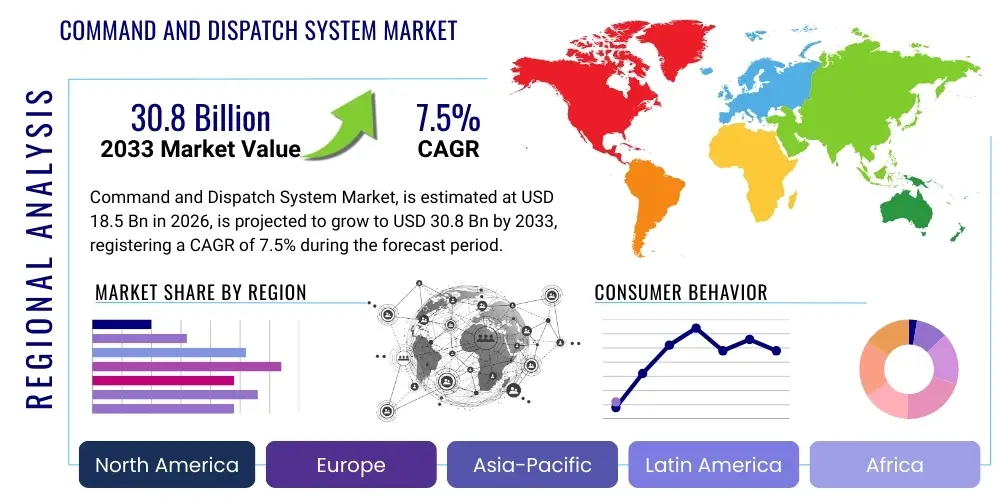

Command and Dispatch System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437058 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Command and Dispatch System Market Size

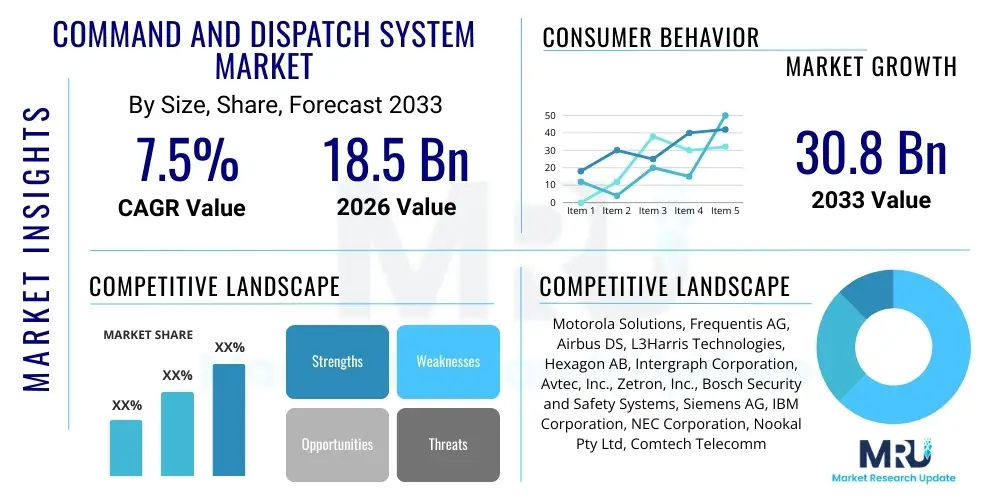

The Command and Dispatch System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 30.8 Billion by the end of the forecast period in 2033. This substantial growth is fundamentally driven by the escalating demand for enhanced public safety infrastructure, modernization of emergency response services, and the crucial requirement for seamless, reliable communication among disparate field units and control centers, particularly in response to rising geopolitical instability and complex urban management challenges. The integration of advanced digital technologies, such as cloud computing and enhanced data analytics, further solidifies this upward trajectory, allowing for more efficient resource allocation and predictive incident management across governmental and private sectors globally.

Command and Dispatch System Market introduction

The Command and Dispatch System Market encompasses sophisticated communication and information technology platforms designed to manage mission-critical operations, coordinate resources, and facilitate rapid, secure communication within public safety agencies, utility companies, transportation networks, and defense organizations. These systems integrate various communication technologies, including Land Mobile Radio (LMR), IP-based systems, telephony, video feeds, and data streams, into a unified operational environment. The primary function is to provide real-time situational awareness and maintain a centralized operational control point (control center or dispatch center) to effectively manage emergencies, routine operations, and large-scale incident responses, ensuring timely and effective dissemination of instructions and resource deployment to field personnel.

The core components of a modern Command and Dispatch System often include Computer-Aided Dispatch (CAD) software, Geographic Information System (GIS) mapping integration, recording and logging capabilities, resource management modules, and user-friendly console interfaces. Major applications span across law enforcement, fire and rescue services, emergency medical services (EMS), military operations, critical infrastructure protection, and commercial logistics. Benefits derived from deploying these advanced systems are substantial, including significantly reduced response times, improved operational efficiency, enhanced data security, and superior interoperability between different agencies and jurisdictions, which is crucial during multi-agency incidents or disaster relief efforts.

Driving factors propelling market growth include increasing global governmental investments in smart city initiatives, which require sophisticated centralized command structures, and the mandatory need to upgrade aging analog communication infrastructure to digital, standardized platforms like Project 25 (P25) or TETRA. Furthermore, the proliferation of Internet of Things (IoT) devices and sensors across operational environments generates massive amounts of real-time data that necessitates robust dispatch systems capable of processing and converting this data into actionable intelligence. The market is also heavily influenced by regulatory mandates requiring superior incident documentation and transparent reporting, making advanced, integrated dispatch systems indispensable tools for modern operational management.

Command and Dispatch System Market Executive Summary

The Command and Dispatch System Market is undergoing a rapid technological transformation, shifting from proprietary, hardware-centric solutions toward flexible, software-defined, and cloud-hosted platforms. Business trends emphasize subscription-based models (SaaS) and the incorporation of advanced data analytics for predictive policing and resource optimization. Key industry participants are focusing on achieving superior system interoperability, especially between legacy LMR systems and emerging broadband push-to-talk (PTT) solutions over 4G/5G networks, driving fierce competition in the integrated communications platform segment. Geographically, North America remains the dominant revenue generator due to early adoption, stringent compliance standards, and significant investments in Next Generation 9-1-1 (NG9-1-1) infrastructure, while the Asia Pacific region is demonstrating the highest growth potential, fueled by massive infrastructure development in countries like China and India, alongside increasing security concerns requiring sophisticated military and civil defense command systems.

Segment trends highlight the growing dominance of IP-based and digital solutions over traditional analog systems, particularly within the software segment, where AI-driven CAD systems are becoming standard for optimizing dispatch recommendations and predicting incident hotspots. The transportation and utilities sectors are demonstrating accelerated adoption rates, utilizing dispatch systems not just for emergency response but also for routine operational monitoring, fleet management, and infrastructure maintenance coordination. Furthermore, the market for ruggedized and mobile command and dispatch solutions is expanding rapidly, reflecting the need for command center functionality to be accessible outside fixed physical locations, supporting tactical teams and remote operations effectively. Cybersecurity remains a persistent challenge and a critical investment area, with demand rising for highly resilient systems that can withstand sophisticated cyber-attacks aimed at critical communication infrastructure.

AI Impact Analysis on Command and Dispatch System Market

Common user questions regarding AI's influence in the Command and Dispatch System Market revolve primarily around three core themes: efficiency, accuracy, and autonomy. Users frequently ask if AI can replace human dispatchers, how AI can expedite response times by optimizing resource deployment, and what role machine learning plays in handling the massive data influx from smart sensors and IoT devices. There is also significant interest in AI's capacity to filter noise and prioritize critical alerts, minimizing human error during high-stress situations. Key expectations center on achieving predictive capabilities—forecasting incident locations, predicting required resources, and dynamically adjusting communications channels. Conversely, users express concerns regarding the ethical implications of AI-driven decisions in public safety, data privacy, and the validation of AI models used in mission-critical environments, all of which necessitate robust governance and transparency mechanisms.

The implementation of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming the dispatch environment by enhancing the capabilities of Computer-Aided Dispatch (CAD) systems. AI algorithms are now crucial for processing unstructured data, such as audio transcripts from emergency calls, social media monitoring, and video analysis, converting disparate information into structured alerts that provide dispatchers with a unified operational picture almost instantaneously. This advanced data processing capability minimizes the time spent on manual data entry and correlation, allowing human operators to concentrate on tactical decision-making. Moreover, AI is instrumental in managing the complexity introduced by Next Generation 9-1-1 (NG9-1-1) systems, which integrate multimedia inputs, ensuring that relevant data (like photos or videos from the scene) is appropriately routed and analyzed for better resource staging and preparation.

This integration results in significant operational improvements, moving dispatch centers toward a proactive, rather than reactive, model. For instance, predictive algorithms utilize historical incident data, coupled with real-time variables like traffic flow, weather patterns, and major events schedules, to anticipate areas prone to criminal activity or accidents. This enables pre-positioning of resources (predictive dispatching) to reduce reaction latency. Furthermore, AI systems are being developed to automatically synthesize complex incident reports and compliance documentation, significantly reducing the administrative burden on dispatchers and field personnel, thereby ensuring that human capital is optimally utilized for complex human interaction and tactical supervision.

- Enhanced Data Synthesis: AI processes multimedia inputs (text, video, voice) for faster incident categorization and prioritization.

- Predictive Dispatching: Machine learning models anticipate demand and optimize resource location based on historical patterns and real-time environmental factors.

- Automated Triage: AI rapidly analyzes emergency call context to recommend initial instructions and appropriate service responses, reducing human cognitive load.

- Improved Interoperability: AI algorithms facilitate seamless data translation and communication between disparate agency systems and communication protocols.

- Cybersecurity Automation: AI-driven threat detection monitors communication networks for anomalies and potential breaches in real-time.

- Dynamic Resource Allocation: Automated algorithms recommend optimal routes and available units, minimizing response times during large-scale incidents.

DRO & Impact Forces Of Command and Dispatch System Market

The Command and Dispatch System Market is propelled by compelling drivers, including the rapid global urbanization necessitating complex centralized operational control, the critical need to comply with stringent government regulations regarding emergency communication standards (e.g., NG9-1-1 rollout), and the widespread adoption of 4G/5G broadband networks that enable high-definition video and data transmission for improved situational awareness. However, the market faces significant restraints, primarily the enormous initial investment required for system implementation and migration from legacy infrastructure, the persistent shortage of technically skilled personnel capable of managing complex integrated platforms, and high levels of cybersecurity vulnerability inherent in interconnected communication systems. These competing factors create intense impact forces, driving manufacturers toward developing cloud-native, scalable, and highly secure Software-as-a-Service (SaaS) dispatch solutions to lower the entry barriers and mitigate complexity, simultaneously emphasizing resilience and data integrity as core competitive differentiators.

A key driver revolves around the modernization cycle of Public Safety Answering Points (PSAPs). Many national and regional authorities are mandated to transition to digital, IP-based NG9-1-1 systems that handle diverse digital media inputs beyond voice calls. This technological upgrade inherently requires completely new, advanced Command and Dispatch systems capable of multimedia processing, location-based services (LBS) integration, and enhanced data logging. Furthermore, the increasing frequency and complexity of natural disasters and large-scale public safety events worldwide amplify the need for resilient, interoperable dispatch systems that can coordinate multi-agency responses effectively, transcending geographical and technological silos. This demand ensures sustained government spending on robust communication infrastructure upgrades.

Opportunities in the market are abundant, particularly in the integration of geospatial analytics and drone technology into dispatch workflows, offering enhanced aerial views and accurate location tracking during emergencies. The convergence of mission-critical LMR networks (TETRA, P25) with Commercial Off-the-Shelf (COTS) broadband communication solutions presents a significant avenue for growth, allowing agencies to leverage lower-cost consumer technology while maintaining mission assurance. Moreover, the vast untapped potential in emerging economies, coupled with growing private sector demand from large industrial complexes, oil and gas operations, and massive logistics hubs that require specialized dispatch and asset tracking capabilities, ensures diversified growth beyond traditional public safety expenditure. However, addressing the restraint of legacy system lock-in and convincing stakeholders of the long-term ROI for integrated digital platforms remains paramount for market penetration, requiring robust case studies and flexible financing models.

Segmentation Analysis

The Command and Dispatch System Market is highly fragmented and segmented based on technology, component, application, and deployment model, reflecting the diverse and specialized requirements of end-users. Analysis of these segments is crucial for identifying targeted growth strategies. The segmentation highlights a fundamental shift toward software and service segments, driven by the desire for operational flexibility and reduced capital expenditure. Key technological differentiations exist between traditional Land Mobile Radio (LMR) dispatch consoles and the newer, fully IP-based Next Generation dispatch platforms, with the latter rapidly gaining market share due to their superior data handling and interoperability capabilities required by modern public safety standards. The most significant revenue generation occurs in the public safety sector, though the enterprise and utility sectors are demonstrating higher compound growth rates as they increasingly adopt command systems for routine operational management and industrial security.

- By Component:

- Hardware (Consoles, Servers, Switches, Antennas)

- Software (Computer Aided Dispatch (CAD), Automated Vehicle Location (AVL), Call Taking, Recording/Logging)

- Services (Integration & Installation, Consulting, Maintenance & Support, Managed Services)

- By Technology:

- LMR-based Systems (TETRA, P25, DMR)

- Broadband/IP-based Systems (VoIP, LTE/5G PTT)

- Hybrid Systems

- By Deployment Model:

- On-Premise

- Cloud-Based

- Hybrid Cloud

- By Application:

- Public Safety (Police, Fire, EMS, Emergency Management)

- Transportation & Logistics (Rail, Airports, Maritime, Fleet Management)

- Utilities (Power, Water, Gas)

- Defense & Military

- Oil & Gas and Mining

- Healthcare

- By End-User:

- Government/Public Sector

- Commercial/Private Sector

Value Chain Analysis For Command and Dispatch System Market

The value chain for the Command and Dispatch System Market is complex, involving multiple specialized stages starting from core technology development and culminating in integrated end-user services. The upstream analysis focuses on specialized hardware and software providers who develop core communication chips, standardized protocols (like P25 or TETRA codecs), and underlying operating systems required for resilient mission-critical performance. Key challenges upstream include ensuring secure supply chains and managing the rapid obsolescence cycle of COTS technology integrated into highly specialized hardware. Successfully navigating the upstream requires deep expertise in cybersecurity and ruggedization techniques to ensure components meet the stringent reliability requirements of public safety and defense applications.

The midstream focuses on system integrators and solution providers. These entities acquire core technologies and customize them into complete, functional dispatch systems tailored to specific agency protocols and regional standards (e.g., integrating CAD software with local GIS databases). Distribution channels are predominantly indirect, relying heavily on specialized System Integrators (SIs) and value-added resellers (VARs) who possess the necessary licenses, certifications, and technical capabilities to deploy and maintain mission-critical infrastructure, especially when dealing with complex governmental tenders. Direct sales often occur only for large, national-level defense projects or standardized SaaS subscriptions where integration complexity is lower.

Downstream analysis involves the installation, maintenance, training, and ongoing managed services provided to the end-users (e.g., PSAPs, transit authorities). Given the 24/7 nature of command operations, maintenance and support services represent a significant, recurring revenue stream. The successful delivery of downstream services depends on highly specialized technical support teams capable of rapid troubleshooting and system upgrades without causing operational disruption. The transition to cloud-based architectures is gradually shifting the maintenance burden from the end-user IT staff to the service provider, enhancing overall system reliability and reducing localized maintenance costs, thereby optimizing the long-term value proposition for the customer.

Command and Dispatch System Market Potential Customers

Potential customers for Command and Dispatch Systems are organizations where rapid, coordinated response and continuous communication are paramount for safety, security, and operational efficiency. The primary customer segment remains governmental bodies, encompassing national, state, and local agencies responsible for public safety, including Police Departments, Fire & Rescue services, and Emergency Medical Services (EMS). The migration to Next Generation 9-1-1 standards ensures that these Public Safety Answering Points (PSAPs) are continually upgrading their dispatch infrastructure, making them consistent, high-value purchasers of both software (CAD, logging) and integrated communication hardware.

Beyond traditional public safety, critical infrastructure operators represent a rapidly expanding customer base. This includes utility companies (electric power grids, natural gas pipelines, water treatment facilities) which utilize dispatch systems for managing geographically dispersed field crews, responding to infrastructure failures, and coordinating security measures. Furthermore, major transportation hubs—such as large international airports, metropolitan railway systems, and port authorities—require sophisticated command systems to manage complex logistics, coordinate security patrols, and respond to large-scale incidents affecting passenger safety and cargo movement, demanding integration with video surveillance and access control systems.

The private sector also constitutes a key segment, particularly large-scale industrial complexes (manufacturing plants, petrochemical refineries, mining operations) and extensive commercial logistics providers. These entities require proprietary dispatch solutions for internal security, managing fleet movements across vast sites, and coordinating critical maintenance teams. The underlying motivation for these private entities is often regulatory compliance, minimizing operational downtime, and ensuring the safety of high-value assets and personnel, often favoring cloud-based or hybrid solutions due to their scalability and lower initial procurement costs compared to traditional dedicated governmental systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 30.8 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Motorola Solutions, Frequentis AG, Airbus DS, L3Harris Technologies, Hexagon AB, Intergraph Corporation, Avtec, Inc., Zetron, Inc., Bosch Security and Safety Systems, Siemens AG, IBM Corporation, NEC Corporation, Nookal Pty Ltd, Comtech Telecommunications Corp., Cisco Systems, Inc., Teltronic S.A.U., Leonardo S.p.A., Catalis SE, Priority Dispatch Corp., Rave Mobile Safety |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Command and Dispatch System Market Key Technology Landscape

The technological landscape of the Command and Dispatch System Market is defined by the convergence of traditional mission-critical communication protocols (like TETRA and P25) with high-speed, commercial broadband technologies (4G/LTE and 5G). This convergence is pivotal, enabling dispatch centers to move beyond voice-only communication to incorporating robust, high-bandwidth data streams, including real-time video, large files, and sophisticated location data transmitted via dedicated public safety mobile networks (such as FirstNet in the U.S. or similar initiatives globally). The shift is moving specialized dispatch consoles toward software-defined radio (SDR) and virtualized environments, allowing agencies to manage communications across disparate networks (LMR, cellular, satellite) from a single, unified interface, greatly enhancing interoperability.

Cloud computing and virtualization are central to the future evolution of dispatch systems. The adoption of Cloud-Based CAD and Communication Logging allows for increased resilience, easier scalability, and disaster recovery capabilities that are difficult and expensive to achieve with traditional on-premise hardware deployments. Furthermore, microservices architecture is increasingly utilized in modern dispatch software development, allowing agencies to deploy and update specific functionalities (e.g., mapping, resource tracking) independently, speeding up innovation cycles and customization. This architectural change supports the rapid integration of new data sources, such as IoT sensor inputs from smart city infrastructure or body-worn cameras carried by field officers, directly into the dispatch workflow.

Advanced data analytics and Artificial Intelligence (AI) represent the cutting edge of dispatch technology. AI algorithms are embedded within Computer-Aided Dispatch (CAD) systems to perform automated functions like call prioritization, natural language processing (NLP) of emergency calls, and predictive analysis to anticipate resource needs. Furthermore, enhanced location accuracy, often achieved through technologies like indoor mapping and advanced multi-constellation Global Navigation Satellite System (GNSS) receivers, is vital for accurate dispatching in complex urban environments. These technological advancements collectively drive the market toward highly automated, intelligent systems that maximize the efficiency of scarce human resources and ensure superior public safety outcomes.

Regional Highlights

The Command and Dispatch System Market exhibits distinct regional dynamics influenced by varying regulatory standards, infrastructure maturity, and public safety investment levels. North America currently dominates the global market, largely due to the early and mandatory adoption of sophisticated digital standards, continuous investment in NG9-1-1 infrastructure across the United States and Canada, and the strong presence of key technology vendors. The region has a highly mature ecosystem for integrated command solutions, focusing intensely on cybersecurity resilience, cloud migration, and the utilization of public safety broadband networks like FirstNet. High per capita public safety spending and a strong emphasis on tactical interoperability across state and federal agencies solidify its market leadership.

Europe represents a mature market, driven primarily by the ongoing migration from legacy systems to TETRA standards (especially in government and transportation sectors) and regulatory pressure from the European Union to enhance cross-border emergency communication interoperability. Countries like Germany, the UK, and France are major contributors, with significant investment directed toward integrated security solutions for critical national infrastructure (CNI) and comprehensive disaster management systems. Key growth areas in Europe include the adoption of standardized Public Protection and Disaster Relief (PPDR) broadband solutions, coupled with the increasing integration of GIS mapping tools and real-time data visualization into command platforms.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally. This rapid expansion is spurred by massive urbanization, substantial government spending on smart city projects, and the urgent need to modernize outdated analog communication infrastructure in populous nations such as China, India, and Indonesia. While price sensitivity remains a factor, the demand for sophisticated command systems in defense, transportation (especially high-speed rail networks), and rapidly developing public safety sectors is skyrocketing. The region often prioritizes solutions that integrate seamlessly with localized telecommunication standards and can manage large-scale metropolitan populations efficiently, frequently leading to the deployment of large, centralized command centers managed by local governments.

Latin America and the Middle East & Africa (MEA) regions present evolving opportunities. Latin American growth is sporadic, tied to governmental funding cycles and focused on combating rising crime rates and improving urban policing capabilities, leading to demand for mobile dispatch solutions and basic CAD systems. The MEA market, particularly the Gulf Cooperation Council (GCC) countries, is characterized by high defense and internal security spending, leading to rapid adoption of highly advanced, often military-grade, Command and Control (C2) and dispatch systems for border security, critical infrastructure protection (oil and gas facilities), and large-scale smart city developments, often incorporating the latest technologies like 5G and AI-driven monitoring.

- North America: Market leader; driven by NG9-1-1 upgrades, robust cybersecurity mandates, and FirstNet implementation.

- Europe: Mature market; focusing on TETRA upgrades, EU interoperability standards, and critical national infrastructure protection.

- Asia Pacific (APAC): Fastest growth region; fueled by smart city initiatives, mass urbanization, and large defense procurement programs (China, India).

- Latin America (LATAM): Growth concentrated in urban centers; driven by public safety modernization and crime reduction efforts.

- Middle East & Africa (MEA): High expenditure on security and defense; rapid adoption of advanced C2 systems for critical asset protection.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Command and Dispatch System Market.- Motorola Solutions

- Frequentis AG

- Airbus DS

- L3Harris Technologies

- Hexagon AB

- Intergraph Corporation

- Avtec, Inc.

- Zetron, Inc.

- Bosch Security and Safety Systems

- Siemens AG

- IBM Corporation

- NEC Corporation

- Nookal Pty Ltd

- Comtech Telecommunications Corp.

- Cisco Systems, Inc.

- Teltronic S.A.U.

- Leonardo S.p.A.

- Catalis SE

- Priority Dispatch Corp.

- Rave Mobile Safety

Frequently Asked Questions

Analyze common user questions about the Command and Dispatch System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between LMR-based and IP-based Command and Dispatch Systems?

LMR (Land Mobile Radio) systems utilize specialized radio frequency channels primarily for voice communication, offering high reliability in localized mission-critical environments. IP-based systems leverage commercial broadband networks (4G/5G) for high-bandwidth data, video, and multimedia transmission, enabling superior interoperability and scalability, often deployed via cloud or hybrid models.

How is Next Generation 9-1-1 (NG9-1-1) impacting the demand for Command and Dispatch Systems?

NG9-1-1 mandates a shift from traditional voice-only PSAPs to IP-based centers capable of receiving multimedia data (text, photos, video). This directly drives the demand for modern Computer-Aided Dispatch (CAD) systems and integrated dispatch consoles that can process and manage this diverse, high-volume digital information effectively.

What role does Artificial Intelligence (AI) play in modern dispatch operations?

AI enhances dispatch operations by automating data synthesis, prioritizing incoming emergencies based on severity and context, and providing predictive analytics for optimizing resource deployment, thereby reducing response times and minimizing cognitive burden on human dispatchers during peak demand.

What are the major cybersecurity risks associated with integrated Command and Dispatch Systems?

Major risks include Denial-of-Service (DoS) attacks targeting communication channels, ransomware attacks on critical databases (CAD, AVL data), and unauthorized access to highly sensitive operational data. Systems require advanced encryption, resilient network architecture, and continuous monitoring to mitigate these threats effectively.

Which application segment shows the highest potential for future market growth?

While Public Safety remains the largest revenue generator, the Transportation and Utilities segments, driven by requirements for fleet management, infrastructure monitoring, and industrial security coordination across vast networks, are projected to exhibit the highest CAGR due to accelerated digital transformation efforts.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager