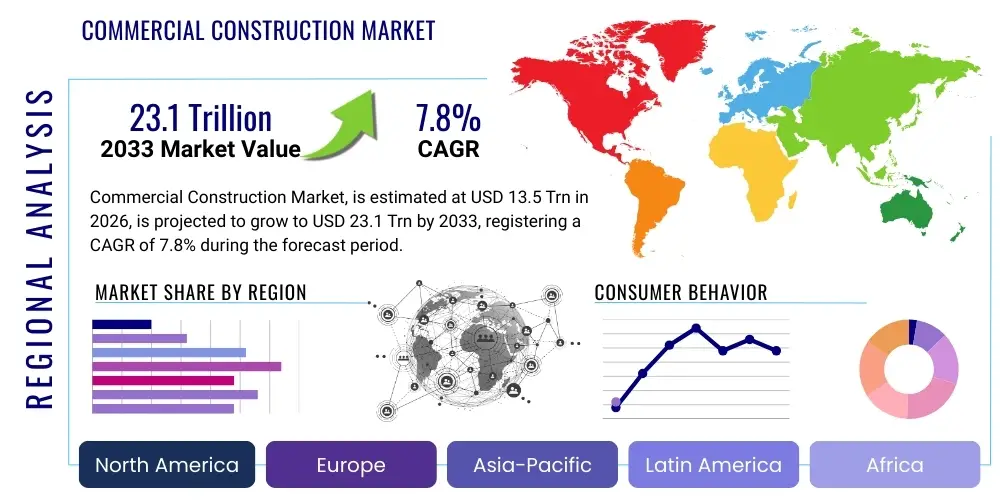

Commercial Construction Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438161 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Commercial Construction Market Size

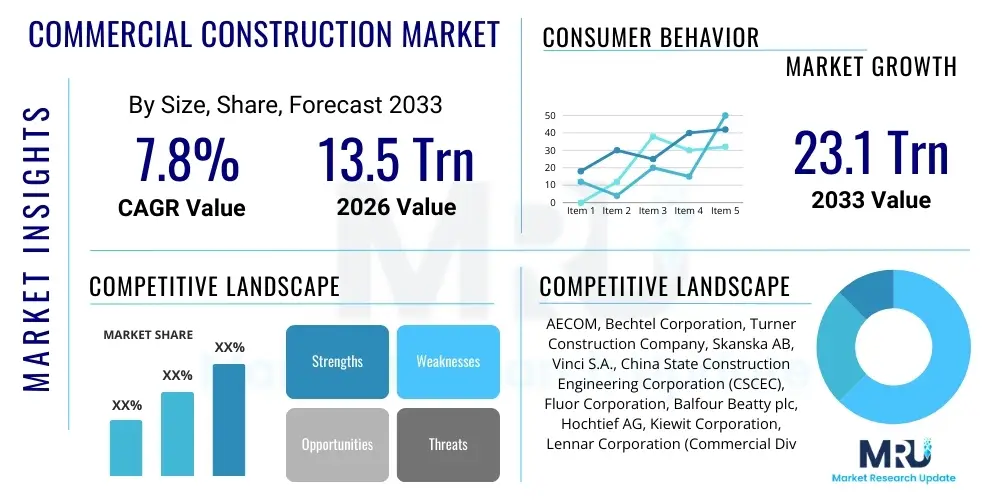

The Commercial Construction Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $13.5 Trillion in 2026 and is projected to reach $23.1 Trillion by the end of the forecast period in 2033.

Commercial Construction Market introduction

The Commercial Construction Market encompasses all building activities related to non-residential infrastructure designed for business purposes, including office buildings, retail centers, hospitality establishments, healthcare facilities, educational institutions, and data centers. The market size is expanding globally, driven by rapid urbanization, substantial foreign direct investment (FDI) in emerging economies, and the continuous need for modern, sustainable, and technologically integrated workspaces that adhere to stringent green building standards. Major applications involve ground-up construction, renovation, and retrofitting projects across metropolitan areas. The primary benefits derived from this sector include economic stimulation through job creation, enhanced regional infrastructure capacity, and the provision of specialized facilities required by modern service economies.

Key driving factors fueling the expansion of this market include favorable government policies supporting infrastructure development, historically low interest rates enabling large-scale commercial real estate investments, and the global trend toward digital transformation, which necessitates the construction of specialized facilities like advanced server farms and flexible co-working spaces. Furthermore, demographic shifts, particularly the migration of populations into urban and suburban centers, increase the demand for localized commercial amenities and services, directly spurring new construction starts. The integration of Building Information Modeling (BIM) and modular construction techniques is also accelerating project timelines and improving overall efficiency, further enhancing market attractiveness.

Commercial Construction Market Executive Summary

The Commercial Construction Market is characterized by robust business trends driven by significant investments in mixed-use developments and the modernization of existing structures to comply with contemporary energy efficiency mandates. Post-pandemic recovery has redirected investment focus towards specialized commercial asset classes, such as logistics warehouses and high-tech manufacturing plants, supplementing traditional office and retail demand. Regional trends indicate that Asia Pacific (APAC) will maintain its dominant growth trajectory, powered by massive infrastructure programs in China, India, and Southeast Asian nations, while North America and Europe prioritize sophisticated retrofitting projects incorporating smart building technologies. Segment trends reveal strong momentum in the healthcare and data center construction sectors, driven respectively by aging global populations and the proliferation of cloud computing services, overshadowing relatively slower growth in conventional retail construction, which is undergoing substantial transformation due to e-commerce penetration. Sustainability remains a central theme, dictating material sourcing and design practices across all segments.

AI Impact Analysis on Commercial Construction Market

User inquiries regarding the integration of Artificial Intelligence (AI) in commercial construction primarily revolve around efficiency gains, risk mitigation, and predictive maintenance capabilities. Common questions address how AI can optimize project scheduling, minimize material waste, and enhance on-site safety protocols. There is significant interest in understanding the tangible Return on Investment (ROI) derived from AI-powered tools such as generative design software and autonomous equipment operation. Key concerns often center on the initial capital investment required for AI implementation, the necessary workforce reskilling, and the challenges associated with integrating disparate data streams from various project phases. Users generally expect AI to fundamentally shift the industry from reactive management to proactive optimization, leading to faster delivery times and substantially lower operational costs throughout the asset lifecycle.

The core expectation is that AI will address chronic industry inefficiencies, particularly in managing complex supply chains and predicting potential project delays. AI-driven predictive analytics tools are sought after for real-time risk assessment, allowing project managers to identify and mitigate bottlenecks before they escalate. Furthermore, users are keen on leveraging machine learning algorithms to automate repetitive design tasks, thereby freeing up specialized architects and engineers to focus on higher-value creative and strategic planning activities. This operational shift promises to enhance productivity and maintain competitiveness in a market increasingly constrained by skilled labor shortages.

The deployment of computer vision powered by AI is also rapidly gaining traction for continuous quality control and safety monitoring on large-scale construction sites. These systems analyze video feeds and sensor data to detect deviations from design specifications, track workforce compliance with safety gear requirements, and identify hazardous conditions instantly. This move towards automated surveillance and compliance enforcement is expected to dramatically reduce the frequency and severity of workplace accidents, fulfilling the industry's need for enhanced safety measures while also improving insurance claim profiles. This technological integration transforms safety management from periodic inspections into continuous, intelligent monitoring.

- AI-driven generative design optimizes structural integrity and material usage, reducing design iteration cycles significantly.

- Predictive maintenance schedules for operational commercial buildings are refined using machine learning on sensor data, minimizing downtime and extending asset life.

- Autonomous construction equipment and robotic systems, guided by AI, enhance precision in complex tasks like welding, masonry, and site surveying.

- AI tools analyze project management data to forecast budgetary overruns and schedule deviations with high accuracy, enabling proactive intervention.

- Computer vision enhances site safety monitoring by identifying non-compliance issues (e.g., lack of PPE) and optimizing material flow and logistics in real-time.

- AI facilitates the creation of highly detailed and accurate Digital Twins, improving facility management and energy consumption optimization post-construction.

DRO & Impact Forces Of Commercial Construction Market

The market is significantly influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. Key drivers include global economic recovery, low-interest rate environments in developed nations facilitating large-scale lending for construction projects, and accelerated urbanization, particularly in emerging economies requiring vast amounts of new commercial space. Restraints often manifest as volatility in raw material pricing (steel, cement, timber), persistent supply chain disruptions exacerbated by geopolitical events, and severe labor shortages, particularly for highly skilled trades. Opportunities lie primarily in embracing sustainable building technologies (green construction), digital transformation (BIM, modular construction), and public-private partnerships (PPPs) that de-risk large infrastructure investments. These forces create a dynamic environment where adaptation through technological leverage is critical for sustained competitive advantage.

Drivers are predominantly macro-economic and demographic. The increasing global demand for modern infrastructure that can support digital commerce and advanced services necessitates substantial commercial development. Government initiatives focused on economic stimulus through infrastructure spending further propel the market forward, especially in specialized sectors like data centers and logistics parks. Furthermore, the mandatory need for existing commercial stock to comply with increasingly strict global Environmental, Social, and Governance (ESG) standards drives extensive retrofitting and renovation activity, providing a stable, recurring revenue stream for construction firms specializing in sustainable upgrades and energy efficiency improvements.

Conversely, restraints impose significant operational friction. Regulatory complexity and lengthy permitting processes often introduce unpredictability into project timelines. The substantial capital expenditure required for adopting advanced technologies like large-scale prefabrication facilities acts as a barrier for smaller market participants. Moreover, the cyclical nature of the real estate market means that commercial construction is highly susceptible to global financial instability, with sudden changes in investor confidence leading to project deferrals or cancellations. Successfully navigating these restraints requires robust financial planning, diversification across construction segments, and strategic vertical integration to secure material sourcing and minimize logistical vulnerabilities, thereby transforming potential threats into manageable risks.

Opportunities center around innovation and specialization. The growing acceptance of modular and off-site construction techniques provides a unique opportunity to address labor shortages while simultaneously improving quality control and speeding up project completion. The global push for Net Zero emissions has created a burgeoning market for specialized green construction expertise, including zero-energy buildings and advanced facade systems. Firms that can successfully integrate advanced data analytics and predictive modeling into their service offerings are poised to capture premium market segments seeking optimized operational performance and reduced long-term maintenance costs. The transition towards smart cities also necessitates commercial buildings that are natively integrated with municipal networks, opening up new design and engineering requirements.

Segmentation Analysis

The Commercial Construction Market is comprehensively segmented based on the type of construction, the end-user sector, and the specific offering (new construction vs. renovation). This structured analysis allows for a precise understanding of market dynamics within high-growth verticals. The end-user segmentation, particularly focusing on healthcare, hospitality, and data centers, highlights areas of inelastic demand driven by long-term demographic and technological megatrends. Geographically, segmentation underscores the disparities in market maturity and regulatory frameworks across key regions, dictating preferred construction methods and investment priorities. Understanding these segment dynamics is crucial for strategic resource allocation and competitive positioning within this capital-intensive industry.

- Type:

- New Construction (Greenfield projects, focused on large-scale expansion)

- Renovation & Retrofitting (Modernization, energy efficiency upgrades, change of use projects)

- End-Use Sector:

- Office Space (Traditional offices, corporate campuses, co-working facilities)

- Retail & Leisure (Shopping centers, malls, entertainment complexes, theaters)

- Hospitality (Hotels, resorts, conference centers, short-term rental facilities)

- Healthcare (Hospitals, clinics, medical office buildings, specialized research facilities)

- Education (Universities, K-12 schools, specialized training centers)

- Infrastructure/Heavy Civil (Related supporting commercial infrastructure like transportation hubs)

- Data Centers & Technology (Server farms, cloud infrastructure hubs, mission-critical facilities)

- Industrial & Logistics (Warehouses, distribution centers, light manufacturing commercial spaces)

- Material Used:

- Concrete

- Steel

- Wood

- Glass & Aluminum

- Construction Method:

- Traditional Stick-Built

- Modular & Prefabricated Construction

- 3D Printing (Emerging application for small commercial structures)

- Regional Analysis:

- North America (U.S., Canada, Mexico)

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, South Korea, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (UAE, Saudi Arabia, South Africa, Rest of MEA)

Value Chain Analysis For Commercial Construction Market

The Commercial Construction Value Chain is highly fragmented, commencing with upstream activities dominated by raw material suppliers and specialized equipment manufacturers. Upstream analysis focuses on the procurement of critical resources such as structural steel, concrete aggregates, specialized HVAC systems, and architectural finishes. Efficiency in this stage is paramount, as fluctuations in commodity prices directly impact project profitability. Key players in this segment are global material producers and large machinery suppliers who establish long-term contracts with major construction firms to ensure supply stability and preferential pricing. The adoption of sustainable materials and resource-efficient supply logistics represents a competitive differentiator at the upstream level, optimizing environmental performance and reducing overall transportation costs.

The core of the value chain involves design, engineering, and construction execution. This midstream segment is characterized by the integration of technology, including BIM for clash detection and collaborative design, and the use of sophisticated project management software. Direct engagement involves general contractors (GCs) and specialized subcontractors responsible for site preparation, foundation work, structural erection, and mechanical, electrical, and plumbing (MEP) installations. The selection of distribution channels—whether direct sourcing from manufacturers or utilization of large regional distributors—varies significantly based on project scale and material type. Direct channels are often preferred for high-value custom components, while indirect channels provide greater flexibility and inventory management for standardized goods.

Downstream activities center on the commissioning, handover, and subsequent facility management and maintenance of the completed commercial asset. Downstream customers are the end-user organizations, property developers, or real estate investment trusts (REITs) who utilize or lease the building. A critical component of the downstream value is the provision of integrated Facility Management (FM) services, which are often provided by specialized service providers or integrated divisions of the primary construction firm. The effectiveness of the value chain is increasingly measured by the asset's performance during its operational life, necessitating seamless data transfer (e.g., Digital Twin data) from the construction phase to the operational phase, ensuring that the building delivers projected energy efficiency and occupant comfort levels.

Commercial Construction Market Potential Customers

Potential customers in the Commercial Construction Market are diverse, ranging from large multinational corporations seeking new headquarters to government agencies requiring public amenities, and specialized real estate developers focused on niche markets. End-users or buyers typically fall into categories based on asset ownership and purpose. Real Estate Investment Trusts (REITs) and institutional investors constitute a major segment, as they commission massive commercial projects (e.g., skyscraper office complexes, regional shopping centers) with the primary goal of long-term rental income generation and capital appreciation. These customers demand highly efficient, Class A assets with built-in flexibility and technological readiness to maximize tenant appeal and command premium lease rates. Their procurement decisions prioritize reliability, adherence to budget, and high quality of construction to minimize future operating expenses.

Another significant group comprises private corporate entities (e.g., tech companies, financial institutions, pharmaceutical firms) building specialized, owner-occupied facilities such as corporate campuses, research laboratories, and proprietary data centers. For these buyers, the construction project is strategic; it must align perfectly with their core business operations, necessitating high customization and often stringent regulatory compliance (e.g., clean room standards or specific security protocols). Decisions are often driven less by initial cost and more by long-term strategic value, operational resilience, and the ability of the construction partner to integrate highly specialized mechanical and IT infrastructure into the building shell.

Furthermore, government and public sector bodies (municipalities, state agencies, educational boards) are essential customers, funding projects like public hospitals, libraries, educational facilities, and administrative offices. Procurement for these entities is typically managed through competitive bidding processes, emphasizing transparency, local employment benefits, and compliance with public accessibility and environmental mandates. Finally, specialized asset developers focusing on high-growth areas—such as logistics park developers or specialized healthcare facility operators—are increasingly important, seeking construction partners capable of rapidly deploying standardized, yet technically complex, commercial structures across multiple geographies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $13.5 Trillion |

| Market Forecast in 2033 | $23.1 Trillion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AECOM, Bechtel Corporation, Turner Construction Company, Skanska AB, Vinci S.A., China State Construction Engineering Corporation (CSCEC), Fluor Corporation, Balfour Beatty plc, Hochtief AG, Kiewit Corporation, Lennar Corporation (Commercial Division), Bouygues Construction, PCL Construction, Laing O’Rourke, DPR Construction, Swinerton, Gilbane Building Company, Clark Construction Group, Jacobs Engineering Group, Shapoorji Pallonji Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Construction Market Key Technology Landscape

The commercial construction technology landscape is undergoing a dramatic paradigm shift, moving away from traditional methods towards highly integrated digital ecosystems aimed at enhancing efficiency, accuracy, and sustainability. Building Information Modeling (BIM) remains foundational, providing a collaborative, object-oriented 3D model that centralizes project data and facilitates clash detection across architectural, structural, and MEP disciplines. Advanced BIM integration, often linked with generative design tools, allows for rapid scenario testing and optimization of building performance before physical construction begins. This digital reliance accelerates decision-making and significantly reduces rework rates on site, addressing critical cost drivers within the industry.

The adoption of modular and prefabricated construction techniques represents a pivotal technological change, allowing large components or entire volumetric units to be manufactured in controlled factory environments. This off-site approach mitigates risks associated with adverse weather, improves quality control through industrialized processes, and drastically reduces construction waste. The integration of robotics and automation in these factories, including automated welding and assembly, further increases throughput and consistency. This technology is particularly favored for high-volume, standardized commercial structures such as hotels, student housing, and specific industrial facilities, offering rapid deployment capabilities critical for time-sensitive projects.

Furthermore, on-site technology deployment involves the use of Internet of Things (IoT) sensors, drones, and advanced data analytics platforms. IoT devices monitor equipment utilization, environmental conditions (e.g., concrete curing temperatures), and structural health in real-time. Drones equipped with high-resolution cameras perform rapid site surveys and progress monitoring, comparing current site conditions against the BIM model to ensure accurate execution. These data streams feed into proprietary construction management software powered by AI, enabling predictive risk assessment and optimizing labor distribution, thereby transforming construction sites into highly data-driven operational environments that maximize resource efficiency and safety compliance.

Regional Highlights

The global Commercial Construction Market exhibits significant regional variations influenced by economic maturity, regulatory environments, and prevailing technological adoption rates. North America and Europe, characterized by highly mature markets, emphasize renovation, retrofitting, and the construction of high-value, sustainable assets, driven by stringent energy efficiency mandates and a focus on upgrading existing urban infrastructure. Investment in these regions heavily targets specialized sectors like high-security data centers and state-of-the-art healthcare facilities, requiring advanced technical expertise and compliance with complex safety standards. The construction industry in these areas leads the way in adopting advanced digital technologies such as Digital Twins and sophisticated BIM Level 3 protocols.

Asia Pacific (APAC) stands out as the primary engine for global market growth, fueled by rapid urbanization and massive government-led infrastructure investments, particularly in emerging economies like India and Indonesia. This region focuses heavily on new construction across all commercial segments, including large-scale mixed-use developments, new corporate headquarters, and extensive logistics networks necessary to support booming e-commerce activities. While investment volume is highest, technological adoption is often hybrid, with traditional construction methods coexisting alongside the rapid integration of modern prefabrication techniques to meet the immense scale and speed requirements of megaprojects. China remains a dominant force, although recent emphasis has shifted towards high-quality, green construction practices.

Latin America and the Middle East & Africa (MEA) represent high-potential, albeit often volatile, growth regions. The MEA market, specifically the Gulf Cooperation Council (GCC) nations, benefits from ambitious national transformation plans (e.g., Saudi Vision 2030, UAE Centennial 2071) that allocate substantial capital to tourism, hospitality, and massive commercial real estate projects designed to diversify economies away from reliance on hydrocarbons. Latin America’s market growth is more localized, influenced heavily by commodity cycles and political stability, with concentrated activity in key metropolitan areas focusing on retail and logistics infrastructure development. Both regions are increasingly becoming adopters of global construction standards and modularization technologies to overcome local logistical challenges and accelerate project delivery timelines.

- North America (NA): Dominant in technological adoption and high-value specialization. Focus is shifting towards sustainable commercial office retrofits and the expansion of hyperscale data centers. Stringent building codes drive demand for high-performance materials and advanced safety systems. Canada and the U.S. lead in BIM implementation and green building certifications.

- Europe: Characterized by mandatory energy performance standards (Net Zero targets), propelling significant investment in the refurbishment of commercial buildings. Germany and the UK are strong markets for advanced manufacturing facilities and specialized healthcare construction. Modular construction is gaining acceptance as a solution to urban density constraints and labor shortages across Western Europe.

- Asia Pacific (APAC): Highest volume growth globally due to unprecedented urbanization rates and substantial FDI flow into infrastructure. India and Southeast Asia (Vietnam, Philippines) are key beneficiaries of manufacturing supply chain diversification, boosting industrial and logistics construction. China focuses on sophisticated, vertically integrated commercial complexes and transit-oriented development (TOD) projects.

- Latin America (LATAM): Market activity is concentrated in Brazil and Mexico, driven by retail segment growth and expansion of logistics infrastructure supporting international trade. Political stability and economic fluctuations pose regional risks, but there is growing demand for modern, secure commercial assets, particularly in the financial services sector.

- Middle East and Africa (MEA): Large-scale, government-backed megaprojects define the GCC construction market, heavily focused on hospitality, entertainment, and commercial assets designed to attract global tourism and foreign investment. Africa’s growth is nascent but promising, centered around commercial hubs like South Africa and Nigeria, driven by increasing consumer spending and nascent technological infrastructure requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Construction Market.- AECOM

- Bechtel Corporation

- Turner Construction Company

- Skanska AB

- Vinci S.A.

- China State Construction Engineering Corporation (CSCEC)

- Fluor Corporation

- Balfour Beatty plc

- Hochtief AG

- Kiewit Corporation

- Lennar Corporation (Commercial Division)

- Bouygues Construction

- PCL Construction

- Laing O’Rourke

- DPR Construction

- Swinerton

- Gilbane Building Company

- Clark Construction Group

- Jacobs Engineering Group

- Shapoorji Pallonji Group

- Tishman Speyer

- Brookfield Properties

- Cushman & Wakefield (Project Management)

- JLL (Integrated Facilities Management)

- Suffolk Construction

- Hensel Phelps

- Mortenson Construction

- The Walsh Group

- Structure Tone Organization

- Whiting-Turner Contracting Co.

Frequently Asked Questions

Analyze common user questions about the Commercial Construction market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the current growth in the global Commercial Construction Market?

Growth is primarily driven by accelerating global urbanization, substantial public and private infrastructure investment, and the increasing demand for specialized commercial assets, particularly in the data center, logistics, and healthcare sectors. The need for retrofitting existing buildings to meet modern sustainability and technological standards is also a major growth driver, especially in mature economies.

How is modular construction impacting project timelines and costs?

Modular construction significantly impacts the market by moving large portions of the building process off-site into controlled factory environments. This reduces project timelines by up to 50% compared to traditional methods, minimizes on-site disruption, improves quality consistency, and mitigates risks associated with weather delays, leading to more predictable overall project costs and faster occupancy rates for commercial tenants.

Which regional market holds the greatest potential for new commercial construction investment?

The Asia Pacific (APAC) region currently holds the greatest potential for new commercial construction investment, fueled by rapid economic development, high population density, and massive state-sponsored infrastructure programs in countries like India, China, and Southeast Asian nations. This region is seeing extensive new development across the retail, office, and logistics segments.

What role does BIM (Building Information Modeling) play in modern commercial projects?

BIM serves as the essential digital foundation for modern commercial projects, enabling comprehensive 3D modeling, collaborative design between diverse stakeholders, accurate quantity takeoffs, and advanced clash detection prior to construction. It drastically reduces errors, optimizes resource allocation, and facilitates the creation of a 'Digital Twin' for long-term facility management and operational efficiency post-handover.

What are the primary restraints affecting profitability in the commercial construction sector?

The primary restraints affecting profitability include persistent volatility in raw material prices (steel, concrete), complex and often unpredictable global supply chain disruptions, an intensifying shortage of skilled labor across various trades, and the rising costs associated with integrating advanced sustainable and technological systems to meet rigorous green building mandates.

How are commercial buildings adapting to post-pandemic remote work trends?

Commercial buildings are adapting by shifting away from dense, fixed office layouts towards highly flexible, agile, and technology-rich co-working and hybrid office models. New construction emphasizes superior HVAC systems, touchless technologies, increased natural light, and biophilic design elements to prioritize occupant health and maximize flexibility, attracting tenants who value adaptable, high-quality workspace.

What is the significance of green building standards in commercial development?

Green building standards (such as LEED or BREEAM) are critical as they certify a building’s operational efficiency and environmental performance. These standards are increasingly mandated by regulations and investor ESG criteria, leading to lower operating expenses, reduced carbon footprints, higher asset valuations, and enhanced marketability to environmentally conscious tenants seeking reduced utility costs.

Which end-use sector is expected to show the fastest growth rate in the forecast period?

The Data Centers & Technology sector is anticipated to exhibit the fastest growth rate in the commercial construction market throughout the forecast period. This acceleration is driven by the unrelenting global demand for cloud computing services, Artificial Intelligence infrastructure, and 5G network expansion, necessitating rapid deployment of mission-critical, highly specialized facilities globally.

How does automation and robotics contribute to commercial construction site efficiency?

Automation and robotics contribute by executing repetitive, hazardous, or high-precision tasks such as bricklaying, welding, site surveying, and demolition. This increases construction speed, ensures consistent quality, significantly enhances worker safety by removing them from high-risk environments, and allows human laborers to focus on complex decision-making and project management roles.

What is the role of Public-Private Partnerships (PPPs) in the commercial construction market?

PPPs are vital in financing and executing large-scale, complex commercial projects that serve public interests, such as major transportation hubs, large healthcare campuses, or educational facilities. PPPs distribute financial risk, leverage private sector efficiency and innovation, and provide access to long-term government contracts, ensuring the successful delivery of critical civic infrastructure that often includes significant commercial components.

How are geopolitical factors influencing the supply chain for commercial construction materials?

Geopolitical factors, including trade disputes, sanctions, and regional conflicts, introduce significant volatility and risk into the supply chain. They necessitate diversification of material sourcing and compel construction firms to implement advanced supply chain resilience strategies, often involving regionalized sourcing or locking in long-term procurement contracts to mitigate price spikes and logistical bottlenecks for essential materials like steel and specialized electronics.

What technological advancement is crucial for optimizing facility management post-construction?

The creation and utilization of the Digital Twin is crucial for optimizing facility management post-construction. A Digital Twin is a virtual replica of the built asset, fed by real-time IoT data, allowing facility managers to simulate operational scenarios, predict equipment failures, optimize energy consumption dynamically, and conduct remote diagnostics and maintenance planning, drastically reducing operational expenditure.

What is the current trend regarding investment in the commercial retail construction segment?

Investment in the traditional retail construction segment is shifting away from large, enclosed shopping malls towards smaller, experience-focused retail centers and mixed-use developments that integrate residential and commercial components. There is substantial growth in the construction of logistics and fulfillment centers required to support e-commerce, rather than traditional brick-and-mortar storefronts, reflecting changing consumer behavior.

How does the Commercial Construction Market interact with the specialized Industrial Construction segment?

The markets overlap significantly, particularly in the construction of hybrid facilities such as light manufacturing plants, complex warehouses, and high-tech R&D facilities. Commercial construction expertise is often required for the office, administrative, and employee amenity components within large industrial parks, ensuring compliance with commercial codes and aesthetic standards alongside specialized industrial requirements.

What are the challenges associated with adopting AI and automation on construction sites?

Challenges include the high initial capital investment required for specialized hardware and software, the need for extensive workforce retraining and upskilling, difficulties in ensuring interoperability between diverse proprietary systems, and the persistent challenge of capturing, cleaning, and standardizing the massive amounts of data generated on dynamic construction sites for effective AI analysis.

What are the key differences between new construction and renovation projects in terms of market dynamics?

New construction is highly dependent on macro-economic conditions and land availability, offering high revenue potential but higher cyclical risk. Renovation and retrofitting projects, conversely, are driven by regulatory compliance (e.g., energy mandates) and demographic shifts, offering more stable, less cyclical revenue streams focused on improving asset lifespan, energy efficiency, and modernizing interiors of existing Class B/C assets.

How are sustainability goals affecting the selection of construction materials?

Sustainability goals are compelling developers to prioritize low-carbon materials such as mass timber, recycled steel, and low-embodied carbon concrete. Material selection is now heavily scrutinized based on lifecycle assessments, demanding transparency from suppliers regarding their manufacturing processes and transportation impact to help projects achieve stringent certification requirements and ESG mandates.

What is meant by the "Skilled Labor Shortage" restraint in commercial construction?

The Skilled Labor Shortage refers to a widespread deficit of experienced tradespeople, including specialized engineers, welders, electricians, and plumbers, often due to an aging workforce and insufficient influx of young talent. This shortage increases labor costs, extends project timelines, and often necessitates greater reliance on prefabrication, automation, and outsourced international labor to maintain project schedules.

How important is cybersecurity in the construction of modern commercial buildings, particularly data centers?

Cybersecurity is critically important, moving beyond just IT infrastructure to include operational technology (OT) systems within the building itself. For data centers, robust physical and digital security protocols are paramount to protect sensitive client data and maintain uptime. Building Management Systems (BMS) are increasingly targeted, requiring advanced network segmentation and continuous monitoring to prevent unauthorized access or system disruption, making security a core construction requirement.

What role do real estate investment trusts (REITs) play in commercial construction demand?

REITs are major drivers of demand, particularly for large, income-generating commercial properties such as office towers, hospitals, and logistics parks. They provide the necessary substantial capital for new development, prioritizing high-quality construction that maximizes long-term rental income, attracts premium tenants, and maintains high occupancy rates, thereby acting as significant anchor clients for general contractors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager