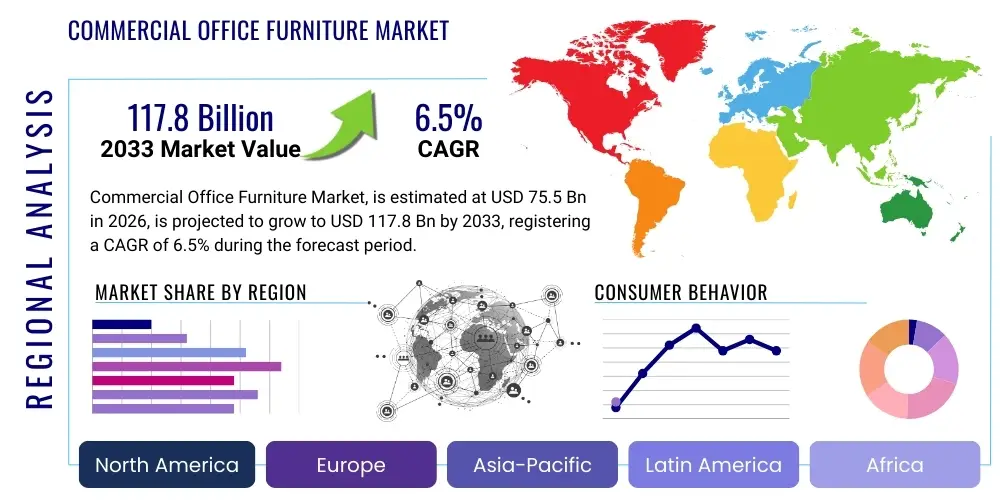

Commercial Office Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435306 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Commercial Office Furniture Market Size

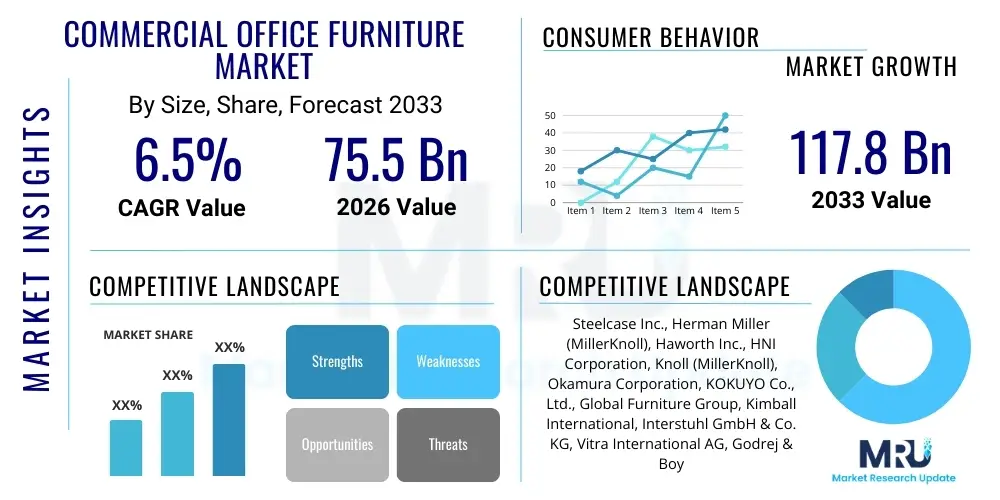

The Commercial Office Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 75.5 Billion in 2026 and is projected to reach USD 117.8 Billion by the end of the forecast period in 2033.

Commercial Office Furniture Market introduction

The commercial office furniture market encompasses the design, manufacture, and distribution of furniture items specifically tailored for professional workspaces, including corporate offices, educational institutions, healthcare facilities, and government buildings. This market is highly dynamic, driven by evolving workplace philosophies, particularly the widespread adoption of hybrid work models which necessitate flexible, ergonomic, and technology-integrated furniture solutions. Key products range from ergonomic seating and height-adjustable desks to modular systems, storage units, and collaborative furniture designed to optimize both individual productivity and team synergy. The fundamental objective of commercial office furniture is to enhance employee well-being, facilitate communication, and reflect the organizational brand identity through interior aesthetics and functional design.

The core product offerings are increasingly focused on sustainability and smart integration. Manufacturers are incorporating recycled materials, emphasizing circular economy principles, and embedding power and data connectivity directly into furniture pieces, transforming static offices into dynamic, responsive environments. Major applications span new office fit-outs, existing office renovations, and the continuous procurement cycle necessitated by organizational expansion or downsizing. The benefits derived from high-quality commercial furniture include improved employee health, documented increases in productivity due to better ergonomics, and a stronger capacity to attract and retain talent by offering superior working conditions. Furthermore, well-designed office spaces can significantly reduce operational overheads through efficient space utilization and durability.

Driving factors for sustained market growth include rapid urbanization and commercial real estate development in emerging economies, coupled with regulatory demands in developed nations for safer and more ergonomic workplace standards. The ongoing shift from fixed floor plans to agile and activity-based working (ABW) layouts demands versatile furniture that can be easily reconfigured. Additionally, corporations globally are prioritizing environmental, social, and governance (ESG) criteria, leading to a strong demand pull for certified sustainable and ethically sourced furniture products, further accelerating innovation within the manufacturing sector.

- Product Description: Ergonomic seating, height-adjustable workstations, modular storage solutions, acoustic panels, and collaborative lounge systems designed for commercial environments.

- Major Applications: Corporate headquarters, co-working spaces, specialized institutional facilities (libraries, labs), and large-scale government administration offices.

- Benefits: Enhanced ergonomics, improved employee well-being, optimized space utilization, reduced noise pollution, and facilitation of flexible, hybrid work models.

- Driving Factors: Global adoption of hybrid and flexible work, regulatory push for ergonomic standards (OSHA/HSE compliance), rapid commercial construction, and rising corporate focus on sustainability.

Commercial Office Furniture Market Executive Summary

The Commercial Office Furniture Market is undergoing a fundamental transformation, shifting its focus from volume manufacturing to specialized, experience-based design, strongly influenced by post-pandemic business trends emphasizing flexibility and employee comfort. Business trends indicate a robust demand for adaptive furniture that supports quick shifts between focused individual work and spontaneous team collaboration. This has spurred innovation in reconfigurable systems and furniture-as-a-service (FaaS) models, allowing businesses to scale their office capacity dynamically without major capital expenditure. Manufacturers are strategically investing in digital technologies, such as advanced manufacturing techniques and virtual reality (VR) tools for space planning, to gain a competitive edge and reduce time-to-market for customizable solutions.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive foreign direct investment, rapid establishment of multinational corporation (MNC) offices, and increasing disposable income leading to higher spending on aesthetic and functional workspace improvements, especially in Tier 1 and Tier 2 cities. North America and Europe maintain high market maturity but are driving innovation, particularly in sustainable materials (e.g., bioplastics, reclaimed wood) and smart furniture integration. Regulatory landscapes across Europe, focusing heavily on employee safety and minimum ergonomic standards, ensure sustained replacement and upgrade cycles, reinforcing the demand for certified, high-end products. Conversely, regions in Latin America and MEA show nascent growth, driven primarily by government infrastructure projects and expanding IT and financial sectors.

Segment trends highlight the dominance of seating and desks/tables, which form the bedrock of any office environment, but the fastest growth is observed in the collaborative space and acoustic furniture segments. The shift towards open-plan offices initially created noise and privacy issues, which acoustic pods, partitions, and specialized sound-dampening furniture are effectively solving. Furthermore, the material segment shows a clear trend away from traditional veneer and toward engineered wood, laminates, and recycled polymers, reflecting cost efficiencies and the increasing push for environmental certifications. The medium-sized enterprise (MSE) segment is emerging as a crucial consumer base, seeking affordable, durable, and highly flexible furniture systems that can adapt to rapid organizational changes typical of scaling businesses.

- Business Trends: Increased adoption of Furniture-as-a-Service (FaaS), integration of digital tools for space planning, focus on highly customizable and flexible furniture systems (modular design), and stringent supply chain scrutiny for ethical sourcing.

- Regional Trends: APAC leading in new commercial construction and demand; North America and Europe focusing on premium, ergonomic, and sustainable replacements; MEA and LATAM showing rising demand driven by infrastructure investment and corporate expansion.

- Segments Trends: High growth in collaborative furniture (e.g., modular lounges, mobile whiteboards) and acoustic solutions (soundproof pods), steady demand for ergonomic seating, and significant uptake of height-adjustable desks across all company sizes.

AI Impact Analysis on Commercial Office Furniture Market

Common user questions regarding AI's impact on the commercial office furniture market often revolve around how technology will change office density, the necessary functionality of future furniture, and the role of customization in a data-driven world. Key concerns focus on whether AI-driven space management will reduce the overall need for furniture, or conversely, if it will necessitate highly specialized, sensor-enabled furniture. Users are keen to understand how AI influences ergonomic design parameters and supply chain efficiency. The consensus theme is the expectation that AI will transition furniture from a static asset to a responsive component of the smart building ecosystem, optimizing occupancy, climate control, and personalization.

AI's primary influence is manifesting in two critical areas: optimizing the workspace ecosystem and revolutionizing the manufacturing and logistics chain. Within the office, AI-powered space utilization sensors embedded in or associated with furniture (such as smart desks and seating) analyze real-time occupancy and usage patterns. This data provides facility managers with unprecedented insights, allowing them to dynamically adjust floor plans, predict maintenance needs, and optimize the quantity and type of furniture required. This analytic capability drives demand for sensor-ready furniture and predictive maintenance contracts, fundamentally changing the relationship between client and furniture vendor. Furthermore, AI algorithms are beginning to influence ergonomic customization, tailoring desk heights, lighting levels, and even material selection based on individual employee biometrics and preference data, creating hyper-personalized workstations.

On the supply side, AI is transforming everything from design conceptualization to last-mile delivery. Generative design tools, powered by AI, enable furniture designers to rapidly iterate complex, structural forms that prioritize material efficiency and ergonomic compliance, significantly reducing design cycles. In manufacturing, AI optimizes cutting patterns to minimize waste and manages highly complex assembly processes required for modular and customized components. Logistically, machine learning models predict fluctuating demand cycles and optimize warehousing and distribution networks, ensuring just-in-time delivery and reducing inventory holding costs. This confluence of manufacturing efficiency and sophisticated utilization tracking ensures that while the total volume of furniture might be adjusted (potentially reduced due to optimized density), the value and technological sophistication per unit will dramatically increase.

- Predictive Maintenance: AI analyzes usage data from embedded sensors to predict wear and tear, scheduling maintenance before failure, increasing furniture longevity.

- Space Optimization: AI-driven utilization tracking informs facility managers on optimal seating arrangements and density, reducing unused inventory and lowering real estate costs.

- Generative Design: AI algorithms assist designers in creating highly ergonomic, material-efficient, and structurally sound furniture prototypes rapidly.

- Hyper-Personalization: Customizing furniture settings (height, temperature, posture support) based on individual user profiles and real-time biometric input via integrated sensors.

- Supply Chain Efficiency: Machine learning optimizes inventory management, demand forecasting, and logistics routes for customized orders, speeding up delivery timelines.

DRO & Impact Forces Of Commercial Office Furniture Market

The market is critically balanced by robust drivers, structural restraints, and significant opportunities, which collectively define the impact forces shaping its trajectory. The primary drivers revolve around global economic growth fueling commercial expansion, particularly the expansion of technology and financial services sectors that demand premium, innovative office spaces. The necessity for complying with increasingly strict ergonomic and health standards (driven by governmental regulations and corporate wellness initiatives) mandates frequent furniture upgrades. Conversely, the market faces strong restraints, primarily volatility in raw material prices (steel, aluminum, wood pulp) and long lead times for highly customized products, which can complicate large-scale procurement processes. Furthermore, the rising adoption of remote work necessitates fewer physical desks, posing a structural challenge to traditional volume growth models.

Key opportunities emerge from addressing these restraints through innovation. The strongest opportunity lies in the 'reconfiguration economy,' where furniture manufacturers offer flexible, modular systems that can easily adapt to changing headcounts, catering directly to the needs of hybrid work environments. Developing circular economy models, including comprehensive furniture take-back programs and refurbishment services, not only addresses sustainability goals but also provides manufacturers with a stable source of secondary materials and creates new revenue streams (FaaS). Furthermore, penetrating the education and healthcare sectors—which are experiencing major modernization waves and require specialized, durable, and highly functional furniture—offers avenues for diversification away from the traditional corporate office segment.

The resulting impact forces indicate a shift toward high-value, sustainable, and service-oriented market dynamics. The intense competitive rivalry means companies must continuously innovate in design and material science, while the high bargaining power of large corporate buyers forces downward pressure on pricing, mitigated only by offering value-added services like space planning and installation. Sustainability is not merely a trend but a major impact force; customers prioritize BIFMA level certifications and LEED compliance, compelling manufacturers to overhaul their supply chains. Ultimately, success hinges on moving beyond selling products to selling integrated workspace solutions that enhance employee experience and operational efficiency.

- Drivers (D): Global rise in commercial construction, focus on ergonomic compliance, widespread adoption of hybrid work requiring flexible layouts, and corporate investment in employee wellness programs.

- Restraints (R): Volatility and inflation of key raw material costs, high initial capital investment for premium ergonomic furniture, and the potential reduction in overall office footprint due to sustained remote work.

- Opportunity (O): Expansion into Furniture-as-a-Service (FaaS) models, developing sustainable and circular economy products, and targeting specialized sectors like institutional learning and healthcare.

- Impact Forces: Intense competitive rivalry demanding continuous design innovation, strong pressure for ESG compliance and certified products, and the shift from product sales to integrated solution provisioning.

Segmentation Analysis

The Commercial Office Furniture Market is structurally segmented across product type, material, end-user application, and distribution channel, providing a granular view of market dynamics and specialized consumer demand. The segmentation by product is crucial as it reflects functionality requirements, with Seating (task chairs, executive chairs, visitor chairs) consistently holding the largest revenue share due to replacement cycles and ergonomic mandates. However, the systems furniture and collaborative furniture categories are demonstrating the fastest growth, reflecting the move towards flexible, activity-based working environments where integrated desks, partitions, and meeting pods are paramount. Understanding these segments is key for manufacturers to align production capabilities with evolving workplace demands.

Material segmentation reveals the increasing importance of sustainability and cost management. While metal and wood remain foundational, there is a pronounced shift towards engineered wood (MDF, particleboard) and plastics/polymers, driven by lower costs and the ability to integrate recycled content. The end-user analysis provides insights into purchasing power and volume requirements; the corporate sector dominates, yet government, institutional (education and libraries), and healthcare sectors represent specialized, high-durability segments with distinct procurement processes and regulatory needs. Healthcare, for instance, requires specialized non-porous and easy-to-clean materials, while educational institutions prioritize durability and high-volume, standardized pieces.

Furthermore, geographic segmentation is vital for optimizing sales and logistics strategies. Developed markets focus on replacement and premium products, whereas emerging economies drive volume growth through new construction. The distribution channel segmentation, encompassing direct sales (contract), specialized retailers, and e-commerce, reflects varying consumer needs for customization versus immediate availability. The direct contract channel remains essential for large corporate projects requiring customized layouts and installation services, while e-commerce is growing rapidly for small to medium-sized business (SMB) purchases and simple, standard items like standalone desks or accessories.

- Product Type: Seating (Task, Executive, Visitor), Tables & Desks (Conference, Height-Adjustable, Training), Storage Units (Filing Cabinets, Bookcases), Systems Furniture (Cubicles, Partitions), Collaborative Furniture (Pods, Lounges).

- Material: Wood (Solid Wood, Engineered Wood), Metal (Steel, Aluminum), Plastic/Polymer, Glass, Textiles/Fabrics.

- End-User: Corporate Offices (IT/Telecom, Finance, Consulting), Government/Public Sector, Educational Institutions, Healthcare Facilities, Hospitality (Co-working spaces).

- Distribution Channel: Direct Sales (Contract Channel), Specialized Retailers, E-commerce Platforms.

Value Chain Analysis For Commercial Office Furniture Market

The value chain for commercial office furniture is complex, starting with the sourcing of diverse raw materials and culminating in the highly specialized installation and after-sales service. Upstream activities involve the procurement of critical materials, including various metals (steel, aluminum for framing), timber, engineered wood panels, fabrics, and plastics. This phase is characterized by intense price negotiations and the growing necessity for supplier certification (e.g., FSC certification for wood) to meet client sustainability mandates. Manufacturers must manage significant risks related to material price volatility and geopolitical factors affecting global supply chains, requiring strategic hedging and dual-sourcing strategies to maintain production stability and competitive pricing.

Midstream processes center around manufacturing, which includes core activities like cutting, shaping, upholstery, assembly, and finishing. Leading firms leverage advanced technologies such as robotic assembly, CNC machining, and highly sophisticated upholstery systems to ensure precision, quality, and mass customization capabilities. The distribution channel acts as the crucial link between production and the end-user. Direct sales, through dedicated contract sales teams, handle large, complex corporate tenders, offering personalized design and space planning consultation. Indirect channels, including specialized dealers, interior design firms, and large retail chains, cater to smaller businesses and standardized orders, providing essential local market access and installation services.

Downstream activities focus heavily on sales, delivery, and post-installation services. Given the complexity of modern office environments, professional installation, often managed by the manufacturer or certified third-party logistics (3PL) providers, is critical to ensure proper function and warranty compliance. After-sales service, including warranty management, repair, maintenance, and increasingly, furniture take-back and refurbishment programs, forms a vital component of the value proposition, driving long-term customer relationships and supporting the shift towards circular economy models. The efficiency of the distribution network, whether direct or indirect, is paramount to maintaining competitive lead times, especially for projects with tight construction schedules.

- Upstream Analysis: Sourcing of raw materials (metal, wood, polymers), component manufacturing (e.g., gas lifts, casters), focus on sustainable and certified material procurement.

- Downstream Analysis: Professional installation and setup, maintenance contracts, warranty services, refurbishment programs, and sustainable disposal management.

- Distribution Channel: Direct Contract Sales (large enterprises), Dealer Networks (mid-market and specialized regional penetration), E-commerce (standard products and SMBs).

- Direct and Indirect: Direct sales offer high customization and relationship management; Indirect channels (dealers/retailers) offer wider geographic reach and localized service delivery.

Commercial Office Furniture Market Potential Customers

Potential customers for commercial office furniture span a broad spectrum of organizational sizes and sectors, requiring specialized product lines that address distinct operational needs, procurement structures, and aesthetic standards. The primary customer segment remains large multinational corporations (MNCs) in the finance, technology, and consulting industries. These entities require high volumes of premium, ergonomic, and brand-consistent furniture, often engaging in multi-year contract agreements that demand global supply chain capabilities and sophisticated space planning services. Procurement in this segment is highly centralized, focusing on total cost of ownership (TCO), durability, and compliance with corporate sustainability guidelines (LEED, WELL standards).

The secondary, but rapidly growing, customer base consists of Small and Medium-sized Businesses (SMBs) and co-working spaces. SMBs typically purchase through e-commerce or local dealers, prioritizing flexibility, affordability, and quick delivery turnaround times. Co-working operators, such as WeWork and Regus, are volume buyers who demand robust, highly flexible, and stylish furniture that can withstand heavy use and rapid reconfiguration to maximize space utilization and attract freelance and startup clients. Their purchases often lean heavily towards modular systems and collaborative seating that can support diverse working styles in a shared environment.

Beyond the corporate sphere, institutional buyers form a stable and essential segment. This includes government agencies, which procure furniture based on strict tender processes prioritizing compliance and long-term durability; educational institutions (universities, K-12), demanding resilient furniture suited for high traffic and collaborative learning environments; and healthcare facilities (hospitals, clinics), which require specialized, anti-microbial, and easily cleanable furniture that adheres to rigorous health and safety regulations. Manufacturers targeting these institutional segments must emphasize product certifications, warranty periods, and lifecycle costs over purely aesthetic appeal.

- End-User/Buyers of the product:

- Large Multinational Corporations (Finance, Tech, Consulting)

- Small and Medium-sized Enterprises (SMBs)

- Co-working Spaces and Shared Office Providers

- Government and Public Sector Agencies

- Educational Institutions (Higher Education and K-12)

- Healthcare Providers (Hospitals, Clinics, Senior Living)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 75.5 Billion |

| Market Forecast in 2033 | USD 117.8 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Steelcase Inc., Herman Miller (MillerKnoll), Haworth Inc., HNI Corporation, Knoll (MillerKnoll), Okamura Corporation, KOKUYO Co., Ltd., Global Furniture Group, Kimball International, Interstuhl GmbH & Co. KG, Vitra International AG, Godrej & Boyce Mfg. Co. Ltd., Senator Group, Teknion Corporation, Fursys Inc., Kinnarps AB, Bisley Office Furniture, AURORA Corporation, VS America Inc., IKEA (Commercial Division). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Office Furniture Market Key Technology Landscape

The commercial office furniture market is increasingly defined by the integration of technology, moving products beyond mere aesthetic and functional objects into smart, data-gathering assets within the connected workplace. The key technology driver is the embedding of Internet of Things (IoT) sensors within desks, chairs, and partitions. These sensors monitor real-time usage, occupancy levels, ambient temperature, and noise, feeding critical utilization data back to facility management systems. This data empowers organizations to optimize cleaning schedules, adjust HVAC systems, and most importantly, refine space allocation, ensuring every square foot of office space is used efficiently. The adoption of smart furniture significantly improves operational efficiency and validates investment in high-end office fit-outs.

Another dominant technological trend involves advanced manufacturing techniques tailored for customization and material efficiency. Computer Numerical Control (CNC) machinery and robotic assembly lines are standardizing the production of highly complex, modular furniture pieces, allowing for rapid customization (e.g., bespoke finishes, size adjustments) without incurring massive cost penalties associated with traditional bespoke manufacturing. Furthermore, additive manufacturing (3D printing) is being utilized by designers for prototyping and creating specialized, low-volume components, particularly complex joints and ergonomic supports, driving material innovation and reducing waste. These technologies enable manufacturers to respond faster to evolving design trends and specific client requirements.

Crucially, the user experience is being enhanced through integrated power and data solutions, transforming furniture into productive hubs. This includes built-in wireless charging pads, accessible USB-C power outlets integrated directly into desk surfaces and seating, and sophisticated cable management systems that maintain a clean aesthetic while supporting multiple devices. Virtual and Augmented Reality (VR/AR) technologies are playing a massive role in the sales and planning process. Clients can use AR to visualize potential furniture layouts within their actual office space or use VR tools to experience a proposed workspace design, minimizing costly design errors and accelerating the decision-making cycle, thereby streamlining the procurement process significantly.

- IoT Integration: Embedded sensors in seating and desks for real-time occupancy tracking, utilization analysis, and personalized ergonomic adjustments.

- Advanced Manufacturing: Use of CNC machining, robotic assembly, and 3D printing for rapid prototyping, complex component creation, and mass customization.

- Integrated Power and Data: Seamless integration of wireless charging, power outlets, and sophisticated cable management into workstations and conference tables.

- Virtual and Augmented Reality (VR/AR): Utilizing VR for immersive space planning and AR for visualizing furniture placement during the sales cycle.

- Ergonomics Technology: Automated height adjustment mechanisms and smart feedback systems that prompt users to adjust posture or move, driven by software interfaces.

Regional Highlights

North America represents a mature yet highly valuable market, characterized by high adoption rates of ergonomic and premium furniture, largely driven by the dominance of the technology and financial sectors demanding state-of-the-art office environments. The US market, in particular, leads in integrating smart office technology, sustainable practices (e.g., LEED certification requirements), and advanced ergonomic standards (BIFMA). Post-pandemic, demand has shifted significantly towards agile and collaborative furniture to support hybrid models, driving replacement cycles focused on reconfigurable systems and acoustic solutions. Canada follows similar trends, emphasizing quality and design innovation, ensuring sustained growth through high-value sales despite slower volume increases compared to emerging markets. Major manufacturers are headquartered here, setting global design and quality benchmarks.

Asia Pacific (APAC) is undeniably the fastest-growing region globally, primarily due to unprecedented commercial infrastructure development, massive urbanization trends, and the relocation and expansion of global manufacturing and service hubs into countries like China, India, and Southeast Asian nations. These markets are driven by volume and new construction, though increasing economic maturity in countries like Japan and Australia shows a rapid transition towards premium, western-style ergonomic solutions and an intense focus on smart office integration. Governments across APAC are major buyers, investing heavily in modernizing public offices and educational facilities. This region presents vast untapped potential for global furniture manufacturers, though competition from strong local players is intense, necessitating highly localized supply chain strategies.

Europe exhibits high market stability and is defined by strict regulatory adherence to ergonomic and environmental standards (e.g., EU directives on worker health and safety). Western European countries (Germany, UK, France, Scandinavia) prioritize sustainability (FSC, PEFC certifications) and high-quality, long-lasting design, fueling strong demand for European-designed premium brands known for longevity and minimalist aesthetics. Eastern Europe is experiencing growth driven by new corporate centers and outsourcing hubs. The European market leads in the circular economy approach, with strong market acceptance for refurbished and 'furniture-as-a-service' models, emphasizing longevity and resource efficiency over immediate cost savings. This preference for sustainability makes compliance a prerequisite for market entry.

- North America: Market leader in premium ergonomic products and smart office technology integration; strong replacement demand driven by hybrid work reconfiguration.

- Asia Pacific (APAC): Fastest-growing region driven by massive new commercial construction in China and India; increasing shift towards high-quality and smart furniture in mature markets like Japan and Australia.

- Europe: Defined by strict environmental and ergonomic regulations; high demand for certified sustainable products; strong uptake of FaaS and circular economy models.

- Latin America (LATAM): Growth driven by infrastructure spending and expansion of retail/financial sectors in Brazil and Mexico; focus on cost-effective yet durable solutions.

- Middle East & Africa (MEA): Growth tied to diversification efforts (e.g., Saudi Vision 2030, UAE investment); significant demand for luxury, bespoke office fit-outs and government projects.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Office Furniture Market.- Steelcase Inc.

- Herman Miller (MillerKnoll)

- Haworth Inc.

- HNI Corporation

- Knoll (MillerKnoll)

- Okamura Corporation

- KOKUYO Co., Ltd.

- Global Furniture Group

- Kimball International

- Interstuhl GmbH & Co. KG

- Vitra International AG

- Godrej & Boyce Mfg. Co. Ltd.

- Senator Group

- Teknion Corporation

- Fursys Inc.

- Kinnarps AB

- Bisley Office Furniture

- AURORA Corporation

- VS America Inc.

- IKEA (Commercial Division)

Frequently Asked Questions

Analyze common user questions about the Commercial Office Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving current growth in the Commercial Office Furniture Market?

The primary factor driving current market growth is the widespread global adoption of hybrid and activity-based working (ABW) models. This necessitates significant investment in flexible, reconfigurable, and modular furniture systems (like acoustic pods and mobile workstations) designed to support varied employee needs and maximize space efficiency in reduced office footprints. Corporate focus on employee well-being and advanced ergonomics further compels upgrades.

How is sustainability impacting material selection and procurement processes?

Sustainability is now a critical prerequisite, not a differentiator. Customers increasingly demand products with environmental certifications (FSC, BIFMA level), pushing manufacturers to prioritize recycled plastics, reclaimed wood, and low-VOC finishes. Procurement processes are heavily weighted toward suppliers demonstrating transparent, circular economy practices, including product take-back and refurbishment services, thereby reducing lifecycle carbon footprints.

Which product segment offers the highest growth potential in the forecast period?

The collaborative furniture and acoustic solutions segment exhibits the highest growth potential. As open-plan offices persist and hybrid teams require dedicated meeting and focused zones, demand for soundproof office pods, modular meeting tables, and technological integration within lounge settings is rapidly outpacing traditional fixed workstations and storage units.

What role does IoT technology play in modern commercial office furniture?

IoT technology is crucial for optimizing the smart office. Sensors embedded in furniture track real-time occupancy and utilization rates, providing facility managers with data to dynamically allocate resources, adjust HVAC systems, and inform future space planning decisions. This data integration transforms furniture into an active component of operational efficiency and personalized workplace management.

Why is the Asia Pacific region projected to be the fastest-growing market?

The Asia Pacific region is fueled by unprecedented growth in commercial real estate development, particularly in emerging economies (China, India, Southeast Asia). Rapid urbanization, extensive foreign direct investment, and massive infrastructural projects, coupled with a growing corporate focus on employee experience, collectively drive high-volume demand for new office fit-outs and furniture systems.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager