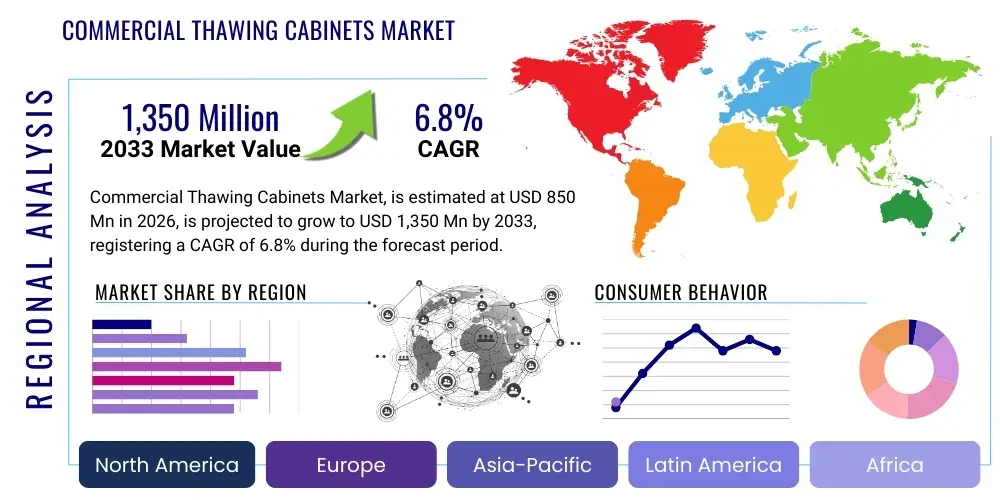

Commercial Thawing Cabinets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437022 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Thawing Cabinets Market Size

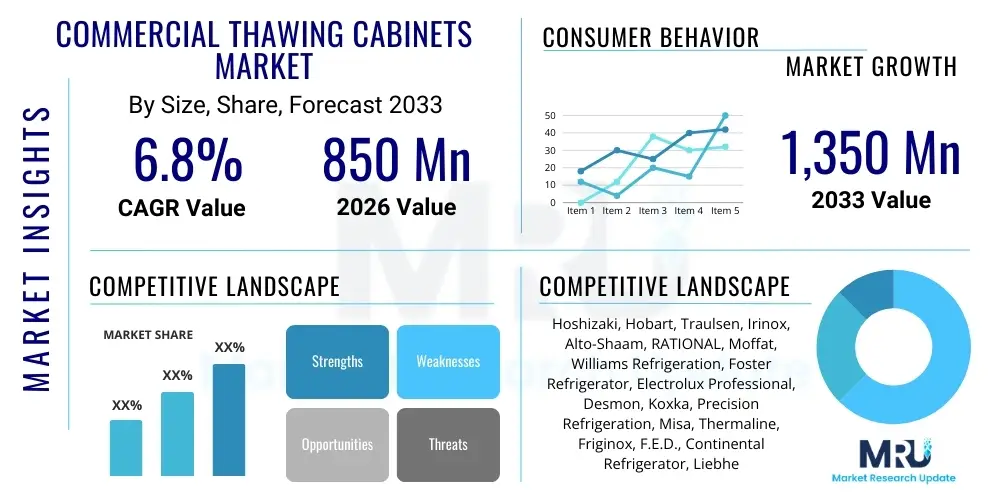

The Commercial Thawing Cabinets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. This robust growth trajectory is driven by stringent food safety regulations globally, emphasizing controlled and hygienic thawing processes, coupled with the rising demand for prepared and flash-frozen food items across the hospitality and institutional sectors. The increasing adoption of advanced blast chilling and freezing techniques necessitates corresponding high-quality thawing equipment to maintain product integrity and prevent microbial proliferation during the transition phase.

The market is estimated at USD 850 Million in 2026, serving a wide array of end-users including high-volume commercial kitchens, large-scale catering operations, hospitals, and educational institutions. The valuation reflects the current investment in energy-efficient and highly automated thawing solutions designed to minimize labor costs and improve kitchen throughput. Initial market size is bolstered by significant replacement cycles for older, less energy-efficient equipment in developed economies, alongside aggressive expansion in emerging markets.

The market is projected to reach USD 1,350 Million by the end of the forecast period in 2033. This projected expansion is significantly influenced by technological innovations such as smart temperature monitoring systems, humidity control integration, and IoT connectivity, which enhance traceability and compliance. Furthermore, the global shift towards centralized catering and commissary models, particularly in urban areas, mandates the use of reliable, high-capacity thawing cabinets to manage large volumes of frozen ingredients efficiently and safely, thereby solidifying the market's long-term revenue generation potential.

Commercial Thawing Cabinets Market introduction

The Commercial Thawing Cabinets Market encompasses specialized refrigeration equipment designed to facilitate the controlled, gradual, and hygienic thawing of frozen food products, primarily for commercial and institutional applications. Unlike conventional air thawing, these cabinets utilize sophisticated mechanisms, often involving regulated air circulation, precise temperature control (typically between 1°C and 4°C), and humidity management, to bring food from a frozen state to a usable temperature safely and without compromising quality or texture. These systems are critical components in the modern cold chain management infrastructure, particularly in sectors focused on maximizing operational efficiency and adhering to strict Hazard Analysis and Critical Control Points (HACCP) protocols.

The core product offerings within this market range from standard vertical cabinets suitable for smaller restaurants to large, walk-in or roll-in high-capacity units utilized by industrial food processors and large catering companies. Key technologies employed include forced air circulation systems, which ensure uniform temperature distribution, and advanced climate control features that prevent surface drying or 'thaw burn.' Major applications span the preparation of raw meat, poultry, seafood, baked goods, and prepared meals in hotels, restaurants, hospitals, military installations, and centralized commissaries, where speed, safety, and yield retention are paramount business drivers.

The market expansion is fundamentally driven by the increased global consumption of frozen and processed foods, the rising stringency of governmental food safety standards requiring verifiable thawing processes, and the inherent labor savings associated with controlled, automated thawing versus traditional, uncontrolled methods. Benefits derived from using commercial thawing cabinets include superior microbiological safety by maintaining products out of the danger zone (4°C to 60°C), preservation of sensory attributes, significant reduction in food waste due to optimized thawing yield, and enhanced operational predictability in high-throughput kitchen environments, solidifying their status as indispensable assets in professional foodservice operations.

Commercial Thawing Cabinets Market Executive Summary

The Commercial Thawing Cabinets Market is poised for substantial growth, characterized by strong demand driven by food safety compliance and operational efficiency improvements across the global foodservice industry. Business trends indicate a pronounced shift towards integrated smart thawing solutions featuring IoT capabilities for remote monitoring and data logging, essential for HACCP documentation and quality assurance. Furthermore, manufacturers are focusing intensely on developing energy-efficient models utilizing natural refrigerants and superior insulation technologies to reduce operational expenditure, aligning with global sustainability initiatives. Key commercial strategies involve long-term leasing agreements, comprehensive maintenance contracts, and specialized cabinet designs catering specifically to complex products like delicate seafood or artisan baked goods, broadening the addressable market beyond traditional meat thawing.

Regionally, North America and Europe maintain dominance, attributed to mature foodservice infrastructures, early adoption of automated kitchen technology, and strict enforcement of cold chain regulations that mandate precise thawing controls. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, spurred by rapid urbanization, increasing consumer reliance on commercial dining, and significant investments in modernizing food processing facilities, particularly in emerging economies like China and India. Latin America and the Middle East and Africa (MEA) are also emerging as viable markets, driven by the expansion of international hotel chains and quick-service restaurant (QSR) franchises that rely on standardized frozen ingredients and centralized food preparation models, necessitating reliable thawing infrastructure.

Segmentation analysis reveals that the high-capacity, roll-in cabinet segment is expected to witness accelerated growth, primarily fueled by the needs of large catering events and institutional kitchens. Technology-wise, forced-air circulation systems with advanced humidity control dominate due to their speed and precision, offering superior thawing uniformity compared to static cooling methods. The end-user landscape is seeing heightened spending from the institutional sector, particularly healthcare and educational catering, where the priority on food safety and standardized portion control is extremely high, translating into consistent demand for verifiable, automated thawing technologies capable of handling diverse product loads reliably.

AI Impact Analysis on Commercial Thawing Cabinets Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move thawing cabinets beyond simple temperature control into predictive and adaptive systems. Common questions center on the possibility of AI learning specific product thawing profiles (e.g., bone-in versus boneless meat), automatically adjusting humidity and airflow parameters based on real-time external conditions (ambient temperature, humidity), and generating predictive maintenance alerts to prevent equipment failure during critical thawing cycles. Key user expectations revolve around AI’s ability to guarantee absolute food safety compliance through automatic data logging and anomaly detection, optimize energy consumption based on predicted usage patterns, and eliminate human error in setting complex thawing programs. This analysis suggests a strong desire for 'self-optimizing' cabinets that integrate seamlessly into broader smart kitchen ecosystems, ensuring maximum product yield and minimized operational risk.

- AI-driven Predictive Maintenance: Utilizing ML algorithms to analyze operational data (compressor runtime, fan speed deviations, energy spikes) to forecast component failure, allowing for proactive servicing and minimizing unexpected downtime in busy commercial kitchens.

- Adaptive Thawing Cycles: Employing AI to learn and store thousands of optimal thawing profiles based on product type, initial freezing method (blast-frozen vs. slow-frozen), and internal load density, automatically adjusting temperature ramps and humidity levels for perfect results.

- Real-Time Compliance and Audit Trail Generation: Integrating AI to monitor temperature and humidity readings continuously, detecting any deviation outside HACCP parameters, and instantaneously generating detailed, immutable reports required for regulatory audits, enhancing traceability.

- Energy Consumption Optimization: Using ML to analyze kitchen scheduling and peak usage patterns, allowing the cabinet to strategically modulate cooling cycles and defrost intervals during off-peak hours, significantly reducing overall energy expenditure.

- Ingredient Quality Prediction: Developing sophisticated sensors linked to AI to assess the thawed product's internal conditions (e.g., core temperature uniformity, drip loss estimation) and providing an objective quality score, helping chefs determine optimal readiness for cooking.

DRO & Impact Forces Of Commercial Thawing Cabinets Market

The Commercial Thawing Cabinets Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively define the Impact Forces governing market expansion and technological innovation. The primary driver is the increasing global emphasis on verifiable food safety standards, particularly HACCP protocols, which explicitly discourage uncontrolled room-temperature thawing methods, thereby mandating the use of specialized, controlled equipment. Simultaneously, operational efficiency in the high-volume foodservice sector serves as a crucial impetus, as controlled thawing significantly reduces labor requirements and enhances product yield compared to traditional techniques. However, the high initial capital investment required for advanced, high-capacity thawing units, especially those featuring precise humidity control and smart technology, acts as a notable restraint, limiting adoption among smaller, independent food service operators and those in developing markets facing budget constraints.

A significant opportunity lies in the integration of Internet of Things (IoT) connectivity and cloud-based monitoring solutions, enabling remote diagnostics, immediate performance verification, and automated compliance reporting, creating substantial value for multi-site organizations and centralized commissaries. Furthermore, the rising consumer demand for premium frozen products, such as artisanal baked goods and specialty seafood, necessitates high-precision thawing technology to maintain delicate textures and flavors, opening niche segments for specialized cabinet manufacturers. Conversely, the market faces impact forces from the ongoing innovation in alternative preservation technologies, such as advanced pressure freezing or microwave-assisted thawing methods, which, if commercialized successfully, could potentially cannibalize market share from traditional forced-air cabinets, requiring continuous research and development to maintain competitive edge and technological superiority.

The market environment is highly sensitive to regulatory changes pertaining to cold chain management and permissible food handling practices. The necessity for reliable, documented thawing processes creates a constant demand floor (Driver), while the complexity of maintenance and the energy consumption concerns associated with continuous climate control equipment present ongoing challenges (Restraint). The successful navigation of these forces depends heavily on manufacturers developing accessible, modular, and highly energy-efficient thawing solutions that offer demonstrable return on investment (Opportunity), thereby mitigating the impact of high entry costs and maximizing user adoption across the diverse spectrum of commercial kitchen sizes and operational complexities.

Segmentation Analysis

The Commercial Thawing Cabinets Market is segmented across various dimensions including Product Type, Technology, Capacity, and End-User Application, reflecting the diverse operational needs of the foodservice and institutional sectors. Analyzing these segments provides strategic insights into consumer preferences, technological adoption rates, and regional expenditure patterns. The segmentation based on capacity, specifically between standard upright cabinets and large roll-in units, is crucial for assessing growth potential, as the trend toward centralized food preparation and high-volume catering significantly favors larger, industrial-grade thawing solutions capable of handling palletized loads. This detailed segmentation allows manufacturers to tailor product specifications—such as optimal airflow design and humidity range—to specific application needs, ensuring high performance across various frozen matrices, from dense meat blocks to delicate seafood fillets, maximizing market penetration.

From a technological perspective, the distinction between forced-air circulation systems and static/water-based methods highlights the industry’s preference for speed and uniformity, driven by the need to minimize the time spent in the bacterial danger zone. Forced-air systems, often coupled with advanced humidity control, currently dominate due to their superior performance metrics in large-scale operations. Furthermore, the End-User segmentation provides the most critical commercial intelligence; while restaurants and hotels remain the historical backbone of the market, the rapid expansion of institutional catering (hospitals, schools, corporate canteens) and dedicated food processing plants indicates a shifting demand landscape towards extremely rugged, verifiable, and highly automated equipment, creating distinct market pockets for specialized cabinet variants.

- By Product Type:

- Standard Upright Cabinets (Lower capacity, suitable for small to mid-sized kitchens)

- High Capacity Roll-in Units (Suitable for large volume processing, accommodating Gastronorm or industrial trollies)

- Specialized Benchtop Models (Designed for delicate or laboratory applications)

- By Technology:

- Forced Air Circulation Thawing (Dominant, offering speed and uniformity)

- Static Thawing (Used primarily in smaller or specialized applications)

- Water Bath Thawing Systems (Niche application, often for sealed, vacuum-packed products)

- By Capacity (Liters):

- Below 500 Liters

- 500 L – 1500 Liters

- Above 1500 Liters (Industrial and Commissary Scale)

- By End-User:

- Full-Service Restaurants and Casual Dining

- Hotels and Hospitality (Including Resorts and Catering)

- Institutional Catering (Hospitals, Schools, Military)

- Food Processing and Commissary Kitchens

- Quick Service Restaurants (QSR) and Fast Food Chains

- By Operation Mode:

- Manual/Programmable Thawing

- Semi-Automatic Systems

- Fully Automatic (Sensor-Driven) Thawing

Value Chain Analysis For Commercial Thawing Cabinets Market

The value chain for the Commercial Thawing Cabinets Market initiates with the upstream analysis involving raw material suppliers and component manufacturers, principally focusing on specialized materials such as high-grade stainless steel for hygienic interiors, sophisticated insulation foams (like polyurethane), and critical refrigeration components including compressors, condensers, and precise digital controllers. The quality and availability of energy-efficient compressors, particularly those using natural refrigerants (R290, R600a), significantly impact the final product cost and environmental footprint. Sourcing reliable, high-precision temperature and humidity sensors is also a crucial upstream activity, ensuring the cabinets meet required food safety verification standards. Manufacturers often establish long-term relationships with key component providers to ensure supply chain stability and quality consistency, thereby minimizing production risks and maintaining competitive pricing structures.

Midstream activities involve the core manufacturing, assembly, and quality control processes. This stage is characterized by high levels of specialized labor required for welding stainless steel and integrating complex refrigeration circuits and electronic control interfaces. Product differentiation at this stage often relies on proprietary air circulation designs, advanced humidity management systems, and the integration of smart technology (IoT modules). Effective quality control, including rigorous testing of temperature uniformity and recovery time, is paramount before product release. The strategic location of manufacturing facilities, optimizing proximity to both material suppliers and large distribution hubs, is critical for controlling logistics costs and improving responsiveness to market demand fluctuations.

Downstream analysis focuses on distribution channels and the ultimate delivery to end-users. Direct channels are often utilized for large, custom, or high-value institutional orders, where manufacturers engage directly with large catering corporations or government procurement agencies, providing specialized installation and training services. Indirect distribution, leveraging extensive networks of commercial kitchen equipment dealers, authorized regional distributors, and online specialized marketplaces, serves the broad base of small to mid-sized restaurants and hotels. The distribution phase relies heavily on technical support and post-sales maintenance services, which are often provided either by the manufacturer’s in-house team or highly trained third-party service contractors, ensuring optimal equipment performance and longevity in demanding commercial settings.

Commercial Thawing Cabinets Market Potential Customers

The primary customer base for Commercial Thawing Cabinets is highly concentrated within the professional foodservice, hospitality, and institutional catering sectors, where the requirement for safe, high-volume, and time-sensitive thawing operations is mandatory. End-users include high-end full-service restaurants and centralized commissaries that rely on controlled thawing to manage inventory and maintain ingredient quality for complex menus, alongside large-scale hotels and resorts that operate high-throughput kitchens requiring consistency and regulatory compliance across numerous meal services. These customers prioritize equipment reliability, precise temperature adherence, and ease of cleaning and sanitation, typically investing in premium, digitally controlled, forced-air cabinets to ensure minimal food loss and maximum operational predictability.

Institutional catering segments, encompassing hospitals, schools, and corporate campuses, represent a rapidly expanding customer group, driven by extremely stringent hygiene standards and a shift towards centralized, batch-cooked meal preparation. For these buyers, verifiable HACCP compliance features, such as integrated data logging and remote monitoring capabilities, are non-negotiable purchasing criteria. The need to handle vast quantities of frozen prepared meals, often on tight schedules, drives demand for high-capacity, durable, and energy-efficient roll-in models. Furthermore, industrial food processors that freeze raw ingredients or finished goods prior to distribution also constitute a significant customer segment, utilizing the largest industrial thawing rooms and cabinets to prepare products for further processing or immediate packaging, prioritizing yield optimization and throughput speed above all else.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hoshizaki, Hobart, Traulsen, Irinox, Alto-Shaam, RATIONAL, Moffat, Williams Refrigeration, Foster Refrigerator, Electrolux Professional, Desmon, Koxka, Precision Refrigeration, Misa, Thermaline, Friginox, F.E.D., Continental Refrigerator, Liebherr Commercial, Metalfrio, Carrier Commercial Refrigeration, True Manufacturing, Delfield, Eurofrigor, Norpe. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Thawing Cabinets Market Key Technology Landscape

The current technology landscape in the Commercial Thawing Cabinets Market is defined by a strong focus on precise environmental control, energy optimization, and data connectivity. The dominant technology is advanced forced-air circulation systems, which utilize high-efficiency fans and optimized ductwork to ensure that air speed and temperature are uniformly distributed across the entire cabinet volume, minimizing the risk of localized warm spots or outer layer spoilage. Modern iterations of forced-air systems integrate sophisticated heat exchange mechanisms and modulating valves to precisely control the internal temperature range, typically maintaining a tight band between 1°C and 4°C, maximizing microbiological safety while facilitating gradual thawing. Furthermore, manufacturers are increasingly incorporating variable speed drive (VSD) compressors and Electronically Commutated (EC) fans, dramatically improving energy efficiency compared to older fixed-speed units, addressing a critical operational expenditure concern for commercial end-users.

A second crucial technological development involves integrated humidity management systems, often using ultrasonic humidifiers or complex moisture injection techniques, which are essential for thawing delicate products like fish and specialty meats without excessive moisture loss (drip loss) or surface dehydration. Maintaining high internal humidity (around 90% or higher) prevents the food surface from drying out, preserving weight and quality, which is critical for maximizing profit margins in the foodservice industry. The effectiveness of these humidity controls is a major differentiator among premium thawing cabinet brands. Moreover, there is an accelerating shift towards implementing environmentally friendly refrigeration technologies, with R290 (propane) and R600a (isobutane) rapidly replacing high Global Warming Potential (GWP) hydrofluorocarbons (HFCs) like R404A, driven by global phase-down regulations and corporate sustainability mandates.

Finally, smart technology and IoT integration represent the future direction of the market. Key cabinets are now equipped with Wi-Fi or Ethernet connectivity, enabling operators to remotely monitor thawing progress, retrieve detailed temperature logs, and receive real-time alerts via cloud platforms. This data connectivity is indispensable for automated HACCP documentation, streamlining compliance reporting and reducing the administrative burden on kitchen staff. Advanced models feature touch-screen interfaces with pre-set programs for hundreds of different food types, allowing chefs to select the exact product, weight, and desired ready time, after which the cabinet automatically manages the entire thawing cycle, leveraging sensor feedback to adapt conditions minute-by-minute for optimal, repeatable results, thereby transitioning thawing from an unpredictable task to a fully automated process.

Regional Highlights

Geographic analysis reveals distinct market dynamics driven by regional regulations, economic maturity, and foodservice trends across key global areas. North America, encompassing the United States and Canada, represents a highly mature market characterized by stringent food safety enforcement, large-scale catering operations, and a strong propensity for adopting automated, high-throughput kitchen technology. The region benefits from early technological adoption and high investment capacity in premium, IoT-enabled thawing cabinets, especially within national restaurant chains and industrial food preparation facilities that prioritize standardization and documented compliance.

Europe, particularly Western European countries such as Germany, the UK, and France, maintains a dominant market share, fueled by rigorous EU food safety directives (like the Cold Chain Management standards) and a mature hospitality sector that demands high quality and energy efficiency. European regional trends include a strong preference for cabinets utilizing natural refrigerants (R290) and modular designs that maximize space utilization in often-smaller professional kitchens. Furthermore, the region’s robust institutional sector (healthcare and education) provides a steady, high-volume demand base for reliable, verifiable thawing equipment.

Asia Pacific (APAC) is projected to exhibit the highest CAGR during the forecast period. This exponential growth is underpinned by rapid urbanization, significant expansion of the middle-class consumer base, and extensive modernization of the food processing and cold chain infrastructure across economies like China, India, and Southeast Asian nations. The region is witnessing a strong influx of international QSR and hotel brands, which necessitate standardized thawing procedures. While price sensitivity remains a factor, the increasing awareness regarding foodborne illness risks and rising regulatory enforcement are rapidly pushing local businesses toward investing in controlled thawing solutions.

Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets for commercial thawing cabinets. LATAM market growth is driven by the expansion of large centralized food service providers serving growing urban populations, while the MEA region sees demand stemming primarily from the rapid development of the luxury hospitality sector and international tourism hubs, which maintain world-class standards for food preparation and storage, requiring reliable, high-capacity cold chain equipment to manage imported frozen goods.

- North America (USA, Canada): High demand for smart, integrated systems; driven by HACCP compliance and operational scale in large corporate catering facilities and national chains.

- Europe (Germany, UK, France): Focus on energy efficiency, natural refrigerants (R290), and modular designs; regulations heavily influence purchasing decisions in mature institutional sectors.

- Asia Pacific (China, India, Japan): Fastest growth rate; spurred by cold chain modernization, QSR expansion, rising consumer safety awareness, and increasing investment in centralized kitchens.

- Latin America (Brazil, Mexico): Emerging market potential driven by urbanization and the expansion of modern foodservice logistics and centralized school meal programs.

- Middle East and Africa (UAE, Saudi Arabia, South Africa): Demand concentrated in the high-end hotel and hospitality sector; focused on robust equipment capable of handling diverse environmental conditions and large volumes of imported frozen goods.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Thawing Cabinets Market. These companies are actively engaged in product innovation, strategic partnerships, and geographic expansion to maintain competitive advantage in the global market.- Hoshizaki Corporation

- Hobart Corporation (ITW Food Equipment Group)

- Traulsen (ITW Food Equipment Group)

- Irinox SpA

- Alto-Shaam, Inc.

- RATIONAL AG (Specialized Cabinets Division)

- Moffat Limited

- Williams Refrigeration

- Foster Refrigerator (A division of ITW)

- Electrolux Professional AB

- Desmon S.p.A.

- Koxka Refrigeration (Onnera Group)

- Precision Refrigeration

- Misa S.p.A. (Epta Group)

- Thermaline (Continental Manufacturing)

- Friginox (Ali Group)

- F.E.D. (Food Equipment Distributors)

- Continental Refrigerator

- Liebherr Commercial Refrigeration

- Metalfrio Solutions S.A.

- Carrier Commercial Refrigeration (Specific models integrated into cold chain solutions)

- True Manufacturing Co., Inc.

- Delfield (A Welbilt Brand)

- Eurofrigor SRL

- Norpe (A division of Viessmann Refrigeration Solutions)

Frequently Asked Questions

Analyze common user questions about the Commercial Thawing Cabinets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary benefit of using a commercial thawing cabinet over standard refrigeration?

The primary benefit is superior food safety and quality preservation. Commercial thawing cabinets utilize precise, controlled forced-air and humidity management to thaw food rapidly and uniformly while keeping the core temperature strictly above freezing but below the microbial danger zone (4°C), minimizing bacterial growth and preventing yield loss associated with dehydration.

Which technology segment dominates the Commercial Thawing Cabinets Market?

The Forced Air Circulation Thawing technology segment dominates the market. This dominance is due to its efficiency in achieving uniform temperature distribution, speed, and reliability, essential for high-volume commercial kitchens adhering to strict HACCP compliance requirements and seeking optimal product throughput.

How is AI impacting the operational efficiency of thawing cabinets?

AI is transforming operational efficiency by enabling predictive maintenance, automatically adjusting thawing cycles based on product characteristics (Adaptive Thawing), and automating detailed data logging for HACCP audit trails, thereby reducing human error, optimizing energy consumption, and ensuring consistent product quality without continuous manual supervision.

Which geographic region exhibits the fastest growth rate in this market?

The Asia Pacific (APAC) region is projected to register the fastest Compound Annual Growth Rate (CAGR). This acceleration is driven by extensive investments in modern cold chain logistics, rapid urbanization, the expansion of global quick-service and hospitality chains, and increased consumer demand for verifiable food safety standards in emerging economies.

What is the estimated market size projection for Commercial Thawing Cabinets by 2033?

The Commercial Thawing Cabinets Market is projected to reach an estimated value of USD 1,350 Million by the end of the forecast period in 2033, exhibiting a robust CAGR of 6.8%, fueled by regulatory necessity and ongoing technological advancements in cold chain management solutions.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager