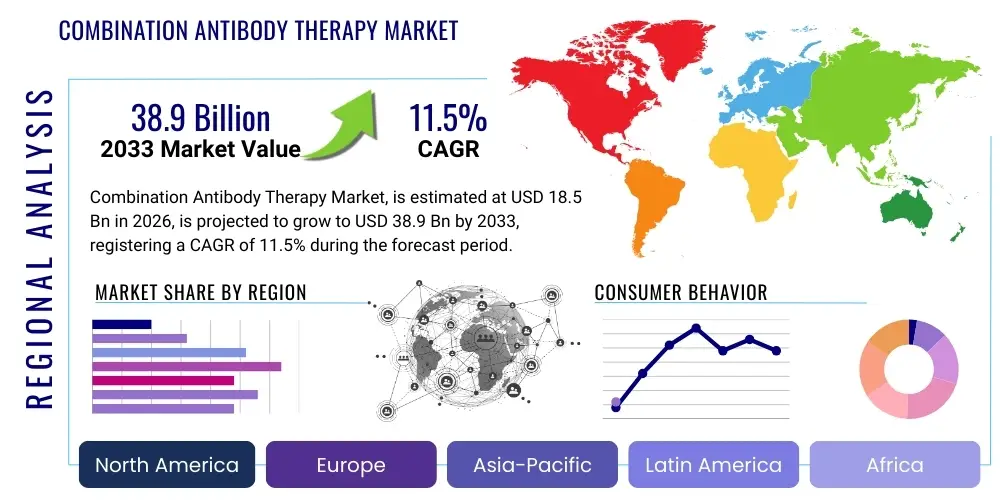

Combination Antibody Therapy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438066 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Combination Antibody Therapy Market Size

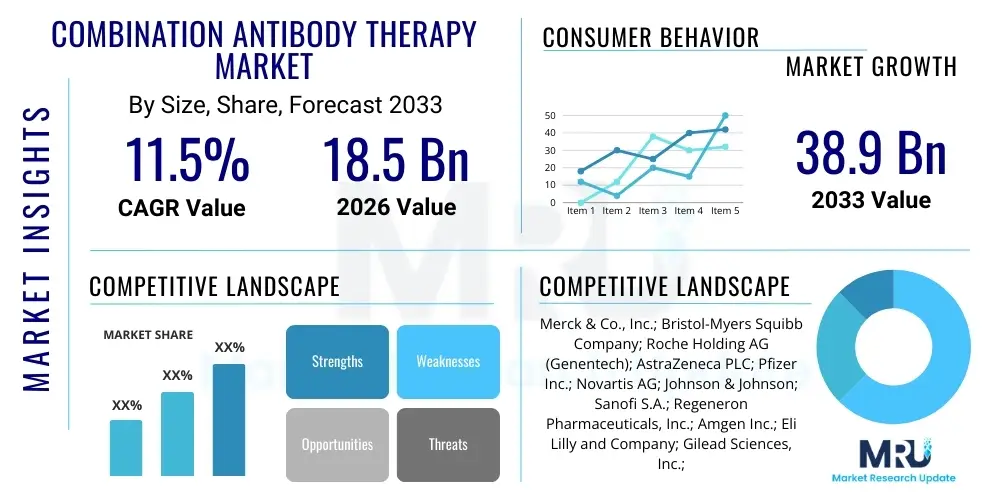

The Combination Antibody Therapy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 38.9 Billion by the end of the forecast period in 2033.

Combination Antibody Therapy Market introduction

Combination Antibody Therapy represents a critical advancement in immunotherapeutics, specifically involving the simultaneous administration of two or more distinct monoclonal antibodies (mAbs) or antibody-drug conjugates (ADCs) to target multiple antigens or pathways within a disease mechanism, most prominently in oncology and increasingly in complex autoimmune disorders. This synergistic approach aims to enhance therapeutic efficacy, reduce drug resistance, and improve patient outcomes compared to monotherapy. The core principle leverages the varied mechanisms of action of different antibodies, such as blocking different signaling pathways, maximizing T-cell activation, or targeting heterogeneous tumor cell populations. Key applications primarily center on solid tumors, hematological malignancies, and chronic inflammatory conditions where single-agent treatments often fail due to adaptive resistance mechanisms.

The product description encompasses various combination modalities, including combining immune checkpoint inhibitors (e.g., anti-PD-1/PD-L1) with targeted therapy antibodies (e.g., anti-HER2 or anti-VEGF), or combining two distinct checkpoint blockade agents. The major applications span lung cancer, breast cancer, colorectal cancer, melanoma, and several hematological cancers. Benefits of this therapeutic strategy include deeper and more durable responses, expanded indications for existing antibodies, and the potential for dose reduction of individual agents, which can sometimes mitigate specific toxicities. Combination therapies are particularly effective in addressing the complex biological landscape of cancer, where multiple genetic and microenvironmental factors drive disease progression and immune evasion.

Driving factors for market growth include the robust and accelerating clinical development pipeline, increasing regulatory approvals for fixed-dose combinations, rising prevalence of chronic and complex diseases, and significant investment from pharmaceutical and biotech companies focused on precision medicine. The success of initial combination therapies, such as combining ipilimumab and nivolumab for melanoma, has set a high benchmark, encouraging further research into novel synergistic antibody pairings. Furthermore, technological advancements in antibody engineering, including bispecific and trispecific antibodies that inherently function as combinations, are rapidly expanding the scope and efficacy of this therapeutic area.

Combination Antibody Therapy Market Executive Summary

The Combination Antibody Therapy Market is characterized by intense research and development activity, driven largely by the unmet needs in advanced cancer treatment and complex autoimmune diseases. Business trends show a strategic shift toward partnerships and collaborations between large pharmaceutical corporations and specialized biotech firms to pool proprietary antibody libraries and optimize clinical trial designs, particularly focusing on accelerated regulatory pathways. Mergers and acquisitions are common as companies seek to consolidate intellectual property related to synergistic targets and delivery mechanisms. Key competitive differentiators include efficacy data in resistant patient populations, favorable safety profiles, and strategic positioning in highly prevalent indications like non-small cell lung cancer (NSCLC) and metastatic breast cancer. Pricing strategies remain premium due to the complexity and high value derived from improved survival rates, though pressure from payors to demonstrate cost-effectiveness relative to sequential monotherapies is growing.

Regional trends indicate North America currently dominates the market share due to high healthcare expenditure, established clinical trial infrastructure, and the presence of numerous leading biopharmaceutical companies and advanced oncology centers. Europe follows, buoyed by supportive regulatory bodies like the European Medicines Agency (EMA) and strong public funding for cancer research. The Asia Pacific region is projected to exhibit the highest growth rate, fueled by improving healthcare access, increasing prevalence of target diseases, and governmental initiatives encouraging biopharmaceutical manufacturing and clinical research, particularly in China and Japan. Emerging markets in Latin America and MEA are focused on adopting established combination protocols rather than pioneering new ones, although localized clinical trials are beginning to increase.

Segment trends highlight that the Oncology application segment maintains the largest market share, specifically combinations targeting immune checkpoints and cell surface receptors. The product type segment is seeing rapid growth in proprietary fixed combinations and cocktail therapies, offering convenience and standardized dosing. Furthermore, the route of administration segmentation shows a continuing preference for intravenous delivery in the immediate clinical setting, though subcutaneous formulations are increasingly being developed to improve patient convenience and potentially shift administration to outpatient settings or home care. Segmentation by end-user confirms hospitals and specialized cancer centers as the primary consumers, but the rise of integrated specialty clinics is influencing distribution models.

AI Impact Analysis on Combination Antibody Therapy Market

Users frequently ask how Artificial Intelligence (AI) can accelerate the notoriously complex development cycle of combination antibody therapies, specifically querying AI's role in target identification, patient stratification, and optimizing drug synergy to minimize toxicity. Concerns revolve around the reliability of AI predictions in biologically complex systems and the regulatory hurdles for AI-derived therapeutic combinations. The core expectation is that AI will dramatically reduce the time and cost associated with preclinical testing by predicting optimal antibody pairings and identifying patient cohorts most likely to respond, thereby enhancing clinical trial success rates. Key themes focus on utilizing machine learning for analyzing vast omics data to uncover novel synergistic pathways and personalizing combination regimens based on individual tumor signatures, moving beyond empiric combinations to data-driven therapeutic design.

- AI accelerates target validation by analyzing high-throughput screening data and identifying novel, non-obvious synergistic antibody targets.

- Machine learning algorithms optimize antibody pairing selection, predicting optimal combinations based on genetic and proteomic profiles of disease models.

- Predictive modeling enhances clinical trial design by accurately stratifying patients into response and non-response groups, improving trial efficiency and success probability.

- Natural Language Processing (NLP) assists in synthesizing vast quantities of published literature and clinical data to inform combination rationale and dosage optimization.

- AI-driven simulation platforms reduce the need for extensive in vivo testing by modeling complex pharmacokinetic and pharmacodynamic interactions between multiple antibodies.

- Deep learning contributes to toxicity prediction by correlating combinatorial antibody profiles with adverse event datasets, aiding in the development of safer regimens.

- AI supports personalized medicine by identifying biomarkers specific to combination response, enabling tailored therapeutic deployment in real-time clinical settings.

DRO & Impact Forces Of Combination Antibody Therapy Market

The Combination Antibody Therapy Market is propelled by compelling clinical success stories in oncology, particularly in previously intractable cancers, alongside technological drivers related to advanced antibody engineering and high-throughput screening for synergistic effects. Restraints primarily involve the high cost of development and commercialization, coupled with regulatory complexity associated with approving fixed-dose combinations where pharmacodynamic interactions must be rigorously proven. Opportunities lie in expanding combination therapies beyond oncology into infectious diseases (e.g., HIV, COVID-19) and chronic autoimmune disorders, as well as the integration of novel delivery systems. The interplay of these forces, particularly the need to balance enhanced efficacy (Driver) against potential additive toxicity and manufacturing complexity (Restraint), dictates the market trajectory and competitive landscape.

Drivers include the increasing rate of acquired and intrinsic drug resistance to monotherapies, necessitating multi-pronged therapeutic strategies. Furthermore, the demonstrated ability of combination regimens to induce durable complete responses in high-risk cancers—a critical endpoint in clinical trials—validates the scientific premise and attracts significant investment. The maturation of immune checkpoint blockade therapies has generated a portfolio of clinically approved antibodies whose synergistic potential is now being explored through hundreds of ongoing combination trials. This expanding clinical evidence base solidifies the driver effect, promoting wider adoption across standard clinical practice guidelines, particularly in first-line settings where maximizing initial response is crucial for long-term survival.

Restraints center on the formidable economic and logistical challenges inherent in combination development. Developing two or more proprietary antibodies simultaneously involves exponential increases in manufacturing costs, supply chain management complexity, and intellectual property negotiation. Moreover, the regulatory burden is heightened, requiring extensive non-clinical and clinical data to prove that the combination provides a true benefit over sequential administration or monotherapy, without introducing unacceptable or unmanageable levels of synergistic toxicity. This increased complexity translates into protracted development timelines and significant financial risks for pipeline candidates, deterring smaller firms without established funding pathways.

Opportunities reside in leveraging platform technologies, such as bispecific and trispecific antibodies, which inherently streamline combination delivery into a single molecule, simplifying manufacturing and administration. The application scope extension into non-oncology areas, such as developing antibody cocktails for neurodegenerative diseases or complex viral infections that require multi-target inhibition, represents a vast, untapped market potential. Furthermore, integrating advanced diagnostics, including companion diagnostics that identify patients most likely to benefit from a specific antibody combination, improves therapeutic precision and reinforces the value proposition, thereby paving the way for differentiated market entry and premium pricing justification.

- Drivers: Growing prevalence of cancer and chronic diseases; high incidence of drug resistance to monotherapies; significant investment in immunotherapy R&D; established clinical success leading to rapid adoption in standard care.

- Restraints: High cost and complexity of developing and manufacturing multiple biological entities; stringent regulatory requirements for combination efficacy and safety; potential for additive or synergistic toxicities; intellectual property challenges involving combination rights.

- Opportunities: Expansion into non-oncology therapeutic areas (autoimmunity, infectious diseases); development of novel multi-specific antibody formats (bispecific/trispecific); utilization of AI and machine learning to optimize combination selection and patient stratification.

- Impact Forces: High clinical unmet need (positive); regulatory stringency (negative); technological innovation in biologics engineering (positive); cost containment pressures from payors (negative).

Segmentation Analysis

The Combination Antibody Therapy Market is fundamentally segmented based on the type of product deployed, the specific therapeutic application, the mechanism of action targeted, and the end-user setting where these complex therapies are administered. Analyzing these segments provides critical insights into market dynamics, identifying areas of rapid innovation and dominant revenue streams. The market remains heavily skewed towards oncology, reflecting the scientific success and pressing need for advanced treatments in this domain, but growth is accelerating across non-oncology applications as therapeutic strategies mature.

The Product Type segmentation distinguishes between established Antibody Cocktails, where multiple standalone antibodies are co-administered, and Fixed-Dose Combinations, often involving co-packaged products or even genetically engineered Multi-Specific Antibodies (e.g., bispecifics). The therapeutic superiority and manufacturing efficiencies of multi-specific antibodies are projected to drive the fastest growth within the product segment over the forecast period, offering enhanced precision and administrative convenience compared to traditional cocktails. This technological shift is a key indicator of market evolution.

Further segmentation by Application, notably Oncology, Autoimmune Diseases, and Infectious Diseases, clarifies the core market priorities. Within Oncology, the combination of immune checkpoint inhibitors with other targeted antibodies (such as HER2 antagonists) forms the backbone of the largest revenue subset. End-User segmentation, covering Hospitals, Cancer Centers, and Specialty Clinics, reflects the specialized nature of combination antibody administration, which typically requires intensive monitoring and management by highly trained healthcare professionals in institutional settings, though shifts towards specialized outpatient clinics are gaining traction for maintenance treatments.

- By Product Type:

- Antibody Cocktails

- Fixed-Dose Combination Products

- Multi-Specific Antibodies (Bispecific, Trispecific)

- By Target Mechanism:

- Immune Checkpoint Blockade Combinations (e.g., PD-1/CTLA-4)

- Targeted Receptor Inhibitor Combinations (e.g., HER2/VEGF)

- Immunomodulatory/Cytokine Combinations

- By Application:

- Oncology

- Lung Cancer (NSCLC, SCLC)

- Breast Cancer

- Melanoma

- Colorectal Cancer

- Hematological Malignancies (Lymphoma, Myeloma)

- Autoimmune Diseases (e.g., Rheumatoid Arthritis, Lupus)

- Infectious Diseases (e.g., Viral Neutralization)

- Oncology

- By End User:

- Hospitals

- Specialized Cancer Centers

- Ambulatory Surgical Centers/Specialty Clinics

Value Chain Analysis For Combination Antibody Therapy Market

The value chain for Combination Antibody Therapy is complex, beginning with extensive upstream activities including target discovery and validation, cell line development, and early-stage antibody engineering, often involving high-cost R&D and significant intellectual property creation. The manufacturing stage is critical and resource-intensive, requiring advanced mammalian cell culture facilities and stringent quality control processes for producing two or more distinct biological entities, or a highly engineered multi-specific molecule, ensuring purity, stability, and batch consistency. This upstream phase is characterized by high barriers to entry and domination by specialized biotechnology and large pharmaceutical firms with extensive capabilities.

Midstream activities focus heavily on rigorous preclinical and clinical development (Phases I, II, and III) to establish both the safety of the individual components and, crucially, the synergistic efficacy and favorable tolerability profile of the combination. Regulatory approval pathways for combinations necessitate meticulous documentation of complex pharmacokinetic/pharmacodynamic interactions, representing a significant bottleneck. Distribution channels, forming the downstream segment, are highly controlled due to the cold chain requirements and high value of these therapeutics. Direct distribution models are common, involving sales teams working closely with specialized wholesalers who deliver to hospitals and certified oncology centers.

Indirect distribution is minimized but involves specialty pharmacies managing outpatient or home infusion services, particularly for certain subcutaneous combinations. The final stage involves the prescriber (oncologist/specialist) and the end-user institution, where market access, reimbursement negotiation, and patient support programs become paramount. The efficiency of the value chain is highly dependent on effective collaboration between R&D, manufacturing, and regulatory affairs, especially given the necessity of coordinating the supply of multiple active pharmaceutical ingredients (APIs) for a single therapeutic regimen.

Combination Antibody Therapy Market Potential Customers

The primary potential customers and end-users of Combination Antibody Therapy are institutional healthcare providers and clinical research organizations focused on treating complex diseases, particularly cancer. Specialized hospitals and comprehensive cancer centers represent the largest segment of buyers, as these institutions have the necessary infrastructure, specialized medical staff (oncologists, immunologists), and high-volume patient populations undergoing advanced therapeutic regimens. These centers are key decision-makers, driving formulary inclusion and determining treatment protocols based on clinical guidelines and institutional experience.

A rapidly growing customer segment includes specialized oncology clinics and ambulatory infusion centers, which increasingly handle the administration of maintenance or less acutely toxic combination regimens, providing a more convenient setting for patients. These clinics are potential high-volume purchasers, although their procurement power is often aggregated through group purchasing organizations (GPOs). Furthermore, government and private payors significantly influence the market by dictating reimbursement policies and access, effectively acting as financial gatekeepers who prioritize combinations demonstrating superior survival benefits or quality-of-life improvements over established alternatives.

Clinical research organizations (CROs) and academic research institutions constitute another vital customer base, utilizing these antibodies for ongoing clinical trials exploring novel pairings, biomarkers, and expanded indications. These entities are early adopters of combination protocols and are instrumental in generating the clinical evidence required for subsequent commercial success. Ultimately, the end-user/buyer profile is highly sophisticated, requiring detailed health economic data and clinical validation before integration into standard therapeutic practice.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 38.9 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck & Co., Inc.; Bristol-Myers Squibb Company; Roche Holding AG (Genentech); AstraZeneca PLC; Pfizer Inc.; Novartis AG; Johnson & Johnson; Sanofi S.A.; Regeneron Pharmaceuticals, Inc.; Amgen Inc.; Eli Lilly and Company; Gilead Sciences, Inc.; Takeda Pharmaceutical Company Limited; AbbVie Inc.; GlaxoSmithKline PLC; Biogen Inc.; Seagen Inc.; Xencor, Inc.; MacroGenics, Inc.; Zai Lab Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Combination Antibody Therapy Market Key Technology Landscape

The technological landscape of the Combination Antibody Therapy Market is defined by continuous innovation in antibody engineering, focusing on achieving synergistic effects with enhanced precision and reduced immunogenicity. A cornerstone technology is the development of Multi-Specific Antibodies, predominantly bispecific antibodies, which are engineered to bind simultaneously to two different targets (e.g., a tumor antigen and a T-cell activating receptor like CD3). This allows for localized targeting and simultaneous immunological stimulation, effectively functioning as a fixed combination therapy within a single molecule. Various formats exist, including tandem diabodies, dual-affinity retargeting (DART) platforms, and knob-into-hole technologies, each offering unique advantages in terms of half-life, production feasibility, and efficacy.

Another critical area is the use of high-throughput screening platforms, often integrated with AI and machine learning, to identify optimal antibody pairs from extensive libraries. These technologies accelerate the preclinical phase by rapidly testing thousands of combinations for synergistic cytotoxicity or immune modulation, moving beyond traditional, slow, and expensive empirical testing. Furthermore, the advancement in Antibody-Drug Conjugates (ADCs) is influencing combination strategies, where combinations might involve an ADC targeting a specific tumor marker paired with a naked antibody that modulates the tumor microenvironment or enhances immune response, creating a multi-modal attack on the cancer cell and its defenses.

Finally, formulation and delivery technologies are crucial. Innovations in subcutaneous formulations are aimed at improving patient compliance and reducing the burden on infusion centers, requiring specialized formulation science to maintain the stability and high concentration of multiple large biological molecules in a small injection volume. Parallel developments in personalized diagnostics and companion testing (liquid biopsies, genomic profiling) are integral, ensuring that the selection of the precise antibody combination is guided by individual patient molecular markers, maximizing therapeutic potential and optimizing resource allocation within the clinical setting.

Regional Highlights

- North America: North America, led by the United States, holds the dominant share of the Combination Antibody Therapy Market, driven by pioneering R&D activities, massive healthcare spending, and a robust framework for rapid regulatory approval (FDA Breakthrough Therapy Designation). The region is home to the vast majority of key opinion leaders, leading academic research centers, and pharmaceutical headquarters, ensuring early adoption of novel combination regimens. High patient awareness and sophisticated insurance coverage mechanisms facilitate the rapid uptake of premium-priced combination therapies, especially in oncology. Furthermore, the region's focus on precision medicine and personalized cancer treatment heavily relies on complex combination diagnostics and therapeutics, cementing its market leadership.

- Europe: The European market represents the second-largest regional segment, characterized by high-quality universal healthcare systems and a strong commitment to clinical research, particularly in countries like Germany, the UK, and France. Market growth is supported by favorable policies from the European Medicines Agency (EMA) and national health technology assessment (HTA) bodies, although pricing and reimbursement negotiations often lead to regional variations in access and utilization. The ongoing challenge for European countries remains balancing the significant cost of these combination therapies against budget constraints, driving demand for robust comparative effectiveness data.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapidly improving healthcare infrastructure, substantial government investment in biotechnology and R&D, and the large patient pool suffering from cancer and chronic diseases. China, Japan, and South Korea are key growth engines. Japan maintains advanced regulatory processes and high research capabilities, while China is rapidly becoming a major hub for biosimilars and innovative drug development, often focusing on combination regimens suitable for local prevalence patterns. Increasing affordability and accessibility of advanced treatments are key drivers propelling the market expansion across emerging APAC economies.

- Latin America (LATAM): The LATAM region presents a growing but complex market, constrained by economic volatility and highly fragmented healthcare systems. Uptake of combination antibody therapies is typically slower, concentrating primarily in private healthcare sectors and major metropolitan areas in countries like Brazil and Mexico. However, rising investment in oncology infrastructure and increasing insurance penetration are gradually expanding patient access, with a primary focus on adopting proven combination standards established in North America and Europe.

- Middle East and Africa (MEA): The MEA market is heterogeneous, with significant demand concentrated in the wealthier Gulf Cooperation Council (GCC) countries (e.g., Saudi Arabia, UAE), which boast sophisticated healthcare infrastructure and high capacity for treating complex diseases. Market penetration in Africa remains low but is improving through philanthropic efforts and governmental initiatives focused on establishing regional specialty hospitals. Growth in MEA is highly dependent on favorable public procurement policies and establishing clear regulatory pathways for advanced biologics, which are currently progressing steadily.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Combination Antibody Therapy Market.- Merck & Co., Inc. (Focused on KEYTRUDA combinations)

- Bristol-Myers Squibb Company (Leaders in Opdivo and Yervoy combinations)

- Roche Holding AG (Genentech)

- AstraZeneca PLC (Strong combination pipeline, particularly with PD-L1 inhibitors)

- Pfizer Inc.

- Novartis AG

- Johnson & Johnson (Janssen)

- Sanofi S.A.

- Regeneron Pharmaceuticals, Inc.

- Amgen Inc.

- Eli Lilly and Company

- Gilead Sciences, Inc.

- Takeda Pharmaceutical Company Limited

- AbbVie Inc.

- GlaxoSmithKline PLC

- Biogen Inc.

- Seagen Inc. (Now part of Pfizer, focusing on ADC combinations)

- Xencor, Inc. (Specializing in bispecific antibody platforms)

- MacroGenics, Inc.

- Zai Lab Limited

Frequently Asked Questions

Analyze common user questions about the Combination Antibody Therapy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Combination Antibody Therapy, and how does it differ from Monotherapy?

Combination Antibody Therapy involves using two or more distinct monoclonal antibodies simultaneously to target different disease mechanisms or antigens, aiming for synergistic effects. This differs from monotherapy, which uses a single antibody. Combinations are typically employed to achieve deeper, more durable responses and overcome drug resistance, particularly in heterogeneous diseases like advanced cancer.

Which application segment holds the largest share in the Combination Antibody Therapy Market?

The Oncology application segment dominates the market share. This is due to the complexity of cancer and the proven clinical success of combining agents like immune checkpoint inhibitors (anti-PD-1, anti-CTLA-4) with other targeted antibodies to achieve superior outcomes compared to using single agents alone.

What technological advancements are driving the future of combination antibody development?

The development of Multi-Specific Antibodies (e.g., bispecifics and trispecifics) is the key technological driver. These engineered molecules combine two or three therapeutic mechanisms into one agent, streamlining manufacturing, simplifying administration, and providing targeted synergistic function at the cellular level.

How significant is the impact of high development cost on market penetration?

High development and manufacturing costs represent a significant restraint. Developing and gaining regulatory approval for combination regimens is exponentially more complex and expensive than monotherapies, resulting in premium pricing. This complexity often leads to delays in patient access, particularly in cost-sensitive markets, despite proven clinical benefits.

Which region is expected to show the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly expanding healthcare expenditure, increasing incidence of target diseases, rising R&D investment, and improving regulatory environments, particularly in major markets like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager