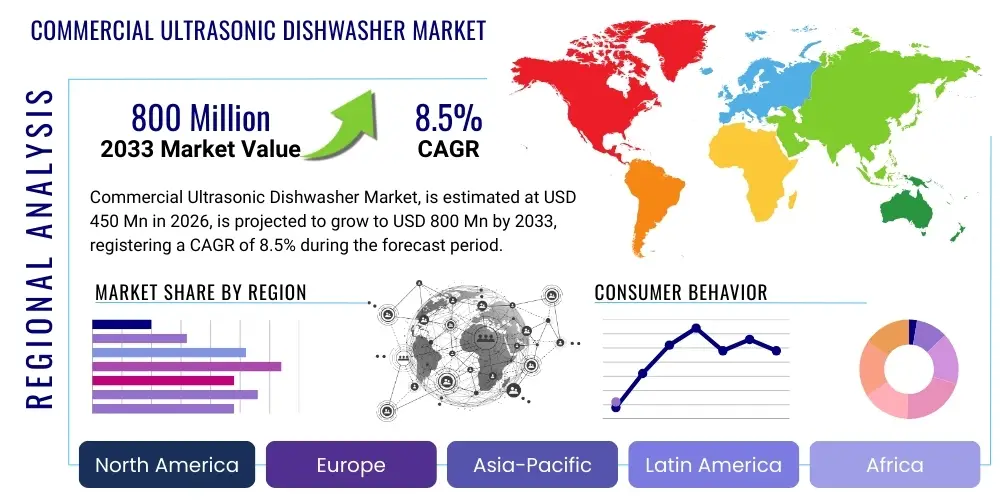

Commercial Ultrasonic Dishwasher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437493 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Commercial Ultrasonic Dishwasher Market Size

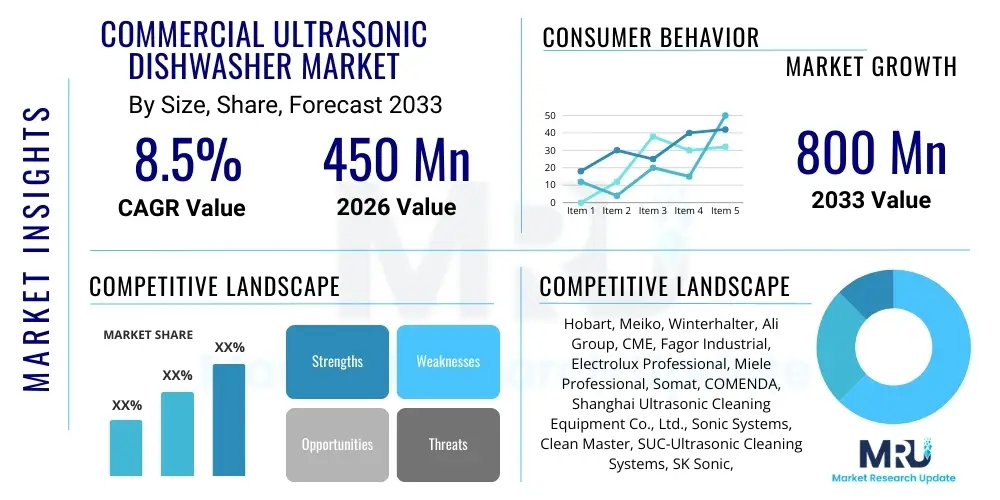

The Commercial Ultrasonic Dishwasher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 800 Million by the end of the forecast period in 2033.

Commercial Ultrasonic Dishwasher Market introduction

The Commercial Ultrasonic Dishwasher Market encompasses specialized heavy-duty cleaning equipment designed for high-volume food service operations, utilizing high-frequency sound waves (ultrasound) to create microscopic cavitation bubbles in a liquid solution. These bubbles implode upon contact with surfaces, effectively dislodging stubborn food residue, grease, and baked-on soils from dishes, cutlery, pots, and pans. Unlike conventional spray-arm dishwashers, ultrasonic technology offers superior cleaning penetration into complex geometries and heavily soiled crevices, significantly reducing the need for intensive pre-scraping and manual labor, thereby enhancing operational efficiency in professional kitchens. The core product functions center on precision cleaning, sanitation, and rapid throughput, critical attributes for the demanding environment of commercial catering and hospitality sectors where strict hygiene standards and speed are paramount.

Major applications for these sophisticated units span the entire food service ecosystem, including large institutional kitchens, fine dining establishments, quick service restaurants (QSRs), flight catering facilities, and hospital canteens. The primary benefit driving adoption is the unparalleled sanitation capability; ultrasonic waves can sterilize surfaces and reach areas traditional high-pressure washing often misses, offering a substantial advantage in maintaining Hazard Analysis and Critical Control Points (HACCP) compliance. Furthermore, these systems often use less water and energy compared to older commercial washing models, particularly when considering the reduced need for high-temperature boosters, contributing positively to sustainability goals and operational expenditure reduction in the long term, positioning them as an efficient capital investment.

The market is currently being driven by several macro-environmental factors, chiefly the global shortage and rising cost of skilled kitchen labor, which compels establishments to seek automation solutions for routine tasks like dishwashing. Secondly, increasingly stringent public health regulations worldwide, especially following global public health concerns, necessitate higher standards of cleanliness and verifiable sanitization, which ultrasonic technology inherently delivers. Thirdly, the expansion of the hospitality and tourism sectors in emerging economies fuels the demand for high-capacity, efficient kitchen equipment. These drivers collectively necessitate advanced equipment capable of delivering consistent, high-quality results under intense operational pressure, solidifying the market position of commercial ultrasonic dishwashers as essential kitchen infrastructure.

Commercial Ultrasonic Dishwasher Market Executive Summary

The Commercial Ultrasonic Dishwasher Market is experiencing dynamic growth, characterized by a fundamental shift toward automation and integration within smart kitchen ecosystems. Business trends indicate a strong focus on modular designs and customization, allowing end-users to tailor units based on specific capacity requirements, whether large flight kitchens requiring multi-tank systems or small QSRs needing compact benchtop units. Key industry participants are investing heavily in improving transducer longevity and efficiency, alongside developing advanced proprietary cleaning solutions optimized for ultrasonic operation. Furthermore, there is a pronounced strategic emphasis on subscription-based maintenance services and integrated data analytics capabilities, enhancing the value proposition beyond the initial equipment sale and ensuring sustained performance monitoring crucial for commercial operations.

Regionally, Asia Pacific (APAC) stands out as a critical growth engine, primarily driven by rapid urbanization, significant infrastructure development in the hospitality sector, and the burgeoning growth of institutional catering services across populous nations like China and India. While North America and Europe remain mature markets characterized by replacement cycles and high adoption rates of energy-efficient models, APAC's momentum is derived from first-time installations in newly established food service outlets and widespread modernization efforts. Regulatory convergence towards higher food safety standards across all geographies is equally influencing market penetration, particularly in regions where manual washing practices are traditionally prevalent, thus mandating a rapid transition to automated and validated cleaning processes offered by ultrasonic systems.

Segment trends highlight the growing preference for automated lift-and-load systems and integrated pre-treatment zones, streamlining the workflow and minimizing operator involvement. In terms of technology segmentation, units utilizing piezoelectric transducers are dominating due to their higher frequency capability, which translates to finer and more effective cavitation, crucial for delicate or complex kitchenware. The large-capacity, multi-tank systems segment, suitable for centralized production kitchens and high-throughput environments, is anticipated to record the highest growth rate, reflecting the industry trend towards consolidating cleaning operations into highly efficient zones. Smaller, benchtop units are also gaining traction in niche markets, such as specialty coffee shops or small bakeries, prioritizing footprint efficiency and targeted ultrasonic cleaning for specialized tools.

AI Impact Analysis on Commercial Ultrasonic Dishwasher Market

Common user questions regarding AI’s impact on commercial ultrasonic dishwashers frequently revolve around three core themes: predictive maintenance effectiveness, optimization of cleaning cycles, and the integration of dishwashing data into overall kitchen management systems. Users are concerned about whether AI can genuinely reduce downtime and operational costs by accurately predicting component failure, specifically the lifespan of transducers and heating elements. There is also significant user curiosity concerning how AI algorithms can analyze soil levels and automatically adjust ultrasonic power and duration, moving beyond pre-set programs to ensure optimal energy and water usage for every wash load. Finally, establishments seek confirmation on how AI-driven data from the dishwashing station—such as throughput rates, sanitization compliance records, and resource consumption—can be seamlessly integrated into broader cloud-based kitchen operating systems (KOS) to improve overall inventory and labor scheduling efficiency. These questions underscore a clear expectation that AI should transform the dishwashing station from a reactive cleaning point into a proactive, data-generating node critical for optimized kitchen logistics and validated food safety compliance.

The incorporation of Artificial Intelligence is poised to significantly elevate the operational intelligence of commercial ultrasonic dishwashers, moving them into the realm of truly smart appliances. AI algorithms are crucial for analyzing multivariate operational data, including water hardness, water temperature fluctuations, acoustic energy output, and historical cleaning success rates. By processing this complex dataset, AI enables advanced predictive maintenance scheduling, flagging potential failures in components like transducers or generators long before they result in equipment downtime. This capability drastically reduces unexpected service interruptions, which are highly costly in high-volume commercial settings, and allows kitchen managers to transition from reactive repairs to proactive, scheduled maintenance, thereby maximizing equipment uptime and extending the asset lifecycle. Furthermore, AI optimizes detergent and rinse aid dosing based on real-time water quality analysis, minimizing chemical expenditure and environmental impact.

Beyond maintenance, AI facilitates highly dynamic and context-aware cleaning cycles. Through the use of integrated sensors and vision systems, AI can potentially identify the type and degree of soiling present on items placed into the dishwasher—differentiating between light grease, heavily baked protein residues, or starch buildup. Based on this real-time assessment, the system adjusts the optimal combination of ultrasonic frequency, power modulation, and cycle duration. This customization ensures that kitchen items are cleaned using the minimal necessary resources (time, water, energy), drastically improving throughput during peak hours while guaranteeing optimal sanitation outcomes. This adaptive intelligence eliminates the inefficiencies associated with standard, fixed-duration wash cycles that often over-clean lightly soiled items or insufficiently treat heavily soiled equipment, providing unparalleled efficiency and consistent performance across varying loads.

- AI algorithms enable precise predictive maintenance for critical components (transducers, generators), minimizing costly operational downtime.

- Real-time soil analysis using integrated sensors allows AI to dynamically adjust ultrasonic frequency and cycle duration, optimizing resource consumption.

- AI facilitates seamless data integration (throughput, compliance logs, resource usage) into larger Kitchen Operating Systems (KOS) for holistic management.

- Machine learning models improve energy efficiency by fine-tuning heating and acoustic power delivery based on load characteristics.

- Automated compliance reporting powered by AI ensures verifiable sanitation records are maintained, simplifying regulatory audits.

DRO & Impact Forces Of Commercial Ultrasonic Dishwasher Market

The market dynamics are fundamentally shaped by a balanced interplay of robust drivers, specific constraints, and significant latent opportunities. The primary driver is the pervasive and increasing need for superior hygiene and verifiable sanitation in the food service industry, spurred by stricter global health standards and consumer expectations for cleanliness. This is compounded by persistent labor challenges, including shortage and high turnover, making automated, reliable cleaning solutions indispensable investments. Restraints largely center on the relatively high initial capital outlay required for advanced ultrasonic systems compared to traditional spray washers, potentially hindering adoption among smaller, budget-constrained establishments. Additionally, concerns regarding noise levels, particularly in enclosed kitchen environments, and the requirement for specialized training for maintenance and optimal usage present minor friction points that must be addressed by manufacturers. However, substantial opportunities exist in integrating these systems with broader smart kitchen IoT frameworks and developing energy-efficient models utilizing renewable energy integration, promising future scalability and market penetration in previously untapped sectors.

Key drivers are deeply rooted in operational necessity and regulatory compliance. The intense competitive pressure within the hospitality sector compels businesses to maximize efficiency and minimize operational costs; commercial ultrasonic dishwashers achieve this by reducing labor time associated with pre-scraping and manual scrubbing by up to 50%, translating directly into measurable labor savings. Furthermore, the specialized nature of these systems ensures minimal damage to delicate kitchenware and reduces breakage rates often associated with aggressive mechanical cleaning. The ongoing technological advancements, specifically in transducer material science and frequency modulation, are enhancing cleaning effectiveness while simultaneously lowering the overall system footprint and energy requirements, making them increasingly viable for diverse kitchen layouts and sizes. The verification of sanitation status through integrated sensors and data logging capabilities is becoming a mandatory requirement for large corporate and institutional clients, strongly favoring ultrasonic solutions over manual or conventional processes that lack verifiable digital records.

Conversely, market restraints require careful mitigation. The initial investment hurdle remains significant, particularly for independent operators, necessitating creative financing and leasing models from equipment providers to encourage adoption. Furthermore, the effectiveness of ultrasonic cleaning is highly dependent on precise maintenance, proper chemical balance, and optimized water quality, requiring dedicated operator training—a potential logistical challenge for multi-site organizations with high staff turnover. The secondary impact force involves the competitive pressure from advanced conventional dishwashers that are continuously improving water and energy efficiency, narrowing the operational cost gap. Manufacturers must consistently demonstrate the distinct, non-replicable benefits of cavitation technology—namely superior soil removal and deep sanitization—to justify the premium price point and overcome resistance stemming from familiarity with conventional washing methods. Addressing the perception of complexity and ensuring easy, intuitive operation will be critical to sustaining market momentum against simpler, though less effective, alternatives.

Segmentation Analysis

The Commercial Ultrasonic Dishwasher Market is primarily segmented based on the core operational parameters, configuration type, application environment, and technological specifications such as frequency and power output. Analyzing these segments provides a nuanced understanding of varying end-user demands across the food service industry. Configuration types, such as benchtop (smaller capacity) and floor-standing (high capacity, often multi-tank systems), delineate market applicability, with benchtop units targeting smaller cafes or specialized culinary stations and floor-standing models dominating large cafeterias, industrial food processors, and institutional settings. Technological segmentation, notably between piezoelectric and magnetostrictive transducers, determines the unit's frequency range, cleaning intensity, and suitability for specific materials, impacting performance and efficiency metrics sought by professional users.

Further analysis focuses on the application segmentation, where distinct requirements necessitate tailored features. Restaurants and hotels demand versatility for diverse items ranging from glassware to large cooking pots, prioritizing rapid cycle times and low noise. Institutional settings (hospitals, schools, prisons) emphasize verifiable, high-level disinfection and massive throughput capacity, making durable, robust systems essential. Conversely, specialized application segments like flight catering often require standardized cleaning protocols for specialized trays and containers, demanding customized jigging and automated material handling integration with the ultrasonic unit. Understanding the unique pressure points and regulatory environments of each application segment is crucial for manufacturers developing market-appropriate equipment and ancillary services.

Finally, segmentation by operational characteristics, such as single-tank versus multi-tank systems, governs throughput capacity and operational flexibility. Single-tank systems are typically suitable for medium-volume needs where space is restricted, focusing on simplicity. Multi-tank systems, however, incorporate stages such as pre-wash, ultrasonic clean, rinse, and sanitization cycles in a continuous flow setup, providing the highest throughput and ensuring continuous operation in 24/7 environments like large factory kitchens. The trend toward multi-tank, conveyor-style ultrasonic systems underscores the industry’s push towards assembly-line efficiency in commercial dish cleaning, mirroring factory automation principles to minimize labor intervention and maximize sanitation consistency across thousands of items daily.

- By Type:

- Benchtop Ultrasonic Dishwashers

- Floor-Standing Ultrasonic Dishwashers (Single Tank)

- Floor-Standing Ultrasonic Dishwashers (Multi-Tank/Conveyor Systems)

- By Technology:

- Piezoelectric Transducers

- Magnetostrictive Transducers

- By Frequency:

- Low Frequency (20–28 kHz)

- Mid Frequency (28–40 kHz)

- High Frequency (40 kHz and above)

- By Application/End-User:

- Restaurants and Cafes

- Hotels and Hospitality

- Institutional Catering (Hospitals, Schools)

- Aviation and Flight Kitchens

- Food Processing Plants

Value Chain Analysis For Commercial Ultrasonic Dishwasher Market

The value chain for the Commercial Ultrasonic Dishwasher Market is complex, beginning with the procurement of highly specialized upstream components and culminating in specialized after-sales service and maintenance. Upstream analysis highlights the critical reliance on key raw material suppliers, particularly those providing specialized stainless steel alloys (essential for durability and resistance to chemicals and corrosion), high-performance electronic components (power generators and control boards), and, most critically, transducer manufacturing (both piezoelectric ceramics and magnetostrictive materials). The quality and consistency of these upstream suppliers directly influence the final product's efficiency, acoustic output consistency, and lifespan. Manufacturing complexity lies in the precise integration and calibration of the ultrasonic generator with the tank structure and transducer array, ensuring uniform cavitation across the entire washing volume, a critical differentiation factor in market quality.

The midstream process involves advanced manufacturing, assembly, and rigorous quality control. Manufacturers often engage in vertical integration for core components, such as building their proprietary generators, to optimize the frequency tuning necessary for maximum cleaning efficacy. Distribution channels form the crucial downstream link, where equipment often moves through a combination of direct and indirect sales strategies. Direct sales are preferred for large institutional contracts or highly customized systems, allowing manufacturers to maintain direct control over specification, installation, and initial training. Conversely, indirect channels, utilizing specialized commercial kitchen equipment distributors, dealers, and value-added resellers (VARs), are essential for broader market penetration, especially targeting small and medium-sized enterprises (SMEs) within the HORECA sector, leveraging the distributors' established regional presence and local maintenance capabilities.

The importance of the downstream segment is further emphasized by the necessity of ongoing technical support, spare parts availability, and preventative maintenance contracts. Unlike consumer appliances, commercial equipment failure can cripple an operation, making rapid response service agreements crucial components of the total value proposition. This service component is often facilitated by the indirect channel—the local dealers or service partners—who manage installation and ongoing troubleshooting. The value chain is constantly optimizing toward greater efficiency, driven by pressure to reduce lead times for custom-built systems and the need for digital integration capabilities (IoT readiness) that simplify monitoring and maintenance, adding significant perceived value for the end-user seeking reduced Total Cost of Ownership (TCO).

Commercial Ultrasonic Dishwasher Market Potential Customers

The primary end-users and potential buyers for commercial ultrasonic dishwashers are concentrated within high-volume, quality-sensitive food preparation and service environments where cleaning speed, consistency, and hygiene validation are non-negotiable operational requirements. This segment includes large-scale institutional catering operations, such as central kitchens serving hospital groups, military bases, university campuses, and correctional facilities, all of which require continuous, industrial-scale dishwashing capabilities. These institutional buyers prioritize durability, regulatory compliance, energy efficiency metrics, and the ability to handle standardized trays, pots, and utensils with minimal labor involvement, often favoring heavy-duty, multi-tank conveyor systems integrated into facility blueprints.

Another significant customer demographic comprises the luxury hospitality sector, including five-star hotels, high-end resorts, and fine dining restaurants. For these establishments, the investment in ultrasonic technology is driven not only by efficiency but also by the need to maintain pristine, undamaged appearance of expensive tableware, silverware, and specialty glassware. Ultrasonic cleaning prevents the scratching or etching common with high-pressure spray washers, preserving the aesthetic quality of their dining implements. Furthermore, these environments often demand ultra-quiet operation, pushing demand toward systems engineered with advanced noise reduction technologies, justifying a premium price point for specialized equipment that delivers superior results without compromising the dining atmosphere or kitchen acoustics.

The third major group includes Quick Service Restaurants (QSRs) and global chain restaurants, which require robust, standardized cleaning solutions across hundreds or thousands of locations. While QSRs may initially opt for smaller, high-throughput benchtop or single-tank units, the core requirement is rapid turnaround for reusable equipment, consistency across all franchises, and simplified, fail-safe operation requiring minimal staff training. Flight kitchens and cruise line catering facilities represent a specialized, highly demanding subset, requiring equipment capable of cleaning unique tray systems and specialized galley equipment under extremely tight turnaround schedules, making them key purchasers of customized, fully automated, high-frequency ultrasonic systems optimized for rapid soil removal and confirmed disinfection, essential for global regulatory compliance across aviation and maritime sectors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 800 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Hobart, Meiko, Winterhalter, Ali Group, CME, Fagor Industrial, Electrolux Professional, Miele Professional, Somat, COMENDA, Shanghai Ultrasonic Cleaning Equipment Co., Ltd., Sonic Systems, Clean Master, SUC-Ultrasonic Cleaning Systems, SK Sonic, Telsonic Group, Blue Wave Ultrasonics, KKS Ultraschall, Cleaning Technologies Group, Feinmechanik AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Ultrasonic Dishwasher Market Key Technology Landscape

The technological landscape of commercial ultrasonic dishwashers is defined by advancements in three primary areas: transducer technology, frequency optimization, and integration of complementary features like automated scraping and filtration. Transducer technology remains the core differentiator, with manufacturers constantly refining the materials used in piezoelectric ceramics to improve efficiency and reduce energy loss during the conversion of electrical energy into acoustic waves. Piezoelectric transducers are favored for high-frequency applications (above 40 kHz) because they produce smaller, more numerous cavitation bubbles, ideal for achieving fine cleaning and sanitization on intricate surfaces and delicate items. Conversely, magnetostrictive transducers, while typically operating at lower frequencies (20-28 kHz) and being more robust, are preferred for heavy-duty applications involving large pots and pans with stubborn, heavily baked-on soil, where the larger cavitation bubbles provide a more aggressive scrubbing action, requiring systems capable of managing this duality effectively.

A crucial technological trend is the move toward multi-frequency operation and frequency sweeping (modulation). Modern ultrasonic generators are increasingly capable of automatically sweeping through a range of frequencies during a single cycle, ensuring that cleaning effectiveness is maximized across different soil types and object geometries. This frequency modulation addresses the inherent limitation that a fixed frequency might leave certain areas unclean (standing wave effects). By continuously shifting the acoustic field, manufacturers guarantee uniform cleaning coverage throughout the tank, significantly improving performance consistency. Furthermore, advancements in power delivery systems ensure stable output regardless of water temperature or load presence, maximizing the consistency and longevity of the ultrasonic cleaning effect, which is critical for maintaining industrial throughput and achieving validated sanitation standards in commercial settings.

Complementary technologies are also critical for overall system performance and market acceptance. Advanced filtration systems, including automatic oil skimming and particulate removal, are essential for maintaining the purity of the cleaning solution, which directly impacts the efficiency of cavitation and the quality of the final rinse. Automated material handling systems, such as conveyor belts, automated lid lifters, and customized racks/jigs, are integrating seamlessly with the ultrasonic tanks, transforming the process into a streamlined, low-touch operation. Looking ahead, sensor technology linked to IoT and AI is becoming standard, offering real-time monitoring of water quality parameters, chemical concentration, and acoustic output, allowing for self-diagnosis and instantaneous optimization of cleaning parameters, ensuring the equipment operates at peak efficiency while providing digital verification of sanitation compliance to management systems.

Regional Highlights

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate globally, driven by massive investments in tourism infrastructure, rapid expansion of the organized food service sector, and increasing regulatory pressure for food safety standardization in countries like China, India, and Southeast Asia. The region is characterized by a significant transition from manual cleaning practices to automated solutions, making it a primary destination for new market entrants and technology deployment. The proliferation of large-scale central kitchens serving massive populations further fuels demand for high-capacity, multi-tank conveyor systems, ensuring high sustained regional sales.

- North America: North America represents a mature, high-value market focused heavily on replacement cycles and technology upgrades. The dominant drivers here are high labor costs, stringent energy efficiency standards (driving demand for high-efficiency inverter-based generators), and the strong uptake of smart kitchen technology. Customers in the US and Canada prioritize systems that offer detailed data logging and compliance traceability, often favoring vendors who provide robust, vertically integrated service networks and IoT-enabled predictive maintenance capabilities to minimize operational risk and maximize ROI in a highly unionized labor environment.

- Europe: The European market demonstrates steady, moderate growth, strongly influenced by European Union regulations regarding hygiene (HACCP), environmental protection, and noise reduction standards. Western European nations, particularly Germany and the UK, exhibit high adoption rates for premium, technologically advanced units, emphasizing sustainability credentials such as reduced water consumption and use of biodegradable cleaning agents. The market is fragmented but highly quality-conscious, preferring established brands known for durable, reliable machinery and long-term parts availability, often incorporating advanced acoustic dampening technology.

- Latin America (LATAM): Growth in LATAM is localized and accelerating, primarily concentrated in metropolitan areas and tourism hubs across Brazil, Mexico, and Chile. The demand is often price-sensitive, balancing between initial cost and necessary capacity, leading to strong interest in mid-range models and refurbished equipment options. Market expansion is contingent on stable economic development and increasing regulatory enforcement of food safety standards in the burgeoning hotel and institutional sectors, driving early adoption among large corporate caterers seeking operational validation.

- Middle East and Africa (MEA): The MEA region is characterized by high spending on luxury hospitality, particularly within the Gulf Cooperation Council (GCC) states. Significant infrastructure projects, including new hotels and massive leisure developments, drive demand for state-of-the-art, high-capacity ultrasonic units often imported from leading European or North American manufacturers. The high investment in tourism and the presence of large flight catering operations in regional hubs make this a premium niche market where cleaning performance and speed are valued above cost, coupled with the need to handle highly diverse, international food preparation equipment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Ultrasonic Dishwasher Market.- Hobart Corporation (Part of ITW Food Equipment Group)

- Meiko Maschinenbau GmbH & Co. KG

- Winterhalter Gastronom GmbH

- Ali Group S.p.A.

- CME Group

- Fagor Industrial S. Coop.

- Electrolux Professional AB

- Miele Professional

- Somat (Division of Oneida)

- COMENDA ALI S.p.A.

- Shanghai Ultrasonic Cleaning Equipment Co., Ltd.

- Sonic Systems Inc.

- Clean Master Ultrasonic

- SUC-Ultrasonic Cleaning Systems

- SK Sonic

- Telsonic Group

- Blue Wave Ultrasonics

- KKS Ultraschall

- Cleaning Technologies Group

- Feinmechanik AG

Frequently Asked Questions

Analyze common user questions about the Commercial Ultrasonic Dishwasher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of commercial ultrasonic dishwashers over traditional spray washers?

The primary technical advantage is the use of cavitation, where high-frequency sound waves generate microscopic bubbles that implode, creating an intense cleaning action capable of reaching inaccessible areas, crevices, and complex geometries. This process provides superior sanitation and removes stubborn, dried-on soil and grease without requiring extensive manual pre-scraping, significantly reducing labor time and achieving higher verifiable hygiene standards crucial for regulatory compliance in professional kitchens.

How does AI technology specifically enhance the operational efficiency and ROI of ultrasonic dishwashers?

AI technology enhances operational efficiency by enabling predictive maintenance through the analysis of operational sensor data, anticipating component failures (e.g., transducers) before critical downtime occurs. Furthermore, AI systems use machine learning to optimize cleaning cycles in real-time based on actual soil load detection, minimizing water, energy, and chemical consumption, thereby directly improving throughput, maximizing uptime, and substantially increasing the overall return on investment (ROI) for high-volume commercial users.

Which market segment is expected to show the fastest growth rate and why?

The multi-tank/conveyor system segment within the floor-standing configuration is expected to show the fastest growth rate. This acceleration is driven by the increasing global trend toward central kitchen models and large institutional catering (hospitals, university food services, flight kitchens), which require continuous, industrial-scale throughput capacity and validated, automated cleaning processes to manage extremely high volumes of diverse catering equipment efficiently and reliably under tight operational schedules.

What are the main restraints impacting the wider adoption of this technology in the HORECA sector?

The main restraints include the relatively high initial capital expenditure compared to conventional commercial dishwashers, posing a financial barrier for smaller independent establishments. Additionally, the need for specialized chemical solutions and specific operator training to maintain optimal cleaning efficacy and manage water quality parameters represents a perceived complexity. Manufacturers must focus on demonstrating long-term cost savings (reduced labor and utilities) to overcome this initial investment resistance.

How significant is the Asia Pacific region's contribution to the future growth of the commercial ultrasonic dishwasher market?

The Asia Pacific region is highly significant, positioned as the primary growth engine due to robust urbanization, massive infrastructure development in the hospitality and tourism sectors, and tightening governmental regulations concerning food hygiene and worker safety. This combination is driving widespread modernization and the mass replacement of manual cleaning methods with high-tech automation solutions, resulting in substantial demand for both localized benchtop units and large-scale facility installations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager