Commercial Fluorescent Lighting Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432502 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Fluorescent Lighting Market Size

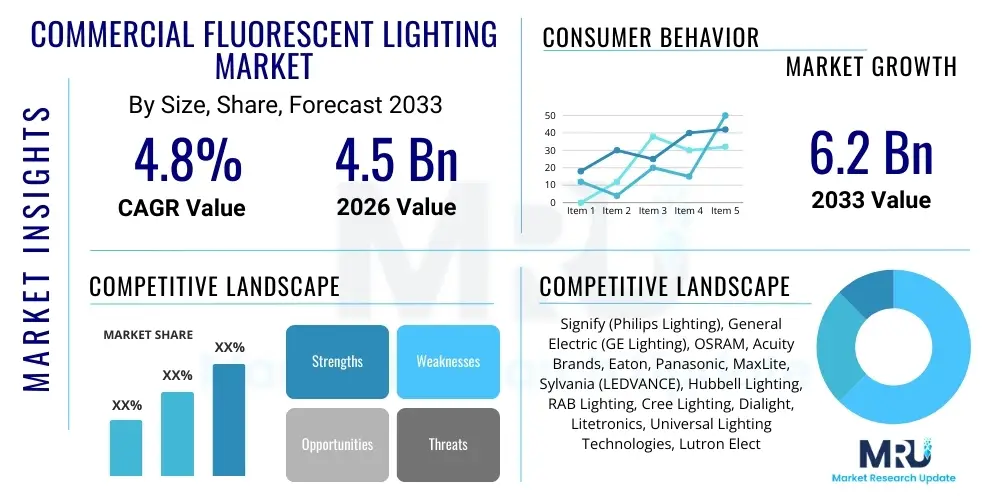

The Commercial Fluorescent Lighting Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.2 Billion by the end of the forecast period in 2033.

Commercial Fluorescent Lighting Market introduction

The Commercial Fluorescent Lighting Market primarily encompasses the manufacturing, distribution, and maintenance of fluorescent lamps and associated ballasts used across various commercial, institutional, and industrial facilities. Historically, fluorescent lighting systems, particularly linear T8 and T5 lamps, have been the dominant choice for general illumination due to their relatively high energy efficiency compared to incandescent sources, longevity, and superior light quality over older discharge lamps. While the market faces intense competitive pressure from the superior performance metrics and environmental benefits of LED (Light Emitting Diode) technology, a vast installed base of fluorescent fixtures across global commercial real estate ensures sustained demand for replacement lamps, ballasts, and specialized retrofit components throughout the forecast period.

Major applications of commercial fluorescent lighting include general illumination in office buildings, educational institutions, hospitals and healthcare facilities, large retail spaces, and warehousing. Key benefits associated with fluorescent technology, which maintain its relevance in certain cost-sensitive or specific operational environments, include lower initial fixture costs compared to advanced networked LED systems, wide availability of replacement components, and familiarity among maintenance crews. The driving factors sustaining this market segment are primarily the large-scale requirement for replacement lighting in existing infrastructure, the slower adoption of full LED retrofits in budget-constrained public sectors, and the specific needs met by high-output or specialized color temperature fluorescent lamps where immediate conversion to LED is not technically or financially feasible.

Commercial Fluorescent Lighting Market Executive Summary

The Commercial Fluorescent Lighting Market is undergoing a fundamental transformation characterized by a strategic pivot from new installations toward sophisticated maintenance and retrofit solutions, driven largely by global regulatory mandates phasing out less-efficient mercury-containing lamps. Business trends indicate a consolidation among traditional ballast and lamp manufacturers, who are increasingly diversifying their portfolios to include dedicated fluorescent-to-LED retrofit kits, leveraging their existing distribution channels and established relationships with facility management companies. The market’s resilience stems from the necessity of servicing the monumental legacy infrastructure, making the replacement cycle (re-lamping and re-ballasting) the primary revenue driver, even as new commercial construction overwhelmingly favors solid-state lighting solutions.

Regionally, market dynamics are segmented based on the aggressiveness of energy efficiency policies and waste disposal regulations. Europe and North America exhibit a robust decline in market volume for traditional products due to stringent bans (such as the EU's RoHS directive expansion banning certain T8 fluorescent lamps), forcing rapid transitions to LED alternatives, which ironically drives demand for high-quality fluorescent replacement parts for facilities delaying the full changeover. Conversely, regions in Asia Pacific and parts of Latin America still maintain significant demand for cost-effective fluorescent solutions in certain developing commercial and industrial sectors, although these regions are also observing an accelerated trajectory toward LED adoption influenced by falling LED component costs.

Segment trends reveal that the highest value retention is observed within the high-efficiency T5 and specialty fluorescent lamp categories, which offer superior performance in specific applications like controlled grow environments or complex indirect lighting systems where immediate LED conversion requires prohibitively expensive fixture replacement. The ballast market segment is seeing increasing demand for electronic ballasts capable of supporting both fluorescent and potential hybrid LED-compatible systems. This focus on component compatibility and extended service life for existing fixtures defines the operational strategy for major market participants aiming to maximize returns from the declining, yet substantial, legacy asset base.

AI Impact Analysis on Commercial Fluorescent Lighting Market

Users frequently inquire about how advanced analytics and Artificial Intelligence (AI) can optimize the operational lifespan and maintenance of aging fluorescent lighting systems, particularly concerning energy waste and proactive failure detection. Common concerns revolve around whether implementing expensive AI systems is justified when the long-term strategy is migration to LED, or if AI can specifically manage mixed lighting environments containing both old fluorescent and new LED fixtures efficiently. The consensus derived from user interest suggests a focus on utilizing AI for predictive maintenance scheduling, inventory management of critical replacement components (lamps and ballasts), and anomaly detection to minimize unscheduled downtime. AI's primary influence in this mature market lies not in the innovation of the light source itself, but in extending the cost-effectiveness of the operational life of the existing installed base until phased replacement is financially viable.

- AI-driven predictive maintenance scheduling for ballast and lamp replacement, optimizing operational expenditure.

- Enhanced energy monitoring and auditing of legacy fluorescent systems using machine learning algorithms to identify and mitigate excessive power consumption.

- Automated failure reporting and inventory management for replacement components, reducing logistical delays and waste.

- Integration of fluorescent lighting system data into wider smart building management platforms (BMS) for centralized control and efficiency analysis.

- Optimization of procurement cycles for fluorescent lighting components based on predicted regulatory timelines and regional phase-out dates.

DRO & Impact Forces Of Commercial Fluorescent Lighting Market

The market for commercial fluorescent lighting is governed by a complex interplay of regulatory drivers mandating higher efficiency, inherent technical restraints related to lifespan and environmental impact, and specific niche opportunities arising from the massive installed base worldwide. Primary drivers include mandatory energy efficiency standards established by governmental bodies (such as the U.S. Department of Energy and European directives), which compel facility managers to upgrade or replace legacy systems, often leading to temporary surges in demand for high-efficiency fluorescent replacements like T5 linear lamps before a full LED migration occurs. Furthermore, the sheer scale of commercial and institutional buildings that rely solely on fluorescent technology creates a persistent replacement market ensuring sustained component sales for the next decade.

Restraints are dominated by the superior technical performance and decreasing costs of competing LED technologies. LEDs offer significantly longer operational lifetimes, vastly lower energy consumption, superior environmental sustainability (being mercury-free), and enhanced functionalities like dimming and color control, which fluorescent systems inherently struggle to match. Regulatory phase-outs, particularly the rapid global removal of mercury-containing products, severely restrict the supply and accessibility of many traditional fluorescent product lines, accelerating the obsolescence of older fixtures and component standards, thereby limiting market growth potential.

Opportunities are strongly centered around the retrofit segment. The development and aggressive marketing of plug-and-play and ballast-bypass LED tubes designed to seamlessly replace fluorescent lamps offer manufacturers a transitional revenue stream while leveraging existing customer relationships. The impact forces show that technological substitution is the strongest influencing factor, consistently pushing the market toward LED adoption, but institutional inertia and high initial capital expenditure associated with comprehensive fixture replacement serve as counter-forces that maintain the residual market for fluorescent solutions. Strategic planning must focus on the eventual decommissioning of fluorescent assets and maximizing value through highly efficient replacement components in the interim.

Segmentation Analysis

The Commercial Fluorescent Lighting Market is primarily segmented based on the product type (lamps and ballasts), lamp form factor (linear, compact), application (office, retail, industrial), and the mechanism of control (dimmable, non-dimmable). Analyzing these segments provides crucial insight into the shifting demand patterns driven by efficiency mandates and the widespread adoption of solid-state lighting technology. The linear segment, specifically focusing on T8 and T5 lamps, continues to dominate the replacement market due to their prevalence in large commercial and educational facilities, although volume is rapidly declining in favor of LED tubular replacements. Conversely, the market for compact fluorescent lamps (CFLs) has seen a dramatic reduction in demand, being almost entirely supplanted by LED alternatives in general downlighting and decorative applications.

- By Product Type:

- Fluorescent Lamps (T5, T8, T12, Compact Fluorescent Lamps (CFLs))

- Ballasts (Magnetic, Electronic, Hybrid)

- Fixtures and Luminaires

- Retrofit Kits

- By Application:

- Office Space and Corporate Facilities

- Retail and Hospitality

- Educational Institutions

- Healthcare Facilities

- Industrial and Warehouse Facilities

- By Lamp Form Factor:

- Linear Fluorescent Lamps

- Compact Fluorescent Lamps (CFLs)

- By Distribution Channel:

- Direct Sales

- Electrical Wholesalers

- Retail/E-commerce

- Energy Service Companies (ESCOs)

Value Chain Analysis For Commercial Fluorescent Lighting Market

The value chain for the Commercial Fluorescent Lighting Market begins with upstream activities involving the sourcing of raw materials, predominantly glass tubing, phosphor coatings (which determine light quality), electrodes, and critical components for ballasts (e.g., semiconductors, capacitors, and magnetic coils). This upstream segment is characterized by specialized chemical and component suppliers, particularly those dealing with rare earth phosphors, which are essential for color rendering. Manufacturing processes, once highly specialized, are now optimized for mass production and focus intensely on minimizing mercury content and improving the reliability of electronic ballasts to meet modern efficiency requirements. However, the market faces increasing pressure as investment shifts away from fluorescent manufacturing R&D and toward advanced LED technology.

Downstream analysis highlights the critical role of distribution channels, which link manufacturers to end-users. The market heavily relies on established networks of electrical wholesalers and distributors who stock a vast inventory of replacement lamps and various ballast types, catering directly to electricians and facility management companies responsible for routine maintenance. Energy Service Companies (ESCOs) represent an increasingly important indirect channel, often coordinating large-scale commercial retrofits where they assess existing fluorescent infrastructure and propose either high-efficiency fluorescent replacements or full LED conversions, driving project-based sales. The dominance of wholesalers ensures rapid delivery of replacement parts, essential for maintaining operational continuity in commercial environments.

Direct sales often occur with large multinational commercial entities or government bodies procuring standardized components in high volumes directly from the manufacturer for new construction or centralized inventory management. However, the bulk of the replacement market transactions flow through indirect channels due to the fragmented nature of commercial maintenance needs. The competitive edge in the current value chain is defined not just by product quality, but by supply chain efficiency, inventory stocking capabilities, and the ability of distributors to provide guidance on the transition path from traditional fluorescent to compliant, high-efficiency lighting solutions, including hybrid retrofit options.

Commercial Fluorescent Lighting Market Potential Customers

The primary consumers and end-users of commercial fluorescent lighting products are organizations responsible for maintaining large-scale non-residential properties, where maintaining existing fixtures is often prioritized over immediate, expensive full system replacement. Major potential customers include institutional sectors such as public and private K-12 schools, higher education campuses, and governmental administrative buildings, which often operate under restrictive capital budgets that favor the incremental cost of replacement lamps and ballasts over large capital expenditure projects for LED upgrades. These entities rely heavily on maintaining consistent lighting standards while minimizing initial outlay.

Furthermore, owners and operators of vast commercial real estate portfolios, including older office towers built between the 1970s and 2000s, represent a significant segment. While premium properties may accelerate LED adoption for competitive advantage, many class B and C commercial facilities continue to utilize fluorescent systems, generating continuous demand for consumables. Industrial users, such as large manufacturing plants and conventional warehousing facilities, also constitute a core customer base, particularly where high light output or specific fixture types (like vapor-tight fluorescents) are needed and the existing infrastructure provides adequate coverage without warranting a costly overhaul.

Healthcare facilities, including hospitals and medical office buildings, also remain key customers, requiring specialized fluorescent lamps for areas demanding high Color Rendering Index (CRI) or specific lighting controls that are challenging to instantly replicate with basic LED retrofits. Facility management companies and third-party maintenance contractors, who service these diverse properties, act as pivotal buyers, making purchasing decisions based on longevity, ease of installation, and compliance with immediate operational requirements, reinforcing the importance of a reliable supply of replacement components across all commercial verticals.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.2 Billion |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Signify (Philips Lighting), General Electric (GE Lighting), OSRAM, Acuity Brands, Eaton, Panasonic, MaxLite, Sylvania (LEDVANCE), Hubbell Lighting, RAB Lighting, Cree Lighting, Dialight, Litetronics, Universal Lighting Technologies, Lutron Electronics, Howard Lighting Products, Fulham Co., Technical Consumer Products (TCP), Venture Lighting International, EiKO Global |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Fluorescent Lighting Market Key Technology Landscape

The technology landscape within the Commercial Fluorescent Lighting market is defined by efforts to maximize the efficiency and lifespan of existing fluorescent systems while facilitating a smooth transition toward solid-state lighting. The core technologies utilized remain the T5 and T8 linear fluorescent lamp standards, characterized by their high efficacy (lumens per watt) compared to older T12 systems. Recent technological advancements have primarily centered around electronic ballasts, which replace older, less-efficient magnetic ballasts. Electronic ballasts operate at high frequencies, eliminating visible flicker, reducing humming, and significantly improving overall system efficiency and power quality, making them crucial for maximizing the performance of modern fluorescent tubes.

A significant area of technical focus is the development of ultra-low mercury or mercury-free fluorescent lamps to comply with increasingly strict environmental regulations, especially in Europe and North America. Manufacturers are investing in specialized phosphor blends that maximize light output while minimizing the environmental footprint. Furthermore, the burgeoning demand for hybrid lighting solutions has driven innovation in ballast technology that is 'LED-ready,' meaning the ballast can power both traditional fluorescent tubes and specialized plug-and-play LED replacement tubes, providing facility managers with flexibility during phased retrofits and easing the financial burden of immediate full system replacement.

Beyond the core components, the integration of basic control technologies such as occupancy sensors and daylight harvesting controls into fluorescent fixtures allows for significant energy savings by turning off or dimming lights when not needed. While fluorescent systems generally offer less sophisticated dimming capabilities than LEDs, the combination of high-frequency electronic dimming ballasts with external building management systems (BMS) remains a vital component of energy conservation strategies in facilities not yet converted to full digital lighting networks. This focus on control technologies ensures that fluorescent installations remain compliant with modern energy codes until the end of their operational life.

Regional Highlights

- North America: This region represents a mature, high-value replacement market driven by rigorous energy efficiency standards (e.g., DOE mandates) and the aggressive retirement of inefficient T12 and standard T8 lamps. Regulatory pressure and the strong incentive programs offered by utilities accelerate the conversion of fluorescent systems to LED, focusing regional demand on high-performance electronic ballasts and premium quality replacement T5 lamps. The U.S. and Canada prioritize reducing mercury exposure, leading to rapid market shrinkage for traditional components but sustained demand for advanced retrofit solutions.

- Europe: Europe is characterized by the most stringent regulatory environment globally, led by the RoHS directive restricting hazardous substances, including mercury, which effectively bans numerous common fluorescent products. This creates immediate, mandatory substitution requirements. The market is defined by accelerated decline in traditional product volumes, compensated by high demand for specialized fluorescent components that comply with strict sustainability criteria, mainly serving the remaining niche applications that require high quality or specific light distributions not easily achieved with simple LED linear replacements.

- Asia Pacific (APAC): APAC is the largest market volume-wise, segmented into developed economies (like Japan and South Korea) prioritizing rapid LED conversion due to high energy costs, and developing economies (like India and Southeast Asia) where fluorescent lighting remains a cost-effective initial installation choice for rapidly expanding commercial and industrial infrastructure. While overall market share is shifting rapidly toward LED, the sheer scale of new construction and the price sensitivity in emerging markets ensure that cost-effective, basic fluorescent systems maintain a substantial presence, particularly in mid-tier and industrial segments.

- Latin America and Middle East & Africa (MEA): These regions are experiencing steady, albeit slower, transitions toward modern lighting. Market growth here is primarily driven by industrialization and commercial infrastructure development. While major urban centers favor advanced LED technology, secondary markets utilize fluorescent lighting due to its lower initial purchase cost and established supply chains. Demand centers on standard T8 lamps and ballasts, with gradual adoption of higher efficiency T5 systems driven by governmental energy efficiency initiatives in response to grid capacity challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Fluorescent Lighting Market.- Signify (Philips Lighting)

- General Electric (GE Lighting)

- OSRAM

- Acuity Brands

- Eaton

- Panasonic

- MaxLite

- Sylvania (LEDVANCE)

- Hubbell Lighting

- RAB Lighting

- Cree Lighting

- Dialight

- Litetronics

- Universal Lighting Technologies

- Lutron Electronics

- Howard Lighting Products

- Fulham Co.

- Technical Consumer Products (TCP)

- Venture Lighting International

- EiKO Global

Frequently Asked Questions

Analyze common user questions about the Commercial Fluorescent Lighting market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the continued demand for commercial fluorescent lighting products despite the rise of LED technology?

Demand is sustained by the massive global installed base of existing fluorescent fixtures. Facility managers often opt for replacement lamps and ballasts, especially high-efficiency T5 models, as a lower-cost alternative to expensive, full-scale LED retrofits, driving the replacement segment of the market.

How do global regulations, such as RoHS, affect the availability and pricing of traditional fluorescent lamps?

Regulations like the EU's RoHS directive are phasing out mercury-containing lamps, significantly restricting the supply of older, less-efficient fluorescent types (like standard T8 and T12). This scarcity increases demand and potentially the price for compliant, ultra-low mercury alternatives and accelerates the transition to LED.

What are the key benefits of upgrading from magnetic ballasts to electronic ballasts in existing fluorescent systems?

Electronic ballasts offer significant improvements over magnetic versions, including higher energy efficiency, reduced noise and flicker, extended lamp life, and compatibility with modern lighting controls and sensors, optimizing the performance of the remaining fluorescent infrastructure.

Which commercial sectors are currently the largest buyers of replacement fluorescent lighting components?

The largest buyers are institutional sectors with constrained capital expenditure budgets, primarily educational institutions (schools and universities), healthcare facilities, and older, large-scale commercial office buildings prioritizing operational expenditure efficiency through routine maintenance.

Are fluorescent-to-LED retrofit kits considered part of the Commercial Fluorescent Lighting Market?

Yes, plug-and-play and ballast-bypass LED tubes designed specifically for fluorescent fixtures are crucial components of the market's transition strategy. They represent a significant revenue opportunity for traditional manufacturers leveraging their existing supply chain and customer relationships.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager