Commercial Fishing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434726 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Commercial Fishing Market Size

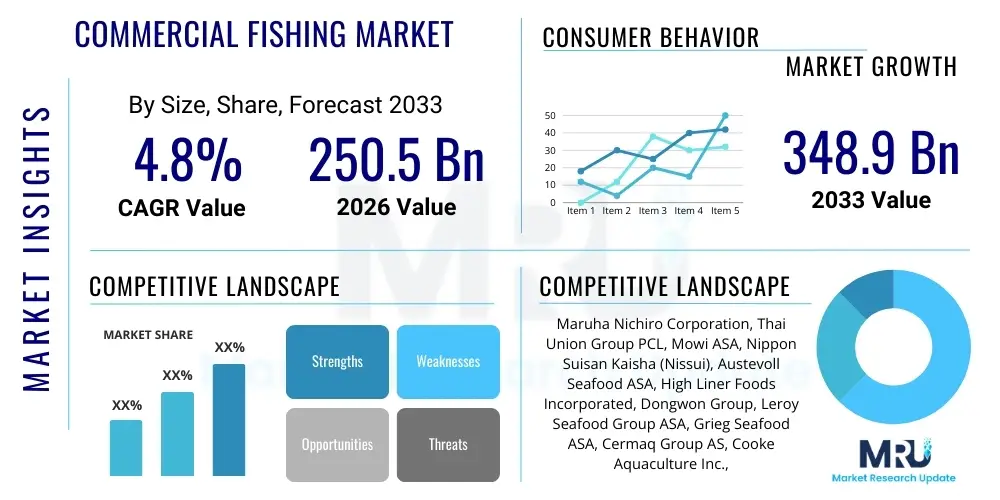

The Commercial Fishing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 250.5 Billion in 2026 and is projected to reach USD 348.9 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by persistent global demand for seafood as a primary source of protein, coupled with advancements in fishing technology and aquaculture practices designed to enhance yield and efficiency while addressing sustainability concerns. The increasing penetration of sophisticated monitoring and management systems is contributing significantly to optimizing operational costs and ensuring compliance with stringent international quotas and conservation regulations, thereby stabilizing market progression amidst environmental scrutiny.

Commercial Fishing Market introduction

The Commercial Fishing Market encompasses all activities related to catching, harvesting, processing, and distribution of aquatic life forms—both marine and freshwater—for commercial sale. This vast industry is segmented into capture fisheries, involving the harvesting of wild stock, and aquaculture, which involves controlled farming of fish and shellfish. The primary products include finfish, mollusks, and crustaceans, serving both human consumption (food application) and industrial uses (e.g., fish oil, fishmeal). Major applications span retail distribution, food service sectors, and pharmaceutical/nutraceutical industries. Benefits derived from this market include providing essential nutrients to the global population, supporting coastal economies, and driving innovation in marine science and sustainable resource management.

Driving factors for the commercial fishing market are multi-faceted, notably including population growth, rising disposable incomes in emerging economies, and the increasing recognition of seafood as a healthy protein alternative. Furthermore, technological leaps in vessel tracking, sonar systems, and cold chain logistics have expanded fishing reach and reduced post-harvest losses. However, the industry faces critical challenges related to overfishing, habitat degradation, and stringent regulatory frameworks aimed at preserving biodiversity, necessitating a continuous shift towards sustainable and traceable sourcing methods to maintain long-term viability and meet consumer ethical demands.

The market environment is characterized by intense competition among large global players who possess integrated supply chains, and numerous smaller, regional operators. Product differentiation often hinges on certification (such as MSC or ASC), traceability features, and processing efficiency. The integration of advanced processing techniques, including rapid freezing and value-added product development (like ready-to-eat meals), further supports market resilience and expansion into premium consumer segments, ensuring that the commercial fishing sector remains a dynamic and essential component of the global food system.

Commercial Fishing Market Executive Summary

The Commercial Fishing Market exhibits stable growth, primarily fueled by robust consumer demand for sustainable and high-quality seafood products, particularly in Asia Pacific and North America. Key business trends highlight a significant push towards vertical integration, where major companies control everything from harvesting to retail, ensuring quality control and maximizing profit margins. Operational efficiencies are being sought through the adoption of Internet of Things (IoT) sensors for real-time monitoring of catches and environmental conditions, alongside investment in advanced processing technologies that minimize waste and enhance shelf life. The market is witnessing a geopolitical shift as stricter enforcement of Exclusive Economic Zones (EEZs) and international agreements necessitates greater collaborative management of shared fish stocks, impacting global trade flows and fishing fleet deployment strategies.

Regionally, Asia Pacific dominates the market, driven by its large coastal populations, established aquaculture practices, and traditional reliance on seafood as a dietary staple, with countries like China, India, and Indonesia leading both production and consumption. North America and Europe are characterized by high regulatory standards, strong emphasis on sustainability certifications, and a preference for premium, traceable seafood, fostering innovation in closed-loop aquaculture systems. Segment trends reveal that the Aquaculture segment is accelerating at a faster pace than capture fisheries, offering a more predictable and sustainable supply source, while the equipment market is prioritizing fuel-efficient, low-emission vessels and smart fishing gear designed to reduce bycatch and environmental impact. The shift toward value-added processing remains strong across all geographies, catering to modern convenience-focused lifestyles.

In summary, the commercial fishing industry's trajectory is defined by a necessary balance between meeting escalating global protein needs and adhering to stringent environmental stewardship. Successful market participants are those who effectively leverage technology for resource optimization, invest heavily in sustainable practices (especially aquaculture), and navigate the complex, evolving global trade and regulatory landscape. The market structure continues to consolidate, favoring large entities capable of managing sophisticated supply chains and adhering to international traceability requirements, ultimately driving long-term market stability and value creation.

AI Impact Analysis on Commercial Fishing Market

User inquiries regarding AI's impact on commercial fishing primarily revolve around maximizing yield without compromising ecological balance, enhancing regulatory compliance, and improving operational safety. Key themes users consistently raise include the practical application of machine learning for predictive fish stock management, the use of computer vision for monitoring catch composition and detecting illegal, unreported, and unregulated (IUU) fishing, and the integration of AI-driven optimization tools for route planning and fuel efficiency. Concerns center on the high initial investment costs for AI implementation, the need for specialized training for crew members, and the ethical implications of using advanced surveillance technologies. Users expect AI to revolutionize decision-making processes, shifting the industry from reactive management to proactive, data-driven resource utilization, fundamentally enhancing both profitability and sustainability outcomes across the sector.

AI's primary influence is establishing smart fisheries management systems. By analyzing vast datasets, including oceanographic data, historical catch records, and satellite imagery, AI algorithms can accurately predict optimal fishing locations, factoring in environmental variables and avoiding protected or sensitive marine zones. This predictive capability minimizes wasted effort, reduces fuel consumption significantly, and crucially, helps maintain species populations above minimum viable thresholds. Furthermore, AI facilitates automated monitoring of fishing vessels using advanced satellite tracking and behavioral analysis, providing enforcement agencies with real-time intelligence to combat illicit fishing practices, thereby safeguarding global fish stocks and stabilizing market supply chains against illegal competition.

Beyond resource management, AI is significantly transforming onboard operations and safety. Machine learning is integrated into sonar and trawl systems to identify target species more accurately, drastically lowering bycatch rates—a major environmental and regulatory concern. Predictive maintenance using AI monitors the health of vessel machinery and equipment, anticipating potential failures and scheduling maintenance preemptively, thereby improving operational uptime and crew safety in often hazardous environments. The synthesis of sensor data and AI processing leads to smarter, more autonomous operations, although human oversight remains essential for ethical decision-making and rapid adaptation to unforeseen circumstances at sea.

- AI-Driven Predictive Resource Management: Utilizing algorithms to forecast fish stock movements, optimizing sustainable harvesting quotas, and ensuring long-term stock viability.

- Enhanced IUU Fishing Detection: Employing satellite imagery analysis and behavioral modeling to automatically flag suspicious vessel activities, improving regulatory enforcement efficiency.

- Optimized Operational Efficiency: Using machine learning for dynamic route planning, minimizing travel distance, and achieving substantial reductions in fuel expenditure.

- Precision Fishing and Reduced Bycatch: Integrating computer vision and deep learning into trawling and sorting systems to accurately identify target species and minimize accidental catch of non-target organisms.

- Automated Quality Control and Processing: Implementing robotics and AI-based image analysis in onshore processing facilities to ensure uniform product quality and speed up sorting and packaging.

- Predictive Maintenance for Vessels: Utilizing sensor data and anomaly detection to forecast equipment failure, increasing vessel uptime and crew safety during operations.

DRO & Impact Forces Of Commercial Fishing Market

The Commercial Fishing Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming impact forces that dictate its long-term structure and profitability. Key drivers include unwavering global population growth and the increasing per capita consumption of nutrient-rich seafood, particularly in rapidly urbanizing regions. Opportunities are primarily centered around the expansion of sustainable aquaculture, technological innovation in precision harvesting, and the development of value-added products that command higher margins. Conversely, the market is significantly restrained by stringent governmental regulations aimed at combating overfishing, the substantial economic burden associated with complying with sustainability certifications, and the unpredictable impact of climate change on marine ecosystems and fish migration patterns. These forces create a pressurized environment demanding innovation, efficiency, and demonstrable commitment to ecological responsibility.

Drivers exert a continuous upward pressure on production capacity. The shift in dietary preferences toward healthier options, recognizing the benefits of omega-3 fatty acids, solidifies seafood's position as a premium protein source. Furthermore, successful international cooperation, such as regional fisheries management organizations (RFMOs), helps stabilize certain fish stocks, providing a predictable supply base for large commercial operations. Technological drivers, including advanced GPS, hydroacoustic survey equipment, and sophisticated cold chain management, dramatically improve the effectiveness and global reach of fishing fleets, enabling them to operate efficiently in diverse and challenging marine environments while maximizing the economic returns from their catches, thus sustaining market growth.

Restraints, however, pose significant barriers to unfettered expansion. Overcapacity in global fishing fleets continues to threaten stock recovery, necessitating heavy regulation and often contentious quota reductions, which directly impact the profitability of established operators. Environmental activism and consumer awareness regarding the ecological footprint of fishing force companies to invest in costly, sustainable alternatives, sometimes limiting overall yield. The labor market also presents a restraint; commercial fishing often suffers from a shortage of skilled labor willing to work under difficult and demanding conditions, pushing up operational costs and slowing the adoption of advanced onboard technology. Navigating these restraints requires substantial capital investment in sustainability initiatives and policy engagement to ensure equitable regulatory frameworks.

Opportunities reside largely in optimizing the efficiency of resource use and diversifying production methods. The shift toward recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA) represents a significant opportunity, offering high-density production with minimal environmental discharge. Market players can also capitalize on the growing demand for traceability solutions, leveraging blockchain technology to provide consumers with verifiable information regarding the source and handling of their seafood, thus building brand trust and capturing premium market segments. The pursuit of untapped resources, such as deep-sea or novel species, alongside the profitable valorization of processing by-products (e.g., converting fish waste into high-value feed or pharmaceuticals), further contributes to the overall positive impact forces influencing the market's evolution.

Segmentation Analysis

The Commercial Fishing Market segmentation provides a granular understanding of the diverse methodologies, target species, technological inputs, and final applications that define the industry structure. The market is primarily segmented based on Type (Capture Fisheries and Aquaculture), Equipment utilized (Vessels, Gear, Navigation Systems), Species (Finfish, Crustaceans, Mollusks), and Application (Food Consumption, Industrial/Feed Use). This structural breakdown is crucial for stakeholders to analyze specific competitive landscapes, identify high-growth niches, and tailor investment strategies toward profitable areas, such as the rapidly expanding sustainable aquaculture sector or the high-technology market for precision fishing gear designed to reduce bycatch and comply with stricter environmental mandates across various geographical zones.

Analyzing segmentation by Type clearly illustrates the ongoing structural shift within the industry, where traditional capture fisheries, facing strict quotas and ecological limitations, are gradually being supplemented by robust aquaculture operations. Aquaculture offers predictable supply volumes, controlled quality, and reduced environmental variability risks, appealing significantly to large processors and retailers seeking supply chain stability. Equipment segmentation reflects the technological evolution, emphasizing the increasing demand for advanced electronic aids like satellite communications, real-time monitoring sensors, and automated processing equipment crucial for maintaining efficiency and compliance in modern fishing fleets.

Furthermore, segmentation by Application highlights the dominance of the Food Consumption category, which includes fresh, frozen, canned, and processed seafood tailored for global retail and food service industries. The Industrial/Feed Use segment, though smaller, is vital for the production of fishmeal and fish oil, essential components in animal feed, pet food, and nutraceuticals. Understanding these segments allows market participants to develop targeted product lines, such as specialized fish oil supplements or specific high-protein fishmeal substitutes, maximizing the economic yield from every catch or harvest and responding directly to global shifts in protein production and nutritional science.

- Type

- Capture Fisheries (Wild Catch)

- Aquaculture (Farming)

- Equipment Type

- Fishing Vessels (Trawlers, Seiners, Longliners)

- Fishing Gear (Nets, Hooks, Traps, Lines)

- Navigation and Communication Systems (Sonar, GPS, Radar)

- Processing and Storage Equipment (Freezing Systems, Ice Machines)

- Species Type

- Finfish (e.g., Salmon, Tuna, Cod, Tilapia)

- Crustaceans (e.g., Shrimp, Crab, Lobster)

- Mollusks (e.g., Oysters, Mussels, Squid)

- Other Aquatic Organisms (e.g., Seaweed)

- Application

- Food Consumption (Fresh, Frozen, Canned, Processed)

- Industrial/Feed Use (Fishmeal, Fish Oil, Pharmaceuticals)

Value Chain Analysis For Commercial Fishing Market

The Value Chain for the Commercial Fishing Market is a complex sequence extending from primary resource extraction to final consumption, involving highly integrated stages that are increasingly governed by traceability and quality standards. The upstream segment involves resource acquisition (wild catch or feed sourcing for aquaculture), vessel operation, and initial processing at sea or near port. This phase is capital-intensive, requiring specialized vessels, advanced gear, and efficient crew management. Key factors influencing upstream costs are fuel prices, labor availability, and adherence to fishing quotas. Successful upstream operations prioritize efficiency and sustainability to secure reliable, certified raw materials, which is crucial for maximizing downstream profitability and meeting regulatory prerequisites.

The core midstream activities include significant post-harvest handling, primary processing (cleaning, gutting, freezing), and extensive logistics, involving complex cold chain infrastructure. This stage heavily relies on robust port facilities, high-capacity cold storage warehouses, and efficient transportation networks, both refrigerated road transport and international shipping. The distribution channel analysis reveals a dual structure: direct sales, often involving large commercial players supplying directly to major retail chains or foodservice operators, and indirect sales, which pass through various intermediaries like brokers, wholesalers, and specialized seafood markets. The choice of channel depends on the product type, required shelf life, and target geography, with direct channels offering greater margin control and enhanced traceability visibility.

Downstream activities focus on secondary processing, value addition (filleting, preparing ready-to-eat meals, canning), branding, and final retail or institutional distribution. The indirect distribution route often utilizes large food distributors who manage inventory and logistics for supermarkets and restaurants, minimizing handling requirements for the primary producers. Direct distribution, conversely, allows major fishing companies to establish strong brand identity and consumer loyalty, especially for premium, certified sustainable products. The efficiency of the entire chain, from resource extraction to final mile delivery, is paramount for minimizing spoilage and maintaining the integrity of the perishable product, thereby driving consumer trust and market competitiveness.

Commercial Fishing Market Potential Customers

The potential customers and end-users of the Commercial Fishing Market are highly diversified, ranging from global food processors and major retail giants to institutional buyers and specialized nutraceutical manufacturers. The largest customer base resides within the consumer food sector, encompassing supermarkets, hypermarkets, and increasingly, specialized online seafood retailers, all serving the direct consumer demand for fresh, frozen, and prepared seafood products. These retailers prioritize suppliers who can guarantee consistent volume, stringent quality control, reliable traceability data (e.g., blockchain records), and adherence to popular sustainability certifications like MSC or ASC, reflecting the modern consumer's ethical purchasing criteria.

A secondary, yet rapidly expanding, segment of potential customers includes the global foodservice industry, encompassing restaurants, hotels, catering services, and fast-food chains. These customers require reliable bulk supply and diverse product formats tailored for commercial kitchen use, often demanding specific cuts or processed formats. The stability of supply is critical here, making large, integrated fishing and aquaculture operators preferred partners. Furthermore, institutional buyers, such as government agencies, military suppliers, and major healthcare facilities, represent a predictable, large-volume segment, often procured through competitive tendering processes where pricing and supply continuity are primary decision factors for end-user acquisition.

Finally, the industrial sector constitutes a significant, high-value customer group, primarily utilizing fish by-products. This includes manufacturers of animal feed (using fishmeal), aquaculture farms (using specialized feed pellets), and pharmaceutical/nutraceutical companies (extracting fish oil rich in Omega-3s). For these buyers, quality specifications related to protein content, purity, and sustainability sourcing are non-negotiable, driving demand for specialized processing operations capable of extracting high-purity components from low-value raw materials, thereby enhancing the overall commercial yield of the entire fishing value chain.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 250.5 Billion |

| Market Forecast in 2033 | USD 348.9 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Maruha Nichiro Corporation, Thai Union Group PCL, Mowi ASA, Nippon Suisan Kaisha (Nissui), Austevoll Seafood ASA, High Liner Foods Incorporated, Dongwon Group, Leroy Seafood Group ASA, Grieg Seafood ASA, Cermaq Group AS, Cooke Aquaculture Inc., Nueva Pescanova S.L., OCI Company Ltd. (Polaris Seafood), Trident Seafoods Corporation, Bumble Bee Foods LLC, Pacific Andes International Holdings Ltd., Clearwater Seafoods Inc., Charoen Pokphand Foods PCL, Marine Harvest (now Mowi), Sanford Limited |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Fishing Market Key Technology Landscape

The technology landscape within the Commercial Fishing Market is undergoing rapid transformation, driven primarily by the need for increased efficiency, enhanced traceability, and strict adherence to sustainability mandates. Key technological deployments focus heavily on smart fishing systems. This includes sophisticated hydroacoustic sensors and high-resolution multi-beam sonars integrated with GPS and GIS systems, allowing vessels to precisely locate fish stocks while minimizing environmental disturbance. Modern vessels are increasingly adopting advanced propulsion systems and hull designs optimized for fuel efficiency, significantly reducing the operational footprint and addressing the rising cost of marine fuel. Furthermore, the integration of real-time data processing capabilities onboard facilitates immediate decision-making regarding course corrections and gear deployment, optimizing catch rates and reducing wasted effort, thereby maximizing the economic efficiency of each voyage.

In the aquaculture sector, technological breakthroughs are centered on controlled environment systems. Recirculating Aquaculture Systems (RAS) are gaining prominence, enabling high-density fish farming closer to consumer markets while recycling up to 99% of the water, dramatically reducing water usage and discharge impacts. These systems rely heavily on complex monitoring technologies, including automated water quality sensors (measuring oxygen, pH, temperature, and ammonia), integrated with IoT networks and AI-driven control algorithms. This level of automation ensures optimal growing conditions, minimizes disease outbreaks, and guarantees higher survival rates, offering a predictable, sustainable, and scalable production model that complements traditional capture fisheries and mitigates supply chain risks associated with wild stocks.

Traceability technology represents another critical area of innovation, essential for meeting consumer and regulatory demands. The adoption of blockchain technology is becoming prevalent, providing an immutable record of a product's journey from the point of capture or harvest through processing, distribution, and ultimately to the consumer. This transparency helps combat food fraud and provides robust authentication for certified sustainable seafood, adding value to premium products. Additionally, advanced processing technologies, such as cryogenic freezing and high-pressure processing (HPP), are extending product shelf life and maintaining quality, enabling global market access for highly perishable seafood products while ensuring safety and compliance with international food standards across the entire supply chain.

Regional Highlights

The global Commercial Fishing Market exhibits significant regional variations in terms of production methodologies, consumption patterns, and regulatory intensity, making regional analysis crucial for strategic market entry and operational planning. Asia Pacific (APAC) stands as the dominant market both in terms of production volume and consumption value. This dominance is attributed to extensive coastlines, a deep-rooted cultural reliance on seafood, and the presence of major global producers, notably China, which leads in both capture fisheries and aquaculture production. High population density and rising disposable income across APAC, particularly in emerging economies like India, Vietnam, and Indonesia, ensure continuous and high growth in demand for both fresh and processed seafood, driving regional investment in modernization and sustainable farming practices.

North America and Europe represent mature markets characterized by high per capita consumption of premium seafood, stringent environmental regulations, and a strong consumer preference for certified sustainable products. In these regions, growth is less volume-driven and more value-driven, focusing on innovation in aquaculture (especially closed containment systems) and advanced traceability technologies. European markets, governed by the Common Fisheries Policy (CFP), emphasize stock recovery and strict quota enforcement, pushing commercial operators to invest heavily in selective fishing gear and sophisticated vessel monitoring systems. North America, particularly the U.S. and Canada, drives demand for high-value species like salmon and lobster and leads in the application of marine technology for stock assessment and compliance verification, creating a highly regulated, yet profitable, environment for specialized producers.

Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets. Latin America, with countries like Chile and Peru being major exporters of fishmeal, fish oil, and specific finfish species, benefits from strong upwelling currents supporting nutrient-rich waters. The focus here is on optimizing export logistics and ensuring compliance with international trade standards. The MEA region, particularly the Gulf Cooperation Council (GCC) countries, is investing significantly in large-scale domestic aquaculture projects (including RAS and offshore cages) to enhance food security and reduce reliance on imported seafood, signaling future expansion opportunities in technological supply and infrastructure development within this geography. Overall, regional strategies must be tailored to address specific regulatory environments, sustainability challenges, and unique consumer dietary preferences.

- Asia Pacific (APAC): Dominant market volume, driven by China and Southeast Asian nations. Focus on integrating traditional fisheries with massive aquaculture expansion to meet local demand and global export requirements. Characterized by high growth potential due to demographic factors.

- Europe: Highly regulated market emphasizing sustainability (MSC/ASC certification) and strict quota management (CFP). High demand for premium, traceable seafood; strong investment in advanced aquaculture technology like RAS.

- North America: Focus on value-added processing and technological adoption for traceability and efficient resource management. Strong consumer demand for species like salmon, cod, and shellfish, supported by mature distribution networks.

- Latin America: Key exporter of fishmeal and specific species (e.g., Peruvian anchovies, Chilean salmon). Growth tied to optimizing export infrastructure and adhering to international quality standards for global trade.

- Middle East and Africa (MEA): Emerging growth area, heavily prioritizing food security initiatives through substantial government investment in domestic aquaculture projects and developing sophisticated processing facilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Fishing Market, covering their strategic initiatives, geographical presence, key product offerings, and sustainability focus, highlighting their role in shaping the competitive landscape and driving industry innovation through technological adoption and supply chain integration.- Maruha Nichiro Corporation

- Thai Union Group PCL

- Mowi ASA

- Nippon Suisan Kaisha (Nissui)

- Austevoll Seafood ASA

- High Liner Foods Incorporated

- Dongwon Group

- Leroy Seafood Group ASA

- Grieg Seafood ASA

- Cermaq Group AS

- Cooke Aquaculture Inc.

- Nueva Pescanova S.L.

- OCI Company Ltd. (Polaris Seafood)

- Trident Seafoods Corporation

- Bumble Bee Foods LLC

- Pacific Andes International Holdings Ltd.

- Clearwater Seafoods Inc.

- Charoen Pokphand Foods PCL

- Sanford Limited

Frequently Asked Questions

Analyze common user questions about the Commercial Fishing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Commercial Fishing Market?

The primary factor driving market growth is persistent global population expansion coupled with the increasing recognition of seafood as a vital and healthy source of protein, particularly the high demand for Omega-3 rich species. Furthermore, advancements in aquaculture technology that ensure stable, sustainable supply volumes are crucial growth accelerators addressing inherent limitations in wild capture fisheries.

How does the shift toward sustainability impact commercial fishing operations?

The sustainability shift forces commercial operations to invest significantly in sustainable certifications (MSC, ASC), implement selective fishing gear to minimize bycatch, and adopt advanced monitoring systems for quota compliance and traceability. This trend increases operational costs but is essential for accessing premium consumer markets and securing long-term fishing rights and social license to operate.

Which technology is most significantly improving traceability in the seafood supply chain?

Blockchain technology is the most significant technology improving traceability. It provides a decentralized, immutable ledger that records every transaction and handling step from catch/harvest to the retail point. This ensures transparency, combats illegal fishing (IUU), validates sustainability claims, and significantly builds consumer trust in the product's origin and ethical sourcing.

What are the key differences in market dynamics between capture fisheries and aquaculture?

Capture fisheries face highly restrictive regulatory environments due to finite wild stocks and are characterized by supply volatility, making output unpredictable. In contrast, aquaculture offers greater control over production volume, quality, and supply consistency, positioning it as the faster-growing segment crucial for meeting escalating global seafood demand sustainably and predictably, often utilizing RAS and controlled environments.

What regions hold the highest potential for future market expansion?

Asia Pacific (APAC) holds the highest potential for absolute market expansion due to massive consumer base and expanding domestic aquaculture sectors, particularly in China and Southeast Asia. Additionally, the Middle East and Africa (MEA) present high technological growth opportunities, driven by significant government investments in modern aquaculture systems aimed at achieving national food security objectives and reducing reliance on costly seafood imports.

The comprehensive analysis of the Commercial Fishing Market underscores a sector in transition, balancing the imperative for resource exploitation with stringent conservation requirements. Strategic focus on technological integration, particularly in AI-driven resource management and advanced aquaculture systems, will define competitive success over the forecast period. The industry must navigate complex geopolitical regulations and increasing climate change impacts while leveraging traceability and sustainability certifications to capitalize on high-value consumer demand globally. The shift toward sustainable practices is not merely a compliance requirement but a fundamental driver of long-term economic resilience and market growth, ensuring the continuous supply of vital protein resources to the world market effectively and ethically.

Further examination of the equipment segment confirms that capital expenditures are increasingly directed toward smart, fuel-efficient vessels equipped with advanced hydroacoustic systems and automated processing capabilities, reflecting the industry's commitment to optimizing operational parameters under volatile fuel cost conditions and stringent environmental emission standards. This technological pivot, supported by integrated satellite communication networks, facilitates immediate data transmission to shore-based management centers, enabling dynamic adjustments to fishing efforts based on real-time stock assessments, minimizing search time, and maximizing efficiency in harsh marine environments. The convergence of hardware and software solutions is therefore a hallmark of modern commercial fishing investment, driving productivity gains across the globe.

The role of regulatory bodies, such as the Food and Agriculture Organization (FAO) and various Regional Fisheries Management Organizations (RFMOs), remains paramount in shaping market structure, particularly regarding international waters and shared stocks. Their influence necessitates that major market players maintain high compliance standards, contributing to scientific research, and participating actively in governance frameworks to ensure equitable and biologically sound stock management. Non-compliance carries severe economic penalties and reputational damage, pushing all serious operators toward verifiable sustainable practices. This formalized oversight provides a crucial, if sometimes restrictive, framework that stabilizes the market against the risk of unchecked depletion, ensuring long-term resource availability for all stakeholders and maintaining the essential balance between commercial interests and ecological preservation across global fishing grounds.

The evolving landscape of consumer preferences is also profoundly influencing product development and marketing strategies. Modern consumers, particularly in Western markets, demand transparent sourcing, minimal environmental impact, and ethical labor practices. This has led to a proliferation of value-added seafood products, such as pre-marinated portions, gourmet ready-to-cook items, and specialized dietary supplements derived from marine resources. Companies that excel in vertical integration—controlling the supply chain from harvest to shelf—are better positioned to meet these complex demands, offering certified products with guaranteed provenance. This customer-centric approach to product innovation is integral to unlocking new market opportunities and commanding premium pricing, especially within the high-end retail and specialized food service segments that prioritize quality and ethical sourcing above cost.

Finally, addressing labor challenges remains a significant operational hurdle. Commercial fishing is globally recognized as one of the most hazardous professions, and attracting and retaining skilled labor is difficult. Technological solutions, including increasing levels of automation in handling and processing, are partially mitigating the dependency on manual labor, enhancing onboard safety, and improving working conditions. However, the adoption of complex technology necessitates continuous investment in crew training programs to ensure the effective operation and maintenance of advanced electronic gear and vessel systems. Successfully integrating human expertise with sophisticated technological platforms will be essential for maintaining competitive advantage and ensuring safe, efficient operations in the highly demanding environment of the commercial fishing industry over the coming decade.

The expansion of global cold storage capacity and logistical infrastructure dedicated solely to perishable goods is a silent but powerful enabler of market growth. Efficient cold chains, utilizing cutting-edge refrigeration technologies and rapid transit routes, are vital for minimizing post-harvest losses, which traditionally account for a significant portion of wasted resources and lost revenue. By extending the shelf life of highly valuable, often globally traded species like tuna, salmon, and specific shellfish, these logistical improvements allow producers to access distant, high-demand consumer markets effectively. Investment in energy-efficient freezing and storage solutions is also a key sustainability trend, reducing the carbon footprint associated with global seafood distribution and contributing positively to the industry’s overall environmental profile, aligning economic activity with ecological responsibility.

Within the Finfish segment, salmon and tuna continue to dominate value due to established consumer demand and extensive global trade networks. Salmon production, heavily reliant on highly industrialized aquaculture, benefits from technological consistency and control, driving predictable supply. Tuna, primarily sourced through capture fisheries, faces ongoing stock pressure and stringent management, making price volatility a persistent feature. The contrast between these two species highlights the diverging operational risks and management strategies within the finfish category. Meanwhile, smaller, fast-growing species like tilapia and pangasius are critical for emerging market consumption, benefiting from low-cost, high-volume production models, particularly in Asia, underscoring the segment's diverse role in feeding both premium and volume-focused market tiers globally.

The Crustaceans segment, featuring high-value products such as shrimp, crab, and lobster, remains a significant contributor to the market's overall valuation, often commanding premium prices in foodservice and luxury retail settings. Shrimp farming, particularly in Southeast Asia and Latin America, represents a major component of the aquaculture industry, though it continually battles issues related to disease management and environmental impact, driving innovation toward closed-system and bio-secure farming practices. Conversely, wild-caught crab and lobster markets are highly regulated and geographically specific, with supply dictated by rigorous quota systems designed to preserve these highly sensitive populations, emphasizing resource stewardship as a core operational constraint in this lucrative segment.

Finally, industrial applications, beyond human consumption, underscore the circular economy potential within commercial fishing. The demand for high-quality fishmeal and fish oil is tightly linked to the expanding global aquaculture industry itself, which requires nutrient-dense feed, creating an interdependency that stabilizes demand for processed by-products. This segment also serves the burgeoning nutraceutical industry, extracting high-purity Omega-3 fatty acids for dietary supplements. Advances in processing technology are making the extraction of these valuable components more efficient and sustainable, ensuring that nearly all parts of the harvested biomass are utilized, enhancing the economic yield of the total catch and minimizing waste across the entire production cycle.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager