Commercial Food Processors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432640 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Commercial Food Processors Market Size

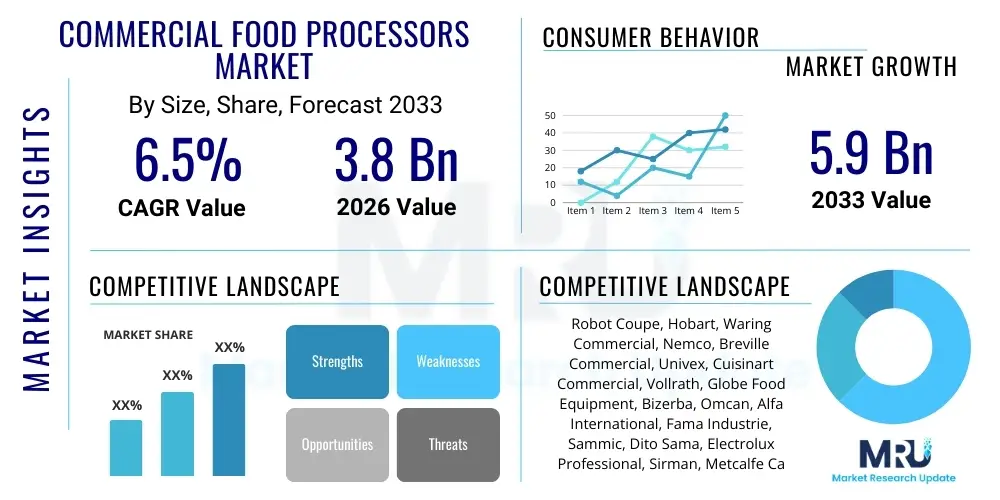

The Commercial Food Processors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.8 Billion in 2026 and is projected to reach USD 5.9 Billion by the end of the forecast period in 2033.

Commercial Food Processors Market introduction

The Commercial Food Processors Market encompasses specialized mechanical devices designed for high-volume, repetitive food preparation tasks within professional kitchens and food service establishments. These machines are engineered for durability, efficiency, and consistent output, significantly reducing manual labor required for chopping, slicing, shredding, kneading, mixing, and pureeing ingredients. The primary product categories include batch bowl processors, continuous feed systems, and combination units, catering to varying operational needs based on capacity and required application. Major applications span across the entire HoReCa (Hotel, Restaurant, Catering) sector, institutional kitchens (hospitals, schools), and industrial food preparation facilities seeking optimization of prep time and consistency of final products.

The substantial benefits derived from adopting commercial food processors include drastically improved operational efficiency, higher food safety standards through reduced human handling, and enhanced ingredient consistency, which is vital for standardized recipes. These processors save considerable labor costs, especially in regions facing labor shortages in the culinary sector. Furthermore, modern commercial processors are increasingly incorporating features like variable speed controls, robust safety interlocks, and modular components, allowing chefs to handle diverse culinary tasks from fine slicing of vegetables to heavy-duty dough preparation using a single machine.

The growth of the market is predominantly driven by the global expansion of the organized food service industry, increased consumer demand for processed and prepared foods, and stringent food hygiene regulations mandating minimal manual contact with ingredients. Furthermore, technological advancements leading to more powerful, compact, and multi-functional processors are accelerating replacement cycles in established markets. As global urbanization increases and disposable incomes rise, the proliferation of new restaurants, cloud kitchens, and specialty food production facilities continues to create sustained demand for high-quality, dependable food processing equipment.

Commercial Food Processors Market Executive Summary

The Commercial Food Processors Market is experiencing robust expansion fueled by significant business trends centered on automation and efficiency in the food service sector. Key business drivers include the rise of centralized commissary kitchens and the growing popularity of quick-service restaurants (QSRs) and fast-casual dining, all requiring standardized, high-volume prep work. Manufacturers are responding by focusing on developing smart processors integrated with IoT capabilities for remote monitoring, predictive maintenance, and optimized performance tracking. Sustainability is also a growing trend, influencing the design of energy-efficient motors and durable, recyclable materials, while the move towards customized culinary experiences necessitates flexible and versatile processing units capable of handling complex preparation requirements.

Regionally, Asia Pacific is anticipated to demonstrate the fastest growth rate, driven by the rapid growth of the middle class, expansion of international food chains, and increasing investment in food processing infrastructure, particularly in developing economies like China and India. North America and Europe remain mature markets characterized by high penetration rates and demand primarily driven by replacement cycles and the adoption of premium, advanced models focused on energy saving and ergonomic design. Regulatory harmonization concerning food safety and sanitation standards across major continents is globally influencing product design and material choices, favoring stainless steel and antimicrobial surfaces.

Segmentation trends indicate a strong preference for high-capacity, continuous feed processors in institutional settings and large catering operations due to their ability to handle massive ingredient volumes without frequent stopping. Conversely, smaller, modular batch processors remain essential for independent restaurants and specialty food shops requiring flexibility and precision. The component segment highlights increasing demand for specialized attachments, such as dicers and whipping units, transforming basic processors into multi-functional culinary workstations. The competitive landscape is characterized by a few global established players dominating the premium segment, while local manufacturers compete aggressively on price and regional service availability, leading to continuous innovation and price sensitivity in the mid-range category.

AI Impact Analysis on Commercial Food Processors Market

User inquiries regarding the impact of Artificial Intelligence (AI) on commercial food processors predominantly revolve around achieving higher levels of automation, optimizing resource utilization, and maintaining unparalleled food quality consistency. Users are keenly interested in how AI can move beyond simple machine control to enable predictive functions, such as anticipating maintenance needs before failure occurs (minimizing downtime) and dynamically adjusting processing parameters (like speed or blade height) based on ingredient characteristics (e.g., density, ripeness) detected by integrated sensors. Furthermore, there is significant interest in AI’s role in traceability, ensuring compliance with increasingly strict food safety regulations by logging and analyzing every batch processed.

AI integration is transforming commercial food processors from static mechanical tools into intelligent, interconnected kitchen assets. The immediate impact is seen in operational efficiency: AI algorithms analyze historical performance data and real-time usage patterns to schedule optimal processing times, manage energy consumption, and signal low inventory for frequently used attachments. This minimizes labor overhead and ensures the processor operates at peak efficiency. For large-scale industrial processors, AI monitors machine health variables like motor temperature, vibration, and torque deviation, providing actionable predictive maintenance alerts that drastically reduce unplanned outages and extend the lifespan of costly equipment.

Looking forward, AI is expected to enable true mass customization in commercial food preparation. By integrating with kitchen management software and Point-of-Sale (POS) systems, intelligent processors can receive real-time demand signals and automatically adjust batch sizes or ingredient cuts to match immediate order requirements, reducing food waste significantly. This level of granular control, coupled with AI-driven quality checks (using integrated cameras and machine vision to verify ingredient consistency and preparation standards), elevates the standard of output, especially crucial for global chains striving for absolute uniformity across all locations.

- AI-driven Predictive Maintenance: Analyzing machine telemetry data to forecast component failure and schedule preventative service, maximizing uptime.

- Ingredient Recognition and Optimization: Utilizing machine vision and AI algorithms to identify ingredient types, sizes, and ripeness, automatically adjusting processing speed and technique for optimal results.

- Automated Batch Consistency: Real-time monitoring of output texture, moisture, and particle size, ensuring compliance with specific recipe standards without human intervention.

- Energy Consumption Optimization: AI management systems dynamically adjust power usage during peak and off-peak times, leading to reduced utility costs for high-volume operations.

- Enhanced Traceability and Compliance: Automated logging of processing parameters (time, date, temperature) for every ingredient batch, facilitating rapid recall identification and regulatory audits.

DRO & Impact Forces Of Commercial Food Processors Market

The dynamics of the Commercial Food Processors Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively influencing the pace and direction of growth. A primary driver is the pervasive labor shortage and the escalating cost of labor across the global food service industry, making automation through efficient processing equipment a financial necessity rather than a luxury. This is coupled with increasingly stringent global food safety and sanitation standards, pushing establishments to adopt machines that minimize manual handling and are certified for quick, thorough cleaning, thereby reducing the risk of cross-contamination and foodborne illnesses.

Despite strong tailwinds, the market faces significant restraints. The initial capital investment required for high-quality, durable commercial food processors can be substantial, particularly for small and independent food service businesses, acting as a barrier to entry. Furthermore, the complexity of integrating advanced, multi-functional processors into existing kitchen infrastructure, coupled with the need for specialized training for kitchen staff, presents operational challenges. Maintenance and repair costs associated with proprietary parts and highly specialized sensors in smart processors also contribute to overall ownership expense, which can deter budget-sensitive buyers.

However, substantial opportunities exist, driven by evolving consumer habits and technological progress. The rise of cloud kitchens and ghost kitchens, which operate purely on efficiency and standardization, presents a massive growth avenue for continuous feed and high-capacity batch systems. Furthermore, the increasing focus on healthy eating and specialized diets (vegan, gluten-free) drives demand for specialized attachments and precision processing capabilities. Technological opportunities lie in developing highly modular systems integrated with IoT for seamless remote management, energy harvesting capabilities, and the use of sustainable, advanced materials that enhance both durability and hygiene standards, tapping into the burgeoning smart kitchen segment.

The impact forces influencing this market relate strongly to urbanization, which necessitates faster food preparation solutions, and global supply chain disruptions, which increase the focus on localized, efficient processing of seasonal ingredients. Competition from emerging market manufacturers offering highly competitive pricing impacts the profitability of established Western brands, forcing them to emphasize superior build quality, advanced features, and comprehensive service networks to maintain their premium positioning. Regulatory enforcement, especially concerning motor efficiency and noise pollution in high-density urban environments, also compels manufacturers to innovate continuously on mechanical design and operational footprint.

Segmentation Analysis

The Commercial Food Processors Market is extensively segmented based on capacity, product type, end-use application, and distribution channel, providing a granular view of demand across various operational scales and service models. Understanding these segments is critical for manufacturers to tailor their product offerings, sales strategies, and service models to specific customer needs, ranging from small cafes needing versatility to large institutional facilities demanding high throughput and durability. The segmentation highlights the market's diversity, driven by differing requirements for power, precision, and continuous operation across the HoReCa landscape.

By Product Type, the market is broadly classified into Batch Processors, Continuous Feed Processors, and Combination Processors. Batch processors are the traditional workhorses, offering high precision and flexibility for specific tasks but requiring manual loading/unloading, making them popular in standard restaurant settings. Continuous feed models, conversely, are designed for high-volume operations like catering or central processing facilities where continuous input and output are essential. Capacity segmentation reflects the diverse kitchen sizes, moving from small, compact units suitable for bars or limited spaces, to industrial-scale machines exceeding 50 quarts, tailored for institutional or mass food production.

The End-Use segment reveals where the primary consumption occurs. Restaurants (including QSRs and fine dining) remain the largest consumers, valuing speed and versatility. The institutional segment (schools, hospitals, corporate canteens) relies heavily on durability and high capacity to manage large daily volumes efficiently and consistently. The rising prominence of cloud kitchens and central catering facilities marks an emerging end-use segment demanding specialized, highly automated, and space-efficient processing units that can handle peak demands without failure. Analyzing these segments helps in forecasting maintenance and service demand, as high-usage segments require more robust after-sales support.

- By Product Type:

- Batch Bowl Processors

- Continuous Feed Processors

- Combination Processors (Batch and Continuous Feed Capabilities)

- By Capacity:

- Small Capacity (Up to 10 Quarts)

- Medium Capacity (10–25 Quarts)

- Large Capacity (Above 25 Quarts)

- By End-Use Application:

- Restaurants (Fine Dining, Casual, QSR)

- Hotels and Hospitality

- Institutional (Schools, Hospitals, Military)

- Catering and Central Kitchens

- Bakeries and Patisseries

- By Distribution Channel:

- Offline (Specialty Distributors, Retail Stores)

- Online (E-commerce Platforms, Company Websites)

- By Operation Type:

- Electric

- Manual/Hybrid

Value Chain Analysis For Commercial Food Processors Market

The value chain for the Commercial Food Processors Market begins with upstream activities focused on raw material procurement and component manufacturing. This includes the sourcing of specialized materials such as high-grade stainless steel (essential for hygiene and durability), specialized plastics (for bowls and covers), and advanced electronics for motors and control boards. Key suppliers in the upstream segment focus on adhering to strict food-grade certifications and providing components that can withstand demanding commercial kitchen environments. Efficiency in this stage relies on stable commodity prices and reliable supply of custom motors and precision-engineered blades, which are often proprietary intellectual property of the main equipment manufacturers.

Midstream activities involve the design, assembly, and testing of the final food processing units. Leading manufacturers invest heavily in R&D to optimize motor efficiency, develop new safety features (like magnetic safety systems), and create versatile attachment systems. Manufacturing processes are increasingly automated to ensure high precision and consistency, particularly in the alignment of blades and bowls. Quality control and certification (e.g., NSF, UL, CE) are critical midstream activities that directly influence market acceptance and regulatory compliance. Assembly often takes place in optimized facilities, frequently consolidating operations near major end markets to reduce logistics costs.

Downstream activities center on distribution, sales, installation, and essential after-sales service. The distribution channel is bifurcated, utilizing both direct sales teams for large institutional contracts and indirect channels through specialized food service equipment distributors and wholesalers. E-commerce platforms are gaining significance, especially for smaller, modular units and replacement parts. Effective downstream management requires robust service networks capable of providing prompt maintenance, repairs, and technical support, as downtime for a commercial processor can significantly cripple a food service operation. The long-term profitability of manufacturers often hinges on their ability to manage the service life cycle efficiently, selling high-margin replacement parts and maintenance contracts.

Commercial Food Processors Market Potential Customers

The primary customers for commercial food processors are any establishment involved in preparing food on a large scale for immediate consumption or further distribution, spanning the entire breadth of the food service and hospitality sectors. Restaurants constitute the largest customer segment, ranging from high-end fine dining establishments requiring precision cutting for presentation, to high-volume Quick Service Restaurants (QSRs) needing rapid and consistent chopping and mixing for standardized recipes. These buyers prioritize reliability, speed, and ease of cleaning, directly linking the machine's efficiency to their overall profitability and customer satisfaction rates.

Institutional buyers, including hospitals, schools, universities, military bases, and corporate dining facilities, represent another critical customer base. Their demands are centered on maximizing capacity and durability, often opting for continuous feed systems that can manage thousands of meals daily. For these customers, the emphasis is heavily placed on long service life, minimal maintenance requirements, and strict adherence to hygiene standards, necessitating processors built with robust, easy-to-sanitize materials. Purchasing decisions in this segment are typically based on total cost of ownership (TCO) rather than just initial purchase price.

Furthermore, specialty food production facilities, such as central commissaries, large catering operations, industrial bakeries, and pre-packaged meal manufacturers, are increasingly high-value customers. These organizations often require highly specialized processors capable of advanced functions like emulsifying, fine grinding, or large-scale dough kneading. The rise of centralized "ghost kitchens" and cloud food preparation services, driven by the delivery economy, represents an accelerating segment requiring compact, highly automated, and energy-efficient processors tailored for rapid, continuous, and diverse preparatory tasks under immense time pressure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.8 Billion |

| Market Forecast in 2033 | USD 5.9 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Robot Coupe, Hobart, Waring Commercial, Nemco, Breville Commercial, Univex, Cuisinart Commercial, Vollrath, Globe Food Equipment, Bizerba, Omcan, Alfa International, Fama Industrie, Sammic, Dito Sama, Electrolux Professional, Sirman, Metcalfe Catering Equipment, Berkel, and SEB Professional. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Food Processors Market Key Technology Landscape

The technological evolution within the Commercial Food Processors Market is characterized by a push towards connectivity, precision, and enhanced ergonomics, fundamentally changing how food preparation is managed in commercial settings. A critical advancement involves the integration of Variable Speed Drive (VSD) technology, which allows precise control over blade speed and power delivery. This level of control is essential for processing sensitive ingredients or achieving specific textures, such as fine emulsifications or chunky salsa, which fixed-speed processors struggle to accomplish consistently. Furthermore, VSDs contribute significantly to energy efficiency, optimizing power consumption based on the workload rather than operating continuously at maximum output.

Another dominant technology trend is the development of magnetic safety systems and interlocking mechanisms. These sophisticated safety features prevent the machine from operating unless all components—bowl, lid, and pusher—are correctly and securely fastened, thereby minimizing the risk of operator injury and meeting stringent global occupational safety standards. Materials science also plays a vital role; manufacturers are increasingly using proprietary, high-carbon stainless steel for blades to ensure extended sharpness and superior resistance to corrosion, alongside composite polymers for bowls that offer durability while being lighter and easier to clean than traditional metal components.

The move toward "Smart Kitchen" integration heavily features IoT and sensor technology within commercial processors. Integrated sensors monitor internal temperature, vibration levels, and component wear, transmitting real-time operational data to cloud-based kitchen management systems. This connectivity enables remote diagnostics, utilization tracking, and facilitates predictive maintenance, allowing service technicians to address potential issues proactively. These technological leaps are instrumental in offering higher return on investment (ROI) to food service owners by minimizing unscheduled downtime and optimizing long-term performance.

Regional Highlights

- North America: North America represents a mature and highly lucrative market, primarily driven by the high penetration of large fast-casual chains and institutional facilities that demand premium, high-capacity equipment. The region is characterized by high labor costs, making automation through efficient processors a key economic driver. Regulatory frameworks, particularly those enforced by the NSF and UL, set global benchmarks for hygiene and safety, compelling manufacturers to continuously upgrade product specifications. Demand here focuses on advanced, energy-efficient models with comprehensive service contracts and seamless integration with existing kitchen technology ecosystems.

- Europe: The European market displays steady growth, significantly influenced by stringent EU regulations regarding food traceability, energy efficiency (ErP directive), and noise levels. Western European countries exhibit high adoption rates, favoring brands known for their German or Italian engineering precision and build quality, such as those strong in the artisanal bakery and patisserie segments. Eastern Europe shows accelerating demand as the HoReCa sector modernizes, adopting medium-capacity units. The emphasis across the continent is on modularity, versatility, and processors designed with sustainability and low energy consumption as core priorities.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, massive growth in the middle-class population, and the subsequent explosion of the organized food service sector, particularly in China, India, and Southeast Asia. The rise of centralized cloud kitchens and mass catering services to support growing urban populations is creating enormous demand for continuous feed, industrial-capacity machines. Price sensitivity remains a factor in emerging APAC economies, leading to a dual market structure where high-end global brands coexist with locally manufactured, cost-effective alternatives.

- Latin America (LATAM): The LATAM market is characterized by varied levels of development. Countries like Brazil and Mexico demonstrate strong demand driven by international food chain expansions and robust tourism sectors, requiring professional processing solutions. Economic instability in some nations poses a challenge, sometimes leading to slower adoption rates and preference for long-life, robust machines over high-tech features. Opportunities exist in the modernization of smaller, independent food preparation businesses seeking to improve consistency and reduce manual prep time to scale operations.

- Middle East and Africa (MEA): Growth in the MEA region is strongly linked to infrastructure development, particularly in the Gulf Cooperation Council (GCC) states due to massive investments in tourism, hotels, and large-scale public facilities. The high temperatures and large-scale hospitality projects necessitate durable, high-capacity processors capable of continuous, heavy-duty operation. Food security and reducing reliance on manual labor are central drivers, favoring imported, high-quality brands that offer reliable performance in challenging operational climates. Africa presents long-term potential as organized retail and food service infrastructure gradually develops beyond major urban centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Food Processors Market.- Robot Coupe

- Hobart

- Waring Commercial

- Nemco

- Breville Commercial

- Univex

- Cuisinart Commercial

- Vollrath

- Globe Food Equipment

- Bizerba

- Omcan

- Alfa International

- Fama Industrie

- Sammic

- Dito Sama

- Electrolux Professional

- Sirman

- Metcalfe Catering Equipment

- Berkel

- SEB Professional

Frequently Asked Questions

Analyze common user questions about the Commercial Food Processors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Commercial Food Processors Market?

The Commercial Food Processors Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 6.5% during the forecast period spanning from 2026 to 2033, driven primarily by automation demands in food service.

Which region is expected to lead market growth in commercial food processors?

The Asia Pacific (APAC) region is anticipated to demonstrate the fastest market growth, fueled by rapid urbanization, significant expansion of the organized food service sector, and increased investment in central kitchen infrastructure.

What are the primary factors driving the adoption of commercial food processors?

Key drivers include persistently rising labor costs, necessitating automation for efficiency, and increasingly strict global food safety regulations that require minimal manual handling and easy-to-sanitize preparation equipment.

How is AI impacting the functionality of commercial food processing equipment?

AI is primarily used to enable predictive maintenance, optimize energy consumption, and enhance consistency through real-time adjustment of processing parameters based on ingredient recognition and automated quality control checks.

What is the most significant restraint challenging market expansion?

The most significant restraint is the high initial capital investment required for durable, professional-grade continuous and large-capacity processors, which presents a financial barrier, especially for small and medium-sized enterprises (SMEs).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager