Commercial Medical Protection Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434353 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Commercial Medical Protection Insurance Market Size

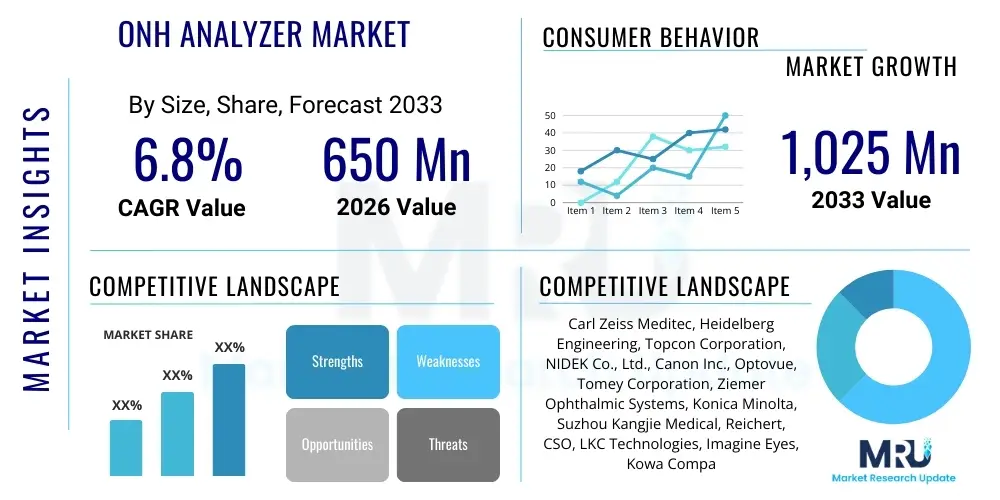

The Commercial Medical Protection Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 77.5 Billion by the end of the forecast period in 2033. This robust expansion is fueled by increasing corporate awareness regarding employee welfare, escalating healthcare costs globally, and mandatory regulatory requirements in various jurisdictions compelling employers to provide comprehensive health coverage, especially in volatile economic environments where medical liabilities pose a significant risk to organizational stability and workforce retention.

Commercial Medical Protection Insurance Market introduction

The Commercial Medical Protection Insurance Market encompasses specialized insurance products designed to mitigate financial risks associated with medical emergencies, routine healthcare, and long-term illness for employees of commercial entities. This insurance category, distinct from individual health plans, is crucial for businesses seeking to offer competitive benefits packages, thereby improving morale, productivity, and reducing turnover rates. Key products include fully insured plans, self-funded arrangements with stop-loss coverage, and integrated wellness programs, all tailored to the scale and industry risk profile of the purchasing organization, ranging from small and medium enterprises (SMEs) to large multinational corporations.

Major applications of Commercial Medical Protection Insurance extend across various industries, including manufacturing, technology, financial services, and retail, serving as a fundamental component of employee compensation. The market is primarily driven by macro-economic factors such as aging populations, rising incidence of chronic diseases, and technological advancements in medical treatments which, while beneficial, substantially increase the cost of care. Furthermore, governmental policies mandating employer-sponsored health insurance in developed and rapidly developing economies create a stable baseline demand for these complex financial products.

The primary benefits for businesses include tax advantages associated with offering benefits, enhanced risk transfer capabilities against catastrophic employee medical claims, and compliance with labor laws. Driving factors include the persistent escalation of healthcare inflation, competitive pressure among employers to attract top talent by offering superior benefit packages, and the continuous evolution of insurance technology (InsurTech) which facilitates personalized plan design, efficient claims processing, and sophisticated risk assessment models, thereby optimizing costs for both the insurer and the insured commercial entity.

Commercial Medical Protection Insurance Market Executive Summary

The Commercial Medical Protection Insurance market is currently characterized by significant business trends focusing on digitalization, personalization of coverage, and the integration of preventative care components. Insurers are increasingly leveraging data analytics to refine underwriting processes, moving away from generalized risk pools towards highly individualized corporate plans based on employee demographics and historical claims data. Regionally, North America continues to dominate due to established regulatory frameworks and high healthcare expenditure, while the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by expanding middle classes, rapid urbanization, and mandatory government initiatives in countries like China and India encouraging corporate health benefits adoption. Segmentation trends show a pronounced shift towards self-funded (ASO – Administrative Services Only) models among large corporations seeking greater cost control, balanced by the strong uptake of comprehensive, fully insured plans by SMEs requiring predictable premiums and complete risk assumption by the carrier.

Regulatory shifts, particularly those related to transparency in pricing and minimum coverage standards, are influencing product design globally, necessitating flexible yet compliant insurance offerings. Key market players are engaging in strategic mergers and acquisitions (M&A) to expand geographical reach and technological capabilities, focusing intensely on reducing administrative costs through automation. The integration of telemedicine and virtual care services into standard commercial policies is emerging as a critical competitive differentiator, addressing access barriers and potentially mitigating overall utilization costs, thereby offering improved value proposition to corporate clients navigating post-pandemic healthcare consumption patterns.

In essence, the market outlook is overwhelmingly positive, underpinned by inelastic demand derived from regulatory mandates and the fundamental corporate requirement for risk management. Future growth will be highly dependent on the ability of insurers to innovate coverage structures, manage the volatility associated with inflation in medical services, and successfully deploy AI-driven tools for efficient policy management and predictive modeling. The emphasis remains on sustainable premium growth linked directly to demonstrable improvements in employee health outcomes, achieved through value-based insurance design and strategic partnerships with healthcare providers.

AI Impact Analysis on Commercial Medical Protection Insurance Market

Common user questions regarding AI's impact on commercial medical insurance frequently revolve around several critical areas: the potential for AI to reduce premiums through efficient claims processing, the ethics of using predictive analytics for underwriting and pricing, and how AI-driven tools can personalize policy recommendations for diverse employee populations. Users are keenly interested in whether AI integration will lead to faster authorization of complex medical procedures and reduce the necessity for extensive manual documentation. A major concern is the transparency and bias inherent in algorithms determining risk assessment for specific employee groups or medical conditions, ensuring fair and non-discriminatory access to comprehensive corporate coverage. Users also seek clarity on the role of AI in fraud detection and its subsequent effect on genuine claimants.

The core themes indicate a high expectation that AI will revolutionize operational efficiency, specifically in the claims lifecycle, potentially lowering the Expense Ratio (ER) for insurers and passing some savings to corporate clients. However, there is simultaneous apprehension about data privacy, security breaches associated with large-scale data aggregation for predictive modeling, and the 'black box' nature of complex machine learning models used in high-stakes financial assessments. The demand is for AI tools that are auditable, transparent, and seamlessly integrate into existing Human Resources Information Systems (HRIS) used by commercial clients to manage benefits enrollment and administration, ensuring smooth digital transformation without disrupting essential business continuity.

Ultimately, expectations center on AI moving commercial medical protection insurance from a reactive service—processing claims after an event—to a proactive health management partnership. This involves AI-powered tools identifying high-risk employees early and prompting preventative interventions, potentially stabilizing or reducing long-term healthcare expenditure for the employer. The successful deployment of AI will redefine competitive advantage, favoring carriers that can effectively balance innovation in risk assessment with robust ethical governance and data protection frameworks, thereby building trust with corporate clients who are managing the sensitive health data of their employees.

- Enhanced personalized risk assessment and precise underwriting through machine learning analysis of aggregated health data and corporate claim history.

- Automation of the claims submission, verification, and payment processes using Natural Language Processing (NLP) and robotic process automation (RPA), leading to significantly faster cycle times.

- Improved fraud detection capabilities utilizing anomaly detection algorithms to flag suspicious activity in medical billing patterns, reducing leakage for insurers.

- Development of predictive models forecasting employee health trends, allowing employers to implement targeted wellness and preventative health programs, thus optimizing health outcomes and controlling long-term costs.

- Deployment of AI-powered chatbots and virtual assistants for 24/7 customer service and complex policy inquiries, improving employee experience and reducing administrative load on HR departments.

- Optimization of provider networks by analyzing utilization data, cost-effectiveness, and quality outcomes, ensuring corporate plans offer the best value for money.

- Creation of dynamic pricing models that adjust premiums based on real-time organizational health data and proactive risk mitigation efforts undertaken by the company.

DRO & Impact Forces Of Commercial Medical Protection Insurance Market

The market dynamics of Commercial Medical Protection Insurance are shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming the Impact Forces. Key drivers include the relentless global increase in medical treatment costs, which heightens the financial necessity for risk pooling through insurance, coupled with regulatory pressure in many major economies mandating comprehensive employer health coverage. Conversely, significant restraints involve the complexity and high cost of administering self-funded plans for smaller businesses, the volatility of regulatory environments which require frequent policy adaptations, and the persistent challenge of healthcare provider consolidation leading to reduced negotiation power for insurers, thereby driving up overall healthcare spending that insurers must cover.

Opportunities for growth are concentrated in the untapped SME sector in emerging markets, where formalized benefits are becoming standard, and in technological integration, specifically the use of advanced InsurTech for behavioral economics and personalized health incentives. The demand for integrated mental health and wellness benefits, accelerated by global events, also presents a substantial opportunity for product diversification and premium growth within the commercial segment. The convergence of these factors means that innovation in cost containment strategies—such as reference-based pricing and direct-to-employer primary care contracts—will determine the long-term profitability and competitiveness of market participants.

Impact forces are currently dominated by macroeconomic uncertainty, healthcare inflation, and the shift towards value-based care models. Inflationary pressures directly translate to higher premiums, potentially dampening demand from cost-sensitive businesses. The transition to value-based care, however, forces insurers to innovate benefit design, emphasizing preventative and chronic disease management, which aligns corporate goals of workforce productivity with the insurer’s goal of claims reduction. Regulatory stability or instability in major regions acts as a primary exogenous impact force, dictating compliance burdens and minimum benefit levels that insurers must adhere to, fundamentally shaping the operational structure of the entire commercial protection sector.

Segmentation Analysis

The Commercial Medical Protection Insurance market is broadly segmented based on Type, Coverage, Enterprise Size, and Distribution Channel, reflecting the diverse needs of the global corporate landscape. Segmentation by Type distinguishes between fully insured plans, where the carrier assumes all claims risk in exchange for a fixed premium, and self-funded plans (ASO), where the employer retains the risk but outsources administration and often purchases stop-loss coverage for catastrophic claims. Segmentation by Enterprise Size is critical, as the risk profile, financial capacity, and regulatory requirements differ significantly between Large Enterprises (LEs), which often prefer self-funding, and Small and Medium Enterprises (SMEs), which overwhelmingly rely on fully insured group policies for simplicity and risk transfer.

Coverage segmentation involves specialized plans such as Preferred Provider Organizations (PPOs), Health Maintenance Organizations (HMOs), Exclusive Provider Organizations (EPOs), and Point of Service (POS) plans, offering varying degrees of network flexibility and cost structures. The growing need for global mobility coverage also drives demand for specialized international medical protection plans. Distribution Channel segmentation highlights the reliance on direct sales channels for large, complex corporate accounts requiring bespoke plans, alongside the increasingly dominant role of brokers, agents, and now, online aggregator platforms, particularly for standardized SME offerings, necessitating strong relationships across the intermediary network to maintain market share.

- By Type:

- Fully Insured Plans

- Self-Funded/Administrative Services Only (ASO) Plans

- Stop-Loss Insurance (Specific and Aggregate)

- By Coverage Model:

- Preferred Provider Organization (PPO)

- Health Maintenance Organization (HMO)

- Exclusive Provider Organization (EPO)

- Point of Service (POS) Plans

- High Deductible Health Plans (HDHPs) with Savings Accounts (HSA/HRA)

- By Enterprise Size:

- Small and Medium Enterprises (SMEs) (1-500 employees)

- Large Enterprises (LEs) (500+ employees)

- By Distribution Channel:

- Insurance Brokers and Agents

- Direct Sales

- Bancassurance

- Online Channels and Aggregators

- By End-Use Industry:

- IT and Telecommunications

- Manufacturing

- Financial Services

- Retail and E-commerce

- Healthcare and Pharmaceuticals

- Other Service Industries

Value Chain Analysis For Commercial Medical Protection Insurance Market

The value chain for Commercial Medical Protection Insurance begins with upstream activities focused on risk modeling and product development. This stage involves deep data analysis, actuarial science, and regulatory compliance review to determine appropriate pricing and coverage limits. Key upstream stakeholders include reinsurers, who mitigate catastrophic risk for primary carriers, and sophisticated data analytics providers, who supply the models necessary for competitive underwriting. The quality of upstream risk data and actuarial expertise directly influences the insurer's ability to offer sustainable and competitive premiums to the commercial market, requiring significant investment in technology and human capital specializing in healthcare economics.

Midstream activities constitute the core functions of the primary insurer, encompassing sales, distribution, policy administration, and claims management. Distribution channels, both direct and indirect (brokers/agents), play a pivotal role in matching complex corporate needs with appropriate insurance products. Direct channels are vital for large, customized contracts, while the brokerage network is essential for accessing the fragmented SME market. Claims processing and utilization review are central to this stage, where efficiency and fairness directly affect customer satisfaction and the insurer's operational cost structure, relying heavily on integrated IT platforms.

Downstream activities involve the interaction with the end-users (the corporate client and the covered employee) and the relationship with healthcare providers. Effective provider network management—contracting, quality control, and payment processing—is crucial for cost containment and employee satisfaction. The shift towards digital engagement, including telemedicine services and online policy management portals, forms a significant downstream activity aimed at enhancing the overall policyholder experience, thereby influencing corporate renewal rates. The flow of funds moves from the employer (premium/fees) through the insurer (claims payment) to the healthcare provider (service delivery), concluding the economic cycle of medical protection.

Commercial Medical Protection Insurance Market Potential Customers

The primary customers and end-users of Commercial Medical Protection Insurance are commercial enterprises across all sectors and sizes, driven by the necessity to comply with labor laws and to compete effectively for skilled labor. Large multinational corporations represent a critical segment, often seeking sophisticated self-funded arrangements and global coverage solutions to manage hundreds or thousands of employees across diverse jurisdictions. These customers demand highly customized plan designs, robust reporting capabilities on utilization and costs, and integrated wellness management services tailored to their specific workforce demographics and health risks.

Small and Medium Enterprises (SMEs) constitute another vast and increasingly important customer segment. While they typically opt for standardized, fully insured group plans due to limited internal HR and financial resources, their collective demand volume is immense, especially in high-growth service sectors. Regulatory incentives or requirements often push SMEs into the formal insurance market. Furthermore, specialized entities such as non-profit organizations, educational institutions, and governmental contractors also form key customer bases, often requiring specific regulatory compliance mechanisms integrated into their medical protection plans, focusing heavily on budgetary predictability and comprehensive, affordable coverage options for their specialized workforce.

Ultimately, the market caters to any entity employing a workforce that requires comprehensive medical benefits as part of their employment contract or statutory obligation. The decision-makers within these organizations are typically HR directors, CFOs, and benefits administrators, whose purchasing decisions are influenced by premium affordability, network quality, ease of administration, and the perceived value proposition for employee retention and organizational health management, making the insurer's reputation and service quality paramount in securing long-term corporate contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 77.5 Billion |

| Growth Rate | CAGR 7.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | UnitedHealth Group, Anthem (Elevance Health), Cigna, Aetna (CVS Health), Humana, Allianz SE, AXA, Munich Re, Zurich Insurance Group, MetLife, Prudential Financial, Kaiser Permanente, Nippon Life Insurance, Ping An Insurance, Generali Group, Bupa, Blue Cross Blue Shield (various affiliates), Swiss Re, Chubb Limited, Assurant Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Medical Protection Insurance Market Key Technology Landscape

The technology landscape underpinning the Commercial Medical Protection Insurance market is rapidly evolving, driven by the need for efficiency, personalization, and enhanced risk management. Central to this evolution is the widespread adoption of cloud computing platforms, which provide the scalability and flexibility required to manage massive volumes of sensitive employee health data and dynamic policy changes inherent in corporate accounts. This shift allows insurers to consolidate legacy systems, streamline administrative processes, and significantly improve data accessibility for both internal actuarial teams and external corporate clients needing claims utilization reports, ensuring real-time operational transparency which is highly valued in commercial negotiations.

Further technological advancements are concentrated in InsurTech applications, particularly in predictive analytics and machine learning (ML). These tools are crucial for refining underwriting accuracy, moving beyond traditional demographic pooling to granular risk assessment based on corporate wellness participation rates, geographical health risks, and historical claim patterns of the specific employee population. Telemedicine integration is also a critical component, with policies increasingly incorporating virtual primary care and specialist consultations, which serve as a technological mechanism for cost containment by steering employees towards lower-cost, high-convenience care settings, directly benefiting the employer through reduced overall medical expenditures.

Blockchain technology, while still nascent, holds promise for improving the security and immutability of medical records and claims data, potentially transforming the complex and often fraud-prone processes between employers, employees, providers, and insurers. Moreover, sophisticated Application Programming Interfaces (APIs) are becoming standard, enabling seamless integration between insurer platforms and the Human Resources Information Systems (HRIS) used by corporate clients (e.g., Workday, SAP SuccessFactors), automating enrollment, eligibility checks, and billing reconciliation. This technological integration is a mandatory requirement for carriers targeting large, technologically advanced commercial clients, emphasizing interoperability as a core capability.

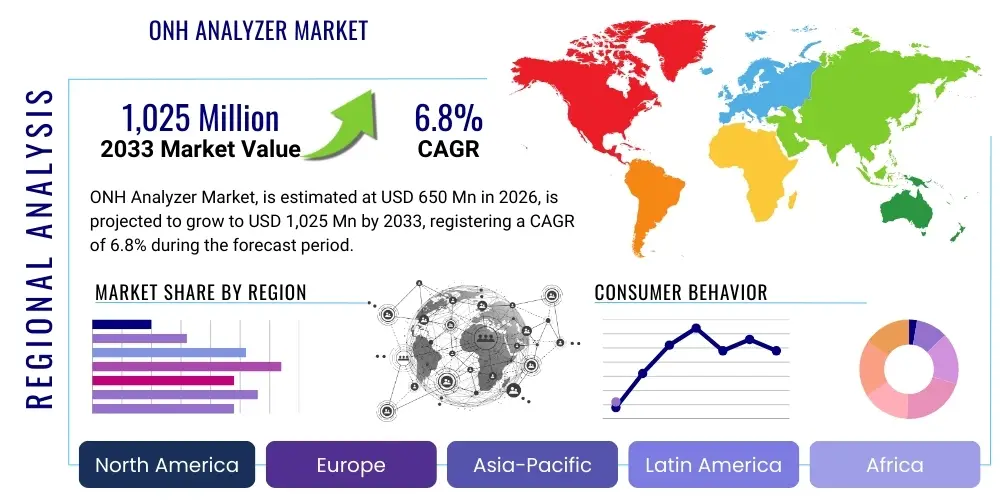

Regional Highlights

- North America: This region maintains the largest market share, characterized by high penetration rates of employer-sponsored coverage, primarily driven by the private healthcare system dominance in the US and the regulatory structure of the Affordable Care Act (ACA). The market here is highly mature, competitive, and technologically advanced, with significant emphasis on self-funded arrangements (ASO) and stop-loss products for major corporations seeking cost certainty amidst escalating medical inflation.

- Europe: The European market shows varied structures due to strong public healthcare systems across the continent. Commercial Medical Protection Insurance often serves as supplementary coverage (e.g., access to private facilities, faster service, specialized care), particularly in the UK, Germany, and France. Growth is moderate and steady, driven by multinational corporations ensuring standardized benefits across their European branches and increasing demand for specialized occupational health insurance tailored to specific EU labor laws.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This explosive growth is fueled by rapid economic expansion, increasing disposable incomes, and the expansion of formalized employment sectors, particularly in China, India, and Southeast Asia. Regulatory environments are evolving rapidly, pushing mandatory corporate health insurance. The market is highly diverse, ranging from advanced digital adoption in developed markets (Japan, Australia) to high potential in emerging economies (India, Indonesia) where penetration rates are lower but accelerating significantly.

- Latin America (LATAM): The LATAM region presents a mix of public and private systems, with commercial protection often viewed as a premium benefit to attract high-value employees, especially in countries like Brazil, Mexico, and Chile. Political and economic instability often pose challenges, leading insurers to focus on products designed to manage currency volatility and local regulatory variations, with key growth centered around supplementary coverage that bridges gaps in public healthcare quality.

- Middle East and Africa (MEA): Growth in the MEA region is heavily influenced by mandatory insurance schemes, particularly in the Gulf Cooperation Council (GCC) countries (e.g., UAE, Saudi Arabia) where expatriate labor requires compulsory health coverage. The region is investing heavily in healthcare infrastructure, creating a structured demand environment for high-quality commercial plans, although political risk and varying income levels across Africa pose significant operational challenges for standardized product delivery.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Medical Protection Insurance Market.- UnitedHealth Group

- Anthem (Elevance Health)

- Cigna

- Aetna (CVS Health)

- Humana

- Allianz SE

- AXA

- Munich Re

- Zurich Insurance Group

- MetLife

- Prudential Financial

- Kaiser Permanente

- Nippon Life Insurance

- Ping An Insurance

- Generali Group

- Bupa

- Blue Cross Blue Shield (various affiliates)

- Swiss Re

- Chubb Limited

- Assurant Inc.

- Aflac

- Travelers Companies

- Liberty Mutual Insurance

- Hiscox Ltd.

- Mapfre S.A.

- Tokio Marine Holdings

- Standard Life Aberdeen

- Legal & General Group

- Hannover Re

- R+V Versicherung

Frequently Asked Questions

Analyze common user questions about the Commercial Medical Protection Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between fully insured and self-funded commercial plans?

In a fully insured plan, the insurance carrier assumes all financial risk for claims in exchange for a fixed premium, offering predictability to the commercial client. In a self-funded (ASO) plan, the employer bears the direct risk for employee medical claims but typically purchases stop-loss insurance to protect against catastrophic losses, outsourcing only the administrative services to the insurer, thereby potentially achieving greater cost savings and plan flexibility.

How is rising healthcare inflation impacting commercial medical protection premiums?

Escalating healthcare inflation directly increases the cost base for insurers, compelling them to raise commercial premiums to maintain profitability and solvency. Insurers are responding by shifting risk via higher deductibles, emphasizing preventative care (wellness programs), and implementing sophisticated reference-based pricing strategies to negotiate lower rates with healthcare providers, attempting to mitigate the full premium burden passed onto corporate clients.

What role do brokers and agents play in the commercial medical insurance market?

Brokers and agents are crucial intermediaries, particularly for Small and Medium Enterprises (SMEs), acting as consultants who analyze a company's needs, navigate complex regulatory requirements, compare multiple carrier offerings, and assist in plan implementation and renewal. For large enterprises, brokers often provide sophisticated risk analysis and negotiation expertise for complex, tailored self-funded arrangements.

Which technology is most significantly driving change in commercial insurance operations?

Artificial Intelligence (AI) and Machine Learning (ML) are the most significant technological drivers, optimizing underwriting accuracy, automating claims processing, and enabling advanced fraud detection. Furthermore, cloud computing provides the essential scalable infrastructure required for the secure management and analysis of vast datasets related to corporate health metrics and claims history.

What are the key opportunities for market growth in the Asia Pacific (APAC) region?

The APAC region's growth is primarily driven by regulatory mandates in developing economies requiring employer-sponsored health benefits, rapid urbanization, and a growing middle class demanding higher quality medical services than those offered by public systems. The key opportunity lies in providing scalable, digitally accessible group plans to the expanding SME sector and multinational companies operating regionally.

How does the segmentation by enterprise size influence product offerings?

Large Enterprises (LEs) frequently seek highly customizable self-funded plans with stop-loss coverage, prioritizing flexibility, comprehensive data reporting, and complex integrations with internal HR systems. Small and Medium Enterprises (SMEs), conversely, prioritize fully insured plans that offer budgetary predictability, administrative simplicity, and standardized, readily available provider networks, often accessed through digital platforms or third-party brokers.

What is stop-loss insurance and why is it essential in the commercial market?

Stop-loss insurance is a critical component for employers utilizing self-funded commercial medical plans. It protects the employer from unpredictable, excessive financial liability resulting from very high individual claims (specific stop-loss) or from unusually high aggregate claims across the entire employee population (aggregate stop-loss). It transfers catastrophic risk back to the insurer, providing a necessary financial safety net for corporate budgets.

Are regulatory changes globally leading to standardization or greater fragmentation in commercial coverage?

Regulatory changes are leading to both standardization and fragmentation simultaneously. Standardization occurs in minimum coverage requirements (e.g., ACA in the US or similar mandates in emerging markets), forcing baseline consistency. However, local tax laws, specific benefit mandates (e.g., maternity, mental health), and local licensing rules ensure significant fragmentation, requiring multinational insurers to maintain highly flexible and localized product suites.

How is the focus on corporate wellness programs affecting commercial insurance products?

Corporate wellness programs are increasingly integrated into commercial insurance offerings, shifting the focus from reactive treatment to proactive prevention. Insurers often incentivize participation through lower premiums or deductibles. This integration aims to mitigate long-term health risks, improve employee productivity, and ultimately reduce the corporate client's overall claims utilization rate, making it a crucial component of value-based insurance design.

What are the primary upstream activities in the commercial medical protection value chain?

Upstream activities involve data acquisition, sophisticated actuarial risk modeling, product design, and obtaining reinsurance. These processes establish the financial viability and competitiveness of the insurance product, requiring intense computational power and specialized expertise to accurately predict claims frequency and severity while complying with strict capital reserve requirements.

Why is the integration of telemedicine critical for commercial medical insurance?

Telemedicine is critical because it offers a cost-effective alternative to traditional in-person visits for routine care, diagnosis, and prescription refills, significantly improving access and convenience for employees. For the employer and insurer, this shift helps manage utilization costs and reduces time lost from work, contributing to better overall workforce productivity metrics, especially valuable for large geographically dispersed commercial clients.

Which industries represent the highest potential growth in commercial medical protection adoption?

The highest growth potential is concentrated in the IT and Telecommunications sector globally, driven by intense competition for highly skilled talent who demand premium health benefits. Additionally, the Manufacturing and Retail sectors in emerging markets, characterized by large, formalizing workforces, are showing robust increases in demand as regulatory compliance and competitive pressure necessitate comprehensive group coverage.

How do High Deductible Health Plans (HDHPs) fit into the commercial medical protection landscape?

HDHPs are a growing segment, particularly popular among large commercial clients aiming to manage premium costs. They feature lower monthly premiums but higher out-of-pocket costs before coverage kicks in, often paired with tax-advantaged savings accounts (HSAs). They incentivize employees to become more active and cost-conscious consumers of healthcare services, providing a mechanism for corporate cost control.

What specific challenges does the Latin America (LATAM) market pose for insurers?

The LATAM market is challenging due to economic volatility, leading to potential currency risks and high inflation which destabilizes premium calculations. Additionally, complex and frequently changing local regulatory frameworks, coupled with varying public healthcare infrastructure quality across countries, necessitate highly adaptive and localized product development and claims management strategies.

What impact does provider network consolidation have on commercial insurance pricing?

Provider network consolidation (e.g., mergers of hospitals or physician groups) generally reduces competition among healthcare service providers. This often translates to increased negotiation leverage for the providers, forcing insurers to accept higher reimbursement rates, which subsequently results in increased claims costs and ultimately drives up the premiums charged to commercial clients.

How is Generative Engine Optimization (GEO) applied in market reporting for this sector?

Generative Engine Optimization (GEO) involves structuring detailed, contextually rich, and query-responsive content that addresses complex, multi-faceted inquiries typical of B2B users (HR executives, CFOs). For this market, GEO ensures the report provides highly detailed technical comparisons (e.g., PPO vs. HMO), explains the 'Why' behind market shifts (e.g., AI impact on underwriting), and uses natural language definitions to serve sophisticated informational needs directly.

What are the key considerations for large multinational corporations when selecting global medical protection?

Multinationals prioritize standardized global policy design that ensures equitable benefits across diverse jurisdictions, consolidated administration via a single global platform, robust compliance with local labor and insurance laws, and the ability to transfer complex risks across borders efficiently, often requiring a single carrier with extensive international operational capabilities.

Beyond traditional medical coverage, what specialized benefits are showing increasing demand in commercial plans?

There is rapidly increasing demand for specialized benefits covering comprehensive mental health services (including teletherapy), enhanced substance abuse treatment, robust fertility benefits, and extensive chronic disease management programs. These specialized coverages are now viewed as essential for attracting and retaining younger, highly educated workforces in competitive markets.

How does the distribution channel choice affect the cost of commercial medical protection for SMEs?

For SMEs, utilizing brokers often adds a commission cost but ensures they receive unbiased advice and access to the best-priced options tailored to their small group size. Direct sales channels might offer lower initial administrative fees but often lack the comparative breadth of coverage options available through established brokerage networks, impacting the SME's ability to optimize value for money.

What is the current trend regarding self-funded versus fully insured plans in the US commercial market?

The trend shows a steady migration towards self-funded plans among mid-sized companies (500-1,000 employees), in addition to large corporations, seeking to capture savings when claims are low and gain greater control over health data. However, fully insured plans remain the dominant choice for the majority of small businesses due to the predictable budgeting and complete transference of catastrophic risk to the insurance carrier.

How does the complexity of the value chain affect the end-cost of commercial medical protection?

The complexity, involving reinsurers, data providers, multiple distribution layers, and extensive provider networks, adds administrative and intermediary costs throughout the value chain. Inefficiencies in claims processing or high costs associated with manual documentation directly increase the insurer's expense ratio, which is ultimately reflected in higher premiums charged to commercial clients.

Why is data transparency and reporting crucial for large commercial clients?

Large commercial clients, particularly those with self-funded plans, require high levels of data transparency (utilization reports, claim patterns, cost drivers) to effectively manage their risk, assess the return on investment of wellness programs, and inform strategic decisions regarding future benefit design. Transparent reporting enables them to forecast future liabilities and negotiate better stop-loss terms.

What is the primary restraint to market growth in the highly regulated European region?

The primary restraint in Europe is the pervasive presence and high quality of public healthcare systems, which limits the necessity for full-scale commercial primary insurance. Commercial products are largely restricted to supplemental roles, such as enhancing speed of access or specialized treatments, constraining the overall market size compared to the US or high-growth APAC markets.

How are global reinsurers influencing the pricing and risk management in this market?

Global reinsurers provide the essential capital backup for primary carriers, particularly for stop-loss coverage against catastrophic corporate claims. Their pricing models and capacity decisions are based on aggregated global healthcare risk trends, directly influencing the primary insurer's ability to assume large risks and consequently affecting the cost and availability of comprehensive coverage for very large commercial entities.

What defines a 'Point of Service' (POS) plan in the commercial coverage segment?

A POS plan is a hybrid coverage model combining features of HMOs and PPOs. Employees benefit from lower costs by staying within the plan’s provider network (like an HMO), but they retain the flexibility to seek care outside the network (like a PPO) at a higher cost. This balance offers greater choice to employees while maintaining some cost controls for the employer.

How does technological integration (APIs) improve the commercial client experience?

API integration allows seamless, automated data exchange between the insurer's system and the client's HRIS or payroll platforms. This vastly simplifies administrative tasks such as employee enrollment, eligibility confirmation, and premium billing reconciliation, reducing manual errors and saving significant time for the corporate HR and benefits administration teams.

What is the significance of the shift toward value-based care in commercial insurance design?

The shift toward value-based care moves reimbursement away from fee-for-service toward payment tied to patient health outcomes and quality metrics. In commercial insurance, this encourages plan designs that incentivize high-quality, cost-effective provider networks and preventative interventions, aligning the insurer's goal of claims reduction with the corporate client's goal of maintaining a healthy, productive workforce.

Are small enterprises in developing markets primarily seeking fully insured or self-funded plans?

Small enterprises in developing markets overwhelmingly seek fully insured plans. They typically lack the financial reserves or the administrative expertise required to manage the volatility of self-funded plans, prioritizing the fixed premium structure and comprehensive risk transfer offered by traditional fully insured group policies to ensure budgetary stability.

Which regulatory compliance factor is most burdensome for multinational commercial insurers?

The most burdensome factor is managing the complex interplay of local statutory minimum benefit requirements, data privacy laws (like GDPR or HIPAA equivalents), and local insurance licensing mandates across every jurisdiction in which their commercial clients operate, necessitating extensive legal and compliance resources for product deployment and claims handling.

How is the adoption of blockchain technology anticipated to affect claims processing efficiency?

Blockchain is expected to create a secure, transparent, and immutable ledger for medical claims and patient data. This would significantly reduce verification time, eliminate disputes over documentation, minimize fraud, and automate contractual payouts via smart contracts, leading to substantial gains in claims processing speed and reductions in administrative overhead across the commercial sector.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager