Commercial Overhead Doors Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432557 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Commercial Overhead Doors Market Size

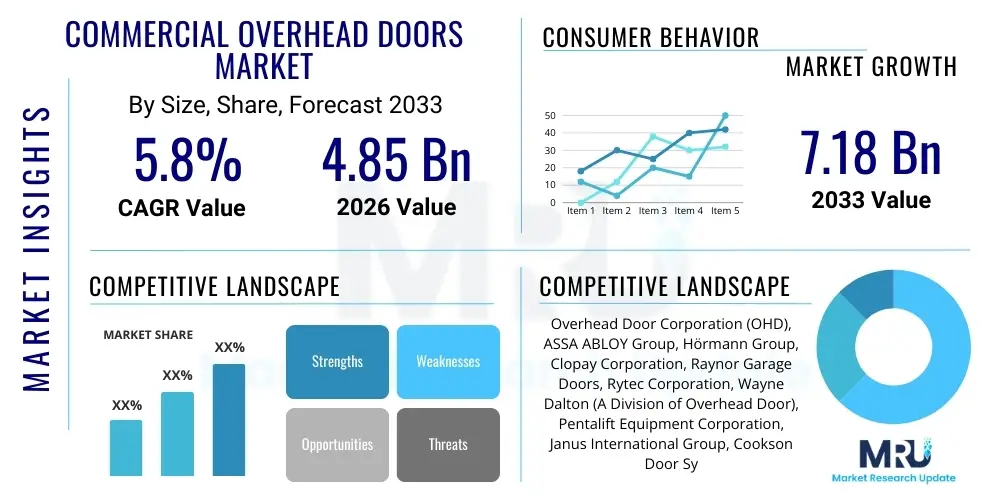

The Commercial Overhead Doors Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.85 Billion in 2026 and is projected to reach USD 7.18 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating globalization of supply chains, the burgeoning expansion of e-commerce infrastructure, and the subsequent demand for sophisticated, high-performance doors in warehousing, logistics, and manufacturing facilities globally. Modern commercial overhead doors are increasingly viewed not merely as security barriers but as integral components of operational efficiency and climate control systems, driving investment across developed and emerging economies.

Commercial Overhead Doors Market introduction

The Commercial Overhead Doors Market encompasses the design, manufacture, and installation of large-scale access systems utilized primarily in commercial and industrial settings, including sectional doors, rolling steel doors, high-speed doors, and fire-rated options. These products are crucial for maintaining operational workflow, ensuring physical security, and managing thermal efficiency across a diverse range of facilities such as distribution centers, heavy manufacturing plants, specialized healthcare logistics hubs, and large retail outlets. The functional complexity of these doors often involves integration with advanced features like automated sensors, robust insulation packages, and specialized material construction (e.g., aluminum, galvanized steel, composite panels) to meet stringent performance requirements demanded by modern industrial applications.

Major applications of commercial overhead doors span logistics and transportation (warehouses, loading docks), manufacturing (factory access, internal bay separation), automotive service centers, and agricultural facilities. The principal benefits derived from deploying high-quality overhead doors include enhanced thermal efficiency, which significantly reduces energy costs; superior security against unauthorized access; improved operational speed, particularly with high-performance rapid roll-up doors that minimize cycle times; and adherence to stringent safety regulations through integrated features like photoelectric sensors and break-away mechanisms. These doors serve as critical interfaces between internal and external environments, necessitating durability and reliability under high-frequency use.

The market growth is fundamentally driven by several macro-economic and industrial factors. Key among these are the robust expansion of the global e-commerce sector, which necessitates continuous investment in new mega-warehouses and fulfillment centers requiring numerous loading dock and access points. Furthermore, increasing infrastructure spending globally, particularly in industrial revitalization and expansion projects, acts as a significant catalyst. The emphasis on sustainable construction and energy conservation standards compels businesses to upgrade existing, outdated door systems with highly insulated and IoT-enabled smart doors, thereby stimulating the replacement market and promoting innovation in door panel technology and operational mechanisms.

Commercial Overhead Doors Market Executive Summary

The Commercial Overhead Doors Market is defined by intense competition and rapid technological evolution, moving away from purely mechanical solutions toward integrated smart access systems. Current business trends indicate a strong inclination towards automation, with motorized and high-speed doors dominating new installations, driven by the need for faster cycle times and reduced labor interaction in automated logistics facilities. Key industry players are focusing heavily on developing robust insulation technologies, such as advanced polyurethane foaming and thermal breaks, to capitalize on global mandates for energy efficient building envelopes. Furthermore, consolidation activities, including strategic acquisitions and partnerships, are prevalent as manufacturers seek to expand their geographic footprint, particularly in rapidly urbanizing regions, and diversify their product portfolios to include specialized industrial applications like cleanrooms and cold storage facilities.

Regional trends reveal that North America and Europe currently represent mature, high-value markets, characterized by high replacement rates, rigorous safety standards (like stringent fire safety codes), and demand for premium, customized, and durable products. Conversely, the Asia Pacific (APAC) region, spearheaded by rapid industrialization in countries like China, India, and Southeast Asia, is poised for the fastest expansion. This growth in APAC is primarily volume-driven, fueled by massive investment in manufacturing capacity expansion, the establishment of vast logistics parks, and accelerated urbanization efforts that require fundamental commercial infrastructure development. The Middle East and Africa (MEA) are also showing promising growth, attributed to diversification strategies away from oil dependence, leading to investments in non-oil industrial sectors and transportation infrastructure.

Segmentation trends highlight a pronounced shift towards high-performance and specialty doors. While traditional rolling steel and standard sectional doors maintain steady demand, the high-speed door segment (including rolling fabric and rigid panel designs) is experiencing disproportionately high growth due to its critical role in maintaining temperature differentials and improving material flow in highly active distribution centers. Operationally, the motorized and automated segment continues to gain market share over manual operation, reflecting broader industry efforts toward automation and integration with warehouse management systems (WMS). Additionally, the focus on sustainable and corrosion-resistant materials, such as aluminum and fiberglass composites, is rising, particularly in food processing and coastal industrial environments where longevity and hygiene are paramount considerations.

AI Impact Analysis on Commercial Overhead Doors Market

Common user questions regarding AI’s impact on commercial overhead doors typically revolve around how artificial intelligence can enhance predictive maintenance schedules, improve security protocols, optimize door operational cycles for energy savings, and seamlessly integrate access control systems with broader industrial IoT networks. Users are concerned about the practicality and cost-effectiveness of implementing AI-driven monitoring systems, the required sensor technology upgrades, and the ability of AI algorithms to accurately diagnose potential mechanical failures before they lead to costly downtime. Furthermore, there is significant interest in AI’s role in automating loading dock processes, potentially using vision systems for autonomous vehicle (AGV/AMR) interaction and safety verification, indicating a core expectation that AI will transition these systems from reactive maintenance assets to proactive, intelligent components of the supply chain infrastructure.

AI algorithms are being leveraged to process real-time data streaming from integrated door sensors (e.g., cycle count, motor temperature, spring tension). This data is analyzed to create predictive models that accurately forecast the remaining useful life (RUL) of critical components like springs, cables, and motors. This shift from time-based or reactive maintenance to predictive maintenance significantly reduces unforeseen downtime, minimizes repair costs, and maximizes operational continuity, which is critical in high-throughput logistics environments. Moreover, AI-driven energy management systems can learn facility traffic patterns and ambient conditions, adjusting door opening heights and cycle speeds optimally to minimize conditioned air loss, thereby improving the overall energy performance of the facility envelope.

In terms of security and access control, AI is enabling sophisticated identity verification and object detection at the door interface. Vision systems powered by machine learning can verify whether a vehicle or person has the appropriate clearance, detect foreign objects that could obstruct door operation, or identify safety breaches such as tailgating or misuse. This intelligent monitoring goes beyond simple sensor inputs, offering contextual awareness that enhances both security integrity and operational safety, especially when interfacing with autonomous material handling equipment. As connectivity standards improve, AI's role in coordinating door operations within complex WMS environments will become central to achieving true supply chain automation.

- Enhanced Predictive Maintenance: AI analyzes vibration, cycle, and temperature data to forecast component failure, drastically reducing unexpected downtime.

- Optimized Energy Consumption: Machine learning algorithms adjust opening times and speeds based on traffic flow and real-time climate data to minimize thermal loss.

- Advanced Access Control: AI-powered vision systems enable secure, context-aware verification of personnel and autonomous vehicles (AGVs/AMRs).

- Integration with WMS/IoT: Facilitates seamless coordination of door operations with automated material handling systems and broader logistics networks.

- Improved Safety and Compliance: Real-time anomaly detection identifies potential safety hazards, obstructions, or non-compliance during operation.

- Automated Diagnostics: Remote diagnostic capabilities are enhanced through AI, allowing manufacturers to service and troubleshoot complex issues remotely.

DRO & Impact Forces Of Commercial Overhead Doors Market

The dynamics of the Commercial Overhead Doors Market are shaped by a complex interplay of positive growth drivers, constraining factors, and strategic opportunities. The foremost driver is the inexorable expansion of the global e-commerce ecosystem, which mandates continuous construction and modernization of large-scale logistics and distribution facilities, inherently increasing demand for reliable, high-cycle overhead doors. Simultaneously, global regulatory pressure demanding enhanced thermal efficiency in commercial buildings compels businesses to invest in high-R-value insulated doors, pushing manufacturers toward material innovation. The growing trend of automation in manufacturing and warehousing also requires doors that can interface seamlessly with robotic systems and operate at high speeds, further fueling demand for specialized products like high-performance fabric doors.

However, the market faces significant restraints, including the substantial initial capital investment required for installing advanced, highly specialized overhead door systems, particularly high-speed or integrated smart doors, which can deter smaller enterprises or those with tighter operational budgets. Furthermore, the specialized nature of installation and maintenance, coupled with a shortage of trained, certified technicians, presents a logistical challenge that can impact service quality and long-term product reliability. Economic volatility, particularly in infrastructure spending and commercial real estate development in certain regions, can temporarily suppress demand for new construction projects, impacting market volume growth despite resilient replacement demand in established regions.

Opportunities for market players are abundant in the domains of sustainability and connectivity. Developing doors manufactured from recycled or highly sustainable materials, and doors designed for superior energy performance, allows companies to capture environmentally conscious segments. Moreover, the integration of doors with IoT platforms, providing real-time performance monitoring, remote diagnostics, and automated operation linked to facility management systems, represents a crucial growth vector, transforming doors into data-generating assets. The increasing need for sophisticated climate-controlled environments (e.g., pharmaceutical logistics, cold chain) also creates niche opportunities for specialized insulated and airtight sealing door systems. These forces collectively dictate market trajectory, favoring innovation in performance, safety, and digital integration.

Segmentation Analysis

The Commercial Overhead Doors Market is comprehensively segmented based on critical technical and application parameters, allowing for precise market sizing and strategic targeting. Key segmentation categories include the Material utilized (e.g., steel, aluminum, fiberglass), which impacts durability and thermal performance; the Application or end-use environment (e.g., Warehouse/Logistics, Manufacturing, Retail); the Operation Type (Manual, Motorized, Automatic/Sensor-driven); and the specific Design or Type (Sectional, Rolling Steel, High-Speed Doors, Specialty Doors). Analyzing these segments reveals shifting preferences toward lightweight yet durable materials like aluminum for high-speed applications and the persistent dominance of heavy-duty galvanized steel for traditional security-focused rolling doors in industrial settings. The underlying purpose of segmentation analysis is to understand how functional demands translate into product requirements across different commercial verticals, guiding product development and marketing efforts.

The segment differentiation highlights the critical role of the product type in determining operational efficiency. High-speed doors, for instance, are essential in facilities with high-frequency traffic and strict climate control needs, such as refrigerated storage or pharmaceutical manufacturing, commanding a premium price point and high growth rate. Conversely, the motorized operation segment captures the largest market value, reflecting the pervasive trend of automation across all commercial infrastructures seeking to improve labor efficiency and safety compliance. Furthermore, the segmentation by end-user application demonstrates differential demand patterns; the logistics sector demands resilience and speed, whereas manufacturing often requires fire-rated and highly secure rolling doors, necessitating customized solutions from vendors.

Strategic analysis must delve into sub-segments, such as insulated vs. non-insulated doors, and standard lift vs. high-lift or vertical lift mechanisms, as these factors directly correlate with energy efficiency goals and building envelope constraints. The market's future growth hinges on the Motorized/Automatic segment, particularly those doors integrated with sophisticated safety and monitoring sensors, fulfilling the increasing industrial focus on safety regulations and operational data logging. This granularity in segmentation provides manufacturers with the necessary intelligence to allocate resources towards high-growth areas, such as composite material research for lightweight sectional doors and the development of IoT-enabled motor control systems.

- By Type:

- Sectional Overhead Doors

- Rolling Steel Doors/Coiling Doors

- High-Speed Doors (Rigid and Fabric)

- Fire-Rated Doors

- Traffic Doors (Swing Doors)

- By Material:

- Steel (Galvanized and Stainless)

- Aluminum

- Fiberglass and Composites

- Wood (Limited Industrial Use)

- By Operation:

- Manual

- Motorized (Electric Operation)

- Automatic (Sensor/Radar Activated)

- By End-User Application:

- Warehousing and Logistics

- Manufacturing and Industrial Facilities

- Retail and Automotive Service Centers

- Healthcare and Pharmaceutical Logistics

- Food & Beverage and Cold Storage

- Energy and Utilities

Value Chain Analysis For Commercial Overhead Doors Market

The value chain for the Commercial Overhead Doors Market begins with upstream activities focused on raw material procurement and component manufacturing. Upstream analysis primarily involves securing bulk quantities of galvanized steel, aluminum extrusions, proprietary foam insulation materials (polyurethane or polyisocyanurate), high-tensile spring steel for torsion mechanisms, and specialized electronic components for motor and control units. Price volatility in base metals like steel and aluminum significantly influences the upstream cost structure, requiring manufacturers to engage in robust hedging strategies or establish long-term supply agreements. Key upstream stakeholders include steel mills, aluminum suppliers, and specialized component manufacturers focused on door hardware like rollers, tracks, and hinges. Efficiency gains at this stage are crucial, focusing on minimizing material waste and negotiating favorable commodity pricing for large-volume production runs.

The midstream phase involves the core manufacturing process, encompassing panel fabrication, assembly of door sections, integration of operating mechanisms (motors, gears, and control boards), and rigorous quality assurance testing for safety and performance compliance (e.g., wind load ratings, cycle durability). Manufacturers typically operate highly automated fabrication lines to achieve precision and scale, often specializing in either traditional sectional doors or complex high-speed mechanisms. Distribution channels represent a critical link between manufacturing and the downstream end-user. Distribution is bifurcated into direct sales channels, typically utilized for large, custom industrial projects requiring specialized engineering input, and indirect channels relying on an extensive network of independent dealers, authorized distributors, and certified installation companies that handle sales, customization, installation, and essential post-sale maintenance services for localized markets. The selection of distribution method is often dependent on project complexity and regional geographic density.

Downstream activities center on installation, post-sale service, repair, and ongoing maintenance contracts, which are vital for generating recurring revenue and maintaining long-term customer relationships. Installation requires highly skilled labor due to the large size, weight, and complex wiring of commercial systems. Potential customers (end-users) include large-scale logistics operators, industrial property developers, and facilities managers responsible for maintaining operational efficiency. The downstream market emphasizes responsive service and parts availability, making authorized dealers who can offer 24/7 emergency repair services highly valuable. The direct channel offers greater control over branding and pricing, while the indirect channel provides wider market penetration, especially for replacement and smaller refurbishment projects, highlighting the importance of managing channel conflict and supporting dealer networks with comprehensive training and certification programs.

Commercial Overhead Doors Market Potential Customers

Potential customers in the Commercial Overhead Doors Market are characterized by organizations requiring frequent, secure, and climate-controlled access for materials, vehicles, and personnel in high-traffic commercial environments. The primary end-users are large-scale logistics and warehousing operators, driven by the need for high-speed, durable doors at loading docks to handle massive throughput associated with modern supply chain demands and e-commerce fulfillment. These customers prioritize minimal downtime, energy efficiency (high insulation values), and integration capabilities with WMS and dock management systems. Investment decisions are heavily influenced by Total Cost of Ownership (TCO), focusing on reliability and long-term maintenance costs over initial purchase price, leading to high demand for premium, robust products like insulated sectional doors and rapid-roll fabric doors.

Another major customer segment resides within the manufacturing and heavy industrial sectors, including automotive assembly, aerospace, and general fabrication plants. These facilities demand specialized doors that can withstand harsh environments, provide necessary fire separation (fire-rated coiling doors), or accommodate oversized loads, often requiring highly customized lift mechanisms (vertical lift, high lift). Security and physical separation are paramount here, driving demand for heavy-duty rolling steel doors. Furthermore, specialized industries like food and beverage processing, and cold chain logistics, represent lucrative potential customers requiring high hygiene standards, resistance to corrosive washdowns, and exceptional thermal sealing capabilities, leading to the adoption of stainless steel or composite doors with tight sealing features to prevent contamination and control extreme temperatures.

The third substantial group includes commercial developers, property management companies, and large retail chains that operate service bays, mall receiving areas, and general commercial storage facilities. While their door cycle requirements may be lower than those in dedicated logistics hubs, they prioritize aesthetics, ease of maintenance, and compliance with local building codes, including those related to wind load and accessibility standards. These customers often procure doors through indirect distributor channels, relying on local expertise for rapid installation and standardized maintenance agreements. Targeting these diverse end-user profiles requires manufacturers to maintain a broad product portfolio, offering solutions ranging from basic steel coiling doors to technologically advanced, high-performance insulated sectional systems.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.85 Billion |

| Market Forecast in 2033 | USD 7.18 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Overhead Door Corporation (OHD), ASSA ABLOY Group, Hörmann Group, Clopay Corporation, Raynor Garage Doors, Rytec Corporation, Wayne Dalton (A Division of Overhead Door), Pentalift Equipment Corporation, Janus International Group, Cookson Door Systems, Loading Dock Systems, Pioneer Industrial Doors, Alutech Group, Kinro Manufacturing, TKO Dock Doors, DMF International, Crown Industrial, TNR Doors, Flexon Inc., Manusa Automatic Doors. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Overhead Doors Market Key Technology Landscape

The technological evolution within the Commercial Overhead Doors Market is driven primarily by the need for increased speed, enhanced safety, superior thermal performance, and seamless digital integration. A pivotal technological trend involves the deployment of advanced Internet of Things (IoT) sensors and connectivity modules embedded within the door's motor and control systems. These systems enable real-time monitoring of operational parameters, including cycle counts, current draw, motor temperature, and overall mechanical health. This data is transmitted to cloud-based platforms, facilitating remote diagnostics and enabling sophisticated predictive maintenance protocols, thereby maximizing uptime and reducing operational costs for facility managers. Furthermore, the adoption of variable frequency drive (VFD) technology in motors is becoming standard, ensuring smooth acceleration and deceleration of the door curtain, which minimizes wear and tear, reduces noise, and allows for precise speed control necessary for high-performance operations.

Safety technology remains a key area of innovation, extending beyond traditional mechanical safety edges and requiring sophisticated, non-contact detection methods. Modern commercial doors, particularly high-speed variants, increasingly incorporate advanced radar and infrared sensors (photo eyes) capable of creating complex detection fields around the doorway. These systems are programmed to differentiate between personnel, forklifts, and objects, enabling adaptive response actions such, as slowing the door or stopping its descent immediately upon intrusion detection, significantly enhancing workplace safety and reducing costly damage caused by accidental collisions. The integration of magnetic loop detectors and specialized remote controls further streamlines the high-speed operation, allowing for tailored access control based on vehicle type or clearance level, minimizing unnecessary door cycles and supporting optimal workflow efficiency within the facility.

Material science and insulation technology are also advancing rapidly to meet stringent energy codes and demanding environmental specifications, especially in cold storage and pharmaceutical logistics. Manufacturers are developing multi-layered sectional doors utilizing high-density, closed-cell polyurethane foam cores with integrated thermal breaks to achieve high R-values (thermal resistance), far surpassing traditional non-insulated steel panels. In the high-speed door segment, the use of highly durable, fire-retardant PVC and specialized composite fabrics ensures both speed and environmental separation. Furthermore, the development of robust, corrosion-resistant hardware, often featuring stainless steel components or specialized coatings, addresses the longevity challenge in harsh industrial environments such as car wash facilities, wastewater treatment plants, and coastal industrial zones, ensuring extended operational life under extreme conditions and supporting higher lifecycle value propositions.

Regional Highlights

- North America: This region represents a mature and technologically advanced market characterized by high demand for replacement and retrofit projects, driven by stringent energy efficiency codes and a massive established base of distribution centers and manufacturing facilities. The U.S. and Canada prioritize premium, high-speed doors and highly insulated sectional doors (high R-value) to mitigate severe weather conditions and reduce operating expenses. Market growth is sustained by the continuous expansion of e-commerce logistics infrastructure and significant investment in smart building technologies, favoring vendors that offer integrated, IoT-enabled access solutions and comprehensive service networks.

- Europe: The European market is highly regulated, placing significant emphasis on safety, fire protection standards (e.g., CE marking requirements), and sustainability (Green Building initiatives). Demand is strong for specialized applications, including fire-rated rolling doors and insulated doors tailored for cold chain logistics and food processing, especially in Germany, the UK, and France. Manufacturers in this region often focus on design optimization, incorporating aesthetic appeal even for industrial applications, and providing customized solutions that comply with diverse national technical specifications and high-level performance mandates.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by explosive urbanization, massive infrastructure spending, and the relocation of global manufacturing activities. Countries like China, India, and Southeast Asian nations are investing heavily in new industrial parks, logistics hubs, and automobile manufacturing plants, generating enormous volume demand for both standard rolling steel doors and high-performance sectional units. While cost-sensitivity remains a factor, increasing awareness of energy efficiency and operational safety is beginning to shift demand towards higher-quality, sophisticated doors, particularly among multinational corporations establishing bases in the region.

- Latin America (LATAM): The LATAM market, particularly Brazil and Mexico, exhibits steady growth linked to local industrial expansion and improving international trade infrastructure. The market is primarily price-sensitive, with a preference for durable, simple rolling steel doors for security applications. However, modernization efforts in key urban logistics corridors are gradually introducing higher-performance products. Political and economic stability fluctuations often influence the pace of new construction, making replacement and renovation projects a more reliable segment in certain countries.

- Middle East and Africa (MEA): Growth in the MEA region is closely tied to economic diversification efforts, large-scale infrastructural projects (e.g., ports, specialized industrial cities), and the development of temperature-sensitive storage facilities required for cold chain management in extreme climates. Demand centers around highly durable, corrosion-resistant doors for coastal and desert environments, and fire-rated solutions. Government initiatives and investments in the logistics sector, such as those in the UAE and Saudi Arabia, are crucial drivers for market upliftment, focusing on premium security and cooling retention features.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Overhead Doors Market.- ASSA ABLOY Group

- Overhead Door Corporation (OHD)

- Hörmann Group

- Clopay Corporation

- Rytec Corporation

- Wayne Dalton (A Division of Overhead Door)

- Raynor Garage Doors

- Pentalift Equipment Corporation

- Janus International Group

- Cookson Door Systems

- Loading Dock Systems

- TNR Doors

- Pioneer Industrial Doors

- Alutech Group

- Kinro Manufacturing

- TKO Dock Doors

- Flexon Inc.

- Crown Industrial

- DMF International

- Manusa Automatic Doors

Frequently Asked Questions

Analyze common user questions about the Commercial Overhead Doors market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driving factor for the growth of the Commercial Overhead Doors Market?

The predominant driver is the global expansion of e-commerce and logistics infrastructure, necessitating the construction and modernization of large fulfillment and distribution centers that require high-cycle, durable, and energy-efficient overhead doors for loading dock operations.

Which type of commercial overhead door is currently experiencing the fastest growth?

The High-Speed Door segment, including both rigid and fabric panel designs, is showing the fastest growth. This is due to its critical role in optimizing workflow, reducing air exchange for climate control, and enhancing efficiency in high-traffic industrial and cold storage environments.

How is IoT technology impacting the functionality of commercial overhead doors?

IoT integration allows for real-time performance monitoring, remote diagnostics, and predictive maintenance scheduling by collecting operational data like cycle counts and motor health. This reduces unexpected downtime and optimizes door performance through connectivity with facility management systems.

What are the most important considerations for choosing a commercial overhead door for cold storage applications?

Key considerations include superior insulation (high R-value), the integration of thermal breaks to minimize heat transfer, airtight sealing mechanisms to prevent frost buildup, and the use of high-speed operation to limit exposure time during cycles.

Which geographical region holds the greatest market potential for commercial overhead door manufacturers?

The Asia Pacific (APAC) region, specifically driven by rapid industrialization, massive investments in manufacturing expansion, and burgeoning logistics infrastructure, is projected to exhibit the highest growth rate and volume potential in the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager