Commercial Bar Cabinet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432422 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Commercial Bar Cabinet Market Size

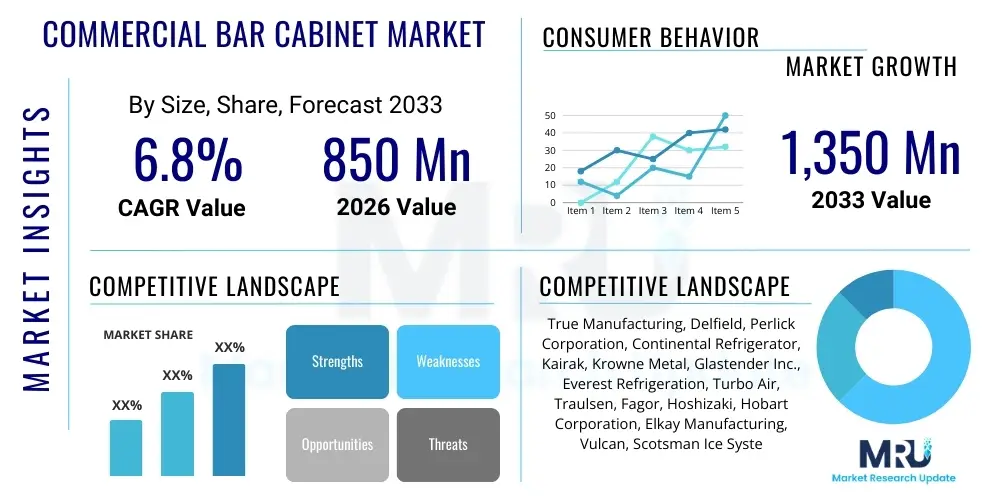

The Commercial Bar Cabinet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Commercial Bar Cabinet Market introduction

The Commercial Bar Cabinet Market encompasses the design, manufacturing, and distribution of specialized furniture and equipment engineered for storage, preparation, and presentation of beverages in professional hospitality and entertainment settings. These cabinets are distinct from residential units, prioritizing durability, modularity, high-capacity storage, specialized refrigeration, and compliance with commercial sanitation standards. The core functionality centers on optimizing workflow for bartenders, ensuring rapid service delivery, and maintaining specific temperature requirements for diverse alcoholic and non-alcoholic components. Product descriptions range from complex modular stainless steel back bars equipped with integrated ice bins, speed rails, and sinks, to aesthetically refined front bar cabinets utilizing high-pressure laminates and solid surface materials designed to enhance the venue’s overall ambiance. The market is highly influenced by architectural trends in restaurant and hotel design, demanding solutions that are both highly functional and visually appealing, capable of supporting high-volume operations consistently.

Major applications for commercial bar cabinets span a wide array of end-user sectors, primarily dominated by full-service restaurants, luxury hotels, dedicated nightlife establishments such as bars and clubs, and large-scale entertainment venues like casinos and sports arenas. Increasingly, there is demand from corporate offices and high-end event catering services requiring robust, often portable, bar setups. The primary benefits derived from these advanced systems include enhanced operational efficiency due to optimized spatial layout, superior inventory control through integrated storage solutions, and significant improvement in customer experience stemming from faster and more organized service. Furthermore, modern commercial bar cabinets often integrate ergonomic features, reducing physical strain on staff during peak operating hours, thus contributing to higher staff retention and productivity. The investment in high-quality commercial cabinetry is viewed by operators as essential infrastructure that directly impacts profitability and brand perception.

Driving factors propelling the expansion of this market include the global resurgence and diversification of the hospitality sector, characterized by a growing consumer preference for curated beverage experiences and sophisticated social environments. Urbanization and the rise of middle-class disposable income in developing regions further fuel the establishment of new restaurants and hotels, each requiring state-of-the-art bar infrastructure. Technological advancements, particularly in material science leading to lighter yet more durable construction materials, and the incorporation of sophisticated, energy-efficient refrigeration technologies, are major market accelerators. The trend towards ‘experiential dining’ necessitates visually striking bar areas, pushing manufacturers to innovate in design and integration of lighting and display features. Regulatory compliance concerning food safety and alcohol storage also mandates the use of specialized, commercial-grade equipment, continuously refreshing the demand pool for compliant and certified cabinet solutions across all major geographies.

Commercial Bar Cabinet Market Executive Summary

The Commercial Bar Cabinet Market demonstrates robust growth, driven primarily by strong capital expenditure in the global hospitality sector, particularly within Asia Pacific and North America. Key business trends indicate a definitive shift toward highly modular and customizable bar systems that allow quick reconfiguration to match evolving menu requirements or temporary event needs. Sustainability and energy efficiency have emerged as critical purchasing criteria, compelling manufacturers to utilize recyclable materials and integrate high-efficiency refrigeration components compliant with stringent environmental standards. Regionally, North America maintains market leadership due to high disposable income and a mature restaurant industry, while Asia Pacific, particularly China and India, is registering the fastest growth owing to rapid urbanization, massive infrastructure development in tourism, and the proliferation of international hotel chains demanding premium, standardized equipment. Segment trends highlight the increasing adoption of stainless steel cabinets for their durability and hygiene, alongside significant growth in the built-in and under-counter refrigeration segments, reflecting the optimization of limited floor space in urban venues. The market remains competitive, with focus shifting from merely storage function to integrated workflow optimization systems incorporating smart dispensing and inventory tracking capabilities to drive operational excellence.

AI Impact Analysis on Commercial Bar Cabinet Market

User queries regarding AI's impact on commercial bar cabinets often center on efficiency gains, inventory loss mitigation, and the role of automation in drink preparation and service delivery. Key concerns revolve around the integration feasibility of AI tools with existing physical infrastructure, the initial investment cost for "smart bar" systems, and how AI might streamline the complex supply chain of high-volume bar operations. Users are particularly interested in machine vision systems for automated monitoring of stock levels, predictive analytics for demand forecasting of specific ingredients, and robotic dispensing mechanisms that rely on AI algorithms for precise mixing and speed. The collective expectation is that AI will transform the bar cabinet from a passive storage unit into an active, intelligent hub capable of optimizing labor, reducing waste, and ensuring consistent product quality, thereby justifying the substantial upfront investment through long-term operational savings and enhanced customer service experiences.

AI's primary influence is moving beyond simple point-of-sale systems to embedded intelligence within the cabinet structure itself. For instance, sensors and image recognition software integrated into chillers and storage compartments can automatically track every bottle removed or added, generating real-time inventory reports that flag discrepancies and prevent shrinkage, a major operational loss in the sector. Furthermore, predictive maintenance powered by AI monitors the performance metrics of critical components like compressors and cooling coils, scheduling preventative service before catastrophic failure occurs. This proactive approach minimizes downtime, which is crucial for high-traffic commercial environments. The customization of beverage recipes based on customer preferences derived from anonymized transactional data is also being explored, allowing AI to suggest optimized layouts or stock rotation schedules directly to bar managers, making the physical cabinet infrastructure a data-gathering ecosystem.

The future iteration of commercial bar cabinets will likely feature AI-driven robotic arms or automated dispensing units built directly into the countertop or back bar. These systems use complex algorithms to ensure volumetric accuracy and speed, especially for standard, high-turnover cocktails. This integration fundamentally alters the requirements for cabinet design, necessitating precise housing for sophisticated electromechanical components, integrated wiring, and robust cooling systems to handle the heat generated by electronics. This shift necessitates collaboration between traditional cabinet manufacturers and technology firms specializing in robotics and machine learning, driving innovation towards integrated hardware and software solutions that promise unparalleled consistency and speed of service, particularly appealing to large chain operators seeking standardization across global locations. The seamless integration of these technologies into durable, commercially viable enclosures represents the next frontier for market growth.

- AI-Powered Inventory Management: Automated tracking of spirits and mixers using weight sensors and machine vision to minimize shrinkage and optimize restocking schedules.

- Predictive Maintenance: Algorithms monitoring refrigeration unit health, alerting staff to potential failures before operational disruption occurs.

- Robotic Dispensing Integration: Built-in compartments and housing optimized for automated cocktail mixing systems, ensuring speed and recipe consistency.

- Demand Forecasting: Utilizing AI analytics to predict peak consumption patterns, informing real-time stock allocation within the cabinet infrastructure.

- Optimized Layout Planning: Generative design tools leveraging AI to recommend ergonomic and efficient bar cabinet layouts based on specific venue size and service model.

- Energy Consumption Optimization: Smart controls that adjust cooling cycles based on real-time load and ambient conditions, maximizing energy efficiency.

DRO & Impact Forces Of Commercial Bar Cabinet Market

The dynamics of the Commercial Bar Cabinet Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the key Impact Forces. A major Driver is the continuous global expansion and refurbishment cycle of the hospitality and tourism sectors, mandating updated, aesthetically pleasing, and highly efficient bar infrastructure. The growing consumer demand for premium, complex, and varied beverage services, requiring specialized storage like wine and beer preservation units integrated within the main cabinet structure, also strongly pushes market volume. Conversely, the market faces significant Restraints, primarily stemming from the substantial capital expenditure required for high-end, custom commercial installations, particularly impacting independent or small-chain operators. Furthermore, fluctuations in raw material costs, especially stainless steel and specialized hardwoods, can compress manufacturer margins and increase final product prices. Opportunities abound in the realm of smart technologies, sustainability, and modular design, allowing manufacturers to offer quick-install, customizable, and eco-friendly solutions, particularly targeting fast-growing segments like ghost kitchens and temporary event setups, thus mitigating the impact of cyclical construction downtime and high cost pressures.

The primary Impact Forces driving market evolution revolve around regulatory standards, technological advancement, and socio-economic changes. Strict global health and safety regulations, requiring non-porous, easily sanitized materials (like high-grade stainless steel) and certified refrigeration units, continually drive product innovation and replacement cycles, acting as a strong upward force. Technological advancements, notably in energy-efficient compressors, touch-screen controls, and material coatings that resist fingerprints and corrosion, enhance the value proposition of newer cabinets over legacy systems. Socio-economic forces, such as the increasing global emphasis on aesthetic quality in public spaces, demand cabinets that serve not just functional roles but also act as prominent design elements, pushing manufacturers towards collaborations with interior designers and architects. These forces collectively dictate pricing power, competitive intensity, and the overall rate of technological adoption, demanding that manufacturers maintain agility in design and production to stay relevant.

While the market benefits significantly from the premiumization trend in the beverage industry, the high degree of customization required for commercial projects often leads to extended lead times and complexity in manufacturing, which acts as a structural restraint. Manufacturers must strategically balance the demand for bespoke design with the efficiencies gained from standardized, modular components. The most substantial opportunity lies in integrating data connectivity into standard bar equipment, turning the cabinet into a central data node for business intelligence. Addressing the environmental pressure by developing cabinets with lower Global Warming Potential (GWP) refrigerants and certified sustainable materials offers a clear pathway for competitive differentiation and capturing institutional customers focused on corporate social responsibility. Successful navigation of these Impact Forces requires robust supply chain management, strong partnerships with large hotel and restaurant developers, and continuous investment in ergonomic and energy-saving designs.

- Drivers:

- Rapid global expansion and refurbishment of the hospitality sector (hotels, restaurants, clubs).

- Increasing consumer demand for specialized and high-quality craft beverage services requiring complex equipment.

- Growing focus on ergonomic design and workflow optimization to improve bartender productivity.

- Technological advancements in durable, hygienic, and energy-efficient refrigeration components.

- Restraints:

- High initial investment cost for advanced, integrated commercial bar systems.

- Volatile raw material pricing, particularly stainless steel and specialty laminates.

- Long lead times and high complexity associated with custom design and fabrication projects.

- Opportunities:

- Integration of IoT and smart inventory management systems (AI/sensors).

- Development of highly modular and quick-assembly cabinets for pop-up or temporary venues.

- Adoption of eco-friendly materials and low GWP refrigerants to meet sustainability targets.

- Impact Forces:

- Regulatory Compliance (Health and sanitation standards mandate commercial-grade materials).

- Competitive Intensity (Market fragmentation drives product differentiation through design and technology).

- Economic Fluctuations (Capital expenditure of hospitality chains highly sensitive to macroeconomic conditions).

Segmentation Analysis

The Commercial Bar Cabinet Market is comprehensively segmented based on several critical dimensions, allowing for precise market sizing and strategic targeting. The key segmentation dimensions include the Material utilized, the Type of cabinet structure, and the End-User application. Understanding these segments is vital as purchasing criteria differ significantly; for example, luxury hotel chains prioritize aesthetic appeal and high-end finishes (often wood or solid surface materials for the front bar), while high-volume institutional bars focus predominantly on rugged stainless steel construction and maximum capacity (Type: Built-in/Modular). The modularity segment is gaining traction due to the flexibility it offers in maximizing limited urban real estate, enabling operators to quickly adapt their bar layout to various events or seasonal demands. The structural complexity involved in accommodating various functions—such as multiple sink basins, dedicated glassware washers, waste disposal, and specialized wine refrigeration zones—defines the product offerings within each segment and dictates pricing levels, leading to diverse competitive landscapes across the various material and type categories.

Further granularity in segmentation reveals distinct market demands within the end-user categories. Hotels, particularly those targeting four or five stars, demand highly customized back-bar and front-bar combinations that are often aesthetically integrated into the lobby or dining area’s design theme, often requiring specialized lighting and display features. Conversely, independent restaurants and dedicated sports bars prioritize extreme durability and ease of cleaning, opting for robust, standard stainless steel units with maximum access to speed rails and ice wells. The segmentation by function, such as under-counter refrigeration versus full back bar systems, also provides insight into operational spending. Under-counter units, critical for efficient use of space and regulatory compliance (e.g., proper storage of open mixers), represent a high-volume, standardized segment, while full back bar systems are generally customized project-based sales, reflecting higher individual revenue but lower transactional frequency.

The evolution of materials also drives segmentation shifts. While stainless steel remains the industry standard for hygiene and structural integrity, advancements in composite materials and high-performance laminates (HPL) are carving out niches for lightweight, aesthetically versatile, and relatively lower-cost alternatives, especially for portable or temporary setups. Manufacturers must therefore maintain diverse product portfolios capable of addressing the low-cost, high-volume demand (e.g., standard metal back bars) alongside the high-margin, bespoke design demand (e.g., integrated wood and stone cabinets for luxury venues). Strategic analysis confirms that the Type segmentation, particularly the rise of highly functional, customizable Modular Systems, will be the primary engine of innovation and growth over the forecast period, as it offers the best solution for the hospitality industry's dual need for specialized function and adaptive physical infrastructure.

- By Material:

- Stainless Steel (Dominant due to hygiene and durability)

- Wood and Veneers (Used primarily for aesthetic front-bar designs in premium venues)

- Laminates and Solid Surface Materials (Cost-effective and aesthetically versatile options)

- Composite Materials (Used for lightweight and specialized applications)

- By Type:

- Built-in/Fixed Systems (Permanent, custom installations)

- Modular Systems (Flexible, interchangeable components)

- Portable/Mobile Cabinets (For catering, events, and temporary setups)

- By End-User:

- Hotels and Resorts (High customization, luxury focus)

- Restaurants and Pubs (Functionality, volume focus)

- Bars and Nightclubs (Speed, capacity, and durability focus)

- Casinos and Entertainment Venues (Large scale, high-volume capacity)

- Catering and Event Services (Portable and quick-assembly demand)

- By Function:

- Under-counter Refrigeration

- Back Bar Systems (Storage and display)

- Front Bar Structures (Service and aesthetic elements)

- Integrated Workstations (Ice bins, sinks, speed rails)

Value Chain Analysis For Commercial Bar Cabinet Market

The Value Chain for the Commercial Bar Cabinet Market begins with the Upstream Analysis, which involves the sourcing and processing of core raw materials. This stage is dominated by suppliers of high-grade stainless steel (304 and 316), specialized refrigeration components (compressors, condensers, and refrigerants), hardwoods, and high-performance laminates. Efficiency at this stage is crucial, as volatile commodity prices directly influence manufacturing costs. Manufacturers engage in design and precision fabrication, focusing on bending, welding, insulation, and integration of plumbing and electrical systems, requiring specialized machinery and skilled labor. Downstream analysis involves the complex logistics of distribution, installation, and after-sales service, which often dictates the final customer experience. Given the custom nature of many commercial projects, the distribution channel heavily relies on specialized commercial kitchen and bar equipment dealers, design consultants, and direct contracts with major hospitality development firms. Direct sales are common for large chain accounts seeking centralized procurement and installation standards across multiple venues, while indirect sales through regional distributors cater effectively to smaller, independent operators, requiring technical support and localized inventory.

The efficiency of the distribution channel is a paramount competitive differentiator. Due to the size and weight of commercial bar cabinets, logistical costs can be substantial, making effective warehousing and timely installation services provided by the channel partners essential. Commercial equipment dealers play a crucial role by providing local expertise, handling complicated permitting and installation processes, and integrating the bar cabinets with other necessary systems (plumbing, drainage, ventilation). The direct channel, often involving original equipment manufacturers (OEMs) working directly with architects and general contractors, bypasses intermediate margins but requires significant internal sales engineering and project management capabilities. The shift towards modular units has simplified logistics slightly, making indirect distribution via e-commerce and specialized regional wholesalers increasingly viable for standardized products. This channel must also manage the inevitable spare parts and warranty fulfillment, emphasizing the necessity of robust after-sales support to maintain high customer satisfaction in demanding commercial environments.

Service provision within the value chain extends beyond installation to ongoing maintenance and potential retrofitting. Suppliers who offer comprehensive service contracts for refrigeration and specialized components gain a competitive edge, as minimizing downtime is critical for bar operations. Upstream, manufacturers are increasingly seeking vertical integration or long-term contractual agreements with material suppliers to stabilize input costs and ensure material quality consistency, particularly for proprietary anti-microbial coatings or specialized cooling technologies. The ultimate value delivery is realized when the cabinet design not only meets functional specifications but also adheres to stringent regulatory requirements and enhances the visual appeal of the venue, ensuring that the initial investment translates into measurable improvements in operational flow and customer throughput. The interaction between design consultants and fabricators, often through Computer-Aided Design (CAD) software, is where value is fundamentally created by turning operational needs into physical, customized infrastructure.

Commercial Bar Cabinet Market Potential Customers

The core customer base for the Commercial Bar Cabinet Market is highly specialized, revolving around professional venues requiring high-volume, standardized, and often bespoke beverage service infrastructure. The primary End-Users/Buyers include institutional players within the global hospitality industry, specifically large international hotel chains (e.g., Marriott, Hilton, Hyatt), major full-service restaurant groups, and entertainment corporations owning large-scale venues like casinos, theme parks, and major sports stadiums. These institutional buyers are characterized by high purchasing power, strict adherence to global brand standards, and procurement cycles that often involve complex tender processes and long-term supply contracts. The purchasing decision is typically driven by criteria such as product durability, energy efficiency ratings, compliance certifications (e.g., NSF, UL), and the manufacturer's capacity to deliver customized, standardized units across a wide geographic area. This segment provides the largest revenue opportunity due to its high volume requirements during new constructions and extensive periodic renovation cycles.

A significant secondary customer segment comprises independent and regional operators, including boutique hotels, high-street bars, local microbreweries, and specialized cocktail lounges. While individual order volumes are lower, this segment demands greater flexibility in design and often seeks solutions tailored to smaller, unique physical spaces. Purchasing decisions here are influenced heavily by local design trends, perceived return on investment, and the availability of financing or leasing options provided by distributors. The growth of specialized beverage concepts, such as dedicated craft breweries requiring specialized cold storage and dispensing cabinets, or theme bars needing highly aesthetic, non-standard material finishes, further characterizes the diversity within this mid-tier customer group. Manufacturers target this segment effectively through regional distribution networks offering customization advice and rapid local installation services, utilizing standardized components to maintain cost control while offering perceived bespoke solutions.

Emerging potential customers include high-end corporate campuses and dedicated event catering companies. Corporate offices are increasingly investing in elaborate internal entertainment spaces and staff amenities, driving demand for modern, integrated bar setups that reflect professional standards and functionality. Catering companies require robust, professional-grade portable bar cabinets that can be rapidly deployed, assembled, and broken down, necessitating a focus on lightweight yet durable construction and quick connection mechanisms for plumbing and power. Furthermore, the proliferation of 'dark bars' or ghost kitchens specialized only in delivery cocktails presents a new, highly functional customer group focusing solely on operational efficiency and speed, rather than aesthetic front-bar design. Identifying and developing specialized product lines, such as modular, compact units optimized for delivery logistics, is key to capitalizing on these evolving niche end-user segments, demonstrating the continuous necessity for market adaptation and specialized product development.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | True Manufacturing, Delfield, Perlick Corporation, Continental Refrigerator, Kairak, Krowne Metal, Glastender Inc., Everest Refrigeration, Turbo Air, Traulsen, Fagor, Hoshizaki, Hobart Corporation, Elkay Manufacturing, Vulcan, Scotsman Ice Systems, Beverage-Air, Duke Manufacturing, Middleby Corporation, Manitowoc Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Bar Cabinet Market Key Technology Landscape

The technological landscape of the Commercial Bar Cabinet Market is centered on enhancing three primary attributes: energy efficiency, operational durability, and smart functionality. Modern commercial cabinets extensively utilize advanced refrigeration technologies, moving away from Hydrofluorocarbons (HFCs) to natural refrigerants such as R290 (propane) and R600a (isobutane), which offer significantly lower Global Warming Potential (GWP) and improved energy performance, aligning with stringent international environmental mandates. This necessitates the use of high-efficiency variable-speed compressors and specialized insulation materials, like high-density polyurethane foam, to minimize heat gain and reduce running costs, which is a major concern for commercial operators. Furthermore, the integration of solid-state electronic controls and digital thermostats ensures precise temperature management for different storage zones (e.g., deep chilling for beer versus cellar temperatures for specific wines), a critical functional requirement for modern, diversified bar menus.

Material science innovation also plays a vital role. Manufacturers are increasingly employing high-grade, often anti-microbial-treated, stainless steel that enhances hygiene and reduces cleaning time, particularly in high-moisture environments typical of commercial bars. Proprietary surface coatings are being developed to resist scratching, corrosion from acidic spills, and visible fingerprints, maintaining a professional appearance during heavy use. In terms of structural design, Computer-Aided Design (CAD) and advanced Finite Element Analysis (FEA) are routinely used to optimize the cabinet structure for maximum strength-to-weight ratio and ergonomic workflow, ensuring that the physical dimensions and component placements adhere strictly to ergonomic standards defined by industry bodies, minimizing staff fatigue during long shifts. The modular construction trend relies heavily on advanced manufacturing processes that ensure precise alignment and interchangeability of components, requiring automated cutting and welding techniques.

The integration of Information Technology (IT) represents the most significant recent technological shift. Smart cabinets incorporate IoT sensors for inventory monitoring, tracking the weight or presence of bottles and kegs. These sensors communicate wirelessly with centralized management software, providing real-time data on stock levels and usage patterns, thus automating the ordering process and significantly reducing manual labor associated with inventory checks. Beyond inventory, advanced dispensing technologies, including integrated draft beer systems with precise temperature control and carbonation management, and specialized wine preservation systems (e.g., nitrogen-based dispensing) are becoming standard features in high-end commercial cabinets. These technologies transform the bar cabinet from a simple storage unit into a high-performance, data-enabled food and beverage preparation hub, optimizing both the product quality and the operational speed, thereby justifying the higher cost of technologically advanced equipment.

Regional Highlights

- North America: North America, particularly the United States, holds a dominant position in the Commercial Bar Cabinet Market characterized by high levels of discretionary spending, a mature and competitive hospitality industry, and stringent regulatory standards requiring high-quality, certified equipment. The region shows a strong demand for sophisticated, integrated bar workstations and high-capacity under-counter refrigeration units, driven by extensive renovation and new construction projects in major metropolitan hubs like New York, Las Vegas, and Miami. Technological adoption is rapid here, with commercial operators quickly embracing IoT-enabled inventory management and energy-efficient systems to mitigate high utility and labor costs. The demand for customized, aesthetically advanced front-bar designs that complement the high-end dining and nightlife scene ensures sustained investment in premium, bespoke cabinetry solutions. The market is also heavily influenced by quick-service and sports bar chains that demand robust, standardized, and easily replicable modular systems for multi-site deployment. The region is a key testing ground for new ergonomic and automated bar technologies.

- Europe: The European market is characterized by diverse demands influenced by varying national hospitality traditions and regulations. Western Europe, notably the UK, Germany, and France, exhibits high demand for bespoke, high-quality cabinets that often require integration into historic or architecturally complex buildings, necessitating highly specialized fabrication. Sustainability is a primary regional driver, with strict EU regulations pushing the mandatory adoption of low GWP refrigerants and environmentally friendly manufacturing processes. Eastern Europe is experiencing rapid market penetration due to increasing tourism and foreign investment leading to the development of new hotel infrastructure and modern entertainment venues, showing a higher growth trajectory for standardized, cost-effective stainless steel units. The emphasis across Europe remains on craftsmanship, long-term durability, and aesthetic integration, supporting a strong market for premium woods and high-performance, non-metallic finishes alongside standard commercial equipment. The modular design trend is accelerating, addressing the need for flexible utilization of limited commercial space in dense urban centers.

- Asia Pacific (APAC): The APAC region is projected to be the fastest-growing market, fueled by unprecedented infrastructure development, a booming tourism sector, and the expansion of international hotel and restaurant brands, particularly in emerging economies like China, India, and Southeast Asia. Market growth is driven by large-scale projects, including new casino resorts, integrated resort complexes, and international convention centers, all requiring vast quantities of standardized, yet high-specification, commercial bar cabinets. While cost sensitivity remains a factor in certain sub-regions, the overarching trend is a move towards high-capacity, durable equipment that can withstand high-volume usage characteristic of the massive population bases. Manufacturers entering APAC must navigate diverse regulatory environments but benefit from the rapid urbanization that consistently drives the establishment of new food and beverage outlets. The market is highly competitive, emphasizing efficient supply chains and local manufacturing capabilities to manage logistical complexities.

- Latin America (LATAM): The LATAM market shows potential, driven primarily by tourism-focused areas in Mexico, Brazil, and the Caribbean islands. Demand is heavily concentrated in coastal regions and major capitals, often linked to foreign direct investment in luxury resorts and entertainment complexes. The market typically requires robust, corrosion-resistant materials due to high humidity and temperature variations, making specialized stainless steel finishes and durable components essential purchasing criteria. Economic volatility can sometimes restrain large capital expenditures, leading to a preference for mid-range, modular solutions that offer a balance between functionality and cost. The emphasis on vibrant social dining experiences also necessitates visually appealing front-bar designs, often incorporating locally sourced aesthetic materials alongside commercial-grade functionality.

- Middle East and Africa (MEA): The MEA region, particularly the Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia, Qatar), represents a high-value segment driven by massive luxury hospitality projects, including the continuous development of world-class hotels and resorts designed to attract high-net-worth tourism and business travel. These projects demand the highest specification in custom, integrated bar systems, often incorporating exotic materials, advanced technology, and exceptionally high aesthetic standards. Compliance with regional quality standards and the capacity for large, complex project management are non-negotiable requirements for successful manufacturers. Africa presents heterogeneous opportunities, with South Africa showing maturity in its hospitality sector, while other nations are beginning to invest in modern bar infrastructure, primarily targeting standardized, reliable refrigeration and storage solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Bar Cabinet Market. These companies represent global leaders in commercial refrigeration, kitchen, and bar equipment fabrication, driving innovation in durability, energy efficiency, and modular design. Their competitive strategies focus on optimizing supply chain logistics, expanding service networks, and integrating advanced smart technologies into their core product lines to capture major institutional contracts and meet stringent regulatory requirements worldwide.- True Manufacturing

- Delfield (Part of Manitowoc Foodservice)

- Perlick Corporation

- Continental Refrigerator

- Kairak

- Krowne Metal

- Glastender Inc.

- Everest Refrigeration

- Turbo Air

- Traulsen (Part of Illinois Tool Works)

- Fagor Professional

- Hoshizaki Corporation

- Hobart Corporation (Part of Illinois Tool Works)

- Elkay Manufacturing

- Vulcan (Part of ITW Food Equipment Group)

- Scotsman Ice Systems (Part of Middleby Corporation)

- Beverage-Air

- Duke Manufacturing

- Middleby Corporation

- Manitowoc Company (Welbilt)

Frequently Asked Questions

Analyze common user questions about the Commercial Bar Cabinet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected CAGR for the Commercial Bar Cabinet Market and what factors are driving this growth?

The Commercial Bar Cabinet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This growth is primarily driven by the robust expansion and refurbishment cycles within the global hospitality and tourism sectors, increased consumer spending on specialized beverages, and the ongoing demand for energy-efficient and highly ergonomic bar workstation designs that optimize service speed and staff productivity.

Which materials are most commonly used in commercial bar cabinet construction and why is hygiene a major concern?

The most commonly used material is high-grade Stainless Steel (304), preferred for its exceptional durability, non-porous surface, and resistance to corrosion, which are essential attributes for adhering to strict commercial hygiene and sanitation standards (such as NSF certification). Hygiene is a major concern because these cabinets house food and beverage ingredients, requiring materials that are easy to clean and inhibit microbial growth, minimizing health risks in high-volume public environments.

How is technological integration, particularly IoT and AI, impacting the design and functionality of bar cabinets?

IoT and AI are transforming bar cabinets into intelligent operational hubs. IoT sensors embedded in the units facilitate automated, real-time inventory tracking and stock management, significantly reducing shrinkage and streamlining restocking. AI is also leveraged for predictive maintenance of refrigeration components and for optimizing bar layout based on workflow analysis, moving the function beyond simple storage to complex operational efficiency management.

Which geographic region currently dominates the market, and which is expected to show the fastest growth?

North America currently holds the largest market share due to its established and high-spending hospitality sector, mature regulatory environment, and high adoption rate of sophisticated bar technology. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, driven by rapid urbanization, massive investment in hotel infrastructure, and expanding tourism industries in countries like China and India.

What are the key advantages of choosing modular bar cabinet systems over traditional built-in installations for commercial venues?

Modular bar cabinet systems offer superior operational flexibility and reduced installation complexity compared to traditional built-in installations. They allow venue operators to quickly reconfigure the bar layout for different events, adjust to evolving menu requirements, and facilitate easier relocation or replacement. This adaptability is highly valued in dynamic urban environments where space optimization and venue versatility are crucial for maximizing revenue potential.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager