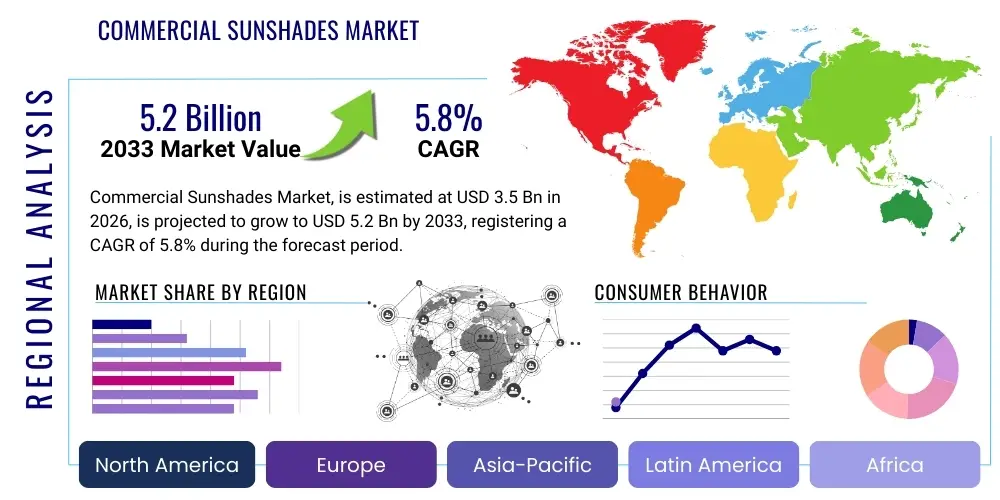

Commercial Sunshades Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436723 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Commercial Sunshades Market Size

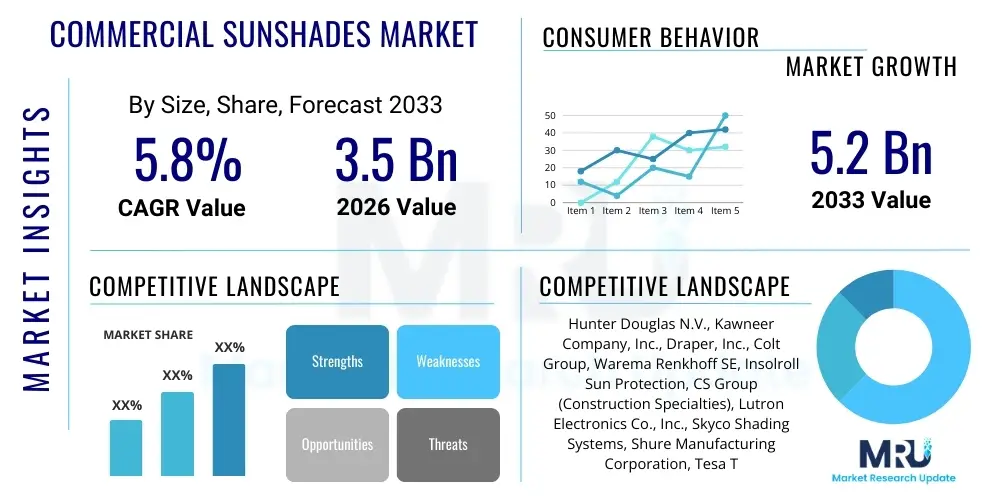

The Commercial Sunshades Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033.

Commercial Sunshades Market introduction

The Commercial Sunshades Market encompasses the manufacturing, distribution, and installation of fixed or retractable exterior solar control systems designed for non-residential buildings, including offices, retail centers, educational institutions, healthcare facilities, and hospitality venues. These architectural elements, often integrating louvers, screens, awnings, or specialized facade systems, serve a critical dual purpose: enhancing the aesthetic appeal of modern architecture while significantly improving building energy performance and occupant comfort. The escalating global focus on sustainable construction practices and stringent energy efficiency regulations, such as those promoted by LEED, BREEAM, and various national building codes, are key accelerators driving the adoption of high-performance sunshading solutions across major developed and emerging economies. The fundamental function of these systems is to mitigate solar heat gain, which is the primary contributor to excessive cooling demands in glazed commercial structures, thereby directly influencing a building's operational expenditure and carbon footprint.

Product categories within this market range from simple fixed horizontal or vertical aluminum louvers, engineered for static shading performance, to sophisticated automated systems integrated with Building Management Systems (BMS) that adjust dynamically based on solar incidence angles and internal climate data. Major applications include new commercial construction projects, where sunshades are often specified as integral components of the building envelope design from the outset, particularly those aiming for superior environmental certifications. Crucially, the market also serves the burgeoning retrofit sector, where existing commercial buildings, often built before modern energy standards, seek facade upgrades to significantly reduce cooling loads and enhance interior light quality without compromising the building's structural integrity or daily operations. The demand for aesthetically pleasing and functionally optimized solutions requires manufacturers to offer extensive customization in terms of material, color, span, and integration complexity, moving away from standardized products towards bespoke architectural solutions.

The primary benefits realized by commercial entities implementing these systems include reduced operational energy costs, which often translate into millions in savings over the lifespan of a large commercial tower. Furthermore, sunshades improve occupant health and productivity by offering superior daylighting control, preventing screen glare, and maintaining stable internal temperatures. This focus on tenant well-being is increasingly critical in competitive commercial leasing markets. The market momentum is further amplified by technological integration, specifically the incorporation of sensors, actuators, and advanced control algorithms that allow sunshades to dynamically adjust based on solar orientation, local weather conditions, and even building occupancy profiles. This transformation elevates sunshades from mere passive components to active, intelligent components of the overall high-efficiency building system, cementing their status as essential infrastructure in resilient and environmentally responsible commercial architecture worldwide.

Commercial Sunshades Market Executive Summary

The Commercial Sunshades Market trajectory is defined by a strong convergence of sustainability mandates, technological innovation, and infrastructural growth, creating a highly competitive landscape focused on optimized thermal performance and architectural integration. Current business trends indicate a definitive shift towards customized, high-performance systems over standard, off-the-shelf products, driven by the specialized needs of large commercial complexes requiring precise solar control solutions across different cardinal orientations of the building facade. Key industry participants are investing heavily in lightweight, maintenance-free materials and smart automation capabilities, positioning dynamic sunshades as critical infrastructure elements that contribute measurably to a building's net-zero goals. The dominant trend involves the integration of sunshades within prefabricated, unitized facade systems, streamlining the construction process, ensuring quality consistency, and improving installation efficiency on massive skyscraper projects globally.

Regionally, Asia Pacific is emerging as the dominant market driver in terms of volume, fueled by massive, ongoing investment in commercial real estate development and rapid urbanization, particularly in high-density areas where cooling demand is critically intense. Conversely, North America and Europe lead in the adoption of advanced, automated, and IoT-enabled shading technologies, driven by established, rigorous green building standards and high regulatory penalties for non-compliance with energy efficiency benchmarks. Segment trends highlight the persistent demand for the Type (Fixed Sunshades) category due to their structural simplicity and cost-effectiveness, especially in regions with consistent solar paths. Simultaneously, the Mechanism (Automated) segment is experiencing the fastest growth, reflecting the industry's pivot toward active facade management required to meet modern building performance specifications and tenant expectations for optimized environmental control.

The overall market outlook remains robust, underpinned by legislative support for energy conservation across developed nations and the rising financial impetus for reduced operational expenditure globally. While challenges related to the complexity of integrating highly customized solutions and the high initial capital investment persist, manufacturers are strategically addressing these hurdles through modular design and lifecycle costing models that clearly demonstrate rapid Return on Investment (ROI) via energy savings. The competitive structure is moving towards holistic solution provision, where successful enterprises offer not just the hardware but also the software integration and long-term predictive maintenance services, fostering strategic alliances between shading manufacturers, control system developers, and large-scale general contractors to deliver comprehensive, high-efficiency building envelope solutions.

AI Impact Analysis on Commercial Sunshades Market

Common user questions regarding AI's impact on the Commercial Sunshades Market frequently revolve around the potential for truly autonomous energy management, how AI systems justify their higher implementation cost, and the specifics of predictive maintenance capabilities. Users are particularly interested in how advanced AI algorithms can leverage vast data sets—including hyper-local microclimate readings, internal occupancy sensors, and historical energy performance records—to move beyond simple reactive adjustments. The consensus expectation is that AI will introduce optimization layers that far exceed traditional rule-based or scheduled automation. Concerns focus on data security, system uptime, and the need for standardized communication protocols to ensure seamless interoperability between proprietary AI shading control systems and existing legacy Building Management Systems (BMS). This shift signifies the transformation of sunshades from passive building components to active, intelligent subsystems that contribute dynamically and proactively to a building's complex thermal and lighting strategy.

- AI-driven predictive control systems utilize machine learning models to anticipate solar heat gain and glare based on forecasted weather patterns, cloud cover density, and seasonal solar geometry, enabling proactive adjustment of sunshade position for maximum energy savings.

- Optimization of daylight harvesting algorithms via AI ensures that sunshades maximize the use of natural light penetration into the building core while simultaneously preventing direct glare, achieving the delicate balance required for occupant comfort and reduced artificial lighting costs.

- AI facilitates predictive maintenance schedules by continuously analyzing operational sensor data (e.g., motor torque, cycle counts, positional accuracy) from mechanized sunshades, identifying subtle anomalies indicative of component wear before critical failure occurs, significantly enhancing system reliability and reducing unforeseen downtime.

- Integration with advanced Building Information Modeling (BIM) platforms allows AI to validate and refine the thermal performance of sunshade designs during the conceptual phase, simulating millions of operational scenarios to ensure peak performance upon construction.

- AI-enabled fault detection and diagnostics (FDD) systems provide instantaneous alerts regarding sensor malfunctions or motor errors, drastically reducing the time required for maintenance technicians to identify and rectify operational issues in complex facade systems.

DRO & Impact Forces Of Commercial Sunshades Market

The dynamics of the Commercial Sunshades Market are powerfully influenced by a set of interrelated Drivers, Restraints, and Opportunities (DRO), which collectively shape investment decisions, product development, and geographic focus. The primary drivers are deeply rooted in the global imperative for energy conservation, explicitly mandated through government regulations and industry standards requiring verifiable improvements in building thermal performance. For instance, the enforcement of nearly zero-energy building (NZEB) standards in various regions compels commercial developers to adopt high-efficiency facade technologies, making external solar control a non-negotiable design component. Furthermore, the driver of increasing public and corporate awareness regarding climate change and corporate social responsibility (CSR) drives demand for certified green building materials and systems, ensuring sustained market growth regardless of short-term economic fluctuations. The measurable Return on Investment (ROI) derived from significant reductions in electricity bills acts as a fundamental economic accelerator for system adoption.

This positive momentum is counterbalanced by significant restraints, primarily revolving around the high initial capital expenditure required for installing technologically advanced and customized facade shading systems. These specialized installations, particularly those involving automated controls and bespoke large-span structures, command a substantial premium compared to conventional internal shading options. The complexity of integration with diverse architectural styles and the structural requirements for mounting heavy external systems, especially on high-rise structures where wind load considerations are critical, introduce engineering challenges and associated costs. Additionally, the lack of standardized regulatory frameworks across different geographies regarding testing and certification of solar control performance can occasionally lead to inconsistencies and reluctance among smaller developers to invest in systems where performance assurances are difficult to quantify pre-installation.

However, substantial opportunities exist to overcome these restraints and sustain robust growth. The vast potential of the retrofit market, targeting the massive inventory of existing, energy-inefficient commercial building stock worldwide, represents a continuous growth channel. Manufacturers are capitalizing on this by developing modular, easily installable systems designed specifically for facade rehabilitation projects, minimizing structural modification needs. Furthermore, the opportunity created by technological advancement—particularly the continued refinement of smart controls, predictive maintenance using IoT, and the incorporation of integrated building-applied photovoltaics (BAPV) into sunshades—is opening new high-value market niches. This focus on providing comprehensive, data-driven energy solutions positions the sunshade industry to transition from a mere construction component supplier to a critical provider of high-performance, energy-generating facade solutions, ensuring long-term market expansion and technological differentiation based on measurable performance indicators.

Segmentation Analysis

The Commercial Sunshades Market is meticulously segmented based on Type, Material, Mechanism, and Application, providing a detailed framework for understanding market dynamics and targeted growth strategies. This granular approach helps manufacturers tailor their product offerings and distribution channels to specific end-user requirements, ranging from high-security government buildings to aesthetically driven hospitality complexes. Analyzing these segments is crucial for identifying areas of high growth, such as automated systems and high-performance materials like composites, which are increasingly favored over traditional fixed aluminum structures in premium developments. The differentiation between fixed and operable systems is fundamental, with fixed solutions offering structural simplicity, superior wind resistance, and lower lifecycle cost, while operable systems provide optimal dynamic solar control and enhanced occupant interface flexibility, justifying their higher initial investment.

The segmentation across materials is key to determining durability, thermal performance, and aesthetic outcome. Aluminum remains the dominant material due to its longevity, high recyclability, and architectural flexibility, particularly for large louver systems capable of spanning significant distances. However, the fabric segment, utilizing high-tensile, durable technical textiles, is rapidly growing, especially for large retractable awning and facade screen applications where light diffusion, view-through visibility, and wind resistance are key performance priorities. Composite materials, such as fiberglass and high-density polymers, offer superior insulation properties and greater design freedom for bespoke architectural forms, appealing to projects targeting the highest sustainability ratings. The Material segment’s evolution reflects the architectural trend towards lighter, more resilient, and non-corrosive building materials that reduce the overall structural load on the facade.

Furthermore, the segmentation by mechanism—Manual, Motorized, and Automated—highlights the market’s accelerating technological maturity. The shift towards Automated/Integrated Systems is the most significant trend, fueled by the demand for smart, responsive buildings capable of self-adjusting their external envelope. These automated systems leverage advanced sensors and sophisticated proprietary algorithms, often integrating AI functionality, to make proactive adjustments, maximizing energy savings and occupant comfort without manual intervention. The application segment underscores market demand concentration, with Office Buildings consistently holding the largest share due to vast glazed areas, extended operating hours, and the critical link between thermal comfort and quantifiable worker productivity and well-being. Retail centers and large-scale hospitality venues follow closely, where the need to manage interior light quality, protect merchandise, and maintain a high-end, comfortable customer environment drives investment in premium shading solutions.

- Type: Fixed Sunshades, Retractable/Operable Sunshades.

- Material: Aluminum, Fabric (Tensile Structures), Wood, Composites (Fiberglass, GRC), Others (Glass Fins, Polycarbonate).

- Mechanism: Manual Systems, Motorized Systems, Automated/Integrated Systems.

- Application: Office Buildings, Retail and Shopping Centers, Hospitality (Hotels, Resorts), Educational Institutions, Healthcare Facilities, Industrial & Logistics Centers.

Value Chain Analysis For Commercial Sunshades Market

The value chain for the Commercial Sunshades Market begins with upstream activities centered on raw material procurement and primary processing, primarily involving specialized suppliers of aluminum extrusions, high-grade architectural fabrics, and composite polymers. Given that aluminum is the dominant material, the cost volatility and quality consistency of primary aluminum billets, along with specialized surface treatments like powder coatings or anodizing processes for superior corrosion protection, critically impact the final product’s integrity and lifecycle pricing. Strategic sourcing is vital, requiring established relationships with global metal suppliers who can meet strict environmental, structural, and fire safety certifications applicable to modern commercial high-rise construction. For fabric-based systems, specialized textile manufacturers providing durable, UV-resistant, flame-retardant mesh and vinyl are essential suppliers, ensuring compliance with rigorous building safety codes.

Midstream activities involve core manufacturing, design customization, precision fabrication, specialized surface finishing, and the integration of highly sensitive mechanical and electronic components. Unlike mass-market consumer products, commercial sunshades are often bespoke architectural components, necessitating high engineering rigor and the use of computational design tools for accurate structural analysis to account for specific building geometry, differential thermal expansion, and extreme wind shear forces. The assembly process meticulously incorporates low-voltage, silent motors, IoT-enabled sensors, and robust wiring, requiring adherence to stringent international electrical and safety standards. Quality control and performance testing, particularly rigorous wind and cycle stress testing for automated systems, are significant value-adds at this stage. Manufacturers that successfully implement highly streamlined, digitally-managed fabrication processes and offer rapid prototyping cycles gain a decisive competitive edge in delivering large, complex commercial projects on strict timelines.

Downstream activities encompass sales, specialized distribution, and critical installation services. Sales are predominantly executed through direct channels for large, high-profile projects, involving intense technical support provided directly to architectural specification firms, facade consultants, and general contractors from the project's inception. Indirect distribution relies on a highly specialized network of certified installers, regional distributors, and authorized dealers who handle localized sales, project management, and critical warranty services, particularly for smaller commercial buildings or geographically dispersed rollouts. The installation phase represents a crucial touchpoint; the efficiency and long-term reliability of a sunshade system are heavily dependent on precise, professional installation, accurate alignment, and successful digital integration with the client's existing Building Management System (BMS). Post-installation support, including proactive maintenance contracts, remote monitoring, and software updates for automated systems, concludes the value chain, ensuring continuous optimal performance and long-term customer satisfaction.

Commercial Sunshades Market Potential Customers

The primary customers for commercial sunshades are entities involved in the ownership, development, or long-term management of non-residential properties who are strongly motivated by minimizing operational expenses, achieving premium environmental certifications (e.g., LEED Platinum), or enhancing tenant experience and productivity. End-users fall broadly into distinct categories: institutional buyers, such as government agencies, large university systems, and healthcare providers, who prioritize longevity, regulatory compliance, and verifiable long-term energy savings; and private commercial developers, including large real estate investment trusts (REITs), global corporate headquarters, and high-end hospitality chains, who focus intensely on architectural differentiation, premium aesthetics, and maximizing lease value through the provision of high-efficiency, technologically advanced building amenities. Architects, facade engineers, and general contractors often serve as crucial technical influencers and specifiers in the purchasing decision process, guiding clients toward products that meet stringent design and structural performance criteria.

The largest segment of potential buyers includes developers initiating new Class A office towers in major metropolitan areas globally, driven by strict regulatory mandates for energy performance and the competitive necessity to attract high-value tenants demanding superior working environments characterized by optimized daylighting and thermal comfort. Simultaneously, owners of existing, aging commercial buildings represent a growing and highly lucrative retrofit market, seeking cost-effective solutions to modernize outdated facades and drastically reduce soaring cooling and maintenance costs without undertaking full-scale demolition. This retrofit demand often favors modular, less structurally invasive shading systems. Furthermore, healthcare and educational facilities are critical customers, where controlling harsh glare and managing interior temperature fluctuations are essential for specific functional requirements, such such as promoting patient healing environments, reducing stress, and ensuring optimal focus conditions for learning.

The purchasing decision in the commercial sunshade market is complex, usually involving a multidisciplinary team. It is typically weighted heavily towards total lifecycle cost savings (reduced cooling bills, lower maintenance) and performance guarantees over the initial acquisition cost. Buyers strongly favor manufacturers who can provide certified performance data, sophisticated integration capabilities with existing building automation systems, and comprehensive warranty and service support. The trend toward Integrated Project Delivery (IPD) further emphasizes the need for early engagement between manufacturers and project teams, positioning those companies that offer comprehensive design consultation and engineering support as preferred vendors for high-complexity, high-value commercial construction projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hunter Douglas N.V., Kawneer Company, Inc., Draper, Inc., Colt Group, Warema Renkhoff SE, Insolroll Sun Protection, CS Group (Construction Specialties), Lutron Electronics Co., Inc., Skyco Shading Systems, Shure Manufacturing Corporation, Tesa Tende, QMotion Advanced Shading Systems, Alshading Solutions, Levolor Inc., Corradi S.p.A., Nulite Systems, Helioscreen, Soltis Textiles (Serge Ferrari Group), Sunbrella (Glen Raven, Inc.), EFCO Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Sunshades Market Key Technology Landscape

The technological landscape of the Commercial Sunshades Market is rapidly evolving, marked by a critical convergence of advanced material science and sophisticated digital control systems. The current focus is heavily weighted toward developing high-performance, low-maintenance materials. Key advancements include the refinement of aluminum alloys to maximize strength-to-weight ratios while resisting corrosive environmental factors, particularly crucial in coastal or highly polluted urban environments. Furthermore, manufacturers are increasingly utilizing high-grade technical textiles and specialized polymer composites that offer exceptional durability, UV stability, and flame resistance. These materials allow for larger, lighter, and more architecturally complex installations while ensuring the longevity required for external facade components, often incorporating advanced coatings for self-cleaning properties to reduce maintenance cycles and associated costs.

In terms of operational technology, the most impactful trend is the comprehensive adoption of intelligent automation. Modern commercial sunshades are driven by low-voltage, silent motorized systems equipped with precise positional feedback. These motors are controlled by Internet of Things (IoT) controllers that integrate multiple inputs from photometric sensors, thermal sensors, and anemometers (wind sensors). This data is processed locally or via cloud platforms using complex control algorithms to perform highly optimized, zone-specific adjustments. Communication relies on robust, commercial-grade protocols such as BACnet, Modbus, and open APIs, ensuring flawless integration with centralized Building Management Systems (BMS), thus allowing the shading system to act as a coordinated component of the overall thermal and lighting regulation strategy, maximizing energy efficiency across the entire building envelope.

Looking forward, emerging technologies include the incorporation of flexible thin-film Building Integrated Photovoltaics (BIPV) directly onto the sunshade louver or fabric surfaces, transforming solar control devices into micro-power generation units, further enhancing the system's contribution to net-zero building design. Computational design tools, such as advanced 3D modeling and Computational Fluid Dynamics (CFD), are becoming standard practice during the engineering phase. These tools allow architects and manufacturers to simulate the precise aerodynamic performance, thermal gains, and daylighting factor under specific geographic and climatic conditions before construction, effectively de-risking the installation and guaranteeing predicted performance metrics. This commitment to data-driven design and integration underscores the industry's shift towards providing high-certainty, high-performance facade solutions.

Regional Highlights

The global Commercial Sunshades Market exhibits pronounced regional variations driven by differing climatic requirements, regulatory environments, and construction activity levels. Asia Pacific (APAC) stands out as the highest growth region, primarily due to the accelerated pace of commercial infrastructure development and urbanization in populous countries like China, India, and Vietnam. The prevalence of intense solar radiation across much of the region, combined with massive investment in high-rise office and mixed-use developments, ensures consistently high volume demand for effective solar control solutions. While APAC leads in market volume growth potential, North America and Europe collectively dominate the market in terms of technological maturity, R&D investment, and the adoption of sophisticated, highly integrated automated systems, driven by rigorous, established energy efficiency mandates and a strong corporate focus on worker productivity enhancements.

In Europe, the market is characterized by strict adherence to energy performance directives (EPBD) and a mature architectural preference for aesthetically integrated, high-quality shading systems that efficiently preserve natural light while managing heat gain. Countries such as Germany, the Netherlands, and the UK are pioneers in enforcing NZEB standards, fueling demand for dynamically controlled external louvers and facade screens that comply with stringent performance thresholds. North America's market growth is propelled by the continuous expansion of corporate campuses, particularly in the tech and finance sectors, and the increasing institutional requirement for third-party green building certification (LEED). This mandates implementation of proven solar heat mitigation strategies to secure premium leasing rates and achieve sustainability targets.

- Asia Pacific (APAC): Exhibits the highest CAGR fueled by rapid urbanization, substantial commercial real estate construction, and the necessity for solar heat mitigation in high-temperature zones across China, India, and Southeast Asia. The focus is on robust, scalable, and cost-effective fixed and motorized solutions.

- North America: Market maturity is driven by widespread adoption of voluntary and mandatory green building standards (LEED, Energy Star), high demand from the corporate sector for technologically advanced, smart shading systems, and the imperative to maximize occupant comfort and productivity in large office complexes.

- Europe: Growth is firmly supported by strict EU energy performance mandates (EPBD and NZEB targets), emphasizing thermal optimization, aesthetically sensitive integration into historical and modern facades, and a strong market for highly reliable automated and weather-sensing control mechanisms, especially in Central and Western Europe.

- Middle East & Africa (MEA): A vital, high-value segment characterized by extreme desert climates where solar control is a functional imperative, not an option. This drives intense demand for heavy-duty, highly durable, customized aluminum louvers, specialized reflective coatings, and systems designed to withstand high winds and dust ingress.

- Latin America: An accelerating developing market with increasing adoption spurred by rising awareness of long-term operational energy costs and the gradual but increasing implementation of international green building practices in rapidly expanding commercial hubs such as São Paulo, Mexico City, and Santiago.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Sunshades Market.- Hunter Douglas N.V.

- Kawneer Company, Inc.

- Draper, Inc.

- Colt Group

- Warema Renkhoff SE

- Insolroll Sun Protection

- CS Group (Construction Specialties)

- Lutron Electronics Co., Inc.

- Skyco Shading Systems

- Shure Manufacturing Corporation

- Tesa Tende

- QMotion Advanced Shading Systems

- Alshading Solutions

- Levolor Inc.

- Corradi S.p.A.

- Nulite Systems

- Helioscreen

- Soltis Textiles (Serge Ferrari Group)

- Sunbrella (Glen Raven, Inc.)

- EFCO Corporation

Frequently Asked Questions

Analyze common user questions about the Commercial Sunshades market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of commercial sunshades and how is it measured?

The primary driver is the global emphasis on improving building energy efficiency, primarily to comply with stringent government regulations (such as those tied to LEED or BREEAM certification) that mandate the reduction of cooling loads and overall energy consumption in new and retrofitted commercial properties. Sunshades are proven to significantly reduce Solar Heat Gain Coefficient (SHGC) and lower cooling energy demand by intercepting solar radiation before it enters the glass envelope, contributing directly to a lower Energy Use Intensity (EUI) for the building. This measurable energy saving and compliance guarantee are the most compelling economic justifications for adoption.

How do automated sunshades contribute to HVAC system efficiency and interior daylight management?

Automated sunshades integrate with Building Management Systems (BMS) via sensors to dynamically adjust based on real-time solar angles, internal temperature, and occupancy profiles. By proactively blocking direct solar radiation, they drastically mitigate the primary source of interior heat gain, thereby reducing the operational load and energy consumption of the HVAC system by up to 30%. Concurrently, these smart systems are calibrated to maximize daylight penetration (Daylight Autonomy), ensuring interior spaces receive optimal natural light while preventing disruptive glare on computer screens, thereby enhancing occupant productivity and reducing the reliance on artificial lighting.

Which material segment holds the largest share, and what are the key benefits of using composites?

Aluminum currently holds the largest market share in the material segment due to its superior strength-to-weight ratio, high durability, excellent corrosion resistance, and versatility in achieving various complex architectural geometries, making it the standard for fixed and motorized louver systems. However, composite materials (such as fiberglass and polymer matrices) are gaining traction, particularly for specialized applications, because they offer better thermal performance (lower conductivity than aluminum), greater resistance to fading, and more freedom for non-standard, custom curved designs without the substantial weight penalty of heavier metals.

What are the main restraints impacting the growth of this market and how are manufacturers mitigating them?

The chief restraint is the high initial capital investment required for complex, customized external sunshading systems, especially automated and integrated solutions, compared to simpler interior window treatments. Additionally, the need for specialized engineering and installation to ensure proper facade integration and resistance to severe wind loading presents a logistical challenge. Manufacturers are mitigating these restraints by developing modular, prefabricated unitized facade shading solutions that reduce on-site installation time and complexity, alongside providing clear, detailed life-cycle cost analysis demonstrating rapid payback periods derived from verifiable energy savings performance data.

How does the retrofit market influence overall commercial sunshade demand, and what technologies are crucial for retrofits?

The retrofit market is a crucial growth avenue, representing a vast inventory of older commercial buildings requiring modernization to meet current energy standards. These existing structures often have outdated glazing and lack effective solar control. Retrofit projects influence demand by favoring lightweight, easily attachable, and non-intrusive systems that minimize disruption to building tenants. Technologies crucial for retrofits include low-profile motorized systems, exterior screen fabrics that allow for minimal structural modification, and wireless IoT controls that simplify integration without extensive, disruptive rewiring of the existing building infrastructure, prioritizing ease of installation and minimal aesthetic intrusion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager