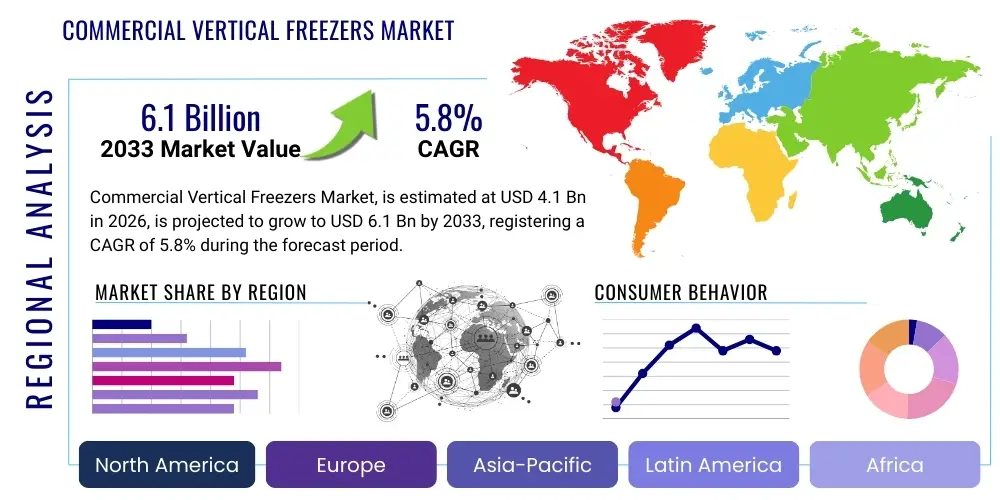

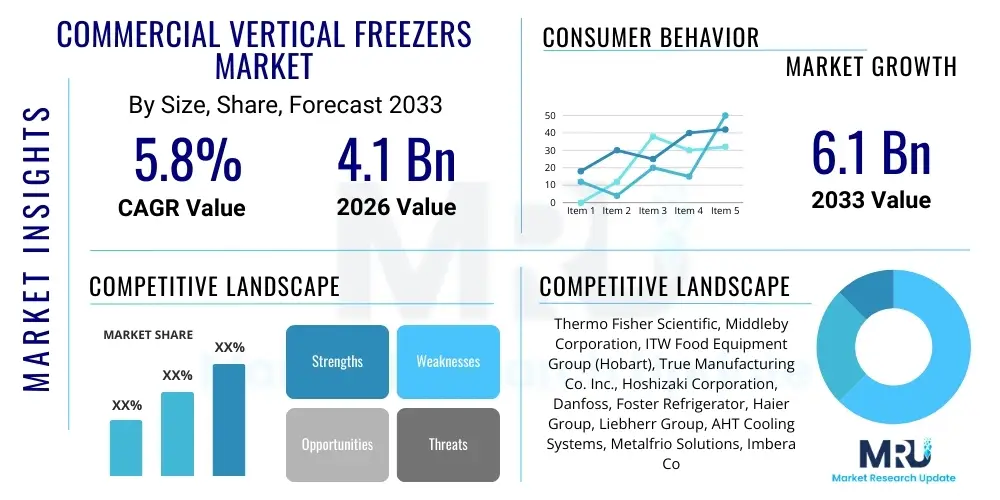

Commercial Vertical Freezers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437751 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Commercial Vertical Freezers Market Size

The Commercial Vertical Freezers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Commercial Vertical Freezers Market introduction

The Commercial Vertical Freezers Market encompasses the manufacturing, distribution, and sale of upright refrigeration units specifically designed for commercial applications, ranging from foodservice and retail environments to institutional settings like hospitals and laboratories. These freezers are essential for the safe and prolonged storage of perishable goods, including frozen foods, ingredients, and critical biological samples. Key characteristics defining these units include high-efficiency compressors, precise temperature control mechanisms, often reinforced stainless steel construction, and features optimized for frequent opening and closing cycles typical of commercial operations. The fundamental design emphasizes vertical space utilization, maximizing storage capacity while maintaining a smaller footprint compared to chest freezers, making them ideal for high-traffic retail or busy kitchen environments where floor space is premium.

Major applications driving demand include high-volume retail locations such as supermarkets and hypermarkets, where aesthetic display and easy accessibility are crucial for impulse buying, alongside the quick-service restaurant (QSR) sector, which relies on standardized frozen ingredients. Furthermore, the burgeoning demand from the healthcare and life sciences sectors for ultra-low temperature (ULT) vertical freezers used for vaccine and sample storage contributes significantly to market growth. The inherent benefits of these systems—such as superior temperature uniformity, advanced energy management features mandated by increasingly stringent environmental regulations, and integration capabilities with smart inventory management systems—cement their indispensable role in the modern cold chain infrastructure. The shift towards natural refrigerants and modular design configurations further defines the current technological trajectory of the market.

Driving factors stimulating market expansion are multifaceted, anchored primarily by the robust growth of the global organized retail sector and the increasing consumer preference for frozen and ready-to-eat meals, which necessitates efficient commercial storage solutions. Regulatory mandates promoting energy efficiency and the phasing out of high Global Warming Potential (GWP) refrigerants, such as HFCs, compel businesses to invest in newer, compliant vertical freezer models. Moreover, rapid urbanization, improvements in global cold chain logistics, and the continuous technological advancements focused on reducing operational costs (through features like variable speed compressors and improved insulation materials) collectively act as powerful catalysts for sustained market uptake across all geographical regions.

Commercial Vertical Freezers Market Executive Summary

The Commercial Vertical Freezers Market is characterized by intense competition driven by technological innovation centered on energy efficiency and sustainability. Current business trends indicate a strong move toward "smart" refrigeration units equipped with IoT sensors for real-time monitoring, predictive maintenance, and optimized energy consumption. The integration of sophisticated inventory tracking and remote diagnostic capabilities is becoming standard, offering businesses substantial operational cost savings and improved compliance. Furthermore, Original Equipment Manufacturers (OEMs) are increasingly focusing on customization, offering tailored sizes and configurations to meet the specific aesthetic and operational needs of diverse end-users, particularly in the premium retail and high-end hospitality sectors. The market also sees continued consolidation among smaller players, as major conglomerates seek to acquire specialized technology firms focused on natural refrigerant solutions or advanced connectivity features to bolster their portfolio and global reach, addressing the complex demands of the modern frozen goods supply chain.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by rapid infrastructure development in emerging economies, the expansion of modern organized food retail chains, and significant government investments in strengthening cold chain logistics, particularly in countries like China and India. North America and Europe, while mature, remain dominant in terms of revenue contribution, driven by stringent energy efficiency regulations (such as those enforced by the U.S. Department of Energy and the EU F-Gas Regulation) which necessitate continuous equipment upgrades and replacement cycles. These developed regions are also pioneers in adopting advanced technologies, including CO2 and hydrocarbon-based refrigeration systems, reflecting a mature market demand for high-performance, environmentally friendly solutions. Latin America and the Middle East & Africa (MEA) exhibit steady growth, largely dependent on the expansion of urbanization and increased foreign direct investment into the foodservice and quick commerce delivery sectors, requiring decentralized, efficient freezing capabilities.

Segment trends highlight the dominance of the Reach-In vertical freezer category due to its versatility and ubiquity across most commercial settings. However, the Pass-Through segment is gaining traction, especially in high-volume, quick-service environments where efficiency in stock rotation and back-of-house workflow is paramount. From a refrigerant perspective, natural refrigerants, particularly R290 (Propane) and CO2 (R744), are experiencing exponential growth, mandated by regulatory pressures and corporate sustainability goals, rapidly displacing conventional synthetic HFC refrigerants. The Supermarkets/Hypermarkets application segment continues to hold the largest market share, but the institutional segments, notably healthcare and bio-storage, are demonstrating the highest growth trajectory, reflecting the global focus on vaccine preparedness and advanced biological sample management requiring reliable, precise ULT freezing capabilities.

- Business Trends: IoT integration, smart monitoring, customized solutions, and sustainable refrigerants (R290, R744).

- Regional Trends: APAC rapid growth due to infrastructure expansion; North America and Europe driven by regulatory replacement cycles and technological leadership.

- Segments Trends: Reach-In dominance; fastest growth in Pass-Through and institutional applications; rapid shift towards natural refrigerants.

AI Impact Analysis on Commercial Vertical Freezers Market

User queries regarding AI in the Commercial Vertical Freezers Market frequently center on how Artificial Intelligence can optimize energy use, predict component failures, and streamline complex inventory management in highly decentralized retail environments. Users express keen interest in understanding the ROI of integrating AI-powered algorithms for dynamic temperature setpoint adjustments based on external factors like ambient temperature or internal factors like door opening frequency and current stock load. Concerns often revolve around data privacy, the cost of implementing sophisticated sensor networks and analytical platforms, and the necessary cybersecurity measures to protect connected refrigeration assets against unauthorized access. The core expectation is that AI should transform the operational model from reactive maintenance and static scheduling to proactive, highly adaptive, and predictive asset management, ultimately extending equipment lifespan and minimizing energy waste while ensuring superior food safety compliance across geographically disparate locations.

The integration of AI is moving commercial vertical freezers from passive storage units to active, decision-making nodes within the overall cold chain ecosystem. Machine learning algorithms analyze historical performance data, maintenance records, and real-time operational parameters (compressor load, fan speed, defrost cycles) to build robust predictive models. These models allow facility managers to anticipate component wear or refrigerant leaks long before they cause critical failures, scheduling preventative maintenance precisely when needed. This shift from time-based maintenance to condition-based maintenance drastically reduces downtime, lowers repair costs, and ensures continuous optimal performance, which is vital for high-value frozen goods.

Furthermore, AI algorithms are critical for achieving peak energy efficiency. By analyzing usage patterns, customer traffic flow, and utility tariffs, AI can dynamically adjust cooling cycles, optimizing the defrost schedule and modulating compressor output to align with peak demand hours or inventory requirements. This dynamic setpoint management ensures that the freezer maintains necessary safety temperatures while minimizing energy draw, often leading to double-digit percentage reductions in electricity consumption. In retail, AI-driven demand forecasting, tied directly to inventory levels reported by smart shelving systems within the freezer, allows for automated reordering processes, reducing spoilage and ensuring optimal stock availability, fundamentally transforming the efficiency of retail freezer operations.

- Enables predictive maintenance through analysis of operational data, minimizing downtime.

- Optimizes energy consumption via dynamic temperature setpoint adjustments based on load and external factors.

- Facilitates advanced inventory tracking and automated stock rotation using computer vision and sensor data.

- Improves food safety and compliance through continuous, real-time temperature deviation alerts analyzed by ML models.

- Streamlines supply chain integration by providing accurate demand forecasting based on retail traffic analysis.

DRO & Impact Forces Of Commercial Vertical Freezers Market

The dynamics of the Commercial Vertical Freezers Market are heavily shaped by a robust set of Drivers (D), Restraints (R), and Opportunities (O), which collectively determine the market trajectory, alongside significant Impact Forces. Key drivers include the global expansion of organized food retail, necessitated by rapid urbanization and the subsequent shift in consumer lifestyles favoring convenience and ready-to-eat frozen meals. This is further amplified by stringent global regulations, particularly in developed economies, mandating the adoption of energy-efficient and environmentally sustainable refrigeration technologies, forcing mandatory replacement cycles for older, non-compliant equipment. The increasing demand from the biomedical and pharmaceutical sectors for ultra-low temperature vertical freezers for critical storage, especially post-pandemic, provides a high-growth, high-value application driver that insulates the market from standard economic cycles.

However, the market faces significant restraints, primarily the high initial capital investment required for modern, energy-efficient vertical freezer units, especially those incorporating natural refrigerants (like CO2) which demand specialized components and installation expertise. Furthermore, volatility in raw material costs, particularly for steel and specialized insulation foams, exerts margin pressure on manufacturers, which is then passed on to end-users. A persistent challenge remains the requirement for skilled technicians capable of installing, maintaining, and repairing advanced refrigeration systems utilizing complex natural refrigerants, creating a bottleneck in widespread adoption, particularly in developing regions where infrastructure and training programs lag behind technological advancements.

Opportunities abound, centering on the vast potential of IoT and AI integration to transform operational efficiency, offering service providers lucrative recurring revenue streams through software-as-a-service (SaaS) models for monitoring and predictive analytics. The rapid expansion of e-commerce and quick commerce (Q-commerce) platforms necessitates decentralized, high-efficiency vertical freezing solutions for local fulfillment centers and dark stores, opening up entirely new application domains. Moreover, continuous innovation in thermal insulation technologies, such as Vacuum Insulated Panels (VIPs), promises to deliver the next generation of highly energy-efficient freezers with slimmer profiles, maximizing usable storage volume and appealing strongly to space-constrained urban retailers. These forces combine to create a highly dynamic and resilient market environment, favoring manufacturers who prioritize sustainability and intelligent connectivity.

- Drivers: Global expansion of organized retail; stringent energy efficiency and environmental regulations; growth in bio-storage and pharmaceutical cold chain requirements.

- Restraints: High initial investment costs for sustainable units; complexity and cost associated with natural refrigerant systems; volatility in raw material prices.

- Opportunities: Integration of IoT/AI for predictive maintenance and energy optimization; rapid growth of Q-commerce requiring decentralized freezers; adoption of advanced insulation materials (VIPs).

- Impact Forces: Regulatory compliance requirements (e.g., F-Gas regulation) exert high impact; technological advancements in compressors (variable speed drives) and refrigerants create moderate-to-high impact on competitiveness; global supply chain instability affects raw material cost volatility.

Segmentation Analysis

The Commercial Vertical Freezers Market is comprehensively segmented based on Type, Application, and Refrigerant Type, providing a detailed view of product diversity and end-user behavior. Segmentation by Type, including Reach-In, Pass-Through, and Roll-In models, addresses specific operational workflows and space constraints, with Reach-In units dominating due to their versatility in standard kitchen and retail settings. Application segmentation reveals the diverse demand landscape, where supermarkets and hypermarkets command the largest share, driven by high display and storage volume requirements, closely followed by the high-growth institutional sectors like healthcare and research laboratories demanding specialized, often ultra-low temperature, capabilities. The increasing focus on environmental stewardship and regulatory compliance is heavily reflected in the Refrigerant Type segmentation, marking a decisive transition from conventional hydrofluorocarbons (HFCs) to environmentally benign natural refrigerants such as hydrocarbons and carbon dioxide.

- By Type: Reach-In, Pass-Through, Roll-In

- By Application: Supermarkets/Hypermarkets, Convenience Stores, Restaurants/Foodservice, Hospitals/Laboratories, Hotels, Others (Catering, Institutional Kitchens)

- By Refrigerant Type: Natural Refrigerants (R290, R600a, R744), Synthetic Refrigerants (R404A, R410A, R448A/R449A)

Value Chain Analysis For Commercial Vertical Freezers Market

The value chain for commercial vertical freezers begins with upstream activities involving the sourcing and processing of core raw materials, predominantly high-grade stainless steel for cabinet construction, specialized insulation materials (e.g., polyurethane foam, vacuum insulated panels), and critical refrigeration components such as compressors, condensers, evaporators, and electronic controllers. Key upstream suppliers include steel mills, chemical companies, and specialized component manufacturers like Danfoss, Embraco, and Copeland. The efficiency and quality of these components directly dictate the final product's energy rating and longevity. Strong focus is placed on establishing resilient sourcing strategies, especially for advanced components like variable speed drive (VSD) compressors and sensor technology, which are essential for manufacturing energy-efficient, smart units compliant with modern standards.

The central manufacturing stage involves component assembly, system integration, and rigorous quality testing. OEMs invest heavily in automated production lines to ensure precision in brazing, refrigerant charging, and cabinet finishing. Post-manufacturing, the distribution channel plays a pivotal role. Direct distribution involves large OEMs selling directly to major institutional buyers (e.g., large hospital networks, global supermarket chains) or large QSR franchises, allowing for customized orders and direct service agreements. Indirect distribution, which is more common, utilizes specialized refrigeration distributors, third-party logistics (3PL) providers, and wholesale equipment dealers, who manage regional inventory, provide localized support, and handle installation services. These distributors often maintain relationships with small-to-midsize restaurants, convenience stores, and independent retailers.

Downstream activities involve installation, commissioning, maintenance, and end-of-life management. Aftermarket services, including spare parts supply, preventative maintenance contracts, and technical support, represent a significant revenue stream and a crucial differentiator for manufacturers. The shift towards IoT and AI-enabled units has created a new downstream layer: data service and predictive analytics platforms, often offered via subscription models, which enhance the value proposition beyond the physical equipment. Ultimately, the end-user (potential customers) determines the success, with feedback influencing future R&D, particularly concerning ease of cleaning, energy consumption, and ergonomic design for high-traffic commercial environments. The increasing complexity of natural refrigerants necessitates enhanced technical training throughout the distribution and servicing tiers.

Commercial Vertical Freezers Market Potential Customers

The primary consumers and end-users of commercial vertical freezers span a broad spectrum of industries united by the necessity of safe, efficient frozen storage and display. Supermarkets and hypermarkets represent the largest customer base, requiring high-capacity, display-oriented units (often glass-door vertical freezers) that optimize visual merchandising while maintaining strict temperature control for vast arrays of frozen foods, including ice cream, prepared meals, and packaged vegetables. Their purchasing decisions are heavily influenced by energy efficiency ratings, merchandising aesthetics, and overall total cost of ownership (TCO) over a long operational lifespan, making regulatory compliance a high priority.

The foodservice sector, including quick-service restaurants (QSRs), casual dining establishments, and institutional catering operations, constitutes another critical customer group. These buyers typically prioritize durable, high-throughput, stainless steel back-of-house models (Reach-In or Roll-In) designed for harsh kitchen environments and rapid ingredient retrieval. For QSRs, standardization, ease of cleaning, and reliability are key, as equipment failure can halt operations. Convenience stores and small retail outlets, conversely, require smaller, footprint-optimized vertical freezers, often relying on plug-and-play units with robust temperature stability for packaged goods and beverages, prioritizing accessibility and minimal maintenance requirements.

Finally, the healthcare, pharmaceutical, and research sectors are rapidly expanding customer segments, demanding highly specialized, often certified, vertical freezers capable of maintaining ultra-low and cryogenic temperatures for sensitive samples, reagents, and biological materials, including vaccines. Their purchasing criteria are non-negotiable regarding temperature precision, redundancy features, alarm systems, and data logging capabilities to meet stringent regulatory requirements (e.g., FDA, GMP). These institutional buyers represent the premium segment of the market, focusing on reliability and validated performance rather than mere price point, driving innovation in advanced control systems and non-CFC refrigerants.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Middleby Corporation, ITW Food Equipment Group (Hobart), True Manufacturing Co. Inc., Hoshizaki Corporation, Danfoss, Foster Refrigerator, Haier Group, Liebherr Group, AHT Cooling Systems, Metalfrio Solutions, Imbera Commercial Refrigeration, Carrier Global Corporation, Electrolux Professional, Williams Refrigeration, Delfield (Welbilt), Perlick Corporation, Continental Refrigerator, Traulsen (ITW), Blue Air Refrigeration. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Vertical Freezers Market Key Technology Landscape

The technological landscape of commercial vertical freezers is currently defined by a decisive pivot towards energy efficiency, sustainable refrigerants, and digital connectivity, primarily driven by escalating energy costs and tightening global environmental protocols. Central to this evolution is the widespread adoption of natural refrigerant technologies, predominantly R290 (Propane) and R744 (CO2). R290 is favored in smaller, self-contained units due to its high thermodynamic efficiency and ultra-low Global Warming Potential (GWP), while R744 transcritical systems are becoming essential for large centralized refrigeration racks in supermarkets and hypermarkets. This shift requires sophisticated component redesigns, including specialized heat exchangers and robust systems engineered to handle the higher pressures associated with CO2, ensuring safety and compliance across diverse operational temperatures.

Energy management technologies are equally crucial. The replacement of fixed-speed compressors with highly optimized Variable Speed Drives (VSDs) or inverter technology allows the cooling system capacity to precisely match the load demand, resulting in substantial energy savings, particularly in units subjected to frequent door openings or fluctuating ambient conditions. Coupled with enhanced insulation materials, such as the increasing integration of Vacuum Insulated Panels (VIPs) on cabinet walls, manufacturers are achieving higher Energy Star ratings and compliance with strict standards like the Minimum Energy Performance Standards (MEPS) across global markets. The focus on improved airflow management systems, including sophisticated fan and duct designs, ensures better temperature uniformity across the vertical cabinet, mitigating freezer burn and enhancing product quality assurance, which is a major concern for retail end-users.

Furthermore, the rise of the smart freezer ecosystem has positioned IoT connectivity and advanced control electronics as standard features. Modern vertical freezers are equipped with networked sensors that monitor operational parameters (temperature, humidity, compressor health) and transmit data to cloud-based monitoring platforms. This facilitates remote diagnostics, over-the-air software updates, and predictive maintenance schedules. Electronic Expansion Valves (EEVs) are replacing traditional thermal expansion valves (TXVs) to provide precise and rapid refrigerant flow control, optimizing performance and reducing pull-down times. This integration of hardware and software transforms the freezer from a passive storage unit into an active, manageable, and highly traceable asset within the modern cold supply chain infrastructure, bolstering efficiency and regulatory traceability.

Regional Highlights

- Asia Pacific (APAC): Expected to exhibit the highest CAGR due to rapid urbanization, significant government investment in cold chain infrastructure (especially in India and China), and the explosive growth of organized retail and Q-commerce platforms. The increasing regulatory emphasis on adopting energy-efficient appliances also drives demand for modern vertical freezers.

- North America: A mature market characterized by high regulatory stringency (EPA/DOE standards) driving replacement demand. Dominated by demand for technologically advanced, energy-efficient units featuring natural refrigerants (R290). High adoption rates in the QSR and institutional (laboratory/biotech) sectors ensure continuous innovation and revenue stability.

- Europe: Leading the global transition to sustainable refrigeration, driven by the F-Gas Regulation (phasing down HFCs). This legislative environment ensures consistent investment in R744 and R290 systems across all commercial verticals. Germany, UK, and France are key markets due to strong retail and pharmaceutical sectors demanding high-specification equipment.

- Latin America (LATAM): Growth driven by the expansion of international supermarket chains and increasing foreign investment in the region's foodservice industry. While price sensitivity remains a factor, there is growing acceptance of higher-efficiency models in major economies like Brazil and Mexico to mitigate high local energy costs.

- Middle East and Africa (MEA): Market expansion is tied to infrastructure development, tourism, and hospitality sector growth. The extreme climate conditions necessitate robust, high-performance vertical freezers, often driving demand for specialized heavy-duty cooling systems and prioritizing reliable temperature management in challenging operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Vertical Freezers Market.- Thermo Fisher Scientific

- Middleby Corporation

- ITW Food Equipment Group (Hobart)

- True Manufacturing Co. Inc.

- Hoshizaki Corporation

- Danfoss

- Foster Refrigerator

- Haier Group

- Liebherr Group

- AHT Cooling Systems

- Metalfrio Solutions

- Imbera Commercial Refrigeration

- Carrier Global Corporation

- Electrolux Professional

- Williams Refrigeration

- Delfield (Welbilt)

- Perlick Corporation

- Continental Refrigerator

- Traulsen (ITW)

- Blue Air Refrigeration

Frequently Asked Questions

Analyze common user questions about the Commercial Vertical Freezers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory drivers impacting the shift in commercial vertical freezers?

The primary regulatory drivers globally are the phase-down of Hydrofluorocarbons (HFCs) under the Kigali Amendment to the Montreal Protocol and regional regulations like the European Union's F-Gas Regulation and the U.S. EPA SNAP rules, which restrict the use of high Global Warming Potential (GWP) refrigerants. Additionally, energy efficiency standards, such as those imposed by the U.S. Department of Energy (DOE) and regional Minimum Energy Performance Standards (MEPS), necessitate continuous upgrades to technologically superior, low-GWP, and highly efficient vertical freezer models.

How is the adoption of natural refrigerants affecting the operational cost of vertical freezers?

The adoption of natural refrigerants, particularly R290 (Propane) and R744 (CO2), positively impacts long-term operational costs primarily by significantly reducing energy consumption. These refrigerants often possess superior thermodynamic properties compared to older HFCs, allowing systems to operate more efficiently, especially when paired with modern variable speed compressors. While the initial capital cost for R744 systems can be higher, the substantial reduction in electricity bills and the avoidance of potential future taxes on high-GWP fluids deliver a favorable total cost of ownership (TCO).

What key features should buyers look for when selecting a commercial vertical freezer for foodservice applications?

Foodservice buyers should prioritize durability, temperature uniformity, and rapid recovery time. Key features include stainless steel construction for hygiene and longevity, high-density insulation, effective air circulation systems to ensure consistent freezing throughout the cabinet (preventing hot spots), and heavy-duty, self-closing doors designed to withstand frequent use. Furthermore, certifications related to sanitation (e.g., NSF compliance) and integration with smart monitoring systems for HACCP compliance are crucial for modern commercial kitchen operations.

What role does IoT integration play in enhancing the efficiency of commercial vertical freezers?

IoT integration transforms efficiency by enabling real-time remote monitoring and predictive maintenance. Sensors continuously track critical performance metrics (temperature, voltage, compressor cycles). This data is analyzed via cloud platforms to identify deviations, predict potential component failures before they occur, and optimize energy use by dynamically adjusting setpoints based on usage patterns and ambient conditions. This proactive management minimizes spoilage risk, reduces emergency repair costs, and ensures maximum uptime, which is vital for high-value cold chain assets.

Which application segment is demonstrating the fastest growth rate in the vertical freezers market?

The Hospitals and Laboratories segment, often grouped under institutional applications, is currently exhibiting the fastest growth rate. This acceleration is driven by the global need for robust ultra-low temperature (ULT) freezers (-40°C to -86°C) required for storing complex biological samples, critical pharmaceuticals, and specialized vaccines. Increased investment in biopharma research, biobanking facilities, and heightened preparedness for public health crises necessitate reliable, high-precision vertical freezing solutions, pushing this segment to lead in technological adoption and growth.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager