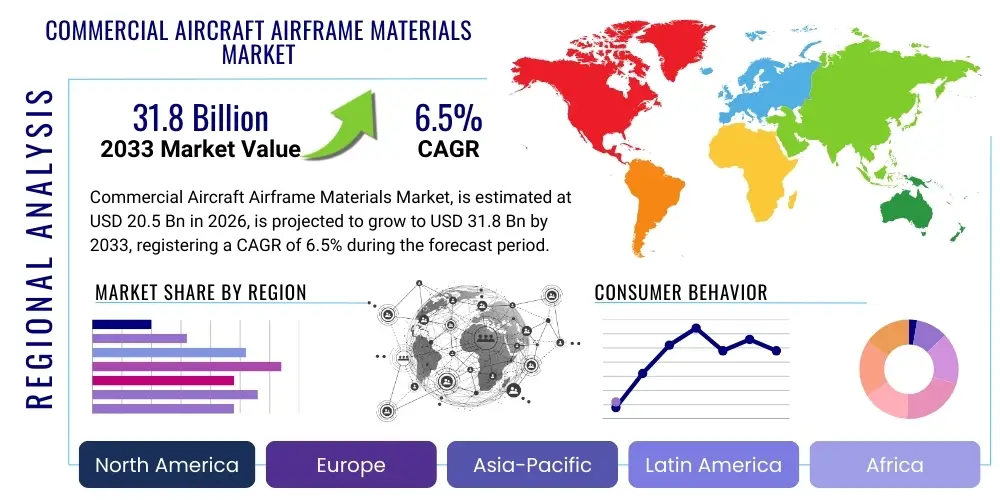

Commercial Aircraft Airframe Materials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437534 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Commercial Aircraft Airframe Materials Market Size

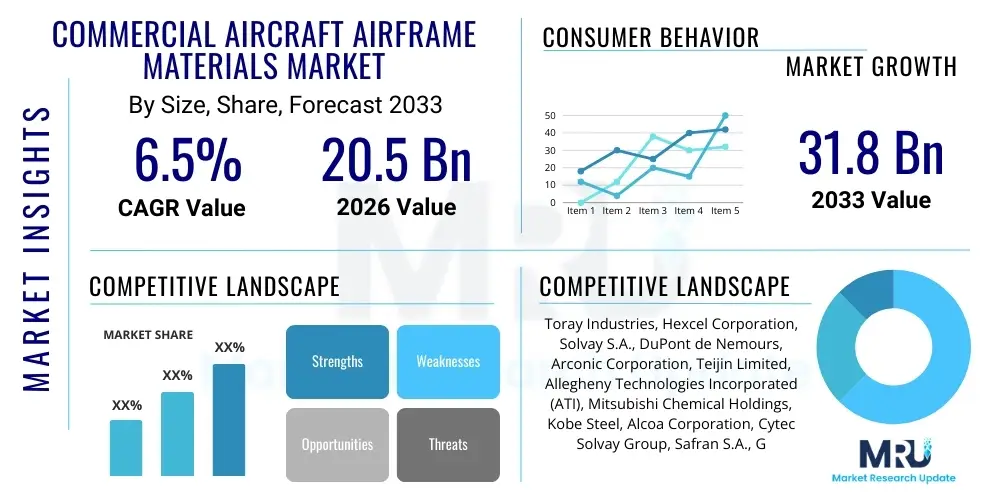

The Commercial Aircraft Airframe Materials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 20.5 Billion in 2026 and is projected to reach USD 31.8 Billion by the end of the forecast period in 2033.

Commercial Aircraft Airframe Materials Market introduction

The Commercial Aircraft Airframe Materials Market encompasses the supply and integration of advanced materials crucial for the structural integrity and performance of civil aviation platforms. This market is fundamentally driven by the relentless pursuit of enhanced fuel efficiency and reduced operational costs, which mandates the use of lightweight yet high-strength components. Key materials include carbon fiber reinforced polymers (CFRP), advanced aluminum alloys (such as Al-Li), and high-performance titanium alloys, each selected based on specific structural requirements concerning stress, temperature tolerance, and corrosion resistance.

The shift towards new-generation aircraft, exemplified by models like the Boeing 787 Dreamliner and the Airbus A350 XWB, has dramatically accelerated the adoption of composite materials, which now often constitute over 50% of the primary airframe structure by weight. These materials offer superior specific strength and stiffness compared to traditional metallic alloys, enabling complex aerodynamic shaping and reducing overall aircraft weight, directly translating to lower fuel burn and extended range capabilities. Major applications span the fuselage, wing structures, empennage, and flight control surfaces.

The market benefits significantly from global air traffic recovery and increasing demand for new, fuel-efficient fleet replacements, particularly in emerging economies. The primary driving factors involve strict environmental regulations targeting carbon emissions and noise pollution, compelling OEMs (Original Equipment Manufacturers) to invest heavily in material science innovations. Furthermore, continuous advancements in material processing technologies, such as Automated Fiber Placement (AFP) and Resin Transfer Molding (RTM), are reducing manufacturing costs and improving the reliability of composite components, thereby securing their long-term dominance in the aerospace material portfolio.

Commercial Aircraft Airframe Materials Market Executive Summary

The Commercial Aircraft Airframe Materials Market is experiencing a definitive transition driven by sustainability mandates and the operational requirements of next-generation aircraft programs. Business trends indicate sustained capital expenditure on material innovation, particularly focusing on hybrid structures that combine the resilience of metallic alloys with the lightweight nature of composite materials. The supply chain is consolidating around specialized Tier 1 suppliers capable of handling the complex processing and rigorous quality assurance required for advanced materials, leading to strategic partnerships between material producers and major OEMs.

Regional trends highlight the Asia Pacific (APAC) region as the fastest-growing market, propelled by massive fleet expansion and the establishment of local manufacturing and Maintenance, Repair, and Overhaul (MRO) capabilities to service this growth. North America and Europe, while mature, remain critical hubs for research, development, and high-value manufacturing, particularly concerning advanced metallic alloys and highly specialized composite prepregs. Investment in automated manufacturing technologies across all regions is a key trend aimed at reducing labor costs and improving the repeatability required for mass production.

Segmentation trends confirm the increasing market share commanded by carbon fiber reinforced plastics (CFRP), driven by their extensive use in wide-body and modern narrow-body aircraft programs. While aluminum alloys remain dominant in older fleets and specific low-stress applications, high-performance materials like titanium are essential for highly stressed areas, such as engine pylons and wing box structures, maintaining stable demand despite the shift toward composites. The market dynamics are characterized by high barriers to entry due to stringent regulatory certification processes (e.g., FAA, EASA), favoring established suppliers with proven track records and robust certification data.

AI Impact Analysis on Commercial Aircraft Airframe Materials Market

Common user questions regarding AI's influence in the airframe materials domain center primarily on how these technologies can accelerate the discovery of new materials, optimize complex manufacturing processes, and enhance the lifecycle management of components. Users frequently inquire about the application of machine learning (ML) in predicting material fatigue life under various environmental conditions and the integration of AI-driven sensor networks for real-time structural health monitoring (SHM). The key themes emerging from this analysis revolve around AI’s potential to drastically reduce the time and cost associated with materials qualification, automate high-variability processes like composite layup, and shift airframe maintenance from reactive to highly predictive models, thereby enhancing both safety and aircraft availability.

AI is fundamentally transforming the material science pipeline by enabling high-throughput screening of potential alloy compositions and polymer formulations. Machine learning algorithms can process vast datasets from simulations and physical tests to predict performance characteristics, such as corrosion resistance or fracture toughness, far quicker than traditional trial-and-error methodologies. This accelerated R&D capability is crucial for meeting the ever-increasing performance demands of aerospace engineers, particularly when developing next-generation materials designed for extreme temperatures or novel load distributions.

In the manufacturing sector, AI drives precision and efficiency. Computer vision systems combined with robotic automation are employed to inspect composite ply alignment during the layup process, ensuring zero-defect component assembly before curing. Furthermore, predictive modeling utilizes operational data to optimize parameters within complex manufacturing steps, such as autoclave curing cycles or heat treatments for metallic parts, minimizing waste, saving energy, and ensuring consistent quality across large-scale production runs. The integration of digital twins, powered by AI, allows manufacturers to simulate the entire component lifecycle, optimizing material usage and improving overall supply chain resilience.

- AI accelerates the discovery and qualification of novel materials (e.g., metal matrix composites, thermoplastic composites).

- Machine Learning (ML) algorithms predict material performance degradation and fatigue life under operational stress.

- Computer vision systems enhance quality control during composite layup and automated inspection, ensuring geometric accuracy.

- Predictive maintenance schedules are optimized using AI analysis of structural health monitoring (SHM) sensor data.

- AI-driven optimization of manufacturing parameters reduces material waste and energy consumption in processing.

- Digital twin technology leverages AI to simulate and optimize airframe component lifespan and maintenance cycles.

DRO & Impact Forces Of Commercial Aircraft Airframe Materials Market

The market for commercial aircraft airframe materials is currently energized by significant drivers, primarily the compelling economic necessity for fuel efficiency, which directly correlates with reduced airframe weight. This driver is powerfully supported by the massive global backlog of new aircraft orders, demanding consistent high-volume supply of advanced, lightweight materials. However, the market faces stern restraints, chiefly the extremely high capital expenditure required for materials production and processing (especially for carbon fibers and titanium), coupled with the protracted and highly bureaucratic certification cycles mandated by global aviation regulatory bodies, which can delay the commercial introduction of innovative materials by several years.

Opportunities for growth are abundant, particularly in the development of thermoplastic composites, which offer superior recyclability and faster processing times compared to traditional thermoset alternatives, aligning with sustainability objectives. Furthermore, the burgeoning MRO sector represents a significant opportunity, driving demand for repair materials and specialized tooling for advanced composite structures. The industry is also exploring smart materials and hybrid structures that offer multi-functionality, integrating features such as self-healing capabilities or embedded sensors, opening new avenues for product differentiation and value creation.

In terms of impact forces (Porter's five forces analysis), supplier bargaining power is high, dominated by a few key producers of aerospace-grade carbon fiber and specialized metal alloys. Buyer power, however, is also substantial, as major OEMs like Airbus and Boeing dictate stringent material specifications and volume commitments, often leading to fierce competition among material suppliers. The threat of new entrants is low due to the immense investment and regulatory hurdles. Substitute materials (e.g., from different generations of alloys or composite types) pose a moderate threat, continuously pushing suppliers toward material performance limits. Overall, the competitive rivalry remains high, driven by technological differentiation and pricing pressures in long-term supply agreements.

Segmentation Analysis

The Commercial Aircraft Airframe Materials Market is comprehensively segmented based on three primary factors: Material Type, Aircraft Type, and Application. Material Type segmentation is crucial, differentiating between traditional metallic materials (Aluminum Alloys, Titanium Alloys, Steel Alloys) and advanced non-metallic materials (Carbon Fiber Composites, Glass Fiber Composites). This division reflects the technological maturity and cost structure associated with each category, with composites commanding a higher market value due to their superior performance characteristics and complex manufacturing requirements.

The Aircraft Type segmentation provides insight into consumption patterns, distinguishing demand based on Narrow-body Aircraft (single-aisle), Wide-body Aircraft (twin-aisle), and Regional Aircraft/Business Jets. Wide-body aircraft, due to their larger structural size and emphasis on long-haul fuel efficiency, are the largest consumers of high-performance composite materials. The Application segmentation specifies where the material is used within the airframe, including the Fuselage (cabin structure), Wings (primary lift surfaces), Empennage (tail section), and Interior Structures/Flight Control Surfaces, allowing suppliers to tailor their product offerings to specific structural loads and environmental exposures.

- By Material Type:

- Aluminum Alloys (e.g., Al-Li Alloys)

- Titanium Alloys (e.g., Ti-6Al-4V)

- Steel Alloys

- Carbon Fiber Reinforced Plastics (CFRP)

- Glass Fiber Reinforced Plastics (GFRP)

- Hybrid Composites

- By Aircraft Type:

- Narrow-body Aircraft

- Wide-body Aircraft

- Regional Jets & Business Aircraft

- By Application:

- Fuselage

- Wings

- Empennage

- Interior Structures & Components

Value Chain Analysis For Commercial Aircraft Airframe Materials Market

The value chain for commercial aircraft airframe materials is complex and highly stratified, beginning with upstream raw material processing. This stage involves the production of fundamental materials like bauxite (for aluminum), titanium ore, and acrylonitrile (for carbon fiber precursors). High capital intensity characterizes this upstream segment, which is dominated by a few global chemical and mining giants. The subsequent stage involves primary material manufacturing, where raw inputs are converted into aerospace-grade forms, such as rolled aluminum sheets, titanium forgings, and prepreg composite fabrics. Specialized material certification requirements make this conversion process a high-value activity.

Midstream activities involve Tier 2 and Tier 1 suppliers. Tier 2 suppliers often create sub-components or highly specific material forms, such as machined parts or complex textile preforms. Tier 1 suppliers then integrate these materials into large, certified airframe structures, such as fuselage barrels, wing boxes, and large composite panels, before delivering them to the OEMs (Original Equipment Manufacturers). This stage demands advanced manufacturing capabilities, including Automated Fiber Placement (AFP) and large-scale machining centers, alongside rigorous testing and quality control.

The downstream segment is dominated by the aircraft OEMs (e.g., Boeing, Airbus, COMAC), who handle the final assembly and system integration. Distribution channels are predominantly direct for high-volume, critical components, characterized by long-term supply agreements ensuring quality and pricing stability. Indirect channels are utilized mainly for MRO parts, where certified distributors hold stock for airlines and independent repair facilities. The entire chain is heavily regulated, with strict oversight from certification bodies ensuring traceability and conformance to airworthiness standards from the initial raw material source through to the final installation on the aircraft.

Commercial Aircraft Airframe Materials Market Potential Customers

The primary customers for commercial aircraft airframe materials are the global Original Equipment Manufacturers (OEMs), notably Airbus and Boeing, who represent the largest volume purchasers dictating market standards and material specifications. These OEMs require massive volumes of certified materials for their flagship programs (A320neo, 737 MAX, A350, 787) and typically engage in multi-year, multi-billion-dollar supply contracts directly with material producers or Tier 1 integrators. Their purchasing decisions are driven by total cost of ownership, material consistency, and supplier capacity to meet stringent production rate increases.

Secondary, yet critically important, customers include large Tier 1 aerostructures manufacturers such as Spirit AeroSystems, Triumph Group, and Leonardo. These companies specialize in complex component fabrication—like fuselages, nacelles, and wing components—and source raw materials and preforms directly to fulfill their sub-contracts with the major OEMs. Their demands focus heavily on material form factor (e.g., specialized prepregs, near-net-shape titanium forgings) and manufacturing feasibility, requiring materials that lend themselves well to highly automated production processes.

Furthermore, the Maintenance, Repair, and Overhaul (MRO) organizations constitute a specialized segment of the customer base. MRO customers require certified repair materials—including patches, resins, and specialized fasteners—for both scheduled maintenance and unplanned damage repair. While MRO volumes are lower than OEM production, the demand is constant and requires materials with rapid availability and specific properties compatible with aging airframe structures. Finally, specialized defense contractors that often share commercial material supply chains also act as significant customers for high-performance, high-cost alloys and advanced composites, particularly for dual-use technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 20.5 Billion |

| Market Forecast in 2033 | USD 31.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toray Industries, Hexcel Corporation, Solvay S.A., DuPont de Nemours, Arconic Corporation, Teijin Limited, Allegheny Technologies Incorporated (ATI), Mitsubishi Chemical Holdings, Kobe Steel, Alcoa Corporation, Cytec Solvay Group, Safran S.A., General Electric, Spirit AeroSystems, Premium Aerotec, VSMPO-AVISMA. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Aircraft Airframe Materials Market Key Technology Landscape

The technological landscape of the airframe materials market is centered on achieving higher production rates, reducing material waste, and improving the intrinsic performance of structural components. A pivotal technology is Automated Fiber Placement (AFP) and Automated Tape Laying (ATL). These robotic systems precisely place prepreg materials onto complex molds, minimizing human error, achieving intricate ply geometries, and enabling the rapid, high-quality fabrication of large composite structures like wing skins and fuselage sections, essential for scaling up production of aircraft like the A350 and 787.

Another transformative technology involves advanced molding and curing techniques. Resin Transfer Molding (RTM) and Vacuum-Assisted Resin Transfer Molding (VARTM) are increasingly utilized to manufacture net-shape components, reducing the need for extensive post-curing machining, particularly for parts with complex internal features. Furthermore, the development of high-performance thermoplastic composites, processed via fast, repeatable techniques such as welding and thermoforming, stands in contrast to the lengthy autoclave curing cycles required for traditional thermosets. This transition is critical for improving the sustainability and rate capability of future narrow-body programs.

In the metallic sphere, the focus is on advanced alloy processing and Additive Manufacturing (AM). Technologies like Friction Stir Welding (FSW) are replacing traditional riveting in large aluminum structures, resulting in lighter, stronger joints. Meanwhile, AM (3D printing) using powder bed fusion and directed energy deposition is gaining traction for producing complex, near-net-shape titanium and nickel-alloy parts, drastically reducing material waste associated with subtractive machining of expensive metals. These technological advancements collectively drive the lightweighting trend while enhancing the durability and reducing the manufacturing complexity of the final airframe structure.

Regional Highlights

- North America: This region maintains its position as the largest market share holder, driven by the presence of major OEMs (Boeing) and leading Tier 1 suppliers, alongside significant governmental and private investment in advanced material R&D, particularly in high-temperature polymers and aerospace-grade aluminum-lithium alloys.

- Europe: Europe is a vital hub, anchored by Airbus and key material innovators (e.g., Solvay, Toray Europe). The region leads in the adoption and certification of complex composite primary structures and benefits from strong collaborative research programs aimed at developing sustainable, recyclable airframe materials.

- Asia Pacific (APAC): APAC is the fastest-growing market due to rapid fleet modernization and expansion driven by booming air travel demand, particularly in China and India. Government initiatives supporting domestic aerospace manufacturing (e.g., COMAC programs in China) are driving increased local demand for material supply and processing capabilities.

- Latin America (LATAM): This region exhibits moderate growth, focused primarily on MRO activities and regional jet manufacturing (Embraer). Demand is highly specific, often utilizing proven, certified material solutions rather than frontier technologies, focusing on cost-effective maintenance and repair solutions.

- Middle East and Africa (MEA): Growth in MEA is spurred by substantial investment in airline fleet expansion and the development of regional MRO hubs. The market relies heavily on imported, high-grade materials to service the latest generation wide-body fleets operated by major regional carriers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aircraft Airframe Materials Market.- Toray Industries, Inc.

- Hexcel Corporation

- Solvay S.A.

- DuPont de Nemours, Inc.

- Arconic Corporation

- Teijin Limited

- Allegheny Technologies Incorporated (ATI)

- Mitsubishi Chemical Holdings

- Kobe Steel, Ltd.

- Alcoa Corporation

- Cytec Solvay Group

- Safran S.A.

- General Electric (GE Aviation Materials)

- Spirit AeroSystems Holdings, Inc.

- Premium Aerotec GmbH

- Constellium SE

- Nippon Graphite Fiber Corporation

- VCT Composite

- Norsk Titanium AS

- VSMPO-AVISMA Corporation

Frequently Asked Questions

Analyze common user questions about the Commercial Aircraft Airframe Materials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from metallic alloys to composite materials in commercial airframes?

The shift is primarily driven by the imperative for enhanced fuel efficiency and reduced structural weight. Carbon Fiber Reinforced Plastics (CFRP) offer a superior strength-to-weight ratio and greater resistance to fatigue and corrosion compared to traditional aluminum, enabling lighter aircraft designs that significantly lower operating costs and meet stringent emissions targets.

What regulatory challenges face new materials entering the aerospace market?

New airframe materials face rigorous and lengthy certification processes mandated by regulatory bodies like the FAA and EASA. Challenges include generating extensive testing data on fatigue, damage tolerance, and long-term durability, ensuring material traceability, and proving reliable manufacturing processes before commercial approval for use in critical structural applications.

How does the MRO sector influence demand for airframe materials?

The MRO (Maintenance, Repair, and Overhaul) sector maintains a stable, high-value demand for specialized repair materials, especially certified prepregs, adhesives, and composite repair patches. As the global fleet ages and the proportion of composite structures increases, demand for certified repair and specialized material tooling is continuously growing.

Which material segment holds the largest market share and why?

Currently, Carbon Fiber Reinforced Plastics (CFRP) holds the largest and fastest-growing market share in terms of value, largely due to their extensive use as primary structural materials in modern wide-body platforms (e.g., Boeing 787 and Airbus A350). However, traditional Aluminum Alloys still hold significant volume share, especially in legacy fleets and high-volume narrow-body segments.

What role does Additive Manufacturing (3D Printing) play in this market?

Additive Manufacturing is crucial for producing complex, near-net-shape components, particularly those made from expensive materials like titanium alloys. AM significantly reduces material waste and lead times for specialized parts, mainly in secondary structures, tooling, and potentially in highly stressed primary structures as regulatory confidence increases.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager