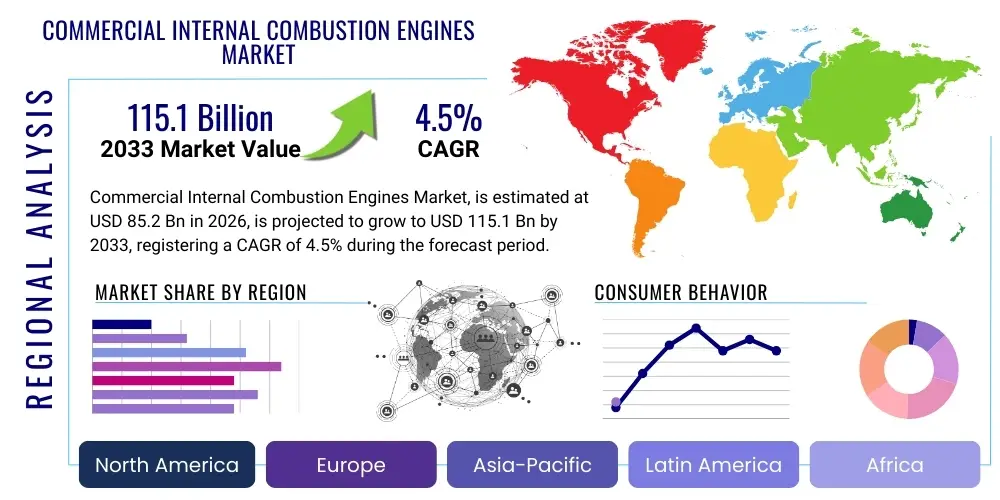

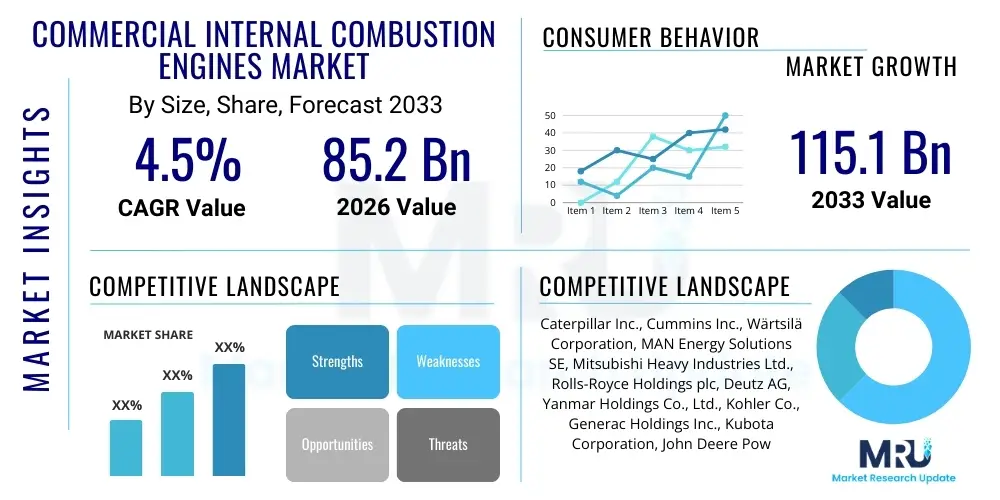

Commercial Internal Combustion Engines Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436564 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Commercial Internal Combustion Engines Market Size

The Commercial Internal Combustion Engines Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 85.2 Billion in 2026 and is projected to reach USD 115.1 Billion by the end of the forecast period in 2033.

Commercial Internal Combustion Engines Market introduction

The Commercial Internal Combustion Engines (ICE) Market encompasses the design, manufacturing, and distribution of robust engine systems utilized across various non-consumer sectors, including heavy-duty transportation, maritime shipping, power generation, and specialized industrial machinery. These engines, predominantly fueled by diesel, gasoline, and increasingly, natural gas or alternative fuels, function by converting chemical energy into mechanical work through controlled combustion within a confined cylinder. Major applications include powering large freight vehicles, construction equipment, agricultural machinery, and providing backup or primary power in remote or grid-isolated locations. The primary benefit of commercial ICEs lies in their high power density, proven reliability, and relatively low initial installation cost, particularly for heavy-load applications. Driving factors for market stability and moderate growth include ongoing infrastructural development globally, the necessity for robust off-highway equipment, and the steady demand for reliable power generation solutions in emerging economies, even as stricter emissions regulations compel manufacturers toward optimization and hybridization.

Commercial Internal Combustion Engines Market Executive Summary

The Commercial Internal Combustion Engines market is navigating a complex transition defined by rigorous environmental mandates and rapid technological shifts, yet sustaining strong demand in critical heavy-duty sectors. Business trends emphasize the strategic pivot toward engines compatible with lower-carbon fuels such as bio-diesel, hydrogen, and liquefied natural gas (LNG), alongside significant investments in advanced aftertreatment systems to comply with Tier 4 Final and Euro VI standards. Segment trends indicate robust growth in the medium to high horsepower categories, driven by expanding mining and construction activities in APAC and Latin America, while the power generation segment sees increased adoption of natural gas engines due to cost efficiency and reduced local emissions. Regionally, the Asia Pacific dominates the market, fueled by massive industrialization and infrastructure projects in China and India, although Europe and North America remain leaders in adopting premium, high-efficiency, and low-emission engine technologies, driven by proactive governmental policies focused on decarbonizing transportation and logistics supply chains.

AI Impact Analysis on Commercial Internal Combustion Engines Market

Analysis of common user queries regarding AI’s influence on the Commercial Internal Combustion Engines market reveals concentrated interest in three core areas: predictive maintenance capabilities, engine performance optimization, and the role of AI in accelerating the development of alternative fuel ICEs. Users frequently ask how AI-driven diagnostics can extend engine lifespan and reduce operational downtime in high-stress environments like mining or marine transport. Another significant concern centers on whether AI algorithms can dynamically adjust combustion parameters in real-time to meet stringent emission targets without compromising efficiency or power output. These queries underscore the expectation that AI is not merely an auxiliary tool but a transformative technology essential for keeping ICEs competitive against electric or fuel cell alternatives, particularly by solving complex trade-offs between efficiency, emissions, and reliability through sophisticated data analysis and machine learning models.

AI's integration into commercial ICE development is revolutionizing the traditionally mechanical discipline through the application of advanced algorithms for simulation and system optimization. Machine learning models are being utilized extensively during the design phase to predict material stress, analyze thermodynamic efficiencies under various load conditions, and optimize internal geometries such as piston heads and injector placement, dramatically reducing physical prototyping cycles. This allows manufacturers to bring cleaner, more powerful, and more durable engines to market faster, addressing the pressing need for improved fuel economy and reduced greenhouse gas emissions. Furthermore, AI facilitates the management of complex hybrid powertrain architectures, ensuring seamless transition between electric and combustion power sources to maximize energy recovery and efficiency in varied operational cycles.

Operationally, AI systems are moving beyond basic telematics to provide holistic engine health management. By analyzing massive streams of sensor data—including temperature fluctuations, vibration signatures, oil quality indicators, and combustion noise profiles—AI can detect subtle anomalies indicative of potential component failure long before conventional warning systems trigger an alert. This shift toward truly predictive maintenance enables operators to schedule necessary repairs precisely when required, minimizing catastrophic failures and significantly enhancing operational uptime, which is crucial for profitability in sectors like logistics and marine transport where downtime costs are exceptionally high. The insights derived from these AI platforms also feed back into engine control units (ECUs), allowing for real-time calibration adjustments to compensate for environmental variables (altitude, humidity) or fuel quality variations, further optimizing performance and compliance.

- AI-driven predictive maintenance reduces unplanned downtime by 20-30%.

- Machine Learning optimizes combustion parameters for real-time emissions compliance.

- AI accelerates new engine design and simulation, cutting R&D cycles.

- Enhanced fleet management using AI to monitor fuel consumption and operational efficiency across diverse assets.

- Development of complex controls for hybrid ICE architectures ensuring optimal power blending.

DRO & Impact Forces Of Commercial Internal Combustion Engines Market

The Commercial Internal Combustion Engines market is strongly influenced by stringent regulatory frameworks (Restraints), ongoing infrastructure investments (Drivers), technological innovation in low-carbon fuels (Opportunities), and the competitive pressure from electrification and hydrogen alternatives (Impact Forces). Global initiatives like IMO 2020 for marine applications and increasingly demanding on-road vehicle standards (e.g., Euro VII, US EPA Tier regulations) necessitate substantial R&D spending, acting as a restraint but simultaneously driving innovation. The primary driver remains the indispensable nature of high-torque, durable ICEs for heavy-duty applications where battery weight and recharging infrastructure pose significant logistical challenges. Opportunities are emerging in the integration of synthetic and bio-fuels, potentially extending the lifecycle of ICE platforms. The pervasive impact force is the aggressive push toward complete decarbonization in developed economies, forcing manufacturers to commit significant capital to engine hybridization and alternative fuel compatibility.

Drivers: Significant global infrastructure projects, particularly in developing nations, necessitate heavy-duty equipment such as excavators, bulldozers, and large trucks, all powered primarily by commercial ICEs. The sheer scale and power requirements of these applications often exceed the current viable capacity of electric or hydrogen powertrains, ensuring continued demand for diesel and natural gas engines. Furthermore, the established, globally accessible fuel infrastructure for diesel remains a critical factor, particularly for long-haul transportation and remote operations where reliable refueling points are essential. The reliability and robustness of ICEs in extreme environments, whether very cold climates or high-dust mining operations, continue to drive procurement decisions in these critical industrial sectors.

Restraints: The most significant restraint is the escalating global focus on decarbonization and air quality improvement, leading to ever-stricter emission regulations (NOx, PM, CO2). Compliance requires complex, expensive aftertreatment systems (SCR, DPF), increasing the manufacturing cost and operational complexity of the engines. Additionally, the increasing capital allocated by end-users and governments towards electric vehicles (EVs) and fuel cell electric vehicles (FCEVs) in medium and light commercial sectors poses a long-term threat to the market share of traditional ICEs. The volatile pricing and supply chain uncertainties related to key raw materials used in engine production and aftertreatment catalysts also contribute to market instability.

Opportunities: Major opportunities reside in the rapid development and commercialization of engines optimized for cleaner fuels, specifically natural gas (CNG/LNG), hydrogen, and various forms of sustainable bio-fuels. Manufacturers focusing on flexible fuel engines or dedicated hydrogen ICEs (which burn hydrogen but retain the mechanical structure of an ICE) can capture substantial market share as environmental pressures intensify. The integration of advanced turbocharging, thermal management systems, and mild hybridization (48V systems) offers opportunities to significantly improve fuel efficiency and transient response, keeping ICEs competitive. Emerging markets with rapidly expanding economies and less mature EV infrastructure represent continued strong demand opportunities.

Impact Forces: The most profound impact force is the technological disruption emanating from electrification. While full electrification remains challenging for heavy-duty applications, the gradual encroachment of battery technology into medium-duty trucks and port equipment is undeniable. Simultaneously, the impact of digitalization, enabling advanced telematics and predictive maintenance, fundamentally changes the service model. Geopolitical instability affecting oil and gas supplies directly influences fuel costs and strategic sourcing decisions for engine components, impacting manufacturing footprints and pricing structures globally. Public perception and policy decisions favoring zero-emission vehicles further intensify the pressure on ICE manufacturers to demonstrate clear pathways toward sustainability.

Segmentation Analysis

The Commercial Internal Combustion Engines market segmentation provides critical insights into the varying demands across different end-use sectors, fuel preferences, and required power outputs. The market is primarily divided based on Fuel Type, Application, and Power Output. Diesel engines historically dominate due to their superior torque and fuel economy in heavy-duty cycles, but natural gas and dual-fuel systems are gaining traction due to regulatory incentives and lower operational costs in specific geographies. The Application segmentation highlights the crucial role of ICEs in crucial industries such as marine and construction, which require bespoke engine designs optimized for continuous, high-load operation. Understanding these segment dynamics is essential for strategic planning, allowing manufacturers to allocate R&D resources effectively towards the most promising and regulation-compliant technologies.

- By Fuel Type:

- Diesel

- Gasoline

- Natural Gas (CNG, LNG)

- Alternative Fuels (Hydrogen, Bio-fuels, Methanol)

- By Application:

- Transportation (Heavy-duty Trucks, Buses, Rail)

- Marine (Propulsion, Auxiliary Power)

- Power Generation (Prime, Standby, Peaking Power)

- Industrial and Agricultural Equipment (Construction, Mining, Farming)

- By Power Output:

- Low Power Output (Below 100 kW)

- Medium Power Output (100 kW - 500 kW)

- High Power Output (Above 500 kW)

- By Engine Type:

- Spark Ignition (SI)

- Compression Ignition (CI)

Value Chain Analysis For Commercial Internal Combustion Engines Market

The value chain for commercial ICEs is intricate, beginning with specialized raw material extraction and component manufacturing (upstream) and culminating in complex distribution, installation, and long-term maintenance (downstream). Upstream activities involve sourcing high-grade materials like specialized alloys for blocks, heads, and sophisticated materials for turbochargers and fuel injection systems, often requiring high precision machining and stringent quality control. Midstream operations involve the core engine assembly, integration of proprietary control software (ECUs), and extensive testing to meet certification standards. Downstream encompasses global distribution channels, which rely heavily on direct manufacturer relationships for large fleet orders or an extensive network of authorized dealers and specialized system integrators for localized sales and critical after-sales support.

Upstream analysis reveals that component suppliers, specializing in areas like fuel systems (injectors, pumps), turbochargers, and aftertreatment systems (SCR catalysts, DPFs), hold significant leverage due to the technical complexity and high cost associated with these components, especially those required for Tier 4/Euro VI compliance. The shift towards electrification places additional demands on upstream suppliers for integrating sensors and control mechanisms compatible with hybrid architectures. Manufacturers often form long-term strategic alliances with these suppliers to secure proprietary technology and stabilize the quality of critical components, essential for the reliability demanded by commercial applications.

Downstream analysis highlights the critical role of distribution channels and after-sales service in market competitiveness. Direct distribution is common for large OEM contracts (e.g., selling engines directly to truck or ship builders). For aftermarket sales and localized industrial applications, a vast network of highly trained service dealers is indispensable. These dealers provide installation services, crucial parameter calibration, and ongoing maintenance, often leveraging advanced diagnostic tools and telematics data. The effectiveness of the service network directly impacts engine uptime and customer satisfaction, making it a pivotal competitive differentiator, particularly in remote geographical areas where reliance on prompt servicing is high.

The distribution channel mechanism is increasingly bifurcated: large engine sales (e.g., for maritime or power plant installations) rely on direct sales teams and specialized engineering consultancy, ensuring engines are tailored to site-specific requirements. Smaller, standardized commercial engines (e.g., used in farming tractors or smaller construction vehicles) are primarily moved through strong indirect dealer networks. The increasing prevalence of digital tools, including online parts ordering and remote diagnostic services, is streamlining the efficiency of both direct and indirect channels, providing quicker access to necessary parts and expertise.

Commercial Internal Combustion Engines Market Potential Customers

Potential customers for commercial internal combustion engines represent critical infrastructure and industrial sectors that demand continuous, high-power operation where alternatives are either unfeasible or prohibitively expensive. The primary end-users include major Original Equipment Manufacturers (OEMs) specializing in heavy-duty vehicles (such as Daimler Trucks, Volvo Group, and Navistar), global construction and mining equipment manufacturers (like Caterpillar, Komatsu, and John Deere), and specialized marine vessel builders (shipyards). Furthermore, utility companies and independent power producers constitute a significant buyer segment, relying on robust ICEs for standby power generation, peak shaving, and providing reliable electricity in off-grid locations. The purchasing decision is heavily influenced by total cost of ownership (TCO), fuel flexibility, durability, and compliance with the most current emission standards.

The transportation sector remains the largest consumer, driven by the logistics required for global commerce. Long-haul trucking demands engines with high thermal efficiency and longevity, justifying the premium cost associated with advanced diesel ICEs equipped with sophisticated emission controls. Similarly, the marine industry, despite increasing pressure to switch to LNG or potentially ammonia, still relies on high-horsepower medium-speed and low-speed diesel engines for the propulsion of large container ships and tankers, emphasizing operational reliability over many years of service. These customers often procure engines directly from major manufacturers like Cummins, Wärtsilä, or MAN Energy Solutions, often bundled with long-term maintenance and service contracts.

In the industrial segment, buyers are typically looking for customized solutions tailored to highly variable load factors and harsh operating conditions. Mining operators require extremely powerful and reliable engines that can function effectively at high altitudes and in dusty environments, making durability and ease of maintenance critical selection criteria. Agricultural machinery producers need engines that balance high torque output for tillage operations with improved fuel efficiency to reduce farm operating costs. For these buyers, the engine must integrate seamlessly with the machine's hydrostatic or mechanical drivetrain, requiring close collaboration between the engine manufacturer and the equipment OEM during the design phase to optimize performance and compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.2 Billion |

| Market Forecast in 2033 | USD 115.1 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Caterpillar Inc., Cummins Inc., Wärtsilä Corporation, MAN Energy Solutions SE, Mitsubishi Heavy Industries Ltd., Rolls-Royce Holdings plc, Deutz AG, Yanmar Holdings Co., Ltd., Kohler Co., Generac Holdings Inc., Kubota Corporation, John Deere Power Systems, Volvo Penta, IHI Corporation, FPT Industrial. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Internal Combustion Engines Market Key Technology Landscape

The technological landscape of the Commercial Internal Combustion Engines market is characterized by intensive development aimed at enhancing efficiency, reducing emissions, and ensuring compatibility with emerging fuel sources, maintaining relevance against zero-emission alternatives. Key technological advancements center around sophisticated fuel injection systems, such as common rail diesel injection, which allows for precise control over combustion timing and pressure, crucial for optimizing efficiency and reducing particulate matter. Exhaust aftertreatment remains a central technological focus, involving complex integration of Selective Catalytic Reduction (SCR) systems for NOx reduction and Diesel Particulate Filters (DPFs) to capture soot, driven heavily by regulatory compliance requirements across all major regions.

Further innovation is concentrated on engine architecture optimization, particularly through downsizing and turbocharging techniques. Downsizing allows manufacturers to achieve the required power output from smaller, lighter engines, improving fuel economy and packaging space, which is critical in confined industrial applications. Variable geometry turbochargers (VGTs) are widely employed to ensure optimal air supply across a wide range of engine speeds and loads, crucial for dynamic commercial operations. Moreover, the integration of advanced sensors and Engine Control Units (ECUs) facilitates real-time monitoring and adaptive calibration. These smart systems utilize complex algorithms to adjust operational parameters, compensating for environmental variations or component wear, thereby maximizing the time between service intervals and ensuring regulatory compliance under varied operating conditions.

The most transformative technology trend currently influencing the market is the shift toward alternative fuel readiness and hybridization. Manufacturers are investing heavily in dual-fuel engine technology, allowing engines to run on a primary fuel (like diesel) supplemented by a cleaner secondary fuel (like LNG or hydrogen), providing operational flexibility and reduced carbon footprint. Mild hybridization, incorporating 48V electrical systems, is gaining traction, especially in commercial vehicles, utilizing electric motors to assist during high-load periods and enabling start-stop functionality. This hybridization improves transient response and reduces idling fuel consumption. Looking ahead, dedicated hydrogen combustion engines are being explored as a bridge technology, offering zero tank-to-wheel carbon emissions while leveraging the existing ICE manufacturing expertise and robust mechanical structure.

Regional Highlights

Regional dynamics significantly influence the Commercial Internal Combustion Engines market, primarily driven by differing regulatory speeds, infrastructure investment cycles, and local fuel availability.

Asia Pacific (APAC)

APAC stands as the largest and fastest-growing market globally, characterized by expansive industrialization and massive infrastructure investment, particularly in China and India. The demand for medium- and high-horsepower engines for construction, mining, and power generation remains exceptionally strong. While key economies in the region are adopting stricter emission standards (e.g., China’s National VI), the sheer volume of new equipment purchasing overshadows the restrictive impacts. Local manufacturers are rapidly scaling up production capabilities, often through joint ventures, to meet this overwhelming demand, focusing on reliability and competitive pricing. The marine sector in countries like South Korea and Japan also sustains high demand for large, efficient propulsion engines.

North America

The North American market is highly mature and technology-intensive, driven primarily by stringent EPA and CARB regulations. This region leads in the adoption of sophisticated aftertreatment systems (SCR/DPF) and advanced telematics. Demand is robust in heavy-duty trucking (Class 8 vehicles) and the oil and gas sector, which relies on high-reliability stationary engines. Manufacturers here prioritize Total Cost of Ownership (TCO) and fuel efficiency. There is a rapidly increasing acceptance of natural gas engines, particularly LNG, for fleet operations due to localized price advantages and emission benefits.

Europe

Europe is at the forefront of the technological transition towards zero-emission transport, acting as a global benchmark for environmental regulation, such as Euro VI and the upcoming Euro VII standards. This stringent regulatory environment forces rapid innovation towards alternative fuels, including LNG, hydrogen, and hybridization. While the overall volume growth is slower than APAC, the market value is sustained by the high cost of compliant, high-technology engines. Key demand segments include construction equipment and specialized marine vessels, where efficiency and low noise operation are highly valued.

Latin America (LATAM)

LATAM presents a mixed market, driven primarily by mining operations, agricultural expansion in countries like Brazil and Argentina, and fluctuating economic conditions. Engine demand is generally focused on reliability and durability over cutting-edge emission controls, although standards are gradually tightening. Infrastructure development remains a critical driver, sustaining demand for medium and heavy-duty vehicles and off-highway equipment.

Middle East and Africa (MEA)

The MEA market is heavily influenced by the oil and gas industry, which uses commercial ICEs for drilling, pumping, and remote power generation. Demand is also strong for standby power solutions due to grid instability in many regions of Africa. The adoption of advanced emission technologies is slower than in developed regions, focusing primarily on robust, easy-to-maintain diesel engines. Investment in major construction projects in the GCC states (e.g., Saudi Arabia, UAE) is a short-term demand booster.

- Asia Pacific: Market leader and growth engine, driven by massive construction and industrial scale-up, demanding high-volume production.

- North America: Focuses on technological compliance (EPA standards), TCO, and increasing adoption of natural gas in logistics and energy sectors.

- Europe: Regulatory innovation hub, driving development in hybridization, bio-fuels, and ultra-low emission engine technologies.

- Latin America: Sustained demand from commodity sectors (mining, agriculture), prioritizing durability and operational simplicity.

- Middle East and Africa (MEA): Critical market for stationary and remote power generation, heavily reliant on diesel engines for reliability.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Internal Combustion Engines Market.- Caterpillar Inc.

- Cummins Inc.

- Wärtsilä Corporation

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- Rolls-Royce Holdings plc

- Deutz AG

- Yanmar Holdings Co., Ltd.

- Kohler Co.

- Generac Holdings Inc.

- Kubota Corporation

- John Deere Power Systems

- Volvo Penta

- IHI Corporation

- FPT Industrial

- Isuzu Motors Ltd.

- JCB Limited

- Weichai Power Co., Ltd.

- Power Solutions International (PSI)

- Hyundai Heavy Industries Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Commercial Internal Combustion Engines market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for commercial ICEs despite electrification trends?

The indispensable demand for high power density and extended range in heavy-duty applications such as marine propulsion, mining equipment, and long-haul transport necessitates the continued use of commercial ICEs. Current battery technology limitations concerning weight, volume, and extended operational cycles make ICEs the only viable option for maximum load scenarios.

How are commercial ICE manufacturers adapting to strict global emission regulations like Tier 4 Final and Euro VII?

Manufacturers are investing heavily in advanced exhaust aftertreatment systems, including Selective Catalytic Reduction (SCR) and Diesel Particulate Filters (DPF), coupled with high-precision fuel injection (common rail) and advanced electronic controls. Furthermore, platforms are being developed for alternative fuels such as hydrogen, LNG, and bio-diesel to achieve long-term compliance.

Which fuel type is experiencing the fastest growth in the commercial ICE sector?

Natural gas (both CNG and LNG) is experiencing rapid growth, particularly in the power generation and road transport segments, due to its cleaner combustion profile, competitive pricing in regions with abundant gas supply, and government incentives supporting its use as a transitional fuel.

What role does hybridization play in the future of commercial internal combustion engines?

Hybridization, particularly mild hybrid systems (48V), extends the viability of ICEs by improving fuel efficiency through regenerative braking, enabling engine stop/start functionality, and providing torque assistance during high-demand acceleration. This technology mitigates some of the performance gaps perceived when comparing ICEs to fully electric systems.

Which geographical region dominates the commercial internal combustion engines market in terms of volume?

The Asia Pacific (APAC) region, led by China and India, dominates the market volume due to massive ongoing infrastructure projects, rapid industrialization, and strong demand across the construction, agricultural, and general transportation sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager