Commercial Aircraft Turbine Blades & Vanes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433994 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Aircraft Turbine Blades & Vanes Market Size

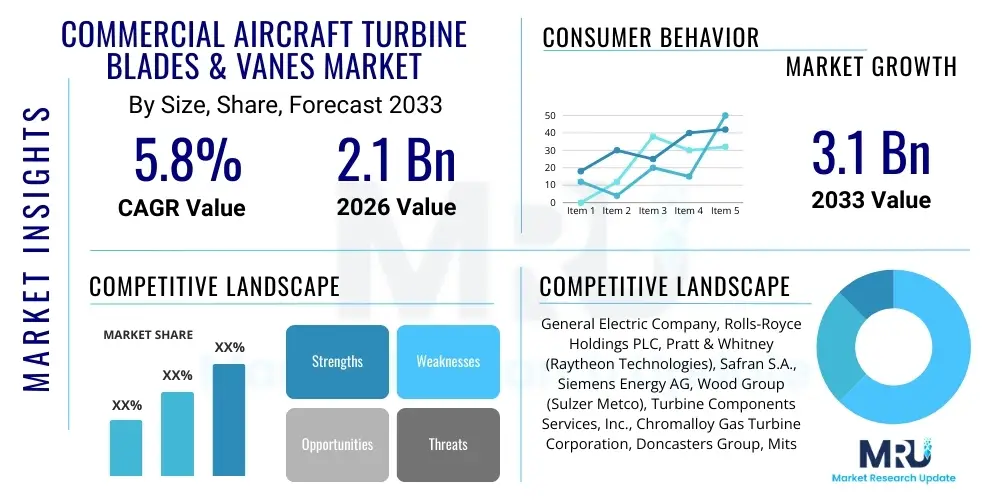

The Commercial Aircraft Turbine Blades & Vanes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Commercial Aircraft Turbine Blades & Vanes Market introduction

The Commercial Aircraft Turbine Blades & Vanes Market encompasses the manufacturing, supply, and maintenance of critical components situated within the hot section of gas turbine engines used in commercial aviation. These components—specifically high-pressure and low-pressure turbine blades and stationary vanes (nozzles)—are essential for converting thermal energy into mechanical rotational power. Operating under extreme conditions, including temperatures exceeding 1500°C and immense centrifugal stress, these parts must exhibit exceptional mechanical strength, oxidation resistance, and thermal fatigue life. The longevity and efficiency of these components directly impact fuel consumption, maintenance intervals, and overall aircraft operational costs. The market is fundamentally driven by stringent airworthiness regulations, the need for lighter, more efficient engine designs (such as those incorporating geared turbofan architectures), and the global demand for air travel, which mandates consistent MRO activities and new engine deliveries.

The product description centers around components typically manufactured using advanced nickel-based or cobalt-based superalloys, often employing complex manufacturing processes like investment casting, directional solidification (DS), and single-crystal (SC) technology. These blades and vanes are invariably coated with Thermal Barrier Coatings (TBCs) and high-performance metallic coatings to prevent immediate degradation from the high-temperature combustion environment. Major applications span across various aircraft platforms, including narrow-body aircraft (which dominate maintenance demand), wide-body aircraft, and regional jets. The primary benefits derived from these advanced components include significant improvements in engine thrust-to-weight ratio, reduced nitrous oxide (NOx) emissions, and extended time on wing, which lowers operating costs for airlines.

Driving factors for sustained market expansion include the massive backlog of commercial aircraft orders, particularly for fuel-efficient narrow-body platforms like the Airbus A320neo family and the Boeing 737 MAX series, necessitating robust new engine production. Furthermore, the increasing complexity and efficiency requirements of next-generation engines (e.g., CFM LEAP and Pratt & Whitney GTF) demand highly specialized materials and manufacturing tolerances, pushing up the average unit cost of replacement and new blades and vanes. The aftermarket segment, fueled by the cyclical nature of Maintenance, Repair, and Overhaul (MRO) activities required for engine fleets reaching mid-life, provides a stable, high-value stream crucial to the market's overall valuation. Technological advancements in coatings and additive manufacturing are continuously redefining product performance and supply chain dynamics.

Commercial Aircraft Turbine Blades & Vanes Market Executive Summary

The Commercial Aircraft Turbine Blades & Vanes Market is characterized by high barriers to entry, driven by stringent regulatory compliance, proprietary design requirements, and the need for certified supply chain security. Current business trends indicate a critical shift toward MRO optimization, where airlines and third-party service providers are increasingly seeking advanced repair technologies, such as laser cladding and specialized coating repair, to extend the life of expensive single-crystal components rather than opting for immediate replacement. Original Equipment Manufacturers (OEMs) are vertically integrating their supply chains or establishing sophisticated MRO joint ventures to capture maximum value from the lucrative aftermarket segment. Furthermore, sustainability pressures are accelerating the development and adoption of Ceramic Matrix Composites (CMCs) and advanced superalloys that allow for higher operating temperatures, directly enhancing engine thermal efficiency and reducing fuel burn per flight hour.

Regional trends highlight the dominance of North America and Europe due to the presence of major engine OEMs (like General Electric, Rolls-Royce, and Pratt & Whitney) and a high density of established airline MRO hubs. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by unprecedented fleet expansion and rising domestic air traffic in emerging economies such as China and India. This regional growth necessitates significant localized investment in specialized MRO capabilities and parts distribution networks. In contrast, the Middle East and Africa (MEA) market growth remains linked to long-haul fleet operations and the establishment of global transit hubs, driving demand for wide-body engine component maintenance.

Segmentation trends reveal that the Aftermarket segment (MRO) holds a dominant market share, exceeding 60% of total revenue, primarily because turbine components are high-wear items requiring scheduled replacement or complex repair multiple times over an engine's lifespan. By component type, high-pressure turbine blades and vanes represent the highest value segment due to their critical function and exposure to the most extreme thermal loads, requiring the most expensive materials (single-crystal superalloys). In terms of material, Nickel-based Superalloys remain the foundational material, but CMCs are gaining traction, specifically in the low-pressure turbine and stationary vane applications, signaling future material transitions driven by weight reduction and temperature capability goals.

AI Impact Analysis on Commercial Aircraft Turbine Blades & Vanes Market

Common user questions regarding AI's impact on this highly specialized market revolve primarily around three core areas: Predictive Maintenance efficiency, optimization of complex manufacturing processes (such as investment casting and TBC application), and supply chain resilience. Users frequently inquire if AI algorithms can accurately predict the remaining useful life (RUL) of individual turbine blades based on operational data, thereby shifting MRO from time-based scheduling to condition-based monitoring, reducing unnecessary component replacement costs. Concerns also focus on how Machine Learning (ML) can be integrated into Non-Destructive Testing (NDT) processes, specifically thermal imaging and X-ray inspection, to identify minute material defects or coating degradation much earlier and more accurately than human inspectors. Expectations are high that AI will significantly streamline quality control in additive manufacturing (AM) of complex geometries, ensuring metallurgical consistency and adherence to strict aerospace tolerances.

The primary influence of Artificial Intelligence in the turbine components sector centers on enhancing operational reliability and reducing lifecycle costs. By leveraging vast streams of sensor data generated by modern engine monitoring systems (such as EGT, vibration, and flight profile data), AI models can identify subtle anomalies indicative of impending blade or vane failure. This capability enables highly targeted maintenance actions, maximizing the time-on-wing (TOW) for engine assets. Furthermore, in the production environment, AI optimizes furnace parameters during investment casting and fine-tunes robotic plasma spray processes for TBC application, ensuring superior coating uniformity and minimal material waste, leading to a demonstrable reduction in manufacturing scrap rates and improved overall part quality compliance with aerospace standards.

The implementation of predictive analytics allows OEMs and major MRO providers to manage their spares inventory with unprecedented accuracy. Instead of holding large, expensive stocks based on generalized failure rates, AI forecasts anticipate demand based on the specific condition of individual engine serial numbers globally. This optimization reduces capital tied up in inventory and improves the responsiveness of the highly specialized supply chain for critical turbine components. While AI is not directly involved in the material science development itself, it significantly accelerates the qualification process for new alloys and coating systems by simulating complex thermal and mechanical stresses, drastically reducing the time required for rigorous testing and certification.

- Enhanced Predictive Maintenance (CBM): AI algorithms analyze engine telematics data to forecast individual component failure probabilities, reducing unplanned outages.

- Optimized Manufacturing Yield: Machine Learning models control critical processes like investment casting and coating application, improving part consistency and reducing scrap rates.

- Accelerated NDT Inspection: AI-driven image recognition and analysis automate and enhance the accuracy of detecting micro-cracks or coating delamination in MRO environments.

- Supply Chain Optimization: Predictive demand forecasting based on fleet health ensures timely and cost-effective availability of specialized spare blades and vanes.

- Digital Twin Development: Creation of high-fidelity digital models of turbine components allows for simulated stress testing and optimization of repair procedures using AI.

DRO & Impact Forces Of Commercial Aircraft Turbine Blades & Vanes Market

The Commercial Aircraft Turbine Blades & Vanes Market is shaped by powerful forces emanating from technological innovation, regulatory mandates, and global economic cycles. The primary drivers include the escalating global demand for air travel, necessitating continuous production of new, fuel-efficient aircraft and subsequent engine deliveries, coupled with the critical replacement demand generated by the aging global fleet undergoing scheduled heavy maintenance visits. Restraints largely center on the extremely high capital expenditure required for sophisticated manufacturing facilities (e.g., single-crystal growth furnaces) and the long, arduous certification process mandated by regulatory bodies like the FAA and EASA, which limits the entry of new market participants. Opportunities reside in the emerging field of advanced materials, particularly Ceramic Matrix Composites (CMCs), and the industrialization of additive manufacturing for specialized repair and low-volume production of unique geometries, offering potential cost reductions and lead-time improvements. These factors converge to create a market defined by high-value transactions, technological expertise, and a resilient, cycle-resistant aftermarket demand.

The key impact forces driving sustained growth are predominantly technological and operational. Engine OEMs are relentlessly pursuing higher engine pressure ratios and operating temperatures to improve fuel efficiency, directly translating to increased performance requirements for turbine blades and vanes. This technological push necessitates constant material science innovation, forcing a cycle of replacement and upgrade. Furthermore, the longevity of these components is directly related to flight hours and duty cycles; thus, the rapid recovery of global air traffic following macroeconomic slowdowns instantaneously translates into accelerated MRO demand for hot section components. Geopolitical stability and global trade volumes indirectly influence this market by affecting the profitability of airlines and their subsequent investment capacity in engine modernization and maintenance programs.

Conversely, the high cost of raw materials—specifically nickel, cobalt, and rhenium used in superalloys—poses a structural restraint, increasing production costs and making efficient material use paramount. The market also faces restraint from intellectual property protection, as critical blade geometries and proprietary coating formulas are tightly guarded secrets of OEMs, making independent MRO providers reliant on licensing or sourcing from approved vendors. However, opportunities in sustainability and decarbonization present a long-term benefit; as airlines commit to net-zero targets, demand for new, highly efficient engines utilizing advanced turbine components that minimize emissions will only intensify, creating a lucrative replacement market for older, less efficient engine types. The push towards engine fleet commonality (e.g., similar engines across different aircraft types) also offers opportunities for standardized component production and repair processes.

Segmentation Analysis

The Commercial Aircraft Turbine Blades & Vanes Market is segmented based on critical factors including the component type, the engine application area (high-pressure vs. low-pressure), the material used, the type of aircraft, and the market category (OEM vs. Aftermarket). This structured segmentation is vital for market participants to understand where the highest value pools and growth opportunities reside. The segmentation by market category remains the most impactful differentiation, as the Original Equipment Manufacturer (OEM) segment is highly concentrated, tied directly to new aircraft delivery cycles, while the Aftermarket (MRO) segment, being highly resilient, captures the majority of the total component value over the engine's operational life. Component complexity, as determined by the engine section, significantly dictates material choice and manufacturing cost.

- By Component Type:

- Blades (Rotor Components)

- Vanes (Stator Components/Nozzles)

- By Engine Application:

- High-Pressure Turbine (HPT)

- Low-Pressure Turbine (LPT)

- By Material Type:

- Nickel-based Superalloys (Monocrystalline/Directionally Solidified)

- Cobalt-based Superalloys

- Ceramic Matrix Composites (CMCs)

- Intermetallics

- By Aircraft Type:

- Narrow-Body Aircraft (NBA)

- Wide-Body Aircraft (WBA)

- Regional Jets (RJ)

- By Market Category:

- Original Equipment Manufacturer (OEM)

- Aftermarket (MRO)

Value Chain Analysis For Commercial Aircraft Turbine Blades & Vanes Market

The value chain for commercial aircraft turbine components is intricate, capital-intensive, and defined by multiple tiers of highly specialized suppliers. Upstream analysis begins with the extraction and refinement of strategic raw materials such as nickel, cobalt, and critical rare earth elements used in superalloys. Tier-3 suppliers specialize in the alloying process, creating master alloys with precise metallurgical compositions. Tier-2 manufacturers, often highly specialized foundries, then use complex processes like investment casting, Directional Solidification (DS), and Single Crystal (SC) growth techniques to produce the near-net-shape blade and vane components. This stage involves significant intellectual property regarding mold design and process control to achieve the required internal cooling passage geometry and structural integrity.

The mid-stream of the value chain is dominated by critical processing steps, including machining, surface treatment, and the application of sophisticated Thermal Barrier Coatings (TBCs) and environmental coatings (EBCs). These processes are primarily performed by specialized sub-contractors or vertically integrated OEM divisions. Quality control, including Non-Destructive Testing (NDT) such as fluorescent penetrant inspection (FPI) and X-ray analysis, is paramount at this stage to ensure zero defects before final assembly. The distribution channel then bifurcates significantly: the direct channel involves components flowing directly to the major engine assemblers (OEMs) for integration into new engines (Original Equipment Segment).

The downstream analysis focuses heavily on the MRO (Maintenance, Repair, and Overhaul) segment, which accounts for the most activity and value throughout the engine's lifecycle. Components enter the indirect channel when they are supplied as spares to airlines, independent MRO facilities, or OEM-affiliated repair centers. The secondary market involves extensive repair services, including blending, welding, hot isostatic pressing (HIP), and recoating of used blades and vanes, often extending their operational life by multiple cycles. Direct distribution ensures timely supply for new engine builds, while the robust indirect channel supports the geographically dispersed and high-demand MRO requirements globally, driven by stringent engine overhaul schedules imposed by aviation authorities. The long-term profitability of this market relies heavily on managing the efficiency and certification requirements within this indirect aftermarket channel.

Commercial Aircraft Turbine Blades & Vanes Market Potential Customers

The primary customers and end-users of commercial aircraft turbine blades and vanes are highly concentrated and fall into distinct categories defined by their procurement needs and operational scale. Original Equipment Manufacturers (OEMs) of gas turbine engines—specifically, those involved in manufacturing high-thrust turbofans—are the largest direct buyers of new components for engine assembly. These OEMs require vast volumes of components that adhere to proprietary designs and material specifications. The secondary, and arguably most valuable, customer group is the global collection of Commercial Airlines and Fleet Operators. While airlines may not manufacture the components, they are the ultimate buyers of MRO services and spare parts, directly influencing demand cycles for replacement blades and vanes based on their fleet size, utilization rates, and operational flight profiles.

The third significant customer segment includes independent Third-Party Maintenance, Repair, and Overhaul (MRO) service providers. These facilities specialize in the disassembly, inspection, repair, and reassembly of engines for various airline clients globally. They serve as major procurement hubs for approved replacement parts, sophisticated repair materials, and specialized coating services necessary to bring used blades and vanes back to serviceable condition. These independent MROs often seek parts from authorized distributors or through specialized surplus material channels, provided the parts maintain full traceability and airworthiness certification. Their demand is driven by cost efficiencies and the need for fast turnaround times (TAT) in engine shop visits.

Finally, specialized leasing companies and asset management firms that own and manage engines as financial assets also act as crucial potential customers. These entities require comprehensive parts management and repair services to maintain the high residual value and leaseability of their engine portfolio. Their focus is on ensuring compliance with maintenance contracts and minimizing long-term ownership costs. This diverse customer base—ranging from proprietary design users (OEMs) to service facilitators (MROs) and asset holders (Leasing Firms)—ensures continuous, robust demand for turbine components across the entire aerospace value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric Company, Rolls-Royce Holdings PLC, Pratt & Whitney (Raytheon Technologies), Safran S.A., Siemens Energy AG, Wood Group (Sulzer Metco), Turbine Components Services, Inc., Chromalloy Gas Turbine Corporation, Doncasters Group, Mitsubishi Heavy Industries, IHI Corporation, Barnes Group Inc., GKN Aerospace, Howmet Aerospace Inc., VDM Metals, Haynes International, PCC Structurals (Precision Castparts Corp.), Tusa Turbine Technologies, Hi-Tempered Tools, Inc., and MTU Aero Engines AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Aircraft Turbine Blades & Vanes Market Key Technology Landscape

The technology landscape governing the production and maintenance of commercial aircraft turbine blades and vanes is intensely focused on materials science and advanced manufacturing precision, aiming to push the boundaries of thermodynamic efficiency and component longevity. The foundational technology remains advanced investment casting, specifically incorporating Directional Solidification (DS) and Single Crystal (SC) techniques. SC technology is crucial as it eliminates grain boundaries in the component's microstructure, drastically improving creep resistance and thermal fatigue life under the extreme operating conditions of the High-Pressure Turbine (HPT). The refinement of these casting methodologies—achieving precise cooling channels and complex internal baffling—is a major technological differentiator among manufacturers, directly impacting engine performance specifications.

Beyond the base material, surface engineering represents a critical technology pillar. Thermal Barrier Coatings (TBCs), typically yttria-stabilized zirconia (YSZ) applied via electron beam physical vapor deposition (EBPVD) or plasma spray, are essential for insulating the metallic blade substrate from high combustion temperatures. Technological advances are focused on developing next-generation TBCs with higher temperature stability and improved spallation resistance, crucial for extending Time on Wing (TOW). Furthermore, the emerging use of Ceramic Matrix Composites (CMCs) in the hottest sections of the engine marks a profound shift. CMCs, typically silicon carbide fiber reinforced with a silicon carbide matrix, offer substantially lighter weight and tolerance to higher temperatures than traditional superalloys, promising a new generation of more efficient engine architectures.

In the MRO sector, the integration of Additive Manufacturing (AM), particularly Directed Energy Deposition (DED) and Laser Powder Bed Fusion (LPBF), is gaining traction, primarily for complex repair applications. AM allows for the precise repair of minor cracks and the controlled build-up of material on worn airfoils, significantly reducing the cost and lead time associated with traditional repair methods or full replacement. Predictive maintenance technologies, supported by advanced sensor integration (e.g., embedded fiber optic temperature sensors) and AI analysis, complete the technological picture, enabling operators to manage component life proactively. The convergence of superior materials, highly precise coatings, and intelligent repair methodologies defines the state-of-the-art in this market.

Regional Highlights

The global distribution of the Commercial Aircraft Turbine Blades & Vanes Market is highly correlated with the location of major aircraft engine OEMs, established airline MRO networks, and areas experiencing significant fleet expansion.

- North America: This region maintains market leadership due to the presence of key engine OEMs (GE Aviation, Pratt & Whitney) and a mature, extensive MRO infrastructure. The market is driven by high regulatory standards, continuous military and commercial engine modernization programs, and substantial investment in advanced manufacturing technologies, including additive manufacturing for specialized components. The region acts as a global center for research and certification of new superalloys and composite materials.

- Europe: Europe represents another foundational pillar of the market, hosting major players like Rolls-Royce and Safran, and boasting highly capable independent MRO providers. The demand here is stable, fueled by the maintenance requirements of legacy wide-body fleets and the deployment of new, highly efficient narrow-body aircraft. Europe is focused on achieving strict environmental targets, driving the adoption of high-efficiency component designs and sustainable repair practices.

- Asia Pacific (APAC): APAC is recognized as the fastest-growing region globally, propelled by rapidly increasing middle-class populations, resulting in unprecedented growth in air passenger traffic and corresponding fleet size expansion. Countries such as China and India are investing heavily in establishing domestic MRO capabilities and developing their own engine platforms, creating localized demand for blades and vanes, though the market remains largely dependent on imports from Western OEMs and certified suppliers for high-technology components.

- Middle East and Africa (MEA): Growth in the MEA region is concentrated around major international hub airlines (e.g., in the UAE and Qatar) that operate large fleets of wide-body, long-haul aircraft. This necessitates robust maintenance capabilities for high-thrust engines, leading to significant expenditure on MRO and high-value turbine component replacements. The region is increasingly positioning itself as an international MRO service provider.

- Latin America: This region exhibits modest but steady growth, primarily driven by fleet renewal programs replacing older aircraft with modern, fuel-efficient models. The market relies heavily on imported components and international MRO partnerships due to limited local high-technology manufacturing capabilities, focusing mainly on immediate component replacement rather than complex specialized repair.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aircraft Turbine Blades & Vanes Market.- General Electric Company

- Rolls-Royce Holdings PLC

- Pratt & Whitney (Raytheon Technologies)

- Safran S.A.

- Siemens Energy AG

- Wood Group (Sulzer Metco)

- Turbine Components Services, Inc.

- Chromalloy Gas Turbine Corporation

- Doncasters Group

- Mitsubishi Heavy Industries

- IHI Corporation

- Barnes Group Inc.

- GKN Aerospace

- Howmet Aerospace Inc.

- VDM Metals

- Haynes International

- PCC Structurals (Precision Castparts Corp.)

- Tusa Turbine Technologies

- Hi-Tempered Tools, Inc.

- MTU Aero Engines AG

Frequently Asked Questions

Analyze common user questions about the Commercial Aircraft Turbine Blades & Vanes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Commercial Aircraft Turbine Blades and Vanes market?

Market growth is primarily driven by the massive global backlog of new, fuel-efficient aircraft orders (e.g., Airbus A320neo and Boeing 737 MAX), which mandates high volumes of new engine component production. Simultaneously, the large, aging global fleet requires constant, scheduled maintenance, creating a resilient and lucrative aftermarket MRO demand.

How do Ceramic Matrix Composites (CMCs) impact the future of turbine components?

CMCs are pivotal as they are lighter and can withstand significantly higher operating temperatures than traditional superalloys. Their adoption allows engine designers to achieve higher engine efficiency and reduce fuel consumption, representing a key technology trend for next-generation, high-thrust turbofan engines.

Which segment, OEM or Aftermarket, holds the largest market share for these components?

The Aftermarket (MRO) segment consistently holds the largest share of the total market revenue. Turbine blades and vanes are high-wear components requiring replacement or complex repair several times throughout an engine's operational life, ensuring sustained, high-value demand independent of new aircraft delivery cycles.

What is the significance of Single Crystal (SC) technology in blade manufacturing?

Single Crystal technology is essential for manufacturing High-Pressure Turbine (HPT) blades as it eliminates crystalline grain boundaries. This elimination drastically improves the component's resistance to creep, rupture, and thermal fatigue at the extremely high operating temperatures (often exceeding 1500°C), thereby maximizing engine efficiency and component lifespan.

What role does Additive Manufacturing (AM) play in the supply chain for turbine components?

AM is currently playing a crucial role primarily in the MRO segment for complex repair processes. Directed Energy Deposition (DED) and similar techniques allow technicians to precisely repair damaged airfoils and restore original specifications, offering cost-effective and faster alternatives to complete component replacement while adhering to strict regulatory standards.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager