Commercial Kitchen Electrical Equipment & Appliances Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432691 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Kitchen Electrical Equipment & Appliances Market Size

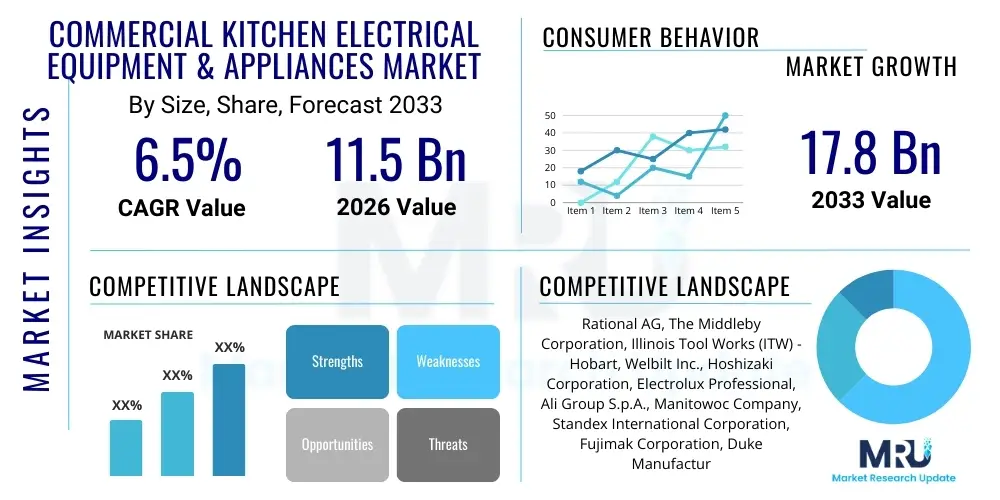

The Commercial Kitchen Electrical Equipment & Appliances Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 11.5 Billion in 2026 and is projected to reach USD 17.8 Billion by the end of the forecast period in 2033.

Commercial Kitchen Electrical Equipment & Appliances Market introduction

The Commercial Kitchen Electrical Equipment & Appliances Market encompasses a diverse range of robust, high-performance machinery essential for professional food service operations, including restaurants, hotels, catering services, and institutional kitchens. These appliances are specifically designed for continuous, heavy-duty use, contrasting sharply with residential counterparts, focusing on speed, efficiency, and adherence to strict hygiene and safety standards. Key products range from sophisticated combi ovens and high-capacity refrigeration units to advanced warewashing systems and specialized food preparation machinery. The demand is intrinsically linked to the global expansion of the hospitality and quick-service restaurant (QSR) sectors, driven by evolving consumer dining habits and increased urbanization. Furthermore, sustainability and energy efficiency are increasingly mandated design criteria, pushing manufacturers towards developing innovative technologies that reduce operational costs and environmental impact, thereby redefining the lifecycle value of commercial kitchen assets.

The operational landscape of commercial kitchens demands equipment that maximizes throughput while minimizing labor dependence, a critical factor given the persistent challenges in global food service staffing. Products such as smart fryers with automatic lift capabilities, self-cleaning ovens, and integrated connectivity for predictive maintenance exemplify the industry's shift toward automation and digitalization. Major applications span high-volume cooking (baking, grilling, frying), rapid chilling and freezing (blast chillers, walk-in coolers), and stringent cleaning protocols (commercial dishwashers, sanitizers). The primary benefit derived from these appliances is enhanced consistency in food quality, reduced preparation time, improved inventory management through connected systems, and strict compliance with food safety regulations.

Driving factors for sustained market growth include the rising popularity of global cuisine requiring specialized cooking methods, the stringent regulatory environment necessitating precise temperature control and sanitation standards, and the persistent technological advancements focused on energy conservation and operational intelligence. The urbanization trend, particularly in emerging economies, fuels rapid growth in the number of commercial food establishments, necessitating significant capital investment in durable and efficient electrical infrastructure. Moreover, the increasing adoption of cloud kitchen models and ghost restaurants, which rely almost exclusively on high-efficiency, space-saving commercial appliances, presents a substantial and accelerating demand vector for smart, specialized electrical equipment.

Commercial Kitchen Electrical Equipment & Appliances Market Executive Summary

The Commercial Kitchen Electrical Equipment & Appliances Market is undergoing a rapid transformation driven by three core forces: technology integration, sustainability mandates, and shifting business models like cloud kitchens. Business trends highlight a strong industry focus on Internet of Things (IoT) integration, enabling predictive maintenance, remote diagnostics, and recipe standardization across multiple outlets, thereby optimizing operational continuity and reducing unplanned downtime. Manufacturers are heavily investing in research and development to introduce smart appliances that feature advanced controls, artificial intelligence (AI) driven cooking cycles, and enhanced energy recovery systems to address escalating utility costs and regulatory pressures. The competitive landscape is characterized by strategic mergers and acquisitions aimed at achieving vertical integration and expanding geographical footprint, particularly in high-growth areas of Asia Pacific and Latin America, where rapid infrastructure development is accelerating market penetration.

Regional trends indicate North America and Europe retaining mature market leadership due to established food service chains and early adoption of highly automated, energy-efficient equipment, largely driven by strict environmental, social, and governance (ESG) reporting requirements and high labor costs. Conversely, the Asia Pacific region is poised for the highest growth trajectory, fueled by demographic shifts, increasing disposable incomes, and the massive expansion of organized retail food service and international hotel chains across China, India, and Southeast Asia. This region exhibits a growing demand for compact, multi-functional appliances suitable for smaller, high-density urban environments. Latin America and the Middle East & Africa (MEA) are emerging markets, showing robust growth primarily in the QSR and hospitality segments, emphasizing durability and affordability alongside basic energy efficiency features.

Segmentation trends reveal that the Cooking Equipment segment, particularly advanced combi ovens and induction cooking technologies, maintains the largest market share due to their versatility and labor-saving benefits. However, the Refrigeration segment, especially blast chilling and flash freezing equipment, is experiencing accelerating demand due to enhanced focus on food preservation, reduction of waste, and adherence to strict cold chain management protocols enforced by global safety authorities. Furthermore, the Quick Service Restaurant (QSR) end-user segment is dominating consumption, necessitated by the need for high-speed, standardized production processes essential for maintaining brand consistency and meeting rapid service demands. The shift toward electrification, away from gas appliances in certain regulatory jurisdictions, is also a significant underlying segmental driver, impacting procurement decisions across all equipment categories.

AI Impact Analysis on Commercial Kitchen Electrical Equipment & Appliances Market

Common user inquiries concerning AI’s influence on the Commercial Kitchen Electrical Equipment & Appliances Market center heavily on issues of labor replacement, efficiency gains, and initial implementation costs. Users frequently ask how AI can automate complex cooking tasks, standardize quality across chain locations, and move beyond simple connectivity (IoT) into true operational intelligence. Key concerns revolve around the reliability of AI algorithms in dynamic kitchen environments, data privacy for proprietary recipes and usage patterns, and the necessary specialized training required for kitchen staff to manage sophisticated AI-enabled equipment. Furthermore, there is significant interest in AI's role in optimizing energy consumption and predicting equipment failure far in advance, transforming equipment maintenance from reactive to predictive, thereby significantly enhancing uptime and reducing overall operational expenses.

The integration of Artificial Intelligence (AI) algorithms is fundamentally shifting the utility and functionality of commercial kitchen equipment, moving it from mere mechanical tools to intelligent operational assets. AI facilitates dynamic demand forecasting by analyzing point-of-sale data, local weather patterns, and historical trends to optimize cooking schedules and inventory levels, minimizing food waste—a major cost factor in the industry. For electrical appliances, this means AI can modulate power consumption in real-time based on predicted loads, leading to substantial energy savings and extended component lifespan. The development of AI-driven robotic arms and automated food prep stations is also progressing, addressing the persistent challenge of labor shortages and high staff turnover by automating repetitive and dangerous tasks while maintaining impeccable hygiene standards.

Specific AI applications include advanced sensor data analysis in combi ovens to automatically adjust humidity and temperature for perfect results regardless of ingredient variations; machine learning models applied to refrigeration compressors to anticipate maintenance needs based on vibration and acoustic signatures; and intelligent ordering systems that directly integrate with supplier logistics. These advancements position AI not just as an added feature but as a core component of next-generation kitchen infrastructure, demanding greater processing power and enhanced data handling capabilities within the electrical appliances themselves. Consequently, the purchasing criteria for commercial operators are rapidly evolving to prioritize integrated intelligence over standalone physical capabilities, emphasizing long-term operational cost reduction achieved through AI optimization.

- AI optimizes energy consumption by dynamically adjusting power draw based on real-time operational load and external factors.

- Predictive maintenance driven by machine learning algorithms significantly reduces downtime and component failure rates.

- Recipe standardization is achieved through AI-controlled cooking cycles, ensuring consistent food quality across multi-site operations.

- Automated inventory management and waste reduction are enhanced by AI forecasting models integrating equipment usage data.

- AI-enabled robotics handle high-precision, repetitive preparation and plating tasks, addressing labor scarcity.

DRO & Impact Forces Of Commercial Kitchen Electrical Equipment & Appliances Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively shaped by powerful Impact Forces stemming from technological advancement and regulatory mandates. The core driver is the escalating global demand for convenience food and out-of-home dining experiences, which continuously fuels the expansion of the food service sector across all formats, including institutional catering, full-service dining, and QSRs. Simultaneously, technological innovation, particularly in IoT and smart connectivity, offers a compelling value proposition by maximizing operational efficiency and reducing reliance on skilled labor, making the high upfront cost of premium equipment justifiable through long-term savings. Regulatory pressures, especially those enforcing high standards for food safety (e.g., HACCP compliance requiring precise temperature logging) and energy efficiency (e.g., Energy Star certification), further mandate the replacement of older, less compliant equipment with modern electrical solutions, thereby sustaining market momentum.

However, significant Restraints challenge market growth, most notably the high initial capital investment required for state-of-the-art commercial electrical appliances, which can deter smaller businesses or independent operators, particularly in price-sensitive developing markets. Furthermore, the complexity associated with integrating diverse systems from multiple vendors into a unified smart kitchen environment presents technical hurdles and necessitates specialized installation and maintenance expertise, adding to the total cost of ownership (TCO). Trade protectionism and fluctuating raw material costs, particularly steel and electronic components, introduce volatility in production costs and final pricing, which can impact procurement cycles and budgetary planning for food service operators, slowing down the pace of equipment upgrades.

Opportunities for exponential growth are concentrated in the areas of smart kitchen infrastructure and specialized solutions for niche markets. The transition toward cloud kitchens and ghost restaurants represents a massive opportunity for manufacturers to supply highly specialized, space-efficient, and fully automated appliance suites. Furthermore, the increasing focus on sustainability and net-zero goals is generating substantial demand for high-efficiency heat recovery systems and induction cooking technologies, presenting a clear competitive edge for companies leading in green technology development. The primary Impact Forces shaping the future are technological disruption (IoT, AI, automation), shifting consumer preferences (demand for customized and ethically sourced food), and governmental regulation (energy standards and food safety laws), all of which compel operators to invest in advanced, reliable electrical equipment to remain competitive and compliant. This pressure ensures that innovation in areas like modular design and self-diagnostic capabilities remains a critical factor for market success.

Segmentation Analysis

The Commercial Kitchen Electrical Equipment & Appliances Market is systematically segmented based on Product Type, End-User, and Distribution Channel, allowing for granular analysis of demand drivers and regional consumption patterns. Product classification captures the functional diversity of the equipment, ranging from high-heat cooking systems to precise cold storage solutions, reflecting the complex operational needs of modern commercial kitchens. The End-User segmentation provides insight into where the highest volume and value demand originates, differentiating between standardized, high-throughput environments like QSRs and sophisticated, custom-requirement settings like luxury hotels. Analyzing distribution channels, encompassing both traditional offline dealers and rapidly expanding online marketplaces, helps understand the preferred procurement methods and the impact of digital commerce on market access and pricing transparency across various geographies.

The Product Type segment is dominated by Cooking Equipment, which includes power-intensive appliances such as combi ovens, induction ranges, and large-capacity fryers, reflecting the core function of any food service operation. However, the Refrigeration segment, comprising walk-in coolers, freezers, and specialized blast chillers, is gaining prominence due to the escalating need for stringent food safety compliance and waste minimization strategies globally. The End-User segmentation reveals that the Restaurant and QSR categories combined account for the largest share, characterized by high equipment turnover and a constant need for durable, standardized units capable of sustained operation under intense pressure. Institutional settings, such as schools and hospitals, represent a stable, but often budget-constrained, segment focusing heavily on durability, compliance, and energy efficiency over technological bells and whistles, unlike the premium hotel segment which prioritizes advanced features and aesthetic integration.

Geographically, while mature markets like North America focus on replacement cycles and technology upgrades, the most dynamic growth is occurring in the Asia Pacific region, driven by the sheer scale of new restaurant openings and the increasing penetration of organized retail and international chains. Understanding these segmental dynamics is crucial for manufacturers to tailor their product offerings, whether focusing on high-efficiency, premium models for Western markets or robust, cost-effective solutions for rapidly developing economies. The overarching trend points towards integrated, modular systems that offer flexibility and scalability, enabling businesses to adapt quickly to changing menu trends and operational footprints without major infrastructure overhauls.

- Product Type:

- Cooking Equipment (Combi Ovens, Induction Ranges, Fryers, Grills)

- Refrigeration Equipment (Walk-in Coolers, Freezers, Blast Chillers)

- Warewashing Equipment (Commercial Dishwashers, Glasswashers, Sinks)

- Preparation Equipment (Mixers, Slicers, Food Processors)

- Beverage Equipment (Commercial Coffee Machines, Juicers, Dispensers)

- End-User:

- Full-Service Restaurants (FSRs)

- Quick-Service Restaurants (QSRs)

- Hotels and Hospitality

- Institutional (Schools, Hospitals, Corporate Cafeterias)

- Catering and Others (Cloud Kitchens)

- Distribution Channel:

- Offline (Direct Sales, Dealers, Distributors)

- Online (E-commerce Platforms, Company Websites)

Value Chain Analysis For Commercial Kitchen Electrical Equipment & Appliances Market

The value chain for Commercial Kitchen Electrical Equipment & Appliances begins with upstream activities involving the sourcing of highly specialized raw materials, including high-grade stainless steel, advanced insulation materials, complex electronic components, and specialized heating elements. Key activities in this stage include material procurement, design and engineering, and the manufacturing of sub-components. Manufacturers rely heavily on a specialized network of suppliers who can guarantee consistency, adherence to food-grade standards, and robust supply chain resilience. The trend toward smart appliances necessitates close collaboration with technology providers for sensors, IoT modules, and software platforms, increasing the complexity and value addition at the upstream level. Efficiency in this stage directly dictates the quality, durability, and eventual energy efficiency ratings of the final product, making strategic supplier partnerships critical for maintaining competitive advantage.

The midstream involves the core manufacturing process, encompassing assembly, quality control, rigorous performance testing, and system integration (especially for connected equipment). This stage is capital-intensive and requires skilled labor and specialized machinery. Downstream activities focus on reaching the end-user through various distribution channels. The distribution network is bifurcated into direct sales, often utilized for large, bespoke installations like new hotel projects, and indirect channels relying on certified dealers, distributors, and kitchen design consultants. These intermediaries play a vital role in providing local installation, after-sales service, and essential preventative maintenance contracts, which are crucial for ensuring the long operational lifespan of commercial equipment. The effectiveness of the downstream network, particularly in terms of service responsiveness, significantly influences customer satisfaction and repeat business.

Direct sales channels offer manufacturers greater control over pricing and customer relationship management, often targeting large institutional buyers or national QSR chains requiring standardized, high-volume orders and customized solutions. Conversely, the indirect channel, consisting of authorized regional dealers and specialized kitchen outfitters, provides market penetration into smaller and independent restaurant segments, offering crucial local expertise regarding installation logistics and maintenance protocols specific to regional regulations. Furthermore, the emerging prominence of online marketplaces facilitates the procurement of smaller, replacement parts and standardized countertop appliances, introducing greater price transparency but also increasing competition. Successful market penetration hinges on optimizing both channels, ensuring seamless integration between manufacturing intelligence (upstream) and customer service (downstream), ultimately driving the perceived value and reliability of the electrical equipment over its long service tenure.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 11.5 Billion |

| Market Forecast in 2033 | USD 17.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Rational AG, The Middleby Corporation, Illinois Tool Works (ITW) - Hobart, Welbilt Inc., Hoshizaki Corporation, Electrolux Professional, Ali Group S.p.A., Manitowoc Company, Standex International Corporation, Fujimak Corporation, Duke Manufacturing, Alto-Shaam Inc., Unox S.p.A., MKN GmbH & Co. KG, Moffat Group, Lincat Group, Hatco Corporation, Blodgett Oven Company, Rapi-Kool, Vulcan Equipment. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Kitchen Electrical Equipment & Appliances Market Potential Customers

The primary customers for commercial kitchen electrical equipment are any entities operating professional-grade food service facilities that require reliable, high-volume output and adherence to strict health and safety codes. This extensive customer base spans the entire spectrum of the global hospitality industry. Quick-Service Restaurants (QSRs) and major national/international chains represent a crucial segment due to their standardization requirements, high volume of transactions, and need for equipment capable of extreme duty cycles and predictable performance across thousands of locations. These customers prioritize equipment with built-in diagnostic capabilities and strong service networks, favoring large, established manufacturers who can manage global deployment and long-term service contracts. Their purchasing decisions are heavily influenced by Total Cost of Ownership (TCO) assessments, emphasizing energy efficiency and rapid return on investment (ROI).

Another major customer group includes Full-Service Restaurants (FSRs) and the vast network of independent culinary establishments. While FSRs might require more specialized, aesthetically pleasing equipment, their core need remains high reliability and performance precision, especially in fine dining environments where consistency is paramount. Institutional buyers—such as government facilities, military bases, large corporate cafeterias, schools, and healthcare systems—form a stable, budget-conscious segment. These institutions demand robust, durable equipment that adheres strictly to governmental purchasing protocols and maximizes ease of cleaning and sanitation. Their purchasing cycle often involves extensive tendering processes, emphasizing low maintenance, simple operation, and regulatory compliance.

The emerging category of cloud kitchens (ghost kitchens) and commissary operations is rapidly becoming a high-growth customer segment. These facilities operate without a dining room and focus exclusively on delivery and high-efficiency production in constrained spaces. They are ideal buyers for compact, modular, and highly automated electrical equipment, such as powerful induction units, high-speed blast chillers, and connected ovens, optimizing space utilization and minimizing manual handling. For manufacturers, understanding the specific workflow and space constraints of cloud kitchens is critical to developing specialized product lines that cater to this explosive demand area, necessitating equipment designed for maximum output density and seamless integration with digital order management systems.

Commercial Kitchen Electrical Equipment & Appliances Market Key Technology Landscape

The technological landscape of commercial kitchen electrical equipment is centered on digital integration, thermal efficiency, and modularity, fundamentally driven by the need to combat labor costs and meet increasingly stringent environmental regulations. The core technology shift involves the widespread implementation of IoT (Internet of Things), where appliances are equipped with sophisticated sensors and Wi-Fi capabilities to communicate real-time operational data, temperature logs, and diagnostic alerts to cloud platforms. This connectivity enables remote monitoring, automated software updates, and predictive maintenance schedules, moving the industry away from traditional break-fix models. Smart control panels, often featuring touchscreens and guided cooking interfaces, allow even minimally trained staff to execute complex recipes with consistent precision, relying on embedded digital intelligence rather than specialized culinary skill. These technologies reduce the variance in food quality and dramatically enhance operational responsiveness.

Energy technology innovations are paramount, focusing on maximizing thermal transfer efficiency and incorporating advanced heat recovery systems. Induction cooking remains a leading technology, offering superior speed, precision, and efficiency compared to traditional electric resistance or gas options, while also improving the ambient working environment by generating less residual heat. Furthermore, advances in refrigeration technology, including variable speed compressors (VSC) and high-efficiency natural refrigerants (like CO2 or hydrocarbons), are essential for meeting F-gas regulations and reducing electricity consumption, making these appliances more sustainable and appealing to environmentally conscious operators. Manufacturers are also integrating rapid cooling technologies, such as advanced blast chilling, which use optimized airflow and electrical chilling components to quickly and safely lower food temperatures, a critical element for HACCP compliance and extending shelf life.

A significant trend is the development of multi-functional and modular equipment designed to save space and capital investment. Combi ovens, which combine the functions of convection, steam, and grilling, represent a highly valued technological convergence, minimizing the footprint required for diverse cooking operations. The emphasis is also increasingly on robust materials science, utilizing self-cleaning, non-stick, and highly durable surfaces that simplify maintenance and guarantee long-term hygienic operation under extreme conditions. Overall, the market is characterized by a push toward integrated systems where preparation, cooking, chilling, and washing appliances communicate and coordinate processes autonomously, optimizing the entire food preparation workflow through intelligent electrical equipment design.

Regional Highlights

- North America: This region maintains a mature and dominant market share, characterized by high adoption rates of automated and highly connected 'smart kitchen' technologies, driven by high labor costs and stringent food safety regulations, particularly in the United States and Canada. Demand is strong for high-efficiency combi ovens and IoT-enabled refrigeration units, with a focus on equipment replacement and technological upgrades in established QSR and hotel chains. The market is also seeing increasing investment in specialized equipment catering to the rapid expansion of virtual kitchens and food delivery services.

- Europe: Europe is a highly regulated market, with growth primarily steered by EU mandates concerning energy efficiency (Ecodesign Directive) and the phase-out of traditional refrigerants (F-gas Regulation). This regulatory environment necessitates continuous equipment replacement cycles, favoring manufacturers that lead in induction technology and natural refrigerant-based chilling solutions. Germany, the UK, and France are key markets, showing robust demand in the institutional catering and fine-dining sectors, prioritizing precision, reliability, and low environmental impact.

- Asia Pacific (APAC): APAC is projected to exhibit the fastest Compound Annual Growth Rate (CAGR) globally, primarily fueled by massive infrastructure development, rising disposable incomes, and the rapid penetration of international food service brands across China, India, and Southeast Asia. The market here is volume-driven, demanding durable, cost-effective equipment suitable for high-density, small-format restaurants and QSRs. Key trends include the surging demand for entry-level professional equipment and substantial investment in refrigeration technology to support developing cold chains.

- Latin America (LATAM): This region is an emerging market characterized by steady growth, mainly concentrated in urban centers within Brazil and Mexico. Market expansion is closely tied to the growth of organized retail and international tourism. Customers prioritize equipment reliability and robust construction, often balancing cost considerations with the need for efficiency. Local manufacturing is expanding, focusing on standardized equipment suitable for regional QSR operations.

- Middle East and Africa (MEA): Growth in the MEA region is heavily influenced by large-scale hospitality and tourism projects, particularly in the UAE and Saudi Arabia, driving demand for premium, high-capacity electrical equipment used in five-star hotels and major catering facilities. The African market is primarily characterized by lower price points and a focus on essential, durable equipment, with growing opportunities in South Africa and Nigeria due to increased urbanization and development of the formal food service sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Kitchen Electrical Equipment & Appliances Market.- Rational AG

- The Middleby Corporation

- Illinois Tool Works (ITW) - Hobart

- Welbilt Inc.

- Hoshizaki Corporation

- Electrolux Professional

- Ali Group S.p.A.

- Manitowoc Company

- Standex International Corporation

- Fujimak Corporation

- Duke Manufacturing

- Alto-Shaam Inc.

- Unox S.p.A.

- MKN GmbH & Co. KG

- Moffat Group

- Lincat Group

- Hatco Corporation

- Blodgett Oven Company

- Rapi-Kool

- Vulcan Equipment

Frequently Asked Questions

Analyze common user questions about the Commercial Kitchen Electrical Equipment & Appliances market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the demand for smart and IoT-enabled commercial kitchen equipment?

The primary drivers are the high cost and scarcity of skilled labor, which necessitate automation and process standardization. IoT integration enables predictive maintenance, remote diagnostics, real-time energy monitoring, and automated adherence to food safety protocols (HACCP), delivering substantial operational cost savings and improved consistency for multi-site food service chains.

Which product segment holds the largest market share in commercial kitchen appliances?

The Cooking Equipment segment, specifically advanced combi ovens and induction units, currently holds the largest market share due to their high utility, versatility in cooking methods, and their critical role in optimizing kitchen workflow and throughput. However, the Refrigeration segment is growing rapidly due to stricter cold chain management regulations.

How do global sustainability initiatives impact the commercial equipment market?

Sustainability mandates, such as the EU's F-gas regulations and global pushes for net-zero carbon operations, significantly impact procurement by demanding high-efficiency appliances. This accelerates the adoption of induction cooking, high-efficiency refrigeration utilizing natural refrigerants, and appliances featuring advanced heat recovery systems to minimize utility consumption and environmental footprint.

Which geographical region is expected to show the fastest growth rate?

The Asia Pacific (APAC) region is forecasted to exhibit the highest CAGR due to rapid urbanization, massive expansion of the food service and hospitality industries, increasing disposable incomes, and the widespread establishment of international QSR and hotel chains across countries like China and India.

What are the main financial restraints impacting the adoption of new commercial kitchen technology?

The chief restraint is the substantial initial capital investment required for purchasing modern, highly automated, and energy-efficient electrical equipment. While offering long-term ROI, this high upfront cost often poses a significant barrier to entry or upgrade for smaller, independent restaurant operators and businesses with limited capital expenditure budgets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager