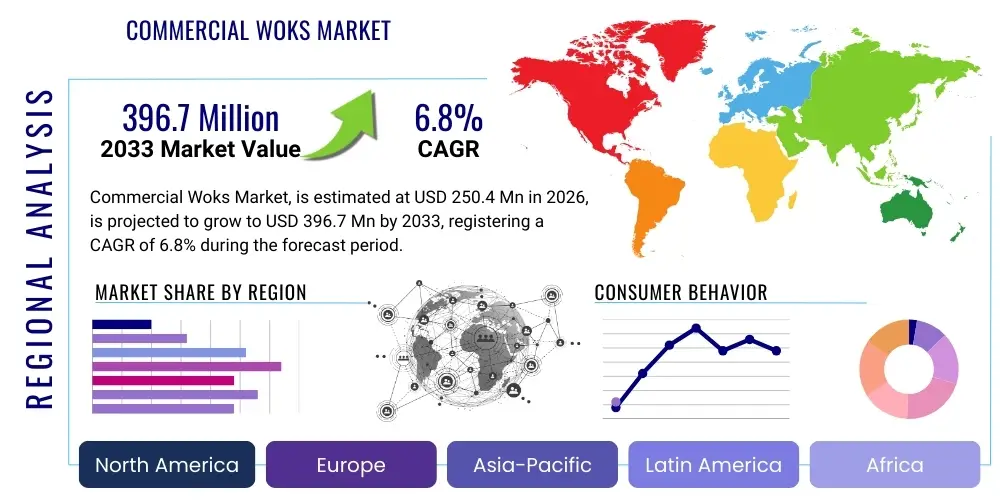

Commercial Woks Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437016 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commercial Woks Market Size

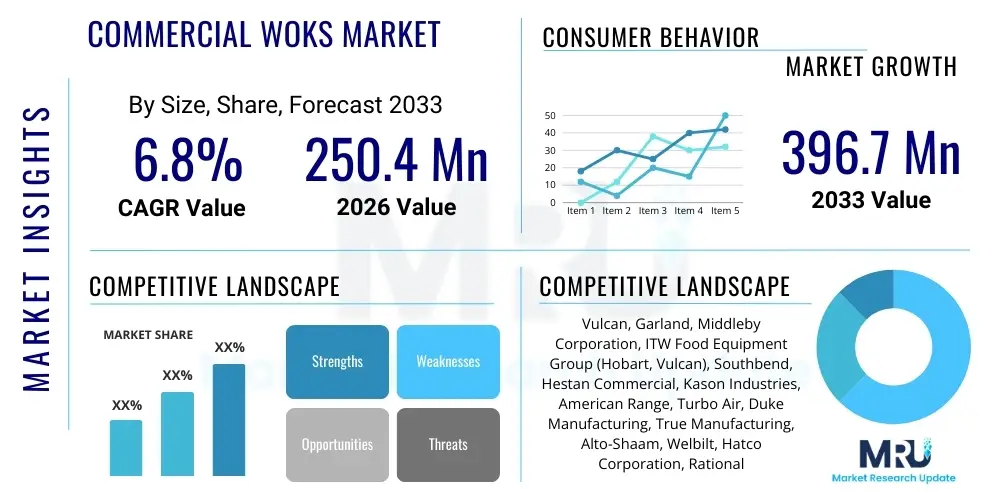

The Commercial Woks Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $250.4 Million in 2026 and is projected to reach $396.7 Million by the end of the forecast period in 2033. This robust growth trajectory is underpinned by the accelerating global expansion of Asian and fusion culinary establishments, coupled with significant technological advancements aimed at enhancing energy efficiency and operational safety within commercial kitchens.

Commercial Woks Market introduction

The Commercial Woks Market encompasses specialized, high-durability cooking apparatus designed exclusively for professional food service operations, including high-volume restaurants, institutional kitchens, and catering businesses. Commercial woks, distinct from residential versions, are characterized by thicker gauge materials, often carbon steel or heavy cast iron, built to withstand continuous high-heat exposure and intense physical stress. Key applications center around stir-frying, deep-frying, braising, steaming, and smoking, requiring uniform heat distribution and rapid temperature recovery. The inherent benefits of commercial woks include high BTU (British Thermal Unit) output for authentic 'Wok Hei' flavor development, superior durability, and ergonomic designs that optimize speed and capacity in busy environments. The primary driving factors for market expansion include the globalization of Chinese, Thai, and Vietnamese cuisines, increasing demand for rapid cooking solutions in Quick Service Restaurants (QSRs), and innovations in induction and automated wok technologies that address rising labor costs and energy conservation mandates.

Commercial woks are integral to the operational success of kitchens specializing in high-heat, high-speed preparations. The materials chosen—often encompassing specialized alloys of stainless steel or high-grade carbon steel—are critical for achieving the necessary thermal inertia and resistance to warping under extreme temperatures, typically ranging from 450°F to 600°F. The construction methodology, including specialized welding and polishing techniques, ensures compliance with stringent international food safety standards, such as those set by NSF International. Furthermore, the accompanying commercial wok ranges, which are typically high-pressure gas burners or sophisticated induction units, are engineered to deliver precise heat control, a necessary feature for consistent quality in professional settings where high throughput is mandatory.

The market’s foundational growth is strongly tied to demographic shifts and cultural assimilation, particularly in North America and Europe, where Asian culinary styles have moved from niche categories to mainstream dining options. This increased consumer familiarity translates directly into higher investment by the Horeca (Hotel, Restaurant, Catering) sector in specialized cooking equipment like commercial woks. Moreover, the industry is witnessing a significant trend toward specialized equipment that minimizes manual intervention, particularly in large chain operations. The latest generation of commercial woks often features integrated filtration systems, automated cleaning cycles, and ergonomic design elements focused on reducing repetitive strain injury among kitchen staff, further solidifying their necessity in modern, efficient commercial layouts.

Commercial Woks Market Executive Summary

The Commercial Woks Market is navigating a period of rapid evolution, primarily driven by shifting business trends favoring automation and energy efficiency. Regionally, the Asia Pacific continues its dominance both in consumption and manufacturing, while North America and Europe exhibit the fastest growth rates due to the surge in ethnic food consumption and the expansion of streamlined QSR concepts. Key segmental trends highlight a strong transition towards induction-compatible woks and automated tilting wok systems, offering improved consistency and addressing persistent skilled labor shortages. Material segments, specifically heavy-duty carbon steel and advanced composite non-stick coatings compliant with commercial standards, are witnessing robust demand, supported by stringent industry requirements for equipment longevity and minimal downtime.

In terms of prevailing business trends, supply chain resiliency has become a paramount concern for manufacturers, necessitating greater diversification of sourcing strategies for raw materials such as high-grade steel and nickel alloys, which are subject to global commodity price volatility. Furthermore, the market is experiencing consolidation, with major commercial kitchen equipment manufacturers acquiring niche specialized wok producers to integrate advanced induction technology and gain a competitive edge in high-efficiency product lines. This strategic alignment is essential as regulatory pressures mount globally, requiring commercial cooking equipment to meet increasingly strict energy consumption and emission standards, thereby accelerating the retirement of older, less efficient gas wok ranges.

Geographically, investment patterns reflect distinct market maturity levels. While developed markets in the West are focused on premium, technologically integrated woks that feature sensors and connectivity (IoT-enabled kitchen solutions), emerging markets in Southeast Asia and Latin America are still heavily focused on capacity expansion and traditional, high-BTU gas-fired systems offering lower initial capital expenditure. However, even in these regions, there is a growing recognition of the long-term operational savings associated with high-efficiency equipment, spurred by rising energy costs. This dual trend underscores a segmented market approach, where customization based on regional energy infrastructure (gas availability versus electric grid stability) and local culinary needs is crucial for market penetration and sustained profitability.

AI Impact Analysis on Commercial Woks Market

User inquiries regarding AI's influence in the Commercial Woks Market primarily revolve around optimizing cooking processes, predictive maintenance for high-BTU ranges, and supply chain efficiency. Key concerns center on whether AI can replicate the subtle, skilled techniques required for authentic wok cooking (the ‘Wok Hei’), the integration cost of smart sensors into traditional kitchen hardware, and the potential for AI algorithms to manage inventory and food safety monitoring automatically. The consensus expectation is that while AI will not replace the human chef’s creativity, it will profoundly enhance consistency, energy management, and equipment lifespan. AI is anticipated to move commercial woks beyond simple heat delivery systems into sophisticated, data-driven cooking stations capable of real-time adjustment and diagnostic reporting, maximizing both culinary output and operational throughput.

The implementation of Artificial Intelligence and Machine Learning (ML) in commercial wok systems is focused heavily on achieving unparalleled consistency in high-volume production. AI algorithms analyze cooking parameters—such as ingredient moisture content, ambient kitchen temperature, oil temperature, and burner intensity—to dynamically adjust heat delivery profiles, ensuring standardized cooking outcomes irrespective of external variables or the experience level of the operator. This level of precision is vital for large restaurant chains that require exact flavor and texture replication across thousands of locations. For instance, ML models can learn and store the optimal thermal curve for specific dishes, enabling the system to guide or even automate the cooking process, drastically reducing food waste caused by over or undercooking and significantly accelerating staff training.

Furthermore, AI plays a pivotal role in the maintenance and operational management of complex, high-power wok ranges. Modern commercial wok ranges contain numerous sensitive components, including high-efficiency combustion systems and electronic control boards. AI-driven predictive maintenance utilizes embedded sensors to monitor vibration, heat fluctuations, gas flow rates, and component wear in real time. By identifying anomalies and predicting potential component failure hours or even days before a critical breakdown occurs, AI systems allow kitchen managers to schedule necessary maintenance proactively during off-peak hours. This dramatically minimizes unexpected equipment downtime, which is exceptionally costly in the high-volume environment of a commercial kitchen, thereby enhancing overall equipment effectiveness (OEE) and ensuring uninterrupted service delivery.

- AI-driven automated temperature control for precise 'Wok Hei' replication and consistency.

- Machine Learning algorithms optimize energy consumption in induction and gas ranges based on load patterns.

- Predictive maintenance analytics minimize unscheduled downtime by forecasting component failure in high-stress wok ranges.

- Integration with kitchen management systems (KMS) for automated inventory tracking linked to recipe execution.

- Real-time sensor data analysis ensures compliance with critical HACCP (Hazard Analysis Critical Control Point) temperature logging requirements.

- Enhanced supply chain optimization by predicting demand fluctuations for specific wok sizes and material grades based on global culinary trends.

- Robotically assisted wok cooking systems utilize computer vision and AI guidance for consistent stirring and tossing actions, mitigating labor dependency.

DRO & Impact Forces Of Commercial Woks Market

The Commercial Woks Market dynamic is characterized by the powerful driver of global Asian culinary acceptance, necessitating specialized equipment that can achieve authentic high-heat cooking profiles. This is balanced by significant restraints, primarily the high capital cost associated with professional-grade, specialized wok ranges and the complexity of ensuring staff possess the necessary skills to operate them safely and effectively. Opportunities reside in the rapid technological adoption of induction cooking systems that provide superior efficiency and safer operating environments, particularly as commercial kitchens prioritize sustainability metrics. The impact forces are predominantly driven by regulatory shifts towards higher energy efficiency standards (a push factor) and the enduring economic pressure of fluctuating raw material costs (a pull factor) which influences final product pricing and manufacturers' profitability margins.

Key drivers include the dramatic rise of fast-casual dining concepts and ghost kitchens that prioritize speed and specialized cooking techniques, making the efficient commercial wok indispensable for menu items requiring rapid cooking times. Furthermore, the development of improved materials science, such as advanced non-stick coatings that can endure commercial scouring and high temperatures without leaching harmful substances, enhances product lifespan and addresses health concerns. The cultural shift towards demanding authentic ethnic flavors directly correlates with the need for high-BTU output equipment capable of generating the signature smoky flavor (Wok Hei) central to various Asian cuisines, thus solidifying the wok's essential status in these establishments. This demand is further amplified by globalization, which makes specialized ingredients and associated culinary traditions more accessible worldwide.

Major restraints involve the significant physical space requirements and complex ventilation systems mandated for high-BTU gas wok ranges, posing a challenge for smaller urban restaurant footprints. Initial investment costs for sophisticated, multi-burner wok stations, often exceeding standard commercial range prices, can be prohibitive for independent restaurateurs. Additionally, the operational constraint of finding and retaining skilled chefs proficient in specialized wok techniques creates reliance on more automated systems. Conversely, major opportunities lie in the integration of smart technologies, offering diagnostic feedback and remote monitoring, which appeals to large chain operators focused on standardized maintenance protocols. The rising emphasis on sustainable kitchen operations globally presents a significant opportunity for manufacturers pioneering induction wok systems that drastically reduce heat waste and require minimal ventilation compared to traditional flame-based models, offering a compelling long-term cost proposition.

Segmentation Analysis

The Commercial Woks Market is systematically segmented across critical dimensions including material composition, heating source technology, specific capacity requirements, and end-user application. Analysis based on material highlights the dominance of heavy-gauge carbon steel due to its superior heat retention and seasoning capabilities, closely followed by durable stainless steel for enhanced hygiene and easier maintenance in high-volume settings. Segmentation by heat source reveals a crucial industry shift, with gas-fired woks remaining prevalent globally, but induction woks gaining rapid momentum, particularly in developed urban markets prioritizing energy efficiency and reduced ambient heat. End-user categories define distinct needs, ranging from large-scale chain restaurants requiring robust, standardized equipment to independent fine dining establishments seeking customized, high-performance units.

Detailed segmentation allows manufacturers to tailor product development and marketing strategies effectively. For example, capacity segmentation distinguishes between single-burner counter-top units suitable for smaller cafés or supplementary use, and large, multi-burner modular systems designed for high-throughput institutional catering or large Chinese banquet halls. This distinction affects the engineering specifications, including the gauge of the metal, the intensity of the burner system (measured in BTU or kilowatt), and the overall footprint of the apparatus. Furthermore, the segmentation by design—stationary vs. tilting or rotating woks—addresses different operational needs, where tilting woks are favored in catering and processing centers for easier large-batch transfer and cleaning, while stationary woks dominate traditional restaurant lines.

The market’s complexity necessitates a nuanced understanding of these segments, as purchasing decisions are often interdependent. A QSR chain might prioritize standardized induction woks (Heating Source) made from stainless steel (Material) with medium capacity (Capacity), driven by the need for quick, repeatable results across multiple locations (End-User). In contrast, a specialized Szechuan restaurant might opt for high-BTU gas woks (Heating Source) constructed from heavy carbon steel (Material) in a large capacity (Capacity), emphasizing the preservation of specific culinary traditions and flavors. Monitoring the shifts between these segments, especially the rapid adoption rates in induction technology, is crucial for accurate market forecasting and strategic investment planning across the value chain, from raw material procurement to final product distribution.

- By Material:

- Carbon Steel Woks

- Stainless Steel Woks

- Cast Iron Woks

- Aluminum Woks (Less common commercially, but used for lighter tasks)

- By Heat Source:

- Gas-Fired Woks (High-BTU Conventional)

- Electric Woks (Standard resistance heating)

- Induction Woks (Energy efficient, precise control)

- By Capacity/Size:

- Small (Under 18 inches diameter)

- Medium (18 to 24 inches diameter)

- Large (Over 24 inches diameter)

- By End-User:

- Full-Service Restaurants (FSR)

- Quick Service Restaurants (QSR)

- Hotels and Catering Services

- Institutional Food Services (Schools, Hospitals)

- By Design:

- Stationary Wok Ranges

- Automated Tilting Woks

- Countertop Portable Woks

Value Chain Analysis For Commercial Woks Market

The value chain for the Commercial Woks Market begins with the highly specialized upstream procurement of raw materials, primarily high-grade, food-safe metals like carbon steel alloys, stainless steel (304 and 316 grades), and cast iron, often requiring specific certification for commercial kitchen use. Manufacturing involves precision processes such as deep drawing, heavy gauge stamping, and high-quality welding to create the robust wok bodies and associated range infrastructure, demanding adherence to strict safety standards (e.g., ETL, NSF). Distribution is typically indirect, utilizing a network of specialized commercial kitchen equipment dealers, Horeca distributors, and project consultants who manage complex kitchen installations. The downstream segment involves installation, staff training, and critical after-sales services, including maintenance contracts and spare parts supply, which are vital given the high-stress environment in which the equipment operates.

Upstream analysis emphasizes the dependence on global steel markets and the need for rigorous quality control during metal fabrication. Manufacturers often maintain long-term relationships with certified metal suppliers to ensure material consistency, which is paramount for the structural integrity and performance of the wok equipment under high heat. The design phase is highly technical, focusing on thermal dynamics—ensuring efficient heat transfer for gas models and optimal magnetic field alignment for induction models. Innovations in this phase, such as developing specialized burner designs for higher efficiency and lower emissions, are critical competitive differentiators. Furthermore, the sourcing of components like high-BTU gas valves, electronic control interfaces for induction, and specialized insulation materials forms a significant part of the upstream complexity.

Downstream market activities are dominated by specialized B2B channels. Direct sales are rare, mostly limited to large governmental or multinational contracts. The prevalent indirect distribution model relies on regional distributors who not only warehouse and transport the heavy equipment but also possess the technical expertise required for complex installation, often involving commercial gas line hookups and advanced electrical wiring for induction units. Project sales, where the wok equipment is integrated into a complete kitchen layout designed by consultants, constitute a substantial portion of the market. After-sales service, including warrantied repair and the provision of certified replacement parts, is crucial for maintaining customer loyalty, as commercial kitchens cannot afford prolonged downtime, making reliability a key purchasing criterion far exceeding consumer standards.

Commercial Woks Market Potential Customers

The primary customers and buyers in the Commercial Woks Market are diverse, encompassing the entire spectrum of the professional food service industry, generically termed the Horeca sector. This includes high-volume establishments such as large Chinese, Thai, and other Asian ethnic chain restaurants that rely on standardized, continuous wok cooking for their core menu items. Additionally, institutional kitchens, including those operated by major corporations, universities, and healthcare facilities, are increasingly adopting commercial woks to diversify menus and cater to varied dietary demands. A rapidly growing segment includes centralized production facilities and ghost kitchens, which require highly robust, often automated, wok systems for high-throughput batch cooking and subsequent distribution.

Within the full-service restaurant segment, potential customers range from independent, high-end fine dining venues specializing in authentic Asian fusion cuisine, which demand precision and high-aesthetics in equipment, to large, casual dining chains seeking durable, standardized models that can withstand intense, continuous usage across multiple locations. The needs of these customers diverge significantly; fine dining often requires custom-built ranges with specialized features like built-in sinks or power adjustment mechanisms, while chain operators prioritize rugged construction, ease of cleaning, and compatibility with proprietary standard operating procedures (SOPs). Understanding this differentiation is vital for market segmentation and product positioning, especially concerning pricing and maintenance service level agreements (SLAs).

Furthermore, the growth of the Quick Service Restaurant (QSR) sector and centralized commissaries represents a major purchasing force, driven by the need for speed and consistency. These facilities often invest heavily in advanced, automated wok systems, such as tilting kettles and robotic woks, which reduce the reliance on highly skilled labor while ensuring product uniformity for mass production. These customers evaluate equipment purchases based primarily on Total Cost of Ownership (TCO), focusing on energy efficiency, minimal required labor input, and long-term durability. The increasing consumer demand for freshly prepared, customized meals, often involving stir-frying techniques, further drives QSR investment in specialized wok stations, viewing them as a necessary tool for menu expansion and differentiation from standard fryer- and grill-based concepts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $250.4 Million |

| Market Forecast in 2033 | $396.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Vulcan, Garland, Middleby Corporation, ITW Food Equipment Group (Hobart, Vulcan), Southbend, Hestan Commercial, Kason Industries, American Range, Turbo Air, Duke Manufacturing, True Manufacturing, Alto-Shaam, Welbilt, Hatco Corporation, Rational AG, Electrolux Professional, Midea Group, Fagor Industrial, Ali Group, and specialized Asian equipment manufacturers. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commercial Woks Market Key Technology Landscape

The technological landscape of the Commercial Woks Market is rapidly transitioning from traditional high-BTU open-flame gas systems toward sophisticated, electronically controlled induction and automated cooking platforms. Induction technology represents the most significant paradigm shift, offering energy conversion efficiencies exceeding 90% compared to typical gas range efficiencies often below 40%. Commercial induction woks utilize powerful magnetic fields to heat the cooking vessel directly, providing instantaneous and highly precise temperature modulation. This precision not only saves energy but also enhances food safety and consistency, appealing heavily to operators concerned with operational cost reduction and standardized product quality across multiple locations. Furthermore, modern induction units often feature digital interfaces and integrated temperature probes, enabling advanced data logging and process control.

Beyond induction, the market is defined by increasing integration of automation and robotics, driven by severe labor shortages in the commercial kitchen sector globally. Automated tilting woks, which were initially common in large institutional settings for bulk stewing or sauce making, have been adapted for complex stir-fry tasks. These systems utilize hydraulic or electric mechanisms for controlled tilting and are often paired with proprietary mixing paddles or robotic arms designed to mimic the chef's stirring motion. This automation significantly increases output capacity while ensuring consistent seasoning and cooking times for large batches. The focus of these automated systems is minimizing physical labor, improving workplace ergonomics, and guaranteeing repeatable results, moving the operational model closer to industrial food processing standards within the restaurant context.

Another pivotal technological area is the development of advanced materials and surface engineering. Manufacturers are investing in research to create commercial wok surfaces that offer superior non-stick properties without compromising the thermal characteristics essential for high-heat cooking, all while meeting stringent commercial durability requirements (e.g., resistance to metal utensils and harsh cleaning agents). Simultaneously, advancements in ventilation technology are essential, particularly the integration of high-efficiency capture systems and heat recovery units directly into the wok range structure. These innovations not only comply with increasingly strict environmental and safety regulations but also significantly reduce the operating costs associated with cooling and heating the kitchen environment, making the modern commercial wok station a complex, capital-intensive piece of integrated technology.

Regional Highlights

The Commercial Woks Market exhibits distinct regional dynamics reflecting cultural tradition, economic development, and regulatory frameworks. Asia Pacific (APAC) holds the dominant market share, primarily driven by its foundational role as the origin and central consumer base for wok-based cuisines. Countries such as China, Vietnam, Thailand, and South Korea view the commercial wok as a staple piece of equipment, and the region houses the largest manufacturing clusters, enabling cost-efficient production and rapid innovation tailored to local high-volume cooking demands. The APAC region is characterized by intense competition among local manufacturers and a dual market structure: high-end automated systems for institutional use coexisting with robust, traditional gas-fired systems for street food and smaller eateries.

North America and Europe represent the fastest-growing regions, propelled by the mainstreaming of Asian fusion cuisine and the associated investment by international restaurant chains. In these Western markets, the adoption of commercial woks is often focused on high-specification, energy-efficient models. Regulatory pressures, particularly in dense urban areas, heavily favor induction woks or highly efficient gas models that meet strict emission and safety standards (e.g., California’s stringent air quality regulations impacting commercial kitchens). The emphasis here is on equipment that provides maximum flavor potential within a compact footprint, supporting the growth of trendy, specialized Asian fast-casual concepts and ghost kitchen networks that prioritize operational cost savings through energy conservation.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets characterized by significant growth potential, although market maturity varies considerably. In LATAM, urbanization and rising disposable incomes are slowly fueling the adoption of global culinary trends, leading to increased demand for professional cooking equipment. However, high import duties and logistical challenges often necessitate reliance on local distributors for maintenance and support. The MEA region, particularly the UAE and Saudi Arabia, shows high demand driven by the robust hospitality and tourism sectors, requiring high-capacity, durable commercial woks for large-scale hotel catering and international food courts. Growth in these regions is heavily influenced by foreign investment in the Horeca sector and the development of modern commercial infrastructure supporting advanced electrical or gas utilities necessary for high-performance equipment.

- Asia Pacific (APAC): Dominates market volume; primary manufacturing hub; strong cultural dependence; rapid adoption of both traditional and automated systems; key markets include China, India, and Southeast Asia.

- North America: Fastest growth in specialized induction woks; driven by QSR expansion and regulatory mandates for energy efficiency; significant investment in smart kitchen technology integration; key markets: U.S. and Canada.

- Europe: Growth fueled by ethnic food popularity and stringent EU environmental standards; strong focus on induction technology adoption in high-cost urban centers; key markets: UK, Germany, France.

- Latin America (LATAM): Emerging market; demand driven by urbanization and rising disposable incomes; growth focused on durability and affordability; reliance on imports.

- Middle East & Africa (MEA): High growth potential linked to large-scale hotel and hospitality infrastructure development; preference for high-capacity, robust equipment; driven by high levels of international cuisine consumption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commercial Woks Market.- Vulcan

- Garland

- Middleby Corporation

- ITW Food Equipment Group (Hobart, Vulcan)

- Southbend

- Hestan Commercial

- Kason Industries

- American Range

- Turbo Air

- Duke Manufacturing

- True Manufacturing

- Alto-Shaam

- Welbilt

- Hatco Corporation

- Rational AG

- Electrolux Professional

- Midea Group

- Fagor Industrial

- Ali Group

- Wok Master Industries

Frequently Asked Questions

Analyze common user questions about the Commercial Woks market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between commercial carbon steel woks and stainless steel woks?

Commercial carbon steel woks are preferred for traditional high-heat stir-frying, as they season over time to create a naturally non-stick surface and achieve superior heat distribution and 'Wok Hei' flavor. Stainless steel woks, conversely, are chosen for their extreme durability, hygiene, and ease of cleaning, often being used in high-volume institutional settings where rapid sanitation protocols are mandatory, though they require more power to achieve comparable high temperatures.

How is induction technology changing commercial wok operations and efficiency?

Induction technology provides high energy efficiency (over 90%), instantaneous heat control, and a significant reduction in ambient kitchen heat, improving working conditions. This shift is critical for compliance in energy-conscious regions and is favored by chains requiring standardized, precise cooking temperatures, replacing older, less efficient high-BTU gas-fired systems.

What are the main regulatory challenges affecting the commercial wok market?

Key challenges include increasingly stringent emission standards for gas-fired equipment (NOx emissions), mandatory energy efficiency targets set by regional governing bodies (e.g., DOE, EU directives), and strict adherence to food safety and sanitation certifications (NSF, ETL) necessary for professional-grade equipment sold in major international markets.

How does the growth of ghost kitchens influence demand for commercial woks?

Ghost kitchens, focused on high-volume delivery, drive demand for specialized, robust commercial woks, often automated or tilting models. These operations prioritize standardized output, minimal physical footprint, and integration with advanced kitchen management systems, making energy-efficient and consistent wok equipment essential for diversified virtual brand menus.

Which geographic region exhibits the highest growth potential for high-end commercial woks?

North America and Europe demonstrate the highest growth potential for high-end, technologically advanced commercial woks, specifically induction and smart automated systems. This growth is driven by rising labor costs, regulatory pushes for sustainability, and the strong consumer demand for authentic, high-quality ethnic cuisine preparation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager