Commercial Kitchen Ventilation Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435208 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Commercial Kitchen Ventilation Systems Market Size

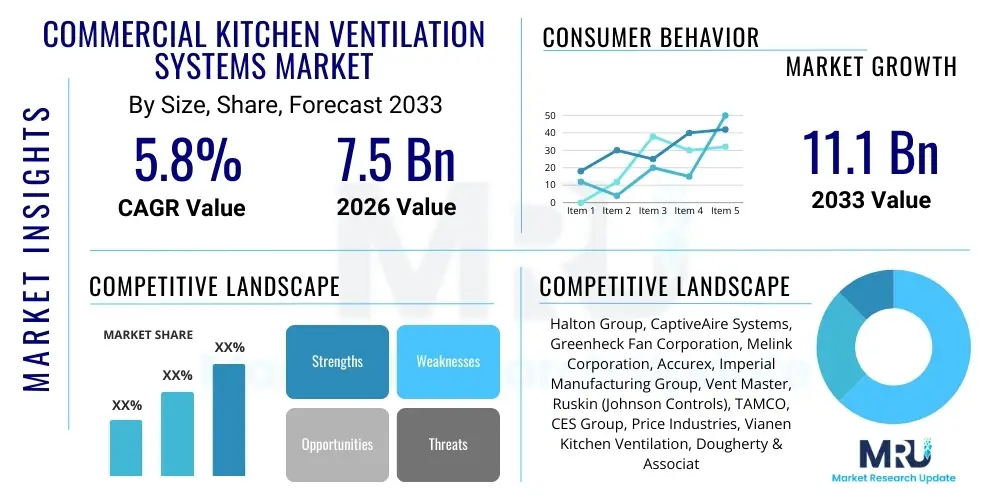

The Commercial Kitchen Ventilation Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $7.5 Billion in 2026 and is projected to reach $11.1 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by stringent regulatory frameworks concerning indoor air quality and fire safety, coupled with the rapid global proliferation of the hospitality and food service sectors.

Commercial Kitchen Ventilation Systems Market introduction

Commercial Kitchen Ventilation Systems encompass a specialized array of equipment designed to manage air quality, remove grease, smoke, heat, and odors generated during cooking processes in professional food establishments. These systems typically include exhaust hoods (canopy, wall-mounted, island), makeup air units (MAUs), exhaust fans, grease filtration technologies (baffle filters, electrostatic precipitators), and integrated control panels. The core function of these systems is not merely compliance with health codes but also maintaining a comfortable and safe working environment for kitchen staff, drastically reducing fire hazards inherent to high-volume cooking operations, and minimizing environmental impact through efficient pollutant capture.

The primary applications of these sophisticated ventilation solutions span across various end-use segments, including full-service restaurants, quick-service restaurants (QSRs), institutional kitchens (hospitals, schools), hotels, and large-scale catering facilities. Modern systems are increasingly integrating advanced features such as demand control ventilation (DCV), which optimizes fan speeds and airflow rates based on real-time cooking load detection using temperature and smoke sensors, leading to significant energy savings. The inherent benefits include improved energy efficiency, enhanced fire protection, strict adherence to local and international health standards, and overall improvement in kitchen operational flow and productivity, making them indispensable components of contemporary commercial kitchens.

Key driving factors accelerating market adoption include the burgeoning growth of the organized food service industry in developing economies, particularly in Asia Pacific, stringent government mandates regarding commercial building safety standards, and the growing focus on sustainability and energy conservation among restaurateurs. Furthermore, the rising awareness about the detrimental health effects of poor indoor air quality (IAQ) and airborne grease particulate matter has pushed facility managers towards investing in high-performance, intelligent ventilation solutions. The replacement cycle of aging infrastructure in established markets like North America and Europe also contributes significantly to sustained market demand for technologically superior, replacement ventilation units.

Commercial Kitchen Ventilation Systems Market Executive Summary

The Commercial Kitchen Ventilation Systems market exhibits robust growth characterized by a significant shift towards smart, energy-efficient solutions and comprehensive integration within building management systems (BMS). Business trends emphasize consolidation among major manufacturers aiming to offer end-to-end solutions, encompassing design, installation, and maintenance services. The market is witnessing accelerated investment in Demand Control Ventilation (DCV) technology, which reduces operational expenditure by modulating airflow based on necessity, directly addressing the pressure on operators to control rising utility costs. Furthermore, the adoption of advanced filtration technologies, such as UV-C light purification systems and highly efficient electrostatic precipitators (ESPs), is gaining traction, particularly in urban centers facing strict emission regulations regarding particulate matter and odor containment.

Regional dynamics indicate that North America and Europe maintain high market maturity, driven primarily by replacement demand and strict adherence to established safety codes like NFPA 96. These regions are pioneers in adopting sophisticated DCV and IAQ monitoring systems. Conversely, the Asia Pacific region is forecast to experience the highest growth rate, fueled by rapid urbanization, significant infrastructure development, and the explosive expansion of the international and domestic QSR chains and hotel industries, necessitating high-volume equipment installation. Latin America and the Middle East & Africa are emerging as pivotal growth frontiers, buoyed by tourism development and increasing foreign direct investment in the hospitality sector, although regulatory enforcement remains varied across these territories.

Segmentation analysis highlights that canopy hoods dominate the product landscape due to their versatility and suitability for standard cooking line arrangements. However, specialized capture hoods designed for specific equipment (e.g., wok stations or dishwashers) are seeing increasing adoption for targeted ventilation. In terms of end-use, full-service restaurants remain the largest segment, yet the QSR segment is projected to show the fastest growth rate, reflecting global dietary shifts and convenience-based food consumption patterns. Technology segmentation confirms the decisive market shift towards integrated, sensor-based controls and automated cleaning systems, maximizing efficiency and minimizing human intervention in maintenance tasks.

AI Impact Analysis on Commercial Kitchen Ventilation Systems Market

User queries regarding AI's influence typically revolve around predictive maintenance, optimal energy consumption scheduling, and enhanced fire risk mitigation within complex kitchen environments. The primary themes consumers and industry professionals are exploring include the feasibility of using AI to dynamically adjust airflow parameters based on predictive modeling of cooking cycles rather than just real-time sensing; integrating visual recognition AI for early anomaly detection (e.g., unusual smoke patterns or filter blockages); and leveraging machine learning algorithms to fine-tune energy management across multiple connected kitchen branches. Concerns often center on the initial investment cost, data security, and the necessity of specialized technical expertise required to manage and service AI-driven ventilation infrastructure, particularly within smaller restaurant operations that lack robust IT support.

The integration of Artificial Intelligence and Machine Learning (ML) is fundamentally transforming commercial kitchen ventilation by moving systems beyond simple automation into predictive and self-optimizing operational modes. AI algorithms analyze historical performance data, real-time sensor inputs (temperature, humidity, pressure, volatile organic compounds, smoke), and external variables (time of day, menu demands) to precisely anticipate ventilation needs. This predictive capability allows the system to preemptively adjust makeup air volumes and exhaust rates before cooking loads change, eliminating energy waste associated with delayed response times inherent in traditional reactive Demand Control Ventilation (DCV) systems. Furthermore, AI enhances equipment longevity by optimizing operational cycles, alerting facility managers to potential mechanical failures or imminent filter saturation through sophisticated pattern recognition, transitioning maintenance from reactive repairs to predictive interventions.

The long-term expectation is that AI will centralize ventilation management, seamlessly integrating with other kitchen appliances and building utilities (HVAC, fire suppression). For fire safety, AI-powered systems can distinguish between normal cooking smoke and dangerous fire conditions with greater accuracy than standard thermal sensors, minimizing false alarms while accelerating crucial response procedures. This not only improves operational efficiency but also offers superior compliance documentation by generating detailed, AI-validated reports on air quality compliance and energy consumption, satisfying increasingly strict regulatory audits and demonstrating commitment to environmental stewardship through minimized carbon footprints.

- AI optimizes Demand Control Ventilation (DCV) by predictive modeling of cooking loads.

- Machine Learning enhances energy efficiency by analyzing temporal and procedural data patterns.

- Predictive maintenance schedules are generated based on anomaly detection in motor performance and airflow integrity.

- AI-driven visual monitoring systems improve early detection of abnormal smoke or grease accumulation, minimizing fire risk.

- Centralized, multi-site management platforms leverage AI for standardized operational control and energy benchmarking across enterprise kitchens.

DRO & Impact Forces Of Commercial Kitchen Ventilation Systems Market

The Commercial Kitchen Ventilation Systems market is significantly impacted by stringent global regulations mandating fire safety and indoor air quality standards (Drivers), countered by high initial installation and maintenance costs (Restraints). Opportunities lie predominantly in the development and adoption of energy-efficient, smart ventilation systems utilizing DCV and advanced filtration technologies, especially in high-growth hospitality sectors. The key impact forces driving market development include mandatory compliance with safety codes (NFPA 96, ASHRAE standards), environmental pressure to reduce carbon emissions, and technological advancements focusing on reducing kitchen operational expenses through optimized utility usage. These forces collectively shape the investment decisions of large food service operators and institutional purchasers.

The primary drivers are rooted in regulatory enforcement. Governments and municipal authorities globally are intensifying inspections and compliance requirements for commercial kitchens to prevent catastrophic grease fires and ensure the health of kitchen personnel. This regulatory push forces continuous upgrades and mandatory adoption of certified components, such as fire-rated ductwork, automatic fire suppression interfaces, and high-efficiency grease extraction filters. Furthermore, the persistent growth in the number of global food service establishments, fueled by demographic shifts towards dining out and increased delivery services, provides a continually expanding base for new system installations, especially in rapidly developing Asian economies and the Middle East where infrastructure build-out is accelerating rapidly.

Conversely, significant restraints hinder market penetration, most notably the high capital expenditure required for sophisticated, energy-efficient ventilation systems, which can be prohibitive for independent or small-scale restaurant operators. Operational restraints include the ongoing cost and complexity of cleaning specialized components like electrostatic precipitators and UV systems, which require trained personnel and consistent maintenance schedules to perform effectively. Opportunities emerge through innovation in material science leading to cheaper, more durable filters and the refinement of IoT-enabled systems that simplify remote diagnostics and maintenance scheduling, making advanced systems more accessible and cost-effective over their lifecycle, particularly for multi-unit operators seeking standardized efficiency across their portfolio.

Segmentation Analysis

The Commercial Kitchen Ventilation Systems Market is categorized across product type, technology, application, and end-use, providing a granular view of market dynamics and adoption trends. Product segmentation is crucial, differentiating between passive and active extraction units designed for various cooking line arrangements and volumes. Technology segmentation highlights the competitive landscape driven by smart integration and energy conservation features. Application and end-use segments define the primary consumer bases, ranging from massive institutional kitchens requiring heavy-duty, customized solutions to small QSRs demanding standardized, high-volume units focused on quick installation and high reliability. The market’s complexity necessitates manufacturers offering tailored systems that comply with specific local codes while maximizing operational efficiency relevant to the specific cooking style employed (e.g., charbroiling versus induction cooking).

The segmentation based on technology clearly shows the bifurcation of the market into traditional systems and advanced systems. Traditional systems, relying heavily on constant volume airflow, are increasingly being phased out in new construction due to energy inefficiency. The advanced segment, dominated by Demand Control Ventilation (DCV), is experiencing aggressive growth. DCV systems use sensors (heat, smoke, vapor) to dynamically adjust fan speeds, reducing overall energy consumption by 30-50% compared to constant volume systems. This energy-saving potential makes DCV a crucial investment for sustainability-focused corporations and large chains seeking to minimize utility expenses.

Further analysis of the end-use segment confirms the dominance of the full-service restaurant category due to their requirement for large, robust ventilation infrastructure to handle diverse and continuous cooking loads. However, institutional catering and hotel kitchens represent lucrative, stable demand sectors due to mandatory compliance and long replacement cycles. The growth trajectory of the QSR and fast-casual segments demands highly efficient, compact, and quick-to-install systems, driving innovation in miniaturized components and pre-engineered modules, creating distinct purchasing criteria compared to large, custom-built, full-service restaurant systems.

- By Product Type:

- Exhaust Hoods (Canopy Hoods, Wall-Mounted Hoods, Island Hoods, Specialized/Capture Hoods)

- Exhaust Fans

- Makeup Air Units (MAUs)

- Ductwork and Accessories

- Filtration Systems (Baffle Filters, Electrostatic Precipitators (ESPs), UV-C Systems)

- By Technology:

- Constant Volume Systems

- Variable Volume Systems (Demand Control Ventilation - DCV)

- By End-Use:

- Full-Service Restaurants

- Quick Service Restaurants (QSR) and Fast Casual

- Hotels and Lodging

- Institutional Kitchens (Hospitals, Schools, Corporate Cafeterias)

- Catering and Others

Value Chain Analysis For Commercial Kitchen Ventilation Systems Market

The value chain for commercial kitchen ventilation systems begins with raw material suppliers, predominantly focusing on metals (stainless steel, aluminum for hoods and ducting), fan components (motors, blades), and electronic sensor components required for DCV. Upstream activities involve intensive research and development, particularly for proprietary filtration media, energy-efficient motor design, and the integration of sophisticated control algorithms (including IoT and AI capabilities). Manufacturers then engage in precision engineering and assembly, often customizing designs based on specific kitchen layouts and anticipated cooking output, creating a high barrier to entry due to the technical complexity and safety certification requirements associated with these products.

The midstream stage is dominated by distribution, heavily relying on specialized HVAC contractors, mechanical engineering consultants, and commercial kitchen equipment distributors. Due to the inherent complexity and regulatory requirements of installation (requiring specific sizing, balancing, and compliance testing), direct sales are less common for complete systems; instead, channel partners manage project consultation, sales, and complex installation logistics. These contractors act as key intermediaries, often specifying the brand and model based on architectural plans and local building codes. This relationship between manufacturers and certified installers is critical for market access and quality control, ensuring systems are commissioned correctly and meet stringent performance criteria.

Downstream activities center on end-user deployment, ongoing maintenance, and aftermarket services. The profitability of the value chain is significantly bolstered by replacement parts (filters, fan belts, motor repairs) and comprehensive service contracts, particularly for advanced systems like ESPs and DCV controls which require specialized cleaning and calibration. Direct interaction with the end-user usually occurs post-installation through service contracts, where manufacturers or certified third-party service providers ensure regulatory compliance and optimal operational performance. The efficiency and reliability of these downstream services significantly influence customer satisfaction and future brand loyalty in a sector where downtime translates directly into operational loss for the restaurant.

Commercial Kitchen Ventilation Systems Market Potential Customers

The primary customers for commercial kitchen ventilation systems are any entity involved in high-volume or commercial food preparation, encompassing a broad spectrum of the hospitality, institutional, and corporate sectors. Full-service restaurants and national or international restaurant chains represent the most critical segment, demanding high-performance, durable, and aesthetically integrated systems that can handle diverse, continuous cooking environments. These operators prioritize energy efficiency and regulatory compliance to protect their investment and maintain uninterrupted operations, often requiring systems designed to handle specific high-heat or grease-intensive cooking methods such as charbroiling.

A rapidly expanding customer base includes Quick Service Restaurants (QSRs) and fast-casual dining concepts. While their kitchen spaces might be smaller, their high throughput and standardized menus necessitate reliable, compact, and often modular ventilation solutions that can be rapidly deployed across multiple locations. They focus heavily on low operational noise, minimal maintenance requirements, and strict odor control, which is increasingly mandated in dense urban locations. Furthermore, institutional buyers—including large hospitals, universities, military facilities, and corporate headquarters—constitute a stable customer segment. These buyers focus on resilience, longevity, ease of maintenance, and adherence to strict internal health and safety protocols, often purchasing systems via large, long-term procurement contracts.

The indirect customers, influencing purchasing decisions, are the mechanical engineers and commercial kitchen consultants who design the infrastructure. Their specifications heavily guide which manufacturers and products are ultimately selected by the end-users. As ventilation systems become increasingly integrated with smart building technology, property developers and facility management companies also become crucial potential customers, seeking systems that offer seamless integration with sophisticated Building Management Systems (BMS) for centralized monitoring and optimized energy performance across large, multi-use commercial properties.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $7.5 Billion |

| Market Forecast in 2033 | $11.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Halton Group, CaptiveAire Systems, Greenheck Fan Corporation, Melink Corporation, Accurex, Imperial Manufacturing Group, Vent Master, Ruskin (Johnson Controls), TAMCO, CES Group, Price Industries, Vianen Kitchen Ventilation, Dougherty & Associates, Unity Manufacturing, FläktGroup, Systemair, Fantech, Broan-NuTone, Prihoda, S&P Soler & Palau. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Kitchen Ventilation Systems Market Key Technology Landscape

The current technology landscape in commercial kitchen ventilation is defined by a rapid convergence of mechanical engineering excellence and digital innovation, prioritizing energy savings and enhanced safety features. Demand Control Ventilation (DCV) stands as the most critical technological advancement, utilizing highly sophisticated sensor arrays (optical smoke detectors, temperature probes, and volatile organic compound analyzers) to precisely measure cooking effluents. This data is fed to microprocessors that modulate the speed of the exhaust and makeup air fans, ensuring optimal capture and containment while minimizing unnecessary air movement and significant heating/cooling costs associated with conditioning excessive makeup air. This shift from constant volume systems is mandatory for future sustainability and regulatory compliance globally.

Filtration technology is undergoing a major revolution, moving beyond traditional baffle filters, which only trap large grease particles. Modern systems incorporate high-efficiency electrostatic precipitators (ESPs) and advanced UV-C light purification systems. ESPs utilize ionization to charge microscopic grease and smoke particles, collecting them on charged plates, drastically reducing grease accumulation in ductwork and minimizing fire risk. UV-C systems utilize shortwave ultraviolet light positioned within the hood plenum to break down grease vapors and odor-causing organic compounds chemically, effectively turning them into harmless byproducts. The adoption of these dual filtration methods significantly extends the time between required duct cleaning and reduces environmental emissions.

The pervasive influence of the Internet of Things (IoT) is establishing smart ventilation as the industry standard. New systems are equipped with embedded connectivity that allows for remote monitoring, diagnostic capabilities, and integration into larger Building Management Systems (BMS). IoT-enabled hoods can transmit real-time performance data regarding fan speeds, energy consumption, and filter status to cloud platforms, allowing facility managers to monitor fleet performance across multiple locations and schedule predictive maintenance. This connectivity ensures maximum uptime, regulatory compliance tracking, and detailed performance metrics necessary for large-scale energy efficiency audits and reporting.

Regional Highlights

- North America: This region holds a significant market share, characterized by high technological maturity and extremely rigorous safety and air quality regulations, most notably NFPA 96 standards. Market growth is primarily driven by the replacement of outdated systems with high-efficiency DCV and advanced filtration units in established QSR chains and institutional settings. The U.S. and Canada are key adopters of IoT-enabled ventilation and sophisticated energy management solutions, viewing these investments as necessary for long-term operational cost reduction and superior risk management. The trend toward open-kitchen designs also drives demand for sophisticated odor and noise control solutions.

- Europe: The European market is mature and highly regulated, with a strong emphasis on sustainability, energy recovery, and compliance with EU directives regarding air emissions and energy performance of buildings (EPBD). Countries such as Germany, the UK, and France are leaders in the adoption of heat recovery ventilation (HRV) systems integrated into commercial kitchens, recovering heat from exhaust air to pre-heat makeup air or domestic hot water. The focus on reducing utility bills through DCV implementation is widespread, supported by government incentives and strong sustainability mandates across the food service sector.

- Asia Pacific (APAC): APAC represents the fastest-growing market globally, fueled by rapid urbanization, significant infrastructure investment in hospitality (hotels, convention centers), and the massive expansion of organized food service chains, particularly in China, India, and Southeast Asian nations. While regulatory enforcement varies, the sheer volume of new construction projects drives massive demand for base ventilation components and standardized solutions. The growing focus on IAQ and fire safety, driven by international brands setting high operational standards, is accelerating the shift toward more advanced filtration and smart control systems.

- Latin America (LATAM): This region is an emerging market, driven by increased tourism and economic stability leading to growth in the restaurant and hotel sectors, particularly in Brazil and Mexico. The market is price-sensitive, with adoption often centered around basic compliance requirements. However, increasing standardization of safety codes and growing influence of international hospitality groups are beginning to drive interest in efficient, durable ventilation products that meet global operational standards, gradually moving away from rudimentary systems.

- Middle East and Africa (MEA): Growth in the MEA region is strongly tied to large-scale infrastructure projects, luxury hospitality development (especially in the UAE, Saudi Arabia, and Qatar), and high energy costs. The extreme climatic conditions necessitate highly robust makeup air units capable of managing high heat and humidity loads efficiently. Regulatory requirements are becoming more strict, particularly concerning fire suppression and air quality in dense urban centers, creating strong demand for specialized, high-capacity, and energy-optimized ventilation systems in premium establishments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Kitchen Ventilation Systems Market.- Halton Group

- CaptiveAire Systems

- Greenheck Fan Corporation

- Melink Corporation

- Accurex (Greenheck Group)

- Imperial Manufacturing Group

- Vent Master

- Ruskin (Johnson Controls)

- TAMCO

- CES Group

- Price Industries

- Vianen Kitchen Ventilation

- Dougherty & Associates

- Unity Manufacturing

- FläktGroup

- Systemair

- Fantech

- Broan-NuTone

- Prihoda

- S&P Soler & Palau

Frequently Asked Questions

Analyze common user questions about the Commercial Kitchen Ventilation Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Demand Control Ventilation (DCV) and why is it essential for commercial kitchens?

DCV is an advanced ventilation technology that dynamically adjusts the exhaust and makeup air volume based on the actual cooking load detected by sensors. It is essential because it significantly reduces energy consumption by avoiding continuous, high-volume fan operation, leading to typical energy savings of 30-50% in heating, cooling, and fan power, ensuring compliance with modern energy efficiency standards.

How do stringent regulatory standards, like NFPA 96, influence market demand?

Stringent standards, such as NFPA 96 (Standard for Ventilation Control and Fire Protection of Commercial Cooking Operations), act as major market drivers by mandating regular maintenance, cleaning, and the use of certified fire-rated components and automatic fire suppression interfaces. This continuous regulatory oversight ensures persistent demand for compliant replacement parts, system upgrades, and professional service contracts, boosting the aftermarket segment.

What are the primary differences between electrostatic precipitators (ESPs) and UV-C filtration systems?

ESPs work by electrically charging grease particles and collecting them on charged plates, primarily removing particulate matter. UV-C systems, conversely, use shortwave ultraviolet light to break down organic grease molecules and odor compounds chemically. While ESPs are highly efficient particle collectors, UV-C is superior for odor mitigation and reducing grease buildup within the ductwork.

Which geographical region exhibits the fastest growth potential for commercial kitchen ventilation systems?

The Asia Pacific (APAC) region currently exhibits the highest growth potential, driven by rapid urbanization, massive investment in the hotel and food service industries, and the large-scale expansion of both international and domestic restaurant chains across rapidly developing economies like China, India, and Southeast Asia.

How does the integration of IoT technology benefit restaurant operators?

IoT integration benefits operators by enabling real-time remote monitoring of system performance, energy usage, and filter status across multiple locations. This connectivity supports predictive maintenance scheduling, minimizes system downtime, ensures operational compliance, and provides data necessary for optimizing utility consumption, leading to centralized, efficient facility management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager