Commercial Ice Makers and Ice Machines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436253 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Commercial Ice Makers and Ice Machines Market Size

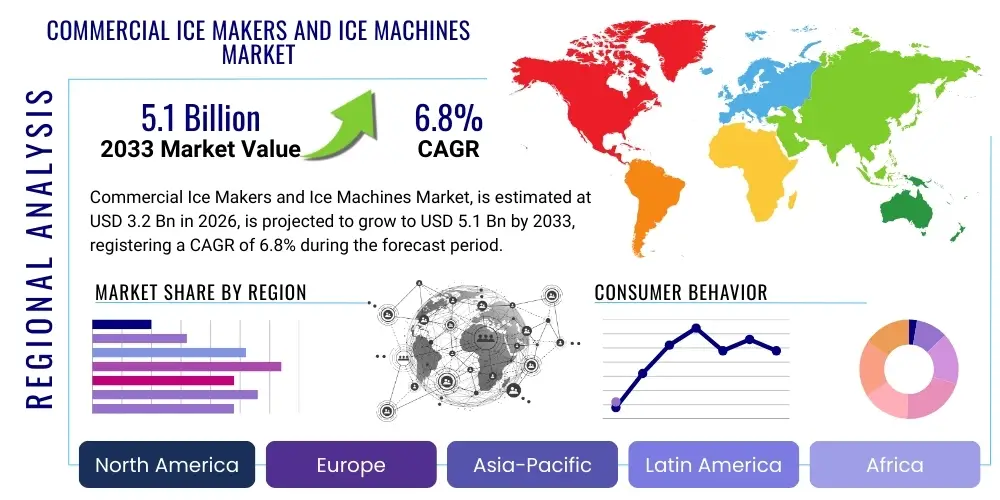

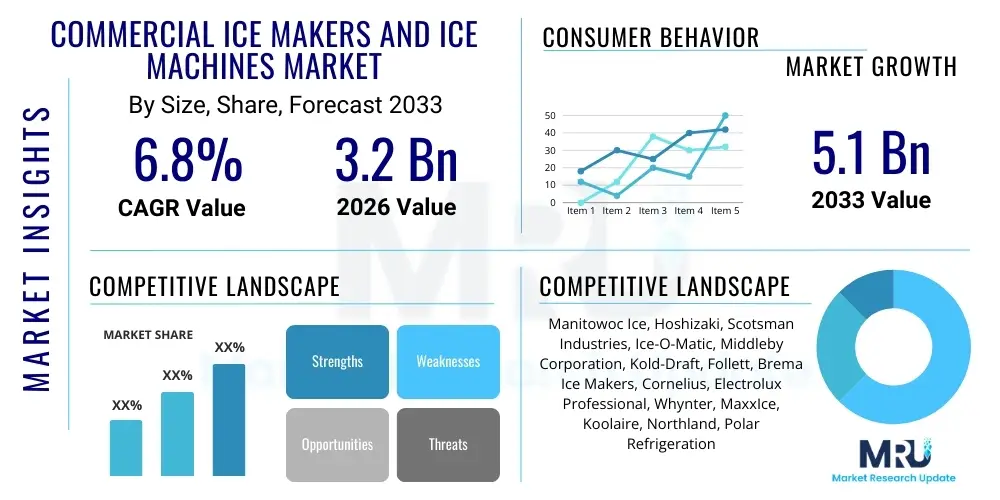

The Commercial Ice Makers and Ice Machines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of [6.8]% between 2026 and 2033. The market is estimated at [USD 3.2 Billion] in 2026 and is projected to reach [USD 5.1 Billion] by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the robust growth in the hospitality, foodservice, and healthcare sectors globally, all of which rely heavily on consistent, high-volume ice production for operational efficiency, product preservation, and consumer service.

Commercial Ice Makers and Ice Machines Market introduction

The Commercial Ice Makers and Ice Machines Market encompasses specialized equipment designed for producing large quantities of ice cubes, flakes, nuggets, or other forms of ice for business operations. These machines are crucial components in industries where food safety, beverage cooling, and temperature control are paramount. Product descriptions include modular ice machines, undercounter units, countertop dispensers, and self-contained ice makers, categorized based on production capacity, ice type, and application environment. Major applications span restaurants, bars, hotels, hospitals, fast-food chains, and retail grocery stores, ensuring quality control and operational readiness. The primary benefits include high-volume, continuous production capabilities, reduced manual labor, enhanced hygiene compared to sourcing ice externally, and energy efficiency features present in newer models. Driving factors include the global surge in quick-service restaurants (QSRs), increasing consumer demand for chilled beverages, stringent health regulations requiring professional ice handling, and technological advancements focusing on smaller footprints and sustainable refrigerants. The integration of IoT and predictive maintenance into these systems further accelerates market adoption, particularly in highly regulated and operational-intensive environments like hospitals and high-end resorts, solidifying their role as indispensable commercial assets.

Commercial Ice Makers and Ice Machines Market Executive Summary

The Commercial Ice Makers and Ice Machines Market is witnessing dynamic shifts driven by evolving consumer dining habits and greater emphasis on operational efficiency and sanitation across the foodservice and healthcare industries. Business trends indicate a strong focus on modular designs and remote monitoring capabilities, allowing large chains and institutions to manage diverse machine fleets centrally and minimize downtime. Regional trends highlight significant investment and expansion in the Asia Pacific (APAC) market, propelled by rapid urbanization, increasing disposable income, and the proliferation of international hotel and restaurant chains. North America remains a mature but innovative market, emphasizing energy-efficient models and advanced sanitation technologies, such as UV sterilization integration, to meet stringent regulatory requirements. Segment trends show considerable growth in the Flake Ice segment, crucial for fresh food display in retail and specific medical applications, while the Cube Ice segment maintains dominance due to its universal applicability in beverages and general cooling. The shift towards sustainable refrigerants (e.g., R290 or R600a) is reshaping the competitive landscape, compelling manufacturers to redesign existing product lines and comply with increasingly strict environmental mandates globally, particularly within the European Union and progressive U.S. states.

AI Impact Analysis on Commercial Ice Makers and Ice Machines Market

User queries regarding AI's impact on the Commercial Ice Makers market predominantly revolve around three core themes: predictive maintenance, energy optimization, and supply chain automation. Users frequently ask how AI can prevent costly machine breakdowns, specifically in high-demand environments like large resorts or hospitals, questioning the accuracy and deployment cost of AI-driven diagnostic systems. A second major concern is the potential for AI algorithms to dynamically adjust machine performance based on real-time factors such as ambient temperature, operational load cycles, and energy pricing, seeking confirmation on genuine energy savings promised by 'smart' ice makers. Finally, questions often address how AI and machine learning (ML) can integrate with broader kitchen management systems to automate ice inventory management, ensuring just-in-time production and reducing waste, especially concerning modular systems connected across multiple outlets of a large franchise. The key expectation is a transition from reactive maintenance and fixed production schedules to highly efficient, autonomous operation managed through cloud-based analytics, minimizing human intervention and maximizing asset lifespan while simultaneously addressing stringent hygiene and food safety standards.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) into the Commercial Ice Makers and Ice Machines Market is fundamentally transforming the operational paradigm, shifting management from manual oversight to automated, data-driven control. AI algorithms are increasingly being used to analyze vast quantities of operational data, including compressor cycles, water quality readings, ambient temperature fluctuations, and historical usage patterns, allowing for unparalleled levels of optimization. This technological infusion enables ice machines to predict mechanical failures long before they occur, drastically reducing unexpected downtime which can be catastrophic in mission-critical environments such as hospitals or high-volume QSR outlets. Furthermore, AI facilitates dynamic energy management, where the machine learns the specific demand profiles of its location and adjusts production cycles to utilize off-peak energy pricing or respond immediately to sudden surges in demand, resulting in measurable cost efficiencies for operators, which is a major driver for high-volume commercial users looking to decrease total cost of ownership (TCO).

Beyond predictive maintenance and energy efficiency, AI is streamlining the service lifecycle and enhancing hygiene compliance, critical factors that influence purchasing decisions in this market. AI-enabled machines can automatically monitor water filtration effectiveness, track sanitation cycles, and even diagnose minor operational issues, relaying precise troubleshooting information directly to technicians or facility managers via integrated IoT platforms. This capability reduces the duration of service calls and improves first-time fix rates. The impact also extends into manufacturing, where AI is optimizing assembly lines and quality control processes for the ice machines themselves, leading to more reliable and defect-free units entering the market. As AI platforms become more standardized and affordable, their inclusion is transitioning from a premium feature to a standard expectation, particularly among large institutional buyers who prioritize seamless integration with existing building management and energy monitoring systems, thereby significantly accelerating the pace of digital transformation within the segment.

- Predictive Maintenance: AI monitors operational parameters (vibration, temperature, pressure) to forecast component failure, initiating preventative maintenance alerts.

- Energy Optimization: ML algorithms dynamically schedule ice production based on predicted demand cycles and real-time utility rates, minimizing consumption during peak hours.

- Inventory Automation: Integration with Point-of-Sale (POS) and inventory systems allows machines to automatically adjust output based on projected service volume, preventing overproduction or shortages.

- Enhanced Diagnostics: AI systems provide precise remote fault diagnosis, reducing technician travel time and improving repair accuracy and speed.

- Water Quality Monitoring: AI assesses water usage patterns and filter performance, alerting users when filtration effectiveness degrades, ensuring hygiene and machine longevity.

- Design Optimization: Manufacturers use AI/ML to analyze real-world performance data to inform future design iterations, improving machine reliability and footprint efficiency.

DRO & Impact Forces Of Commercial Ice Makers and Ice Machines Market

The dynamics of the Commercial Ice Makers and Ice Machines Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, collectively influenced by several high-impact forces. Key drivers include the exponential global expansion of the hospitality sector, specifically hotels and QSRs, which necessitates reliable, high-capacity ice production to support their operations. Simultaneously, stricter food safety regulations, particularly concerning ice handling and storage in both foodservice and healthcare environments, compel businesses to upgrade older, less sanitary equipment with new, certified commercial ice machines featuring integrated sanitation systems. Restraints predominantly center on the high initial capital investment required for commercial-grade machinery, coupled with increasing operational costs associated with maintenance and water consumption in regions facing resource scarcity. Furthermore, the mandatory transition towards environmentally friendly, low Global Warming Potential (GWP) refrigerants presents a significant engineering and compliance challenge, temporarily increasing manufacturing complexity and product cost, thereby acting as a short-term market restraint.

Opportunities for market growth are abundant, primarily rooted in technological innovation and geographical expansion. The development of modular, scalable ice machine systems, particularly those integrated with advanced IoT platforms for remote management and performance analytics, opens lucrative opportunities for servicing large, multi-site customers. There is a burgeoning market for specialized ice forms, such as nugget or flake ice, driven by gourmet beverage trends and specialized medical applications (e.g., patient cooling). Moreover, the increasing adoption of leasing and subscription models for ice machine access is lowering the barrier to entry for smaller businesses, allowing them to access premium, high-efficiency equipment without the burden of large upfront expenditures. These models shift the risk and maintenance responsibility to the provider, making high-quality ice production a predictable operational expense rather than a capital investment.

Impact forces influencing the market trajectory are dominated by technological shifts, economic volatility, and regulatory pressures. The impact force of digitalization, particularly the integration of AI for predictive maintenance and energy optimization, is rapidly accelerating the replacement cycle of traditional machinery. Economic forces, such as fluctuating commodity prices (e.g., stainless steel, copper) and global supply chain disruptions, directly impact manufacturing costs and product availability. Regulatory mandates, specifically the global phase-down of hydrofluorocarbon (HFC) refrigerants under agreements like the Kigali Amendment, exert an intense, non-negotiable force on product design, necessitating significant R&D investment and product redesign across all major manufacturers. These forces collectively define the market structure, rewarding manufacturers who can quickly adapt to environmental compliance while simultaneously leveraging digital technologies to deliver superior efficiency and reliability.

- Drivers:

- Rapid expansion of the global foodservice and hospitality industries.

- Increasingly stringent health, safety, and hygiene regulations for ice production.

- Rising demand for specialized ice forms (nugget, flake) in niche applications.

- Technological advancements in energy efficiency and water conservation.

- Restraints:

- High initial capital expenditure and ongoing maintenance costs.

- Regulatory requirements demanding conversion to expensive, low-GWP refrigerants.

- Volatility in raw material costs impacting manufacturing profitability.

- Significant energy and water consumption associated with high-volume production.

- Opportunities:

- Integration of IoT, AI, and cloud-based solutions for remote monitoring and diagnostics.

- Expansion into untapped emerging markets, especially in APAC and Latin America.

- Development of flexible financing models (leasing, Ice-as-a-Service) for small and medium enterprises (SMEs).

- Focus on modular and customizable ice systems tailored for specific commercial footprints.

- Impact Forces:

- Technological Innovation (High)

- Regulatory Compliance (High)

- Economic Fluctuation (Medium)

- Sustainability Mandates (High)

Segmentation Analysis

The Commercial Ice Makers and Ice Machines Market is highly fragmented and segmented based on multiple critical operational characteristics, including ice type, machine type, application, and end-user vertical. This multi-dimensional segmentation allows manufacturers to target specific market niches with tailored products, optimizing capacity, footprint, and functionality according to specific commercial needs. Segmentation by ice type is crucial, distinguishing between high-demand cube ice, soft flake ice necessary for medical use and seafood display, and nugget ice favored for soft drinks. By machine type, the market splits into modular systems, which require a separate storage bin and are favored by high-volume users, and self-contained units, which integrate production and storage, preferred by smaller establishments. Understanding these segmentations is paramount for market participants to accurately assess competitive positioning and identify high-growth sub-sectors, particularly within the burgeoning healthcare and institutional catering segments which demand specialized equipment and rigorous certifications.

- By Ice Type:

- Cube Ice Makers (Full Cube, Half Cube, Gourmet Cube)

- Flake Ice Makers

- Nugget Ice Makers (Chewable Ice)

- Specialty Ice Makers (Crushed Ice, Scale Ice)

- By Machine Type:

- Modular Ice Makers

- Self-Contained Ice Makers

- Ice Dispensing Machines (Countertop and Freestanding)

- By Production Capacity (Per 24 Hours):

- Less than 300 lbs

- 300 lbs to 700 lbs

- More than 700 lbs

- By Refrigeration Type:

- Air-Cooled

- Water-Cooled

- Remote-Cooled

- By End-User:

- Food Service (Restaurants, QSRs, Bars, Cafes)

- Hospitality (Hotels, Resorts, Catering)

- Healthcare (Hospitals, Clinics, Laboratories)

- Retail & Grocery (Supermarkets, Convenience Stores)

- Education & Institutional (Schools, Universities, Government)

Value Chain Analysis For Commercial Ice Makers and Ice Machines Market

The value chain for the Commercial Ice Makers and Ice Machines Market begins with the upstream sourcing of specialized components, primarily high-efficiency compressors, evaporators, condensers, and advanced control systems (including microprocessors and sensors). Key upstream challenges involve managing the transition to expensive, environmentally compliant refrigerants and ensuring a stable supply of high-grade stainless steel and plastics necessary for durable, food-grade construction. Manufacturers focus on precise assembly, testing, and quality control, ensuring compliance with strict international standards like NSF and ETL. The efficiency and long-term reliability of the final product are heavily dependent on the quality of these sourced components. Strategic partnerships with specialized component suppliers, particularly those focused on IoT integration and energy recovery technologies, are crucial for maintaining a competitive edge and controlling manufacturing costs amidst increasing regulatory complexity.

The midstream phase involves the core manufacturing, branding, and final assembly, followed by the critical distribution channel activities. Distribution is complex, involving both direct and indirect sales strategies. Direct sales are often utilized for large institutional clients (major hotel chains or hospital groups) requiring customization, long-term service contracts, and bulk purchasing discounts. This approach allows manufacturers to maintain tight control over pricing and customer relationships. Indirect distribution, which dominates sales to SMEs and individual restaurants, relies heavily on a network of authorized dealers, food service equipment distributors, and online e-commerce platforms. These distributors provide essential local services, including installation, immediate spare parts inventory, and front-line maintenance support, making them indispensable touchpoints for end-users seeking fast deployment and local expertise.

The downstream component centers on installation, maintenance, and the aftermarket service ecosystem. This stage is critical for generating recurring revenue and maintaining brand loyalty. High-quality service—including preventative maintenance agreements, rapid repair response times, and filter replacement programs—significantly extends the operational lifespan of the machines, increasing customer satisfaction and reducing total cost of ownership. Given the critical nature of ice production, especially in healthcare, proactive maintenance services driven by remote diagnostics (IoT) are becoming standard practice. Furthermore, the final downstream customers often seek financing or leasing options, integrating equipment acquisition into their operational budgeting, thereby influencing how manufacturers structure their sales and service contracts to accommodate these financial requirements.

Commercial Ice Makers and Ice Machines Market Potential Customers

Potential customers for commercial ice makers and ice machines span a broad spectrum of commercial operations, united by the necessity for high-volume, reliable, and hygienic ice production. The largest and most dominant end-users fall within the Food Service industry, encompassing quick-service restaurants (QSRs) and full-service dining establishments, which demand high-capacity cube ice makers to support their beverage programs and kitchen operations. The Hospitality sector, including major hotel chains, cruise lines, and resorts, represents another critical customer base, requiring a diverse mix of modular ice machines for centralized production, and smaller, specialized dispenser units for guest floors and bars. These customers prioritize aesthetics, noise reduction, and continuous reliability, often integrating ice machines into their premium infrastructure.

Beyond traditional food and beverage, the Healthcare and Institutional sectors are experiencing accelerating growth in demand, driven by non-negotiable requirements for sanitation and specialized ice forms. Hospitals, laboratories, and large university cafeterias require flake ice for patient cooling, laboratory processes, and food preservation, alongside large-volume cube ice for general consumption. These institutional buyers are highly sensitive to certifications (NSF, UL), energy efficiency ratings, and the availability of sophisticated sanitation features like UV light sterilization and anti-microbial coatings. The purchasing decisions in these verticals are often centralized, based on long-term maintenance contracts and compliance with stringent public health standards, necessitating a differentiated product and service offering from market vendors.

Emerging potential customers include the burgeoning market of specialized beverage services, such as high-end coffee shops and craft cocktail bars, which increasingly demand specialty ice (e.g., gourmet cube or clear sphere ice) to enhance the perceived quality of their products. Furthermore, the retail sector, encompassing large supermarkets and small convenience stores, utilizes specialized flake and crushed ice machines for displaying perishable goods like seafood and meat, focusing on optimizing food safety and visual appeal. These customers often seek smaller footprint machines or under-counter units that can be seamlessly integrated into existing retail layouts while maintaining high levels of production capacity and efficiency during peak periods.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | [USD 3.2 Billion] |

| Market Forecast in 2033 | [USD 5.1 Billion] |

| Growth Rate | [6.8% CAGR] |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Manitowoc Ice, Hoshizaki, Scotsman Industries, Ice-O-Matic, Middleby Corporation, Kold-Draft, Follett, Brema Ice Makers, Cornelius, Electrolux Professional, Whynter, MaxxIce, Koolaire, Northland, Polar Refrigeration |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Ice Makers and Ice Machines Market Key Technology Landscape

The technology landscape of the Commercial Ice Makers and Ice Machines Market is rapidly shifting towards sustainability, digitalization, and operational efficiency, moving beyond basic refrigeration mechanisms. Central to this evolution is the widespread adoption of low Global Warming Potential (GWP) refrigerants, such as R290 (propane), which offer superior thermodynamic performance while drastically reducing environmental impact compared to older HFCs. This transition necessitates significant redesigns of internal components to handle the unique pressure and safety requirements of natural refrigerants. Concurrently, manufacturers are implementing advanced heat exchange technologies and high-efficiency compressors, often inverter-driven, to reduce energy consumption per pound of ice produced, appealing directly to environmentally conscious operators and organizations facing high utility costs. These hardware innovations are coupled with sophisticated electronic control systems that manage defrost cycles and monitor water purity with enhanced precision.

Digitalization, powered by the Internet of Things (IoT), represents the most disruptive technological advancement in this market. New generation ice machines are equipped with integrated sensors and Wi-Fi connectivity, allowing them to communicate operational data—such as temperature, energy usage, and diagnostic alerts—to cloud-based platforms. This remote monitoring capability is transformative, enabling facility managers to oversee entire fleets of machines across multiple locations from a central dashboard. Furthermore, the data collected fuels predictive maintenance algorithms, drastically reducing reactive service calls and maximizing machine uptime. This technological shift is fundamentally redefining the service agreements offered by manufacturers, transitioning towards proactive, data-informed maintenance subscriptions rather than traditional break-fix models, ensuring asset longevity and consistent ice supply.

A third significant technological pillar involves hygiene and water management innovations, driven by increased public health scrutiny. Advanced water filtration and purification systems, including reverse osmosis and specialized antimicrobial coatings (e.g., silver ion technology) applied to ice contact surfaces, are becoming standard features, ensuring ice quality far surpasses basic requirements. Furthermore, automated sanitation cycles utilizing ozone or UV light technology are being integrated directly into the machines, minimizing the need for manual chemical cleaning and ensuring consistent, verifiable sanitation compliance. These hygiene technologies are particularly valued by end-users in the healthcare and premium food service segments, where the risk associated with contaminated ice is unacceptable, reinforcing the value proposition of modern commercial ice machines as critical public health infrastructure.

Regional Highlights

- North America: This region is characterized by high market maturity and a strong focus on regulatory compliance, specifically concerning energy efficiency (Energy Star) and the transition to low-GWP refrigerants. The US, driven by large QSR chains and extensive hospitality infrastructure, dominates consumption. Demand is shifting towards modular, large-capacity units and advanced sanitation features, with a high willingness to adopt IoT-enabled systems for optimizing operational efficiency and maintenance.

- Europe: The European market emphasizes sustainability and stringent environmental regulations, particularly the F-Gas regulation driving the uptake of natural refrigerant-based ice makers (R290). Germany, the UK, and France are key consumers, propelled by robust tourism and highly regulated food safety standards. The market exhibits strong demand for sophisticated, compact, and design-conscious machines suitable for smaller European commercial kitchens and high-end cafes.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, significant infrastructure investment in tourism and healthcare, and the expansion of global QSR and hotel franchises into developing economies like India and Southeast Asia. Market growth is explosive in China and Japan, characterized by a preference for reliable, durable, high-volume units, often utilizing air-cooled technology due to water scarcity or cost constraints in some areas.

- Latin America (LATAM): Growth in LATAM is linked to expanding tourism sectors in Mexico and Brazil and increasing sophistication in their domestic food service industries. The market is highly price-sensitive but shows growing interest in energy-efficient models to offset high local electricity costs. Distribution complexity and service infrastructure pose challenges, favoring robust, low-maintenance machines.

- Middle East and Africa (MEA): Demand is concentrated in the Gulf Cooperation Council (GCC) countries due to massive hospitality and entertainment projects (e.g., in UAE and Saudi Arabia). Extreme ambient temperatures necessitate the adoption of highly efficient, water-cooled or remote-cooled systems to maintain production capacity, making product reliability under severe heat a primary purchasing criterion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Ice Makers and Ice Machines Market.- Manitowoc Ice (A Welbilt Brand)

- Hoshizaki Corporation

- Scotsman Industries (A Middleby Corporation Company)

- Ice-O-Matic (A Standex International Company)

- Follett Products, LLC

- Brema Ice Makers SpA

- Kold-Draft

- Cornelius, Inc.

- Electrolux Professional

- Mafirol

- MaxxIce

- Whynter

- Koolaire

- Polaris Refrigeration

- Northland Refrigeration

- Rinnai Corporation (Specific product lines)

- True Manufacturing Co., Inc.

- Alpeninox

- Icetro America

- Lancer Corporation

Frequently Asked Questions

Analyze common user questions about the Commercial Ice Makers and Ice Machines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key drivers for the adoption of energy-efficient commercial ice machines?

The primary drivers are stringent government regulations (like Energy Star mandates in North America and F-Gas in Europe), high operational utility costs, and corporate sustainability initiatives. Modern energy-efficient machines, particularly those using R290 refrigerant and smart operational controls, offer significant long-term cost savings and regulatory compliance for large commercial users.

Which type of commercial ice machine is best suited for high-volume quick-service restaurants (QSRs)?

High-volume QSRs typically benefit most from Modular Cube Ice Makers paired with large, sanitary storage bins. Modular units allow for maximum daily production capacity (often exceeding 700 lbs/day) and offer flexibility in bin size, ensuring the continuous supply of half or full cube ice necessary for high-demand beverage service during peak operating hours.

How is IoT technology improving the lifespan and maintenance of commercial ice machines?

IoT integration enables continuous, real-time monitoring of machine performance metrics, allowing for predictive maintenance. This system proactively identifies potential issues—such as irregular pressure, high vibration, or filter degradation—before they cause complete failure, drastically reducing unexpected downtime, minimizing costly repairs, and extending the overall operational lifespan of the unit.

What is the significance of the shift to natural refrigerants like R290 in this market?

The shift to natural refrigerants (like R290 propane) is crucial for regulatory compliance, primarily to reduce the industry's environmental footprint by eliminating high Global Warming Potential (GWP) HFCs. R290 machines are often more energy-efficient and, despite higher initial manufacturing costs, position companies ahead of upcoming global environmental mandates.

What are the critical purchasing criteria for commercial ice machines in the healthcare sector?

Healthcare facilities prioritize hygiene, certification, and reliability. Critical criteria include NSF certification for food safety, integrated sanitation systems (UV or ozone), anti-microbial components, and the ability to produce flake or nugget ice, which is often preferred for patient consumption and clinical applications, ensuring maximum safety and uptime.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager