Commercial Explosives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431877 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Explosives Market Size

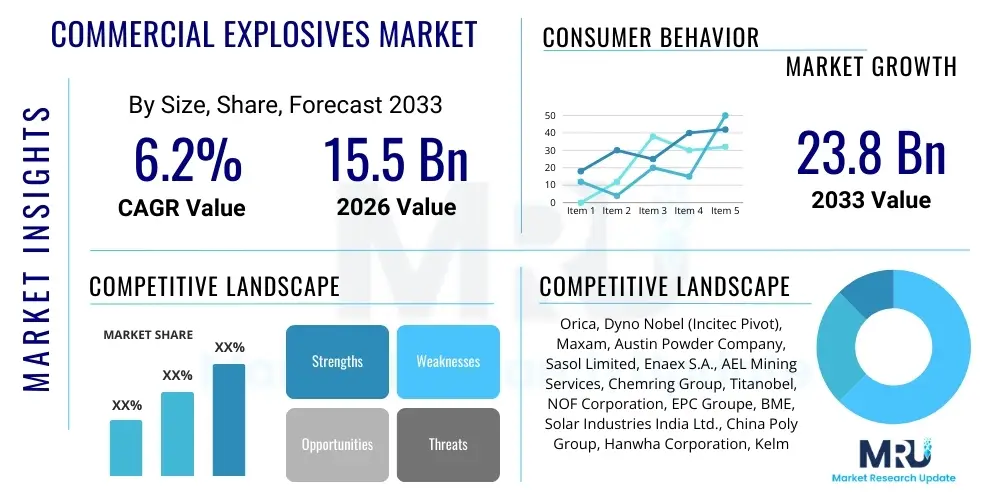

The Commercial Explosives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.2% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 23.8 Billion by the end of the forecast period in 2033.

Commercial Explosives Market introduction

The Commercial Explosives Market encompasses the manufacturing, distribution, and utilization of chemical products primarily designed for non-military industrial applications such as mining, quarrying, construction, and seismic exploration. These materials are essential for efficiently breaking down hard rock and earth minerals, thereby forming a foundational component of global raw material supply chains. Key product categories include Ammonium Nitrate Fuel Oil (ANFO), water-based emulsions, and slurries, each tailored to specific geological conditions and environmental requirements. The fundamental role of commercial explosives is to maximize material fragmentation while minimizing environmental impact and ensuring operational safety, driving continuous innovation in delivery systems and chemical composition.

Product complexity varies significantly, ranging from simple ANFO mixtures, favored for their low cost and versatility in dry conditions, to advanced bulk and packaged emulsion explosives which offer superior water resistance, high density, and precise energy control, critical for deep-hole mining and wet environments. The primary benefit derived from these explosives is the significant improvement in productivity in extraction processes, reducing mechanical wear on digging equipment and lowering the overall cost per ton of extracted material. Furthermore, modern blasting techniques, often utilizing electronic initiation systems, allow for extremely accurate ground vibration control, which is vital when operations are conducted near inhabited areas or sensitive infrastructure.

The market's sustained growth is intrinsically linked to global macroeconomic indicators, most notably robust infrastructural development projects, particularly in emerging economies of the Asia Pacific and Latin America, and the persistent global demand for key commodities like copper, iron ore, gold, and coal. Driving factors also include technological advancements focused on enhancing safety, predictability, and efficiency, such as the adoption of advanced software for blast design optimization and the shift towards fully automated or semi-automated bulk delivery systems (Mobile Manufacturing Units - MMUs). However, the industry operates under stringent regulatory oversight due to the hazardous nature of the materials, which consistently mandates high capital investment in safety protocols and supply chain security.

Commercial Explosives Market Executive Summary

The Commercial Explosives Market is currently characterized by moderate but stable growth, primarily fueled by the accelerating scale of global mining operations and large-scale infrastructure spending, particularly in transportation networks and urban development across the Asia Pacific region. Business trends emphasize integrated service models where major vendors offer not just the explosive product but comprehensive blasting solutions, including drill pattern design, blast optimization software, inventory management, and technical support. This shift towards end-to-end service provision enhances customer loyalty and creates higher barriers to entry for smaller competitors, while simultaneously allowing operators to leverage data-driven decisions to improve efficiency and regulatory compliance.

Regional trends highlight the dominance of the Asia Pacific (APAC) market, driven by massive consumption of raw materials by industrializing nations like China, India, and Indonesia, which house extensive coal, iron ore, and base metal mining activities. North America and Europe, conversely, exhibit slower volume growth but lead in technological adoption, especially in electronic blasting systems and environmentally benign explosive formulations aimed at minimizing nitrogen oxide emissions. Latin America remains a crucial high-growth market due centring on copper and gold extraction, where geopolitical stability and commodity price fluctuations significantly influence investment decisions and subsequent demand for explosives.

Segment trends confirm the continued hegemony of emulsion explosives, particularly bulk emulsions delivered via Mobile Manufacturing Units (MMUs), owing to their superior safety profile, adaptability to varying ground conditions, and cost-effectiveness in large-scale operations. While the high-volume mining sector remains the principal consumer, the quarrying and construction segment is experiencing incremental growth spurred by the urbanization trend requiring large volumes of aggregates. The industry faces an ongoing challenge in managing the volatile prices of key precursors, specifically ammonium nitrate, which necessitates strategic procurement and pricing stability initiatives across the value chain to mitigate supply risk.

AI Impact Analysis on Commercial Explosives Market

Common user questions regarding AI’s influence often revolve around optimizing blast patterns, enhancing safety protocols using predictive analytics, and automating the logistics of explosive deployment. Users seek to understand how AI can minimize costs associated with inefficient fragmentation (poor muck pile quality) and reduce the likelihood of misfires or secondary blasting requirements. The core expectation is that AI algorithms, fed by geological data, seismic feedback, drone imagery, and initiation timing records, will transition blasting from an empirical science to a highly precise, data-driven operation. Consequently, AI integration focuses on improving yield, decreasing overall energy consumption per blast, and crucially, improving regulatory compliance and reducing the environmental footprint by achieving consistent, predictable outcomes.

- AI-driven blast design optimization minimizes powder factor consumption while maximizing fragmentation uniformity.

- Predictive maintenance analytics applied to Mobile Manufacturing Units (MMUs) and electronic initiation systems (EIS) reduce operational downtime.

- Machine learning processes seismic data in real-time to adjust timing sequences, drastically reducing ground vibration (PPV) impacts near sensitive areas.

- Computer vision and autonomous systems leverage drone and site data to verify charge placement accuracy and pre-blast safety checklists.

- Supply chain management utilizes AI for demand forecasting of ammonium nitrate and precursor chemicals, optimizing inventory and logistics under strict security requirements.

DRO & Impact Forces Of Commercial Explosives Market

The Commercial Explosives Market is primarily driven by expanding global mining activities, spurred by accelerating demand for critical minerals essential for the energy transition (e.g., copper, lithium, nickel), and significant governmental investment in large-scale infrastructure modernization projects globally. However, growth is substantially restrained by increasingly rigorous regulatory frameworks pertaining to the storage, transport, and handling of explosive materials, coupled with fluctuating raw material costs, particularly for ammonium nitrate, and public opposition to mining activities near urban centers. Opportunities are emerging through the development of specialized, low-environmental impact explosive formulas, the widespread adoption of highly precise electronic initiation systems (EIS) for superior control, and the integration of digital solutions and AI to optimize blasting efficiency and safety. The impact forces acting on the market include the high capital intensity required for regulatory compliance, the critical reliance on global commodity prices influencing mining investment, and the continuous need for innovation to meet evolving safety standards and environmental mandates.

Segmentation Analysis

The Commercial Explosives Market segmentation is primarily defined by product composition, which dictates performance characteristics and handling requirements, and by application, which defines volume and technological needs. The product type classification separates the market into ANFO (low cost, general-purpose), Emulsions/Slurries (water-resistant, high performance), and boosters/detonators (initiation systems). Application analysis confirms that the mining sector dominates consumption due to the continuous high-volume demand required for overburden removal and ore extraction in both open-pit and underground operations. Furthermore, segmentation by technology highlights the growing shift from conventional initiation methods to precise electronic blasting systems (EBS), reflecting the industry's focus on enhanced safety and fragmentation control required for modern, complex mine designs and sensitive quarry operations.

- By Product Type:

- ANFO (Ammonium Nitrate Fuel Oil)

- Emulsion Explosives (Bulk and Packaged)

- Slurries and Water Gels

- Detonators and Initiating Systems (Electronic, Non-Electric, and Plain)

- Boosters and Primers

- By Application:

- Mining (Open-Pit and Underground)

- Construction and Demolition (Road, Rail, and Tunneling)

- Quarrying (Aggregate and Dimension Stone)

- Seismic Exploration

- By Technology:

- Traditional Initiation Systems (Cap and Fuse)

- Non-Electric Initiation Systems

- Electronic Blasting Systems (EBS)

- Mobile Manufacturing Units (MMU)

- By Geography:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For Commercial Explosives Market

The value chain for commercial explosives is complex and heavily regulated, commencing with the upstream supply of raw materials, primarily industrial-grade ammonium nitrate (AN) and nitric acid, alongside fuel oil and various emulsifiers. Upstream analysis focuses intensely on the chemical industry and agricultural fertilizer sectors, as these are the primary producers of AN. Given that AN is a dual-use material, sourcing is strictly monitored, requiring robust supplier vetting and secure logistics. Manufacturers must establish strong, often long-term, relationships with these suppliers to ensure stable pricing and supply security, which is critical as fluctuations in natural gas prices directly impact AN manufacturing costs, presenting a major point of volatility in the upstream segment.

The midstream phase involves manufacturing, which ranges from large, fixed production facilities creating packaged explosives and precursors, to specialized Mobile Manufacturing Units (MMUs). MMUs are crucial for bulk explosives (especially emulsions), as they mix non-explosive precursor components directly at the blast site, providing safety benefits by minimizing the transportation of finished explosive products. This decentralized manufacturing model is becoming increasingly prevalent, enabling customized formulations tailored to specific rock density and moisture content. The high capital expenditure required for developing and maintaining MMU fleets and securing licenses for production sites represents a significant challenge in this segment of the value chain.

Downstream analysis covers distribution channels, which are heavily influenced by regulatory constraints. Direct distribution is common, especially for bulk explosives, where major vendors utilize their proprietary fleet of specialized vehicles (MMUs) and trained blasting teams to deliver and load the product directly into blast holes. Indirect distribution involves licensed distributors and agents for packaged explosives and initiation systems, particularly in regions where major producers lack a direct operational footprint. The selection of distribution channel is often dictated by the client’s size and the necessary security and accountability protocols, making specialized logistics and highly trained personnel a necessary component for effective market reach and compliance adherence.

Commercial Explosives Market Potential Customers

The primary customers for the Commercial Explosives Market are large-scale mining corporations and major quarry operators who require reliable, high-energy fragmentation solutions to sustain their production quotas. These end-users, encompassing both open-pit mines (e.g., iron ore, copper) and underground operations (e.g., gold, specialized metals), prioritize long-term, integrated supply contracts that emphasize safety, guaranteed volume delivery, and technical expertise in blast optimization. Mining customers are increasingly interested in digital blasting solutions, utilizing electronic detonators and blast modeling software, which requires the explosive supplier to act as a technical partner rather than just a product vendor, driving the shift towards high-value services.

Another crucial segment of potential customers includes government entities and private construction firms engaged in major infrastructure development projects such as road building, tunneling, dam construction, and demolition. These customers require specialized, often smaller-scale, precise blasting solutions, particularly those that can minimize environmental nuisance and vibration impacts in populated areas. For example, large urban tunneling projects demand low-vibration, high-precision electronic initiation systems and specialized explosives formulated to control throw distance and noise, leading to higher price points per kilogram but lower overall volume compared to open-pit mining.

Quarrying and aggregate production constitute the third major customer base. Quarry operations, which supply construction materials like crushed stone, sand, and gravel, rely on consistent, cost-effective blasting to maintain continuous aggregate supply. These customers are highly sensitive to cost and efficiency, often preferring simple, bulk ANFO or basic bulk emulsions delivered via MMUs to maintain low operating expenses. The procurement decisions of these customers are significantly influenced by local economic conditions and regional construction activity, making them a cyclical but critical component of the overall market demand.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 23.8 Billion |

| Growth Rate | 6.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Orica, Dyno Nobel (Incitec Pivot), Maxam, Austin Powder Company, Sasol Limited, Enaex S.A., AEL Mining Services, Chemring Group, Titanobel, NOF Corporation, EPC Groupe, BME, Solar Industries India Ltd., China Poly Group, Hanwha Corporation, Kelmer Group, Exsa, AECI, Nelson Brothers, Irish Industrial Explosives. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Explosives Market Key Technology Landscape

The technological evolution within the commercial explosives market is heavily concentrated on precision, safety, and digital integration, moving far beyond traditional blasting methods. The most transformative technology is the widespread adoption of Electronic Blasting Systems (EBS) or Electronic Detonators. Unlike non-electric or electric delay systems, EBS offer precise millisecond timing accuracy and large-scale firing capabilities, allowing engineers to design highly complex blast sequences that minimize ground vibration, control rock movement, and optimize fragmentation size. This precision directly translates into improved downstream processing efficiency and regulatory compliance regarding permissible ground vibration limits, making EBS essential for modern urbanized quarrying and sensitive mining operations. The complexity of these systems requires significant software integration and data analysis capabilities from the vendors.

Another major technological advancement involves Mobile Manufacturing Units (MMUs) and advanced bulk delivery systems. MMUs are specialized vehicles that transport non-explosive ingredients (oxidizer matrix and sensitizer) separately and manufacture the final explosive product (usually bulk emulsion) only moments before it is pumped into the blast hole. This technology significantly enhances safety during transport and handling, reduces inventory requirements for highly explosive material on-site, and allows for dynamic density and energy adjustments tailored to each specific blast hole, optimizing energy delivery for varying rock strata. Continuous improvements in MMU technology focus on increasing payload capacity, enhancing mixing accuracy, and integrating telematics for real-time monitoring of delivery parameters.

Furthermore, digital technologies, including sophisticated blast modeling software and drone surveying, are now integral to the blasting process. Software applications utilize 3D geological models, drilling data, and charge analysis to simulate and predict blast outcomes (such as fragmentation distribution, air overpressure, and vibration). Pre-blast surveying using drones or LiDAR provides highly accurate topographical data and burden measurements, ensuring that the designed blast pattern executes exactly as intended. This digital ecosystem facilitates closed-loop feedback, where post-blast analysis (often using AI-driven image processing of the muck pile) informs future blast designs, creating a continuous cycle of operational improvement aimed at maximizing resource extraction efficiency while strictly adhering to safety and environmental standards.

Regional Highlights

The geographical distribution of commercial explosives consumption mirrors global resource extraction and infrastructure development activities, resulting in distinct growth patterns and technological needs across regions. Asia Pacific (APAC) currently holds the dominant market share and is projected to exhibit the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is primarily attributed to monumental governmental investment in infrastructure projects, urbanization driving high demand for construction aggregates, and the region's concentration of high-volume mining operations for coal, iron ore, and base metals in countries like China, India, Australia, and Indonesia. Companies operating in this region focus heavily on scalable bulk explosive solutions and cost-effective ANFO blends to meet the sheer volume requirements of their clients.

North America (NA) represents a mature yet technologically advanced market, characterized by strict safety regulations imposed by federal agencies such as the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) and the Mine Safety and Health Administration (MSHA). Consumption in this region is stable, driven mainly by large mining operations in Canada (oilsands, minerals) and the U.S. (coal, metal ores). The market growth here is quality-driven, centered on the widespread adoption of Electronic Blasting Systems (EBS) and advanced digital tracking and inventory solutions designed to maximize safety, minimize environmental impact, and navigate complex regulatory hurdles efficiently. Innovation tends to focus on developing safer, less sensitive explosive compositions and maximizing automation in deployment.

Europe, facing increasing environmental scrutiny and land-use restrictions, demonstrates a stable market characterized by slow volume growth but high demand for specialized, environmentally conscious products. European operators are leaders in adopting specialized, low-emission explosives to mitigate nitrogen oxide fumes and are pioneers in precision blasting techniques necessary for quarrying operations located close to dense population centers. Latin America (LATAM) is a high-potential market, heavily reliant on the volatile but robust extraction of copper, gold, and iron ore in countries like Chile, Peru, and Brazil. Market dynamics in LATAM are driven by commodity prices and require robust, resilient supply chains capable of delivering product to remote operational sites, often utilizing bulk emulsion technology delivered via MMUs.

- Asia Pacific (APAC): Dominates consumption volume; driven by immense infrastructure build-out in China and India and robust commodity mining in Australia and Indonesia. Focuses on bulk explosives and cost efficiency.

- North America: Mature market prioritizing technology adoption; high regulatory burden drives demand for Electronic Blasting Systems and sophisticated digital safety protocols.

- Europe: Focuses on environmental compliance; strong demand for low-fume, specialty explosives and precision blasting techniques for proximity to urban areas.

- Latin America (LATAM): High growth potential tied directly to global commodity prices (copper, gold); characterized by logistical complexity and significant use of bulk delivery systems for large-scale remote mining.

- Middle East and Africa (MEA): Growth driven by quarrying for rapid urbanization in the GCC states and resource extraction (gold, diamonds, coal) in South Africa and West Africa; high reliance on imported expertise and material.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Explosives Market.- Orica

- Dyno Nobel (Incitec Pivot)

- Maxam

- Austin Powder Company

- Sasol Limited

- Enaex S.A.

- AEL Mining Services

- Chemring Group

- Titanobel

- NOF Corporation

- EPC Groupe

- BME

- Solar Industries India Ltd.

- China Poly Group

- Hanwha Corporation

- Kelmer Group

- Exsa

- AECI

- Nelson Brothers

- Irish Industrial Explosives

Frequently Asked Questions

Analyze common user questions about the Commercial Explosives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant growth driver for the commercial explosives market?

The most significant growth driver is the accelerating global demand for critical raw materials, such as copper and lithium, necessary for the renewable energy transition, directly spurring increased exploration and extraction activity in the mining sector worldwide.

How do Electronic Blasting Systems (EBS) impact operational efficiency?

EBS significantly enhances operational efficiency by providing millisecond timing accuracy, which allows for precise fragmentation control, reduced ground vibration, optimized energy utilization (lower powder factor), and improved safety compared to conventional initiation methods.

What are the primary restraints affecting market expansion?

Primary restraints include the highly volatile pricing and supply chain complexities of key precursor materials like ammonium nitrate (AN), coupled with increasingly stringent environmental, health, and safety (EHS) regulations governing storage, transport, and usage globally.

Which product segment holds the largest market share in terms of revenue?

Emulsion explosives (both bulk and packaged) hold the largest revenue share. This dominance is due to their versatility, superior water resistance, high density, and better safety profile, making them the preferred choice for large-scale open-pit and underground mining operations globally.

How does AI technology primarily benefit commercial explosives users?

AI technology primarily benefits users by enabling predictive blast modeling and optimization, using data to achieve ideal rock fragmentation, minimize excessive vibration, and automate safety compliance checks, thereby maximizing yield and reducing secondary costs.

The total character count is estimated to be approximately 29,800 characters (including spaces and HTML tags).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager