Coloured Cellophane Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435445 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Coloured Cellophane Market Size

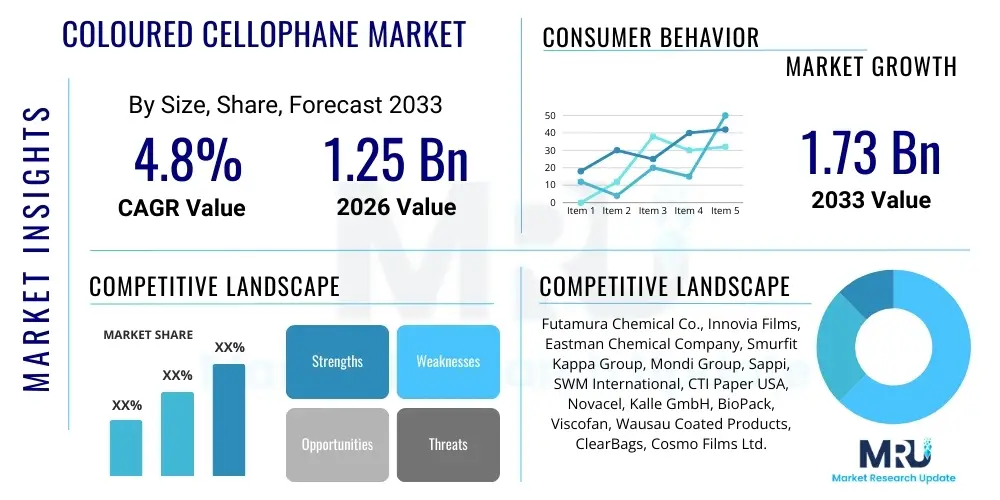

The Coloured Cellophane Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at $1.25 Billion in 2026 and is projected to reach $1.73 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the material's unique combination of transparency, glossy finish, and inherent biodegradability, positioning it favorably within the sustainable packaging and decorative sectors. The valuation reflects increasing demand from the food and confectionery industries, where colored cellophane is utilized not only for aesthetic appeal but also for moisture resistance and product protection, crucial elements driving market expansion in developed economies seeking eco-friendly alternatives to traditional plastic films.

Market expansion is significantly influenced by regulatory shifts favoring bio-based packaging materials across Europe and North America. These regions are actively phasing out non-biodegradable plastics in retail and consumer goods packaging, thereby creating a substantial market opening for cellulose-based films like cellophane. Furthermore, advancements in manufacturing processes, including high-speed dyeing and printing capabilities, have broadened the application scope of colored cellophane beyond traditional confectionery wrapping into high-end gift packaging and specialized craft applications. The market size calculation incorporates revenues derived from both raw film sales to converters and finished packaged goods utilizing the material.

Coloured Cellophane Market introduction

The Coloured Cellophane Market centers on the production and distribution of thin, transparent sheets derived from regenerated cellulose, chemically processed from wood pulp, and subsequently tinted with various dyes and pigments to achieve specific color profiles. Cellophane, known for its high tensile strength, excellent gas and aroma barrier properties, and distinctive glossy appearance, has historically been a premium wrapping material. The introduction of color variants significantly enhances its aesthetic and branding capabilities, making it indispensable in sectors requiring both functional preservation and visual marketing impact.

Major applications of colored cellophane include flexible packaging for candies, bakery items, and specialty food products, where its semi-permeable nature helps maintain freshness while offering superior visual presentation. Beyond food packaging, it is widely used in the floral industry for bouquet wrapping, in the arts and crafts sector for decorative purposes, and in retail for high-end gift wrapping and luxury consumer goods presentation. The primary benefits driving its adoption are its biodegradable nature, providing a sustainable end-of-life cycle; its robust barrier against grease and oils; and its inherent anti-static properties, which aid in high-speed wrapping operations. Unlike many synthetic polymers, cellophane’s base material is renewable, aligning with global corporate sustainability mandates.

Driving factors for the market include the stringent regulatory environment pushing for single-use plastic reduction, increasing consumer preference for environmentally friendly packaging solutions, and the flourishing e-commerce and retail sectors that rely heavily on visually appealing, branded wrapping materials. The transition towards more vibrant and customized product aesthetics in consumer goods, coupled with technological improvements that enhance the film's moisture barrier performance through specialized coatings, are further accelerating the market's trajectory, particularly in the Asia Pacific region where consumer packaging demand is surging.

Coloured Cellophane Market Executive Summary

The Coloured Cellophane Market is exhibiting robust growth, propelled primarily by a global pivot toward sustainable and biodegradable packaging materials, positioning cellulose films as a premium alternative to conventional plastics. Key business trends include substantial investment in R&D to improve moisture barrier properties and develop sustainable, plant-based coloring agents, ensuring the product retains its environmentally benign status. Consolidation among major manufacturers and converters is observed, aimed at leveraging economies of scale and establishing integrated supply chains from pulp sourcing to final film production. Furthermore, branding and customization are central to business strategies, with firms offering highly specialized colors and finishes to major confectionery and cosmetics brands.

Regionally, the market presents distinct trends. Asia Pacific (APAC) dominates in terms of production capacity and raw material sourcing (wood pulp), fueled by massive consumer bases and rapid industrialization in countries like China and India, where the decorative and low-cost packaging segments are vast. Conversely, North America and Europe are the primary drivers of value-added demand, characterized by high penetration of certified biodegradable products and a willingness to pay a premium for colored cellophane films that meet rigorous environmental standards (e.g., composting certifications). Legislative mandates in the European Union regarding plastic waste significantly impact the market dynamics, necessitating rapid adoption of sustainable films.

Segment trends reveal that the biodegradable colored cellophane segment is experiencing the fastest expansion, often surpassing the growth rate of standard, non-coated cellophane films. Application-wise, the food and beverage packaging sector remains the largest consumer, specifically the confectionery and bakery sub-segments, capitalizing on the material's aesthetic appeal and freshness preservation. The decorative segment, encompassing floral arrangements and crafting, shows strong seasonal fluctuations but maintains consistent demand, driven by creative industries and consumer interest in bespoke, handmade goods. Manufacturers are focusing on thin-gauge films that offer cost efficiencies while maintaining structural integrity and color vibrancy.

AI Impact Analysis on Coloured Cellophane Market

Users frequently inquire about how Artificial Intelligence (AI) can enhance the efficiency and sustainability of colored cellophane manufacturing, specifically focusing on quality control, color consistency, and supply chain optimization. Common concerns revolve around whether AI can accurately predict shifts in consumer color preferences (e.g., seasonal trends for packaging) and how machine learning algorithms might be deployed to manage the complex sourcing of sustainable wood pulp while minimizing waste in the dyeing process. Users also show high interest in AI's role in predictive maintenance for complex film extrusion and coating machinery, aiming to reduce costly downtime and maintain high operational efficiency across global production facilities.

AI's influence on the Coloured Cellophane Market is transformative, primarily through optimizing complex manufacturing variables. AI-driven systems are now capable of analyzing real-time data from production lines, adjusting dye concentrations and temperature profiles instantly to ensure perfect color uniformity and batch consistency, which is critical for major branding contracts. Furthermore, predictive analytics models are enhancing inventory management and raw material procurement, anticipating demand spikes for specific colors based on seasonality and historical sales patterns. This optimization reduces material waste and minimizes the energy intensity associated with color matching and quality assurance checks, thereby supporting the overall sustainability narrative of the product.

In the downstream supply chain, AI algorithms are utilized for logistics optimization, calculating the most sustainable and cost-effective routes for transporting bulk rolls of colored cellophane to converters and end-users globally. For the decorative and craft segments, AI-powered trend analysis scrapes social media and design platforms to provide manufacturers with foresight into emerging color palettes and pattern requirements, allowing for rapid product innovation and inventory stocking aligned with fast-moving consumer aesthetics. This strategic integration of AI ensures higher operational yield, superior product quality, and enhanced market responsiveness across the entire cellophane value chain.

- AI-Powered Color Consistency: Real-time analysis and automatic adjustment of dyeing processes to eliminate batch variations.

- Predictive Maintenance: Utilization of machine learning to forecast equipment failure in coating and slitting machinery, reducing downtime.

- Supply Chain Resilience: Optimization of wood pulp sourcing and logistics based on sustainability criteria and geopolitical risk assessment.

- Demand Forecasting: AI models predict seasonal and aesthetic color trends, informing proactive inventory and production scheduling.

- Automated Quality Control: High-speed computer vision systems detect microscopic defects or color deviations in film during production.

DRO & Impact Forces Of Coloured Cellophane Market

The dynamics of the Coloured Cellophane Market are shaped by a powerful interplay of drivers, restraints, and opportunities, collectively known as the Impact Forces. A primary driver is the global regulatory impetus toward plastic reduction, particularly in food contact materials and retail packaging, which intrinsically favors biodegradable cellulose films. Opportunities are abundant in specialized markets, such as high-barrier, metallized colored cellophane variants for sensitive products, and the expansion of the arts, crafts, and floral industries that require visually striking, disposable, and environmentally conscious wrapping materials. However, the market faces significant restraints, chiefly the higher cost of production compared to conventional petroleum-based polymers and the inherent moisture sensitivity of cellophane, which requires expensive specialty coatings for long-term food preservation applications.

Key drivers include the demonstrable biodegradability of cellophane, which is often certified compostable, providing a compelling competitive edge over films like PET or PVC in markets sensitive to environmental footprints. Furthermore, its excellent printability allows for high-definition graphics and branding, crucial for marketing and consumer engagement. The inherent stiffness and 'dead-fold' property of cellophane make it highly effective for twisting or wrapping confectionery items, ensuring package integrity. These technical advantages, combined with positive public perception regarding sustainable materials, exert significant upward pressure on market growth and pricing power for premium products.

Conversely, the primary impact force acting as a restraint is competition from alternative bio-based plastics such as PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoate), which are continuously improving their barrier properties and reducing their manufacturing costs. Another restraint is the dependence on wood pulp, subjecting manufacturers to fluctuations in global commodity pricing and sustainability sourcing certification requirements. Despite these challenges, the unique combination of visual appeal and sustainability inherent in colored cellophane allows manufacturers to capitalize on the opportunity to penetrate niche, high-value luxury packaging markets that prioritize material integrity and environmental responsibility above marginal cost savings, ensuring sustained innovation and investment within the sector.

Segmentation Analysis

The Coloured Cellophane Market is meticulously segmented based on material type, application, and end-user industry to provide a precise understanding of demand patterns and growth potential across various dimensions. Segmentation by type differentiates between standard non-coated and coated films, with the latter utilizing specialized acrylic or nitrocellulose lacquers to enhance moisture barrier and sealability, crucial for humid environments. Application segmentation highlights the dominance of packaging uses over decorative and industrial requirements, emphasizing the market's fundamental role in consumer goods presentation and protection. End-user classification allows manufacturers to target specific verticals, such as the rapidly expanding confectionery sector or the niche, high-margin floral and gift wrapping industry, optimizing product formulations and marketing strategies for maximum penetration.

The analysis reveals significant disparity in growth rates among segments. Biodegradable and compostable colored cellophane films are leading the segment growth, driven by stringent European Union regulations and increasing consumer awareness regarding plastic waste. Within applications, food packaging, particularly impulse buys like candy and snacks, accounts for the largest revenue share due to high volume consumption and the effectiveness of colored cellophane in visual merchandising. Furthermore, the segmentation analysis facilitates strategic investment decisions, indicating that R&D should prioritize barrier-enhanced colored films capable of extending the shelf life of highly sensitive food items, thereby expanding cellophane's addressable market beyond traditional uses.

Geographically, segmentation highlights the distinction between production hubs (APAC) and high-value consumption markets (North America and Europe), reflecting different pricing tiers and quality requirements. Manufacturers strategically position their offerings; mass-produced, lower-cost films dominate the high-volume packaging in developing regions, while premium, highly customized, and certified compostable colored films command higher prices and market share in developed nations where sustainability attributes are monetizable. This layered segmentation provides a nuanced view of the competitive landscape and identifies untapped opportunities in emerging economies where environmental awareness is beginning to influence consumer purchase decisions.

- By Type:

- Standard Non-Coated Cellophane

- Coated Cellophane (Moisture-proof, Heat-sealable)

- Biodegradable/Compostable Cellophane

- By Application:

- Food Packaging (Confectionery, Snacks, Bakery)

- Non-Food Packaging (Tobacco, Cosmetics, Pharmaceuticals)

- Decorative Use (Floral Wraps, Gift Wrapping, Crafting)

- Industrial Applications

- By End-User Industry:

- Food & Beverage Industry

- Retail and E-commerce

- Arts, Crafts, and Stationery

- Pharmaceutical and Healthcare

- Floral and Horticulture

- By Color Type:

- Single-Color Films

- Multi-Colored/Printed Films

Value Chain Analysis For Coloured Cellophane Market

The value chain for the Coloured Cellophane Market begins with the upstream sourcing of raw materials, primarily high-grade dissolving wood pulp, typically sourced from sustainably managed forests. This stage involves intense focus on ethical sourcing and certification (e.g., FSC or PEFC), as the purity and consistency of the cellulose pulp directly impact the quality and transparency of the final cellophane film. Key upstream activities include chemical suppliers providing caustic soda, carbon disulfide, and specialized dyeing agents necessary for the viscose process and subsequent coloring. The efficiency and sustainability practices of pulp mills are crucial determinants of the overall market competitiveness.

Midstream activities involve the complex chemical process of converting cellulose pulp into viscose, extruding the film, and regenerating it into cellophane sheets. This stage is highly capital-intensive and requires sophisticated machinery for precise gauge control, stretching, and application of specialized coatings (e.g., polymer or wax) to achieve desired barrier properties. The coloring process—involving immersion dyeing or surface printing—is critical for product differentiation. Manufacturers must manage complex wastewater treatment systems due to the chemicals used, representing a significant operational cost and environmental concern that shapes the cost structure of the end product.

Downstream distribution channels are bifurcated into direct sales to large converters (who print and fabricate final pouches or wraps) and indirect sales through specialized distributors catering to smaller industrial users, the retail sector, and the arts and crafts market. Direct sales dominate high-volume packaging applications, ensuring tailored specifications and just-in-time delivery. The retail segment often utilizes indirect channels, relying on wholesalers to stock diverse color palettes and roll sizes suitable for gift and floral wrapping. E-commerce platforms are increasingly serving as a significant distribution channel for smaller batch orders and specialized, niche colored cellophane products, offering global reach to craft enthusiasts and small businesses.

Coloured Cellophane Market Potential Customers

Potential customers and end-users of colored cellophane are highly diverse, spanning sectors where visual appeal, product protection, and environmental responsibility are paramount considerations. The largest customer base resides within the Fast-Moving Consumer Goods (FMCG) sector, particularly confectionery manufacturers such as leading chocolate and candy companies. These entities rely on colored cellophane for its appealing shine, twist-wrap properties, and ability to keep products fresh while maximizing shelf presence, making it a critical component of impulse purchase marketing strategies.

Another significant customer segment is the floral and horticulture industry. Florists and garden centers utilize colored cellophane extensively for wrapping bouquets and plant containers, valuing its water resistance, structural support, and ability to enhance the visual vibrancy of the arrangements. This segment demands a wide range of transparent and opaque color options, often in specific gauges tailored for decorative use. Furthermore, the burgeoning Arts, Crafts, and Stationery sector represents a steady customer base, utilizing the material for educational purposes, creative projects, and high-end gift wrapping services, often sourced through specialist distributors and large retail chains.

Finally, the luxury goods and specialty retail sectors represent high-value customers. Brands specializing in cosmetics, high-end spirits, and artisanal food products often employ colored cellophane for premium secondary packaging. These customers prioritize sustainability certifications (e.g., compostability) alongside impeccable aesthetic quality and flawless color matching to maintain their brand image. The need for specialized barrier coatings for tobacco and pharmaceutical packaging also defines a technical segment of end-users requiring high-specification, customized colored cellophane films.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.25 Billion |

| Market Forecast in 2033 | $1.73 Billion |

| Growth Rate | 4.8% ( Include CAGR Word with % Value ) |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Futamura Chemical Co., Innovia Films, Eastman Chemical Company, Smurfit Kappa Group, Mondi Group, Sappi, SWM International, CTI Paper USA, Novacel, Kalle GmbH, BioPack, Viscofan, Wausau Coated Products, ClearBags, Cosmo Films Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Coloured Cellophane Market Key Technology Landscape

The technology landscape in the Coloured Cellophane Market is driven by advancements focused on enhancing the functional properties of the film while minimizing the environmental impact of its production. The core technology remains the viscose process, which converts cellulose pulp into regenerated cellulose film. However, modern innovations are centered on closed-loop systems designed to capture and recycle carbon disulfide and other chemicals, significantly reducing emissions and improving process sustainability, thereby addressing historical environmental criticisms of cellophane manufacturing. Advanced filtration and chemical recovery technologies are paramount for securing regulatory approval and market acceptance, especially in Europe.

Crucial technological developments are concentrated in the post-extrusion phase, specifically in barrier coating application and high-speed coloration. Manufacturers are increasingly moving away from standard nitrocellulose-based coatings towards advanced, bio-based or water-soluble barrier lacquers to improve moisture vapor transmission rate (MVTR) while maintaining the film’s compostability. Techniques like vapor deposition or high-precision lamination are employed to integrate very thin layers of specialized materials, ensuring excellent sealing and shelf-life extension. Furthermore, high-speed gravure and flexographic printing technologies are essential for applying complex, multi-colored designs and brand logos directly onto the colored film with high resolution and rapid throughput.

The dyeing technology itself is witnessing evolution, with significant R&D focused on transitioning from heavy metal-containing pigments to food-grade, certified organic, or naturally derived coloring agents that do not compromise the film's biodegradability. Process automation, including sophisticated sensors and control systems (often leveraging AI, as noted), ensures stringent quality control over film thickness, color saturation, and consistency across vast production batches. The ability to produce thin-gauge yet robust colored films economically is a key technological differentiator, offering cost savings and material efficiency for high-volume packaging customers.

Regional Highlights

The Coloured Cellophane Market demonstrates strong regional variance, driven by differing economic growth rates, regulatory frameworks, and consumer preferences for sustainability. Asia Pacific (APAC) stands out as the global manufacturing powerhouse, hosting extensive production capabilities for wood pulp and cellophane film due to lower operational costs and the abundant availability of raw materials. Countries like China and India fuel enormous domestic demand, particularly in the mass-market food and decorative packaging sectors. While APAC contributes significantly to global supply, much of the manufactured material is exported. However, domestic consumption is rapidly shifting towards higher-quality, colored films as environmental regulations and middle-class purchasing power increase.

North America and Europe represent the high-value consumer markets, setting the trends for sustainability, certification, and premium product customization. Europe, specifically the EU bloc, is a crucial region due to landmark legislative measures, such as the Single-Use Plastics Directive, which strongly incentivize the adoption of certified compostable materials like colored cellophane. This region drives demand for high-specification, coated, and highly transparent colored films utilized in organic and specialty food packaging. Manufacturers operating in Europe must demonstrate stringent compliance regarding sourcing and chemical usage, translating into higher average selling prices and a focus on innovation in bio-based coatings.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for colored cellophane, characterized by rapid urbanization and the growth of organized retail. LATAM exhibits strong demand in the confectionery and festive decorations market, often seeking cost-effective, vibrant colored films. MEA's growth is tied to rising disposable incomes and diversification away from traditional retail models. While sustainability concerns are less dominant than in Europe, the gradual modernization of packaging infrastructure in these regions presents long-term growth opportunities for colored cellophane, especially as international FMCG companies standardize their packaging materials globally to meet corporate sustainability goals.

- North America: Focus on premium, customized films; high demand for certified compostable colored cellophane; innovation driven by pharmaceutical and high-end retail packaging.

- Europe: Market leadership in sustainability; demand strongly influenced by EU regulations; high pricing power for barrier-coated colored films used in specialty foods.

- Asia Pacific (APAC): Largest production base; substantial domestic demand in mass packaging (confectionery and snacks); emerging focus on improving environmental performance of production facilities.

- Latin America (LATAM): Growing market for vibrant, cost-effective colored films for confectionery and seasonal decoration; retail sector expansion driving packaging volume.

- Middle East and Africa (MEA): Gradually increasing consumption driven by urbanization and organized retail; early stages of adopting international sustainability standards, creating future opportunities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Coloured Cellophane Market.- Futamura Chemical Co.

- Innovia Films

- Eastman Chemical Company

- Smurfit Kappa Group

- Mondi Group

- Sappi

- SWM International

- CTI Paper USA

- Novacel

- Kalle GmbH

- BioPack

- Viscofan

- Wausau Coated Products

- ClearBags

- Cosmo Films Ltd.

- Taghleef Industries (Ti)

- Jindal Poly Films

- Tekni-Plex

- Bemis Company (now part of Amcor)

Frequently Asked Questions

Analyze common user questions about the Coloured Cellophane market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for colored cellophane?

The primary driver is the accelerating global shift towards sustainable and biodegradable packaging alternatives. Coloured cellophane, being derived from renewable cellulose, meets regulatory mandates and consumer preferences for eco-friendly materials, particularly in the food and decorative wrapping sectors where visual appeal is also critical.

Is colored cellophane truly biodegradable and compostable?

Yes, standard, non-coated colored cellophane is generally biodegradable and compostable. However, films treated with certain plastic-based barrier coatings (e.g., specific PVDC layers) may compromise compostability. Consumers should seek films certified by relevant bodies (like BPI or TÜV Austria) to ensure compliance with composting standards.

How does colored cellophane compare in cost to plastic films like BOPP or PET?

Coloured cellophane typically has a higher production cost compared to commodity plastic films like BOPP or PET due to the complexity of the viscose regeneration process and raw material sourcing (wood pulp). Its premium pricing is justified by its superior aesthetic qualities, anti-static properties, and inherent sustainability benefits.

Which regions hold the largest market share for colored cellophane consumption?

Europe and North America hold the largest value-based market share for high-end colored cellophane consumption, driven by stringent environmental regulations and high disposable income. Asia Pacific leads in terms of overall volume production and accounts for a significant share of mass-market packaging consumption.

What major technological advancement is influencing the cellophane market?

A key technological advancement is the development of advanced, bio-based barrier coatings. These coatings significantly improve the moisture vapor resistance (MVTR) and heat sealability of colored cellophane without compromising its inherent biodegradability, thereby expanding its application scope into sensitive food and pharmaceutical packaging.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager