Commercial Microwave Ovens Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433963 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Microwave Ovens Market Size

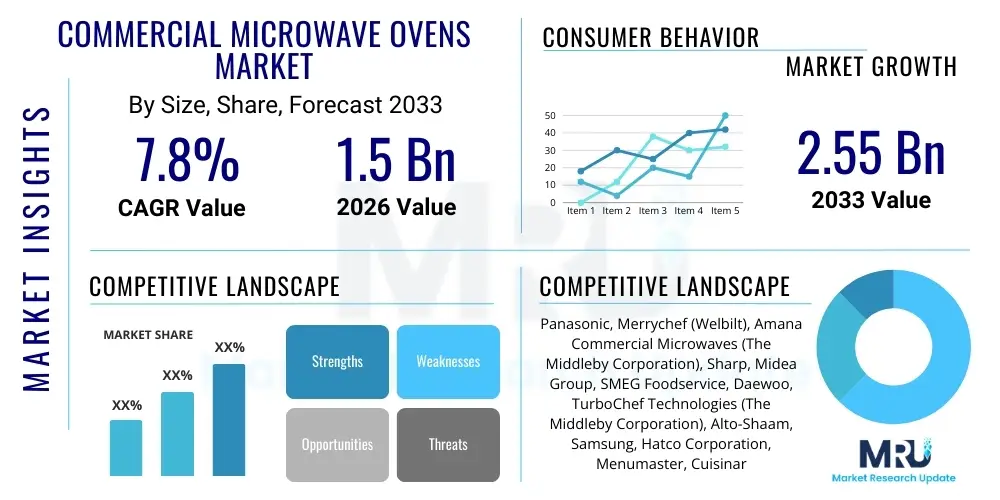

The Commercial Microwave Ovens Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.55 Billion by the end of the forecast period in 2033.

Commercial Microwave Ovens Market introduction

The Commercial Microwave Ovens Market encompasses specialized heating appliances designed for high-volume, continuous operation environments such as quick-service restaurants (QSRs), full-service dining establishments, institutional kitchens (hospitals, schools), and convenience stores. Unlike residential units, these ovens are characterized by higher wattage output (typically 1000W to 3000W+), robust stainless steel construction, enhanced durability, and advanced features like programmable cooking cycles and multiple power levels, ensuring consistent and rapid food preparation crucial for maintaining operational efficiency in the fast-paced foodservice industry. The core function is rapid reheating, defrosting, and light cooking, significantly reducing preparation times and optimizing labor costs for commercial operators.

Key applications for commercial microwave ovens are widespread across the entire HORECA sector (Hotel, Restaurant, Cafe), with a growing presence in non-traditional foodservice settings like corporate cafeterias and vending machine infrastructure. The primary benefits driving adoption include exceptional speed, energy efficiency compared to traditional convection ovens for small tasks, and the ability to standardize menu execution across multiple locations, thereby ensuring product quality and customer satisfaction. Furthermore, the modern commercial oven often incorporates advanced diagnostics and connectivity features, allowing kitchen managers to track usage data and schedule maintenance proactively, which is essential for businesses relying heavily on seamless kitchen operation.

The market is predominantly driven by the robust expansion of the global organized foodservice sector, characterized by the proliferation of chain restaurants and the increasing consumer demand for prepared and convenience foods. Driving factors also include stringent food safety regulations requiring standardized heating processes and the continuous innovation in microwave technology, such as the adoption of inverter technology, which provides more consistent and efficient energy delivery compared to older transformer-based systems. These technological advancements enhance performance while simultaneously addressing operational concerns regarding energy costs and unit longevity.

Commercial Microwave Ovens Market Executive Summary

The Commercial Microwave Ovens Market is currently experiencing robust momentum, fundamentally shaped by dynamic shifts in the global foodservice landscape and technological integration focused on enhancing kitchen workflow efficiency. Business trends indicate a strong move toward high-speed combination ovens, merging microwave capabilities with convection or impingement technologies to provide versatility and reduce overall cooking time for complex items, thus streamlining menu offerings. The widespread adoption of digitalization in kitchen operations further emphasizes the need for IoT-enabled commercial ovens capable of receiving remote updates, logging operational data, and facilitating predictive maintenance schedules, moving the product from a simple appliance to an integrated operational asset.

Regionally, the market presents a varied growth profile. North America and Europe currently represent mature markets characterized by high penetration rates and demand primarily driven by replacement cycles and upgrades to high-efficiency, smart models, especially within established quick-service chains. Conversely, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, fueled by rapid urbanization, significant expansion of the middle-class consumer base, and massive investment in organized retail and foodservice infrastructure across countries like China and India. Latin America and MEA are emerging as crucial growth vectors, influenced by increasing tourism and the introduction of international fast-food franchises demanding reliable, commercial-grade kitchen equipment.

Segmentation trends highlight the increasing preference for high-wattage (above 2000W) units, particularly in high-traffic QSR environments where speed is paramount. Moreover, the segmentation based on technology showcases a shift toward inverter-based systems due to their superior efficiency and ability to maintain consistent power output during the heating cycle, leading to better food quality results. Application segmentation confirms that the Quick-Service Restaurant (QSR) sector remains the dominant end-user, though institutional catering and fast-casual dining are demonstrating strong investment in upgrading their microwave fleet to handle diverse and complex food heating requirements efficiently.

AI Impact Analysis on Commercial Microwave Ovens Market

User queries regarding the impact of Artificial Intelligence (AI) on the Commercial Microwave Ovens Market frequently center on three critical areas: operational optimization, predictive failure analysis, and personalized, standardized cooking outcomes. Users are keen to understand how AI-driven algorithms can monitor appliance health in real-time to forecast magnetron failures or electrical issues, thereby transitioning maintenance from reactive to predictive and significantly reducing costly downtime in high-throughput environments. Furthermore, a major concern is how AI can integrate with complex menu items, adjusting power levels and cooking durations dynamically based on internal food temperature sensors and load weight, ensuring perfect, repeatable results regardless of the operator's skill level.

The adoption of AI is revolutionizing commercial ovens by integrating machine learning models that analyze historical usage data, energy consumption patterns, and sensor feedback to optimize performance parameters automatically. For example, AI can learn the optimal heating curve for a specific frozen product based on ambient kitchen temperature and humidity, adjusting the cooking cycle in milliseconds. This level of precise control addresses a critical pain point in commercial kitchens—inconsistent food preparation—by guaranteeing standardization across all unit operations. This shift positions the commercial microwave oven not merely as a heating device but as an intelligent, self-optimizing component of the overall kitchen management system, enhancing both food quality and operational efficiency substantially.

In addition to performance optimization, AI is also crucial in improving energy efficiency, a primary restraint for high-wattage equipment. By deploying sophisticated scheduling algorithms and power management tools, AI determines the lowest energy setting required to achieve the desired result within the necessary timeframe, minimizing unnecessary power surges and wasted electricity during idle times or low-demand periods. While initial investment in AI-enabled smart ovens is higher, the clear long-term ROI derived from reduced maintenance costs, optimized energy usage, and minimized food waste through improved consistency validates the integration of these advanced computational capabilities into future commercial models, thus fundamentally changing the competitive dynamics of the market.

- Predictive Maintenance: AI algorithms monitor magnetron and transformer health, forecasting potential failures days in advance, minimizing unscheduled downtime.

- Dynamic Cooking Cycle Optimization: Machine learning adjusts power levels and timing based on internal food temperature, weight, and ambient conditions for guaranteed consistency.

- Energy Management and Scheduling: AI optimizes operational schedules to reduce peak load energy consumption and improve overall power efficiency.

- Standardized Menu Execution: Ensures identical quality and temperature across all locations and operators, crucial for chain consistency.

- Usage Pattern Analysis: Generates detailed reports on peak usage times and food preparation bottlenecks, aiding kitchen layout and staffing decisions.

DRO & Impact Forces Of Commercial Microwave Ovens Market

The Commercial Microwave Ovens Market is propelled by significant growth drivers, primarily the rapid global expansion of the organized foodservice industry, coupled with compelling operational requirements for speed and efficiency. The ongoing trend of ‘speed scratching’ and preparing food on-demand necessitates robust, rapid heating solutions that only commercial-grade equipment can provide. However, growth is tempered by substantial restraints, notably the high initial capital investment required for durable, high-wattage units, and the continuous scrutiny regarding energy consumption and the environmental impact associated with equipment disposal. These forces, when balanced, create specific opportunities, particularly in the realm of smart connectivity and specialized application designs.

A major driving force is the increasing global consumer preference for convenience food and quick dining experiences, which directly mandates higher throughput from commercial kitchens. Furthermore, regulatory frameworks related to food safety are becoming stricter, driving commercial operators to invest in equipment with validated, consistent heating profiles to mitigate the risk of foodborne illnesses; programmable commercial microwaves fulfill this requirement better than older, manual units. Technological innovation, such as the introduction of solid-state microwave technology, which offers superior lifespan, control, and efficiency compared to traditional magnetrons, is also accelerating the replacement cycle in mature markets, providing a continuous flow of demand for advanced units. These factors collectively push the market forward by demonstrating clear return on investment (ROI) through enhanced operational flow and reduced labor requirements.

Restraints primarily revolve around costs and perception. The considerable upfront cost of a commercial microwave oven, especially high-end combination or inverter models, can be prohibitive for independent or smaller foodservice establishments operating on tight budgets. Additionally, commercial kitchens face growing pressure to reduce overall energy footprints, and while modern units are more efficient, the inherent high-wattage demand of commercial microwaves remains a point of concern compared to non-powered alternatives. Opportunities are largely concentrated in emerging economies, where the infrastructure for organized foodservice is rapidly being built, creating a greenfield market for new installations. Furthermore, integrating advanced IoT capabilities, allowing for remote diagnostics, firmware updates, and comprehensive energy monitoring, presents a key opportunity for manufacturers to add value and justify premium pricing, positioning these devices as integral components of a smart kitchen ecosystem.

Segmentation Analysis

The Commercial Microwave Ovens Market is highly fragmented and analyzed across multiple critical dimensions, including Power Output (Wattage), Technology Type, Application, and Distribution Channel. Power output is perhaps the most defining segment, directly correlating with the intended use environment, where high-wattage models (2000W and above) cater exclusively to high-volume QSRs, while medium-wattage units (1200W–2000W) are suitable for fast-casual and coffee shop settings. The application segment remains crucial for strategic planning, dictating specific design requirements; for instance, institutional ovens often require additional security features and heavier-duty internal components due to continuous, demanding usage patterns.

Technological segmentation is undergoing rapid transformation, with traditional transformer-based models slowly losing ground to the more efficient and precise Inverter Technology. Inverter models provide continuous, modulated power delivery, preventing food temperature spikes and improving the overall texture and quality of heated items, which is a major selling point for quality-conscious operators. A nascent but important segment involves Solid-State Microwave Technology (SSMT), which uses semiconductors instead of magnetrons, offering unparalleled precision, longer lifespan, and highly compact designs, though current manufacturing costs keep them positioned at the extreme high-end of the market spectrum.

Finally, the distribution landscape is divided between direct sales to large chains and indirect sales through specialized foodservice equipment dealers and wholesale distributors. The strategic management of these channels is essential, as large chains typically negotiate bulk purchasing directly with manufacturers for customization and cost efficiency, while smaller, independent operators rely heavily on distributor networks for installation support, local servicing, and immediate inventory access. Understanding the interplay between these segments is vital for predicting regional adoption rates and tailoring product development initiatives.

- By Technology Type:

- Inverter Technology Ovens

- Transformer Technology Ovens

- Solid-State Microwave Ovens (SSM)

- By Power Output (Wattage):

- Low Duty (Under 1000W)

- Medium Duty (1000W – 2000W)

- Heavy Duty (Over 2000W)

- By Application/End-User:

- Quick Service Restaurants (QSR)

- Full-Service Restaurants (FSR)

- Institutional Foodservice (Hospitals, Schools, Corporate)

- Hotels and Catering Services

- Convenience Stores and Coffee Shops

- By Configuration:

- Solo Microwave Ovens

- Combination Microwave Ovens (Microwave + Convection/Grill)

Value Chain Analysis For Commercial Microwave Ovens Market

The Value Chain for the Commercial Microwave Ovens Market begins with upstream activities involving the sourcing of highly specialized and critical components. This includes the manufacturing and supply of complex high-power components such as magnetrons (or semiconductor components for SSMT), high-voltage transformers (or inverter boards), and durable stainless steel chassis materials. The quality and reliability of these upstream suppliers directly dictate the longevity and performance of the final product, making supplier selection and quality control highly critical. Pricing power in this initial stage often rests with niche technological component manufacturers, especially those holding patents for advanced magnetron or solid-state designs.

The central phase involves design, manufacturing, and assembly. Manufacturers focus heavily on product durability, thermal efficiency, and software integration (for smart models). Commercial oven manufacturing requires adherence to strict international safety and performance standards (e.g., NSF, UL, CE certifications), necessitating sophisticated quality assurance processes. Post-manufacturing, the distribution channel plays a pivotal role. The channels are broadly bifurcated: large manufacturers maintain direct sales forces to manage relationships and contracts with major global QSR chains, often customizing specifications for high-volume orders. This direct approach offers higher margins but requires significant logistical support and after-sales service infrastructure.

The downstream flow relies predominantly on indirect distribution through specialized foodservice equipment dealers, wholesalers, and regional distributors. These intermediaries are essential for reaching independent restaurants, smaller chains, and institutional buyers, providing crucial services like localized installation, technical support, training, and financing options. The final stage involves the end-user (commercial kitchen) and the post-sale service lifecycle, which includes maintenance contracts, parts supply, and eventual replacement cycles. Effective, localized after-sales support significantly influences brand loyalty and replacement purchasing decisions, completing the value chain loop.

Commercial Microwave Ovens Market Potential Customers

The primary customer base for Commercial Microwave Ovens spans the entire spectrum of the professional foodservice industry, defined by organizations requiring high speed, consistency, and durability for food preparation and reheating. Quick Service Restaurants (QSRs) remain the largest and most intensive buyers, driven by their operational model that demands rapid turnover of menu items and utilizes microwaves extensively for reheating prepared components and ensuring product consistency across thousands of global outlets. The specification needs of QSRs typically focus on high-wattage, heavy-duty units with integrated programmable controls to minimize operator error and maximize throughput during peak hours.

Beyond QSRs, the Institutional Foodservice segment represents a significant growth area. This includes organizations such as large hospitals, K-12 school systems, and corporate/university cafeterias. These environments require dependable, often medium-to-heavy duty, units designed for safety and ease of cleaning, focusing less on blistering speed and more on reliability and compliance with strict sanitation protocols. The demand here is cyclical, often linked to government or institutional infrastructure investment cycles. Furthermore, the burgeoning segment of fast-casual dining, coffee chains, and convenience stores are rapidly increasing their appliance footprint, utilizing commercial microwaves for items like sandwiches, pastries, and ready-to-eat meals, driving demand for technologically advanced, often combination units that handle light cooking tasks alongside rapid reheating.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.55 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Panasonic, Merrychef (Welbilt), Amana Commercial Microwaves (The Middleby Corporation), Sharp, Midea Group, SMEG Foodservice, Daewoo, TurboChef Technologies (The Middleby Corporation), Alto-Shaam, Samsung, Hatco Corporation, Menumaster, Cuisinart Commercial, Vollrath Company, Electrolux Professional, Rational AG (Specialty), Ali Group, Hobart Corporation, Duke Manufacturing, ITW Food Equipment Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Microwave Ovens Market Key Technology Landscape

The technology landscape in the commercial microwave sector is rapidly evolving, driven by the need for enhanced energy efficiency, precise heating control, and increased equipment longevity to meet the demands of 24/7 kitchen operations. The most significant advancement is the widespread adoption of Inverter Technology, which utilizes a power control circuit to deliver a continuous stream of power, unlike older models that cycled the magnetron on and off. This constant, modulated power leads to more evenly heated food, reduces energy waste, and minimizes strain on internal components, ultimately extending the service life of the appliance. Manufacturers are consistently integrating advanced sensor technology within these inverter units to monitor steam levels and food core temperature, enabling adaptive heating cycles.

A second crucial technological shift is the emergence of Solid-State Microwave Technology (SSMT). SSMT replaces the bulky, high-maintenance magnetron tube with highly efficient, semiconductor-based amplifiers (like Gallium Nitride or Silicon Carbide). While still niche due to higher production costs, SSMT offers unprecedented frequency and power control, enabling targeted, precise heating patterns, far superior to traditional magnetron technology. SSMT also boasts significantly longer operational lifecycles and eliminates the need for magnetron replacement, positioning it as the future standard for high-end, demanding applications where precision and reliability outweigh initial cost considerations. Continued R&D efforts are focused on driving down the cost of high-power semiconductor components to make SSMT commercially viable for the mass market.

Furthermore, connectivity and integration define the modern commercial microwave. IoT functionality, facilitated by integrated Wi-Fi or Ethernet modules, allows operators to remotely monitor performance, upload new cooking programs, perform diagnostic checks, and implement preventative maintenance schedules. This interconnectedness allows for fleet management across large chains, ensuring all units are running the latest software and adhering to standardized cooking protocols. Coupled with improved cavity design and robust construction materials—like specialized coatings for easier cleaning and enhanced heat reflection—these technological advancements underscore the market's focus on total cost of ownership reduction and operational efficiency optimization, moving beyond basic heating to complex thermal management solutions.

Regional Highlights

The global Commercial Microwave Ovens Market exhibits diverse growth characteristics across key geographical regions, influenced by economic maturity, foodservice regulatory environments, and consumer dining habits. North America, encompassing the United States and Canada, remains a dominant market leader. This region is characterized by an extremely high penetration of organized QSR and fast-casual chains, leading to consistent demand primarily driven by replacement cycles and the continuous upgrade toward sophisticated, IoT-enabled combination ovens. North American operators prioritize speed (heavy-duty wattage) and connectivity for efficient centralized management, resulting in a focus on premium and technologically advanced products. The market here is highly competitive, dominated by established players offering extensive service networks.

Europe represents a mature yet dynamic market. Growth is steady, driven by the strong presence of international hospitality groups and increasingly stringent energy efficiency and food safety regulations imposed by bodies like the European Union. European operators demonstrate a strong preference for high-efficiency inverter technology and combination models that maximize kitchen space versatility, particularly in densely populated urban areas where kitchen real estate is limited. The market is segmented by varying national culinary traditions and regulatory demands; for example, Nordic countries often prioritize sustainability features, while Southern European nations focus heavily on rapid service delivery.

The Asia Pacific (APAC) region is forecasted to be the fastest-growing market during the forecast period. This exponential growth is underpinned by massive demographic shifts, rising disposable incomes, and unprecedented urbanization, leading to an explosion in organized foodservice and retail chains (both local and international franchises). Countries such as China, India, and Southeast Asian nations present vast potential for new installations. While price sensitivity remains higher in this region, the demand for durable, medium-to-heavy duty commercial units is increasing rapidly as operators scale their operations and seek to standardize food quality, making APAC a crucial strategic focal point for global manufacturers.

Latin America (LATAM) and the Middle East and Africa (MEA) constitute emerging markets with promising long-term growth trajectories. LATAM growth is closely linked to stabilizing economies and the expansion of international restaurant brands, necessitating investment in reliable commercial kitchen infrastructure. In MEA, growth is heavily influenced by the tourism sector, large institutional catering projects (especially in the GCC countries), and increasing foreign direct investment in retail. While these regions may adopt less technologically complex models initially compared to North America, the rapid pace of infrastructure development suggests a strong future demand for standard heavy-duty commercial ovens as the organized foodservice sector continues its penetration.

- North America: Market leader; driven by replacement cycles, high adoption of heavy-duty and IoT-enabled smart ovens (QSR dominance).

- Asia Pacific (APAC): Highest growth potential; fueled by urbanization, expansion of international chains, and new installations in China and India.

- Europe: Stable, mature market; demand focused on high-efficiency inverter models and combination units due to space constraints and stringent energy regulations.

- Latin America (LATAM): Emerging market; growth tied to economic stability and the ingress of major international foodservice franchises.

- Middle East and Africa (MEA): Growth driven by tourism, institutional projects, and rapid infrastructure development in the hospitality sector.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Microwave Ovens Market.- Panasonic Corporation

- Merrychef (A brand of Welbilt, Inc., now part of The Middleby Corporation)

- Amana Commercial Microwaves (A brand of The Middleby Corporation)

- Sharp Corporation

- Midea Group

- TurboChef Technologies (A brand of The Middleby Corporation)

- Electrolux Professional

- Samsung Electronics Co., Ltd.

- Alto-Shaam, Inc.

- Hatco Corporation

- Menumaster

- SMEG Foodservice

- Vollrath Company

- Daewoo Electronics

- Rational AG (Specialty Combination Units)

- Ali Group

- Hobart Corporation

- Duke Manufacturing

- ITW Food Equipment Group

- Henny Penny Corporation

Frequently Asked Questions

Analyze common user questions about the Commercial Microwave Ovens market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial and residential microwave ovens?

Commercial microwave ovens are built for heavy, continuous use with higher wattage (often 2000W+) and durable stainless steel construction, featuring programmable settings and enhanced safety standards, contrasting sharply with lower-wattage residential units designed for intermittent use.

How does Inverter Technology benefit commercial kitchen operations?

Inverter technology provides a continuous, steady stream of microwave power, eliminating the cycling on and off that causes inconsistent heating in older models. This ensures even cooking quality, better energy efficiency, and extended component life for high-volume tasks.

Which end-user segment drives the highest demand in the market?

The Quick Service Restaurant (QSR) segment is the largest driver of demand, requiring robust, heavy-duty commercial microwaves for rapid reheating and ensuring standardization and consistency across their extensive chain operations globally.

What role does IoT and AI play in the future of commercial ovens?

IoT enables remote monitoring, data logging, and over-the-air programming updates, while AI integration facilitates predictive maintenance, dynamic cycle optimization based on food input, and improved energy usage scheduling, minimizing downtime and operational waste.

What is the expected CAGR of the Commercial Microwave Ovens Market between 2026 and 2033?

The Commercial Microwave Ovens Market is projected to exhibit a steady Compound Annual Growth Rate (CAGR) of 7.8% during the forecast period, driven by global foodservice expansion and technology upgrades.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager