Combustion & Flue Gas Analyzers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434115 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Combustion & Flue Gas Analyzers Market Size

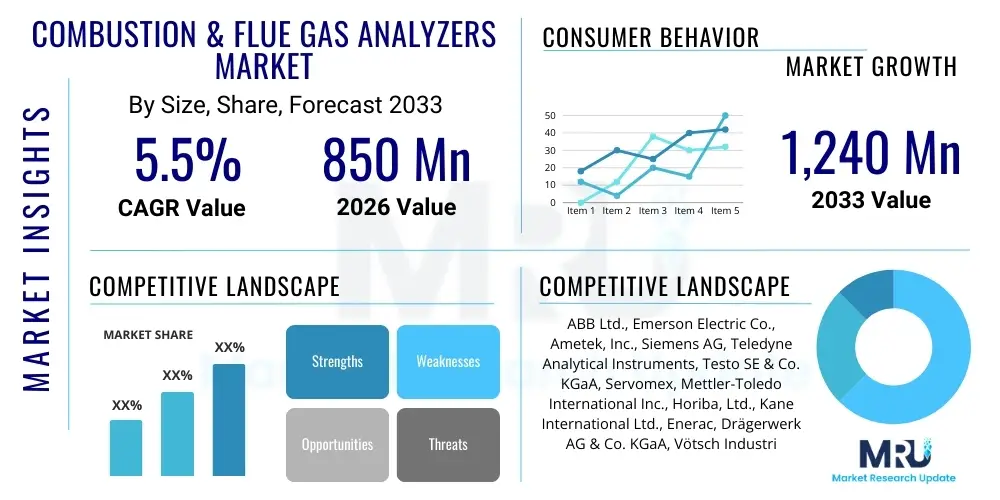

The Combustion & Flue Gas Analyzers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,240 Million by the end of the forecast period in 2033.

Combustion & Flue Gas Analyzers Market introduction

The Combustion & Flue Gas Analyzers Market encompasses specialized instruments designed to measure and monitor the composition of gases generated during combustion processes in industrial, commercial, and utility environments. These analyzers are critical tools for ensuring operational efficiency, optimizing fuel consumption, and, most importantly, achieving stringent compliance with global environmental regulations regarding emissions of pollutants such as nitrogen oxides (NOx), sulfur dioxide (SOx), carbon monoxide (CO), and particulate matter. The core function of these devices is to provide real-time or near real-time data on the air-to-fuel ratio, oxygen levels, and the concentration of various pollutants within the flue gas stream, allowing operators to make immediate adjustments to combustion parameters. The growing imperative for energy conservation and the need to reduce the carbon footprint across heavy industries are fundamental market drivers, positioning these analyzers as indispensable assets in modern industrial operations.

Product offerings in this market span a wide technological spectrum, including portable analyzers used for spot checks and maintenance, fixed continuous emission monitoring systems (CEMS) mandated for large stationary sources, and sophisticated laboratory-grade instruments. Key applications are deeply embedded within power generation facilities, cement and chemical manufacturing plants, oil and gas refineries, and commercial HVAC systems. The benefits derived from deploying these analyzers are multifaceted, extending beyond mere regulatory compliance to encompass substantial economic advantages. By accurately monitoring combustion efficiency, companies can minimize fuel waste, which translates directly into reduced operating costs and enhanced profitability. Furthermore, effective control of combustion processes prolongs the lifespan of costly boiler and furnace equipment by preventing excessive heat or corrosive conditions.

The market's trajectory is primarily driven by the escalating global enforcement of air quality standards, such as those established by the U.S. EPA, the European Union's Industrial Emissions Directive (IED), and equivalent mandates in emerging economies like China and India. These regulations necessitate accurate, verifiable, and continuous monitoring of emissions, thereby creating a sustained demand for CEMS and high-accuracy portable analyzers. Additionally, technological advancements, particularly the integration of Internet of Things (IoT) capabilities and advanced sensing technologies like Non-Dispersive Infrared (NDIR) and Zirconia sensors, are enhancing the reliability, precision, and connectivity of these instruments. These innovations are enabling predictive maintenance strategies and remote diagnostics, further accelerating their adoption across diverse industrial sectors striving for Industry 4.0 integration and operational excellence.

Combustion & Flue Gas Analyzers Market Executive Summary

The global Combustion & Flue Gas Analyzers Market is experiencing robust expansion, fundamentally driven by the intersecting pressures of environmental legislation and the corporate push for maximized operational efficiency and sustainability. Current business trends indicate a definitive shift toward continuous monitoring solutions (CEMS) over periodic portable analyzers, especially among large industrial emitters who require verifiable, tamper-proof data logs for regulatory reporting. Manufacturers are focusing heavily on miniaturization, enhanced sensor longevity, and improved data handling capabilities, recognizing that integration with existing plant control systems (DCS and SCADA) is a critical requirement for market penetration. Furthermore, strategic mergers and acquisitions among key players are common, aimed at consolidating technological expertise, particularly in sophisticated analytical techniques and remote data transmission platforms, ensuring companies can offer complete, integrated compliance and efficiency solutions.

Regionally, the market exhibits divergent growth patterns. North America and Europe currently represent the largest revenue bases, characterized by mature regulatory environments and high penetration rates of sophisticated CEMS, driven by long-standing environmental protection agencies. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate over the forecast period. This rapid expansion is a direct consequence of accelerated industrialization in countries like China, India, and Southeast Asia, coupled with their relatively recent implementation of strict national emission standards aimed at combating severe urban air pollution. This creates significant latent demand for new monitoring infrastructure. In contrast, while the Middle East and Africa (MEA) market remains niche, growth is substantial within the oil and gas and power generation sectors, propelled by capital investments in new energy infrastructure and the adoption of international best practices for environmental stewardship.

Segment trends underscore the rising importance of gas analyzer types employing advanced spectroscopic methods, such as Tunable Diode Laser Absorption Spectroscopy (TDLAS), which offer superior accuracy and lower maintenance compared to traditional electrochemical or infrared sensors, particularly for monitoring trace pollutants. By application, the power generation segment—encompassing both fossil fuel and renewable energy backup systems—retains the largest market share due to its massive scale and high emission profile. However, high-growth applications are emerging in the chemical and petrochemical sectors, where process optimization and safety monitoring are just as critical as regulatory compliance. This segmental evolution emphasizes the market's transition from being purely compliance-driven to becoming an essential component of overall process control and predictive maintenance strategies within the industrial landscape.

AI Impact Analysis on Combustion & Flue Gas Analyzers Market

User queries regarding the impact of Artificial Intelligence (AI) on the Combustion & Flue Gas Analyzers Market predominantly revolve around three critical themes: enhancing predictive maintenance capabilities, improving regulatory forecasting and compliance reporting, and optimizing combustion parameters in real-time. Users frequently ask how AI can extend the calibration cycle of CEMS, reduce false alarms, and accurately predict sensor drift or failure, which are high-cost operational burdens. There is also significant interest in how machine learning algorithms can analyze vast historical and real-time gas data alongside operational inputs (e.g., fuel quality, ambient temperature) to provide dynamic, highly granular insights into potential compliance excursions before they occur, shifting monitoring from reactive reporting to proactive control. Expectations are high that AI will move the market beyond simple data logging toward fully autonomous, optimized combustion management, offering substantial improvements in efficiency and maintenance schedules.

The integration of AI algorithms, particularly Machine Learning (ML), is fundamentally transforming the interpretation and application of flue gas data. Traditionally, analyzer data was used for simple reporting or basic threshold alerts. Now, ML models are trained on massive datasets spanning diverse operational conditions, enabling them to detect subtle deviations from normal operational envelopes indicative of impending equipment failure or inefficient burning. This capability is paramount in minimizing unscheduled downtime, a factor that carries severe economic penalties in continuous process industries like power and cement production. Furthermore, AI facilitates complex multivariate analysis, correlating parameters such as oxygen concentration fluctuations with ambient pressure changes, allowing for highly stable and optimized closed-loop combustion control systems that maximize energy output while minimizing pollutant formation.

AI's role in streamlining regulatory compliance is equally transformative. Sophisticated analytical platforms powered by AI can automatically generate complex compliance reports, ensuring adherence to often labyrinthine regional and international standards (e.g., QAL1, QAL2, and QAL3 requirements under EN 14181). Beyond mere reporting, AI-driven predictive modeling enables facility managers to forecast the environmental impact of planned operational changes, such as switching fuel sources or altering load capacity, thereby ensuring compliance is maintained under all conceivable operating conditions. This digital transformation reduces the human error associated with manual data handling and interpretation, significantly lowers administrative overheads, and provides unprecedented traceability and transparency for environmental auditors, ultimately increasing the trustworthiness and utility of the analyzer data.

- AI impacts in concise points

- Enhanced Predictive Maintenance: AI models analyze sensor degradation and environmental factors to predict optimal calibration intervals and sensor replacement timing, reducing operational expenditure and preventing data inaccuracy.

- Real-time Combustion Optimization: Machine learning algorithms process multi-parameter flue gas data to dynamically adjust air-to-fuel ratios, maximizing thermal efficiency and minimizing NOx/CO formation.

- Automated Compliance Reporting: AI platforms automatically generate standardized regulatory reports, ensuring strict adherence to environmental mandates (e.g., EPA 40 CFR Part 60/75 or EU IED) with high data integrity.

- Anomaly Detection: Advanced statistical modeling identifies minor deviations in gas concentrations that might indicate early-stage equipment malfunction or fuel quality issues, far before standard threshold alarms are triggered.

- Improved Data Integrity and Validation: AI-driven validation processes filter out spurious data points caused by transient process conditions or instrument noise, improving the overall reliability of CEMS readings.

DRO & Impact Forces Of Combustion & Flue Gas Analyzers Market

The dynamics of the Combustion & Flue Gas Analyzers Market are governed by a compelling mix of regulatory pressure, technological innovation, and economic necessity, summarized under Drivers, Restraints, and Opportunities (DRO). The primary driving force remains the globally intensifying regulatory environment, particularly the establishment of increasingly stringent emission caps for conventional pollutants and greenhouse gases. Governments and international bodies are tightening enforcement, necessitating reliable, continuous monitoring infrastructure, which directly stimulates demand for advanced CEMS. Concurrently, the operational imperative for cost reduction through efficiency gains compels industries to adopt these analyzers; maximizing combustion efficiency translates directly into lower fuel costs, providing a clear and measurable return on investment, independent of regulatory mandates. This synergy of environmental compliance and economic benefit creates a strong, sustained demand floor for analytical instrumentation.

However, market growth faces notable restraints, primarily centered around the substantial initial capital investment required for high-end CEMS installations and the ongoing operational costs associated with maintenance and mandatory regulatory calibrations (such as QAL2 audits). The complexity of integrating sophisticated analytical systems into legacy industrial infrastructure presents a significant technical hurdle, particularly in older plants where control systems may lack the necessary communication protocols. Furthermore, the need for highly skilled technical personnel to operate, maintain, and interpret the specialized data generated by these analyzers acts as a constraint, especially in regions facing a talent shortage in instrumentation and control engineering. These factors contribute to extended procurement cycles and often favor less sophisticated, though less accurate, solutions among smaller industrial players.

Opportunities for market expansion are strongly rooted in the global transition toward Industry 4.0 and the increasing penetration of smart factory concepts. The shift from standalone monitoring to fully integrated process control offers significant growth potential, allowing analyzers to become active elements in closed-loop control systems. The rapid growth of hydrogen-based fuels and alternative energy sources (biomass, sustainable aviation fuels) introduces new analytical challenges, requiring instruments capable of measuring a broader, more complex range of gas compositions and trace contaminants, thereby driving innovation in sensor technology. The cumulative impact of these forces is overwhelmingly positive; while restraints slow adoption among smaller enterprises, the overarching regulatory mandate and the clear economic benefit of efficiency optimization ensure that high-quality, smart, and integrated analyzers are quickly becoming standard equipment across all large-scale energy and manufacturing operations.

Segmentation Analysis

The Combustion & Flue Gas Analyzers Market is comprehensively segmented based on technology, measurement type, application, and form factor, enabling tailored solutions for diverse industrial needs. The segmentation by technology is crucial as it dictates the accuracy, cost, maintenance requirements, and the range of gases that can be reliably measured. Technologies range from simple, cost-effective electrochemical sensors, often used in portable devices for basic oxygen and carbon monoxide measurement, to highly precise optical techniques like NDIR (Non-Dispersive Infrared), UV-Vis spectroscopy, and TDLAS (Tunable Diode Laser Absorption Spectroscopy), which are the foundation of sophisticated CEMS required for high-accuracy regulatory reporting. The market's structural evolution shows a clear trend toward optical methods due to their stability, selectivity, and reduced drift, despite their higher initial cost.

By form factor, the distinction between fixed (Continuous Emission Monitoring Systems or CEMS) and portable analyzers defines the market landscape. CEMS solutions dominate the revenue share due to regulatory mandates requiring continuous monitoring in high-emission sectors like power and cement. These systems are permanently installed and integrated into plant control infrastructure. Conversely, portable analyzers serve a vital function in routine maintenance, efficiency tuning, safety checks, and smaller commercial applications, valued for their mobility, quick response time, and user-friendly interfaces. The application segmentation highlights the dominant role of power generation (both coal and natural gas-fired plants) as the largest consumer, followed closely by the oil & gas and chemical sectors, which prioritize both process control and regulatory compliance.

Further granularity exists within the measurement type, distinguishing between process control measurements (primarily O2, CO2, CO for efficiency) and mandatory emission monitoring (NOx, SOx, particulates, and volatile organic compounds). While process control drives the need for real-time measurements to optimize fuel use, emission monitoring dictates the high standards for data accuracy, redundancy, and regulatory certification (such as TUV or MCERTS certifications). This detailed segmentation allows manufacturers to target specific end-user requirements, whether they need rugged, fast analyzers for flare stack monitoring in the oil patch or laboratory-grade precision for complex catalyst testing in chemical manufacturing, ensuring that the market offers appropriate instrumentation across the entire spectrum of industrial requirements.

- List all key segments in bullet format

- By Technology:

- Electrochemical

- NDIR (Non-Dispersive Infrared)

- Zirconia Oxide

- UV/Visible Spectroscopy

- Tunable Diode Laser Absorption Spectroscopy (TDLAS)

- Paramagnetic

- By Form Factor:

- Portable Analyzers

- Fixed/Stationary Analyzers (CEMS)

- By Measurement Type:

- Process Control (O2, CO, CO2, Temperature, Draft)

- Emission Monitoring (NOx, SOx, Particulate Matter, VOCs, Trace Elements)

- By Application:

- Power Generation (Utility and Industrial Boilers)

- Oil and Gas (Refineries, Processing Plants, Pipeline Compressors)

- Chemical and Petrochemical

- Cement, Glass, and Ceramics

- Metals and Mining

- Waste Incineration and Environmental Monitoring

- Commercial HVAC and Boiler Services

Value Chain Analysis For Combustion & Flue Gas Analyzers Market

The value chain for Combustion & Flue Gas Analyzers is intricate, beginning with specialized upstream component suppliers and extending through highly skilled distributors to the diverse end-user base. Upstream activities are dominated by providers of highly specialized components, notably sensor manufacturers (e.g., Zirconia cells, NDIR benches, electrochemical sensor cartridges, and laser components). The quality, reliability, and precision of these components directly determine the performance and regulatory certification potential of the final analyzer product. Manufacturers of the analyzers themselves invest heavily in R&D, focusing on instrument ruggedness, software integration, data connectivity (IoT/cloud capabilities), and securing necessary regulatory certifications (e.g., EPA, TUV, MCERTS), which are major barriers to entry.

The middle segment of the chain involves the assembly, integration, and distribution of the finished analytical systems. Due to the technical complexity and the need for localized support, the distribution channel is critical. Direct sales are common for large, complex CEMS contracts, particularly to major utility or petrochemical clients, involving direct engineering consultations, installation, and commissioning by the manufacturer’s specialized service team. However, indirect distribution through specialized regional partners and value-added resellers (VARs) is essential for penetrating the widespread market for portable and smaller-scale industrial analyzers. These resellers often provide crucial local maintenance, calibration services, and training, which are non-negotiable requirements for end-users relying on analyzer data for critical compliance and process control decisions.

Downstream analysis focuses on the end-user interaction and post-sales service structure. For complex CEMS installations, the value chain extends into long-term service contracts covering routine maintenance, re-certification, and software upgrades, often representing a significant recurring revenue stream for manufacturers. Direct involvement ensures data accuracy and regulatory conformity, protecting the client from massive environmental fines. For portable devices, the downstream value is focused on calibration service centers and rapid repair capabilities. The efficiency of this downstream servicing is a key differentiator in the market, as prolonged downtime of analytical equipment can lead to regulatory non-compliance or significant operational inefficiencies, making robust, reliable, and swift service support an essential link in the overall value proposition.

Combustion & Flue Gas Analyzers Market Potential Customers

The potential customer base for Combustion & Flue Gas Analyzers is vast and vertically diverse, encompassing virtually every industry segment that utilizes fuel combustion for heat, power, or processing. The primary, largest consumers are the utility-scale power generation companies—those operating large coal-fired, natural gas, or oil power plants—who are mandated by environmental agencies to install and maintain Continuous Emission Monitoring Systems (CEMS). Secondary major customers include the heavy manufacturing sectors such as cement, glass, and metals production, where massive furnaces and kilns are essential process components, necessitating efficiency monitoring for cost control and emission monitoring for compliance with local and international industrial standards.

Beyond the heavy industrial core, significant purchasing power comes from the oil and gas sector, particularly refineries and processing facilities that use combustion for steam generation, heating, and flare stack monitoring. In this sector, the analyzers are equally important for safety (monitoring hazardous gas buildup) and environmental reporting. Moreover, the chemical and petrochemical industries rely heavily on these instruments not only for boiler efficiency but also for complex process analytics where gas composition measurements are critical inputs for quality control and reaction optimization, driving demand for laboratory-grade or highly specialized analytical devices.

The commercial and institutional segments represent a rapidly growing customer demographic, especially concerning HVAC and boiler maintenance services. Facility managers in large hospitals, universities, and commercial complexes utilize portable combustion analyzers to tune commercial heating systems for peak energy efficiency, driven primarily by operational cost savings rather than strict CEMS mandates. Procurement decisions across all these sectors are typically made by environmental compliance officers, instrumentation and control engineers, and plant operations managers, ensuring that product adoption is contingent on regulatory approval, technical precision, ease of integration, and demonstrated return on investment through fuel efficiency gains.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,240 Million |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ABB Ltd., Emerson Electric Co., Ametek, Inc., Siemens AG, Teledyne Analytical Instruments, Testo SE & Co. KGaA, Servomex, Mettler-Toledo International Inc., Horiba, Ltd., Kane International Ltd., Enerac, Drägerwerk AG & Co. KGaA, Vötsch Industrietechnik GmbH, California Analytical Instruments, Inc., Fuji Electric Co., Ltd., Thermo Fisher Scientific Inc., Sick AG, Yokogawa Electric Corporation, Nova Analytical Systems, Bacharach (A Part of MSA). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Combustion & Flue Gas Analyzers Market Key Technology Landscape

The technological landscape of the Combustion & Flue Gas Analyzers Market is characterized by continuous innovation aimed at improving accuracy, reliability, and reducing the total cost of ownership (TCO). A significant portion of this innovation focuses on sensor technology. While traditional electrochemical sensors remain prevalent in portable, lower-cost devices, their limitations regarding sensor lifespan and cross-sensitivity to different gases are driving a move toward more stable and selective techniques. Zirconia oxide sensors are the industry standard for oxygen measurement due to their robustness and wide temperature operating range, essential for in-situ measurements in high-temperature flue gas streams. For multi-gas analysis, NDIR technology remains dominant for CO, CO2, and sometimes SO2, offering excellent stability and requiring less frequent calibration than electrochemical cells, which is highly valued in CEMS applications.

The most transformative technology in recent years is the rapid adoption of optical measurement techniques, particularly Tunable Diode Laser Absorption Spectroscopy (TDLAS). TDLAS systems offer unparalleled sensitivity and selectivity, allowing for highly accurate, interference-free measurement of gases like H2O, CO, and various forms of NOx and SOx, often measured at parts per million (ppm) levels or lower. The key advantage of TDLAS is that measurements are taken non-intrusively (in-situ), minimizing sample conditioning requirements, which dramatically reduces system complexity, maintenance needs, and potential measurement error sources. This technology is increasingly utilized in demanding industrial environments where compliance requires the utmost precision and data integrity, particularly within the power generation and large-scale incinerator markets.

Beyond the core analytical methods, connectivity and software are defining the next generation of analyzers. The implementation of IoT protocols allows these instruments to communicate seamlessly with cloud-based platforms and plant control systems, facilitating remote monitoring, diagnostics, and over-the-air software updates. Modern analyzers incorporate advanced microprocessors and proprietary software to execute complex data validation and self-diagnostic routines, significantly improving uptime. Furthermore, the development of robust, specialized sample handling and conditioning systems—which cool, filter, and dry the hot, corrosive flue gas sample before analysis—remains a critical technological element, ensuring the longevity and accuracy of the sophisticated sensors downstream, directly impacting the instrument's ability to maintain regulatory certification over long operational periods.

Regional Highlights

- Highlight key countries or regions and their market relevance

- North America: This region holds a significant share of the global market, driven by the strict enforcement of EPA regulations and continuous industrial investments in modernization. The market is characterized by a high demand for advanced, integrated Continuous Emission Monitoring Systems (CEMS), particularly within the electric utilities and oil and gas sectors. The US is a major technology adopter, favoring sophisticated instruments like TDLAS for highly accurate NOx and greenhouse gas reporting. The maturity of the industrial base necessitates frequent system upgrades and replacements, ensuring steady demand.

- Europe: Driven by the European Union's ambitious climate targets and the Industrial Emissions Directive (IED), Europe is a mature market focused intensely on compliance and efficiency. Germany, the UK, and France are leaders in adopting certified (TUV/MCERTS) analytical equipment. The market shows a strong preference for analyzers integrated with environmental data reporting services and those that excel in monitoring unique emissions from waste-to-energy plants and specialized chemical processes. The transition away from coal necessitates the retrofitting and monitoring of gas-fired plants and hydrogen blending applications.

- Asia Pacific (APAC): APAC is forecast to be the fastest-growing market globally due to rapid industrialization, burgeoning power demand, and a belated but aggressive shift toward environmental regulation, particularly in China and India. The immense scale of new infrastructure projects, ranging from new steel mills to coal power plants, creates massive opportunities for both portable and fixed analyzer sales. While initial demand may be driven by cost-effective solutions, the push for cleaner air in urban centers is rapidly accelerating the adoption of high-precision CEMS required for Tier 1 cities and major industrial zones.

- Latin America (LATAM): Growth in LATAM is concentrated primarily in Brazil and Mexico, linked to their expansive oil and gas exploration, refining capacity, and power infrastructure projects. Market expansion is steady, but often subject to economic volatility and reliance on international standards (e.g., US EPA or European standards) due to less developed local regulatory frameworks. Demand is primarily for robust, simple-to-maintain systems suitable for remote and challenging operational environments common in resource extraction.

- Middle East and Africa (MEA): The MEA market is heavily influenced by large-scale capital investments in the hydrocarbon industry and power generation (desalination and utility plants). The region demands robust, high-performance instruments capable of operating reliably in high-temperature and harsh desert conditions. Regulatory compliance, while enforced, is often driven by international standards stipulated by large multinational operating companies. The expansion of utility infrastructure in the GCC countries fuels consistent growth, particularly for fixed CEMS installations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Combustion & Flue Gas Analyzers Market.- ABB Ltd.

- Emerson Electric Co.

- Ametek, Inc.

- Siemens AG

- Teledyne Analytical Instruments

- Testo SE & Co. KGaA

- Servomex (A Part of Spectris)

- Mettler-Toledo International Inc.

- Horiba, Ltd.

- Kane International Ltd.

- Enerac

- Drägerwerk AG & Co. KGaA

- Vötsch Industrietechnik GmbH

- California Analytical Instruments, Inc.

- Fuji Electric Co., Ltd.

- Thermo Fisher Scientific Inc.

- Sick AG

- Yokogawa Electric Corporation

- Nova Analytical Systems

- Bacharach (A Part of MSA)

Frequently Asked Questions

Analyze common user questions about the Combustion & Flue Gas Analyzers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Combustion & Flue Gas Analyzer?

The primary function is to measure gas concentrations (O2, CO, CO2, NOx, SOx) in the exhaust stream to ensure regulatory compliance with environmental standards and optimize the air-to-fuel ratio, thereby maximizing fuel efficiency and reducing operational costs in boilers, furnaces, and engines.

How do Continuous Emission Monitoring Systems (CEMS) differ from portable analyzers?

CEMS are fixed, highly accurate systems required by regulators for continuous, real-time data logging in large industrial sources (like power plants), providing verifiable compliance records. Portable analyzers are handheld, used for periodic efficiency checks, maintenance tuning, and spot checks, offering flexibility and fast diagnostics.

Which technological trend is most impacting the accuracy of gas analysis?

The rapid adoption of Tunable Diode Laser Absorption Spectroscopy (TDLAS) is significantly impacting accuracy. TDLAS offers highly selective, interference-free, and sensitive measurement of trace gases (e.g., NOx and SOx) directly in-situ, minimizing errors associated with traditional extractive sample conditioning.

What are the main drivers accelerating market growth in the Asia Pacific region?

Market growth in APAC is driven by massive, ongoing industrial infrastructure development, coupled with the introduction and rigorous enforcement of new national and regional environmental emission standards aimed at mitigating severe air pollution in industrialized zones.

How does the integration of AI improve the performance of gas analyzers?

AI improves performance by enabling predictive maintenance for sensors, reducing unplanned downtime, and facilitating real-time, closed-loop combustion optimization by analyzing complex process variables alongside flue gas data to enhance thermal efficiency and maintain continuous compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager