Commercial Dishwasher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435586 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Commercial Dishwasher Market Size

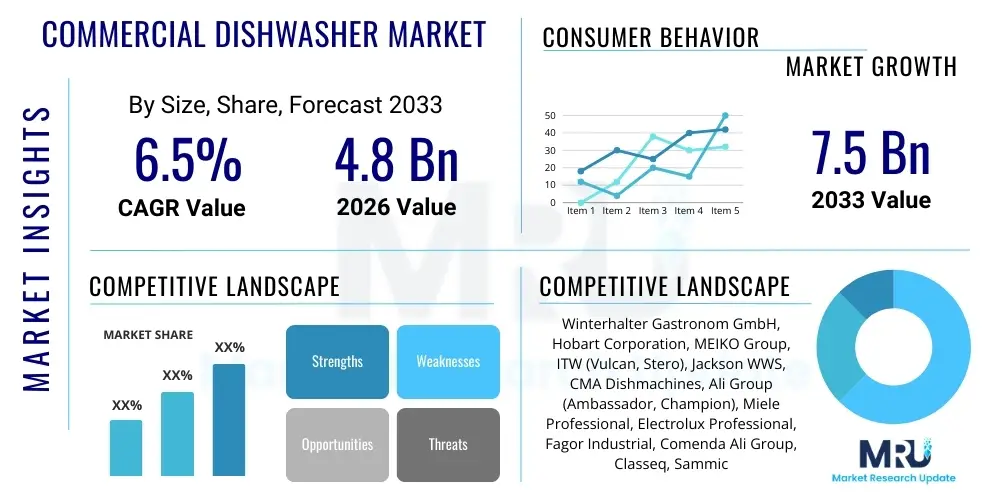

The Commercial Dishwasher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033. This substantial growth is driven primarily by the global expansion of the foodservice industry, coupled with increasingly stringent public health and sanitation regulations mandating high-efficiency cleaning equipment in commercial kitchens, institutional settings, and hospitality establishments.

Commercial Dishwasher Market introduction

The Commercial Dishwasher Market encompasses specialized heavy-duty cleaning equipment designed for high-volume, rapid dish sanitization in non-residential settings. These systems, categorized primarily into under counter, door type (hood style), rack conveyor, and flight type models, are essential assets in environments requiring consistent throughput and adherence to hygienic standards. Products within this market utilize high-pressure water jets, powerful heating elements, and optimized detergent dispensing systems to ensure compliance with strict health codes, providing superior sanitation compared to manual washing methods.

Major applications of commercial dishwashers span the entire spectrum of the hospitality and institutional sectors, including high-end restaurants, hotels, quick-service establishments, educational institutions, corporate cafeterias, and healthcare facilities. The robust design and advanced operational cycles of these machines translate directly into tangible benefits, such as significant labor cost reduction, faster turnaround times for dishware, reduced water and energy consumption in modern units, and, crucially, consistent public safety by guaranteeing effective germ removal and sanitization. The efficacy and reliability of these appliances are fundamental to maintaining operational flow in demanding commercial kitchens.

Key driving factors propelling market expansion include the rapid urbanization and global proliferation of dining establishments, particularly in developing economies, leading to an inherent surge in demand for professional kitchen equipment. Furthermore, escalating operational costs, specifically concerning kitchen labor, incentivize businesses to adopt automated cleaning solutions that maximize efficiency. Technological advancements, such as heat recovery systems and smart dispensing controls, further contribute to market growth by addressing concerns related to utility consumption and environmental impact, making these high-capacity machines more appealing investment assets.

Commercial Dishwasher Market Executive Summary

The Commercial Dishwasher Market exhibits robust growth, heavily influenced by prevailing business trends focusing on operational efficiency and sustainable practices. A major trend involves the increased adoption of advanced conveyor and flight-type dishwashers in high-volume settings, driven by the need for speed and continuous operation. Manufacturers are prioritizing the development of Internet of Things (IoT)-enabled machines that offer remote monitoring, predictive maintenance alerts, and optimized resource usage, aligning with the broader digitalization trend across the commercial equipment sector. Furthermore, the rising cost of utilities has accelerated the demand for sophisticated energy and water-saving technologies, such as advanced heat pump systems and precise dosing controls, significantly impacting design and procurement decisions globally.

Regionally, North America and Europe maintain dominance, characterized by highly established foodservice infrastructures and stringent regulations governing sanitation, which necessitate frequent equipment upgrades. However, the Asia Pacific (APAC) region is poised for the fastest growth, fueled by rapid economic development, changing consumer dining habits, and substantial investment in the hospitality sector, particularly in emerging markets like China and India. Latin America and the Middle East & Africa (MEA) are also showing promising potential, driven by expansion in tourism and the standardization of international hygiene standards, which boosts the installed base of professional dishwashing systems across these territories.

Segment trends highlight the shift towards high-capacity units (conveyor and flight type) in institutional and large-scale catering operations, while door-type and under-counter models remain staples for smaller restaurants and cafés seeking optimal space utilization. The market is also seeing polarization based on technology; standard efficient models serve the price-sensitive sector, while premium models integrating advanced features like reverse osmosis systems for spotless results and superior drying capabilities command higher market share among luxury hotels and upscale dining establishments. Service and maintenance contracts associated with these complex machines are also evolving into critical revenue streams for key market players.

AI Impact Analysis on Commercial Dishwasher Market

User inquiries regarding AI's influence in the commercial dishwasher domain commonly center on predictive maintenance, optimizing wash cycles based on load detection, and enhancing water quality management. Key themes emerging from these questions include concerns about the complexity and cost of integrating smart sensors and machine learning algorithms, the practical benefits of real-time diagnostics in reducing downtime, and the potential for AI to dramatically improve sustainability metrics by minimizing chemical, water, and energy consumption. Users are highly interested in how AI can move dishwashing operations from reactive maintenance schedules to proactive, self-optimizing performance environments, ensuring regulatory compliance and maximizing equipment lifespan without requiring constant human oversight.

AI integration is rapidly transforming commercial dishwashing from a simple utility function into an intelligent, managed service. By deploying sophisticated sensors and machine learning models, modern dishwashers can dynamically adjust parameters such as water temperature, pressure, detergent concentration, and rinse time based on the detected soil level and type of wares being processed, ensuring optimal cleaning results with minimal resource wastage. This level of algorithmic efficiency not only reduces operational expenditure but also significantly decreases the environmental footprint of large-scale catering operations. Furthermore, AI facilitates advanced fault prediction, allowing service teams to intervene before minor component issues escalate into catastrophic failures, thereby preserving uptime and extending the lifecycle of high-value equipment assets in demanding operational environments.

- AI-powered predictive maintenance reduces equipment downtime through continuous sensor monitoring and anomaly detection.

- Machine learning algorithms optimize wash cycle parameters (water use, chemical dosage, energy) based on real-time load assessment.

- Intelligent water management systems use AI to monitor and maintain optimal water hardness and chemical balances, improving sanitation and finish quality.

- AI enables remote diagnostics and self-correction, minimizing the need for immediate technical service calls.

- Load detection and sorting algorithms ensure energy-intensive cycles are only run when the machine is optimally utilized, maximizing efficiency.

DRO & Impact Forces Of Commercial Dishwasher Market

The commercial dishwasher market is shaped by a confluence of influential factors, encompassing strong growth drivers, inherent constraints that limit market potential, and emerging opportunities that key players are strategically capitalizing upon. Drivers, such as globally rising standards for food safety and public hygiene, especially post-pandemic, are compelling businesses to invest in high-efficiency, reliable sanitization equipment. This strict regulatory environment acts as a non-negotiable demand booster. Conversely, the high initial capital expenditure required for purchasing high-capacity conveyor or flight-type systems, coupled with concerns regarding high long-term utility consumption (despite efficiency gains), acts as a primary restraint, particularly affecting small and medium-sized enterprises (SMEs).

Significant opportunities are present in the integration of smart technologies, offering enhanced control, automation, and data analytics capabilities. The shift towards sustainable business practices presents a compelling avenue for innovation, focusing on the development and commercialization of closed-loop water systems and chemical-free washing solutions that appeal to environmentally conscious businesses. The market impact forces dictate a clear preference for efficiency and reliability; equipment that guarantees low total cost of ownership (TCO) through reduced labor, minimal maintenance needs, and lower energy consumption will invariably gain competitive advantage, overriding the initial investment hurdle for large institutional buyers.

The combined effect of these forces places significant pressure on manufacturers to innovate continuously. While regulatory demands necessitate robust sanitation features, market economics demand cost-effective operation. Therefore, success hinges on balancing performance with price point and utility efficiency. The primary impact forces—operational cost pressures and regulatory compliance—ensure that older, less efficient models are phased out, creating consistent replacement demand. Furthermore, the globalization of the foodservice supply chain means market fluctuations in commodity prices (like stainless steel) and logistics costs directly influence the final pricing and profitability of commercial dishwashing units across all geographies.

Segmentation Analysis

The Commercial Dishwasher Market is comprehensively segmented based on product type, end-user application, and operating capacity, reflecting the diverse operational needs within the hospitality and institutional sectors. Understanding these segments is crucial for manufacturers to tailor product development and for buyers to select equipment appropriate for their specific volume requirements and kitchen layouts. The segmentation illustrates a distinct bifurcation between compact, space-saving units preferred by smaller establishments and massive, high-throughput systems essential for large-scale catering operations, hospitals, and educational canteens.

- By Type:

- Under Counter Dishwashers (Ideal for small cafes and bars)

- Door Type / Hood Type Dishwashers (Standard for medium-sized restaurants)

- Rack Conveyor Dishwashers (High throughput for large restaurants and hotels)

- Flight Type Dishwashers (Very high capacity for institutional catering and aviation/cruise lines)

- Glass Washers (Specialized for glassware in bars and pubs)

- By End-User:

- Restaurants and Eateries (Quick Service, Fine Dining)

- Hotels and Lodging (Including Resorts and Cruise Ships)

- Hospitals and Healthcare Facilities (Requiring high sanitization levels)

- Institutional Settings (Schools, Universities, Military Bases)

- Corporate and Industrial Canteens

- Catering Companies and Event Venues

- By Operating Capacity:

- Low Capacity (Up to 500 plates per hour)

- Medium Capacity (500 to 1500 plates per hour)

- High Capacity (Above 1500 plates per hour)

Value Chain Analysis For Commercial Dishwasher Market

The value chain for the Commercial Dishwasher Market initiates with upstream activities centered on the procurement and processing of specialized raw materials, primarily high-grade stainless steel (essential for corrosion resistance and hygiene), plastics, and electronic components such as microprocessors, heating elements, and pumps. Key upstream challenges involve managing fluctuating steel prices and ensuring reliable sourcing of specialized electronic control units which govern modern machine functionality. Manufacturers must maintain stringent quality control over these components as they directly impact the lifespan and performance metrics of the final commercial product. Strategic partnerships with specialized component suppliers are vital to ensure the resilience of the supply chain and to facilitate rapid integration of new technologies like IoT sensors and advanced heat recovery systems.

The manufacturing and assembly stage involves design engineering focused on energy efficiency, ergonomic usability, and modular construction to simplify maintenance. Once produced, the downstream aspect of the value chain is dominated by complex distribution channels. Distribution often involves a mixture of direct sales to large institutional clients (hotels, hospital groups) and reliance on indirect channels via specialized food service equipment dealers, large commercial kitchen outfitters, and regional distributors. These intermediaries often provide vital installation, customization, and initial training services, acting as the primary point of contact for the end-user market.

The direct channel is critical for major players dealing with high-volume, multi-unit purchases where specifications are highly customized, allowing for direct relationship management and negotiation. The indirect channel, however, is crucial for penetrating the dispersed SME market segment, where regional dealer expertise in installation and servicing is highly valued. Furthermore, post-sales support, encompassing maintenance contracts, spare parts supply, and chemical supply agreements, constitutes a crucial final segment of the value chain, generating predictable recurring revenue and reinforcing customer loyalty. The efficacy of the service network is often a primary determinant in purchase decisions for mission-critical commercial equipment.

Commercial Dishwasher Market Potential Customers

Potential customers for commercial dishwashers are predominantly organizations within the HORECA (Hotel, Restaurant, Cafe) sector and various institutional facilities that require high-speed, verifiable sanitation of kitchenware and utensils. The primary buyer profile ranges from independent restaurant owners seeking reliable, entry-level door-type units to multinational hotel chains and major catering corporations requiring advanced, automated flight-type systems capable of processing thousands of racks hourly. These customers prioritize equipment reliability, adherence to local health codes, minimal operational downtime, and a low total cost of ownership (TCO) driven by efficiency in labor, water, and energy consumption.

Healthcare facilities, including large hospitals and specialized clinics, represent a distinct and highly lucrative customer segment. Their purchasing decisions are uniquely driven by the imperative for extreme sanitation levels, often requiring dishwashers capable of thermal disinfection or specialized chemical rinsing to eliminate pathogens rigorously. This segment frequently demands compliance documentation and robust tracking features, elevating their requirements beyond standard commercial kitchen needs. Educational institutions, spanning K-12 schools and major university campuses, also constitute key buyers, focusing on capacity and durability to handle peak meal service times, balancing budgetary constraints with the need for high-volume performance.

The purchasing strategy for these end-users varies significantly; independent restaurants often purchase outright or through leasing arrangements with local dealers, whereas large corporate or institutional buyers typically engage in complex tender processes, prioritizing long-term service agreements and proven technology integration. The consistent growth in global tourism, corporate catering, and the institutional sector ensures a steady, diversified demand base for all types of commercial dishwashing solutions, making the identification of nuanced buyer needs based on volume and sanitation requirements essential for targeted sales strategies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | CAGR 6.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Winterhalter Gastronom GmbH, Hobart Corporation, MEIKO Group, ITW (Vulcan, Stero), Jackson WWS, CMA Dishmachines, Ali Group (Ambassador, Champion), Miele Professional, Electrolux Professional, Fagor Industrial, Comenda Ali Group, Classeq, Sammic, Hoshizaki Corporation, SMEG S.p.A., ADLER S.p.A., Dexing Group, Shanghai Shinelong Kitchen Equipment, Kromo, Mach Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Dishwasher Market Key Technology Landscape

The technology landscape in the commercial dishwasher sector is rapidly shifting towards smart, interconnected systems designed for maximum resource efficiency and operational transparency. A core technological trend is the pervasive adoption of Internet of Things (IoT) connectivity, which enables real-time performance monitoring, remote diagnostics, and data logging critical for compliance verification and operational optimization. These connected machines leverage advanced sensors to track water usage, energy consumption, and chemical concentration, transmitting data to cloud platforms that allow kitchen managers to analyze usage patterns and schedule preventative maintenance before critical failures occur, significantly enhancing machine uptime and reliability.

Energy and water management innovations represent another cornerstone of modern commercial dishwasher technology. High-efficiency heat recovery systems, such as exhaust heat exchangers and heat pump technology, are becoming standard, capturing thermal energy from waste water or steam and reusing it to pre-heat incoming water. This significantly lowers the energy load required for boosting rinse temperatures, reducing utility costs and improving environmental sustainability. Furthermore, advanced filtration systems, including multi-stage filters and reverse osmosis integration, are employed to minimize mineral deposits and ensure spot-free drying results, reducing the labor required for polishing glassware and improving the overall aesthetic quality of the cleaned wares.

Chemical dosing precision and cycle customization are also defining features of the current technology landscape. Manufacturers utilize sophisticated electronic controls and peristaltic pumps to ensure exact, minimum necessary amounts of detergents and rinse aids are dispensed, optimizing cleaning efficacy while minimizing chemical wastage. Coupled with self-cleaning cycles and intelligent load sensors that dynamically adjust wash intensity based on soil level, these technologies contribute to a lower operational expenditure profile. The emphasis remains on delivering consistently hygienic results under pressure, ensuring the equipment meets the increasingly rigorous sanitization protocols required by global health organizations, particularly in sensitive environments like healthcare and institutional catering.

Regional Highlights

- North America: This region maintains a leading position in market value, driven by a highly mature foodservice sector, early adoption of automation technology, and strict regulatory frameworks imposed by bodies like the FDA regarding hygiene standards. Demand here is characterized by a strong preference for high-efficiency, highly automated conveyor systems and models featuring advanced water treatment capabilities (e.g., reverse osmosis) to handle hard water issues common in various states, alongside maximizing operational savings in labor and utilities. The replacement cycle for commercial equipment is relatively predictable due to stringent maintenance schedules and aggressive sustainability targets set by major corporations.

- Europe: The European market is highly developed and competitive, marked by a strong focus on sustainability, energy efficiency (driven by EU directives), and compact, modular designs suited for often smaller, high-density urban kitchen footprints. Germany, the UK, and France are key contributors, demonstrating robust demand for high-end, premium brands that incorporate advanced heat pump technology and superior washing results. The region also shows significant traction in specialized washers, such as dedicated glass washers, catering to the established pub, bar, and café culture, emphasizing both speed and glassware perfection.

- Asia Pacific (APAC): APAC represents the fastest-growing region globally, fueled by rapid urbanization, significant government and private investment in infrastructure (hotels, airports, educational campuses), and the explosive growth of the organized Quick Service Restaurant (QSR) sector. While initial adoption favors cost-effective door-type and under-counter models, the emergence of large-scale hotel and hospitality projects in China, India, and Southeast Asian countries is driving increasing demand for high-capacity rack and flight-type systems. The market is highly sensitive to price, but rising labor costs are rapidly accelerating the shift towards automated solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions are characterized by rapidly growing tourism and hospitality sectors, generating emergent demand for commercial dishwashing equipment. Market growth in the MEA, particularly the UAE and Saudi Arabia, is linked to massive infrastructure projects and luxury hotel expansion, necessitating high-specification, reliable equipment that meets international standards. LATAM market growth is more localized but steady, driven by the professionalization of the foodservice industry and increasing enforcement of sanitation regulations across major economies like Brazil and Mexico.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Dishwasher Market.- Winterhalter Gastronom GmbH

- Hobart Corporation (A Division of ITW)

- MEIKO Group

- Ali Group (Champion, Comenda, Ambach)

- Jackson WWS, Inc.

- CMA Dishmachines

- Miele Professional

- Electrolux Professional

- Fagor Industrial

- Sammic

- Classeq (Winterhalter Group)

- Hoshizaki Corporation

- SMEG S.p.A.

- ADLER S.p.A.

- Dexing Group

- Shanghai Shinelong Kitchen Equipment Co., Ltd.

- Kromo S.r.l.

- Mach Equipment

- Strahman Valves, Inc.

- Norris Industries

Frequently Asked Questions

Analyze common user questions about the Commercial Dishwasher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What types of commercial dishwashers are most energy and water efficient?

The most resource-efficient models are modern flight-type and conveyor dishwashers that incorporate advanced heat recovery systems (heat pumps/exchangers), sophisticated multi-stage filtration, and AI-driven load sensing technology. These features significantly reduce the need for external energy to heat water and minimize fresh water intake per cycle.

How does the total cost of ownership (TCO) compare between different commercial dishwasher models?

TCO is highly dependent on usage volume. While high-capacity conveyor systems have a greater initial capital cost, their superior efficiency, labor savings, and reduced utility consumption per rack make their long-term TCO lower than multiple smaller units in high-throughput environments. Maintenance and replacement part costs are crucial TCO factors.

What is the role of IoT and connectivity in modern commercial dishwashing equipment?

IoT connectivity enables predictive maintenance, remote diagnostics, real-time performance tracking (water/chemical usage), and automated data logging for regulatory compliance. This technology minimizes equipment downtime, optimizes cleaning cycles, and provides actionable insights for kitchen management to improve operational efficiency.

Which end-user segment drives the highest demand for flight-type dishwashers?

The Institutional Catering segment, particularly large university campuses, major hospital systems, large corporate cafeterias, and mass transit providers (airlines/cruise lines), generates the highest demand for flight-type dishwashers due to their need for continuous, extremely high-volume processing capacity.

Are there significant regional differences in regulatory requirements for commercial dishwashers?

Yes, while global standards are harmonizing, North America (NSF certification) and Europe (CE marking, specific EU efficiency directives) have stringent, localized requirements regarding sanitization temperatures, chemical dosing accuracy, and water safety standards. Compliance varies and heavily influences market access and product specifications across regions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager