Commercial Glazing Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437154 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Glazing Market Size

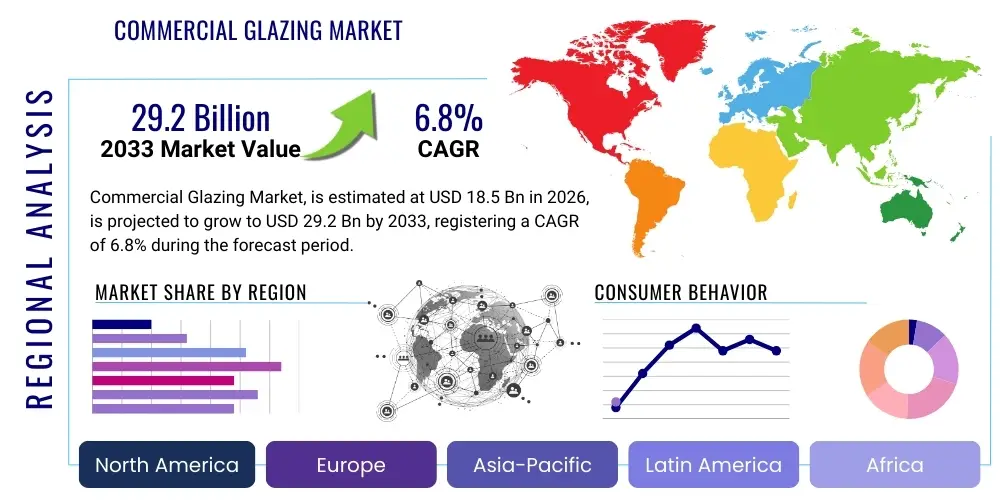

The Commercial Glazing Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 29.2 Billion by the end of the forecast period in 2033.

Commercial Glazing Market introduction

Commercial glazing refers to the glass structures and framing systems utilized in non-residential buildings, encompassing high-performance windows, curtain walls, storefronts, and architectural facades. These systems are crucial for optimizing building aesthetics, structural integrity, energy efficiency, and occupant comfort. Key products include low-emissivity (Low-E) glass, insulated glass units (IGUs), laminated glass, and smart/dynamic glass, all tailored to meet stringent modern building codes related to thermal performance and safety. Major applications span corporate offices, healthcare facilities, educational institutions, retail complexes, and hospitality sectors, all seeking advanced solutions for natural daylight harvesting and reduction of HVAC load. The market benefits significantly from global urbanization trends, heightened awareness of sustainability goals, and technological advancements in glass coatings and framing materials, particularly aluminum and composite frames, driving demand for technologically superior facade solutions.

The core function of commercial glazing has evolved far beyond simple light transmission; it now serves as an active component of a building’s energy management strategy. Modern glazing products integrate sophisticated coatings designed to reflect specific wavelengths of solar radiation while allowing visible light to pass through, effectively mitigating heat gain in warm climates and retaining warmth in colder environments. This dual function directly supports building owners in achieving critical green building certifications, such as LEED, by significantly reducing operational energy consumption. Furthermore, the aesthetic demands of contemporary architecture often necessitate large, expansive glass facades, pushing manufacturers to innovate in terms of size, strength, and structural capabilities of glass panels and supporting frameworks.

Driving factors for sustained market expansion include the increasing focus on retrofitting aging commercial infrastructure in developed economies to comply with updated energy performance standards. Simultaneously, rapid commercial development in emerging economies, particularly across Asia Pacific, fuels the demand for new, high-rise construction featuring extensive curtain wall systems. Regulatory pressure mandating higher thermal resistance (U-values) and solar heat gain coefficient (SHGC) values for new installations ensures that outdated, single-pane glazing solutions are systematically replaced by advanced insulated units and dynamic smart glass technologies, providing robust market momentum well into the forecast period.

Commercial Glazing Market Executive Summary

The Commercial Glazing Market is experiencing robust growth driven by converging factors: strict environmental regulations prioritizing energy efficiency, advancements in smart glass technology, and a global boom in high-density commercial infrastructure development. Business trends indicate a clear shift towards specialized, high-margin products like fire-rated, acoustic, and self-cleaning glass, while manufacturers focus on vertically integrated supply chains to manage the volatility of raw material costs, particularly for aluminum and specialized silicon used in glass production. Sustainability is not just a trend but a fundamental business imperative, with major players investing heavily in closed-loop recycling programs for glass waste and developing low-carbon manufacturing processes, establishing competitive differentiation in tenders for large-scale construction projects worldwide. Furthermore, modular construction techniques are influencing glazing installation, demanding pre-fabricated, large-format IGUs that accelerate project timelines.

Regionally, the Asia Pacific (APAC) market dominates in volume due to massive ongoing urbanization and infrastructural investments in countries like China, India, and Southeast Asian nations, where new commercial floor space is expanding rapidly, driving demand for basic and mid-range insulated glass units. Conversely, North America and Europe lead in terms of value and technological adoption, serving as the primary markets for premium products such as electrochromic glass and vacuum insulated glazing (VIG), driven by stringent energy codes and sophisticated architectural preferences for minimalist design and maximal performance. Europe, in particular, showcases strong growth in the retrofit sector, propelled by EU directives aimed at decarbonizing the existing building stock, creating significant opportunities for advanced thermal break systems and thin-film coatings.

Segmentation trends highlight the Insulated Glass Units (IGUs) segment maintaining the largest market share due to their ubiquitous application and compliance with minimum energy standards globally. However, the specialized glass segments, including Laminated Glass (driven by safety and security requirements in high-risk zones) and Smart Glass (driven by integration into Building Management Systems for automated light control), are projected to exhibit the highest Compound Annual Growth Rates (CAGRs). The demand for structural glazing and curtain wall systems remains paramount in the construction type segment, reflecting the enduring trend of high-rise, glass-intensive commercial buildings that maximize natural light penetration and facade transparency.

AI Impact Analysis on Commercial Glazing Market

User queries regarding AI's influence in the Commercial Glazing Market primarily center on automated design optimization, predictive maintenance of building envelopes, and intelligent control of dynamic glazing systems. Users are concerned with how AI can streamline the complex specification process, ensuring that the chosen glazing material meets precise thermal, acoustic, and daylighting performance targets based on geographic location and building orientation. Key themes include the integration of Machine Learning (ML) algorithms into Building Information Modeling (BIM) software to rapidly iterate through hundreds of glazing options, thereby reducing design time and material waste. Expectations are high that AI will move beyond optimization to enable genuinely adaptive building facades, where smart glass properties (tinting, opacity) are modulated in real-time by AI systems analyzing weather data, internal occupancy, and energy pricing, maximizing comfort while minimizing operational expenditure. There is also significant interest in using AI for quality control during manufacturing and predicting defects in installed glazing systems before catastrophic failure occurs, shifting maintenance from reactive to proactive, ensuring long-term structural integrity and performance.

The manufacturing process benefits significantly from the application of AI, particularly in quality control and process efficiency. Computer vision systems powered by deep learning models are now capable of inspecting large glass sheets for microscopic defects, internal stresses, or inconsistencies in coatings far faster and more accurately than human inspectors. This reduction in defect rates improves yield and material quality, crucial for complex, high-performance units like Vacuum Insulated Glazing (VIG). Furthermore, AI algorithms optimize batch processing and furnace controls, adjusting temperature and cooling curves in real-time based on material composition and environmental factors, thereby decreasing energy consumption during the glass production phase—a traditionally energy-intensive process—and lowering overall manufacturing costs.

In the application phase, AI serves as the backbone for the next generation of smart commercial buildings. Integrating glazing systems with AI-driven Building Management Systems (BMS) allows for predictive operational efficiency. For instance, in buildings utilizing electrochromic or suspended particle device (SPD) glass, AI analyzes future weather forecasts, peak utility times, and occupant schedules to pre-tint or pre-clear the glass facade, preventing solar glare before it occurs and reducing the immediate need for air conditioning. This seamless, intelligent interaction between the physical building envelope and the digital control system represents the cutting edge of sustainable building design, offering superior energy savings and unparalleled occupant experience compared to traditional static or manually controlled shading solutions.

- AI optimizes structural and thermal performance modeling within BIM environments, dramatically reducing design iteration cycles.

- Machine learning enhances manufacturing quality control by detecting minute flaws in glass coatings and composition.

- Predictive analytics monitors environmental stresses (wind load, temperature cycling) on installed glazing to schedule proactive maintenance.

- AI-driven Building Management Systems (BMS) intelligently control dynamic glazing (smart glass) tint levels based on real-time and predicted occupancy/weather.

- Algorithms optimize glass cutting and sequencing in fabrication to minimize raw material wastage and improve supply chain efficiency.

DRO & Impact Forces Of Commercial Glazing Market

The Commercial Glazing Market is principally driven by stringent regulatory frameworks mandating superior energy performance in commercial structures globally, coupled with ongoing technological innovations that improve product efficacy, durability, and aesthetic appeal. However, the market faces significant restraints, primarily centered around the volatility of raw material prices—notably aluminum, silicon, and specialized coatings—and the inherently high upfront costs associated with premium, high-performance glazing solutions, which can deter adoption in price-sensitive markets. Opportunities abound in the burgeoning demand for specialized, value-added products like safety and security glass systems, and the vast potential for retrofitting inefficient existing building stock in developed nations. The major impact forces governing the market's trajectory include the powerful push towards green building standards (Pestle Factor: Environmental/Regulatory) and the rapid urbanization trends, especially in Asia (Pestle Factor: Socio-economic/Demographic), which necessitate rapid, energy-efficient construction, making glazing a critical performance differentiator.

Drivers

A primary driver is the accelerating global focus on reducing building energy consumption, which often accounts for a significant portion of national energy use. Governmental bodies worldwide are continually introducing stricter energy efficiency codes (e.g., EU’s Energy Performance of Buildings Directive, U.S. local green codes) that necessitate the use of advanced glazing technologies, such as highly insulating triple-pane windows or low-emissivity (Low-E) coatings with superior thermal breaks. These regulations effectively phase out less efficient, traditional single and double-pane glass, creating a mandatory replacement cycle and driving steady demand for high-performance Insulated Glass Units (IGUs) and structural glazing systems that adhere to low U-value and low Solar Heat Gain Coefficient (SHGC) requirements. This regulatory push provides a predictable, long-term stimulus for market growth, independent of general economic cycles, as compliance is non-negotiable for new commercial construction and major renovations.

Furthermore, the architectural shift toward maximizing natural daylight (daylight harvesting) and enhancing transparency in modern commercial design significantly boosts the demand for large-format, structurally reinforced glazing solutions. Architects and corporate clients increasingly seek aesthetically pleasing glass facades that improve occupant well-being and productivity, a recognized benefit known as biophilic design. Technological advancements in structural silicones, framing materials, and specialty glass manufacturing now allow for larger, uninterrupted glass expanses that meet rigorous safety standards (e.g., wind load resistance) without compromising thermal performance. This trend not only increases the sheer volume of glass used per building but also mandates higher quality, specialized products, boosting the overall market value.

- Strict global energy efficiency regulations and building codes (e.g., low U-value requirements).

- Growing architectural trend favoring large-format, transparent glass facades for aesthetic appeal and daylighting.

- Increasing adoption of smart glass (dynamic glazing) for integrated energy management in high-tech buildings.

- Rising demand for noise reduction (acoustic glazing) in dense urban commercial centers.

- Infrastructure boom and urbanization in developing economies, necessitating high volumes of new construction.

Restraints

The volatility and inherent cost escalation of raw materials pose a persistent restraint on the market. The production of high-performance glass relies heavily on raw materials like soda ash, sand, and particularly, specialized low-iron glass substrates and noble gases (like argon or krypton) used for insulation fills in IGUs. Additionally, high-performance framing systems are predominantly made from aluminum, the price of which is subject to significant fluctuation based on global commodity markets and trade policies. These unstable input costs make long-term price forecasting difficult for manufacturers and can erode profit margins, especially in fixed-price construction contracts, potentially leading to delayed project commitments or a shift back towards cheaper, less efficient alternatives in certain cost-conscious regions.

Another critical restraint is the high initial capital investment required for installing advanced commercial glazing systems, such as dynamic electrochromic glass or Vacuum Insulated Glazing (VIG). While these systems offer substantial lifecycle cost savings through reduced energy consumption, the initial procurement and installation costs are often significantly higher than those of conventional insulated glass. This high barrier to entry can discourage small to medium-sized commercial developers or projects operating under tight budgets, particularly where payback periods for energy savings are perceived as too long. Educating the market on the total cost of ownership (TCO) versus initial cost remains a significant challenge for widespread adoption of premium, cutting-edge technologies.

- Fluctuation in raw material prices (aluminum, silicon, specialized gases) impacting manufacturing costs.

- High upfront capital expenditure required for premium, high-performance glazing solutions like VIG and smart glass.

- Complex and time-consuming installation processes for custom and large-format architectural glazing.

- Lack of standardized testing and certification procedures across all global markets, creating trade barriers.

- Economic slowdowns or recessionary pressures temporarily delaying major commercial construction projects.

Opportunities

The largest untapped opportunity lies in the massive global market for retrofitting existing commercial buildings, particularly in North America and Western Europe, where millions of square meters of commercial space still utilize energy-inefficient, decades-old glazing systems. Regulatory pressure and corporate sustainability commitments are accelerating the need to upgrade these structures to meet modern energy standards. This retrofit market demands specialized solutions like thin-profile insulated glass or interior-mounted secondary glazing systems that minimize disruption while maximizing thermal improvement, offering a sustained revenue stream independent of new construction cycles.

Furthermore, the rapidly expanding integration of specialized functional glass, such as BIPV (Building-Integrated Photovoltaics) and advanced security/fire-rated glass, presents significant value addition opportunities. BIPV glazing allows facades to generate electricity, transforming the building envelope into an active energy source, which is highly attractive for net-zero energy building goals. Similarly, heightened global concerns regarding security, especially in government, financial, and high-profile corporate facilities, drive demand for multi-layered laminated and ballistic-resistant glass, commanding premium pricing and higher margins for specialized manufacturers.

- Vast retrofit market potential in developed economies seeking to enhance energy performance of aging commercial stock.

- Integration of Building-Integrated Photovoltaics (BIPV) into commercial facades for renewable energy generation.

- Growing demand for multi-functional glass, including security, fire-rated, and hurricane-resistant products.

- Development of sustainable, recycled content glass and lower-carbon manufacturing techniques (Green Glazing).

- Expansion of customized, large-scale, structural glazing systems tailored for complex contemporary architectural projects.

Segmentation Analysis

The Commercial Glazing Market is comprehensively segmented based on product type, material, application, and end-user, providing a clear framework for analyzing market dynamics and competitive landscapes. Product segmentation reveals the dominance of Insulated Glass Units (IGUs), which form the foundational standard for energy-efficient construction, while newer technologies like smart glass offer significant growth potential due to their adaptive energy control features. Material segmentation highlights the reliance on aluminum frames for their durability and lightweight characteristics in curtain wall systems, although PVC and composite materials are gaining traction in specific applications due to superior thermal break capabilities. Analyzing these segments helps stakeholders understand where technological innovation is focused and which markets offer the highest returns based on specific product features and regional regulatory requirements.

The segmentation by application clarifies the diverse performance demands placed upon commercial glazing. The office and corporate segment requires high levels of acoustic attenuation and superior aesthetics, driving the use of custom laminated and structural glazing. Conversely, in the healthcare and educational segments, safety (break resistance, laminated glass) and cleanliness/hygiene are paramount considerations. The performance requirements in high-rise buildings, classified under the curtain wall application, necessitate robust, wind-load resistant, and thermally efficient systems that integrate complex drainage and sealing components, distinguishing it from simpler storefront or window wall systems. These performance variations drive specialization among manufacturers and dictate material selection, reinforcing the market's differentiation based on specific end-use demands.

Geographic segmentation is crucial, differentiating markets based on maturity and growth velocity. Established markets in North America and Europe emphasize replacement, aesthetic specialization, and premium energy solutions (VIG, smart glass), offering high value per unit. In contrast, emerging markets in Asia Pacific are volume-driven, focusing on rapid deployment of standard-to-mid-range IGUs and aluminum framing to meet fast-paced infrastructure expansion. Understanding these regional disparities allows companies to tailor their product offerings—from ultra-high performance to cost-optimized solutions—and establish appropriate distribution strategies to maximize penetration across varying economic environments.

- By Product Type:

- Insulated Glass Units (IGU)

- Laminated Glass

- Tempered Glass (Toughened Glass)

- Coated Glass (Low-E Glass)

- Smart Glass (Dynamic Glazing, Electrochromic, Thermochromic)

- Vacuum Insulated Glass (VIG)

- By Framing Material:

- Aluminum

- Vinyl/PVC

- Wood

- Fiberglass/Composite

- By Application:

- Curtain Walls

- Storefronts and Entrances

- Windows and Ventilators

- Skylights and Atriums

- Interior Glazing (Partitions, Doors)

- By End-User:

- Office and Corporate Buildings

- Retail and Hospitality

- Healthcare Facilities

- Educational Institutions

- Government and Public Sector Buildings

Value Chain Analysis For Commercial Glazing Market

The value chain for the Commercial Glazing Market is highly complex, beginning with the extraction and processing of raw materials like silica sand, soda ash, and limestone, which are critical for primary glass manufacturing (upstream). This stage is characterized by high capital intensity and significant energy consumption. Upstream analysis highlights the necessity for secure sourcing and long-term contracts for key materials, as price volatility directly impacts downstream profitability. Primary manufacturers (float glass producers) convert these materials into large sheets of float glass. A crucial stage involves specialized processing (mid-stream), where float glass is transformed through coating (Low-E), tempering, laminating, and assembly into finished products like IGUs or specialized security glass. This value-addition stage requires high precision machinery and specialized chemical expertise, creating barriers to entry.

Downstream analysis focuses on system integration and installation. Fabricators and system providers design, assemble, and frame the glass into complete architectural systems, such as unitized curtain walls. These products are then distributed through two primary channels: direct sales to large construction contractors or property developers for massive, custom projects, and indirect channels through regional distributors and specialized glazing subcontractors for smaller or standardized installations. The effectiveness of the distribution channel is highly dependent on logistics, as large glass products require specialized transportation and handling to prevent breakage and ensure timely delivery to often congested construction sites. Direct engagement facilitates customization and technical consulting, crucial for complex high-performance facades.

The distribution network plays a pivotal role in market penetration and service delivery. Direct channels ensure close collaboration between the manufacturer and the architect/engineer, allowing for customized specifications critical for structural glazing and high-rise curtain walls. This channel emphasizes technical support, project management, and post-installation service, capturing higher value. The indirect channel, relying on regional distributors and installers, is essential for reaching smaller construction projects, repair and replacement work, and regional residential markets (though the focus here is commercial). Effective inventory management, technical training for local installers on specific product requirements (especially for VIG or smart glass), and rapid fulfillment are the hallmarks of a successful indirect distribution strategy, maintaining market reach across geographically dispersed construction activities.

Commercial Glazing Market Potential Customers

The primary end-users, or potential customers, of commercial glazing products are large-scale property developers, institutional investors, and governmental agencies undertaking significant infrastructure projects. These entities are typically focused on optimizing the lifecycle performance of their assets, meaning their purchasing decisions are heavily influenced not just by initial cost, but also by long-term energy savings, maintenance requirements, and the ability of the building envelope to enhance tenant appeal and rental value. For instance, developers targeting premium tenants will prioritize high-performance acoustic and solar-control glazing systems that provide superior occupant comfort and maximize daylighting, justifying the higher capital outlay through premium rental rates and low operational costs. Furthermore, their need for standardized, repeatable specifications across multiple projects favors manufacturers capable of large-volume, consistent output and strong technical support.

Secondary potential customers include specialized construction contractors and glazing subcontractors who are responsible for the physical installation and integration of the glazing systems into the building structure. These customers are highly concerned with material reliability, ease of installation (e.g., preference for unitized vs. stick-built curtain walls), compliance with local building codes, and the timeliness of product delivery. Their purchasing decisions are often dictated by the project specifications laid out by the architects and engineers, but their loyalty is built on robust logistics and technical documentation provided by the glazing supplier, particularly for complex projects involving structural silicones and specialized hardware. Subcontractors often rely on the indirect distribution channel for readily available stock products and replacement parts.

A third, rapidly growing customer segment is facility management companies and corporate real estate owners managing existing building portfolios. This group drives the significant retrofit market. Their needs revolve around solutions that minimize tenant disruption during installation while dramatically improving energy efficiency and facade integrity. They seek modular, adaptable glazing solutions and services that include detailed energy audits and performance guarantees for replacement products, ensuring rapid return on investment. This segment is less focused on aesthetics (compared to new construction) and more focused on quantifiable performance metrics (U-value improvements, SHGC reduction) and durability, making them key targets for suppliers specializing in innovative retrofit window insert systems and maintenance contracts for smart glass facades.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 29.2 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Saint-Gobain, Asahi Glass Co., Ltd. (AGC), Guardian Glass, Central Glass Co., Ltd., Schott AG, Nippon Sheet Glass Co., Ltd., Corning Inc., Viracon, Inc., View, Inc., Kinestral Technologies, Inc., Padiham Glass Ltd., Consolidated Glass Holdings, Oldcastle BuildingEnvelope, Inc., Vitro Architectural Glass, Tyneside Safety Glass. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Glazing Market Key Technology Landscape

The technology landscape of the Commercial Glazing Market is highly dynamic, driven by the persistent global push for net-zero energy buildings and advancements in materials science. The core technological innovation revolves around low-emissivity (Low-E) coatings, which utilize microscopic metallic layers deposited on the glass surface to selectively filter solar radiation. Modern Low-E coatings are highly sophisticated, tailored specifically for different climates (optimized for heat retention or solar heat rejection) and achieving superior performance with minimal visual distortion. Beyond coatings, the increasing prevalence of Vacuum Insulated Glazing (VIG) represents a significant leap forward, offering thermal performance comparable to a traditional wall, but with a much thinner profile, ideal for challenging retrofit projects and high-performance facades where space and weight are critical constraints.

A transformative area of technology is dynamic glazing, or "smart glass," which allows for the real-time, reversible control of light and heat transmission. Electrochromic technology, the most commercially mature smart glass, uses electricity to change the tint of the glass, dynamically managing solar gain and glare without the need for physical blinds or shades. This integration of electronics into the building envelope shifts the window from a passive element to an active, energy-controlling system. Further innovations include Suspended Particle Device (SPD) technology, which offers near-instantaneous light switching, and thermochromic materials that react passively to temperature changes. These intelligent glazing solutions are fundamentally changing how architects approach facade design and energy modeling, offering unparalleled flexibility in managing interior environmental conditions.

In terms of structural integration, advances in structural silicones and framing systems are equally critical. High-performance aluminum thermal breaks, often using polyamide strips, are essential for minimizing heat transfer through the frame itself, an area traditionally responsible for significant thermal leakage. Furthermore, the development of sophisticated unitized curtain wall systems has streamlined the construction process. These systems, which are largely factory-assembled into large modules comprising frame, glass, and sealing, allow for faster, more accurate, and higher-quality installation on-site. This modular approach leverages precision manufacturing to reduce labor costs and construction timelines, reinforcing the move towards integrated, performance-driven building envelopes and ensuring that complex geometric designs can be realized while maintaining strict performance specifications.

Regional Highlights

Regional dynamics in the Commercial Glazing Market are highly divergent, primarily driven by differing regulatory environments, rates of urbanization, and economic maturity. Asia Pacific (APAC) currently holds the dominant position in terms of market volume due to unprecedented commercial infrastructure development. Countries like China and India are witnessing massive investments in new office towers, retail complexes, and transportation hubs, generating colossal demand for commercial glazing. While the region utilizes a mix of basic insulated glass for cost-efficiency, there is a clear and accelerating trend towards adopting high-performance Low-E coated glass driven by increasingly stringent government mandates on energy conservation, particularly in Tier 1 cities, making it a critical area for volume growth and future technology penetration.

North America is characterized by high value per unit and a strong emphasis on technological sophistication and resilience. Strict energy codes in states like California and jurisdictions across Canada mandate the use of high-performance IGUs and are major drivers for the early adoption of smart glass and VIG technologies. Furthermore, the region faces significant weather challenges, driving demand for specialized hurricane-resistant, blast-mitigating, and fire-rated laminated glass, particularly in coastal and densely populated urban areas. The retrofit market in North America is immense, providing continuous demand for upgrade solutions as commercial property owners seek to modernize and reduce operating costs while complying with evolving sustainability benchmarks.

Europe represents a mature yet robust market, significantly influenced by the European Union’s ambitious climate goals and directives focused on achieving near-zero energy buildings. The emphasis here is heavily placed on maximizing thermal performance and incorporating circular economy principles. The market leads in the adoption of passive house standards for commercial buildings, driving demand for ultra-low U-value products, including triple glazing and highly efficient thermal break systems. The European market also shows a high willingness to invest in aesthetic quality, supporting the use of complex architectural glass and specialized coatings. Western European nations, such as Germany and the UK, are focal points for retrofitting projects, necessitating tailored, high-precision manufacturing and installation expertise to integrate new glazing seamlessly into historic structures.

- Asia Pacific (APAC): Dominant in volume, fueled by rapid urbanization and infrastructure investment in China, India, and Southeast Asia. Growth driven by new construction and gradual increase in demand for mid-range Low-E glass.

- North America: High value market characterized by early adoption of advanced technologies (Smart Glass, VIG) and strong demand for security, safety, and specialized weather-resistant glazing systems due to strict regional codes and climatic volatility.

- Europe: Focus on ultra-high thermal performance (triple glazing, advanced thermal breaks) driven by stringent EU energy efficiency directives and a significant, lucrative market for deep energy retrofitting of existing commercial building stock.

- Latin America (LATAM): Emerging market with increasing commercial development in metropolitan centers (Brazil, Mexico), driven primarily by basic IGU adoption, though often constrained by economic instability and variable regulatory enforcement.

- Middle East & Africa (MEA): High growth potential, especially in the GCC countries, where extreme climate conditions necessitate specialized solar control glazing (high SHGC rejection). Demand is concentrated in large-scale, iconic mega-projects and luxury commercial developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Glazing Market.- Saint-Gobain

- Asahi Glass Co., Ltd. (AGC)

- Guardian Glass

- Central Glass Co., Ltd.

- Schott AG

- Nippon Sheet Glass Co., Ltd.

- Corning Inc.

- Viracon, Inc.

- View, Inc.

- Kinestral Technologies, Inc.

- Padiham Glass Ltd.

- Consolidated Glass Holdings

- Oldcastle BuildingEnvelope, Inc.

- Vitro Architectural Glass

- Tyneside Safety Glass

- Technoform Bautec

- Kuraray Co., Ltd.

- Daiken Corporation

- Sapa Building Systems (Hydro)

- YKK AP Inc.

Frequently Asked Questions

Analyze common user questions about the Commercial Glazing market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the key factor driving the growth of the Commercial Glazing Market?

The primary factor driving growth is the implementation of increasingly stringent governmental energy efficiency regulations and building codes worldwide, which mandate the use of high-performance insulated and Low-E coated glazing to significantly reduce building energy consumption.

How does smart glass technology contribute to commercial building performance?

Smart glass (dynamic glazing) actively manages solar heat gain and glare in real-time, often integrated with Building Management Systems (BMS). This dynamic control maximizes natural light while minimizing the need for HVAC and artificial lighting, directly contributing to energy savings and superior occupant comfort.

Which geographical region represents the largest volume market for commercial glazing?

The Asia Pacific (APAC) region currently holds the largest volume share, primarily due to accelerated urbanization and massive ongoing new commercial and infrastructural construction projects in densely populated countries such as China and India.

What are the main types of glazing products used in commercial construction?

The main commercial glazing products are Insulated Glass Units (IGUs), Laminated Glass (for safety and security), Tempered Glass, and various coated glasses, particularly Low-E glass, which forms the standard for modern energy-efficient building envelopes.

What is the primary restraint facing the adoption of high-performance glazing?

The main restraint is the high initial capital expenditure (upfront cost) associated with advanced solutions like Vacuum Insulated Glazing (VIG) and electrochromic smart glass, coupled with the price volatility of key raw materials like aluminum and specialty silicon.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager