Commercial Electric Fryer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432249 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Commercial Electric Fryer Market Size

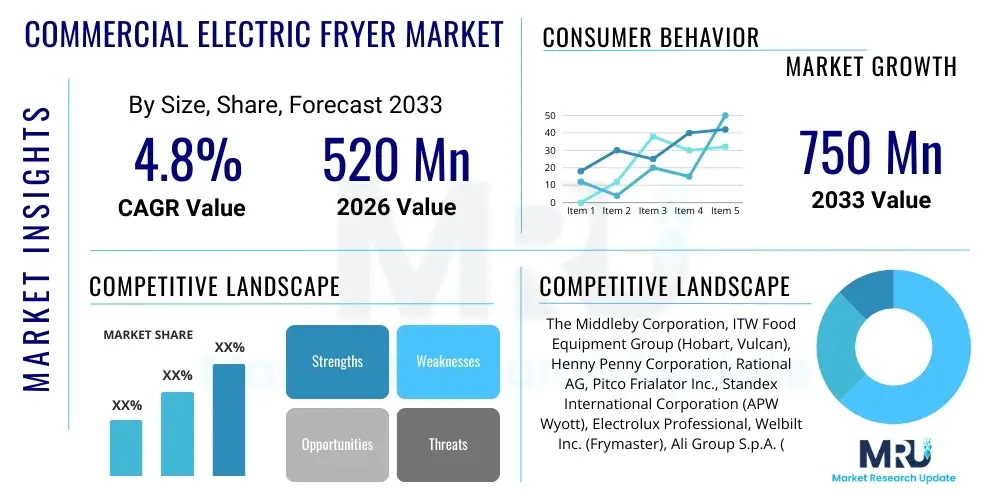

The Commercial Electric Fryer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 520 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by the rapid expansion of the global foodservice industry, coupled with stringent regulations promoting energy-efficient kitchen equipment. The shift towards electrification in commercial settings, driven by sustainability goals and the reduction of reliance on traditional gas infrastructure, further solidifies the market's positive outlook through the forecast period, positioning electric fryers as essential assets in modern professional kitchens.

Commercial Electric Fryer Market introduction

The Commercial Electric Fryer Market encompasses the manufacturing, distribution, and utilization of electrically powered deep fryers specifically designed for heavy-duty use in professional food service establishments. These appliances are critical for rapidly cooking large volumes of food items such as poultry, seafood, potatoes, and other specialty fried goods, maintaining consistent oil temperature, and ensuring high product quality and output efficiency. The product range includes floor models and countertop units, differentiated by capacity, heating element design (open-pot, tube-type), and advanced features like built-in filtration systems and computerized controls.

Major applications for commercial electric fryers span across the entire spectrum of the HORECA (Hotel, Restaurant, and Catering) sector. Quick Service Restaurants (QSRs) heavily rely on high-capacity electric fryers for continuous operation, ensuring speed and consistency across standardized menus. Full-service restaurants and institutional catering operations utilize specialized fryers for diverse menu items, benefiting from the precise temperature control and reduced energy consumption offered by modern electric models compared to gas counterparts. The adoption is also increasing in convenience stores and small independent food kiosks seeking reliable frying solutions with a smaller footprint.

Key benefits driving the adoption include superior temperature accuracy, enhanced energy efficiency resulting in lower operational costs over the long term, and improved safety dueance to the elimination of open flames and controlled heat management systems. Driving factors include the global proliferation of chain restaurants, rising consumer demand for fried food, technological advancements leading to faster recovery times and automatic oil management, and increasingly strict health and safety standards that favor automated and cleaner electric equipment. The market dynamics are largely centered on innovation related to oil longevity and ease of cleaning, directly impacting profitability for end-users.

Commercial Electric Fryer Market Executive Summary

The Commercial Electric Fryer Market is characterized by robust business trends focusing on digitalization and sustainability. Manufacturers are increasingly integrating IoT capabilities into their fryers, allowing for remote monitoring, predictive maintenance, and optimized energy usage patterns, significantly improving the Total Cost of Ownership (TCO) for operators. The trend towards sustainable kitchen operations is propelling demand for high-efficiency, Energy Star-rated electric models that minimize oil usage and energy waste. Competitive strategies revolve around providing comprehensive service packages, including training and maintenance support, alongside the initial equipment sale, fostering long-term client relationships, particularly with major QSR chains requiring standardized global deployment.

Regionally, North America and Europe maintain dominance, driven by established food service infrastructure and high labor costs, which incentivize automation and high-efficiency equipment. However, the Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate, fueled by rapid urbanization, increasing disposable incomes, and the massive expansion of organized retail and international QSR brands into emerging economies like China and India. Regulatory frameworks in regions like the EU, emphasizing carbon neutrality and energy efficiency, further accelerate the replacement cycle for older, less efficient frying equipment, directly benefiting the modern electric fryer segment.

Segmentation trends highlight a growing preference for high-capacity floor models with advanced oil filtration systems, particularly within high-volume QSR environments where operational downtime must be minimized. The open-pot segment remains popular due to ease of cleaning, while pressure fryers continue to hold a niche in specialized segments like fried chicken preparation, valued for moisture retention and reduced frying time. Furthermore, there is a distinct vertical segmentation trend where manufacturers tailor specific fryer models—including specialized baskets and programming—to meet the precise operational demands of different cuisines or large-scale institutional kitchens, ensuring market differentiation and segment saturation.

AI Impact Analysis on Commercial Electric Fryer Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Commercial Electric Fryer Market predominantly center on how AI can optimize operational efficiency, enhance food quality consistency, and reduce waste. Key themes include the integration of machine learning algorithms for predictive oil life management, the automation of cooking cycles based on load detection and desired crispness levels, and the application of AI in remote diagnostics and maintenance scheduling. Operators are keen to understand if AI can move beyond simple automation to true predictive capacity, ensuring oil is changed precisely when quality degradation begins, thereby optimizing food safety and maximizing ingredient cost efficiency. The overarching expectation is that AI will transform fryers from mere heating devices into intelligent, self-optimizing cooking platforms, directly addressing high variable costs associated with labor and oil consumption in commercial kitchens.

- AI-driven Predictive Maintenance: Algorithms analyze temperature fluctuations and error codes to predict component failure, scheduling maintenance before operational disruption occurs.

- Optimized Oil Management: Machine learning models predict the exact optimal time for oil filtration or replacement based on usage frequency, temperature profile, and food throughput, minimizing oil consumption and maximizing food quality.

- Automated Cooking Quality Control: AI sensors monitor the frying process (e.g., color, bubble size) and adjust temperature or time settings in real-time to ensure product consistency across various batches.

- Energy Consumption Optimization: AI analyzes peak usage times and adjusts heating cycles to maintain required temperatures using minimal energy, integrating seamlessly with overall building energy management systems.

- Voice and Gesture Command Integration: Facilitating hands-free operation in busy kitchen environments, enhancing safety and workflow efficiency.

- Menu Standardization and Recipe Control: AI maintains and enforces standardized cooking protocols globally, ensuring brand consistency irrespective of location or operator experience level.

DRO & Impact Forces Of Commercial Electric Fryer Market

The Commercial Electric Fryer Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO). A primary driver is the global imperative for enhanced kitchen efficiency, requiring equipment with fast recovery times and minimal energy wastage. Simultaneously, strict food safety regulations and the need for standardized output drive the adoption of digitally controlled electric fryers, offering precise thermal management superior to traditional gas models. However, the high initial capital expenditure associated with purchasing advanced, high-capacity electric fryers, especially those with built-in filtration and smart features, acts as a significant restraint, particularly for small and independent foodservice businesses. Furthermore, the limited power infrastructure in some developing regions poses a logistical challenge to the installation of high-voltage commercial electric equipment.

Opportunities for market growth are vast, stemming primarily from continuous technological advancements, such as the development of advanced induction heating technologies for fryers, which offer even greater energy efficiency and precise temperature control. The rising trend of ghost kitchens and delivery-only models necessitates reliable, space-efficient, and highly automated cooking equipment, creating a lucrative avenue for compact commercial electric fryers. Moreover, manufacturers have opportunities to expand specialized offerings, such as fryers designed for plant-based alternatives or specific dietary requirements, catering to evolving consumer preferences and expanding the market base beyond traditional applications.

The collective impact forces shaping the market include competitive pressure, driven by major international players striving to offer integrated kitchen solutions, and regulatory forces, especially those concerning carbon emissions and kitchen safety, compelling operators to upgrade. Economic factors, such as fluctuating utility costs and the investment cycles of major QSR chains, significantly influence procurement decisions. These forces collectively push the market towards innovation in efficiency and automation, ensuring that the market trajectory remains upward, although characterized by intense pricing and feature competition.

Segmentation Analysis

The Commercial Electric Fryer Market is highly fragmented and segmented across various parameters, including equipment type, capacity, configuration, and end-user application. Understanding these segments is crucial for manufacturers to tailor their product development and marketing strategies. The primary segmentation distinguishes between open-pot, flat-bottom, and tube-type fryers, each offering different advantages related to ease of cleaning, sediment management, and suitability for specific food items. Furthermore, the market is differentiated by the degree of automation, separating manual, semi-automatic, and fully computerized models with integrated filtration and programmable controls, catering to different operational complexity needs.

- By Type:

- Open Pot Fryers

- Tube Fryers (Heating elements located within tubes submerged in oil)

- Flat Bottom Fryers (Ideal for delicate or battered products)

- Pressure Fryers (Used primarily for poultry)

- By Capacity:

- Small Capacity (Under 30 lbs/15 liters)

- Medium Capacity (30 lbs to 70 lbs/15 to 35 liters)

- High Capacity/Floor Models (Over 70 lbs/35 liters)

- By Configuration:

- Countertop Models

- Floor Models (Free-standing)

- Built-in/Drop-in Units

- By End-User:

- Quick Service Restaurants (QSRs)

- Full-Service Restaurants (FSRs)

- Hotels and Hospitality

- Catering and Institutional Food Service (Schools, Hospitals)

- Bakeries and Snack Manufacturers

Value Chain Analysis For Commercial Electric Fryer Market

The value chain for the Commercial Electric Fryer Market initiates with the upstream activities involving the sourcing of core components, particularly high-grade stainless steel, advanced heating elements (like infrared or induction coils), precise temperature sensors, and sophisticated electronic control boards (PCBs). Key upstream suppliers include specialty metal manufacturers and advanced electronics providers, where component quality directly dictates the longevity and efficiency of the final fryer unit. Manufacturers focus heavily on precision engineering and robust quality control, aiming to produce equipment capable of enduring continuous high-stress commercial kitchen environments. Strategic supplier relationships, particularly for microprocessors and IoT components, are crucial for maintaining a competitive edge in product innovation and cost efficiency.

The middle segment of the value chain is dominated by the fabrication and assembly process. Major manufacturers, such as Middleby Corporation and ITW Food Equipment Group, utilize advanced manufacturing techniques, including robotic welding and assembly lines, to achieve economies of scale and maintain product consistency. Research and Development (R&D) activities are centralized here, focusing on improving oil filtration technology, optimizing heat recovery rates, and integrating smarter digital controls. Certification (e.g., NSF, UL, CE) is a mandatory step in this stage, ensuring compliance with global food safety and operational standards, which are essential for market entry across various jurisdictions.

The downstream flow involves distribution channels, which are characterized by a mix of direct and indirect sales. Indirect channels, primarily through specialized foodservice equipment dealers, regional distributors, and large-scale procurement companies, account for the majority of sales, providing installation, financing, and localized service support. Direct sales often target large national or international QSR chains that demand customized solutions and centralized procurement management. Aftermarket services, including spare parts supply, maintenance contracts, and technical support, represent a significant revenue stream for manufacturers and specialized service providers, ensuring the long-term operational efficiency of the installed base.

Commercial Electric Fryer Market Potential Customers

Potential customers, or end-users, of commercial electric fryers are diverse but share a common need for high-throughput, reliable, and energy-efficient deep-frying capabilities. The largest and most demanding segment is the Quick Service Restaurant (QSR) industry, including global fast-food giants and regional franchises, which require continuous operation, absolute consistency in product output, and equipment that integrates easily with standardized kitchen layouts. These customers prioritize equipment longevity, quick temperature recovery, and advanced oil management systems to manage high transaction volumes and minimize variable operating costs.

The second major category includes Full-Service Restaurants (FSRs) and high-end dining establishments. While their volume requirements might be lower than QSRs, FSRs often require greater precision and flexibility in their frying process to handle diverse, non-standardized menus, leading them to prefer models with advanced programmable controls and multiple smaller vats. Institutional food service—including hospitals, corporate cafeterias, military bases, and large educational institutions—represents another key customer group, focusing on durability, capacity, and compliance with strict hygiene standards, often favoring floor models designed for heavy, batch-style cooking.

Emerging customers include ghost kitchens and centralized catering facilities, which operate purely on delivery and require maximum efficiency within minimal physical space. These customers are highly interested in compact, modular electric fryer systems that are capable of integrating into an entirely digitized, highly streamlined operational environment. Furthermore, specialized food production facilities focused on ready-to-eat meals or frozen appetizers also constitute a growing buyer base, demanding industrial-grade electric frying solutions optimized for specific product dimensions and textures.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 520 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Middleby Corporation, ITW Food Equipment Group (Hobart, Vulcan), Henny Penny Corporation, Rational AG, Pitco Frialator Inc., Standex International Corporation (APW Wyott), Electrolux Professional, Welbilt Inc. (Frymaster), Ali Group S.p.A. (Alto-Shaam), Hatco Corporation, Prince Castle, EVO America, Fagor Industrial, Bizerba SE & Co. KG, Winterhalter Gastronom GmbH, Dean Industries, Star Manufacturing International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Electric Fryer Market Key Technology Landscape

The technological landscape of the Commercial Electric Fryer Market is rapidly advancing, moving beyond basic heating elements towards smart, integrated systems designed for sustainability and maximum operational efficiency. A core development is the pervasive adoption of advanced microprocessor controls that provide highly precise temperature regulation (within 1-2 degrees Fahrenheit), which is essential for consistent product quality and preventing oil degradation. This precision contrasts sharply with older, thermostat-driven models. Additionally, integrated oil filtration and recycling systems, often automatic or semi-automatic, are now standard features in high-end electric fryers, extending oil life significantly, reducing purchasing costs, and minimizing environmental impact associated with oil disposal.

The increasing focus on energy conservation has propelled the development and commercialization of high-efficiency heating technologies. Induction fryers, while still representing a niche, are gaining traction, offering faster heat-up times, immediate heat adjustment, and superior energy transfer efficiency compared to traditional immersion heating elements. Furthermore, the integration of sensors and connectivity features, enabling IoT capabilities, allows fryers to communicate operational data back to kitchen management systems. This connectivity supports features like remote diagnostics, automatic recipe downloads, and centralized performance analysis, which are crucial for large chain operators managing hundreds or thousands of units globally.

Another critical area of innovation involves safety features and automation to mitigate human error and improve kitchen workflow. These include sophisticated fire suppression interfaces, automatic shut-off mechanisms for low oil levels, and integrated lift baskets that automatically retrieve product when the cooking cycle is complete. Future technological advancements are expected to focus heavily on AI integration for adaptive cooking cycles and predictive maintenance, ensuring that the electric fryer maintains its position as the centerpiece of efficient, modern commercial frying operations, significantly boosting throughput while reducing the skill required of the operating staff.

Regional Highlights

- North America: This region holds a dominant share, characterized by a mature foodservice industry, particularly the high density of Quick Service Restaurant (QSR) chains. The market is driven by the continuous replacement demand for high-capacity, energy-efficient electric fryers, encouraged by strict energy standards and the high cost of labor, which necessitates automated equipment. The focus here is on robust construction, advanced filtration, and rapid service network support.

- Europe: Europe is a key market, heavily influenced by strong governmental mandates regarding energy efficiency and emissions reduction, which favor electric models over gas. Countries like Germany, the UK, and France are adopting advanced, sophisticated fryers with integrated smart technology. The presence of strong local and international culinary traditions also drives demand for versatile frying equipment suitable for diverse menu requirements across the hospitality sector.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally. This exponential growth is fueled by rapid economic expansion, urbanization, and the aggressive penetration of international QSR brands into emerging markets such as China, India, and Southeast Asia. The demand is characterized by a mix of high-volume floor models for chains and affordable, compact countertop units for smaller independent vendors. Infrastructure development, while challenging in some areas, is driving significant long-term investment in commercial kitchen equipment.

- Latin America (LATAM): Growth in LATAM is driven by the expansion of tourism and hospitality sectors, particularly in Brazil and Mexico. The market is moderately mature, with increasing adoption of electric fryers in organized retail and local restaurant chains seeking to modernize operations and improve consistency. Price sensitivity remains a factor, influencing the balance between advanced features and baseline operational efficiency.

- Middle East and Africa (MEA): This region is witnessing steady growth, primarily localized in the UAE, Saudi Arabia, and South Africa, fueled by large-scale hotel projects, tourism infrastructure development, and the influx of Western food service concepts. Demand focuses on robust, high-capacity equipment capable of handling large catering volumes and operating reliably in high ambient temperatures.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Electric Fryer Market.- The Middleby Corporation

- ITW Food Equipment Group (Hobart, Vulcan)

- Henny Penny Corporation

- Rational AG

- Pitco Frialator Inc.

- Standex International Corporation (APW Wyott)

- Electrolux Professional

- Welbilt Inc. (Frymaster)

- Ali Group S.p.A. (Alto-Shaam)

- Hatco Corporation

- Prince Castle

- EVO America

- Fagor Industrial

- Bizerba SE & Co. KG

- Winterhalter Gastronom GmbH

- Dean Industries

- Star Manufacturing International

- Imperial Range

- Garland Commercial Ranges

- Anetsberger Brothers, Inc.

- Jade Range, LLC

Frequently Asked Questions

Analyze common user questions about the Commercial Electric Fryer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of electric fryers over gas fryers?

The shift is primarily driven by superior energy efficiency and highly precise temperature control offered by electric models, leading to consistent food quality, reduced operational costs, and compliance with increasingly stringent environmental and safety regulations that favor electrification in commercial kitchens.

How do modern commercial electric fryers maximize oil life and reduce operational expenditure?

Modern electric fryers utilize integrated, automatic filtration systems, advanced thermal controls to prevent oil scorching, and often incorporate IoT sensors that monitor oil quality in real-time. This combination significantly extends the usable life of cooking oil, directly lowering replacement costs and labor associated with manual filtering.

What role does IoT technology play in high-capacity commercial electric fryers?

IoT integration enables remote monitoring of fryer performance, energy consumption, and error diagnostics. This capability is critical for large chain operators to standardize cooking protocols across multiple locations, facilitate predictive maintenance scheduling, and ensure centralized quality control without requiring on-site supervision.

Which geographic region is expected to show the highest growth rate for electric fryers?

The Asia Pacific (APAC) region is forecasted to exhibit the highest growth rate due to rapid foodservice sector expansion, increasing consumer wealth, significant urbanization, and substantial infrastructure investment supporting the establishment of large international Quick Service Restaurant (QSR) chains.

Are countertop electric fryers suitable for high-volume Quick Service Restaurants (QSRs)?

Generally, countertop electric fryers are better suited for smaller operations, satellite stations, or specialty items due to limited capacity. High-volume QSRs typically require large, floor-standing electric fryer banks (70 lbs capacity and above) with continuous filtration to maintain speed and efficiency during peak demand periods.

The evolution of commercial electric fryer technology is fundamentally transforming kitchen operations globally, necessitating a continuous reassessment of equipment lifecycle management by all foodservice stakeholders. The market is pivoting sharply towards solutions that minimize environmental footprint while maximizing throughput. Manufacturers are aggressively investing in R&D focusing on advanced materials that improve heat transfer efficiency and durability, ensuring that the equipment can handle the relentless demands of a 24/7 operating cycle common in institutional and QSR settings. Furthermore, the modular design trend is gaining momentum, allowing operators to easily expand or reconfigure their frying station based on seasonal or menu-driven requirements without needing extensive kitchen renovations. This flexibility is particularly attractive to multi-concept operators and ghost kitchen providers who prioritize rapid deployment and scalable operations.

In the context of competitive analysis, differentiation is increasingly achieved through software and service offerings rather than just hardware specifications. Companies that provide robust training modules, accessible parts inventories, and rapid, global technical support are gaining market preference, especially among international chains seeking operational continuity and standardized training across borders. The regulatory environment continues to tighten, particularly concerning appliance safety, energy consumption ratings (like Energy Star compliance), and materials used in food contact zones, creating significant barriers to entry for smaller manufacturers who cannot afford the rigorous testing and certification processes required in major markets like North America and Europe. This regulatory landscape inadvertently favors established, large-scale players with dedicated compliance departments and superior R&D capabilities.

Looking ahead, the long-term viability of the commercial electric fryer market will be linked to its ability to seamlessly integrate into the broader smart kitchen ecosystem. This includes not only connectivity to monitoring dashboards but also integration with upstream prep stations and downstream holding areas, potentially using AI to manage the entire frying process flow—from frozen product staging to final plate delivery. Such comprehensive integration promises not only unmatched efficiency but also unparalleled consistency, defining the next generation of food preparation technology. The increasing global focus on sustainability also means future electric fryer designs will need to incorporate circular economy principles, maximizing recyclability of components and offering traceable, low-impact manufacturing processes, appealing to the growing number of environmentally conscious businesses.

Detailed market penetration strategies involve targeting specific cuisine types. For instance, manufacturers may develop electric pressure fryers optimized for specific poultry preparations or high-efficiency flat-bottom fryers designed explicitly for delicate, tempura-style vegetables and fish. This micro-segmentation allows brands to capture niche markets that value specialized equipment performance over general utility. Financial models supporting this segment also include leasing and equipment-as-a-service (EaaS) offerings, which help small and medium-sized enterprises (SMEs) overcome the barrier of high upfront capital expenditure, accelerating the modernization cycle across the industry and sustaining market momentum even during periods of economic volatility.

The strategic importance of the supply chain cannot be overstated; geopolitical risks impacting raw material availability (especially nickel and chromium for stainless steel) and the global semiconductor shortage directly influence production capacity and pricing stability. Leading manufacturers are actively diversifying their sourcing and establishing regional production hubs to mitigate these risks and ensure resilience against global economic disruptions. Furthermore, the labor skills gap in kitchen maintenance and repair necessitates more user-friendly equipment designs and advanced remote diagnostic tools, allowing less specialized technicians to troubleshoot issues, thereby reducing service costs and improving equipment uptime for the end-user. This user-centric design approach is becoming a competitive necessity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager