Commercial Dipping Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433930 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Dipping Cabinets Market Size

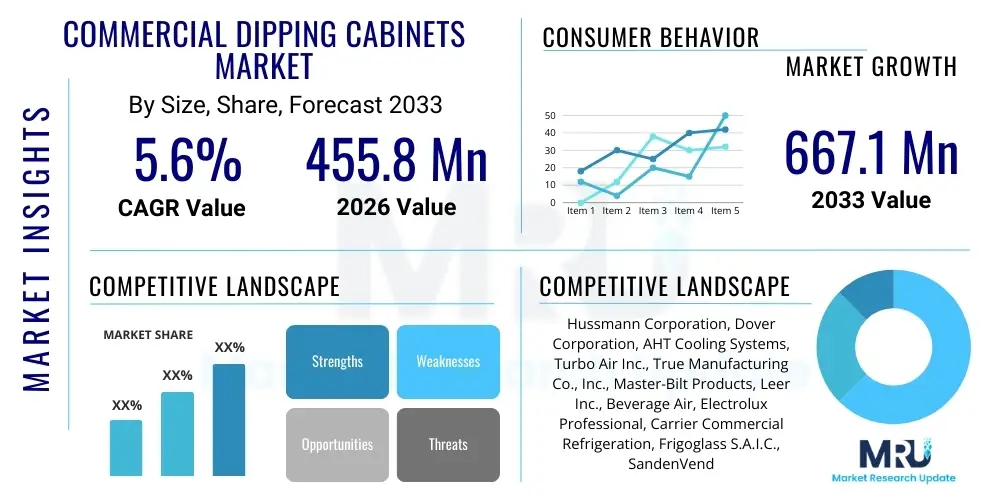

The Commercial Dipping Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.6% between 2026 and 2033. The market is estimated at USD 455.8 Million in 2026 and is projected to reach USD 667.1 Million by the end of the forecast period in 2033.

Commercial Dipping Cabinets Market introduction

The Commercial Dipping Cabinets Market encompasses specialized refrigeration units designed primarily for the optimal storage, temperature maintenance, and visual merchandising of scoopable frozen desserts such as ice cream, gelato, sorbet, and frozen yogurt. These cabinets are engineered to maintain stringent temperature uniformity, typically ranging from -10°F to -20°F (-23°C to -29°C), which is crucial for preserving the texture, consistency, and flavor profile of high-quality frozen products before serving. The defining characteristic of these units is their top-down accessibility, allowing operators to "dip" directly from the containers, enhancing the customer experience and ensuring product freshness. Key design elements include tempered glass lids or canopies for maximum visibility, forced-air refrigeration systems, and robust insulation to minimize temperature fluctuations, especially during periods of frequent lid opening.

Major applications of commercial dipping cabinets span the entire foodservice and retail spectrum, predominantly serving dedicated ice cream parlors, boutique gelato shops, quick-service restaurants (QSRs), convenience stores, mass grocery retail environments, and institutional cafeterias. The demand is heavily influenced by the global expansion of the HoReCa (Hotel, Restaurant, and Catering) sector and the rising consumer preference for premium, artisanal, and customized frozen dessert offerings. Furthermore, the integration of dipping cabinets into high-traffic retail spaces serves as a potent sales driver, capitalizing on impulse purchasing behavior through attractive and well-lit product displays.

The primary benefit of utilizing specialized dipping cabinets, as opposed to standard commercial freezers, lies in their ability to present products aesthetically while maintaining perfect serving temperature and preventing freezer burn or inconsistent hardening. Driving factors for market growth include increasing disposable incomes globally, leading to higher consumption of discretionary food items, coupled with technological advancements focused on energy efficiency, the use of natural refrigerants (such as R-290 propane), and digital temperature management systems. These factors collectively push operators to upgrade older, less efficient units, thereby sustaining consistent demand within the commercial refrigeration equipment sector.

Commercial Dipping Cabinets Market Executive Summary

The Commercial Dipping Cabinets Market demonstrates robust growth driven by favorable business trends, particularly the revitalization and expansion of the global hospitality and foodservice industries post-pandemic, coupled with a fundamental shift toward experiential dining and high-quality frozen dessert consumption. Business trends highlight a strong emphasis on cabinets offering superior merchandising capabilities, such as LED lighting, customizable branding options, and enhanced accessibility features to optimize workflow in busy environments. Furthermore, manufacturers are focusing heavily on developing models that align with stringent global environmental regulations, primarily concerning refrigerant use and energy consumption standards (e.g., California’s energy efficiency mandates and EU F-gas regulations). This technological pivot towards hydrocarbon refrigerants (R-290) and enhanced thermal insulation materials (like vacuum insulated panels) is restructuring manufacturing investment and product offering strategies across the competitive landscape.

Regionally, North America and Europe currently represent the most mature markets, characterized by high adoption rates, a proliferation of large chain ice cream businesses, and a consistent focus on replacing aging equipment with newer, energy-efficient models. However, the highest growth impetus is anticipated from the Asia Pacific (APAC) region, particularly driven by rapid urbanization, the emergence of a middle class with increasing spending power in countries like China and India, and the rapid westernization of dietary habits leading to increased consumption of packaged and scoopable ice cream products. Latin America and the Middle East & Africa (MEA) are also showing strong potential, fueled by tourism growth and investment in organized retail infrastructure, although these markets often prioritize lower initial cost over advanced features like smart monitoring systems.

Segmentation trends indicate a clear preference for specialized dipping cabinets segmented by display style, with Curved Glass models dominating sales due to their superior product visibility and aesthetic appeal. In terms of capacity, models designed for 12 to 16 standard three-gallon tubs (ranging from 10 to 18 cubic feet) hold the largest market share, balancing storage needs with a manageable physical footprint for smaller commercial kitchens and retail fronts. The End-User segment remains dominated by dedicated Ice Cream Parlors and Gelato Shops, which require the highest precision in temperature control and aesthetic presentation. Future segment growth will likely be concentrated in cabinets featuring advanced connectivity for remote diagnostics and inventory management, aligning with broader IoT trends in commercial kitchen operations.

AI Impact Analysis on Commercial Dipping Cabinets Market

User queries regarding the impact of Artificial Intelligence (AI) on commercial dipping cabinets primarily revolve around enhancing operational efficiency, minimizing product spoilage, and enabling proactive maintenance. Key themes users are exploring include: the capability of AI-driven sensors to predict compressor failure before it occurs; optimizing defrost cycles based on real-time environmental humidity and usage patterns; automating inventory tracking through visual recognition of tub levels; and leveraging machine learning algorithms to correlate sales data with temperature set points to maintain ideal product consistency during peak demand periods. The core expectation is that AI will transform these static refrigeration assets into smart, predictive components of a networked commercial kitchen, leading to significant reductions in energy consumption and labor costs associated with manual monitoring and repairs.

- AI facilitates predictive maintenance by analyzing vibration and thermal signatures of compressors and fans, anticipating component failure, and scheduling service proactively.

- Machine learning algorithms optimize cooling cycles, dynamically adjusting refrigeration levels based on door opening frequency and ambient kitchen temperature, ensuring consistent product texture.

- AI-powered visual sensors enable real-time inventory monitoring, alerting operators when specific flavors are running low and generating automated reorder suggestions.

- Demand forecasting integration allows dipping cabinets to prepare for anticipated high-volume sales (e.g., weekends, holidays) by slightly adjusting temperatures in advance for optimal serving readiness.

- Automated regulatory compliance tracking, wherein AI systems log and report temperature data continuously, ensuring adherence to HACCP standards without manual intervention.

- Enhanced energy management through intelligent load shedding and optimization of electrical consumption during non-peak hours.

DRO & Impact Forces Of Commercial Dipping Cabinets Market

The dynamics of the Commercial Dipping Cabinets Market are governed by powerful interplay of Driving factors, Restraints, and Opportunities (DRO), collectively manifesting as significant Impact Forces influencing strategic decisions across the value chain. A primary driver is the accelerating consumer demand for frozen desserts, especially premium and artisanal varieties, which necessitates high-quality, specialized storage solutions that standard freezers cannot provide. Coupled with this is the robust global expansion of the foodservice sector, particularly QSR chains, dedicated dessert shops, and large-scale catering operations, all requiring reliable dipping cabinets as foundational equipment. Furthermore, regulatory pressures mandating the adoption of energy-efficient refrigeration technologies, specifically the phase-out of high Global Warming Potential (GWP) refrigerants, are compelling large-scale equipment replacement cycles, thereby driving demand for new, compliant units.

Conversely, the market faces notable restraints. The initial high capital expenditure required for commercial-grade dipping cabinets, particularly those incorporating advanced features like smart diagnostics and hydrocarbon refrigerants, presents a significant barrier to entry for small, independent operators. Operational costs, particularly electricity consumption, remain a constraint, although manufacturers are actively working to mitigate this through advanced insulation and variable speed compressors. Supply chain volatility, encompassing fluctuations in raw material prices (steel, copper, specialized insulation chemicals) and geopolitical instability affecting international trade logistics, further complicates manufacturing efficiency and potentially increases final product cost for end-users.

Opportunities for sustained growth are centered on technological innovation and market penetration. The adoption of IoT (Internet of Things) functionality, enabling remote monitoring and data analysis, offers significant operational cost savings and predictive service capabilities, appealing strongly to multi-unit operators. Additionally, market expansion into rapidly developing economies in APAC and MEA, driven by rising disposable incomes and changing dietary patterns, provides fertile ground for new installations. Furthermore, capitalizing on niche segments, such as compact, high-design cabinets for specialty coffee shops or modular units for temporary events and food trucks, allows manufacturers to diversify their portfolio beyond traditional ice cream parlors, ensuring resilience against market fluctuations and reinforcing overall growth.

Segmentation Analysis

The Commercial Dipping Cabinets market is comprehensively segmented across several dimensions, including capacity, design type, material, and critical end-user applications, allowing stakeholders to precisely target specific operational needs within the foodservice industry. Design Type segmentation—encompassing flat glass, curved glass, and specialized vertical or horizontal configurations—is particularly crucial as it dictates visibility and product presentation, directly impacting impulse sales. Curved glass models typically command a premium due to enhanced aesthetic appeal and superior light reflection, making them favored by high-end gelato and specialty dessert shops. Capacity remains a fundamental differentiator, with high-volume operators prioritizing 16-24 tub capacity units for efficient stock holding, while smaller cafes opt for 8-12 tub models that balance merchandising with space constraints, reflecting the diverse scale and throughput of potential buyers globally.

- By Type:

- Flat Glass Dipping Cabinets

- Curved Glass Dipping Cabinets

- Hybrid (Storage and Display) Cabinets

- By Capacity:

- Up to 10 Tubs

- 10 to 16 Tubs

- 17 Tubs and Above

- By Refrigerant Type:

- HFC (Hydrofluorocarbons - transitional)

- HFO (Hydrofluoroolefins - lower GWP)

- Natural Refrigerants (R-290, CO2)

- By End-User:

- Dedicated Ice Cream Parlors and Gelato Shops

- Quick Service Restaurants (QSR)

- Hotels, Cafes, and Restaurants (HoReCa)

- Supermarkets and Convenience Stores

- Institutional Food Service (Schools, Hospitals)

Value Chain Analysis For Commercial Dipping Cabinets Market

The value chain for commercial dipping cabinets begins with upstream activities involving the sourcing and processing of core raw materials, predominantly stainless steel (for durability and hygiene), copper tubing (for refrigerant lines), specialized insulation foams (polyurethane, or advanced VIPs), and high-quality tempered glass for display components. Suppliers in this phase are subject to fluctuating commodity prices and rigorous quality standards, particularly concerning chemical composition for insulation and environmental compliance regarding refrigerant purity. Manufacturers then engage in complex assembly, focusing on the integration of refrigeration circuits (compressors, condensers, evaporators), electronic controls, and ensuring structural integrity. Crucially, successful manufacturing requires adherence to specific regional energy efficiency certifications (e.g., ENERGY STAR in North America or EcoDesign directives in Europe), demanding sophisticated R&D investment.

The distribution channel represents a critical downstream element. This market is served both through direct sales and a complex network of indirect channels. Direct sales are often utilized for large, custom orders placed by major multinational QSR or frozen dessert chains, allowing for tailored specifications and negotiated bulk pricing. However, the majority of the market relies on indirect distribution, involving specialized commercial kitchen equipment distributors, certified refrigeration wholesalers, and third-party logistics (3PL) providers. These distributors are essential as they provide localized technical support, installation services, and crucial after-sales maintenance, which is vital for complex refrigeration machinery. The effectiveness of this distribution network is key to ensuring timely delivery and operational longevity of the cabinets across geographically dispersed end-user locations.

The final phase involves the relationship with the end-user and post-purchase support. Maintenance and repair services form an increasingly valuable part of the overall value chain, often handled by certified third-party service organizations or in-house technical teams employed by the primary distributor. Furthermore, financial services, such as leasing and financing options provided by either the manufacturer or specialized equipment financing firms, play a significant role in lowering the entry barrier for small and medium-sized enterprises (SMEs). Optimization of the value chain is focused on reducing logistics costs, enhancing component modularity for easier repair, and integrating digital tools to improve efficiency from raw material tracking to predictive maintenance alerts.

Commercial Dipping Cabinets Market Potential Customers

The primary consumers and end-users of commercial dipping cabinets are diverse entities within the foodservice industry that require specialized, ultra-low temperature storage coupled with high-impact product presentation. The most prominent buyers are dedicated Ice Cream Parlors and Gelato Shops, both independent boutiques and large franchise chains, whose entire business model revolves around the visual quality and ideal serving temperature of their products. These customers prioritize precise temperature stability, high-end display aesthetics (e.g., anti-fog glass, bright LED lighting), and maximum tub visibility to drive impulse purchases. The competitive nature of this segment means buyers often seek highly customizable units that can be integrated seamlessly with interior design.

Another major customer segment includes the Quick Service Restaurants (QSRs) and Fast Casual dining establishments, which utilize dipping cabinets to support their dessert menus, often focusing on standardizing the offering across multiple locations. For QSRs, cabinets must emphasize reliability, ease of cleaning, high operational throughput, and often slightly larger storage capacity to handle peak demand volumes. Hotels, Cafes, and independent Restaurants (part of the broader HoReCa sector) also represent significant buyers, although their needs vary greatly, often requiring smaller, more aesthetically refined cabinets suitable for smaller counter spaces or high-end dining environments where presentation is paramount. Finally, Supermarkets and Convenience Stores utilize dipping cabinets strategically, placing them near checkout lanes or high-traffic areas to maximize impulse sales, prioritizing ruggedness and energy efficiency for continuous operation in a retail setting.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 455.8 Million |

| Market Forecast in 2033 | USD 667.1 Million |

| Growth Rate | 5.6% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hussmann Corporation, Dover Corporation, AHT Cooling Systems, Turbo Air Inc., True Manufacturing Co., Inc., Master-Bilt Products, Leer Inc., Beverage Air, Electrolux Professional, Carrier Commercial Refrigeration, Frigoglass S.A.I.C., SandenVendo, IFI S.p.A., Carpigiani Group, Ugolini S.p.A., Tekna Cold, ISA S.p.A., Excellence Industries, Fogel USA, Kelvinator Commercial |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Dipping Cabinets Market Key Technology Landscape

The technology landscape for commercial dipping cabinets is undergoing a rapid evolution, primarily driven by twin objectives: achieving superior energy efficiency and integrating advanced digital capabilities. Core refrigeration technology is shifting decisively away from traditional high Global Warming Potential (GWP) HFC refrigerants toward natural refrigerants, most notably R-290 (Propane). R-290 systems require redesigned, slightly larger heat exchangers and sophisticated leak detection mechanisms but offer substantial reductions in environmental impact and often improved energy performance due to their superior thermodynamic properties. Manufacturers are also heavily investing in variable speed compressors (VSCs) and electronically commutated motors (ECMs) for fans, which allow the cooling system to modulate output based on heat load, significantly reducing power consumption compared to older, single-speed, on/off compressors, thereby meeting increasingly stringent environmental regulations.

Beyond the core mechanics, advanced materials science is enhancing cabinet performance. The use of Vacuum Insulated Panels (VIPs) in cabinet walls is replacing traditional polyurethane foam in high-end models. VIPs offer dramatically improved thermal resistance, allowing manufacturers to reduce wall thickness, increase internal capacity relative to the cabinet footprint, and minimize heat gain, thereby slashing energy requirements. This focus on insulation works in conjunction with advanced defrost management systems, which utilize adaptive algorithms to determine the optimal timing for defrost cycles, preventing excessive ice buildup without unnecessarily heating the product, maintaining both efficiency and optimal dessert quality.

The most transformative technologies currently entering the market relate to connectivity and digital interface design. Modern dipping cabinets often feature integrated IoT sensors that monitor temperature, humidity, power consumption, and equipment status in real-time. This data is relayed via Wi-Fi or cellular networks to cloud platforms, enabling remote monitoring and diagnostics, which is highly beneficial for multi-location operators seeking centralized oversight. Touchscreen interfaces are replacing analog controls, providing operators with precise digital temperature settings, automated logging capabilities for HACCP compliance, and instructional guides for maintenance. This shift toward smart, connected refrigeration equipment positions the dipping cabinet as a highly efficient, data-generating asset within the modern smart kitchen ecosystem.

Regional Highlights

Regional dynamics play a crucial role in shaping demand and technological adoption within the Commercial Dipping Cabinets Market, reflecting differences in consumer behavior, regulatory frameworks, and market maturity levels. North America stands out as a highly mature market characterized by a strong focus on replacement demand and technological upgrades. Strict energy efficiency standards, such as those imposed by the Department of Energy (DOE) and state-level mandates (e.g., California), necessitate continuous innovation in refrigeration components, driving the rapid adoption of R-290 and IoT-enabled smart cabinets. The high concentration of major QSR chains and large-scale ice cream franchises ensures steady, high-volume demand for reliable, standardized equipment across the region.

Europe represents another key region, particularly leading in the adoption of natural refrigerants, primarily due to the European Union’s ambitious F-Gas Regulation aimed at phasing down HFCs. Countries like Italy, Germany, and the UK boast high concentrations of artisanal gelato and dessert shops, which prioritize cabinets offering exquisite aesthetic design, high-precision temperature control, and premium materials. Italian manufacturers, in particular, hold a strong influence globally due to their traditional expertise in crafting visually appealing, high-performance display cabinets. The market here is balanced between high-end custom units and mass-produced energy-efficient models catering to large supermarket chains.

The Asia Pacific (APAC) region is projected to be the engine of future market growth, fueled by rapid economic expansion, increasing urbanization, and the corresponding growth in organized retail and foodservice sectors across China, India, and Southeast Asia. While initial investment costs are often a major factor, leading to higher demand for cost-effective, durable models, there is an accelerating trend towards premiumization in urban centers. As the cold chain infrastructure improves throughout the region, the penetration of high-quality frozen desserts increases, creating significant opportunities for new cabinet installations. Latin America and the Middle East & Africa (MEA) present emerging market opportunities, heavily influenced by seasonal tourism and population growth. These regions show volatile demand, often seeking robust, easily maintainable cabinets suitable for diverse climatic conditions and fluctuating power grids, though the adoption of advanced, smart technology remains comparatively slower than in developed economies.

- North America: Focus on regulatory compliance (R-290, ENERGY STAR), large QSR chain standardization, and replacement cycles for aging equipment.

- Europe: Strong demand for aesthetically superior design (especially for gelato), driven by F-Gas compliance and high density of independent specialty dessert shops.

- Asia Pacific (APAC): Highest growth potential driven by urbanization, expanding middle class, investment in new organized retail infrastructure, and increasing cold chain reliability.

- Latin America (LATAM): Growth linked to tourism and regional foodservice expansion; demand often focuses on cost-efficiency and robust construction.

- Middle East & Africa (MEA): Market penetration tied to high temperatures requiring powerful cooling capabilities; growth driven by hospitality sector investment and mall development.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Dipping Cabinets Market.- Hussmann Corporation (A Panasonic Company)

- Dover Corporation

- AHT Cooling Systems GmbH (A Daikin Company)

- Turbo Air Inc.

- True Manufacturing Co., Inc.

- Master-Bilt Products

- Leer Inc.

- Beverage Air

- Electrolux Professional

- Carrier Commercial Refrigeration

- Frigoglass S.A.I.C.

- SandenVendo

- IFI S.p.A.

- Carpigiani Group

- Ugolini S.p.A.

- Tekna Cold

- ISA S.p.A.

- Excellence Industries

- Fogel USA

- Kelvinator Commercial

Frequently Asked Questions

Analyze common user questions about the Commercial Dipping Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a dipping cabinet and a standard commercial freezer?

A dipping cabinet is specifically engineered for display and serving, maintaining a precise, slightly warmer temperature (-10°F to -20°F) necessary for optimal scoopability and presentation, using sophisticated forced-air circulation to ensure uniform consistency and prevent crystallization, whereas a standard commercial freezer is designed purely for bulk storage at ultra-low temperatures.

Which refrigerant types are becoming mandatory in new commercial dipping cabinet installations?

Due to stringent environmental regulations, particularly the EU F-Gas regulations and US state-level mandates, natural refrigerants like R-290 (propane) and R-600a (isobutane) are rapidly replacing high Global Warming Potential (GWP) HFCs. R-290 offers superior thermodynamic efficiency and significantly reduced environmental impact, making it the preferred standard for new energy-efficient models.

How does IoT integration enhance the operational efficiency of dipping cabinets?

IoT integration enables real-time remote monitoring of temperature stability, energy consumption, and component diagnostics. This connectivity facilitates predictive maintenance by identifying potential failures before they occur, optimizes defrost cycles based on actual usage, ensures regulatory compliance through automated data logging, and minimizes product spoilage across multi-unit operations.

What are the key factors driving the higher demand for Curved Glass Dipping Cabinets?

Curved glass models are highly favored because they offer enhanced aesthetic appeal and superior product visibility, acting as highly effective merchandising tools. The design maximizes the sightline to the frozen product, encouraging impulse purchasing, and often incorporates specialized anti-fog technology and LED lighting to showcase premium frozen desserts optimally.

What major capacity ranges dominate the current Commercial Dipping Cabinets market?

The market is primarily dominated by mid-sized capacity units ranging from 10 to 16 standard three-gallon tubs. This range offers an ideal balance between sufficient inventory display for high-traffic stores and a manageable physical footprint, catering effectively to the needs of both small independent shops and regional franchise operations.

What impact does insulation technology, such as VIPs, have on cabinet performance?

Vacuum Insulated Panels (VIPs) offer significantly higher thermal resistance compared to traditional polyurethane foam, allowing manufacturers to achieve superior energy efficiency and temperature stability. The use of VIPs permits thinner cabinet walls, increasing internal usable volume without expanding the external footprint, leading to lower operating costs and better space utilization.

Which geographical region is expected to exhibit the fastest growth rate in this market?

The Asia Pacific (APAC) region, driven primarily by strong economic growth in countries like China and India, rapid urbanization, and significant investment in organized foodservice and retail infrastructure, is projected to show the highest compound annual growth rate (CAGR) during the forecast period.

What strategic role do specialized distributors play in the Commercial Dipping Cabinets value chain?

Specialized commercial kitchen equipment distributors are crucial as they provide localized technical support, essential after-sales service and maintenance, expert installation, and often offer financing solutions. They bridge the gap between global manufacturers and diverse local end-users, ensuring equipment longevity and optimal operational performance.

How is the rise of artisanal frozen desserts affecting cabinet design specifications?

The rise of artisanal and high-end gelato requires cabinets with extremely precise, consistent temperature control to maintain the delicate texture and lower fat content typical of these products. This has led to increased demand for cabinets with advanced digital temperature management systems, high-quality Italian design aesthetics, and specialized air-flow systems to prevent temperature stratification.

What are the primary challenges related to the raw material sourcing for dipping cabinets?

The primary challenges include volatile global commodity prices for stainless steel and copper, essential components for the cabinet structure and refrigeration lines. Additionally, manufacturers must manage the supply chain risk associated with procuring specialized insulation chemicals and components for advanced refrigeration systems while navigating complex international trade tariffs and logistics.

Do dipping cabinets require specialized electrical power setups compared to standard freezers?

While many smaller dipping cabinets operate on standard voltage (115V/230V single-phase), high-capacity or aggressively cooled units, particularly those using advanced compressors and R-290 systems, often require dedicated circuits and sometimes three-phase power, necessitating professional electrical installation to ensure safe and efficient operation.

What role does the HoReCa sector play in driving demand for compact dipping cabinets?

The HoReCa (Hotel, Restaurant, Catering) sector drives demand for compact and aesthetically refined dipping cabinets, especially in high-end hotels or smaller cafes. These customers require units that blend seamlessly with decor, offer adequate display for dessert selections, and fit within limited counter space, focusing on design over maximum tub capacity.

How do manufacturers ensure adequate temperature consistency despite frequent lid openings?

Manufacturers utilize powerful forced-air circulation systems combined with specialized cold-wall construction and advanced temperature recovery controls. Some premium models also feature an anti-sweat perimeter heat system and precise internal air baffles to maintain a consistent cold curtain, minimizing temperature ingress during serving periods.

What are the sustainability benefits associated with the use of Variable Speed Compressors (VSCs)?

VSCs significantly enhance sustainability by modulating power consumption based on the actual cooling load, running only at the required speed rather than cycling fully on and off. This drastically reduces overall energy use, lowers noise output, extends the lifespan of the compressor, and provides superior temperature stability compared to traditional fixed-speed units.

Is there a noticeable market segment for customized branding and exterior finishes?

Yes, customization is a key market trend, particularly among large franchise chains and boutique operators who utilize dipping cabinets as central branding elements. Manufacturers offer options for custom exterior wraps, specialized color finishes, LED lighting schemes, and internal branding panels to ensure the cabinet aligns perfectly with the brand identity and store aesthetic.

What regulations govern the disposal of older commercial dipping cabinet units?

Disposal is strictly governed by environmental regulations, primarily concerning the safe removal and reclamation of hazardous refrigerants (especially older HFCs) and proper disposal of electronic components and contaminated insulation foam. Regulations like the EPA’s Section 608 in the US mandate certified technicians handle refrigerant recovery to prevent atmospheric release.

How has the COVID-19 pandemic affected the long-term outlook for this market?

While the pandemic initially caused supply chain disruption and temporary slowdowns in QSR expansion, the long-term outlook remains positive. The market is rebounding strongly driven by pent-up demand in the HoReCa sector, increased investment in optimized kitchen efficiency, and accelerated interest in grab-and-go dessert solutions requiring reliable display equipment.

What role does anti-fog technology play in the dipping cabinet market?

Anti-fog technology, typically achieved through specialized tempered glass or low-level heating elements around the glass frame, is critical for maintaining product visibility. In high-humidity environments, this technology ensures that the glass remains clear, maximizing the cabinet’s effectiveness as a visual merchandising tool and improving the overall customer experience.

Are smaller, countertop dipping cabinets a significant market segment?

Yes, smaller, countertop units (often 4-8 tub capacity) constitute a growing niche segment. These are popular for cafes, convenience stores, and secondary retail locations where space is highly constrained but where offering a limited, high-quality frozen dessert selection is desired. They prioritize compact size, high visibility, and portability.

What is the typical expected lifespan of a commercial dipping cabinet?

With proper routine maintenance, a high-quality commercial dipping cabinet is typically expected to have an operational lifespan ranging from 10 to 15 years. Lifespan is heavily dependent on component quality, adherence to manufacturer maintenance schedules, and the operational environment (e.g., ambient temperature and humidity exposure).

How do manufacturers address potential microbial contamination in dipping cabinets?

Hygiene is ensured through design features such as coved internal corners for easy cleaning, the use of sanitary, corrosion-resistant stainless steel interiors, removable service panels, and, in some advanced models, anti-microbial coatings on frequently touched surfaces. Compliance with HACCP guidelines drives the incorporation of features that simplify sanitation procedures.

What is the impact of changing consumer dietary preferences (e.g., vegan) on cabinet requirements?

The increasing popularity of vegan and dairy-free frozen desserts, which often have different freezing points and consistency profiles than traditional ice cream, drives demand for cabinets with even finer temperature adjustment capabilities. Operators may require separate, highly segmented cabinets to maintain the integrity of these specialized products optimally.

Is financing or leasing of dipping cabinets common practice in the market?

Yes, financing and operational leasing programs are common, especially for small and medium-sized enterprises (SMEs) and new business startups. These financial options help lower the significant initial capital outlay associated with purchasing specialized, high-performance commercial refrigeration equipment, accelerating market penetration.

How does the choice of exterior material (e.g., stainless steel vs. galvanized steel) affect price and durability?

Stainless steel exteriors, particularly food-grade 304 stainless steel, are preferred for high-end dipping cabinets due to their superior corrosion resistance, durability, and ease of cleaning, commanding a higher price. Galvanized steel or painted metal may be used in back panels or lower-cost models, offering a more economical option with potentially shorter longevity in high-humidity settings.

What is the significance of the Energy Star rating for dipping cabinet purchasing decisions?

The Energy Star rating is highly significant, particularly in North America, serving as a consumer assurance of reduced energy consumption. For commercial buyers, Energy Star compliance translates directly into lower long-term operating costs and often qualifies the purchase for governmental rebates or utility incentives, strongly influencing procurement decisions by large chains.

How are advancements in LED lighting influencing dipping cabinet sales?

Modern LED lighting systems offer brighter, more uniform illumination with significantly lower heat generation than traditional fluorescent bulbs. This enhances the visual appeal of the desserts without compromising temperature stability, while also providing substantial energy savings and a longer operational life, making them a standard feature in contemporary cabinets.

What considerations are paramount when selecting a dipping cabinet for a humid, tropical environment?

In humid, tropical environments, paramount considerations include highly effective anti-fog features, reinforced insulation to combat rapid heat ingress, and robust dehumidification capabilities. Cabinets must also feature high-efficiency condensers designed to operate reliably under continuous high ambient temperature stress to prevent system overload and maintain optimal product temperature.

Describe the current trends regarding noise reduction in commercial dipping cabinets.

Noise reduction is a growing concern, particularly for cabinets installed in customer-facing areas of cafes or small retail spaces. Trends include using acoustically dampened compartments for compressors, implementing quieter Variable Speed Compressors (VSCs), and utilizing low-noise electronically commutated (EC) fan motors to minimize operational sound without sacrificing cooling power.

What differentiates a gelato cabinet from a standard ice cream dipping cabinet?

Gelato cabinets (Pozzetti style or specialized display) are typically designed to operate at slightly warmer temperatures than standard ice cream cabinets (-5°F to +5°F) to ensure the distinctive soft texture of gelato. They often feature integrated air flow management to prevent crystallization and may use metal lids or opaque covers to protect the product from light and air exposure, prioritizing quality over visual display.

How does the integration of digital display screens affect customer engagement?

Digital display screens integrated into or mounted near the dipping cabinet enhance customer engagement by providing dynamic information such as flavor descriptions, ingredient lists, allergy warnings, pricing, and promotional videos. This modernizes the retail experience and streamlines operations by eliminating the need for frequent manual updates of physical signage.

What is the significance of the "reverse cycle defrost" technology?

Reverse cycle defrost technology utilizes the refrigeration system in reverse, briefly circulating hot gas through the evaporator coil to melt frost quickly and efficiently, minimizing the temperature rise of the stored product. This leads to faster recovery times and better overall product quality compared to traditional electric resistance defrost methods, which can heat the ice cream surface.

In the segmentation by Type, why do Flat Glass Dipping Cabinets remain popular despite the rise of Curved Glass?

Flat glass dipping cabinets remain popular primarily due to their typically lower manufacturing cost, structural simplicity, and superior stackability or modularity in certain retail environments. They often suit standard freezer applications requiring a clear, simple product view, especially in high-volume, cost-conscious QSR or convenience store settings.

How does the expansion of food truck and mobile catering services influence the market?

The expansion of mobile catering services drives demand for smaller, lightweight, and highly durable dipping cabinets that can withstand transport vibrations and operate efficiently with generator or limited battery power. This niche focuses on compact designs, robust locking mechanisms, and high energy efficiency to maximize operational flexibility.

What are the implications of the high initial capital cost for small businesses?

The high initial capital cost represents a significant entry barrier for small independent operators, often forcing them to choose between purchasing older, less efficient used equipment or utilizing financing/leasing options. This constraint underscores the market need for entry-level models that balance quality refrigeration with lower upfront investment.

What certifications are essential for Commercial Dipping Cabinets sold in the European market?

Cabinets sold in the European market must comply with CE marking requirements, which address safety, health, and environmental protection. Specific critical certifications include the EcoDesign Directive (for energy efficiency), the F-Gas Regulation (for refrigerant type), and relevant EN standards for electrical safety and hygiene (e.g., HACCP compliance).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager