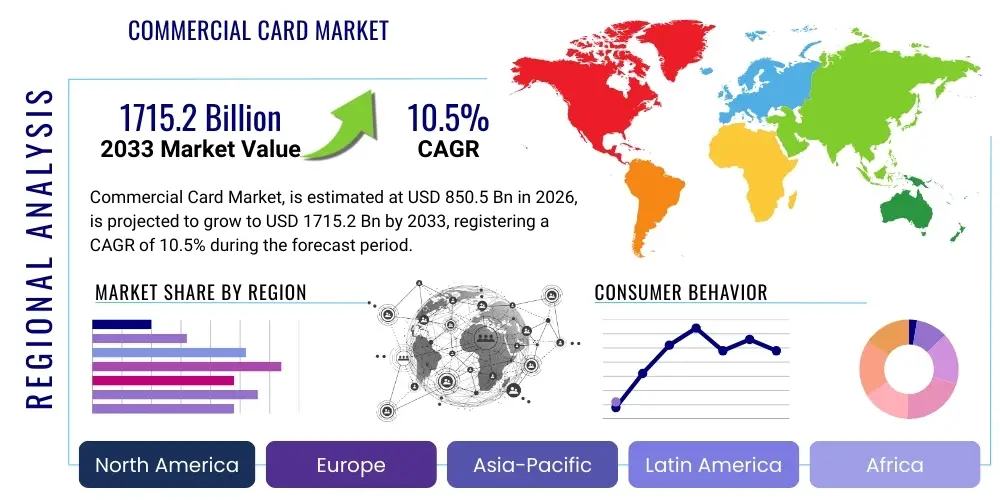

Commercial Card Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434781 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Card Market Size

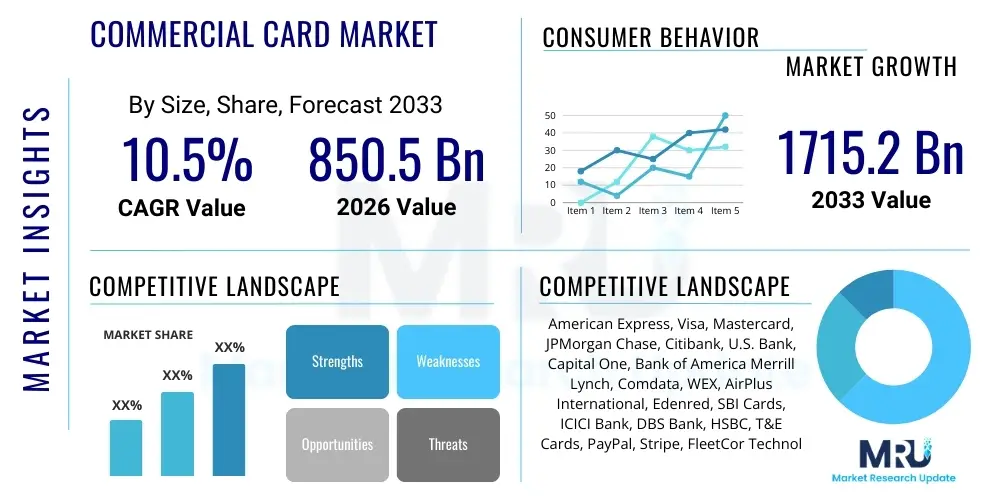

The Commercial Card Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.5% between 2026 and 2033. The market is estimated at $850.5 Billion in 2026 and is projected to reach $1715.2 Billion by the end of the forecast period in 2033.

Commercial Card Market introduction

The Commercial Card Market encompasses payment solutions—including credit, debit, and prepaid cards—specifically designed for business use, facilitating transactions related to corporate travel, procurement, fleet management, and operational expenses. These instruments offer enterprises robust tools for controlling spending, optimizing cash flow, streamlining expense reporting, and achieving greater transparency in financial management. The core product description involves sophisticated banking services integrated with technology platforms that provide real-time data analytics, customized spending limits, and integration capabilities with enterprise resource planning (ERP) systems. The functionality extends far beyond traditional consumer banking, targeting the complex needs of modern B2B transactions and corporate financial governance. Key applications include utilizing purchase cards for high-volume vendor payments, employing travel and entertainment (T&E) cards for employee expenditures, and implementing fleet cards for fuel and maintenance management across vehicle operations.

Major applications of commercial cards span various organizational scales, from small and medium-sized enterprises (SMEs) leveraging simplified expense systems to large multinational corporations utilizing advanced integrated solutions for global supply chain payments. The proliferation of digital procurement platforms and the necessity for automating accounts payable (AP) processes are significantly boosting adoption rates across all sectors, including manufacturing, retail, technology, and professional services. The transition away from traditional, manual payment methods like checks and bank transfers is a central theme driving market momentum, as businesses prioritize efficiency and reduced operational costs. Furthermore, commercial cards provide critical benefits such as extended payment terms, significant rebate opportunities based on spend volume, and enhanced security features mitigating fraud risks inherent in large-scale corporate spending.

Driving factors for the substantial market growth include the global expansion of cross-border trade, increasing demand for instant and transparent B2B payment solutions, and the continuous technological advancements in payment infrastructure, notably the rise of virtual cards and mobile payment integration. Regulatory environments, particularly those encouraging digital finance and electronic invoicing, also play a pivotal role in accelerating adoption. The inherent benefits—such as improved compliance monitoring, automated reconciliation, and better visibility into employee spending patterns—make commercial cards indispensable tools for corporate finance departments aiming for strategic financial oversight and operational excellence in a rapidly digitalizing economy.

Commercial Card Market Executive Summary

The Commercial Card Market is undergoing rapid transformation, fueled primarily by the global shift towards digital B2B payments and enhanced corporate demand for spend control and automation. Key business trends indicate strong traction in the adoption of virtual cards, which offer enhanced security and flexibility for online procurement and subscription management, alongside increased integration of commercial card programs with sophisticated spend management software. Regionally, North America maintains its dominance due to mature financial infrastructure and high corporate adoption of digital tools, while the Asia Pacific region is emerging as the fastest-growing market, driven by accelerating SME digitalization and supportive government initiatives promoting cashless transactions. Segment trends reveal that Purchase Cards continue to hold a substantial market share owing to their utility in optimizing large procurement volumes, yet the Travel & Entertainment segment is experiencing robust recovery and innovation following global travel normalization, focusing heavily on touchless and mobile-integrated solutions. Furthermore, the Mid-Size Enterprise segment exhibits the highest growth potential, as these organizations increasingly seek affordable, scalable commercial card solutions to compete effectively with larger players by streamlining their complex internal financial operations.

A crucial factor defining current market dynamics is the strategic focus of major issuers and fintech collaborators on developing comprehensive ecosystem platforms rather than just standalone card products. This involves leveraging AI and machine learning to offer predictive analytics, dynamic credit risk assessment, and personalized rewards programs tailored to specific vertical industries. Sustainability concerns are also beginning to shape product development, with some card programs offering reporting on carbon footprint associated with purchases. These technological and ethical advancements are setting new industry standards, prompting traditional financial institutions to invest heavily in modernizing their legacy infrastructure to maintain competitive relevance against agile technology providers. The convergence of payment processing, expense management, and treasury services into unified commercial card platforms represents a significant shift in market architecture.

The competitive landscape is characterized by intense strategic partnerships between global networks (Visa, Mastercard) and regional banks, aiming to extend reach into localized markets and offer specialized services tailored to specific regulatory requirements. Looking ahead, future trends point towards the integration of blockchain technology for enhanced cross-border payment efficiency and reduced transaction costs, although widespread implementation remains nascent. The market’s resilience is also tied to global economic stability; while economic downturns might temper T&E spending, they often accelerate the adoption of cost-controlling tools like commercial cards for procurement, ensuring sustained demand growth across the forecast period. The overall executive outlook is highly positive, driven by the unavoidable global trajectory toward digital B2B commerce.

AI Impact Analysis on Commercial Card Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Commercial Card Market predominantly revolve around three critical themes: automation efficiency, fraud prevention capabilities, and the personalization of corporate financial services. Users frequently ask how AI can automate the complex reconciliation process, replacing manual data entry and matching receipts with transactions, thereby reducing the burden on accounts payable departments. A significant concern is the efficacy of AI in detecting sophisticated, non-traditional fraud patterns, such as internal misuse or identity compromise, beyond basic transaction monitoring. Finally, there is immense interest in how AI can optimize spending policies, providing dynamic limits or personalized advisory services based on predictive analytics of a company’s cash flow and procurement needs. The collective expectation is that AI will transform commercial cards from simple transactional tools into intelligent, integrated financial management systems capable of real-time optimization and proactive risk mitigation, demanding higher levels of data security and regulatory compliance in their implementation.

AI's role is fundamentally shifting the value proposition of commercial card providers from being mere credit facilitators to providers of integrated, data-driven financial intelligence. By employing machine learning algorithms, issuers are now able to analyze vast datasets pertaining to spending patterns, industry benchmarks, and vendor behavior in near real-time. This sophisticated analysis allows for the automated classification of expenses, greatly simplifying the cumbersome process of auditing and compliance verification, which traditionally consumes significant administrative resources. Furthermore, AI-powered systems are crucial for generating predictive models that forecast future spending, enabling treasury departments to manage working capital more effectively and optimize liquidity positions.

Moreover, the integration of generative AI is beginning to influence the user experience, particularly in customer service and reporting. Chatbots and virtual assistants powered by natural language processing (NLP) can instantly answer complex queries about expense policies, transaction statuses, and reporting requirements, offering 24/7 support without human intervention. This shift improves operational scalability for card issuers while providing businesses with immediate, accurate information. The net effect of AI integration is a drastic improvement in the speed, accuracy, and security of corporate spending management, positioning commercial cards as essential components of the modern CFO’s digital toolkit, provided the underlying infrastructure is resilient and secure against evolving cyber threats.

- Automated Expense Categorization and Reconciliation: Reduces manual data entry errors and speeds up month-end closing processes.

- Enhanced Real-Time Fraud Detection: Utilizes machine learning to identify anomalous spending patterns indicative of fraud instantly.

- Dynamic Credit Risk Assessment: Adjusts credit limits and spending controls based on predictive analysis of corporate financial health.

- Personalized Spend Policy Optimization: Recommends optimal vendor usage and purchasing behavior tailored to specific business goals.

- Improved Customer Service via NLP: Provides instant, accurate answers to expense-related queries using AI-powered virtual assistants.

- Predictive Cash Flow Modeling: Offers treasury management insights by forecasting future liquidity needs based on commercial card data.

- Integration with ERP Systems: Facilitates seamless data flow between card platforms and corporate resource planning software using intelligent APIs.

DRO & Impact Forces Of Commercial Card Market

The dynamics of the Commercial Card Market are dictated by a powerful combination of Drivers (D), Restraints (R), Opportunities (O), and resulting Impact Forces. The primary drivers include the pervasive global shift towards digital B2B payments, the necessity for corporate expense control automation, and the inherent benefits of enhanced working capital management offered by card float and rebate structures. These drivers are fundamentally altering corporate finance operations, compelling businesses of all sizes to abandon paper-based systems in favor of integrated electronic solutions. Conversely, the market faces significant restraints, notably the persistent legacy systems within many large corporations that hinder seamless integration, the complexity and cost associated with cross-border regulatory compliance, and ongoing concerns regarding data security and the potential for large-scale breaches. While many companies recognize the benefits of commercial cards, the initial implementation cost and the inertia associated with changing established financial workflows often present substantial barriers to rapid adoption, particularly among SMEs with limited technical resources.

Opportunities within this market are vast and centered around technological innovation and geographic expansion. The proliferation of virtual cards and mobile wallets represents a major opportunity, catering to the growing need for secure, temporary, and purpose-specific payment solutions in e-commerce and cloud services procurement. Furthermore, the immense, untapped potential in emerging economies, particularly in Asia Pacific and Latin America, provides significant runway for growth as digitalization initiatives gain momentum supported by governmental mandates. Strategic partnerships between established financial institutions and agile FinTech companies also create opportunities for rapid feature deployment and specialized product offerings, such as industry-specific fleet management tools or tailored programs for the gig economy workforce. Harnessing advanced data analytics to create hyper-personalized card programs that deliver measurable ROI on procurement strategies is a crucial area for future differentiation and market penetration.

These D-R-O factors converge to create powerful Impact Forces reshaping the market structure. The foremost impact force is the intensification of competition, driving down transaction fees and forcing providers to compete based on value-added services like advanced expense reporting software and sophisticated API integration capabilities. A secondary impact force is the necessity for continuous technological investment; providers who fail to adapt to virtualization, cloud integration, and advanced cybersecurity protocols risk obsolescence. Ultimately, the market is being pushed towards a model where commercial cards are no longer just payment instruments but integral components of a holistic financial management ecosystem, where efficiency, security, and real-time data access are paramount to maintaining competitive advantage and meeting the evolving demands of corporate clients globally.

Segmentation Analysis

The Commercial Card Market is segmented based on Type, Application (End-Use), and Enterprise Size, reflecting the diverse requirements of the corporate client base. The segmentation by Type delineates between traditional instruments like Purchase Cards (P-Cards), used primarily for high-volume procurement, and specialized tools such as Travel & Entertainment (T&E) cards and Fleet Cards, tailored for mobility and operational expenses. A crucial and rapidly expanding segment is Virtual Cards, which offer non-physical, tokenized payment methods for enhanced security in online transactions and accounts payable automation. Application-wise, the segmentation focuses on how these cards are utilized across different business functions, from routine expenditure management to cross-border B2B supply chain financing. Understanding these granular segments allows issuers to develop highly targeted products that address specific pain points, thereby maximizing client engagement and facilitating robust market penetration strategies across different industry verticals and organizational scales.

Segmentation by Enterprise Size—Small Business, Mid-Size Enterprise, and Large Enterprise—highlights the distinct financial and technical needs of each group. Large Enterprises demand sophisticated integration with complex ERP systems, global acceptance, and highly customizable policy controls, often driving demand for bespoke corporate programs. Conversely, Small Businesses require simplified, often integrated expense management platforms that are easy to deploy and manage without requiring dedicated IT infrastructure. Mid-Size Enterprises often represent the fastest-growing segment, seeking scalable solutions that offer the analytical power of large corporate systems but packaged affordably to support rapid growth and expanding operational complexity. The differentiation in credit risk models, service level agreements, and integrated software features across these size segments is critical for product success.

Further analysis of the segmentation by End-User often involves distinguishing between financial institutions (FI-issued cards) and specialized non-financial institutions (such as logistics or technology companies offering specialized fleet or procurement cards). This distinction addresses the varying regulatory compliance burdens and the integration of value-added services. The sustained trend toward digitalization ensures that segments focusing on automated reconciliation and virtual payments will experience above-average growth rates throughout the forecast period. Strategic segmentation is thus vital for market participants to allocate resources effectively, target high-growth areas, and develop competitive products that resonate with the precise demands of modern corporate finance operations.

- By Type:

- Purchase Card (P-Card)

- Travel & Entertainment (T&E) Card

- Fleet Card

- Virtual Card

- By Application:

- B2B Payments

- Expense Management

- Supplier Payments

- Payroll and Reimbursement

- By Enterprise Size:

- Small Businesses (SMBs)

- Mid-Size Enterprises

- Large Enterprises

- By End-User Industry:

- Manufacturing

- Retail and E-commerce

- Technology and Telecom

- Healthcare

- Logistics and Transportation

- Professional Services

Value Chain Analysis For Commercial Card Market

The Value Chain for the Commercial Card Market is complex, involving multiple sophisticated layers starting from the upstream infrastructure providers to the downstream end-users. Upstream activities involve the development and maintenance of the core payment network infrastructure by global providers like Visa and Mastercard, alongside the initial funding and underwriting processes conducted by issuing banks. This stage is heavily capital and technology-intensive, requiring advanced fraud protection systems, large-scale data processing capabilities, and robust regulatory compliance frameworks (e.g., PCI DSS standards). Key stakeholders at this initial stage focus on securing inter-bank agreements, developing proprietary payment technologies, and managing credit risk associated with corporate lending portfolios. The efficiency and security established upstream fundamentally determine the reliability and speed of all subsequent card transactions globally.

Midstream activities primarily encompass the issuance, processing, and management of the card programs. Issuing banks or non-bank financial institutions handle customer acquisition, card personalization, transaction authorization, and settlement. The distribution channel is often bifurcated into direct and indirect routes. Direct distribution involves major banks selling card programs directly to large corporate clients through dedicated corporate banking relationship managers. Indirect distribution leverages partnerships with FinTech firms, specialized program managers, or integrated technology providers (like ERP vendors) who embed commercial card functionality within their existing platforms, especially targeting the SME segment. This layer is crucial for delivering tailored expense management software and analytics tools that differentiate one card product from another, moving the value proposition beyond mere payment facilitation.

Downstream analysis focuses on the end-users—the corporations and their employees—and the merchants who accept the payments. The ultimate value delivery is the seamless integration of card spend data into the company's financial reporting and accounting systems. Success downstream is measured by the reduction in administrative cost, improvement in compliance rates, and maximization of potential financial rebates for the corporate client. Feedback from end-users regarding ease of use, mobile accessibility, and reporting granularity drives innovation back up the chain. The shift toward direct, highly digitized distribution channels, bypassing traditional banking intermediaries for specialized virtual card products, is becoming increasingly prominent, challenging established network models and emphasizing real-time data flow between all actors.

Commercial Card Market Potential Customers

Potential customers for the Commercial Card Market span the entire spectrum of commerce, encompassing any organization that incurs expenses related to operations, travel, procurement, and vendor payments. The primary demographic includes Small Businesses, Mid-Size Enterprises, and Large Multinational Corporations across all industries, defined by their annual turnover and geographical footprint. Small and Mid-Size Enterprises (SMEs) are particularly attractive potential customers, as they often rely on simplified, integrated solutions to manage growth without heavy internal finance departments. They seek products that blend payment functionality with basic expense reporting, offering higher credit limits than consumer cards and streamlining the reimbursement process for employees. The clear value proposition for SMEs is enhanced control, reduced complexity, and rapid deployment of financial oversight mechanisms, facilitating professionalization of their financial operations.

For Large Enterprises, the potential customer base demands global acceptance, multi-currency capabilities, and highly customized spending controls enforceable across diverse legal entities and geographies. These companies are actively seeking solutions that integrate seamlessly with advanced Enterprise Resource Planning (ERP) systems (such as SAP or Oracle) and facilitate strategic sourcing and accounts payable automation. The focus here is less on basic payment and more on treasury optimization, risk mitigation, and maximizing rebate opportunities tied to vast transaction volumes. Specific industry verticals, such as Logistics, Healthcare, and Technology, represent high-value potential customers due to their complex supply chains and frequent operational or T&E spending needs, driving demand for specialized Fleet Cards or high-security Virtual Cards for digital procurement.

Beyond traditional corporate clients, the market is expanding to include non-traditional buyers like government agencies, educational institutions, and non-profit organizations, all of whom utilize commercial cards for controlled expenditures, grants, and operational spending subject to stringent budgetary compliance rules. Furthermore, the burgeoning "Gig Economy" and platform businesses are emerging as significant potential customers for specialized B2B payment solutions that allow for rapid, traceable disbursements to contractors and freelancers globally. In essence, any entity requiring a secure, traceable, and automated method for managing corporate or institutional expenditure represents a prime target for commercial card providers seeking to expand their penetration beyond traditional T&E usage into comprehensive working capital management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $850.5 Billion |

| Market Forecast in 2033 | $1715.2 Billion |

| Growth Rate | 10.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | American Express, Visa, Mastercard, JPMorgan Chase, Citibank, U.S. Bank, Capital One, Bank of America Merrill Lynch, Comdata, WEX, AirPlus International, Edenred, SBI Cards, ICICI Bank, DBS Bank, HSBC, T&E Cards, PayPal, Stripe, FleetCor Technologies |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Card Market Key Technology Landscape

The Commercial Card Market relies heavily on a cutting-edge technology landscape dominated by cloud-based platforms, advanced security protocols, and sophisticated data analytics. Central to this landscape is the widespread adoption of Application Programming Interfaces (APIs), which enable commercial card platforms to seamlessly integrate with a client's core Enterprise Resource Planning (ERP) or accounting software (like SAP Concur, Oracle, or QuickBooks). This integration is paramount for automated expense reporting and reconciliation, drastically reducing manual intervention. Furthermore, the shift to cloud infrastructure allows card issuers to offer highly scalable solutions, supporting global operations and rapid deployment for clients ranging from startups to multinational conglomerates. The technological imperative is moving beyond simple transaction processing to providing holistic financial intelligence, demanding systems that are interoperable, robust, and accessible via mobile devices for modern, distributed workforces.

Security technologies form the backbone of the commercial card ecosystem, given the large financial volumes and high-risk nature of B2B transactions. Key advancements include tokenization and encryption, which protect sensitive cardholder data by replacing actual account numbers with secure, unique digital tokens, particularly vital for virtual cards and mobile payments. Additionally, Artificial Intelligence (AI) and Machine Learning (ML) are core components of the fraud detection stack, moving past rules-based systems to behavioral analytics that identify atypical spending patterns in real-time. This level of proactive, adaptive security is non-negotiable for large corporate clients who face increasing regulatory scrutiny and exposure to cyber threats. The move toward biometric authentication for high-value transactions further enhances the physical security of card usage.

Another crucial area is the utilization of Distributed Ledger Technology (DLT), or blockchain, though still in its early stages of commercial application. While not yet universally deployed, blockchain holds significant promise for transforming cross-border B2B payments by providing a more transparent, faster, and lower-cost settlement rail, bypassing traditional correspondent banking systems. Alongside DLT, Big Data analytics tools are essential for card issuers to offer value-added services such as optimizing vendor discounts, calculating carbon footprint for sustainability reporting, and predicting client churn. This comprehensive technological stack ensures that the commercial card remains competitive against emerging payment methods and continues its trajectory as the preferred tool for controlled, digital corporate spending management in the highly interconnected global economy.

Regional Highlights

- North America: Market Dominance Driven by Maturity and Innovation

North America, particularly the United States, commands the largest share of the global Commercial Card Market. This dominance is attributed to a mature financial ecosystem, high penetration of digital payment technologies, and a corporate culture that prioritizes automated expense management and robust internal financial controls. The US market benefits from extensive regulatory clarity and aggressive competition among major domestic and international issuers, leading to continuous innovation in rewards, security, and integration capabilities. Adoption rates of purchase cards (P-Cards) and specialized fleet cards are exceptionally high, driven by the size and complexity of large enterprise supply chains. Furthermore, the region is a global leader in the development and deployment of virtual card technology, which is rapidly being adopted for secure B2B e-commerce transactions and digital subscriptions. The strong presence of global payment networks and leading technology firms ensures sustained investment in next-generation commercial finance solutions.

Canada also contributes significantly to the regional growth, exhibiting a steady shift from traditional payment methods to digital commercial solutions, often paralleling trends seen in the US. The market in North America is highly saturated but continues to grow through vertical specialization—offering tailored card programs for sectors like construction, healthcare, and government—and through aggressive targeting of the small and mid-sized business segment. Future growth will be strongly influenced by the adoption of real-time payments infrastructure, which further enhances the utility and immediacy of commercial card disbursements and settlements, reinforcing the region's position as a hub for commercial finance technology.

- Europe: Regulatory Harmonization and Virtual Card Adoption

The European Commercial Card Market is characterized by a high degree of regulatory complexity, particularly due to the EU's Payment Services Directive (PSD2) and interchange fee caps, which have necessitated strategic adaptation by issuers. Despite these challenges, Europe shows robust growth, heavily driven by the need for simplified, compliant, and cross-border expense management solutions within the Eurozone. The Nordic countries and the UK are particularly advanced in digital adoption, exhibiting high uptake of virtual cards for procurement and strong demand for integrated T&E solutions that comply with local VAT and tax reporting requirements. The focus in Europe is increasingly on providing solutions that offer enhanced data analytics for tax compliance and budget control across multiple jurisdictions.

The growth trajectory across Continental Europe is uneven, with Western European countries showing faster digitalization than some Central and Eastern European counterparts. However, the overarching trend is toward consolidation and the harmonization of payment systems, which simplifies the operation of pan-European commercial card programs. The emphasis on open banking initiatives, facilitated by API development, also provides opportunities for challenger banks and fintechs to embed commercial card features directly into business banking platforms, increasing competition and innovation. Data privacy regulations, such as GDPR, also necessitate the highest security and transparency standards for card program data management, differentiating European offerings in the global market.

- Asia Pacific (APAC): Fastest Growth Driven by Digitalization and SMEs

The Asia Pacific region is projected to be the fastest-growing market globally, fueled by rapid economic expansion, massive governmental pushes for digitalization, and a burgeoning SME sector. Countries like China, India, and Southeast Asian nations are transitioning quickly from cash-dominant economies to digital payment ecosystems. This shift creates unprecedented demand for secure, efficient commercial card solutions to manage growing corporate expenditures and complex cross-border trade flows. While the market is highly fragmented by local regulations and diverse payment preferences, the sheer volume of B2B transactions presents enormous untapped potential. Infrastructure investment in mobile banking and real-time payment networks (like India’s UPI or Singapore’s PayNow) is also accelerating the utility of commercial cards integrated with these local rails.

In mature APAC markets like Japan, Australia, and South Korea, adoption mirrors Western trends, focusing on efficiency and integrated financial systems. However, in high-growth economies, the primary driver is enabling basic corporate financial control and reducing the prevalence of manual processing, making simplified commercial card programs highly appealing. Government mandates promoting electronic procurement and reducing financial fraud are strong catalysts. Issuers must navigate complex multi-currency environments and tailor their offerings to local business practices, often resulting in strong partnerships between global networks and local banks to leverage regional market expertise and regulatory compliance mechanisms effectively.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Markets Potential

Latin America presents a significant growth opportunity, characterized by improving regulatory environments and a strong push toward financial inclusion and digitalization, particularly in Brazil, Mexico, and Colombia. Commercial cards are critical tools for companies navigating high inflation and seeking greater control over cross-border spending and local procurement. Challenges include high processing costs and economic volatility, yet the fundamental need for corporate transparency and fraud reduction sustains market momentum. Virtual cards are gaining traction for international B2B payments, bypassing some traditional banking friction.

The Middle East and Africa (MEA) region is exhibiting robust growth, especially within the Gulf Cooperation Council (GCC) countries, driven by vast infrastructure projects and diversification efforts away from oil economies. These markets prioritize secure, Sharia-compliant financial products and require cards that support global travel and complex regional logistics. In Africa, the adoption is more nascent but rapidly accelerating, focusing heavily on prepaid commercial solutions for fleet management and controlling operational spend in regions with underdeveloped banking infrastructure. Regulatory reforms aimed at modernizing payment systems are key determinants of market expansion across the entire MEA landscape.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Card Market.- American Express Company

- Visa Inc.

- Mastercard Incorporated

- JPMorgan Chase & Co.

- Citibank (Citigroup Inc.)

- U.S. Bank (U.S. Bancorp)

- Capital One Financial Corporation

- Bank of America Merrill Lynch

- Comdata Inc.

- WEX Inc.

- AirPlus International

- Edenred SE

- SBI Cards and Payment Services Ltd.

- ICICI Bank Limited

- DBS Bank Ltd.

- HSBC Holdings plc

- T&E Cards (A specialized FinTech player)

- PayPal Holdings, Inc.

- Stripe, Inc.

- FleetCor Technologies, Inc. (now Corpay)

Frequently Asked Questions

Analyze common user questions about the Commercial Card market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Purchase Card (P-Card) and a traditional Corporate T&E Card?

The primary difference lies in purpose and spending cycle. P-Cards are designed for procurement of goods and services (MRO, supplies), focusing on high-volume transactions, lower policy flexibility, and typically require detailed reconciliation with accounts payable. Corporate T&E Cards are strictly for employee travel and entertainment expenses, demanding high flexibility, integration with expense reporting software, and usually have less restrictive limits on single transactions but tighter controls on policy adherence.

How are Virtual Commercial Cards enhancing B2B payment security and automation?

Virtual cards enhance security by generating unique, temporary 16-digit numbers tied to a specific vendor, amount, and time frame, drastically limiting exposure to fraud compared to physical cards. For automation, they integrate directly into AP workflows, enabling touchless payment execution, instantaneous reconciliation data transfer, and automated policy adherence for online subscriptions and supplier payments, reducing manual processes significantly.

What role does AI play in Commercial Card fraud detection?

AI plays a critical role by utilizing machine learning algorithms to analyze massive amounts of historical transaction data and user behavior patterns in real-time. This allows the system to identify subtle anomalies and non-traditional fraudulent activities that rules-based systems miss, offering faster detection, predictive risk scoring, and significantly reducing false positives, thus improving the efficiency and accuracy of loss prevention strategies.

Which factors are restraining the adoption of Commercial Cards in Small and Mid-Size Enterprises (SMEs)?

Restraints for SMEs include perceived complexity of implementation, especially integrating the card data with existing accounting software, concerns over initial setup costs, and reluctance to adopt centralized spending controls due to fear of restricting employee flexibility. Furthermore, some SMEs lack the IT resources or transaction volume required to fully leverage the advanced analytical and rebate features offered by high-tier commercial card programs, leading to slower adoption rates.

How will the global shift toward real-time B2B payments impact the Commercial Card Market?

The shift toward real-time B2B payments will compel commercial card providers to integrate real-time settlement capabilities, particularly for accounts payable functions, enhancing the card's utility beyond credit provision. This integration will make commercial cards more competitive against traditional bank transfers by offering immediate funds access combined with the superior data capture and reconciliation features inherent to card networks, driving innovation in instantaneous transaction processing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager