Commercial Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437108 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Furniture Market Size

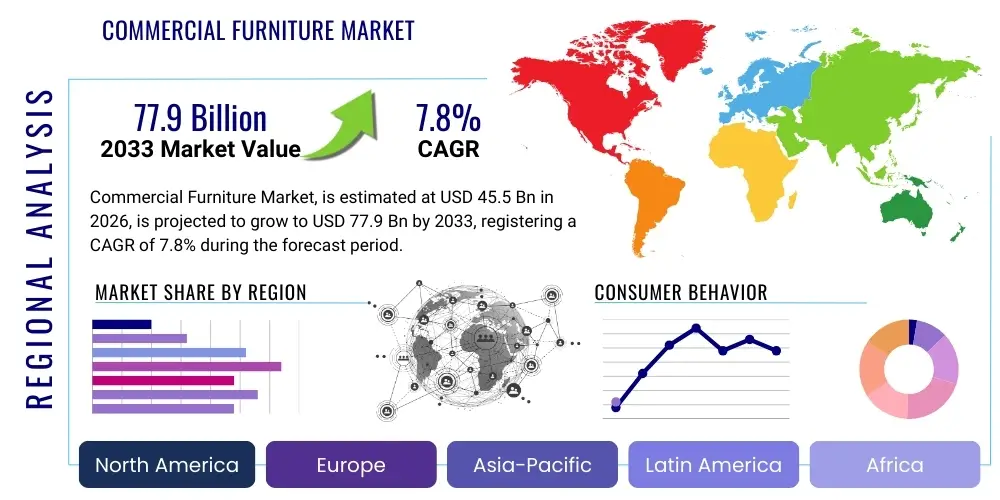

The Commercial Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 45.5 Billion in 2026 and is projected to reach USD 77.9 Billion by the end of the forecast period in 2033.

Commercial Furniture Market introduction

The Commercial Furniture Market encompasses a broad range of fixtures and fittings designed explicitly for non-residential environments, including corporate offices, educational institutions, healthcare facilities, and the burgeoning hospitality sector. This market segment is characterized by products that prioritize durability, ergonomics, modularity, and aesthetic appeal, catering to the functional and design requirements of professional spaces. Product types span traditional seating and storage solutions to advanced acoustic panels and collaborative workspace systems. The inherent longevity and high utilization rates of commercial environments necessitate specialized materials and construction techniques, differentiating this segment significantly from residential furniture markets.

Major applications of commercial furniture are intrinsically linked to the global economic climate and changing work methodologies. The proliferation of flexible workspace models, the demand for activity-based working (ABW) environments, and the critical need for compliance with stringent health and safety standards—especially ergonomic guidelines—are driving demand. Benefits derived from premium commercial furniture include enhanced employee well-being, improved productivity through tailored environments, optimal space utilization, and the establishment of strong organizational branding through interior design. As companies worldwide focus on retaining talent and maximizing real estate investments, the role of high-quality, sustainable commercial furnishings becomes central to strategic planning.

Driving factors propelling market expansion include rapid urbanization, infrastructural development in emerging economies, and the continuous refresh cycle mandated by technological integration. The shift towards hybrid work models is creating paradoxical demand, requiring organizations to invest both in sophisticated home office solutions (B2B sales to employees) and in redesigned, collaboration-focused headquarters. Furthermore, the rising awareness regarding environmental, social, and governance (ESG) factors is accelerating the adoption of certified, sustainable, and recyclable furniture materials, pushing manufacturers to innovate in eco-friendly product lines and circular economy initiatives.

Commercial Furniture Market Executive Summary

The Commercial Furniture Market trajectory is dictated by intertwined business trends focusing heavily on flexibility and digital integration. Key business trends include the shift from traditional office layouts to dynamic, adaptable spaces that support various tasks—from focused work to large-scale collaboration. This necessitates increased investment in modular furniture systems, height-adjustable desks, and integrated technology solutions. The market is witnessing robust merger and acquisition (M&A) activities as large players consolidate market share and acquire specialized firms focusing on sustainable materials or smart furniture technology. Supply chain resilience, following post-pandemic disruptions, remains a critical operational focus, pushing companies toward localized or regionally diversified sourcing strategies to mitigate risks and improve lead times.

Regional trends indicate significant growth divergence, with the Asia Pacific (APAC) region emerging as the primary growth engine, fueled by massive commercial real estate development in India, China, and Southeast Asian economic hubs. North America and Europe, while mature, exhibit strong demand for premium, ergonomic, and design-led products, driven by stringent corporate welfare standards and a high willingness to invest in aesthetic improvements. Within North America, the corporate office segment remains dominant, while Europe shows strong sectoral demand from education and healthcare modernization projects. Sustainability regulations are most advanced in European markets, setting precedents for global product compliance and material innovation.

Segment trends reveal a pronounced preference for specialized product categories such as acoustic furniture and private pod systems, designed to manage noise and provide focus in open-plan settings. The End-User segment is increasingly dominated by Hospitality, experiencing a significant rebound and focusing on durable, aesthetically appealing furniture for hotels, resorts, and specialized co-living spaces. Material trends highlight a transition away from conventional materials towards recycled polymers, certified wood (FSC), and low-VOC (Volatile Organic Compound) finishes, reflecting institutional purchasing mandates centered on employee health and environmental accountability. Technology integration, particularly in managing space usage and optimizing asset tracking via embedded sensors, is defining the high-growth subsegments.

AI Impact Analysis on Commercial Furniture Market

Analysis of common user questions regarding AI's impact on commercial furniture reveals primary concerns centered around personalized ergonomics, supply chain automation, and the integration of smart features into physical products. Users frequently inquire about how AI algorithms can optimize office layouts in real-time based on utilization data, and whether AI-driven design tools will accelerate product customization, making mass-produced furniture obsolete. A key expectation is that AI will enhance the functionality of furniture, moving beyond simple automation to genuine adaptive intelligence, such as desks or chairs that adjust independently to the user's biometric data or workload. Concerns also revolve around the cost implications of integrating advanced sensors and AI processing power into standard commercial products, and the privacy implications of collecting usage data within the workspace.

The immediate impact of AI is transforming the manufacturing and logistics aspects of the commercial furniture industry. AI is being deployed to optimize complex supply chains, predicting material shortages, and streamlining inventory management, which is crucial given the custom nature of many high-end commercial projects. Furthermore, AI-powered computer vision and generative design tools are dramatically reducing the product development lifecycle. Designers can use AI to explore thousands of material combinations and structural configurations instantly, ensuring new products meet aesthetic, ergonomic, and structural durability requirements far faster than traditional methodologies. This digital acceleration allows companies to respond rapidly to shifting market demands, such as the sudden need for more versatile, reconfigurable furniture during the global adoption of hybrid work.

In the application domain, AI enables the creation of truly "smart" workspaces. Furniture embedded with sensors generates data streams regarding occupancy rates, environmental parameters (temperature, light), and usage patterns. AI algorithms process this data to provide facility managers with actionable insights on space efficiency, allowing for the dynamic reconfiguration of office zones to maximize productivity and minimize wasted real estate. This intelligence goes beyond simple utilization tracking; it enables proactive maintenance scheduling, adaptive climate control localized to occupied areas, and personalized ergonomic settings for individual users upon seating, marking a fundamental shift toward data-driven interior architecture.

- AI-Driven Generative Design: Expediting the development of novel, complex ergonomic forms and customized aesthetic variations, drastically cutting prototyping time.

- Predictive Supply Chain Optimization: Utilizing machine learning to forecast demand fluctuations, manage raw material inventory, and optimize shipping routes, enhancing delivery reliability for large projects.

- Adaptive Ergonomics: Implementing sensor-based systems that use AI to learn individual user preferences and automatically adjust chair height, lumbar support, and desk positioning in real-time.

- Space Utilization Analytics: AI processing occupancy data from integrated sensors in seating and tables to provide facility managers with precise, data-backed recommendations for office layout reconfiguration.

- Automated Quality Control: Employing computer vision systems in manufacturing lines to detect minuscule defects, ensuring commercial products meet stringent durability and finish standards before shipment.

- Personalized Acoustic Management: AI-enabled acoustic furniture that dynamically adjusts sound dampening levels or introduces counter-frequency masking based on the detected noise level and density of users in a localized area.

- BIM and Digital Twins Integration: AI facilitating the seamless integration of furniture models into Building Information Modeling (BIM) and digital twin platforms for architects and facility planners, ensuring accurate fit and performance simulation.

DRO & Impact Forces Of Commercial Furniture Market

The Commercial Furniture Market is primarily driven by the corporate world's increasing investment in human capital, recognizing that physical environment profoundly influences productivity and employee retention. The global proliferation of flexible and collaborative workspace concepts, such as hot-desking and breakout areas, necessitates frequent replacement of traditional fixtures with modular, highly durable, and multi-functional furniture systems. Furthermore, regulatory pushes across developed economies mandating adherence to stricter occupational health and safety standards, particularly concerning ergonomics and air quality (low-VOC emissions), compel businesses to upgrade their furniture assets, thereby stimulating robust demand for certified, high-end products. This drive for modern, appealing, and healthy workspaces acts as a perpetual market stimulus, overriding short-term economic fluctuations.

However, the market faces significant restraints, chiefly stemming from the high volatility and unpredictable pricing of essential raw materials, including steel, aluminum, wood pulp, and specialized plastics. These price fluctuations, often exacerbated by global trade disputes and logistical bottlenecks, compress profit margins for manufacturers, particularly those operating on fixed-price project contracts. Additionally, the inherent durability and long lifecycle of commercial furniture products, which can often exceed ten to fifteen years, naturally limit the frequency of replacement cycles compared to consumer goods. Macroeconomic instability, particularly high interest rates impacting commercial real estate development, can also lead to deferred capital expenditure on office fit-outs and refurbishment projects, temporarily slowing market momentum.

Significant opportunities are emerging through technological convergence and sustainability initiatives. The primary opportunity lies in the burgeoning smart furniture segment, integrating power, data connectivity, charging solutions, and sensing capabilities directly into tables, desks, and seating. This caters directly to the digitally native workforce. Secondly, the push towards a circular economy offers opportunities for companies specializing in furniture-as-a-service (FaaS) models, leasing, refurbishment, and high-quality recycling programs, appealing to corporations aiming to minimize their environmental footprint. Finally, geographical expansion into rapidly industrializing regions of Latin America and Africa, where commercial infrastructure is expanding quickly and standards of workplace design are rapidly catching up to global benchmarks, presents untapped revenue potential.

Segmentation Analysis

Segmentation analysis provides a crucial lens through which to understand the varied demands and structural components of the Commercial Furniture Market. The market is fundamentally segmented by Product Type (Chairs, Tables, Storage), End-User (Corporate Office, Hospitality, Education, Healthcare, Retail), and Material (Wood, Metal, Plastic, Fabric/Leather). This detailed segmentation allows manufacturers and strategists to tailor product development, marketing efforts, and distribution channels to address the specific functional, aesthetic, and durability requirements unique to each sector, ensuring optimal market penetration and resonance.

The Product Type segmentation reflects changing utilization patterns. While ergonomic office chairs and versatile tables (collaborative and height-adjustable) constitute the largest revenue generators, the growth rate is highest in specialized segments such as modular partition systems, acoustic pods, and lounge furniture designed for informal collaboration areas. End-User analysis confirms the Corporate Office segment remains the dominant consumer due to its sheer scale and stringent compliance requirements, yet the Hospitality sector is demonstrating the fastest recovery and growth, focusing on high-design, high-durability items that withstand constant public use and align with sophisticated interior design themes.

The Material segmentation is increasingly influenced by sustainability mandates and aesthetic preference. Traditional materials like wood and metal continue to dominate due to their strength and classic appeal, but the market is actively shifting towards recycled content and innovative bio-plastics, particularly in segments requiring lightness and high customization, such as educational furniture. The move toward certified materials, low-emission finishes, and fire-retardant fabrics is not merely a trend but a prerequisite for securing large governmental or institutional contracts, thereby defining future material R&D investment priorities across the industry.

- Product Type:

- Chairs (Task Chairs, Executive Chairs, Visitor Chairs, Stacking Chairs)

- Tables (Desks, Conference Tables, Training Tables, Side Tables, Collaborative Tables)

- Storage Units (Filing Cabinets, Bookcases, Pedestals, Lockers)

- Sofas and Lounge Seating (Modular Systems, Benches, Booths)

- Specialized Systems (Acoustic Pods, Architectural Walls, Ergonomic Accessories)

- End-User:

- Corporate Office

- Hospitality (Hotels, Restaurants, Bars)

- Educational Institutions (Schools, Universities, Libraries)

- Healthcare Facilities (Hospitals, Clinics, Senior Living)

- Retail and Public Spaces

- Material:

- Wood and Wood Composites

- Metal (Steel, Aluminum)

- Plastics and Polymers

- Fabric, Leather, and Textiles

- Distribution Channel:

- Direct Sales (Contract Furnishing, E-commerce)

- Indirect Sales (Dealers, Distributors, Retailers)

Value Chain Analysis For Commercial Furniture Market

The commercial furniture value chain is complex, starting with rigorous upstream analysis focused on sourcing high-quality, often globally sourced, raw materials such as certified timber, specialized steel alloys, proprietary plastics, and advanced textiles. Manufacturers must establish strong, audited relationships with material suppliers to ensure compliance with quality standards (e.g., ANSI/BIFMA) and sustainability certifications (e.g., FSC, LEED compliance). The upstream phase is critical as fluctuations in commodity markets directly impact production costs and final product pricing. Design and engineering activities, involving specialized industrial designers and ergonomic experts, form the core of value creation here, translating market needs into durable, functional products ready for mass production or high-volume custom contract execution.

The midstream process involves advanced manufacturing, encompassing precision cutting, welding, molding, assembly, and finishing. Due to the high aesthetic and durability requirements of commercial clients, quality control processes are exceptionally stringent. Modern factories are increasingly adopting automation and lean manufacturing principles to enhance efficiency and maintain consistency across large contract orders. The focus is shifting toward modular production techniques and custom-configuration capabilities, allowing for rapid adjustment of product lines to meet personalized client specifications without excessive cost penalties. Inventory management and warehousing capabilities are vital here, as commercial projects often require synchronized delivery of numerous specialized items to construction sites.

Downstream analysis highlights the crucial role of specialized distribution channels, primarily contract dealers and direct sales forces, which possess deep expertise in commercial interior design, project management, and installation. Unlike residential retail, commercial sales require complex tendering, precise spatial planning, and integration services. Direct channels are utilized for very large governmental or multinational corporate accounts, offering maximum control over pricing and customer relationship management. Indirect channels, typically independent authorized dealers, leverage local market knowledge and provide extensive after-sales support, installation services, and refurbishment contracts, adding significant value and acting as the primary interface between the manufacturer and the end-user facility manager or architect.

Commercial Furniture Market Potential Customers

Potential customers for commercial furniture are fundamentally institutional buyers, including end-user organizations, government entities, and large-scale real estate developers who are commissioning fit-outs for new or refurbished spaces. These buyers are typically characterized by high-volume procurement needs, sophisticated selection processes involving bids and architectural specifications, and a strong emphasis on compliance with durability standards (BIFMA), environmental mandates (LEED), and ergonomic regulations. These customer groups prioritize total cost of ownership (TCO) over initial purchase price, valuing longevity, maintenance ease, and comprehensive warranties.

The primary segments of potential customers include multinational corporations across all sectors—technology, finance, and professional services—which require standardized, high-quality furniture for their global headquarters and regional offices. Educational institutions, from K-12 to higher education, are significant buyers, focusing on flexible, resilient, and technology-integrated solutions conducive to modern learning environments. Healthcare providers, including hospitals and long-term care facilities, represent a highly specialized customer base demanding medical-grade, easily sanitized, and aesthetically comforting furniture that meets stringent hygiene and patient comfort standards.

Emerging potential customer segments include the rapidly growing co-working and flexible office space providers (e.g., WeWork, Regus), who purchase large volumes of modular, durable, and highly mobile furniture to support rapidly shifting utilization rates. Additionally, the booming hospitality sector, particularly boutique hotels and branded restaurant chains, represents a crucial segment seeking custom-designed, aesthetic furniture that contributes significantly to the customer experience and brand identity while ensuring commercial-grade durability suitable for high-traffic public areas. Architects and interior designers often act as crucial gatekeepers and decision influencers for all these end-user/buyer groups.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.5 Billion |

| Market Forecast in 2033 | USD 77.9 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Herman Miller (MillerKnoll), Steelcase, Haworth, Knoll (MillerKnoll), Okamura Corporation, Teknion, Global Furniture Group, HNI Corporation, KOKUYO Co., Ltd., KI, Kimball International, Vitra, IKEA (Commercial Division), 9to5 Seating, Fursys, Sinetica Industries, Emu Group, VS America, Bene AG, Fantoni Spa. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Furniture Market Key Technology Landscape

The commercial furniture market is rapidly adopting advanced manufacturing and embedded technologies to enhance both production efficiency and product functionality. Key to the manufacturing landscape is the widespread integration of Computer-Aided Manufacturing (CAM) and highly sophisticated CNC machinery, which allows for precision fabrication, minimizes waste, and supports the rapid prototyping necessary for complex custom orders. Furthermore, the adoption of advanced finishing techniques, such as powder coating for metals and low-VOC UV curing for wood surfaces, ensures enhanced durability and adherence to environmental standards. Automation, particularly robotic assembly in repetitive processes, is optimizing labor costs and improving quality consistency across high-volume production runs.

On the product functionality front, the rise of the Internet of Things (IoT) is defining the new generation of commercial furnishings, collectively referred to as "smart furniture." This involves embedding miniature sensors, usually passive infrared or ultrasonic, within seating, desks, and storage units to monitor and transmit real-time data on occupancy and utilization. This data is critical for facility management systems (FMS) to optimize cleaning schedules, adjust climate control zones, and inform real estate strategy. Power and data management integration, including built-in USB-C charging ports, wireless charging pads, and accessible cable routing systems, are now standard expectations in collaborative and individual workstation furniture.

Furthermore, technology related to material science is driving significant innovation. This includes the development and deployment of high-performance technical textiles that are stain-resistant, anti-microbial, and fire-retardant (meeting strict commercial fire codes). Advances in lightweight, high-strength composites and engineered polymers allow for the creation of durable, ergonomic forms that are both visually appealing and cost-effective to ship and assemble. Virtual Reality (VR) and Augmented Reality (AR) tools are also transforming the sales process, allowing architects and corporate clients to visualize furniture placements, material finishes, and spatial configurations within their planned environment before committing to large contracts, significantly reducing design errors and lead times.

Regional Highlights

- North America (NA): North America represents a mature yet highly dynamic market, characterized by early adoption of ergonomic standards (BIFMA) and strong demand for premium, design-led, and technologically integrated office solutions. The US market, in particular, drives innovation in corporate furniture, focusing heavily on flexibility to support hybrid work models, leading to high investment in height-adjustable desks, acoustic separation solutions, and collaborative lounge settings. Canada and Mexico also show steady growth, benefiting from cross-border manufacturing operations and stringent corporate design standards. The healthcare and educational sectors in NA are undergoing significant modernization, fueling consistent demand for specialized, durable furniture.

- Europe: Europe is defined by its strong commitment to sustainability, with markets such as Germany and the Nordic countries leading the charge in requiring FSC-certified wood, low-emission finishes, and circular economy principles. The market is highly fragmented, featuring numerous specialized, high-end design houses alongside major manufacturers. Regulatory drivers related to employee welfare (EU directives on ergonomics) ensure sustained demand for high-quality seating and workstations. Western Europe maintains high spending on corporate fit-outs, while Central and Eastern European countries are rapidly expanding their commercial infrastructure, offering growing opportunities for mid-range and high-volume manufacturers.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive urbanization and massive foreign direct investment into commercial real estate, particularly in India, China, and key Southeast Asian economies (e.g., Vietnam, Indonesia). The demand here spans the entire spectrum, from economical, mass-produced items for government offices to highly sophisticated, luxury furniture for international corporate headquarters and five-star hospitality projects. The region is seeing rapid adoption of global office design trends, often bypassing older models directly for hybrid and smart office layouts. Local manufacturing hubs are growing in capability, challenging Western dominance, though high-end ergonomic products are often still imported.

- Latin America (LATAM): The LATAM market, while facing economic volatility in key economies like Brazil and Argentina, shows promising long-term growth tied to infrastructural development and the establishment of global corporate presence. Demand is primarily focused on durable, cost-effective solutions, though major capital cities exhibit strong demand for high-quality, imported European and North American designs. The region is highly sensitive to commodity prices impacting construction projects, but the need for modernization in public services, including hospitals and schools, ensures a baseline level of commercial furniture procurement.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the Gulf Cooperation Council (GCC) countries (UAE, Saudi Arabia, Qatar), driven by ambitious mega-projects in hospitality, tourism, and financial services. These markets demand ultra-luxury, custom-made furniture, often sourced internationally to meet the high aesthetic standards set by architectural contracts. Africa remains a nascent market, with growth concentrated in commercial centers like South Africa and Nigeria, primarily focusing on essential, durable office furnishings for expanding local businesses and international aid organizations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Furniture Market.- Herman Miller (MillerKnoll)

- Steelcase

- Haworth

- Knoll (MillerKnoll)

- Okamura Corporation

- Teknion

- Global Furniture Group

- HNI Corporation

- KOKUYO Co., Ltd.

- KI

- Kimball International

- Vitra

- IKEA (Commercial Division)

- 9to5 Seating

- Fursys

- Sinetica Industries

- Emu Group

- VS America

- Bene AG

- Fantoni Spa

Frequently Asked Questions

Analyze common user questions about the Commercial Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Commercial Furniture Market?

The Commercial Furniture Market is projected to exhibit a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033, driven by global shifts towards hybrid work models and increased investment in ergonomic, smart office environments across all major regions.

Which end-user segment is driving the highest demand in commercial furniture?

The Corporate Office segment remains the dominant consumer of commercial furniture globally, though the Hospitality sector is demonstrating the fastest recovery and growth due to major investment in hotels, resorts, and specialized communal living spaces requiring high-durability, aesthetic furnishings.

How is AI impacting the commercial furniture supply chain?

AI is significantly optimizing the supply chain by using machine learning algorithms to predict material needs, manage volatile inventory, and streamline logistics. This predictive approach enhances the industry's ability to manage complex, customized contract orders efficiently and reduce lead times for clients.

What role do sustainability and certifications play in commercial furniture procurement?

Sustainability is now a core purchasing requirement, particularly in North America and Europe. Buyers prioritize furniture with certifications like FSC (for wood), LEED compliance, and BIFMA standards, focusing on low-VOC materials and supporting manufacturers who offer circular economy options like refurbishment and leasing (Furniture-as-a-Service).

What are the primary technological features defining modern commercial furniture?

Modern commercial furniture is increasingly "smart," featuring integrated IoT sensors for utilization tracking, power and data solutions (USB-C, wireless charging), and mechanical systems that support personalized, automated ergonomic adjustments, facilitating the creation of highly adaptive workspaces.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager