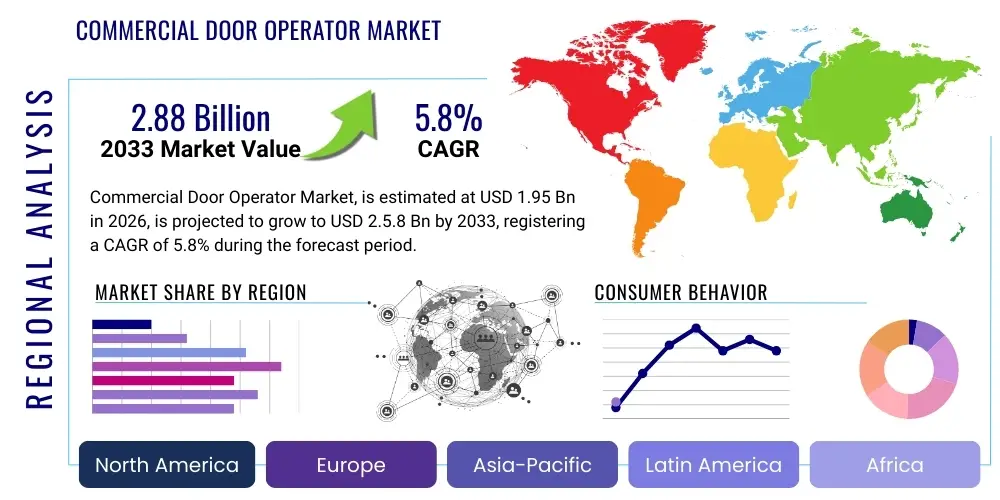

Commercial Door Operator Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435349 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Door Operator Market Size

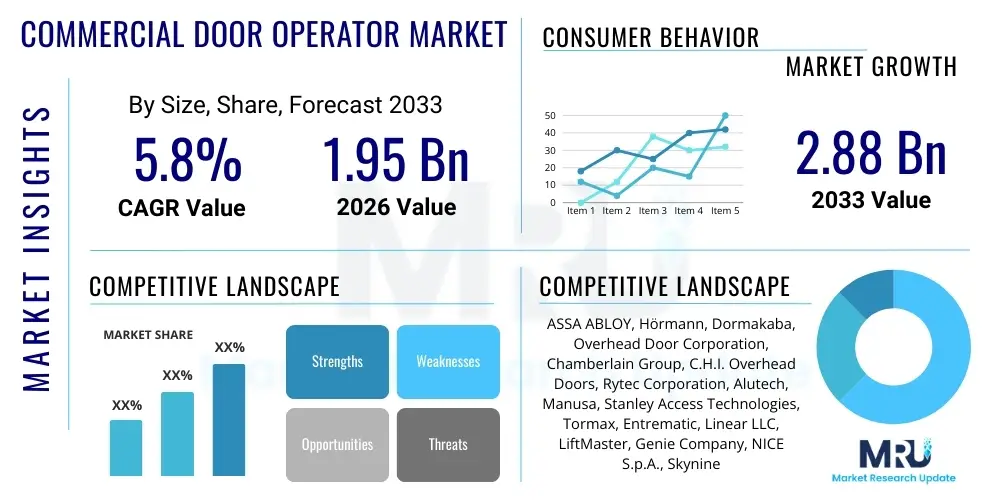

The Commercial Door Operator Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.95 Billion in 2026 and is projected to reach $2.88 Billion by the end of the forecast period in 2033. This growth trajectory is driven primarily by increased global infrastructure spending, stringent safety regulations requiring automated access solutions, and the accelerating integration of smart building technologies into commercial and industrial facilities worldwide.

Commercial Door Operator Market introduction

The Commercial Door Operator Market encompasses the systems and machinery designed for the automated opening and closing of commercial and industrial doors, including sectional doors, rolling doors, fire-rated doors, high-speed doors, and pedestrian automatic doors. These operators are critical components ensuring efficiency, security, and compliance in various settings such as warehousing, manufacturing plants, logistics hubs, large retail centers, and healthcare facilities. Modern operators utilize advanced motor technology, sophisticated control panels, and safety sensors, shifting from simple mechanical systems to complex, interconnected electronic devices capable of remote management and diagnostic capabilities. The core function remains access control and movement facilitation, but the value proposition increasingly includes energy savings and operational data provision.

Product descriptions within this market vary significantly based on application load and cycle demands. Heavy-duty industrial operators, often three-phase systems, are engineered for continuous, high-cycle use typical in distribution centers, prioritizing durability and speed. Conversely, operators used in retail or office environments focus more on aesthetic integration, quiet operation, and enhanced security features compatible with building management systems (BMS). Major applications include loading dock operations, internal partitioning in climate-controlled warehouses, storefront access, and emergency exit maintenance in public buildings. The continuous demand for faster logistics operations and secure premises is fundamentally bolstering the market size and technological complexity of these systems.

The primary benefits derived from adopting commercial door operators involve enhanced security through controlled access, improved energy efficiency by minimizing open door time (especially critical for cold storage), and significant operational efficiency gains through automation, which reduces labor costs and minimizes damage caused by manual handling. Key driving factors include the rapid expansion of global e-commerce necessitating expansive logistics and fulfillment centers, coupled with strict regulatory frameworks, particularly in North America and Europe, mandating compliant safety and fire-rated door systems. Furthermore, the push towards standardized, interconnected smart building infrastructure globally is accelerating the replacement cycle of older, manual, or less efficient operator models.

Commercial Door Operator Market Executive Summary

The Commercial Door Operator Market is currently characterized by a robust transition toward intelligent, network-connected solutions, signifying a major shift in business trends. Manufacturers are heavily investing in integrating Internet of Things (IoT) capabilities, allowing for predictive maintenance scheduling, remote diagnostics, and seamless integration with broader facility management platforms. This focus on connectivity not only improves operational uptime for end-users but also creates recurring revenue streams for providers through service and maintenance contracts. Business strategies are increasingly focused on vertical integration, acquiring specialized software and sensor companies to offer comprehensive, end-to-end access solutions rather than just hardware components. Sustainability is another key trend, with significant demand for energy-efficient DC motor operators replacing traditional AC systems, reducing overall power consumption in large facilities.

Regionally, the market dynamics show significant divergence. North America and Europe remain mature markets, focusing predominantly on system modernization, regulatory compliance upgrades (especially related to fire and safety codes), and advanced feature adoption, such as heightened cybersecurity protocols for networked devices. The Asia Pacific (APAC) region, however, is emerging as the dominant growth engine, fueled by massive urbanization, unprecedented levels of construction activity in commercial and industrial sectors (particularly in China, India, and Southeast Asia), and the rapid expansion of logistics infrastructure driven by e-commerce penetration. Latin America and the Middle East & Africa (MEA) present burgeoning opportunities, often skipping older generations of technology to directly adopt modern automated and digitized systems for new infrastructural developments like ports and smart cities.

Segmentation trends highlight the increasing dominance of high-speed door operators, essential for optimizing workflow in food processing, pharmaceutical, and high-volume logistics environments where climate control and rapid cycle times are paramount. By application, the industrial segment (warehousing, manufacturing) holds the largest market share, though the retail and healthcare segments are experiencing faster adoption rates driven by needs for contactless operation and high standards of cleanliness and security. In terms of technology, the preference is rapidly shifting towards advanced electromechanical operators equipped with sophisticated safety reversal systems and integrated photoelectric sensors, moving away from hydraulic systems, except in specialized, heavy-duty applications. Service and installation revenue is also outpacing pure hardware sales, indicating the maturity and complexity of installed systems requiring specialized expertise.

AI Impact Analysis on Commercial Door Operator Market

Common user questions regarding AI's impact on Commercial Door Operators center around how artificial intelligence can move beyond simple sensor-based automation to genuinely predictive, self-optimizing access control systems. Users frequently inquire about the feasibility of AI algorithms reducing unexpected downtime through advanced diagnostics, optimizing door speeds based on real-time traffic patterns (pedestrian versus vehicular), and enhancing physical security through intelligent threat detection integrated into the operator mechanism. Concerns often revolve around data privacy, the cost implications of implementing AI-driven controllers, and the technical complexity of integrating these advanced systems with legacy building management infrastructures already in place. Expectations are high regarding the automation of maintenance schedules and the creation of highly personalized access profiles, particularly in high-security environments.

The integration of AI is fundamentally transforming commercial door operators from reactive mechanisms into proactive, intelligent assets. AI-powered diagnostic systems utilize machine learning (ML) algorithms to continuously analyze operational parameters—such as motor temperature fluctuations, cycle speed variances, and vibration patterns—to predict component failure with high accuracy weeks or months in advance. This capability drastically reduces costly unplanned downtime, shifting maintenance from reactive to predictive models. Furthermore, AI is being deployed in optimizing operational flow: computer vision combined with ML allows the door operator to recognize and categorize incoming traffic (e.g., forklift vs. pedestrian), dynamically adjusting opening speed, height, and holding time to maximize throughput and safety while minimizing energy loss, leading to optimized total cost of ownership for facility managers.

- AI-Driven Predictive Maintenance: Utilizes sensor data and ML to forecast component failures, drastically reducing unplanned operational downtime.

- Optimized Traffic Flow Management: Computer vision systems analyze movement patterns, adjusting door parameters (speed, duration) in real time for peak efficiency.

- Enhanced Security Protocols: AI algorithms detect abnormal access attempts or lingering presence, triggering immediate security alerts or lock sequences.

- Energy Consumption Optimization: Self-learning systems calibrate door seal pressure and cycle frequency based on ambient temperature and building usage patterns to minimize HVAC energy loss.

- Automated System Calibration: Operators use ML to auto-calibrate settings after installation or repairs, eliminating the need for extensive manual tuning by technicians.

DRO & Impact Forces Of Commercial Door Operator Market

The Commercial Door Operator Market is significantly influenced by a dynamic combination of drivers, restraints, and opportunities (DRO), which collectively constitute the core impact forces shaping its evolution. Key drivers include the exponential growth in global logistics and warehousing due to e-commerce proliferation, necessitating high-speed, reliable, and durable access solutions capable of thousands of cycles daily. Furthermore, increased regulatory emphasis on workplace safety, particularly concerning industrial and fire-rated doors, mandates the installation of certified, often automated, door systems, thereby driving product upgrades and new installations. These forces create a strong impetus for investment in modernizing access infrastructure across all industrialized economies, ensuring sustained volume growth for manufacturers offering compliance-ready solutions.

However, the market faces notable restraints that temper rapid expansion. A significant constraint is the substantial initial investment required for sophisticated automated systems, especially those incorporating advanced IoT and AI features. Small and medium-sized enterprises (SMEs) often find this capital expenditure prohibitive, leading to slower adoption rates in certain segments. Additionally, the technical complexity of installing and maintaining these integrated digital operators requires highly specialized labor, leading to skilled technician shortages in many regions. Economic volatility and fluctuations in commercial construction activity also act as indirect restraints, as new operator sales are directly tied to the pace of new building starts in the industrial and commercial sectors. The integration challenge with disparate legacy building systems poses another technical hurdle for widespread implementation.

Opportunities for growth are concentrated primarily in the development of intelligent, subscription-based service models and the lucrative retrofitting market. The trend towards Smart Buildings and Industry 4.0 provides a major avenue for manufacturers to offer operators as interconnected nodes within a centralized facility management network, enabling valuable data capture and remote control. Retrofitting older manual or semi-automated doors with modern sensor and motor technology represents a vast untapped opportunity, driven by facility managers seeking improved energy efficiency and regulatory compliance without undertaking full structural renovations. Furthermore, developing robust cybersecurity features specifically for networked operators is becoming a critical competitive advantage, addressing end-user concerns about system vulnerability and driving innovation in secured communication protocols for operational technology (OT) hardware.

Segmentation Analysis

The Commercial Door Operator Market is comprehensively segmented based on product type, application, operating mechanism, and geographical region, providing granular insights into market dynamics and growth pockets. Product Type segmentation differentiates between sectional door operators, rolling door operators, high-speed door operators, fire door operators, and swing/slide door operators, each catering to distinct commercial requirements regarding speed, insulation, and space constraints. The complexity and required power rating often dictate the average selling price and replacement cycle within these segments. Understanding this foundational segmentation is crucial for manufacturers to tailor their R&D efforts toward the highest-growth categories, such as high-speed and advanced fire-rated systems, which are increasingly sought after for compliance and productivity benefits.

The segmentation by application further divides the market into industrial, retail, healthcare, hospitality, and public utilities. The industrial segment, encompassing large warehouses and manufacturing facilities, consistently dominates the market volume due to the high cycle requirements and sheer number of access points needed for logistics operations. However, the fastest growth is often observed in specialized applications like healthcare, where the need for hygienic, contactless, and dependable access systems (especially in operating theaters and high-traffic corridors) justifies investment in premium, highly reliable operators. Analysis across these segments reveals varying technological adoption curves, with industrial users prioritizing ruggedness and throughput, while retail and healthcare focus on aesthetics, quiet operation, and smart security integration.

- By Product Type:

- Sectional Door Operators

- Rolling Steel Door Operators

- High-Speed Door Operators

- Fire Door Operators

- Swing and Slide Door Operators (Pedestrian)

- Barrier Gate Operators

- By Operating Mechanism:

- Electromechanical

- Electro-hydraulic

- Direct Drive Systems

- Jackshaft Operators

- Trolley Operators

- By Application:

- Industrial and Manufacturing (Warehouses, Logistics Hubs, Factories)

- Retail (Shopping Malls, Supermarkets)

- Healthcare (Hospitals, Clinics)

- Commercial Facilities (Office Buildings, Hotels)

- Public Infrastructure (Airports, Transportation Hubs)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Commercial Door Operator Market

The value chain for the Commercial Door Operator Market begins with the upstream segment, primarily focused on the procurement and supply of specialized raw materials and components. This includes high-grade steel and aluminum for housing and tracks, advanced motor components (such as brushless DC motors and gearboxes), sophisticated electronic control boards (PCBs, microprocessors, sensors), and safety components (photo eyes, safety edges). Key upstream players are specialized component manufacturers who must meet stringent quality and reliability standards, given the safety-critical nature of the final product. Strong relationships with reliable motor and sensor suppliers are paramount for maintaining product quality and managing manufacturing costs effectively. Integration starts here, as manufacturers often collaborate with semiconductor and software firms to embed connectivity and smart features directly into the control units.

The midstream segment involves the core manufacturing, assembly, and testing of the commercial door operator systems. Major manufacturers design proprietary motor technologies, develop custom firmware for controllers, and undertake complex assembly processes. Quality assurance and compliance testing—especially for UL, CE, and fire safety ratings—are crucial steps at this stage. Economies of scale are highly relevant, favoring large international players who can optimize production lines for diverse global requirements. Distribution channels form the critical link to the downstream market. These channels are often multi-layered, involving direct sales teams for large industrial and governmental projects, specialized dealer networks providing local installation and service expertise, and, increasingly, e-commerce platforms for standardized components and aftermarket parts.

The downstream segment includes professional installation, ongoing maintenance, and end-user engagement. Installation is typically managed by certified, often exclusive, regional distributors or specialized commercial integrators who handle the complexities of integrating the operator with the specific door type and the facility's electrical and safety systems. Service and maintenance—both preventative and reactive—represent a highly lucrative part of the value chain, driven by the need for continuous operational uptime. Direct and indirect channels are both vital: direct channels secure major tenders and provide tailored high-end solutions, while indirect channels (dealers/integrators) ensure widespread market penetration, local support, and specialized servicing, often utilizing service contracts and software subscriptions as primary revenue generators. End-user feedback loops are essential for driving product improvements related to reliability, user interface design, and integration compatibility with proprietary building management software.

Commercial Door Operator Market Potential Customers

The potential customer base for the Commercial Door Operator Market is broad, defined primarily by the need for controlled, secure, and high-cycle access points in non-residential structures. The most significant segment of end-users are large-scale logistics and e-commerce fulfillment centers. These buyers require robust, high-speed, and durable operators capable of continuous operation in high-throughput environments where minimizing downtime is critical to the supply chain efficiency. These customers prioritize total cost of ownership (TCO), energy efficiency, and seamless integration with warehouse management systems (WMS). The selection criteria are heavily biased towards performance specifications like cycle rating, speed, and advanced safety features compliant with stringent industrial standards.

Another major segment includes institutional and public infrastructure buyers, such as hospitals, airports, municipal buildings, and mass transit facilities. These end-users prioritize reliability, long operational lifespan, accessibility compliance (e.g., ADA standards), and specialized safety features, particularly fire and smoke containment capabilities integrated into the door operators. For hospitals and healthcare facilities, the demand for contactless, hygienic pedestrian door operators is a key purchasing driver. Furthermore, large commercial retail complexes and shopping malls represent continuous demand for aesthetically pleasing, quiet, and secure sliding or swinging door operators, ensuring high foot traffic throughput while maintaining strict security perimeters. Lastly, the agricultural and food processing sectors represent niche but high-value customers needing specialized operators designed to withstand harsh, corrosive, or extreme temperature environments, requiring ingress protection (IP) ratings and specialized washdown capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.95 Billion |

| Market Forecast in 2033 | $2.88 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | ASSA ABLOY, Hörmann, Dormakaba, Overhead Door Corporation, Chamberlain Group, C.H.I. Overhead Doors, Rytec Corporation, Alutech, Manusa, Stanley Access Technologies, Tormax, Entrematic, Linear LLC, LiftMaster, Genie Company, NICE S.p.A., Skynine, JCE Door, FAAC Group, Came S.p.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Door Operator Market Key Technology Landscape

The technological landscape of the Commercial Door Operator Market is rapidly evolving, driven by the demand for higher efficiency, safety, and connectivity. A fundamental shift involves the widespread adoption of Brushless DC (BLDC) motors over traditional AC induction motors. BLDC motors offer superior energy efficiency, requiring less power consumption over their operational lifecycle, which is highly attractive for large industrial facilities seeking to reduce utility costs. Furthermore, BLDC technology provides smoother operation, better speed control, and significantly increased longevity with reduced maintenance needs, directly addressing the key industrial requirement for high-cycle reliability. Advanced gearbox designs, utilizing high-precision manufacturing, are also crucial, minimizing acoustic output and maximizing torque delivery, particularly important for high-speed and heavy-duty applications.

Sensor technology and control systems form the intelligence layer of modern door operators. High-resolution encoders provide precise positioning feedback, enabling soft-start and soft-stop functionality that extends the door and operator lifespan. Advanced safety sensors, including laser scanners, radar motion detectors, and integrated pressure-sensitive edges, are now standard, exceeding basic photoelectric requirements to ensure absolute compliance with global safety standards (e.g., EN 13241-1). The controller units themselves are becoming highly sophisticated microprocessors capable of running complex algorithms, facilitating features like self-diagnostics, automated calibration, and integration with external fire and security alarms. The reliability and sophistication of these sensors directly impact the safety rating and operational speed of the door system.

Connectivity and cybersecurity represent the future growth frontier. Modern commercial door operators are increasingly equipped with integrated IoT modules (Wi-Fi, cellular, or Ethernet capabilities) allowing for cloud connectivity. This enables facility managers to monitor the operator status, performance metrics, and energy consumption remotely via web platforms or mobile applications. This remote diagnostics capability underpins predictive maintenance service models. Crucially, as these devices become network endpoints, robust cybersecurity features—including secure boot, encrypted communication protocols (e.g., MQTT over TLS), and frequent firmware updates—are mandatory. Manufacturers are focusing on securing the operational technology (OT) environment to prevent unauthorized access or denial-of-service attacks that could compromise facility security or operational flow, making cybersecurity expertise a critical differentiator in the competitive landscape.

Regional Highlights

The global Commercial Door Operator Market exhibits varied growth patterns and technological adoption levels across major regions, driven by localized economic conditions, infrastructure maturity, and regulatory environments.

- North America (NA): Represents a technologically mature market characterized by high regulatory adherence and robust demand for replacement and modernization of existing infrastructure. The strong presence of e-commerce giants and substantial investment in automated logistics centers drive demand for high-speed, IoT-enabled operators. Focus areas include maximizing energy efficiency and integrating advanced access control security features. The market is competitive, dominated by well-established international and domestic manufacturers, and innovation centers around predictive maintenance and safety compliance standards.

- Europe: The European market is highly regulated, particularly concerning fire safety (CE marking, EN standards) and energy efficiency (ErP directive). This environment consistently drives product innovation toward compliance and certified systems. Western Europe demands high-quality, durable, and highly customized solutions for specialized industries like pharmaceuticals and food processing. Eastern Europe provides steady growth due to ongoing commercial and industrial infrastructure modernization, adopting efficient operator technology as facilities are upgraded.

- Asia Pacific (APAC): Positioned as the fastest-growing region globally, APAC benefits from rapid urbanization, massive investment in industrialization, and the exponential expansion of the e-commerce supply chain, particularly in China, India, and ASEAN countries. This region is characterized by high volume demand for both new installations and retrofits. While price sensitivity is present in some sub-regions, the demand for reliable, high-cycle industrial operators is accelerating, creating significant opportunities for mass-market product deployment and manufacturing localization.

- Latin America (LATAM): This market is emerging, driven by foreign direct investment in manufacturing and commodities sectors, and the development of new port and logistics facilities. Adoption rates are moderate but accelerating, particularly in countries like Brazil and Mexico, where commercial construction activity is regaining momentum. The focus is often on reliability and cost-effectiveness, though there is a growing niche for smart security operators in urban commercial centers.

- Middle East and Africa (MEA): Growth is primarily concentrated in the Gulf Cooperation Council (GCC) countries, fueled by mega-projects (e.g., smart cities, new airports) and significant government investment in non-oil economic diversification, leading to demand for high-spec, technologically advanced operators. Extreme climate conditions in the Middle East necessitate highly durable operators resistant to dust and high temperatures. Africa represents a nascent market, with growth tied to industrialization and infrastructure development projects, focusing on robust, easily maintainable systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Door Operator Market.- ASSA ABLOY

- Hörmann

- Dormakaba

- Overhead Door Corporation

- Chamberlain Group

- C.H.I. Overhead Doors

- Rytec Corporation

- Alutech

- Manusa

- Stanley Access Technologies

- Tormax

- Entrematic

- Linear LLC

- LiftMaster

- Genie Company

- NICE S.p.A.

- Skynine

- JCE Door

- FAAC Group

- Came S.p.A.

Frequently Asked Questions

Analyze common user questions about the Commercial Door Operator market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the growth of the Commercial Door Operator Market?

Market growth is primarily driven by the massive expansion of the global logistics and e-commerce warehousing sector, necessitating high-cycle, automated access points. Additional drivers include stringent government regulations mandating improved workplace safety and fire-rated door systems, alongside the increasing integration of operators into smart building management systems for enhanced efficiency.

How does the integration of IoT technology benefit commercial door operator systems?

IoT integration allows operators to connect to the cloud, enabling remote monitoring, real-time diagnostics, and remote control functionalities. This connectivity facilitates predictive maintenance schedules, drastically reducing unexpected downtime and optimizing operational efficiency by providing facility managers with critical performance data.

Which product segment holds the largest share in the Commercial Door Operator Market?

Industrial sectional and rolling door operators typically hold the largest market share due to their widespread use in high-volume applications such as manufacturing plants, large distribution centers, and warehouses. However, high-speed door operators are the fastest-growing segment, reflecting the industrial focus on increasing throughput and minimizing energy loss.

What are the key technological advancements influencing commercial door operator reliability?

Key advancements include the shift to highly efficient Brushless DC (BLDC) motors for increased longevity and energy savings, sophisticated sensor arrays (laser, radar) for enhanced safety compliance, and the development of AI-driven diagnostic software for predicting system failures before they occur, maximizing operational uptime.

Why is the Asia Pacific region expected to exhibit the highest CAGR during the forecast period?

The high CAGR in the Asia Pacific region is attributed to rapid industrialization, massive commercial construction projects in emerging economies, and accelerated infrastructure spending on modernizing logistics and warehousing facilities to keep pace with the region's explosive e-commerce growth and urbanization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager