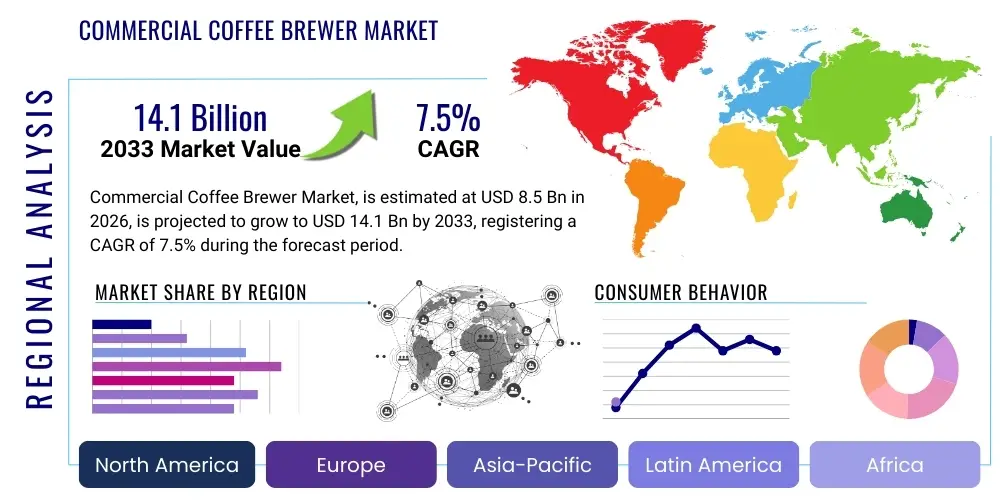

Commercial Coffee Brewer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435810 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Commercial Coffee Brewer Market Size

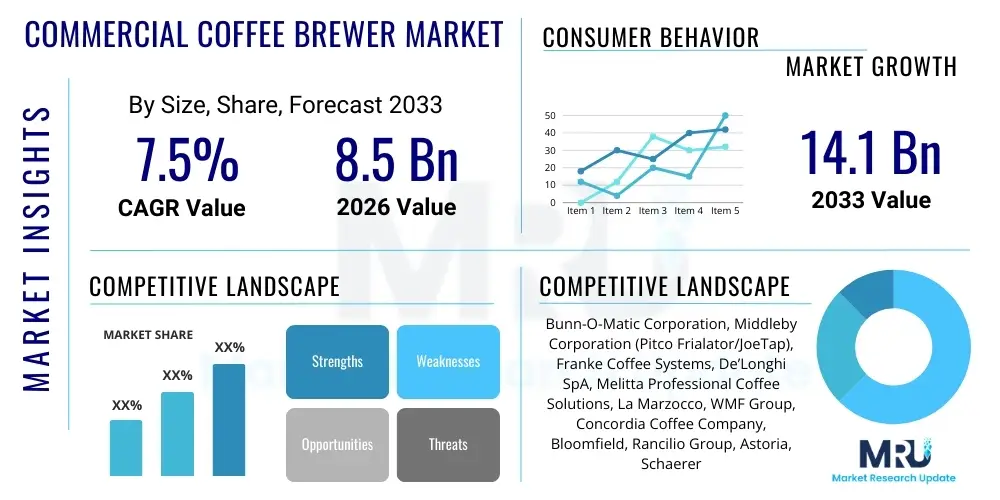

The Commercial Coffee Brewer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. This robust growth trajectory is fueled primarily by the global expansion of the HoReCa (Hotel, Restaurant, and Café) sector and the increasing consumer demand for high-quality, specialty coffee beverages outside the home. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 14.1 Billion by the end of the forecast period in 2033, reflecting substantial investments in automated and high-capacity brewing systems designed for rigorous commercial environments. This valuation underscores the indispensable role that professional coffee equipment plays in enhancing customer experience and operational efficiency across various food service and corporate settings worldwide.

Commercial Coffee Brewer Market introduction

The Commercial Coffee Brewer Market encompasses the sale, distribution, and maintenance of specialized brewing systems designed for high-volume, continuous use in professional and institutional settings, distinct from standard residential appliances. These systems range from traditional batch brewers and espresso machines to advanced automated single-serve units and cold brew preparation equipment. The fundamental product description involves durable construction, precise temperature control, high throughput capacity, and integrated features for consistency and speed, catering to the exacting standards of the modern commercial kitchen or café. Major applications span quick-service restaurants, full-service dining establishments, corporate offices, hotels, hospitals, educational institutions, and dedicated coffee shops, each requiring tailored brewing solutions to meet specific demand patterns and quality expectations. This extensive application base ensures market stability and diversification, making commercial brewers a central investment for businesses prioritizing beverage service.

The primary benefits derived from investing in advanced commercial coffee brewers include significantly improved operational efficiency, reduced labor costs through automation, and, critically, enhanced beverage quality and consistency, which directly impacts customer satisfaction and loyalty. Driving factors for market expansion are multifaceted, anchored by the global proliferation of coffee culture, particularly the surge in demand for specialty and artisanal coffee requiring sophisticated brewing technology. Furthermore, rapid urbanization, the expansion of global food service chains, and technological innovations such as IoT integration for remote monitoring and predictive maintenance are providing substantial impetus. These driving forces compel businesses to continuously upgrade their equipment to remain competitive, ensuring market fluidity and sustaining high levels of equipment replacement and new installation.

The latest generation of commercial brewers is characterized by smart capabilities, including customizable brewing profiles, intuitive touch-screen interfaces, and energy-efficient designs aligned with global sustainability mandates. The market is highly competitive, focusing heavily on durability, modularity, and ease of cleaning to meet stringent health and safety standards. As businesses increasingly view premium coffee service as a critical differentiator, the demand shifts towards high-end, technologically sophisticated machinery capable of producing a wide array of customized beverages rapidly and consistently. This technological sophistication, coupled with the ongoing recovery and expansion of the global hospitality and travel sectors post-pandemic, positions the Commercial Coffee Brewer Market for sustained and accelerated growth over the next decade.

Commercial Coffee Brewer Market Executive Summary

The Commercial Coffee Brewer Market is currently defined by significant business trends centered on automation, connectivity, and customization, driving a robust shift toward super-automatic espresso machines and high-efficiency batch brewers that minimize manual intervention and ensure product consistency. Business trends show major players focusing on comprehensive service contracts, integrating advanced telemetrics for performance optimization, and developing modular designs that allow for easier repairs and upgrades, thereby extending equipment lifespan and improving total cost of ownership for end-users. Segment trends highlight the increasing dominance of the Espresso Machines segment due to the global popularization of espresso-based drinks, alongside a rapid uptake in offices and convenience stores utilizing advanced Single-Serve systems to cater to varied individual preferences and lower waste. Furthermore, sustainability is a growing segment focus, with demand rising for brewers designed to minimize water usage and energy consumption, aligning with broader corporate social responsibility goals.

Regionally, the market exhibits varied dynamics. North America remains the leading consumer base, characterized by high adoption rates of large-capacity drip brewers and advanced automation in quick-service environments, driven by high labor costs and the need for speed. Europe, particularly Western Europe, dictates premiumization trends, showing strong demand for traditional and super-automatic espresso equipment, reflecting its deep-rooted café culture and emphasis on artisanal quality. Meanwhile, the Asia Pacific (APAC) region represents the fastest-growing market, propelled by rapid urbanization, the westernization of dietary habits, the emergence of a strong middle class, and aggressive expansion by international coffee chains, leading to massive investments in new installations across commercial hubs like China and India. The overall market trajectory is one of modernization, where capital expenditure on brewing equipment is increasingly viewed not merely as a necessary utility but as a strategic investment in customer experience and operational resilience, ensuring continued positive market momentum.

AI Impact Analysis on Commercial Coffee Brewer Market

User inquiries concerning the influence of Artificial Intelligence (AI) on the Commercial Coffee Brewer Market predominantly revolve around three key themes: maximizing operational uptime through predictive maintenance, optimizing ingredient usage for cost control, and enhancing customer experience via personalized beverage recommendations. Users frequently question how AI algorithms can monitor component health in real-time to prevent catastrophic failures before they occur, thereby reducing expensive downtime in high-traffic commercial settings. Additionally, there is significant interest in AI's role in inventory management—specifically, using machine learning to analyze consumption patterns and adjust supply chain inputs automatically, minimizing waste of expensive specialty coffee beans. Finally, expectations are high regarding AI-driven personalization, where brewers could potentially analyze customer data (e.g., historical orders, time of day, weather) to suggest custom drink modifications or brewing parameters, leading to highly efficient and tailored service delivery that enhances consumer satisfaction. These inquiries collectively indicate a market expectation for AI to transform commercial brewing from a mechanical process into an intelligent, self-optimizing system.

- AI-driven predictive maintenance monitors vibration, temperature, and pressure fluctuations to forecast potential equipment failure, scheduling maintenance proactively and dramatically improving machine uptime.

- Optimized resource management algorithms use real-time consumption data to fine-tune extraction parameters (grind size, water temperature, flow rate) for maximizing flavor yield and minimizing coffee bean waste.

- Automated inventory and supply chain forecasting utilize machine learning models to predict future coffee and ingredient needs based on historical sales trends, promotional activities, and seasonal variations.

- Personalized customer interaction via AI allows super-automatic machines to store and recall customer preferences, suggesting customized beverages and simplifying the ordering process for repeated clientele.

- Quality control assurance systems employ computer vision and AI to monitor the appearance and consistency of the brew (e.g., espresso crema quality), automatically adjusting machine settings to maintain stringent quality standards.

- Energy consumption optimization utilizes AI to learn peak and off-peak operational times, adjusting heating elements and standby modes to significantly reduce utility costs without compromising readiness.

- Remote diagnostics and troubleshooting are enhanced by AI, allowing technical support to access complex machine data, rapidly identify faults, and, in some cases, resolve minor issues remotely through software adjustments.

DRO & Impact Forces Of Commercial Coffee Brewer Market

The market dynamics of the Commercial Coffee Brewer sector are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the critical Impact Forces guiding strategic investment and technological innovation. The dominant drivers include the global expansion of the HoReCa industry, particularly the rapid proliferation of branded and independent coffee chains demanding high-capacity, reliable equipment to sustain quality across multiple locations. Concurrently, the increasing consumer preference for premium, specialty, and single-origin coffees necessitates advanced brewing technology capable of precise, repeatable extraction parameters—a capability traditional equipment often lacks. These forces push manufacturers towards continuous innovation in automation and digital integration, making the market highly sensitive to shifts in global culinary and beverage consumption trends and resulting in sustained demand for newer, smarter brewing solutions that justify higher initial capital outlay through enhanced operational returns.

However, the market growth faces significant restraints that necessitate careful strategic navigation. The most notable constraint is the substantial initial capital investment required for high-end commercial brewing systems, particularly sophisticated super-automatic espresso machines, which can deter smaller independent businesses or organizations with limited budgets. Furthermore, these complex machines require specialized maintenance and trained technicians, leading to high servicing costs and potentially extended downtime if spare parts are not readily available—a major concern in geographically dispersed operational environments. These restraints highlight a distinct market stratification, where affordability and ease of maintenance often counterbalance the desire for peak performance and full automation, forcing manufacturers to balance technological advancement with total cost of ownership considerations. Addressing these financial and logistical hurdles is paramount for achieving deeper market penetration.

Opportunities within the market are predominantly tied to technological advancements and emerging geographical demand. The burgeoning integration of IoT (Internet of Things) functionality presents vast opportunities for manufacturers to offer value-added services such as preventative maintenance contracts, remote performance optimization, and granular usage data analytics, establishing recurring revenue streams beyond the initial equipment sale. Geographically, the untapped potential in emerging economies across the Asia Pacific and Latin America, driven by expanding middle classes and rapid consumer adoption of Western café culture, represents a major avenue for future growth. Furthermore, the rising demand for energy-efficient and sustainably manufactured equipment—including machines designed for specialized beverages like cold brew and nitro coffee—creates lucrative niche segments for specialized product development. The aggregate impact of these forces indicates a robust market poised for significant value growth, provided manufacturers successfully mitigate high-cost barriers and capitalize on smart technology integration.

Segmentation Analysis

The Commercial Coffee Brewer Market is extensively segmented based on Machine Type, Brewing Technology, End-User Application, and Geography, providing a granular view of demand drivers and technological focus areas within specific market niches. Machine Type segmentation, covering categories such as espresso machines, drip brewers, and single-serve systems, reflects the varied operational needs and beverage focus of commercial entities, with high-volume cafés heavily investing in espresso equipment, while corporate offices often prefer the convenience and variety offered by single-serve solutions. The End-User analysis, differentiating between sectors like HoReCa, Quick Service Restaurants (QSR), and Institutions, demonstrates how purchasing decisions are influenced by throughput requirements and the sophistication of the barista staff available. Understanding these segmentation nuances is crucial for manufacturers to tailor their product offerings and marketing strategies, ensuring optimal alignment with the functional demands of diverse commercial settings, ultimately defining competitive positioning.

- By Machine Type:

- Drip/Filter Coffee Brewers (Batch Brewers)

- Espresso Machines (Traditional, Semi-Automatic, Super-Automatic)

- Single-Serve/Pod Brewers (High-capacity Commercial Systems)

- Cold Brew Systems

- Urn and Satellite Brewers

- By Brewing Technology:

- Traditional Gravity Drip

- Pressure-Based Extraction (Espresso)

- Vacuum/Siphon Brewing

- Immersion Brewing (French Press style commercial units)

- Pulse Brewing Systems

- By End-User Application:

- Hotels, Restaurants, and Cafes (HoReCa)

- Quick Service Restaurants (QSR)

- Corporate Offices and Institutions

- Convenience Stores and Retail

- Hospitals and Healthcare Facilities

- Educational Institutions

- By Distribution Channel:

- Direct Sales (Manufacturer to Large Chain)

- Indirect Sales (Distributors, Wholesalers, Dealers)

- E-commerce Platforms (for parts and accessories)

- By Capacity:

- Low Capacity (Under 5 gallons/hour)

- Medium Capacity (5-15 gallons/hour)

- High Capacity (Over 15 gallons/hour)

Value Chain Analysis For Commercial Coffee Brewer Market

The Value Chain for the Commercial Coffee Brewer Market begins with comprehensive upstream activities focused on raw material sourcing and component manufacturing, crucial elements that determine the final product's quality, durability, and cost structure. Upstream analysis involves the procurement of high-grade stainless steel, specialized heating elements, precision pumps, and sophisticated electronic control systems, often sourced from global specialty suppliers. Manufacturers heavily invest in R&D and design—a critical value-add stage—to integrate features such as precise temperature stability, modular construction, and smart connectivity. Efficient upstream supplier management is vital, as the reliability of internal components, such as boiler systems and grinders, directly impacts the commercial brewer's operational lifespan and total cost of ownership, making quality assurance at the component level a key strategic focus for major market players seeking to minimize warranty claims and enhance brand reputation.

The midstream process is centered on the assembly, quality control, and testing of the finalized brewing systems, where specialized expertise in hydraulics, electrical engineering, and software integration is applied. The distribution channel, which forms the nexus between manufacturing and the end-user, is predominantly indirect, relying heavily on a network of specialized dealers, authorized distributors, and commercial equipment wholesalers. These indirect channels provide crucial value-added services, including financing, installation, on-site training, and mandatory ongoing technical support and maintenance, which are essential for commercial-grade machinery. Direct sales are typically reserved for large, multinational coffee chains or major institutional accounts (e.g., large hotel groups) that require customized bulk orders and integrated supply chain management directly from the manufacturer, streamlining communication and reducing intermediary costs.

Downstream analysis focuses on the end-user deployment and the long-term service ecosystem. The effectiveness of the indirect distribution channel lies in its ability to offer localized support and rapid response times for repairs, minimizing operational downtime for restaurants and cafes. The lifecycle management of commercial brewers, including the provision of certified spare parts and scheduled preventive maintenance, constitutes a significant revenue stream for distributors and manufacturers alike. Furthermore, the downstream activities include extensive operator training to ensure optimal use of sophisticated equipment, translating into consistent beverage quality and reduced user errors. The integrity of this entire value chain—from high-quality raw materials upstream to dependable service downstream—is essential for sustained market competitiveness and maximizing the lifetime value of the commercial brewing assets deployed globally.

Commercial Coffee Brewer Market Potential Customers

The potential customer base for the Commercial Coffee Brewer Market is exceptionally broad and segmented primarily by volume requirement, service sophistication, and operational environment, necessitating highly targeted sales strategies. The primary and highest-volume end-users are encompassed within the HoReCa sector, including high-traffic cafes and full-service restaurants, which require robust espresso machines and high-capacity drip brewers to maintain consistent quality and speed during peak hours. These buyers prioritize reliability, ease of programming, and aesthetic design, as the equipment often operates in visible customer-facing areas. Another critical segment includes Quick Service Restaurants (QSRs) and convenience stores, where the focus shifts toward ultra-fast, super-automatic or single-serve solutions that require minimal staff training and offer consistent output across a geographically dispersed franchise network, prioritizing speed over highly specialized artisanal control.

Beyond the core food service industry, a rapidly growing customer segment includes large corporate offices, co-working spaces, and institutional settings such as universities and hospitals. These environments demand reliable, user-friendly, and often self-service focused brewers, typically favoring bean-to-cup or advanced single-serve systems that offer a wide variety of drinks to cater to diverse employee and visitor preferences throughout the day. The purchasing decision in these institutional sectors is often driven by criteria such as ease of maintenance, energy efficiency, and low consumable waste, rather than artisanal performance. Furthermore, specialized end-users, such as catering companies and event venues, represent an opportunistic customer base requiring highly mobile, often cart-mounted brewing systems capable of delivering high volume in temporary or remote locations, focusing on portability and rapid deployment capabilities. Manufacturers strategically target these diverse customer profiles with product lines ranging from budget-friendly batch brewers to investment-grade, IoT-enabled professional espresso equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 14.1 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bunn-O-Matic Corporation, Middleby Corporation (Pitco Frialator/JoeTap), Franke Coffee Systems, De’Longhi SpA, Melitta Professional Coffee Solutions, La Marzocco, WMF Group, Concordia Coffee Company, Bloomfield, Rancilio Group, Astoria, Schaerer Ltd., Gruppo Cimbali, Fetco, Curtis (Wilbur Curtis Co., Inc.), Nuova Simonelli, Keurig Dr Pepper (for K-Cups Commercial), Thermoplan AG, Eversys SA, Bravilor Bonamat. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Coffee Brewer Market Key Technology Landscape

The technological landscape of the Commercial Coffee Brewer Market is undergoing a rapid transformation, moving beyond simple heating elements and gravity flow toward sophisticated digital control and connectivity, fundamentally driven by the need for superior extraction precision and maximized operational efficiency. A core technological trend is the proliferation of PID (Proportional-Integral-Derivative) temperature control systems, which ensure unparalleled thermal stability throughout the brewing process, a non-negotiable requirement for high-quality espresso and specialty coffee extraction. This precision minimizes batch-to-batch variation, a critical performance metric for multi-location commercial operators. Furthermore, advancements in specialized grinding technology, including ceramic burrs and automatic calibration systems, integrated directly into super-automatic machines, are ensuring optimal particle distribution and consistency, which is foundational to perfect brewing and minimizing waste.

The second major technological shift involves the integration of Smart Technologies and the Internet of Things (IoT). Newer commercial brewers are increasingly equipped with embedded sensors and Wi-Fi connectivity, allowing for real-time remote monitoring of usage statistics, performance metrics, and operational health. This telemetric capability enables manufacturers and operators to utilize predictive maintenance algorithms, dramatically reducing unexpected downtime and streamlining service scheduling, thereby improving the total cost of ownership. User interfaces are also advancing, moving from physical buttons to intuitive, customizable touch-screen displays that allow baristas to easily program and store hundreds of specific drink recipes, including highly complex layered beverages, further enhancing customization capabilities and reducing reliance on extensive manual training.

Sustainability and water management represent another vital area of technological focus. Manufacturers are actively developing high-efficiency boiler designs and optimized heating cycles that significantly reduce energy consumption during both peak operation and standby modes, complying with increasingly strict global energy standards. Advanced water filtration and mineralization systems, often integrated directly within the brewing unit, are becoming standard, ensuring that water quality—a fundamental element of coffee taste—is consistently optimized regardless of local supply variations. Moreover, modular design principles are being adopted to facilitate easier component replacement and recycling, aligning the commercial brewing technology sector with broader circular economy objectives and offering end-users more sustainable and longer-lasting equipment solutions.

Regional Highlights

The global Commercial Coffee Brewer Market displays distinct growth patterns and technological preferences across its major geographic regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA). North America, particularly the United States and Canada, represents a mature market characterized by high consumer spending on away-from-home coffee and significant operational demands for speed and volume. This region shows high penetration of automated and high-capacity batch brewing systems, driven by major quick-service restaurant chains and large corporate catering services. Technological adoption in North America is rapid, focusing heavily on IoT-enabled brewers and predictive maintenance solutions to mitigate high labor costs and ensure maximum operational uptime, making efficiency a central investment criterion.

Europe holds a commanding position in the specialty coffee and espresso segments, where deep-rooted café culture drives demand for highly sophisticated, often semi-automatic and traditional espresso machines that allow for skilled barista control and artistic customization. Countries like Italy, Germany, and the UK prioritize quality, aesthetic design, and sustainability, leading to strong sales of premium, energy-efficient equipment from European manufacturers like Schaerer and Gruppo Cimbali. The market here is defined by premiumization, with consumers expecting meticulously crafted beverages, influencing technological focus towards precision hydraulics and advanced temperature profiling essential for artisanal coffee preparation.

The Asia Pacific (APAC) region is indisputably the fastest-growing market, driven by demographic changes including rapid urbanization, the expansion of Western coffee shop models, and rising disposable incomes, particularly in China, India, and Southeast Asia. This region is witnessing massive installations across new commercial complexes, hotels, and a burgeoning number of local and international coffee chains. The demand is mixed, encompassing both high-volume drip brewers for institutional use and entry-level to mid-range super-automatic espresso machines as consumers rapidly adopt espresso-based drink consumption. This explosive growth necessitates robust and scalable supply chains capable of delivering, installing, and servicing equipment across rapidly developing infrastructure, making logistics and local partnership development key strategic imperatives for market entrants.

- North America: Market dominance in high-volume drip and automated single-serve systems; rapid adoption of IoT for predictive maintenance; high labor costs driving demand for super-automation across QSRs and offices.

- Europe: Strongest demand for premium, traditional, and super-automatic espresso machines; high focus on energy efficiency and sustainable manufacturing; market led by countries with deep-seated café and artisanal coffee traditions.

- Asia Pacific (APAC): Fastest growth trajectory; driven by urbanization and expanding middle class; significant investments in new cafe and QSR installations; increasing demand for both convenience-focused and entry-level espresso equipment.

- Latin America: Important growth market fueled by rising domestic coffee consumption and hospitality sector expansion; strategic importance as a coffee bean producing region often leading to localized sourcing advantages and market familiarity with brewing processes.

- Middle East and Africa (MEA): Emerging market driven by tourism, luxury hotel developments, and expanding corporate infrastructure; high demand for high-end, aesthetic, and automated machines in luxury hospitality settings.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Coffee Brewer Market, encompassing major manufacturers of traditional, super-automatic, and specialized brewing systems, along with companies specializing in related commercial coffee equipment and technology integration. These entities drive innovation in areas such as precision temperature control, automation, energy efficiency, and IoT connectivity, maintaining global market competitiveness through strategic acquisitions and robust distribution networks tailored to the demanding HoReCa and institutional sectors.- Bunn-O-Matic Corporation

- Middleby Corporation (Pitco Frialator/JoeTap)

- Franke Coffee Systems

- De’Longhi SpA

- Melitta Professional Coffee Solutions

- La Marzocco

- WMF Group

- Concordia Coffee Company

- Bloomfield

- Rancilio Group

- Astoria

- Schaerer Ltd.

- Gruppo Cimbali

- Fetco

- Curtis (Wilbur Curtis Co., Inc.)

- Nuova Simonelli

- Keurig Dr Pepper (for K-Cups Commercial)

- Thermoplan AG

- Eversys SA

- Bravilor Bonamat

- Crem International

- Hario (Commercial Equipment Division)

- Jura Elektroapparate AG (Professional Line)

- Dalla Corte S.r.l.

- Lamar Holding Company

- Marco Beverage Systems

- Poursteady

- Sanremo Coffee Machines

- Modbar

- Synesso

Frequently Asked Questions

Analyze common user questions about the Commercial Coffee Brewer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the Commercial Coffee Brewer Market?

The Commercial Coffee Brewer Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.5% over the forecast period spanning 2026 to 2033, driven primarily by globalization of coffee culture and operational advancements in the HoReCa sector globally.

Which commercial coffee brewer segment is expected to see the fastest adoption rate?

The Super-Automatic Espresso Machines segment is anticipated to witness the fastest adoption, especially in corporate offices and QSRs, due to their high consistency, minimal requirement for specialized staff training, and integrated functionality like grinding and milk frothing, maximizing efficiency.

How is IoT technology impacting commercial coffee brewer maintenance and operations?

IoT integration allows commercial brewers to transmit real-time performance data to operators and service providers. This enables advanced predictive maintenance scheduling, reduces costly unplanned downtime, and facilitates remote diagnostics, significantly improving operational uptime and lowering long-term maintenance expenditure.

Which geographic region currently dominates the demand for commercial brewing equipment?

North America currently holds the largest market share, characterized by high demand for sophisticated, large-capacity batch brewers and highly automated systems used across extensive quick-service restaurant networks and institutional catering services, prioritizing speed and capacity.

What are the primary restraints affecting the growth of the Commercial Coffee Brewer Market?

The primary restraints include the high initial capital investment required for technologically advanced espresso and super-automatic systems, coupled with the ongoing elevated costs associated with specialized maintenance, spare parts, and ensuring technical expertise for repairs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager