Commutators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432550 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Commutators Market Size

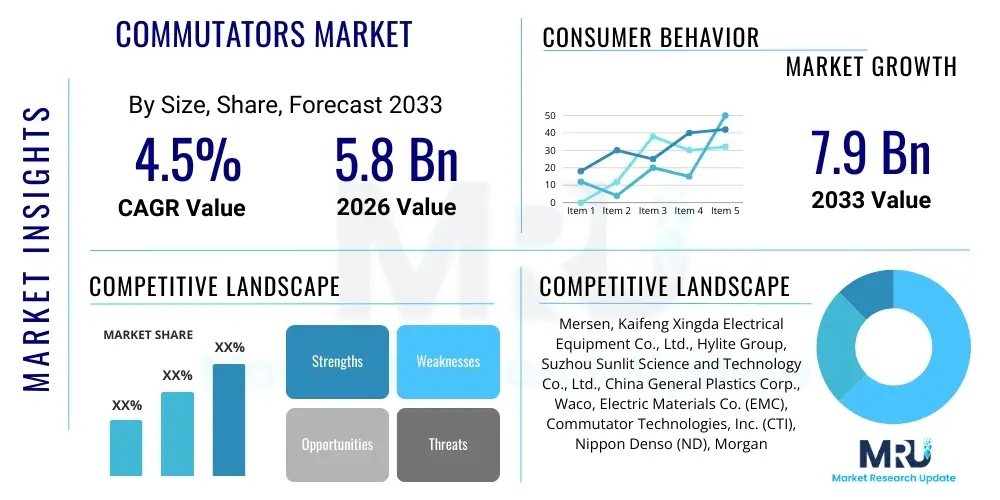

The Commutators Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% between 2026 and 2033. The market is estimated at USD 5.8 Billion in 2026 and is projected to reach USD 7.9 Billion by the end of the forecast period in 2033.

Commutators Market introduction

The global Commutators Market is a vital component within the electrical machinery industry, serving as the rotational electrical switch in certain types of electric motors (DC and universal motors) and electrical generators that periodically reverse the current direction between the rotor and the external circuit. Commutators are fundamental for ensuring continuous rotational movement and efficient power transfer, primarily consisting of segmented conductive materials, typically high-conductivity copper segments insulated from each other and the shaft by mica or high-grade insulating plastics. Their primary function is to convert the alternating current (AC) induced in the armature windings into direct current (DC) for DC generators, or to periodically reverse the current direction in DC motors to maintain torque direction.

Product description highlights the essential structural integrity and material science involved in manufacturing these components. Modern commutators are highly engineered for specific performance requirements, focusing on minimizing electrical noise, wear, and tear under high-speed and high-current operating conditions. Key applications span across the automotive sector (starter motors, window regulators, cooling fans), industrial machinery (drills, pumps, ventilation systems), power tools (drills, saws), and household appliances (vacuum cleaners, blenders). The consistent demand across these diversified end-use industries ensures market stability, even amid the transition toward brushless DC (BLDC) motor technology in some premium applications.

Major driving factors include the sustained global growth of the automotive aftermarket for replacement parts, the expansion of industrial manufacturing capabilities in developing economies, and the robust demand for efficient portable power tools in both professional and consumer segments. Furthermore, the inherent cost-effectiveness and reliability of brushed DC motors, which utilize commutators, keep them relevant in numerous low-to-mid power applications where initial investment costs and simplicity of control are prioritized over maximum efficiency.

Commutators Market Executive Summary

The Commutators Market is characterized by moderate growth, primarily driven by the established infrastructure of brushed motor technology and steady demand from the automotive, power tools, and industrial sectors. Business trends indicate a focus on material innovation, particularly in developing segmented and molded commutators that offer enhanced durability, higher current handling capacity, and reduced maintenance requirements. Manufacturers are strategically positioning themselves by improving production efficiency and utilizing advanced materials such as silver-bearing copper to combat the erosion challenges faced during high-temperature operation. However, the secular trend towards BLDC motors, especially in high-efficiency electric vehicle (EV) applications, presents a long-term restraint, pushing traditional commutator manufacturers to diversify into related motor components or focus intensely on robust aftermarket and industrial maintenance segments.

Regional trends reveal Asia Pacific (APAC) as the largest and fastest-growing market, largely due to booming automotive production (both traditional internal combustion engine vehicles and hybrid models requiring sophisticated starters/alternators) and rapid industrialization in countries like China, India, and Southeast Asian nations. North America and Europe maintain stable demand, supported primarily by the replacement market, robust industrial automation sectors, and stringent quality requirements for specialized motor components used in aerospace and high-precision applications. Segments trends show that the automotive application segment retains the largest market share, while among product types, the molded commutator segment is gaining traction over traditional segmented commutators due to its superior insulation properties and reduced manufacturing complexity.

Overall, the market remains moderately consolidated, with a strong emphasis on supplier reliability and quality certifications (such as ISO/TS 16949 for automotive components). Strategic imperatives for market players include optimizing supply chain logistics to handle volatile raw material costs (especially copper), investing in high-precision manufacturing techniques, and leveraging opportunities arising from the continued global shift toward automated manufacturing processes where brushed DC motors still play a significant role in ancillary systems and conveyance equipment.

AI Impact Analysis on Commutators Market

User queries regarding the impact of Artificial Intelligence (AI) on the Commutators Market often revolve around two central themes: predictive maintenance optimization and the acceleration of the shift towards AI-enabled BLDC systems. Users commonly ask whether AI systems can extend the operational life of commutators through better monitoring, or conversely, if AI's integration into sophisticated automation will inevitably hasten the obsolescence of brushed motor technology altogether. The general consensus analyzed from these inquiries suggests that while AI does not directly influence the component's physical function, it significantly impacts the application ecosystem and manufacturing efficiency. AI-driven simulation and design optimization tools are enabling manufacturers to create lighter, more durable commutators with enhanced thermal characteristics, reducing material waste and improving quality consistency.

In terms of maintenance, AI integration, specifically machine learning algorithms applied to sensor data (vibration, temperature, current load) from brushed motors, is revolutionizing predictive maintenance practices. This allows end-users, particularly in heavy industrial settings, to anticipate commutator wear, brush deterioration, or insulation failure before catastrophic breakdown occurs. This capability reduces unplanned downtime, optimizing motor usage in systems where brushed motors are irreplaceable due to cost or specific torque characteristics. However, the rise of AI in advanced robotics and high-end automotive systems invariably favors BLDC and permanent magnet synchronous motors (PMSM) due to their higher inherent efficiency and compatibility with complex electronic control units (ECUs), thereby presenting an indirect competitive pressure on the traditional commutator market.

- AI-enhanced predictive maintenance algorithms reduce sudden failures, extending commutator lifespan in industrial applications.

- AI optimization tools streamline commutator design for superior thermal management and reduced segment deformation.

- Machine learning applied to manufacturing processes improves defect detection and quality control during production.

- Increased adoption of AI in high-precision and high-efficiency drives accelerates the long-term shift towards BLDC technology, indirectly constraining commutator market growth.

- Supply chain optimization using AI improves inventory management for volatile raw materials like copper and silver.

DRO & Impact Forces Of Commutators Market

The Commutators Market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO). Primary drivers include the massive global automotive starter motor and alternator replacement market, which relies heavily on commutators, alongside sustained demand from the robust industrial maintenance, repair, and overhaul (MRO) sector. The low manufacturing cost and simple control mechanisms of brushed DC motors ensure their continued deployment in cost-sensitive applications, particularly in emerging markets. These factors provide a steady revenue stream and insulate the market from severe volatility, ensuring predictable growth, particularly in the aftermarket segment.

Restraints are dominated by the increasing penetration of brushless DC (BLDC) motors across numerous applications, driven by regulatory mandates favoring energy efficiency (e.g., in HVAC systems and home appliances) and technological advancements in power electronics that make BLDC control more accessible and cost-effective. Furthermore, the inherent wear and maintenance requirements associated with brushes and commutators, which necessitate periodic replacement, limit their adoption in maintenance-free, critical long-life applications. Volatility in copper and silver prices, key raw materials, also poses a significant operational restraint, impacting profitability and requiring sophisticated hedging strategies from manufacturers.

Opportunities reside in the development of specialized, high-performance commutators for hybrid vehicle auxiliary systems and high-power density industrial tools, where performance demands are stringent but the simplicity of the motor design is still advantageous. The increasing global focus on automation and micro-motorization in medical devices and specialized robotics also presents niche growth areas. The dominant impact forces shaping the competitive landscape are technological substitution (BLDC prevalence) and raw material economics, dictating both pricing power and long-term viability for market participants focused solely on traditional brushed technology.

Segmentation Analysis

The Commutators Market is segmented based on critical technical attributes including Product Type, Material Type, Application, and End-Use Industry, providing a comprehensive view of market dynamics and targeted opportunities. Product segmentation primarily differentiates between traditional Segmented Commutators, which are built up from individual bars, and Molded Commutators, where the copper segments are held together and insulated by high-performance plastics like thermoset resins, offering superior dimensional stability and often preferred in high-speed, demanding applications. Analyzing these segments helps stakeholders understand shifting manufacturing preferences and consumer needs based on performance versus cost parameters across various industries.

- Product Type:

- Segmented Commutators

- Molded Commutators

- Hook Type Commutators

- Material Type:

- Copper Commutators (Standard Electrolytic Copper)

- Silver-Bearing Copper Commutators (High performance, reduced softening)

- Alloy Commutators (Specialized uses)

- Application:

- Automotive (Starters, Alternators, Wipers, Fans)

- Industrial Machinery (Pumps, Fans, Conveyors)

- Power Tools (Drills, Saws, Grinders)

- Home Appliances (Vacuum Cleaners, Blenders)

- Others (Medical devices, Aerospace auxiliary systems)

- End-Use Industry:

- OEM (Original Equipment Manufacturers)

- Aftermarket (Replacement and MRO)

Value Chain Analysis For Commutators Market

The value chain for the Commutators Market begins with the upstream sourcing of critical raw materials, primarily high-grade electrolytic copper, specialized alloys (like silver-bearing copper for enhanced thermal stability), and high-dielectric insulating materials such as mica and various engineering plastics (e.g., phenolic resins, melamine). Efficiency in this upstream segment is paramount as copper price fluctuations significantly impact manufacturing costs. Key suppliers must adhere to strict purity and dimensional tolerances to ensure the longevity and performance of the final commutator product. Negotiations and long-term contracts with metal suppliers are crucial for cost control and ensuring stable supply flow, particularly in high-volume production environments.

The midstream phase involves the core manufacturing processes: copper bar drawing, segment cutting, assembly (either mechanically segmenting or molding using injection techniques), curing, high-precision machining (turning and grinding to achieve precise concentricity), and rigorous quality control testing. Manufacturing processes demand extremely high precision, often involving CNC machinery and automated assembly lines to maintain tight tolerances essential for high-speed operation and minimal sparking. This stage represents the highest value addition, converting raw materials into a highly engineered, reliable component suitable for high-demand electrical environments.

Downstream analysis covers the distribution channels, which are bifurcated into direct sales to large Original Equipment Manufacturers (OEMs) and indirect sales through robust distribution networks targeting the aftermarket (MRO). Direct channels serve major automotive and power tool manufacturers, focusing on volume, customized specifications, and long-term contractual agreements. Indirect channels leverage specialized electrical component distributors and wholesale spare parts vendors to reach garages, repair shops, and small industrial users globally. Effective inventory management and regional warehousing capabilities are essential for distributors to meet the immediate replacement demands characteristic of the global automotive aftermarket.

Commutators Market Potential Customers

The primary customers and end-users of commutators are large-scale manufacturers and service providers across various electrically driven industries. These customers include automotive Tier 1 suppliers that specialize in starter motors, alternators, and various auxiliary electric motors used in modern vehicles, such as those for power steering, ventilation, and window operation. High volume consumption also comes from power tool manufacturers (e.g., Makita, Bosch, Stanley Black & Decker), which rely on commutators for their universal motors due to their high torque density and suitability for portable, high-speed operation.

Another significant segment of buyers comprises industrial machinery manufacturers, including producers of specialized pumps, compressors, and material handling systems where durable, cost-effective DC motors are still deployed in large numbers. Furthermore, the global MRO (Maintenance, Repair, and Overhaul) sector forms a perpetual customer base, purchasing replacement commutators through distribution channels to service the vast installed base of brushed DC motors in existing industrial infrastructure and older vehicle fleets. Appliance manufacturers, particularly those focusing on high-suction vacuum cleaners and kitchen equipment, also represent a substantial, recurring purchasing segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.8 Billion |

| Market Forecast in 2033 | USD 7.9 Billion |

| Growth Rate | 4.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mersen, Kaifeng Xingda Electrical Equipment Co., Ltd., Hylite Group, Suzhou Sunlit Science and Technology Co., Ltd., China General Plastics Corp., Waco, Electric Materials Co. (EMC), Commutator Technologies, Inc. (CTI), Nippon Denso (ND), Morgan Advanced Materials, Hangzhou Ailun Electrical Co., Ltd., Motor Components Inc., Nidec Corporation, Electrovac GmbH, Shanghai Xuerui Electric Materials Co., Ltd., Commutator Manufacturing Company (CMC), Kwang Jin Commutator Co. Ltd., Precision Motor Components, HEINRICH DREHKOPF, and Komet Commutator Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commutators Market Key Technology Landscape

The technology landscape in the Commutators Market is evolving primarily through materials science and advanced manufacturing precision, rather than radical changes to the core component function. A key technological focus is the transition towards high-performance insulation systems, moving beyond traditional mica to utilize sophisticated molded thermoset plastics, especially for commutators designed for high-voltage and high-temperature environments. This shift addresses issues related to segment stability, reducing the risk of flashover, and improving overall motor reliability under extreme duty cycles, particularly prevalent in demanding automotive and heavy-duty industrial power tool applications. Furthermore, the use of automated precision machining, including diamond turning and laser welding for segment connections, ensures concentricity tolerances are minimized, which is critical for reducing brush wear and acoustic noise.

Material innovation remains a significant technological driver. The utilization of silver-bearing copper (CuAg) alloys is becoming standard for high-end commutators, offering significantly higher resistance to thermal softening compared to pure electrolytic copper. This characteristic is crucial as motors operate at increased power densities, generating more heat. By maintaining hardness at elevated temperatures, CuAg commutators ensure stable contact resistance, prolonging motor and brush life, thereby enhancing the motor's overall efficiency and reliability. Manufacturers are also exploring surface treatments and coatings to further mitigate environmental degradation and corrosive wear in specialized industrial environments.

Furthermore, technology related to testing and validation has become increasingly sophisticated. Non-contact measurement systems, often integrated with AI-driven quality inspection, are used to measure run-out and segment flatness with micron-level precision post-assembly. This stringent quality control process, facilitated by advanced technological integration, is vital for meeting the zero-defect standards required by global automotive OEMs. The adoption of computer-aided engineering (CAE) tools for stress and thermal analysis during the design phase allows manufacturers to optimize segment dimensions and bar shapes for maximum performance before physical prototyping, shortening the design cycle and improving product robustness.

Regional Highlights

Regional dynamics play a crucial role in shaping the Commutators Market, driven by varying levels of industrialization, automotive manufacturing output, and regulatory frameworks concerning motor efficiency. Asia Pacific (APAC) stands out as the predominant market, characterized by immense manufacturing capacity for both internal combustion engine (ICE) vehicles and consumer electronics. Rapid urbanization and infrastructural investment, particularly in China and India, fuel robust OEM demand for new components, while the expanding middle class drives significant sales of power tools and household appliances, all of which heavily rely on commutator-equipped motors. This region benefits from lower operating costs and the presence of major global electronics and motor manufacturing hubs, making it the epicenter of both production and consumption.

North America and Europe represent mature markets where growth is predominantly driven by the high-value aftermarket segment and strict quality requirements for specialized industrial and aerospace applications. In these regions, while new OEM installations may favor BLDC technology, the massive installed base of existing equipment and vehicles requires a constant supply of replacement commutators. European manufacturers, in particular, focus on high-precision components and compliance with stringent environmental regulations, often supplying components for specialized high-durability motors used in critical machinery and rail transport. The focus here is less on volume manufacturing and more on advanced material performance and long-life guarantees.

Latin America (LATAM) and the Middle East & Africa (MEA) are emerging regions exhibiting steady growth, largely dependent on infrastructure development and automotive assembly activities. LATAM's growth is tied to its local automotive production centers (e.g., Brazil, Mexico) and industrial expansion. MEA's market expansion is linked to increasing localized manufacturing and significant investment in construction and energy sectors requiring specialized industrial motors. In both regions, the demand for cost-effective, durable brushed motors ensures a stable, growing market for commutators, often sourced through highly competitive international distribution networks specializing in maintenance components.

- Asia Pacific (APAC): Dominates the market due to massive automotive production bases (especially in China and India) and high consumption in power tools and consumer appliances; highest growth rate projected.

- North America: Stable market driven primarily by the high-margin aftermarket/MRO segment and strong demand from heavy-duty industrial machinery and specialized defense applications.

- Europe: Focus on high-quality, precision-engineered commutators for specialized industrial automation, rail, and specialized vehicle auxiliary systems; strong regulatory push towards high efficiency impacting new OEM adoption.

- Latin America (LATAM): Growth fueled by localized automotive manufacturing and steady demand for industrial motors in mining and infrastructure projects.

- Middle East and Africa (MEA): Emerging market characterized by increasing urbanization, infrastructure spending, and reliance on imported replacement components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commutators Market, highlighting their market strategies, recent developments, product portfolios, and regional presence. These companies often invest heavily in materials science and precision manufacturing to maintain quality and cost competitiveness.- Mersen

- Kaifeng Xingda Electrical Equipment Co., Ltd.

- Hylite Group

- Suzhou Sunlit Science and Technology Co., Ltd.

- China General Plastics Corp.

- Waco

- Electric Materials Co. (EMC)

- Commutator Technologies, Inc. (CTI)

- Nippon Denso (ND)

- Morgan Advanced Materials

- Hangzhou Ailun Electrical Co., Ltd.

- Motor Components Inc.

- Nidec Corporation

- Electrovac GmbH

- Shanghai Xuerui Electric Materials Co., Ltd.

- Commutator Manufacturing Company (CMC)

- Kwang Jin Commutator Co. Ltd.

- Precision Motor Components

- HEINRICH DREHKOPF

- Komet Commutator Co.

Frequently Asked Questions

Analyze common user questions about the Commutators market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current demand for commutators?

The most significant driver is the continuous and extensive requirement for replacement commutators within the global automotive aftermarket and the maintenance, repair, and overhaul (MRO) sector of heavy industrial machinery using brushed DC motors.

How does the shift towards BLDC technology affect the Commutators Market?

The shift towards Brushless DC (BLDC) technology acts as the primary long-term restraint, as BLDC motors do not require commutators. This pressure is concentrated in new OEM designs for high-efficiency applications like Electric Vehicles and high-end consumer appliances, forcing commutator manufacturers to focus heavily on the durable aftermarket and cost-sensitive segments.

Which material is increasingly favored for high-performance commutators?

Silver-bearing copper (CuAg) is increasingly favored for high-performance applications, particularly in automotive starters and high-power tools. The addition of silver significantly increases the copper's resistance to thermal softening, ensuring structural integrity and stable electrical contact under high heat and high-speed operation.

What is the largest regional market for commutators globally?

Asia Pacific (APAC) is currently the largest and fastest-growing regional market, driven by its massive automotive manufacturing base, large-scale industrialization, and high volume production of power tools and domestic appliances.

What are the key differences between Segmented and Molded commutators?

Segmented commutators are built from individually insulated copper bars, whereas Molded commutators feature copper segments permanently held and insulated by high-performance thermoset resins. Molded commutators generally offer superior dimensional stability and insulation properties, making them suitable for high-speed, demanding applications, while segmented types remain prevalent in traditional, high-current environments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Electric Commutators Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Commutators Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Groove Commutator, Hook Type Commutator, Others), By Application (Automatic Industry, Household Appliances, Power Tools, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager