Commodity Chemicals Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432801 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Commodity Chemicals Market Size

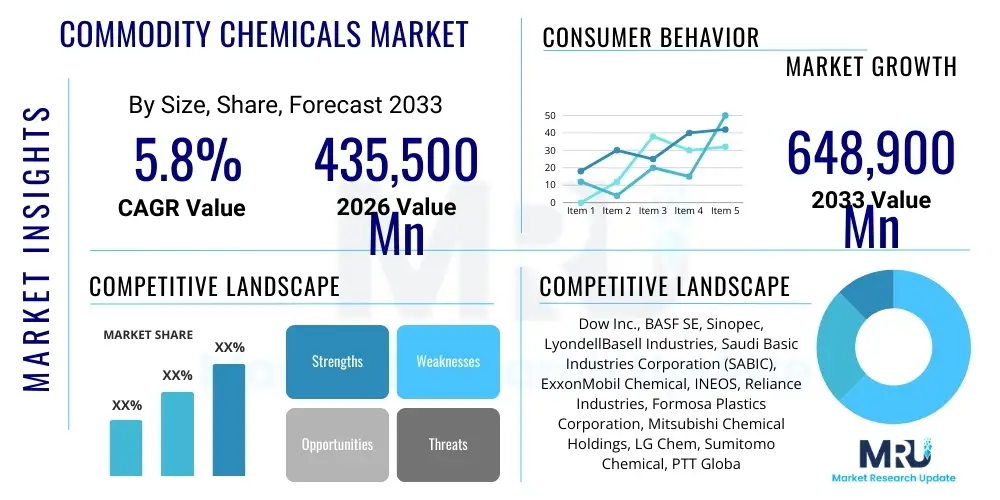

The Commodity Chemicals Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $435.5 Billion in 2026 and is projected to reach $648.9 Billion by the end of the forecast period in 2033.

Commodity Chemicals Market introduction

The Commodity Chemicals Market encompasses high-volume, low-margin basic chemical substances that serve as foundational building blocks for a vast array of industrial and consumer products. These chemicals, including major petrochemicals like ethylene, propylene, and benzene, as well as inorganics like sulfuric acid and chlorine, are essential intermediates utilized extensively across manufacturing sectors such as construction, automotive, packaging, textiles, and agriculture. Their primary characteristics are standardization and high production volumes, making them susceptible to shifts in global feedstock costs, particularly natural gas and crude oil, which significantly influence operational profitability and global trade dynamics.

Major applications for commodity chemicals span the production of polymers and plastics used in packaging materials and durable goods, fertilizers critical for global food security, and solvents and raw materials utilized in construction and infrastructure development. The benefits derived from these foundational chemicals include enabling cost-effective mass production across downstream industries and providing necessary inputs for technological advancements in areas like lightweight automotive components and high-performance insulation. The widespread utility and volume-driven nature of this market mean that global economic health and industrial output directly correlate with the demand for commodity chemicals.

Key driving factors propelling the growth of this market include rapid industrialization and urbanization across emerging economies, especially in the Asia Pacific region, leading to surging demand for building materials and consumer goods. Furthermore, the increasing global population necessitates greater agricultural output, boosting the demand for nitrogenous and phosphatic fertilizers derived from commodity chemicals. Strategic investments in efficient production technologies, coupled with regional competitive advantages in feedstock supply—such as the abundant and inexpensive shale gas in North America—continue to underpin market expansion despite persistent price volatility and increasing regulatory pressure for sustainable chemical production.

Commodity Chemicals Market Executive Summary

The Commodity Chemicals Market exhibits robust growth driven by sustained demand from end-use sectors, although profitability is heavily influenced by volatile raw material pricing and intense global competition, particularly from large-scale, integrated chemical complexes in Asia and the Middle East. Strategic business trends emphasize capacity expansion in regions with competitive feedstock access, coupled with a growing focus on operational efficiency, digitalization, and backward integration to secure supply chains and mitigate margin erosion. Companies are increasingly investing in specialty derivatives of commodity chemicals to capture higher value, balancing the necessary volume production with niche, high-margin opportunities while navigating geopolitical risks that affect global trade flows and logistical stability.

Regional trends indicate that the Asia Pacific (APAC) region remains the dominant growth engine, fueled by massive infrastructure projects, burgeoning manufacturing bases, and large consumer markets in China, India, and Southeast Asia. Conversely, established markets in North America and Europe are focusing heavily on decarbonization, green chemistry initiatives, and transitioning towards circular economy models, particularly for plastics and polymers, which are key derivatives of commodity chemicals. The Middle East continues to leverage its abundant hydrocarbon reserves, solidifying its position as a major low-cost exporter, leading to significant competitive pressure on producers elsewhere.

Segmentation trends highlight the enduring dominance of basic petrochemicals (e.g., ethylene and propylene) due to their integral role in the massive plastics and polymers industry, while the inorganic chemicals segment (e.g., sulfuric acid, caustic soda) sees stable demand linked primarily to mining, water treatment, and pulp and paper production. There is a noticeable shift in the derivatives market toward bio-based or recycled feedstocks, which, while currently small in volume, represents a critical long-term segment trend driven by regulatory mandates and consumer preference for sustainability. This evolution necessitates significant R&D investment to make bio-based equivalents economically viable at the scale required for commodity production.

AI Impact Analysis on Commodity Chemicals Market

Common user questions regarding AI's influence on the Commodity Chemicals Market center primarily on how advanced analytics can stabilize highly volatile production environments and optimize complex global logistics. Users frequently inquire about AI's potential in predictive maintenance (to minimize costly downtime), feedstock price forecasting (to improve hedging strategies), and optimizing massive-scale chemical reaction processes for yield maximization and energy reduction. Key themes emerging from these concerns revolve around the return on investment (ROI) of integrating high-cost AI infrastructure, the necessity of large, clean datasets for accurate predictive modeling, and the potential displacement of human expertise in operational control rooms. The general expectation is that AI will transform commodity chemical manufacturing from a static, volume-driven operation to a highly dynamic, data-centric system that significantly enhances sustainability, safety, and efficiency across the value chain, particularly in minimizing waste and energy consumption.

AI's application extends beyond process optimization into critical supply chain management, where the scale and global nature of commodity chemicals require immense coordination. Users are keen to understand how AI can manage complex global shipping routes, predict supply chain disruptions caused by geopolitical events or natural disasters, and ensure just-in-time delivery of essential raw materials or finished products to industrial buyers. Furthermore, AI tools are being evaluated for their capacity to accelerate research and development in catalyst discovery and green chemistry, potentially speeding up the transition to more sustainable production methods, addressing long-term environmental concerns that currently restrain market growth.

The implementation of AI and machine learning is viewed as a competitive necessity for maintaining cost leadership in this low-margin industry. Firms adopting AI early gain advantages through superior operational expenditure (OPEX) control, superior quality consistency, and faster adaptation to market shifts, positioning them favorably against competitors relying on traditional, slower control systems. However, the requirement for robust cybersecurity protocols to protect intellectual property and highly sensitive operational data is a significant concern that underpins many user inquiries about AI integration strategies.

- Enhanced Predictive Maintenance: AI algorithms predict equipment failure, minimizing unplanned shutdowns and maximizing plant utilization rates crucial for high-volume production.

- Optimized Process Control: Real-time machine learning models adjust parameters (temperature, pressure, flow) to maximize reaction yields and reduce energy consumption.

- Feedstock Price Forecasting: Advanced AI modeling provides more accurate predictions of volatile raw material costs, enabling better procurement and hedging strategies.

- Supply Chain Optimization: AI manages complex global logistics, optimizing inventory levels and shipping routes, critical for global distribution networks.

- Accelerated R&D: AI assists in screening new catalysts and optimizing formulations for sustainable or bio-based chemical production.

- Improved Safety Protocols: Machine vision and anomaly detection systems monitor plant conditions, enhancing worker safety and preventing catastrophic incidents.

- Energy Efficiency Management: AI tools analyze utility data to identify and implement energy-saving measures across large, energy-intensive chemical plants.

DRO & Impact Forces Of Commodity Chemicals Market

The dynamics of the Commodity Chemicals Market are shaped by powerful intertwined forces, including significant drivers such as continuous infrastructural development, particularly in Asia, which necessitates massive inputs of plastic, cement, and fertilizer derivatives. The core restraint remains the extreme volatility in feedstock prices, primarily crude oil and natural gas, which directly impacts production costs and profit margins, forcing companies into complex hedging and procurement strategies. Opportunities are strongly emerging in sustainable chemistry, bio-based feedstocks, and advanced recycling technologies, responding to global regulatory pressures and consumer demand for a circular economy, offering a path for differentiation in a highly homogenized market. These forces exert considerable impact on investment decisions, operational viability, and long-term strategic positioning within the industry.

Key drivers center on global demographic trends, specifically population growth and expanding middle classes, which amplify the demand for products reliant on commodity chemicals, ranging from advanced medical packaging to automotive components. The integration of advanced manufacturing techniques and the rise of mega-projects in infrastructure continue to provide a baseline level of robust demand that cushions the market against cyclical downturns. However, the persistent structural challenge of overcapacity, particularly in key segments like ethylene and methanol production, due to aggressive expansion in regions with low-cost resources, continues to act as a significant restraint, keeping prices competitive and suppressing margins for less efficient or older plants in Western markets.

Impact forces currently reshaping the competitive landscape include increasingly stringent environmental regulations, forcing capital-intensive upgrades for emission controls and waste management, which disproportionately affect smaller producers. Furthermore, geopolitical instability poses a considerable risk to global supply chains, impacting the reliable and cost-effective transportation of raw materials and finished goods. Conversely, technological leaps in digitalization and process automation present transformative opportunities, enabling firms to achieve unprecedented levels of operational efficiency, potentially offsetting the negative impacts of raw material volatility and regulatory burdens. The collective effect of these drivers, restraints, and opportunities dictates market evolution and dictates the long-term viability of different regional chemical complexes.

Segmentation Analysis

The Commodity Chemicals Market is broadly segmented based on product type, application, and end-use industry, reflecting the diverse nature of these foundational materials and their wide-ranging utility across the global economy. Product segmentation is crucial as it dictates the primary feedstock source (petrochemicals vs. inorganics) and subsequent end-market dynamics, while application segmentation details the primary function these chemicals perform, such as polymerization, fertilizing, or solvent use. End-use segmentation provides insight into the major consuming sectors, allowing producers to tailor capacity additions and marketing efforts based on growth rates in key industries like construction, agriculture, and automotive manufacturing.

The market is dominated by the basic organic chemicals derived primarily from naphtha, ethane, or propane cracking, forming the backbone of the plastics industry. This organic segment includes high-volume products like ethylene, propylene, and various aromatics (benzene, toluene, xylene). The inorganic segment, which often relies on minerals, salt, and air as raw materials, includes crucial substances like caustic soda, chlorine, and titanium dioxide, vital for water purification, metallurgy, and pulp/paper manufacturing. Understanding the interplay between these two major segments is key, as petrochemical capacity often relies on global oil and gas prices, while inorganic capacity is more stable but sensitive to localized energy costs and regulatory mandates concerning hazardous materials handling.

The diversity of applications ensures market stability; even if one end-use sector experiences a downturn (e.g., automotive production), others (e.g., packaging, medical devices) often maintain steady demand. This robust dependency underscores the market’s resilience but also necessitates precise forecasting across multiple industrial metrics. Emerging segmentation trends focus on sustainability attributes, particularly the classification of chemicals as "green" or "bio-based," signaling a strategic future direction where regulatory compliance and consumer demand for environmentally friendly inputs will redefine traditional segment boundaries and create premium opportunities within historically low-margin product categories.

- Product Type:

- Basic Petrochemicals (Ethylene, Propylene, Butadiene, Benzene, Toluene, Xylenes)

- Intermediates (Methanol, Ethylene Oxide, Propylene Oxide, Vinyl Chloride Monomer)

- Inorganic Chemicals (Sulfuric Acid, Caustic Soda, Chlorine, Soda Ash, Ammonia, Titanium Dioxide)

- Fertilizers (Urea, DAP, Phosphates, Potash)

- Polymers & Plastics (Polyethylene, Polypropylene, PVC)

- Application:

- Polymerization

- Synthesis of Derivatives

- Solvents

- Fertilization

- Water Treatment

- End-Use Industry:

- Packaging

- Automotive & Transportation

- Construction & Infrastructure

- Agriculture

- Textiles

- Pharmaceuticals & Medical Devices

- Consumer Goods

Value Chain Analysis For Commodity Chemicals Market

The value chain for commodity chemicals begins with the upstream segment, dominated by feedstock sourcing, primarily crude oil, natural gas (shale gas), and mineral extraction (salt, sulfur, phosphates). The efficiency and cost-effectiveness of this initial stage are paramount, as feedstock often accounts for 60% to 80% of the final production cost of many commodity chemicals. Strategic decisions regarding long-term supply contracts, vertical integration into upstream oil and gas production, and securing rights to low-cost shale gas sources determine the ultimate competitive advantage of major chemical producers. Investment in sophisticated cracking and separation technologies at this stage is crucial to maximizing the yield of base chemicals like ethylene and propylene.

The midstream segment involves the large-scale manufacturing processes, including catalytic conversion, pyrolysis, and synthesis, transforming raw feedstocks into basic commodity chemicals. This is the core industrial stage characterized by high capital expenditure for plants and intensive energy requirements. Operational excellence, including predictive maintenance, energy recovery systems, and digitalization (AI/IoT), is critical for maintaining high utilization rates and low conversion costs. Manufacturers in this segment, typically large multinational chemical corporations, focus on global arbitrage, optimizing production schedules based on regional feedstock price differentials and shifting market demand.

The downstream segment encompasses the conversion of commodity chemicals into intermediate and specialized derivatives, such as plastics, fibers, solvents, and fertilizers. Distribution channels are varied, including direct sales to large industrial end-users (e.g., automotive manufacturers, large construction firms) and indirect channels utilizing third-party logistics providers, specialized chemical distributors, and regional warehouses. Due to the bulk nature and potentially hazardous properties of many commodity chemicals, logistics, safe storage, and efficient transportation (pipelines, railcars, tankers) form a critical and costly part of the downstream process. The direct channel is preferred for high-volume, long-term contracts, ensuring pricing stability, while the indirect channel services smaller end-users and provides crucial just-in-time delivery capabilities across fragmented markets.

Commodity Chemicals Market Potential Customers

The potential customer base for commodity chemicals is extraordinarily diverse, spanning nearly all industrial and manufacturing sectors globally, making them essential input materials rather than finished consumer products. The largest end-user segment is the construction and infrastructure industry, which consumes vast quantities of polymers (PVC for piping, polyethylene for insulation), inorganic chemicals (sulfuric acid for concrete treatment), and solvents. This sector’s demand is cyclical but strongly tied to global economic growth and urbanization rates, particularly in rapidly developing regions where major infrastructure projects are underway. Securing long-term contracts with major construction consortia and government-backed infrastructure programs represents a significant revenue opportunity for commodity chemical suppliers.

Another major buyer segment is the agriculture sector, heavily reliant on nitrogenous, phosphatic, and potassic fertilizers derived directly from ammonia and various inorganic acids. The stability of global food demand ensures a consistent, albeit seasonally sensitive, need for these inputs. Chemical producers must maintain strong relationships with large global fertilizer blenders and agricultural cooperatives. Furthermore, the packaging industry constitutes a massive, consistently growing customer base, driven by the global need for protective and sanitary materials, primarily consuming polyethylene (PE), polypropylene (PP), and PET derivatives for films, bottles, and containers, linking commodity chemical output directly to fast-moving consumer goods (FMCG) markets.

The automotive, electronics, and textiles industries also represent substantial potential customers, utilizing commodity chemical derivatives for components ranging from specialized plastics in vehicle interiors (to reduce weight) to fibers and coatings. Pharmaceutical and medical device manufacturers purchase high-purity commodity chemicals for synthesis and sterilization processes. Given the critical nature of these inputs, potential customers prioritize suppliers who offer stringent quality control, reliable delivery schedules, and competitive pricing, often requiring suppliers to meet complex regulatory standards (e.g., REACH in Europe) before procurement contracts are finalized, thereby emphasizing quality and compliance over pure cost optimization in high-stakes applications.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $435,500 Million |

| Market Forecast in 2033 | $648,900 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dow Inc., BASF SE, Sinopec, LyondellBasell Industries, Saudi Basic Industries Corporation (SABIC), ExxonMobil Chemical, INEOS, Reliance Industries, Formosa Plastics Corporation, Mitsubishi Chemical Holdings, LG Chem, Sumitomo Chemical, PTT Global Chemical, Chevron Phillips Chemical, Eastman Chemical Company, Shell Chemicals, Mitsui Chemicals, Evonik Industries, Wanhua Chemical Group, Braskem. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commodity Chemicals Market Key Technology Landscape

The technology landscape in the Commodity Chemicals Market is focused heavily on achieving cost leadership through process intensification, energy efficiency improvements, and feedstock flexibility. Advanced catalyst technologies are paramount, enabling producers to lower reaction temperatures, reduce pressure, and improve selectivity, thereby decreasing overall energy consumption and minimizing unwanted byproducts. Specifically, new generations of metallocene and Ziegler-Natta catalysts are driving higher performance in polyethylene and polypropylene production, allowing for the creation of stronger, lighter, and more specialized polymer grades while maintaining low commodity production costs. Furthermore, the push towards integrating cheaper, lighter feedstocks like ethane and propane (due to shale gas availability) necessitates continuous innovation in cracking furnace designs and separation unit operations to handle these input variations efficiently.

Digital transformation, underpinned by Industrial IoT (IIoT) sensors, Big Data analytics, and predictive modeling (AI/ML), constitutes a major technological trend. Chemical plants are increasingly transitioning to highly automated, self-optimizing facilities where advanced control systems dynamically adjust parameters based on real-time data inputs from thousands of sensors across complex reaction trains and utility units. This level of digitalization allows for 'virtual commissioning' and precise optimization, dramatically reducing both operational variability and safety risks. Furthermore, technologies focusing on Carbon Capture, Utilization, and Storage (CCUS) are gaining traction, especially in Europe and North America, as producers seek viable pathways to decarbonize high-emission processes like ammonia and methanol synthesis, aligning production with net-zero targets and governmental incentives.

A critical long-term technological focus is centered on sustainability, specifically the commercial viability of green chemistry and chemical recycling processes. Bio-based chemical technologies, which convert biomass or waste into monomers (e.g., bio-ethylene), require breakthroughs in fermentation and purification to achieve cost parity and scale with fossil-fuel alternatives. Simultaneously, advanced chemical recycling technologies (e.g., pyrolysis and depolymerization) are being scaled up to transform traditionally non-recyclable plastic waste back into virgin-quality feedstocks, offering a revolutionary closed-loop system for the petrochemical segment. These technologies are not only addressing waste management challenges but are also creating new, sustainable sources of inputs that partially decouple production from volatile fossil fuel markets, representing a pivotal technological shift in the industry's material sourcing strategy.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for commodity chemicals, primarily driven by China and India’s robust manufacturing sectors, rapid urbanization, and massive infrastructural investment. The region benefits from lower labor costs and significant capacity additions in petrochemical complexes, particularly utilizing imported or locally sourced naphtha. Demand for plastic packaging, automotive components, and fertilizers is exceptionally high. However, the market faces challenges related to severe air and water pollution, prompting stricter governmental regulations in key manufacturing hubs, pushing regional players to seek cleaner production methods and adopt advanced wastewater treatment technologies to maintain operational licenses and global export competitiveness.

- North America: North America holds a distinctive competitive advantage due to the availability of inexpensive shale gas (ethane), making it one of the world's lowest-cost regions for producing key petrochemicals like ethylene and its derivatives. This cost advantage has spurred significant capital investment in new crackers and derivative facilities along the U.S. Gulf Coast, positioning the region as a major global exporter. The market is mature but focuses heavily on high-value derivatives and adopting digitalization (AI/ML) to optimize plant efficiency and manage complex logistics systems, ensuring maximum yield from integrated facilities and maintaining export volume despite fluctuating global energy prices.

- Europe: The European market is characterized by maturity, stringent environmental regulation (e.g., REACH), and a strong emphasis on sustainability and the circular economy. Growth is relatively slower compared to APAC, but the region leads in the adoption of green chemistry, bio-based feedstocks, and advanced chemical recycling technologies, often driven by government mandates and strong corporate sustainability commitments. Producers here focus on maintaining high quality and moving towards specialized, high-performance derivatives of commodity chemicals to justify higher operating costs compared to Middle Eastern or North American competitors. Innovation in carbon capture and low-emission production is a strategic imperative.

- Middle East and Africa (MEA): The Middle East is a vital, export-oriented hub, leveraging massive, low-cost crude oil and associated gas reserves to produce high volumes of essential commodity chemicals, especially polymers and methanol, primarily through large, state-backed enterprises like SABIC. Its primary market strategy revolves around scale and cost advantage, supplying fast-growing Asian markets. Africa, while having a smaller share, represents an emerging market with potential for localized production to serve rapidly industrializing nations and growing agricultural needs, though political instability and lack of robust infrastructure remain key constraints that influence investment decisions.

- Latin America (LATAM): The LATAM market, while substantial, faces internal challenges including political instability, currency fluctuations, and reliance on imported feedstocks for many petrochemical operations, limiting global competitiveness. Brazil and Mexico are key players, with strong domestic demand for agricultural chemicals (fertilizers) and packaging materials. The region focuses on securing domestic supply and improving infrastructure to support the internal movement of goods, often seeking joint ventures with large international players to access necessary capital and advanced production technologies to modernize existing facilities and secure cost-effective feedstock supplies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commodity Chemicals Market.- Dow Inc.

- BASF SE

- Sinopec (China Petroleum & Chemical Corporation)

- LyondellBasell Industries

- Saudi Basic Industries Corporation (SABIC)

- ExxonMobil Chemical

- INEOS

- Reliance Industries Limited

- Formosa Plastics Corporation

- Mitsubishi Chemical Holdings

- LG Chem

- Sumitomo Chemical Co., Ltd.

- PTT Global Chemical Public Company Limited

- Chevron Phillips Chemical Company LLC

- Eastman Chemical Company

- Shell Chemicals

- Mitsui Chemicals, Inc.

- Evonik Industries AG

- Wanhua Chemical Group Co., Ltd.

- Braskem S.A.

Frequently Asked Questions

What are the primary factors driving demand in the Commodity Chemicals Market?

The market growth is fundamentally driven by global urbanization, population increase, and sustained demand from end-use industries like construction and packaging, coupled with favorable feedstock availability, particularly low-cost shale gas in North America, which lowers production costs globally and stimulates downstream investment.

How does the volatility of feedstock prices impact the profitability of chemical manufacturers?

Feedstock, predominantly crude oil and natural gas, constitutes the majority of production costs. High volatility directly leads to margin compression, requiring manufacturers to employ sophisticated hedging strategies, secure long-term contracts, and focus intensely on operational efficiency and digitalization to mitigate financial exposure.

Which geographical region dominates the production and consumption of commodity chemicals?

The Asia Pacific (APAC) region, led by China, dominates both the production and consumption of commodity chemicals due to its expansive manufacturing base, large consumer markets, and intensive infrastructure development projects, positioning it as the central hub of global chemical output and demand growth.

What role does sustainability play in the future growth trajectory of the market?

Sustainability is becoming a core strategic imperative, driven by stringent environmental regulations and consumer demand for circular economy solutions. Future growth is heavily dependent on commercializing bio-based chemicals, scaling up advanced chemical recycling technologies, and implementing carbon capture systems to reduce the industry’s massive environmental footprint.

How is AI transforming operations within the Commodity Chemicals manufacturing sector?

AI is transforming operations by enabling predictive maintenance to prevent costly plant shutdowns, optimizing complex chemical processes in real-time to maximize yield and reduce energy consumption, and improving supply chain resilience through sophisticated demand and logistics forecasting models.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager