Commercial Aviation Crew Management Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433330 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Aviation Crew Management Systems Market Size

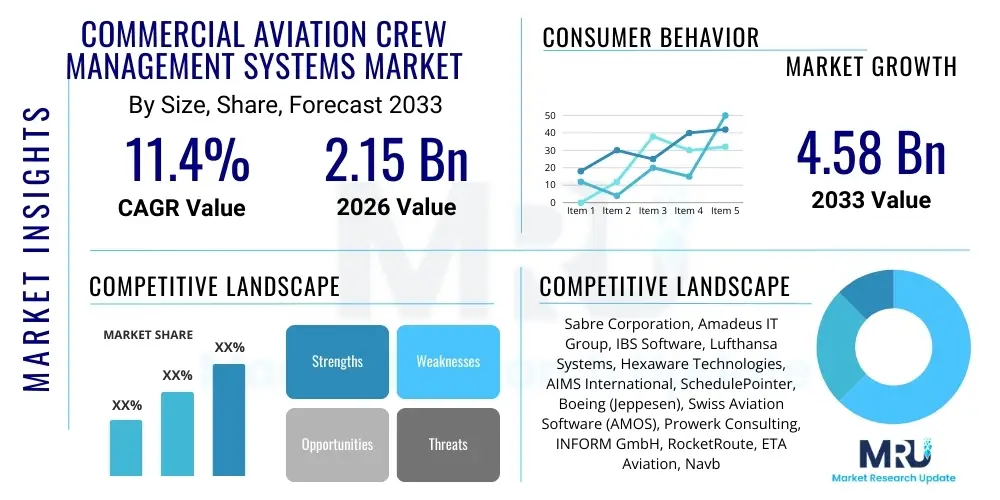

The Commercial Aviation Crew Management Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.4% between 2026 and 2033. The market is estimated at USD 2.15 Billion in 2026 and is projected to reach USD 4.58 Billion by the end of the forecast period in 2033.

Commercial Aviation Crew Management Systems Market introduction

The Commercial Aviation Crew Management Systems (CMS) market encompasses software solutions designed to optimize and manage the complex logistical requirements associated with airline flight and cabin crew, ensuring regulatory compliance, efficiency, and operational safety. These systems handle functions ranging from crew planning, rostering, tracking, training, and communication. The primary goal of CMS is to minimize operational costs, maximize crew utilization while adhering to strict governmental and union regulations regarding duty time limitations and rest periods, collectively known as Flight and Duty Time Limitations (FTDL). Modern CMS solutions integrate advanced optimization algorithms, predictive analytics, and mobile capabilities to provide real-time decision support to dispatchers, planners, and individual crew members.

The adoption of sophisticated CMS is driven significantly by the increasing complexity of global flight schedules, the continuous pressure on airlines to improve operational margins, and the stringent regulatory environment governing crew fatigue. Major applications include long-term strategic planning, tactical day-of-operation management, and disruption recovery, where the system must rapidly reassign crew members while maintaining legality. Benefits derived from implementing robust CMS include substantial reductions in unplanned crew delays, optimization of layovers, reduction in manual administrative overhead, and significant improvements in overall crew satisfaction due to fairer and more predictable rostering practices. These systems are critical infrastructure enabling large carriers to manage thousands of crew members across diverse operational bases globally, ensuring scalability, consistency, and a unified compliance framework, irrespective of the geographic location of the crew base or the specific aircraft type being operated.

Driving factors supporting market growth include the post-pandemic resurgence of air travel demand globally, which necessitates scalable and efficient operational tools; the continuous digitalization efforts by legacy carriers to modernize their IT infrastructure; and the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) for enhanced prediction and optimization capabilities. The necessity to minimize costly crew violations and the strategic need to enhance operational resilience against unforeseen disruptions (such as extreme weather, technical issues, or air traffic control limitations) further solidify the essential nature of CMS investments across the commercial aviation sector, ranging from major global airlines to regional carriers. Furthermore, union demands for increased fairness and transparency in scheduling push airlines towards automated, optimized systems.

Commercial Aviation Crew Management Systems Market Executive Summary

The Commercial Aviation Crew Management Systems market is poised for robust expansion, primarily fueled by the accelerating shift towards cloud-based deployments and the integration of sophisticated predictive analytics for proactive management of crew fatigue and regulatory adherence. Business trends indicate a strong move toward consolidated, platform-based offerings that integrate crew management seamlessly with flight operations, maintenance planning, and centralized HR databases, driving demand for holistic solutions over siloed systems. Key market players are heavily investing in mobile applications and crew self-service portals to enhance crew communication, facilitate real-time bidding, and reduce administrative load on planning departments. The competitive landscape is characterized by continuous innovation in optimization algorithms designed to solve highly complex combinatorial problems associated with large-scale crew scheduling, positioning algorithmic efficiency, speed, and constraint management robustness as critical differentiators among vendors.

Regionally, North America and Europe remain the dominant markets due to the presence of major legacy airlines with complex, high-frequency route networks and historically stringent regulatory oversight, driving continuous replacement cycles of legacy mainframe systems with modern architecture. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market segment, propelled by rapid fleet expansion among low-cost carriers (LCCs) and national flag carriers, coupled with significant governmental and private investments in modernizing aviation infrastructure. Trends in APAC focus heavily on implementation speed and scalability to support explosive growth trajectories, often favoring cloud-native solutions to leapfrog older technologies. Emerging markets in Latin America and the Middle East and Africa (MEA) are showing increasing demand, driven by the establishment of new global airline hubs and the need to achieve world-class operational standards quickly, typically adopting subscription-based CMS models to minimize initial capital expenditure requirements.

In terms of segmentation trends, the software segment, particularly the comprehensive planning and rostering modules, commands the largest market share, as these functions are essential for optimizing long-term staffing needs and generating compliant monthly schedules that satisfy both regulatory and contractual requirements. Concurrently, the services segment, notably complex technical integration, specialized implementation consulting, and ongoing support and training services, is experiencing accelerated growth as airlines require specialized vendor expertise to integrate highly complex optimization engines into existing Enterprise Resource Planning (ERP) and operational environments. Furthermore, large-scale international air carriers, owing to the massive scale and intricacy of their global operations, remain the dominant end-users by revenue, although the medium and small carrier segments are increasingly adopting modular, subscription-based CMS solutions, indicating a widespread democratization of previously enterprise-exclusive advanced crew management technologies.

AI Impact Analysis on Commercial Aviation Crew Management Systems Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on Commercial Aviation Crew Management Systems frequently center on three critical themes: achievable efficiency gains through predictive rostering, the regulatory implications of automated decision-making concerning safety (specifically fatigue management), and the operational resilience AI can provide during massive, unforeseen disruptions. Users often ask how sophisticated ML models can accurately predict which crew members are likely to exceed FTL limits or experience high fatigue levels weeks in advance, allowing proactive schedule adjustments before a legal breach occurs. They also seek rigorous validation on the accuracy and speed of AI-driven disruption recovery tools compared to cumbersome traditional rule-based expert systems. A major concern revolves around the transparency and explainability of AI algorithms when generating highly optimized schedules that may appear counter-intuitive to human planners, demanding systems that maintain robust audit trails crucial for compliance validation and crucial negotiations with crew unions and regulatory bodies. The consensus expectation is that AI will fundamentally move CMS from reactive, administrative management to truly proactive, predictive operational steering, significantly enhancing strategic workforce planning.

AI's primary influence is enabling a paradigm shift from rigid, deterministic, rule-based scheduling systems to dynamic, probabilistic optimization platforms that incorporate real-time operational variables, vast historical performance data, and external factors like localized weather predictions, maintenance schedules, or passenger load factors. Machine Learning models are exceptionally adept at analyzing and synthesizing vast datasets related to crew preferences, historical sick leave patterns, training qualification renewal cycles, and airport congestion indices, resulting in substantially improved forecasts for operational reliability, legality adherence, and overall cost minimization. This advanced predictive capability allows airline planners to construct fundamentally more resilient base schedules, minimizing the incidence of illegalities and ensuring optimal reserve crew coverage, thereby reducing the dependency on expensive last-minute solutions like placing crew on immediate, unexpected standby or relying on external ad-hoc crewing arrangements.

Furthermore, specialized AI algorithms, particularly those leveraging techniques such as deep reinforcement learning and complex neural networks, are fundamentally changing the approach to disruption management and mitigation. Instead of simple, linear rule cascading, AI can evaluate literally millions of potential rescheduling combinations simultaneously during a large-scale disruption (e.g., severe localized weather impacting an entire hub, or cascading technical failures across a fleet) and rapidly propose the globally optimal solution that minimizes both short-term costs and long-term downstream effects on future schedules, all while rigorously adhering to every global and local FTL regulation and union rule. This accelerated response capability is vital for maintaining passenger satisfaction, protecting brand reputation, and significantly reduces the financial penalty associated with extensive flight delays, cancellations, and statutory compensation payouts, firmly positioning AI-enhanced CMS solutions as strategic, revenue-protecting assets rather than merely administrative tools.

- Predictive Rostering: AI uses historical operational and behavioral data to forecast optimal crew placement, minimizing fatigue risks and maximizing productive duty time.

- Disruption Recovery Optimization: ML algorithms rapidly calculate thousands of compliant contingency plans during operational irregularities, optimizing for legality, cost, and minimizing future impact.

- Fatigue Risk Management Systems (FRMS) Enhancement: AI integrates physiological data (potentially from wearables) and complex scheduling variables to offer personalized, real-time fatigue assessments, significantly enhancing FTL compliance.

- Automated Bidding Systems: Sophisticated algorithms process highly complex crew preference data and seniority rules to generate equitable and highly optimized monthly rosters, reducing human intervention.

- Increased Data Accuracy and Auditing: AI-driven data validation and anomaly detection ensure the integrity of inputs used for compliance checks and planning, providing auditable trails for regulatory scrutiny.

DRO & Impact Forces Of Commercial Aviation Crew Management Systems Market

The market for Commercial Aviation Crew Management Systems is strongly influenced by a robust combination of growth drivers (D) centered on acute operational efficiency needs and non-negotiable regulatory demands, restraints (R) related to high implementation costs and extensive integration complexity, and significant opportunities (O) arising from rapid technological advancement and untapped regional markets. The single most critical impact force driving continuous investment remains the non-negotiable, global requirement for regulatory compliance (FTDL), which necessitates sophisticated systems to avoid massive financial fines and potential operational license suspensions. The primary growth driver is the ongoing global air travel recovery and expansion phase, marked by significantly increased flight volumes and utilization rates globally, which puts immense pressure on aging legacy systems, forcing airlines to upgrade their infrastructure to manage heightened complexity, frequency, and regulatory risk effectively.

Restraints, however, pose considerable market challenges, particularly the high upfront capital expenditure required for acquiring and extensively customizing enterprise-level CMS, coupled with the extended implementation timelines often spanning 12 to 24 months due to deep integration needs. Furthermore, integrating these new, highly optimized systems with existing, often decades-old airline legacy IT infrastructures (such as HR systems, complex payroll solutions, and flight planning tools) presents significant technical and data migration hurdles. Another major restraint is resistance to change from entrenched crew planning teams and highly organized unions, who often require extensive retraining and absolute assurance regarding the fairness, transparency, and compliance rigor of algorithm-driven decisions, necessitating vendors to prioritize highly user-friendly interfaces, transparent reporting features, and robust "what-if" scenario planning capabilities within their solutions.

The foremost opportunities in this domain lie in the accelerating expansion of Software as a Service (SaaS) models, which significantly reduce initial capital costs, mitigate implementation risk, and offer rapid deployment capabilities, thereby making advanced CMS functionality economically accessible to small and medium-sized carriers and LCCs that cannot justify traditional perpetual licenses. Secondly, the integration of advanced biometric and wearable technology for passive, real-time crew fatigue monitoring presents a substantial opportunity for vendors to create truly proactive and personalized Fatigue Risk Management Systems (FRMS) that move beyond minimum FTL requirements toward predictive wellness monitoring. Finally, strategic geographic expansion into rapidly growing aviation markets, especially across Southeast Asia, India, and the Middle East, where new airlines are being established and existing ones are scaling rapidly, offers high-growth avenues for specialized CMS providers who can adapt quickly to highly localized regulatory nuances and diverse operational requirements across various jurisdictions.

Segmentation Analysis

The Commercial Aviation Crew Management Systems market is broadly segmented based on Component (Software and Services), Application (Crew Planning, Rostering, Tracking, Training, and Disruption Management), Deployment Type (On-Premise and Cloud-Based), and End-User (Large Carriers, Medium Carriers, and Small Carriers). Analyzing these segments reveals shifting preferences driven by technological maturity, airline budget constraints, and the urgency for digital transformation. The component segmentation clearly highlights the increasing value placed not only on the core software but equally on specialized implementation, highly technical integration, and continuous support services necessary to maintain the high complexity and continuous operational uptime demanded by 24/7 global aviation operations. The deployment type segmentation is undergoing a rapid and transformative shift, with cloud-based (SaaS) adoption accelerating dramatically due to factors such as lower Total Cost of Ownership (TCO), reduced internal IT overhead, and enhanced accessibility, especially beneficial for carriers pursuing rapid scalability and remote operational capabilities across multiple global bases.

The application segmentation illustrates the critical importance of the core scheduling functions; Crew Rostering (the generation of compliant monthly schedules) and Crew Planning (long-term strategic staffing projections) consistently capture the largest revenue share, as these functions directly impact compliance rigor, major operational variable costs, and overall efficiency metrics. However, the specialized application of Crew Disruption Management is witnessing the highest compounded growth rate, directly reflecting the industry's heightened focus on enhancing resilience against increasingly frequent and severe external shocks. This growth necessitates sophisticated, real-time optimization tools that can quickly reconcile crew availability, legality status, and positioning challenges under extreme pressure. End-user analysis clearly defines the purchasing power and feature requirements, with Large Carriers dominating the overall market share, demanding bespoke, highly robust solutions capable of managing complex, integrated international operations and required seamless interfacing with proprietary, often older legacy systems. Conversely, Medium and Small Carriers are the primary drivers of the SaaS market growth, favoring standardized, scalable, and modular solutions with minimal initial infrastructure investment and faster time-to-value deployment cycles.

The granularity of these market segments allows market participants to tailor their offerings precisely to distinct operational needs and budgetary constraints. For example, a vendor focusing specifically on the Crew Training application segment might specialize in virtual reality modules and blended learning tools integrated directly with the crew roster to ensure compliance with recurrent training deadlines and minimize revenue impact from non-availability due to overdue certifications. Meanwhile, vendors targeting large legacy carriers must prioritize deep system integration capabilities, multi-union agreement management, and robust compliance across multiple regulatory jurisdictions (e.g., EASA, FAA, CAAC). The growing acceptance of modular CMS platforms, where airlines can incrementally select specific functionalities like only rostering or disruption management without committing to an entire, integrated suite, further fragments the segmentation, providing flexibility for incremental technology adoption aligned with organizational budget cycles and digital maturity levels.

- Component: Software, Services (Implementation, Consulting, Maintenance, Technical Support, Training)

- Application: Crew Planning (Strategic), Crew Rostering (Tactical Scheduling), Crew Tracking (Day-of-Operation), Crew Training Management, Crew Disruption Management/Recovery

- Deployment Type: On-Premise (Traditional License), Cloud-Based (Software as a Service - SaaS)

- End-User: Large Carriers (Global Network Airlines), Medium Carriers (Regional and Mid-size LCCs), Small Carriers/Regional Operators (Commuter and Charter).

Value Chain Analysis For Commercial Aviation Crew Management Systems Market

The value chain for the Commercial Aviation Crew Management Systems market begins with crucial upstream activities focused on foundational technology development, primarily driven by specialized software vendors and algorithm research developers who invest heavily in complex mathematical optimization models and highly robust database structures. This initial stage involves rigorous, costly research and development to create sophisticated, lightning-fast scheduling engines that can handle millions of constraints and operational variables simultaneously and efficiently. Key inputs at this stage include advanced computational resources, deep domain expertise in aeronautical regulations (FTDL), and high-quality data scientists specializing in combinatorial optimization and predictive analytics. The quality, speed, and efficiency of the underlying algorithms and their optimization processes are the central elements of product differentiation and intellectual property at this upstream level.

The core middle segment of the value chain involves the transformation of raw algorithms into deployable CMS products, encompassing software development, intensive customization for specific airline environments, and critical integration work. This phase transforms the foundational algorithms into reliable software solutions, focusing intensely on intuitive user interface design, robust mobile platform development for crew access, and ensuring seamless API integration capabilities with the airline’s broader existing operational landscape, including HR systems, maintenance planning systems, and real-time flight operations systems (FOS). Distribution channels play a critical role here, often involving direct sales teams and business development executives for negotiating large, multi-year enterprise deals, supplemented by strategic alliances with major global system integrators (SIs) and specialist IT consulting firms, especially necessary for navigating complex, large-scale, multi-jurisdictional implementation projects.

Downstream activities focus predominantly on the end-user interaction and post-deployment lifecycle: initial system implementation, comprehensive crew and planning staff training, ongoing maintenance, and continuous high-level support services. Direct distribution remains common for high-value contracts where CMS vendors maintain direct, long-term relationships with airlines' operational and IT leadership. Indirect distribution, leveraging local regional resellers or specialized consulting partners, is frequently used for penetrating smaller carriers or in geographically distant markets (like parts of Africa or Latin America) where an immediate local support presence is essential for adoption. Post-implementation support, including rapid software updates mandated by continuous global regulatory changes (e.g., updates to EASA or FAA FTL rules), is a continuous and high-value activity, ensuring that the system remains compliant, optimized, and functionally reliable throughout its demanding operational lifecycle. The effectiveness and speed of the maintenance and technical support segment directly impacts long-term customer satisfaction and the perceived total value of ownership.

Commercial Aviation Crew Management Systems Market Potential Customers

The primary and most significant customers for Commercial Aviation Crew Management Systems are entities within the commercial air transport sector that operate scheduled or charter passenger and cargo flights, necessitating stringent, large-scale crew management to ensure global regulatory compliance, operational safety, and optimal cost control. The largest customer segment comprises Tier 1 Global Network Carriers, such as major legacy airlines operating complex, multi-hub, international routes with potentially tens of thousands of crew members and diverse union agreements spanning multiple jurisdictions. These carriers require bespoke, highly resilient, and fully integrated enterprise solutions that can manage extreme complexity and scale. Their purchasing decision is primarily driven by the need for maximal strategic cost savings through highly efficient, optimized scheduling and absolute mitigation of operational and regulatory risk.

A rapidly expanding and highly strategic customer base includes Low-Cost Carriers (LCCs) and ultra-low-cost carriers (ULCCs), particularly prominent in high-growth markets like Asia, Europe, and Latin America. LCCs focus intensely on maximizing both aircraft and crew utilization rates to maintain their core business model of low operating costs and high asset turnover. They typically seek modular, quick-to-deploy, cloud-based CMS solutions that offer high scalability without significant upfront infrastructure investment. Their functional emphasis is on automating and optimizing rapid turnaround times, minimizing non-productive duty hours, and efficiently managing reserve crew placement, viewing CMS as a direct tool for operational profitability improvement rather than just a compliance mandate.

Additional significant potential customers include regional airlines and smaller charter and specialized cargo operators, who benefit most significantly from flexible SaaS CMS models. While their operational scale is considerably smaller, their regulatory burden remains high, and crucially, they often lack the deep internal IT resources of major airlines. They require intuitive, easily integrated systems with strong mobile integration to handle decentralized operations efficiently and minimize reliance on manual processes. Furthermore, specialized government flight operations, private jet management companies handling fractional ownership, and large global air cargo carriers (which have unique long-haul requirements and specialized crew management needs) also represent niche but high-value customer segments, focusing heavily on operational reliability, specialized global regulatory adherence for ultra-long-haul routes, and efficient utilization of highly specialized aircrews under demanding circumstances.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.15 Billion |

| Market Forecast in 2033 | USD 4.58 Billion |

| Growth Rate | 11.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sabre Corporation, Amadeus IT Group, IBS Software, Lufthansa Systems, Hexaware Technologies, AIMS International, SchedulePointer, Boeing (Jeppesen), Swiss Aviation Software (AMOS), Prowerk Consulting, INFORM GmbH, RocketRoute, ETA Aviation, Navblue (Airbus), Empost, CompuGroup Medical, FNT Software, Qantas (Rostering Solutions), Fusion Software, AeroLogic Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Aviation Crew Management Systems Market Key Technology Landscape

The technological landscape of the Commercial Aviation Crew Management Systems market is rapidly evolving, driven by the intense necessity for faster, significantly more accurate, and globally compliant scheduling solutions capable of handling dynamic operational environments. The foundational technology remains the utilization of sophisticated mathematical optimization engines, primarily relying on highly efficient, complex algorithms such as Constraint Programming, Mixed Integer Programming (MIP), and various custom heuristics to rapidly solve the enormous combinatorial problem of matching thousands of qualified crew members to thousands of specific flight segments while simultaneously adhering to thousands of dynamic regulatory and contractual constraints. Recent technological advancements heavily focus on leveraging parallel processing capabilities and high-performance cloud computing infrastructure to dramatically reduce the time required to generate mathematically optimal schedules, often achieving optimization cycles reduction from hours down to just minutes, which is absolutely critical during fast-moving disruption recovery scenarios where time is a severe constraint.

A pivotal and defining technological trend transforming the market is the widespread and rapid adoption of cloud-native architectures (SaaS), which allows for flexible scaling of computing resources, automated and continuous software updates, and much easier integration via modern, standardized API gateways. This industry-wide shift has significantly democratized access to previously proprietary advanced CMS functionalities, successfully moving the sector away from large, restrictive, monolithic on-premise installations. Furthermore, specialized mobile technology is now central to the daily workflow of crew management, with highly specific applications for both flight deck crew and cabin crew providing instant, real-time roster updates, geo-fenced duty sign-in capabilities, direct secure communication channels with operations, and seamless access to personalized training and qualification records. This pervasive and robust mobile integration enhances operational visibility across the board and drastically improves the critical feedback loop between planning departments and front-line crew, which is essential for managing dynamic daily changes efficiently and compliantly.

Finally, the increasing and strategic integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming system capabilities beyond mere optimization. ML models are being extensively used for advanced predictive analytics, forecasting nuanced crew demand based on seasonality, accurately predicting potential sick leave spikes or no-show risks, and optimizing the complex crew bidding processes based on analyzing vast historical data patterns to demonstrably improve roster fairness, transparency, and overall predictability for the crew. Beyond core scheduling, cutting-edge technologies like advanced visualization tools for scenario planning and even nascent exploration of Blockchain technology are being explored, particularly for maintaining immutable, transparent, and distributed records of critical crew training, medical certifications, and compliance logs across multiple regulatory bodies, potentially simplifying the cumbersome auditing processes and significantly enhancing data security and integrity across the entire operational lifecycle, though commercial adoption of blockchain remains cautious.

Regional Highlights

Regional dynamics significantly influence the rate of adoption, the sophistication level, and the specific functional requirements of Commercial Aviation Crew Management Systems globally. North America, encompassing the United States and Canada, currently holds the largest share of the market, primarily characterized by highly mature aviation markets, complex labor union environments demanding sophisticated contractual management features, and the dominance of major legacy carriers (e.g., United, Delta, American) that require highly customized, deeply integrated, and robust enterprise CMS platforms. The stringent regulatory landscape, governed primarily by the FAA’s rigorous FTL rules and emphasis on proactive Fatigue Risk Management Systems (FRMS), drives continuous, large-scale investment in systems that prioritize compliance rigor and highly sophisticated predictive fatigue modeling. Furthermore, North America serves as a major global center for CMS technology development, hosting several key market players and leading the rapid adoption curve for cloud-based and AI-enhanced scheduling solutions for decisive competitive advantage.

Europe represents the second-largest and arguably most technologically fragmented market, marked by intense competition among numerous national flag carriers and the largest global low-cost airlines (e.g., Ryanair, EasyJet). The European market is highly complex in terms of operational jurisdiction and local labor laws but unified under the overarching EASA regulations, driving demand for multi-lingual, multi-currency, and highly multi-regulatory compliant systems capable of managing diverse contractual constraints. European airlines are keenly focused on minimizing operational costs and maximizing efficiency across dense regional route networks. The prevailing technological trend here is the strong, accelerating adoption of modular, cloud-based SaaS systems that can be rapidly deployed across various operational bases within the continent, coupled with a specific focus on robust workforce scheduling tools that effectively balance economic efficiency goals with the continent's stringent worker protection laws and unionized environments.

The Asia Pacific (APAC) region is convincingly projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This exponential growth is fundamentally attributed to massive, ongoing fleet expansion programs, the rapid proliferation of new Low-Cost Carriers, and surging middle-class air travel demand, particularly within key high-volume economies like China, India, and Southeast Asia. Crucially, many APAC carriers are currently building their entire operational IT infrastructure from the ground up (greenfield investment), offering a significant and immediate opportunity for vendors specializing in highly scalable, cloud-native deployments with minimal integration hurdles. While core regulatory environments vary significantly across national boundaries in APAC, the overall trend is rapid operational modernization and the immediate adoption of cutting-edge CMS solutions to support their rapid, large-scale growth. Meanwhile, the Middle East, driven by the strategic expansion of major global hub carriers (e.g., Emirates, Qatar Airways, Turkish Airlines), demands highly scalable, complex systems capable of managing intricate ultra-long-haul routes and diverse multinational crew populations, prioritizing real-time disruption management and sophisticated global compliance features spanning all operational bases.

- North America: Market volume leader; driven by continuous legacy carrier investment, stringent FAA compliance, and demand for sophisticated AI-driven predictive scheduling and FRMS.

- Europe: Second largest market; emphasis on complex EASA compliance, rapid LCC adoption of modular cloud solutions, and optimization across dense, multi-jurisdictional networks.

- Asia Pacific (APAC): Fastest growing market; fueled by unprecedented fleet expansion, high potential for greenfield cloud deployment, and rising demand from rapidly growing regional carriers and LCCs.

- Middle East & Africa (MEA): Focus on managing ultra-long-haul complexity, strategic hub expansion, and procurement of highly scalable enterprise systems tailored for multinational crew management.

- Latin America: Emerging growth market; increasing adoption of standardized SaaS solutions by regional carriers focused on urgent modernization and efficiency improvements amidst economic consolidation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Aviation Crew Management Systems Market.- Sabre Corporation

- Amadeus IT Group

- IBS Software

- Lufthansa Systems

- Hexaware Technologies

- AIMS International

- SchedulePointer

- Boeing (Jeppesen)

- Swiss Aviation Software (AMOS)

- Prowerk Consulting

- INFORM GmbH

- RocketRoute

- ETA Aviation

- Navblue (Airbus)

- Empost

- CompuGroup Medical

- FNT Software

- Qantas (Rostering Solutions)

- Fusion Software

- AeroLogic Systems

Frequently Asked Questions

Analyze common user questions about the Commercial Aviation Crew Management Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for adopting Commercial Aviation Crew Management Systems?

The primary driver is ensuring mandatory global regulatory compliance with all Flight and Duty Time Limitations (FTDL), preventing severe financial penalties and operational stoppages, coupled with the critical economic need for airlines to drastically optimize crew utilization to reduce labor costs and maximize profitability.

How is the adoption of cloud technology impacting the CMS market?

Cloud technology (SaaS) significantly impacts the market by lowering the Total Cost of Ownership (TCO) and dramatically speeding up implementation time, making advanced, highly scalable CMS accessible to small and medium-sized carriers and enabling greater remote accessibility for global crew members.

Which application segment within CMS is experiencing the highest growth rate?

The Crew Disruption Management segment is experiencing the highest compounded growth, fueled by the increasing frequency of external operational disruptions and the necessity for sophisticated, AI-driven optimization tools that can rapidly recover schedules while strictly maintaining regulatory adherence and minimizing subsequent delays.

What role does Artificial Intelligence (AI) play in modern crew management?

AI plays a critical role by enabling predictive rostering, accurately forecasting crew fatigue risk, and executing complex disruption recovery optimization vastly faster and more effectively than traditional rule-based systems, thereby shifting planning from reactive to proactive operational steering.

Which region dominates the Commercial Aviation Crew Management Systems market?

North America currently dominates the market share due to its concentration of established legacy carriers, complex union contract management demands, high investment in sophisticated technology, and stringent adherence to FAA regulatory requirements concerning flight and duty time.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager