Commercial Diving Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434593 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Commercial Diving Market Size

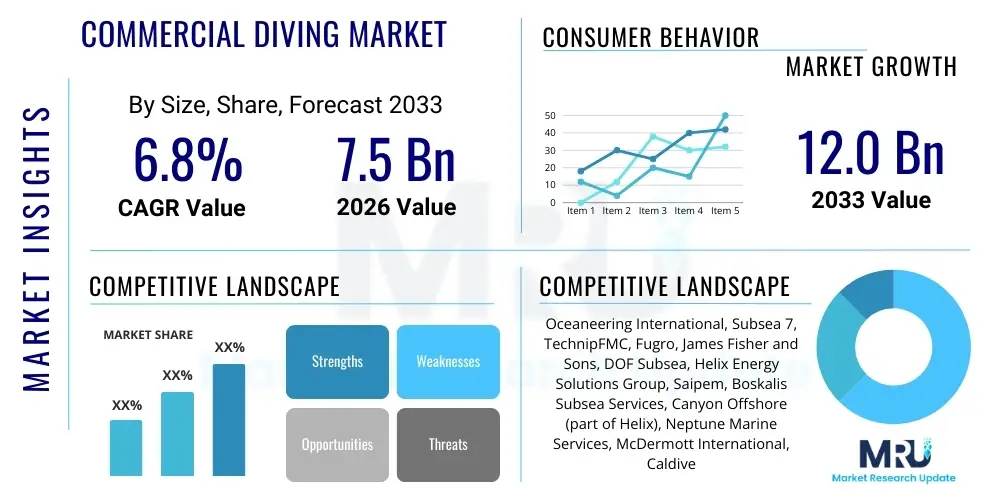

The Commercial Diving Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $12.0 Billion by the end of the forecast period in 2033.

Commercial Diving Market introduction

The Commercial Diving Market encompasses specialized underwater services crucial for maintenance, construction, inspection, and repair across various marine industries. This essential service involves trained professionals utilizing advanced breathing apparatus and specialized equipment to perform complex tasks in submerged environments. The industry supports critical global infrastructure, ranging from subsea pipelines and offshore platforms to renewable energy installations and maritime salvage operations. The demand for these services is intrinsically linked to global energy requirements and the continuous expansion of coastal and marine infrastructure projects.

Major applications of commercial diving services span offshore oil and gas exploration and production, where divers perform crucial tasks like non-destructive testing and installation of subsea assets, and the burgeoning aquaculture sector, requiring net cleaning and habitat maintenance. Furthermore, the development of offshore wind farms and underwater cable laying for telecommunications significantly contributes to market growth. The core benefit of commercial diving remains its ability to provide flexible, human-level dexterity and decision-making capabilities in environments inaccessible to surface vessels or complex remotely operated vehicles (ROVs) for certain high-precision tasks.

Key driving factors accelerating market expansion include the renewed interest in deepwater oil and gas drilling, particularly in areas like the Gulf of Mexico and the North Sea, necessitating saturation diving capabilities. Equally important is the massive global investment in offshore renewable energy infrastructure, such as tidal and offshore wind farms, which require extensive subsea construction and ongoing inspection services throughout their operational life. Regulatory mandates concerning asset integrity and environmental compliance further necessitate routine inspection and repair services performed by certified commercial diving companies.

Commercial Diving Market Executive Summary

The Commercial Diving Market demonstrates robust business trends characterized by a significant shift towards technological integration, prioritizing safety and operational efficiency. Current market dynamics show increased adoption of hybrid solutions, combining traditional human diving expertise with advanced Remote Operated Vehicles (ROVs) and Autonomous Underwater Vehicles (AUVs) to manage risk and expand operational depth capabilities. Key business strategies focus on strategic mergers and acquisitions among service providers to achieve economies of scale and geographical expansion, particularly targeting high-growth areas in offshore wind and deep-sea mineral exploration. Sustainability and compliance with stringent international safety standards, such as those set by IMCA (International Marine Contractors Association), remain central to competitive differentiation and securing high-value contracts.

Regionally, the market exhibits strong activity in North America, driven by mature oil and gas decommissioning projects and regulatory inspection requirements. Europe, particularly the North Sea region, leads in adopting advanced diving techniques and is the epicenter for offshore wind farm construction and maintenance, creating sustained demand for highly specialized shallow and deep-water diving services. Asia Pacific is emerging as the fastest-growing region, fueled by rapid industrialization, increasing energy demands, and large-scale infrastructure projects, including submarine cable installations connecting major economic hubs and expansion in the fisheries and aquaculture sectors.

Segmentation trends indicate that saturation diving, while costly, remains critical for ultra-deepwater projects, ensuring prolonged bottom times and efficiency in complex subsea construction. However, the air diving segment continues to dominate based on volume due to its application in shallow water infrastructure maintenance, port repairs, and coastal defense projects. The application segment is witnessing a pivotal shift, moving away from sole reliance on conventional oil and gas toward significant growth in non-O&G activities, especially within the inspection, maintenance, and repair (IMR) of renewable energy assets and the installation of complex telecom infrastructure.

AI Impact Analysis on Commercial Diving Market

Analysis of common user questions regarding AI's impact on commercial diving reveals key concerns centered on job displacement versus enhancement, the reliability of AI-driven inspection systems, and the ability of AI to improve safety protocols in high-risk environments. Users frequently inquire about how machine learning algorithms can analyze vast amounts of subsea inspection data gathered by divers and ROVs, seeking to understand whether AI can proactively predict equipment failures or optimize diving schedules to minimize costs. A primary expectation is that AI will transform data interpretation, making inspection reports faster, more accurate, and reducing the need for human personnel in purely repetitive or dangerous data collection tasks. However, there is also palpable concern regarding the high initial investment required for sophisticated AI-integrated hardware and the need for specialized training to leverage these technologies effectively within a highly regulated, manual labor-intensive industry.

The integration of Artificial Intelligence is fundamentally altering the inspection and operational landscape of commercial diving. AI algorithms are being deployed to analyze real-time video feeds and non-destructive testing (NDT) data captured by divers, enabling automated defect recognition and severity assessment with high precision. This capability significantly reduces the time required for post-dive data processing and minimizes subjective human error in crucial structural integrity checks. Furthermore, predictive maintenance models, powered by machine learning, use historical data on corrosion rates and operational stress to forecast potential failures in subsea infrastructure, allowing diving crews to be deployed precisely where intervention is most needed, moving the industry from reactive repairs to proactive maintenance planning.

Moreover, AI contributes substantially to enhancing diver safety and optimizing complex operational logistics. AI systems can process environmental sensor data—including current speed, water clarity, and temperature—to provide real-time risk assessments, advising supervisors on optimal dive windows and potential hazards. In terms of logistics, machine learning optimizes the complex scheduling of equipment, personnel, and vessels, especially for saturation diving campaigns that require precise synchronization and resource allocation over extended periods. This optimization leads to reduced vessel time, lower fuel consumption, and ultimately, significant cost savings for clients, solidifying AI's role as an enhancement tool rather than a replacement for specialized human skills.

- AI-Powered Automated Defect Recognition: Machine learning algorithms analyze subsea imagery, significantly speeding up the inspection process and increasing accuracy in identifying minor structural deficiencies.

- Predictive Maintenance Scheduling: AI models utilize sensor and historical inspection data to forecast component failure, allowing divers to perform targeted, preventative repairs.

- Real-time Environmental Risk Assessment: AI processes various oceanographic data points to determine the safest and most efficient operational windows for diving activities.

- Enhanced Data Fusion and Reporting: AI systems fuse disparate data sources (NDT results, visual data, acoustic surveys) into unified, comprehensive, and easily digestible reports.

- Optimized Resource Allocation: Machine learning improves logistical planning for complex saturation diving operations, optimizing vessel time and reducing operational downtime.

DRO & Impact Forces Of Commercial Diving Market

The Commercial Diving Market is shaped by a confluence of accelerating drivers and significant regulatory restraints, while substantial growth opportunities emerge from global energy transitions. A primary driver is the necessity of maintaining the structural integrity of aging global subsea infrastructure, particularly pipelines and platforms installed decades ago, which require mandatory periodic inspection and repair (IMR). Additionally, the dramatic global investment surge in offshore renewable energy, specifically large-scale wind farm construction and the subsequent operational IMR phase, creates continuous, high-volume demand for specialized shallow and intermediate-depth diving services. These drivers are intrinsically linked to global energy security and sustainable infrastructure goals, ensuring sustained expenditure in the sector.

However, the industry faces substantial restraints, primarily concerning stringent safety regulations and the associated high costs of compliance, particularly for saturation diving which requires highly complex logistics and specialized medical support. The high operational risk profile inherently limits the pool of trained and certified personnel, leading to rising labor costs. Furthermore, the increasing capability and decreasing cost of advanced ROVs and AUVs, which can operate in deeper and more hazardous environments without risking human life, act as a disruptive force, capturing some inspection and basic repair tasks traditionally performed by divers. Environmental concerns and the push toward minimizing human presence in sensitive marine ecosystems also impose operational restrictions and increase regulatory scrutiny.

Significant opportunities exist in the decommissioning of defunct oil and gas assets, a multi-billion dollar segment requiring specialized diving and cutting services for safe removal and disposal. The expansion of subsea telecommunications and power cables necessitates extensive diving support for installation, burial, and subsequent repair, particularly in remote areas. The convergence of diving operations with unmanned systems (hybrid solutions) represents a key growth opportunity, allowing divers to focus on complex intervention tasks while robotics handle data acquisition, thereby enhancing overall efficiency, mitigating risks, and expanding the operational envelope to areas previously considered too dangerous or deep for human entry. The impact forces are generally positive, leaning towards high growth driven by infrastructure investment, though tempered by technological disruption and regulatory pressure.

Segmentation Analysis

The Commercial Diving Market is broadly segmented based on Type, Application, and Depth, reflecting the diverse requirements of the end-user industries. Understanding these segments is critical for service providers to tailor equipment and expertise, ensuring compliance with operational standards and efficiency. The type segmentation differentiates between air diving, which is resource-efficient and suitable for shallow tasks, and saturation diving, which mandates highly complex life support systems but is essential for prolonged work at great depths. This delineation determines the scale, cost, and complexity of projects a diving company can undertake.

The application segment highlights the market's reliance on primary marine industries, including oil and gas, infrastructure maintenance, and renewable energy. While oil and gas historically dominated, infrastructure (ports, bridges, coastal defense) provides stable, localized IMR demand, and renewables represent the strongest future growth vector. Depth segmentation is crucial as it directly dictates the necessary technology and safety protocols, influencing operational costs significantly. Shallow-water diving (up to 50 meters) services are more accessible and competitive, whereas deep-water services (requiring saturation diving) are highly specialized, capital-intensive, and less fragmented.

- By Type:

- Air Diving

- Saturation Diving

- Mixed Gas Diving

- By Application:

- Offshore Oil & Gas (Drilling, Maintenance, Decommissioning)

- Renewable Energy (Offshore Wind, Tidal Energy)

- Infrastructure (Ports, Bridges, Dams, Coastal Protection)

- Salvage and Recovery

- Aquaculture and Fisheries

- Submarine Cable Installation and Maintenance

- By Depth:

- Shallow Water Diving (Up to 50 meters)

- Deep Water Diving (Below 50 meters)

Value Chain Analysis For Commercial Diving Market

The value chain of the Commercial Diving Market begins with the upstream segment, primarily involving the procurement of specialized diving equipment and supporting assets. This includes life support systems (saturation diving systems, gas mixers, air compressors), specialized tools (hydraulic cutters, welding apparatus, NDT equipment), and critical safety gear (umbilicals, helmets). Key upstream players are manufacturers of high-pressure equipment, life support systems, and vessel operators who supply the necessary Dive Support Vessels (DSVs) or workboats. Strategic partnerships with reliable original equipment manufacturers (OEMs) are crucial here, as the quality and certification of equipment directly impact operational safety and compliance.

The core of the value chain involves the service providers—the commercial diving companies themselves. These companies manage the direct execution of subsea contracts, encompassing project planning, mobilization, deployment of certified diving teams (supervisors, divers, tenders, medical staff), and execution of specialized tasks (e.g., hyperbaric welding, inspection, installation). This midstream segment is highly skill-dependent, requiring rigorous adherence to international standards set by organizations like IMCA. The operational complexity and the need for immediate, high-quality intervention differentiate leading service providers in this highly competitive stage.

The downstream segment involves the clients (end-users) who contract these services, such as major oil and gas companies, national utility providers, government agencies (navy, coast guard), and increasingly, offshore wind farm developers. Distribution of these services is predominantly direct, via competitive bidding processes and long-term service agreements (LSAs). Indirect distribution occurs through engineering, procurement, and construction (EPC) contractors who subcontract specialized diving work as part of larger integrated subsea projects. Maintaining strong, direct client relationships and offering integrated subsea solutions (combining diving with ROV/Survey services) are vital for capturing large, multi-year contracts and ensuring consistent revenue streams across the highly specialized and regulated commercial diving value chain.

Commercial Diving Market Potential Customers

Potential customers for commercial diving services are predominantly large organizations and governmental bodies requiring the maintenance, construction, or inspection of submerged assets critical to energy supply, transportation, or national security. The primary customer base resides within the global offshore energy sector, where major international oil companies (IOCs) and national oil companies (NOCs) rely heavily on divers for maintaining subsea production systems, pipelines, and drilling infrastructure. These customers require highly reliable, certified services for regulatory compliance and operational continuity, often favoring contractors capable of both air and saturation diving capabilities for deep-water assets.

A rapidly expanding customer base is found in the renewable energy sector, specifically developers and operators of offshore wind farms. These customers require extensive diving support during the installation phase (foundation and cable pull-ins) and ongoing inspection and maintenance of turbine foundations and export cables throughout the facility’s 20-30 year lifespan. As offshore wind projects move into deeper waters, the complexity and value of these contracts increase, solidifying renewable energy companies as long-term, high-growth potential clients for commercial diving services focused on IMR.

Furthermore, government and private infrastructure owners, including port authorities, naval forces, and utilities managing coastal protection systems and underwater tunnels, constitute a consistent segment. These clients often utilize shallow-water air diving services for hull inspection, pier repair, debris removal, and search and recovery operations. The demand from the telecommunications sector for the installation and urgent repair of critical submarine fiber optic cables also represents a focused, high-value customer group that requires rapid, global deployment capabilities, often favoring companies with specialized cable-laying and intervention expertise.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $12.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Oceaneering International, Subsea 7, TechnipFMC, Fugro, James Fisher and Sons, DOF Subsea, Helix Energy Solutions Group, Saipem, Boskalis Subsea Services, Canyon Offshore (part of Helix), Neptune Marine Services, McDermott International, Caldive International, Global Marine Group, Unique Group, Dive Works, SBM Offshore, Mermaid Maritime, Allseas, Enermech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Diving Market Key Technology Landscape

The technological landscape of the Commercial Diving Market is undergoing a rapid evolution, focused primarily on enhancing diver safety, improving efficiency, and integrating digital tools for better data capture. A critical technology involves advanced life support systems, particularly for saturation diving, which now incorporate highly reliable gas management systems, enhanced environmental monitoring within the diving bells and chambers, and improved thermal protection suits. These systems utilize sophisticated sensors and control loops to maintain optimal hyperbaric environments, enabling divers to work safely for extended periods at extreme depths. Additionally, specialized welding and cutting technologies, such as underwater friction stir welding and advanced plasma cutters, are constantly being refined to allow divers to perform complex structural repairs with greater integrity and speed in a submerged state.

The most transformative trend is the increasing reliance on digital technologies and non-destructive testing (NDT) tools utilized by divers. Modern commercial divers are equipped with helmet-mounted augmented reality (AR) displays that overlay schematics and inspection instructions onto their field of view, minimizing reliance on surface communication for procedural checks. High-definition 3D acoustic and visual cameras, often integrated with the diver's helmet or handheld, capture detailed inspection data. This raw data is then processed using advanced software, sometimes incorporating AI for automated analysis of cracks, corrosion, and marine fouling thickness. The focus has shifted from manual data recording to precision digital mapping and structural integrity monitoring.

Furthermore, technology is bridging the gap between human capabilities and robotic limitations through the deployment of "diver-assisted" or hybrid operations. Advanced remotely operated vehicles (ROVs) now possess enhanced tooling interfaces and dynamic positioning systems that allow them to work directly alongside divers, either carrying heavy loads or providing focused lighting and video monitoring. Autonomous Underwater Vehicles (AUVs) are used for pre-dive wide-area surveys, providing comprehensive site intelligence that informs the diving team's operation plan, minimizing the time divers spend on general survey work and allowing them to focus exclusively on intricate intervention tasks that require human dexterity and judgment. This technological synergy optimizes project timelines and significantly reduces inherent operational risks.

Regional Highlights

The global Commercial Diving Market is geographically diverse, with distinct regional drivers influencing market growth and technological adoption. Europe, particularly the countries bordering the North Sea (Norway, UK, Netherlands), represents a mature yet dynamic market. This region leads in adopting advanced deepwater saturation diving techniques due to extensive oil and gas operations and is currently experiencing unprecedented demand fueled by aggressive governmental targets for offshore wind capacity expansion. The stringent regulatory environment in Europe also mandates high safety standards and routine IMR, sustaining significant local market activity.

North America remains a substantial market, driven primarily by activity in the Gulf of Mexico (GOM) for oil and gas production, decommissioning, and pipeline maintenance. While the GOM necessitates both shallow and saturation diving capabilities, the market is also characterized by strong demand from coastal infrastructure projects, including port maintenance and bridge inspections along the East and West coasts. Technological adoption here is focused on efficiency gains and cost reduction in a highly competitive oil and gas service environment.

Asia Pacific (APAC) is projected to be the fastest-growing region globally. This rapid expansion is linked to substantial investments in maritime infrastructure, encompassing new port construction, extensive subsea cable installations connecting archipelagic nations, and booming aquaculture operations. Countries such as China, India, and Southeast Asian nations are increasing domestic energy exploration and developing offshore gas fields, driving demand for specialized diving support. However, regulatory frameworks and local expertise levels vary significantly across APAC, necessitating tailored operational strategies for service providers.

The Middle East and Africa (MEA) region provides consistent demand, primarily concentrated around major oil and gas export hubs (Saudi Arabia, UAE, Qatar, Nigeria). The market here is cyclical, heavily dependent on global oil prices, but structural maintenance of established platforms and export facilities ensures a baseline requirement for IMR services. Latin America, specifically Brazil and Mexico, offers opportunities driven by deepwater exploration activities, particularly concerning pre-salt discoveries, which require advanced, high-specification diving support vessels and saturation diving systems for ultra-deep construction and maintenance.

- Europe: Leading market for offshore renewables IMR; mature deepwater O&G decommissioning; high safety and technological standards mandated by IMCA guidelines.

- North America: Stable demand from Gulf of Mexico O&G (IMR and Decommissioning); significant localized coastal infrastructure maintenance requirements.

- Asia Pacific (APAC): Highest growth trajectory; driven by new subsea cable projects, port expansions, and increasing domestic offshore energy exploration in emerging economies.

- Middle East & Africa (MEA): Demand linked to large-scale, established oil and gas platform maintenance; requires highly reliable deepwater capabilities for strategic energy assets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Diving Market.- Oceaneering International

- Subsea 7

- TechnipFMC

- Fugro

- James Fisher and Sons

- DOF Subsea

- Helix Energy Solutions Group

- Saipem

- Boskalis Subsea Services

- Canyon Offshore (part of Helix)

- Neptune Marine Services

- McDermott International

- Caldive International

- Global Marine Group

- Unique Group

- Dive Works

- SBM Offshore

- Mermaid Maritime

- Allseas

- Enermech

Frequently Asked Questions

Analyze common user questions about the Commercial Diving market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving growth in the Commercial Diving Market?

The market growth is primarily driven by the inspection, maintenance, and repair (IMR) of aging offshore oil and gas infrastructure, coupled with the massive global investment in offshore renewable energy installations, such as wind farms, which require continuous subsea support.

How does saturation diving differ from air diving, and when is each method utilized?

Air diving is suitable for relatively shallow depths (typically less than 50 meters) for short periods, relying on surface-supplied air. Saturation diving is used for deep water (below 50 meters) where divers live in pressurized habitats for days, allowing them extended "bottom time" to complete complex, long-duration construction or welding tasks efficiently.

Is the Commercial Diving Market being negatively impacted by the rise of ROVs and AUVs?

While ROVs/AUVs handle routine inspection and data collection tasks, they are not negatively replacing the market entirely. Instead, they are pushing the industry towards hybrid operations, where divers focus on specialized, complex intervention, repair, and hyperbaric welding tasks that require human dexterity and judgment, enhancing overall efficiency and safety.

Which geographical region holds the highest potential for future market expansion?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate due to rapid industrialization, increasing offshore energy demand, and large-scale government investments in new port infrastructure and complex subsea communication cable networks.

What major technological advancement is most influential in modern commercial diving?

The integration of digital tools and Artificial Intelligence (AI) for real-time data analysis and inspection is the most influential advancement. This technology allows for automated defect recognition, predictive maintenance scheduling, and the use of augmented reality (AR) in diver helmets, significantly improving safety and operational accuracy.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager