- Ferro Corporation

- Heubach GmbH

- Rockwood Pigments

- Pidilite Industries

- Kiri Industries

- Dainichiseika Color & Chemicals Mfg. Co. Ltd.

- Atul Ltd.

- Penn Color Inc.

Frequently Asked Questions

Analyze common user questions about the Colorants market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers for the growth of the sustainable Colorants Market?

The primary drivers are stringent global environmental regulations, particularly in Europe and North America, restricting heavy metal and volatile organic compound (VOC) use. Additionally, increasing consumer and corporate demand for bio-based, non-toxic, and easily recyclable coloring materials in packaging and textiles drives innovation toward sustainable colorant alternatives.

How is digital printing impacting the demand for specialized colorants?

Digital printing demands highly specialized, fluid-stable colorants (inks) with narrow particle size distribution for efficient inkjet performance. This shift drives exponential growth in high-chroma, concentrated liquid dispersions and continuous innovation in formulation chemistry to meet high-speed printing requirements across textiles and packaging.

What is the main difference between dyes and pigments in commercial use?

Dyes are soluble and chemically bond with the substrate, primarily used in textiles and paper where high color intensity is required. Pigments are insoluble particles dispersed within a medium (e.g., coatings, plastics) and provide color via selective light reflection, offering superior light fastness, heat stability, and opacity, making them dominant in industrial applications.

Which region dominates the global Colorants Market and why?

The Asia Pacific (APAC) region dominates the global Colorants Market, primarily due to high volume consumption driven by the massive manufacturing and processing bases in China and India across the textile, construction, and rapidly expanding packaging and automotive industries.

What role does Artificial Intelligence (AI) play in modern colorant R&D?

AI plays a critical role in accelerating R&D by using machine learning to predict optimal chemical formulations based on desired performance characteristics and regulatory compliance, significantly reducing the time, cost, and experimental iteration required for developing new or sustainable colorant products.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Frozen Bakery Additives Market Size Report By Type (Preservatives and reducing agents, Enzymes and oxidizing agents, Emulsifiers, Colorants and flavors, Others), By Application (Frozen Breads, Frozen Cakes, Frozen Pastry and Frozen Pizza Crust), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Statistics, Trends, Outlook and Forecast 2025-2032

- Natural Colorants Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Caramel, Carotenoids & Anthocyanins), By Application (Medical, Food & Beverage Industries, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Textile Chemicals Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Coating and Sizing Chemicals, Colorants and Auxiliaries, Finishing Agents, Surfactants), By Application (Home Furnishing, Apparel Textile, Industrial, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager