Commodity Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435455 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Commodity Services Market Size

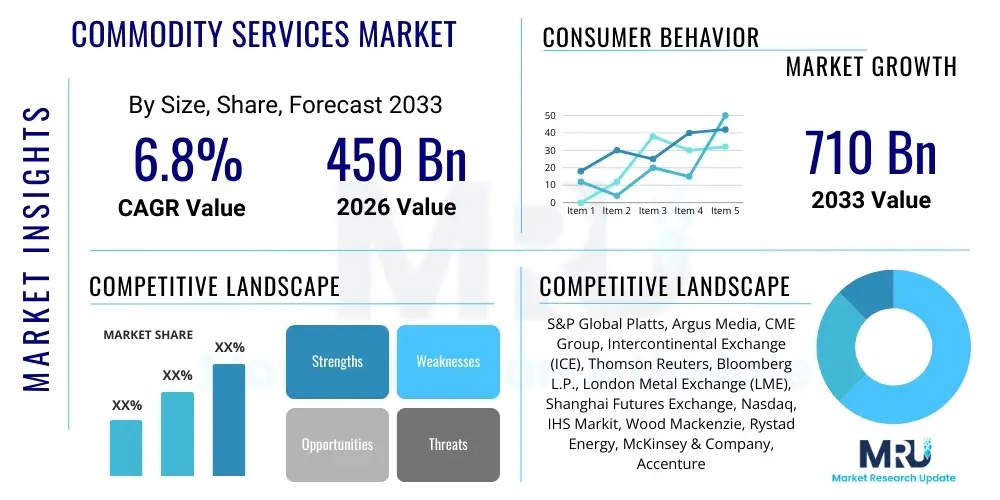

The Commodity Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at 450 USD billion in 2026 and is projected to reach 710 USD billion by the end of the forecast period in 2033. This robust growth trajectory is primarily driven by the increasing complexity of global supply chains, heightened volatility in commodity prices across energy, metals, and agriculture sectors, and the resultant need for sophisticated risk management and compliance solutions. Furthermore, the digitalization of trading platforms and the integration of advanced analytics are expanding the scope and efficiency of service delivery, underpinning the substantial market valuation increase expected over the next decade.

Market expansion is significantly influenced by macro-economic shifts, including geopolitical instability, the global transition towards sustainable energy sources, and rapid industrialization in emerging economies, particularly in the Asia Pacific region. These factors necessitate continuous, real-time access to accurate pricing, market intelligence, and advisory services. Financial institutions, large industrial consumers, producers, and trading houses are increasingly reliant on third-party commodity services to manage exposures, execute trades efficiently, and comply with evolving international regulations, thereby fueling the demand across various service segments such as logistics, risk management, and trading technology provision.

Commodity Services Market introduction

The Commodity Services Market encompasses a wide range of offerings designed to facilitate the production, trading, transportation, and consumption of primary goods, including energy products (oil, gas, electricity), agricultural commodities (grains, softs), and metals (base and precious). These services are critical infrastructure supporting the global economy, providing essential functions such as market intelligence, price discovery, logistics and supply chain management, risk hedging, and regulatory compliance assistance. The core value proposition of commodity services lies in reducing informational asymmetries, enhancing transactional efficiency, and mitigating the substantial financial and operational risks inherent in commodity markets, which are inherently prone to volatility driven by weather events, geopolitical tensions, and macroeconomic policy shifts.

Major applications of commodity services span across several industry verticals. In the energy sector, services include detailed upstream and downstream market analysis, pipeline capacity scheduling, and carbon trading advisory. For agriculture, key applications involve crop forecasting, quality inspection, and multimodal transport optimization. Financial services firms utilize commodity services extensively for derivatives trading, portfolio risk assessment, and structuring complex financial instruments linked to physical assets. The market benefits include improved capital allocation, minimized counterparty risk through standardized clearing mechanisms, and the ability for market participants to focus on core competencies while outsourcing specialized functions like inventory management or regulatory reporting.

The market is currently being driven by several powerful forces. Firstly, the increased global liquidity and the proliferation of commodity-linked financial instruments require robust valuation and trading services. Secondly, the push for transparency and sustainability, particularly related to ESG (Environmental, Social, and Governance) standards, mandates sophisticated traceability and auditing services. Lastly, technological advancements, such as the adoption of blockchain for supply chain verification and the use of satellite imagery for resource monitoring, are driving demand for technologically integrated service solutions that offer greater accuracy and speed in decision-making, ensuring continuous market evolution.

Commodity Services Market Executive Summary

The Commodity Services Market is characterized by accelerating digitalization and a profound shift towards integrated risk management solutions, driven largely by persistent geopolitical volatility and the transition to cleaner energy systems. Business trends indicate a strong movement toward consolidation among service providers seeking to offer comprehensive, end-to-end solutions spanning from data provision and advisory to physical asset logistics. Key players are heavily investing in proprietary AI and machine learning tools to enhance predictive analytics capabilities, thereby offering clients superior forecasting and real-time decision support, positioning data and intelligence services as the primary growth engines within the market ecosystem.

Regionally, the Asia Pacific (APAC) market is projected to exhibit the highest growth rate, fueled by robust industrial and infrastructural development, leading to massive demand for energy and base metals, which necessitates expanded trade execution and logistics services. North America and Europe, however, remain the dominant markets in terms of service sophistication, particularly in financialized commodity derivatives and advanced ESG compliance reporting services. Regulatory harmonization efforts in these established regions are simultaneously driving demand for specialized compliance advisory and standardized transactional reporting, creating distinct regional opportunities tailored to local regulatory frameworks and market maturity levels.

Segment trends reveal that the Risk Management and Advisory Services segment is experiencing rapid expansion, reflecting market participants’ acute need to hedge against extreme price fluctuations and navigate complex regulatory environments. Technology and Data Services are also accelerating, displacing traditional manual processes with automated trading systems and high-frequency data feeds. While physical logistics services remain foundational, they are increasingly being integrated with digital tracking and optimization platforms (e.g., IoT and specialized software) to improve transparency and efficiency across complex, multi-modal transportation networks supporting global commodity flows.

AI Impact Analysis on Commodity Services Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) are transforming traditional commodity trading floors, focusing on areas like price forecasting accuracy, automated trade execution, and the mitigation of human error in complex logistics scheduling. Common concerns revolve around the ethical implications of algorithmic trading, data security when integrating vast unstructured datasets (like satellite imagery or social media sentiment), and the potential for job displacement among market analysts and logistics planners. The consensus expectation is that AI will shift the focus of human capital toward developing sophisticated models and interpreting complex market signals, rather than routine data processing. Users are particularly keen on understanding how AI can provide a competitive edge in optimizing multi-commodity portfolios and predicting supply disruptions before they occur.

The primary themes emerging from user inquiries center on the scalability and reliability of AI-driven trading strategies, especially during black swan events where historical data models might fail. There is high expectation for AI to significantly enhance regulatory compliance through automated monitoring of trading activity (regtech) and improving the veracity of ESG data reporting. Furthermore, users anticipate that AI will fundamentally redefine market intelligence services, moving beyond historical reporting to providing prescriptive analytics that directly guide strategic purchasing and hedging decisions, minimizing basis risk and volatility exposure for end-users and producers alike.

- Automated Price Discovery: AI algorithms analyze billions of data points (weather, geopolitical news, inventory levels) instantly, generating highly accurate short-term and long-term price forecasts.

- Optimized Trade Execution: High-frequency trading systems driven by ML execute large orders with minimal market impact, reducing slippage and transactional costs.

- Enhanced Risk Management: AI models simulate complex market scenarios (stress testing) and identify hidden correlations between different commodity classes, improving portfolio diversification and Value-at-Risk (VaR) calculations.

- Predictive Logistics: Machine learning optimizes shipping routes, predicts equipment failure, and manages inventory levels across global storage facilities, significantly lowering operational costs.

- Regulatory Compliance (RegTech): AI monitors trades for potential market abuse or non-compliance with international sanctions in real-time, automating audit trails and simplifying reporting requirements.

- Supply Chain Traceability: Utilizing blockchain and AI to verify the origin and sustainability credentials of commodities, essential for meeting stringent ESG mandates.

DRO & Impact Forces Of Commodity Services Market

The Commodity Services Market is propelled by increasing globalization, leading to complex cross-border trade and an intensified need for standardized trade execution and settlement mechanisms. Key drivers include heightened commodity price volatility, spurred by climate change and geopolitical conflicts, forcing market participants to urgently adopt sophisticated hedging and risk management services. Conversely, the market faces significant restraints, primarily regulatory uncertainty—differentiation in compliance standards across jurisdictions imposes high costs on service providers and complicates cross-border operations. Opportunities abound in the realm of sustainable commodities, particularly in offering carbon accounting, green logistics, and financial instruments tied to renewable energy credits (RECs), which are high-growth areas demanding specialized service expertise.

Impact forces currently shaping the market are heavily weighted toward technological disruption and sustainability mandates. The accelerating adoption of digital platforms for trading and settlement is a strong positive force, increasing market efficiency and accessibility. However, this digitalization also introduces significant cybersecurity risks, necessitating heavy investment in secure data management infrastructure, which acts as a moderating impact force on smaller players. The overarching global commitment to decarbonization creates continuous demand for new services related to battery minerals, voluntary carbon markets, and specialized consulting on energy transition strategies, ensuring the market's long-term relevance and expansion into novel service domains beyond traditional physical commodities.

Segmentation Analysis

The Commodity Services Market is broadly segmented based on Service Type, Commodity Type, and End-User. This structure reflects the specialized expertise required to navigate different commodity markets and cater to diverse client needs, ranging from energy producers needing sophisticated derivatives hedging to agricultural firms requiring advanced logistics and inspection services. The dominant segmentation factor is often the Commodity Type, as the required services, regulatory environment, and trading dynamics vary significantly between volatile crude oil markets, highly seasonal agricultural markets, and complex industrial metal supply chains, necessitating tailored service portfolios from market players.

- By Service Type:

- Risk Management and Advisory Services

- Market Intelligence and Data Services (Pricing, News, Analytics)

- Logistics and Supply Chain Services (Storage, Transport, Inspection)

- Trading and Brokerage Services (Physical and Financial)

- Software and Technology Solutions (E/CTRM, Automated Trading)

- Regulatory Compliance and Audit Services (ESG, Dodd-Frank, MiFID II)

- By Commodity Type:

- Energy Commodities (Crude Oil, Natural Gas, Electricity, Coal, Refined Products)

- Agricultural Commodities (Grains, Oilseeds, Soft Commodities like Sugar and Coffee)

- Metals and Minerals (Base Metals, Precious Metals, Bulk Commodities)

- Other Commodities (Environmental Products, Water, Freight)

- By End-User:

- Producers and Extractors (Mining, Agriculture, Oil & Gas Companies)

- Financial Institutions and Traders (Hedge Funds, Banks, Asset Managers)

- Industrial Consumers and Manufacturers

- Governments and Regulatory Bodies

Value Chain Analysis For Commodity Services Market

The value chain for the Commodity Services Market is complex, beginning with upstream activities focused on raw data acquisition and market intelligence generation, extending through distribution channels that facilitate trade execution, and culminating in downstream services that ensure physical movement and regulatory adherence. Upstream analysis involves gathering crucial data from primary sources (field reports, satellite data, production reports) and secondary sources (exchange data, government statistics). This raw data is then processed, analyzed, and packaged into actionable market intelligence by specialized data providers and consultancies, forming the foundational layer of the service value chain. The quality and timeliness of this upstream data directly dictate the effectiveness of subsequent services.

Midstream activities primarily involve transactional and advisory services, including trade execution, brokerage, and the provision of sophisticated Enterprise Commodity Trading and Risk Management (E/CTRM) software. Distribution channels are varied: direct channels include proprietary trading platforms and specialized software offered directly to large corporate clients, while indirect channels utilize third-party brokers, custodians, and large financial exchanges (like CME or ICE) which act as central counter-parties and clearing houses. The selection of the channel depends heavily on the commodity type; highly financialized commodities often rely on exchange-based indirect channels, while physical logistics services are usually facilitated through direct contracts with specialized logistics providers and inspection agencies.

Downstream analysis focuses on physical delivery, quality control, and end-user support. This stage involves complex logistics (shipping, storage, blending), which are increasingly optimized using digital platforms (IoT tracking, fleet management software). Crucially, downstream services also encompass mandatory regulatory compliance, ensuring that physical shipments meet quality standards, environmental regulations, and international trade laws. The integration of technology across the entire chain—from satellite-based resource monitoring upstream to real-time delivery tracking downstream—is essential for maximizing efficiency and transparency, particularly in meeting the stringent demands of global commodity consumers and ensuring supply chain resilience.

Commodity Services Market Potential Customers

The primary consumers of commodity services are diverse, spanning the entire lifecycle of a commodity from extraction to end-consumption. Producers, such as multinational oil and gas companies, large-scale mining operations, and major agricultural conglomerates, rely heavily on risk management services to hedge production costs and optimize forward sales strategies. These entities are frequent buyers of market intelligence to gauge future demand and pricing trajectories, aiding in capital expenditure planning and resource allocation. For these upstream players, reliable data services are indispensable for maximizing extraction efficiency and ensuring timely access to market liquidity.

A second major segment comprises financial institutions and independent commodity trading houses. Banks, hedge funds, and asset managers utilize brokerage, clearing, and sophisticated data analytics services to execute complex derivatives strategies, manage institutional portfolios, and facilitate client hedging needs. These financial end-users demand high-speed data feeds, robust technological platforms (E/CTRM), and regulatory reporting solutions (RegTech) to maintain a competitive edge and adhere to stringent financial regulations. Their primary purchase motive is leveraging external expertise to maximize returns through market timing and superior risk modeling.

Finally, industrial consumers—large manufacturers, utilities, airlines, and food processors—constitute a critical customer base. These entities require commodity services to secure reliable raw material supply, minimize procurement costs, and manage inventory risk. They are frequent users of logistics, quality inspection, and customized advisory services focused on structured physical purchase agreements (e.g., long-term power purchase agreements or specialized metal sourcing contracts), where the emphasis is on supply assurance and price certainty rather than speculative trading profits.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | 450 USD Billion |

| Market Forecast in 2033 | 710 USD Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | S&P Global Platts, Argus Media, CME Group, Intercontinental Exchange (ICE), Thomson Reuters, Bloomberg L.P., London Metal Exchange (LME), Shanghai Futures Exchange, Nasdaq, IHS Markit, Wood Mackenzie, Rystad Energy, McKinsey & Company, Accenture, PwC, Glencore (Trading Services), Vitol (Physical Services), Trafigura (Logistics), Mercuria Energy Group, Gunvor Group. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commodity Services Market Key Technology Landscape

The technological landscape within the Commodity Services Market is defined by the rapid convergence of data science, cloud computing, and advanced security protocols, fundamentally transforming how commodities are analyzed, traded, and physically managed. Enterprise Commodity Trading and Risk Management (E/CTRM) systems remain central, but their capabilities are expanding far beyond basic trade capture and settlement to integrate sophisticated features like algorithmic optimization, real-time exposure modeling across diverse physical and financial positions, and integrated regulatory reporting interfaces. Furthermore, the migration of these complex software suites to secure, scalable cloud environments (SaaS models) is accelerating, allowing for faster deployment, reduced IT overhead for end-users, and enabling instantaneous updates driven by evolving market demands or regulatory changes, making technology access more democratized.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful emerging technology vector. AI is being utilized extensively in predictive analytics, ingesting vast amounts of unstructured data—including satellite imagery for crop yield prediction, vessel tracking data for logistics forecasts, and social media sentiment for market mood assessment—to generate highly specific and timely trading signals. This advanced data processing capability is crucial for gaining an informational edge in highly competitive markets. Concurrently, Distributed Ledger Technology (DLT), specifically blockchain, is gaining traction, promising immutable record-keeping and enhanced transparency, particularly for verifying the provenance of minerals, ensuring sustainable sourcing, and streamlining complex cross-border settlements by reducing reliance on intermediary banks and traditional paper-based documentation.

In the physical services domain, the Internet of Things (IoT) is increasingly deployed for real-time monitoring of assets. Sensors embedded in pipelines, storage tanks, and shipping containers provide continuous data streams on inventory levels, asset condition, and environmental parameters (like temperature and pressure). This data feeds directly into E/CTRM and logistics management systems, optimizing operational efficiency, preempting maintenance issues, and significantly reducing losses due to theft or deterioration. The effective integration of these diverse technologies—from cloud-based trading platforms and AI analytics to physical IoT sensors—is the primary differentiator for market participants looking to offer truly comprehensive, future-proof commodity services.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and delivery of commodity services, reflecting varied consumption patterns, regulatory regimes, and economic growth rates globally. North America, particularly the United States and Canada, stands as a mature market dominated by highly sophisticated financial derivatives trading, energy commodity services (driven by vast oil and gas production), and advanced risk hedging solutions. The region benefits from strong capital markets and regulatory frameworks (e.g., the CFTC), which promote robust clearing and standardized contracts, ensuring high liquidity in service demand. Key service areas include complex trading technology and high-level regulatory compliance consultancy.

Europe is characterized by its leadership in the transition to renewable energy and stringent ESG mandates. European commodity service providers specialize in carbon trading, green finance instruments, and sophisticated compliance reporting services (MiFID II, EU Taxonomy). The region hosts major trading hubs like London and Rotterdam, which drive demand for robust physical logistics, inspection, and verification services. Regulatory pressures ensure a high demand for specialized advisory services focused on sustainability and supply chain due diligence across all commodity types.

Asia Pacific (APAC) represents the highest growth potential, driven by accelerating industrialization in China, India, and Southeast Asia. This region is the world's largest consumer of base metals, energy, and key agricultural products, necessitating massive investment in logistics, port management, and import/export facilitation services. Demand here is shifting rapidly from basic transaction services towards integrated data and risk management solutions as local markets mature and participants seek to hedge against global price volatility and supply chain shocks. The region is seeing significant development in local commodity exchanges, increasing the need for associated clearing and brokerage services.

Latin America (LATAM) and the Middle East and Africa (MEA) are critical production hubs, primarily focusing on oil, gas, and agricultural exports (LATAM) or oil and mining (MEA). Demand for commodity services in these regions centers on upstream production advisory, export logistics optimization, and geopolitical risk mitigation. National oil companies (NOCs) and large state-owned enterprises are major clients, requiring tailored services for international market access, hedging their foreign exchange exposures, and implementing technology to enhance operational efficiency in resource extraction and transportation infrastructure.

- North America: Dominant in derivatives and sophisticated risk management; strong focus on energy commodities (WTI, natural gas) and E/CTRM software development.

- Europe: Leading market for ESG compliance, carbon trading advisory, and renewable energy services; high demand for transparency and traceability solutions.

- Asia Pacific (APAC): Highest CAGR, driven by massive consumption of base materials and infrastructure growth; intense focus on logistics efficiency and developing local exchange services.

- Middle East & Africa (MEA): Key growth in physical logistics and upstream oil and gas services; increasing need for geopolitical risk assessment and specialized export advisory.

- Latin America: High demand for agricultural and metals logistics services; market driven by commodity export optimization and associated currency hedging requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commodity Services Market.- S&P Global Platts

- Argus Media

- CME Group

- Intercontinental Exchange (ICE)

- Thomson Reuters

- Bloomberg L.P.

- London Metal Exchange (LME)

- Shanghai Futures Exchange

- Nasdaq

- IHS Markit

- Wood Mackenzie

- Rystad Energy

- McKinsey & Company (Commodity Consulting)

- Accenture (Commodity and Energy Division)

- PwC (Commodity Risk Management)

- Glencore (Trading and Logistics Services)

- Vitol (Physical Trading and Logistics)

- Trafigura (Logistics and Supply Chain Solutions)

- Mercuria Energy Group (Financial and Physical Services)

- Gunvor Group (Physical and Market Access Services)

Frequently Asked Questions

Analyze common user questions about the Commodity Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary role of AI in transforming commodity services?

AI's primary role is enhancing predictive analytics and automating trade execution. It processes large, complex datasets (including real-time satellite data and market sentiment) to improve price forecasting accuracy, optimize supply chain logistics, and ensure real-time regulatory compliance (RegTech).

Which commodity segment drives the most demand for risk management services?

The Energy Commodities segment (Crude Oil, Natural Gas) drives the most acute demand for risk management services due to inherent geopolitical supply risks, high price volatility, and massive capital exposure, necessitating complex derivatives hedging and sophisticated VaR modeling.

How is the market addressing the need for sustainable supply chains?

The market is addressing sustainability through the development of specialized ESG reporting services, blockchain-based traceability solutions for validating commodity provenance, and providing advisory on carbon market participation and renewable energy transition strategies, particularly in Europe and North America.

What are the critical technological restraints impacting market growth?

Critical restraints include the substantial cybersecurity risk associated with digital trading platforms holding highly sensitive financial data, the high implementation cost of advanced E/CTRM software for smaller firms, and the ongoing challenge of integrating disparate data sources across global supply chains efficiently.

Which regional market is expected to experience the fastest growth rate?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by robust industrial consumption, expanding infrastructure development, increasing urbanization, and the rapid establishment and maturity of local commodity exchanges and associated service infrastructure.

What types of data are provided by Market Intelligence Services?

Market Intelligence Services provide comprehensive real-time data covering pricing benchmarks, supply and demand forecasts, inventory levels, detailed geopolitical analyses impacting trade flows, vessel movement tracking, proprietary market research reports, and specialized news feeds tailored to specific commodity sectors.

Who are the major end-users of Logistics and Supply Chain Services?

Major end-users of Logistics and Supply Chain Services include producers (e.g., mining companies), industrial consumers (e.g., manufacturers requiring just-in-time inventory), and large independent trading houses who manage the physical movement, storage, and quality control of commodities globally.

How do specialized advisory services assist producers in the upstream segment?

Advisory services assist upstream producers by providing expertise on capital expenditure optimization, production hedging strategies against long-term price risk, regulatory compliance for extraction and export permits, and strategic consulting on mergers, acquisitions, and resource valuation projects.

What is the role of global exchanges like CME and ICE in the service market?

Global exchanges serve as central hubs for price discovery, standardization of contract specifications, and risk mitigation through central counterparty clearing. They provide crucial brokerage, data feeds, and transactional security services that underpin the integrity and liquidity of the financialized commodity markets.

What is the definition of Basis Risk in the context of commodity services?

Basis Risk is the financial risk that the price of a commodity being hedged differs from the price of the specific hedging instrument used (e.g., the difference between the local physical price of crude oil and the benchmark futures contract price like Brent or WTI). Commodity services mitigate this through complex structuring and tailored hedging solutions.

What technological trends are defining the future of E/CTRM systems?

The future of E/CTRM systems is defined by cloud-native architecture, integration of machine learning for advanced scenario planning, real-time data ingestion from IoT devices, and seamless API connectivity with trading platforms and accounting systems, shifting towards prescriptive rather than merely descriptive capabilities.

Why is geopolitical stability a significant factor in commodity services?

Geopolitical stability is critical because conflicts or trade wars immediately disrupt supply chains, alter production capabilities, and introduce unpredictable regulatory changes (sanctions), causing extreme price volatility that requires urgent, specialized risk mitigation and advisory services.

How do third-party inspection services maintain value in the digital age?

Third-party inspection services maintain value by providing independent verification of commodity quality, quantity, and grade, which is essential for trade finance and settlement. While partially aided by technology (drones, AI analysis of samples), human verification remains necessary for high-stakes physical transactions and loss prevention.

What impact does the growth of electric vehicles have on commodity services?

The growth of electric vehicles dramatically increases demand for services related to battery minerals (lithium, cobalt, nickel). This includes specialized market intelligence, complex supply chain auditing for ethical sourcing, and financial hedging instruments tailored to these rapidly evolving mineral markets.

What distinguishes Advisory Services from Data Services in this market?

Data Services provide raw or aggregated market information (prices, volumes, news). Advisory Services take this data, interpret it within a client’s specific operational context (e.g., regulatory exposure, inventory position), and provide actionable, strategic recommendations for hedging, trading, or investment decisions.

What is the function of clearing houses in commodity markets?

Clearing houses act as central counter-parties, guaranteeing the fulfillment of contractual obligations between buyers and sellers in derivatives markets. They reduce counterparty credit risk and ensure the efficient settlement of trades, fostering market confidence and liquidity.

Which major regulation significantly affects European commodity service providers?

The Markets in Financial Instruments Directive II (MiFID II) significantly affects European providers, imposing strict requirements on transparency, transaction reporting, organizational structure, and algorithmic trading controls, driving demand for specialized compliance software and legal advisory services.

How does the segmentation by End-User influence service customization?

Segmentation by End-User necessitates high service customization. Producers require operational risk and hedging tools, while Financial Traders need high-speed data and derivatives execution capabilities, leading service providers to tailor their technology and expertise to address these distinct operational mandates.

What is the primary factor driving CAGR in the forecasted period?

The primary factor driving the high CAGR is the increasing financialization of commodities combined with the pervasive need for sophisticated technological tools (AI, cloud computing) to manage the escalating complexity and volatility inherent across global energy and materials supply chains.

How is blockchain utilized in agricultural commodity services?

In agricultural services, blockchain is utilized to create secure, immutable records documenting the entire journey of products, from farm to consumer. This enhances supply chain transparency, proves compliance with organic or fair-trade standards, and streamlines trade documentation and payments.

What are "soft commodities" and how do they differ in service needs?

Soft commodities include goods like sugar, coffee, cocoa, and cotton. Their service needs differ due to high susceptibility to weather events, specialized storage/handling requirements, and seasonal production cycles, requiring highly specific forecasting and quality control services that differ from those used for energy or metals.

Describe the current trend regarding market consolidation.

The current trend shows increasing market consolidation, particularly among data and intelligence providers, who are merging or acquiring specialized technology firms to offer clients integrated, end-to-end solutions that combine proprietary market data with advanced trading software and advisory capabilities.

What are the implications of the energy transition for service demand?

The energy transition shifts service demand away from traditional fossil fuels towards services supporting renewables, battery storage, green hydrogen, and carbon capture. This requires new expertise in project finance, specialized market modeling for intermittent power sources, and comprehensive carbon accounting.

Why is data integrity a major concern in the Commodity Services Market?

Data integrity is crucial because trading decisions, risk models, and regulatory compliance rely entirely on the accuracy and trustworthiness of market data. Compromised or inaccurate data can lead to massive financial losses, systemic risk, and regulatory penalties, necessitating robust data validation processes.

What role do consulting firms play in the Commodity Services ecosystem?

Consulting firms (like McKinsey or PwC) play a vital role by advising major commodity companies on strategic initiatives, organizational restructuring, digital transformation roadmaps (implementing E/CTRM), optimizing trading strategies, and navigating complex global regulatory compliance challenges.

How is demand in Latin America characterized?

Demand in Latin America is strongly characterized by the export orientation of its economies, focusing service needs on optimizing logistical flows for agricultural products and metals, ensuring compliance for international trade, and managing significant foreign exchange and political risks associated with exports.

What defines the upstream analysis component of the value chain?

Upstream analysis involves the initial stages of market intelligence creation, including gathering primary data on resource reserves, production volumes, capacity utilization, geopolitical events affecting supply, and processing this raw information into foundational pricing and supply/demand forecasts.

What is the significance of the London Metal Exchange (LME) in the market?

The LME is globally significant as the primary exchange for trading base metals (copper, aluminum, zinc), offering standardized contracts, centralized clearing, and physically delivered settlement, making its data and rules foundational for global metals trading and associated services.

How do Software and Technology Solutions differ from Data Services?

Data Services provide the content (the numbers and news). Software and Technology Solutions provide the tools (like E/CTRM systems and algorithmic trading interfaces) used to ingest, analyze, model, and act upon that data, representing the execution layer of the service ecosystem.

What is the key driver of logistics optimization services?

The key driver is the high cost and low margins associated with physical commodity movement. Optimization services, utilizing IoT and predictive AI, aim to minimize demurrage fees, reduce fuel consumption, manage inventory efficiently, and improve overall supply chain speed and resilience.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager