Commuter Road Bike Helmets Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432748 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Commuter Road Bike Helmets Market Size

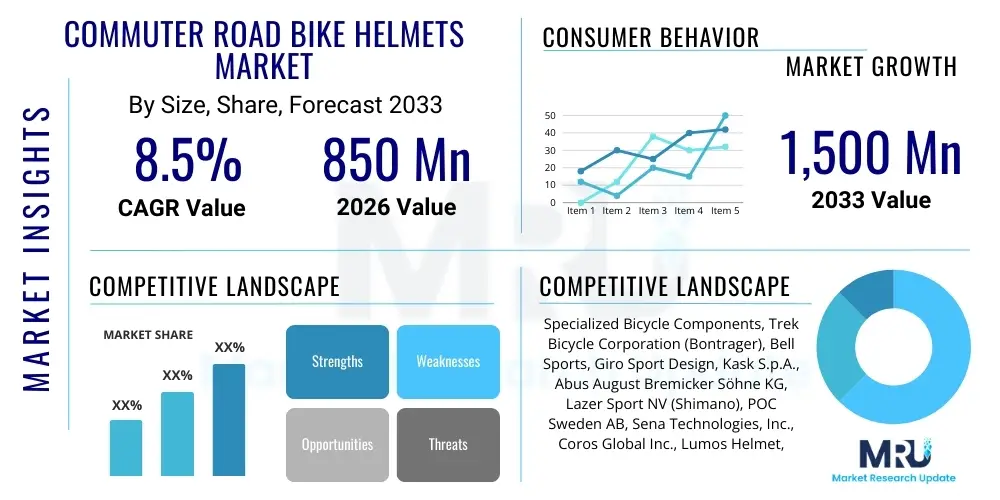

The Commuter Road Bike Helmets Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,500 Million by the end of the forecast period in 2033.

Commuter Road Bike Helmets Market introduction

The Commuter Road Bike Helmets Market encompasses protective headgear specifically designed for urban cycling, blending high safety standards required for road use with features emphasizing comfort, visibility, and convenience essential for daily commuting. These helmets differ from traditional racing helmets by prioritizing robust build quality, enhanced ventilation tailored for slower speeds, and integrated features such as reflective materials, mounting points for lights, and often, enhanced aesthetic appeal suitable for professional environments. The fundamental purpose is to mitigate head injury risk during common cycling accidents in urban settings, aligning with increasing global safety mandates and public health initiatives promoting cycling as a sustainable mode of transport.

The product category primarily includes models certified by major safety organizations like CPSC, EN 1078, and AS/NZS 2063, ensuring compliance with rigorous impact absorption requirements. Major applications of these helmets span daily commutes, casual recreational riding, and use with electric bicycles (e-bikes), where slightly higher speed ratings or integrated components might be necessary. The proliferation of micromobility solutions and dedicated urban cycling infrastructure across major global cities significantly drives product demand. Furthermore, the market benefits from continuous innovation in safety technologies, including rotational energy management systems such as MIPS (Multi-directional Impact Protection System) and proprietary solutions like Wavecel, which address oblique impacts crucial in urban collisions.

Key benefits derived from the adoption of commuter road bike helmets include significantly reduced severity of head and brain injuries, increased rider confidence, and compliance with local traffic laws. Driving factors fueling market expansion involve rising fuel costs making cycling more economical, governmental investments in cycling lanes and infrastructure, and a post-pandemic shift toward active and socially distanced transportation methods. Additionally, demographic trends showing increased adoption of e-bikes by older generations and the youth segment are spurring demand for helmets optimized for comfort, battery integration, and integrated smart features like turn signals and GPS tracking, transforming the helmet from a simple protective gear into a sophisticated safety accessory.

Commuter Road Bike Helmets Market Executive Summary

The Commuter Road Bike Helmets Market is characterized by robust growth, primarily propelled by favorable regulatory environments mandating helmet use and rapid urbanization leading to increased cycling participation. Business trends emphasize product diversification, moving beyond basic protection to offer technologically advanced helmets featuring integrated lighting, connectivity (Bluetooth), and sophisticated impact protection materials like Expanded Polystyrene (EPS) and EPP composites paired with rotational management systems. Manufacturers are strategically focusing on direct-to-consumer (DTC) models alongside traditional retail partnerships to capture maximum market share and improve margin performance. Sustainability is also emerging as a critical trend, with companies exploring recyclable materials and manufacturing processes to appeal to environmentally conscious consumers.

Regionally, Europe and North America remain the dominant markets due to mature cycling cultures, stringent safety standards, and extensive investment in cycling infrastructure. However, the Asia Pacific (APAC) region is demonstrating the highest growth velocity, driven by rapidly developing urban centers, increasing disposable incomes, and widespread adoption of e-bikes, particularly in countries like China and India, where traffic congestion necessitates alternative commuting solutions. This regional shift is compelling global manufacturers to adapt their product portfolios to specific regional climate requirements, such as enhanced ventilation systems suitable for humid environments.

Segmentation trends indicate a strong consumer preference for feature-rich, high-visibility helmets. The MIPS-equipped helmet segment continues to gain traction, becoming a near-standard requirement for premium products, reflecting growing consumer awareness regarding rotational impact injuries. Furthermore, the segmentation by end-user shows steady growth in the adult segment, but the youth and children's segments are also experiencing significant expansion, driven by school commuting initiatives and increased parental awareness regarding safety. The integration of smart technology components, while currently a niche segment, is expected to become mainstream, shifting the market dynamics toward technologically augmented safety gear, justifying higher average selling prices (ASPs).

AI Impact Analysis on Commuter Road Bike Helmets Market

User queries regarding AI's influence in the commuter helmet space typically revolve around three core themes: enhanced safety capabilities, personalized fit and comfort, and supply chain efficiency. Users frequently ask about how AI can improve crash detection accuracy, differentiate between a minor bump and a serious accident, and automatically notify emergency services. There is significant interest in algorithms that can use collected biometric data (e.g., heart rate, fatigue indicators) to pre-emptively warn riders of potential danger. Furthermore, consumers anticipate AI-driven personalization, where 3D scanning and machine learning are used to design helmets offering a perfect, custom fit, thereby maximizing both safety and comfort for prolonged daily use. In the business context, manufacturers are keen on leveraging AI for predicting material stress, optimizing complex composite layering during manufacturing, and forecasting regional demand fluctuations based on real-time traffic and weather data.

AI's primary influence centers on transforming passive protective gear into active safety systems. By integrating sophisticated sensor arrays (accelerometers, gyroscopes, GPS) coupled with machine learning algorithms, modern helmets can analyze impact vectors and severity in milliseconds, significantly reducing false positives in emergency notification systems. This capability is paramount for urban riders who experience frequent minor impacts or sudden stops. The application of AI extends into personalized material science, where algorithms simulate crash scenarios based on specific head geometries and preferred riding styles, leading to iterative design improvements that were previously time-consuming and prohibitively expensive. This integration allows for the rapid development of ultra-safe, yet lightweight and aesthetically pleasing, commuting helmets that cater to diverse urban demographics.

Beyond direct safety enhancements, AI dramatically improves the operational efficiency of the market. Predictive maintenance models powered by AI can analyze usage patterns and environmental factors (temperature fluctuations, UV exposure) to estimate the lifespan of helmet components (e.g., EPS foam integrity), guiding users on when replacement is necessary. On the manufacturing side, AI optimizes factory floor operations, managing inventory levels of specialized components (like rotational liners and complex wiring harnesses) and improving quality control by identifying microscopic defects in composite shells. This holistic application of AI—from personalized user experience to optimized supply chain and manufacturing—is crucial for maintaining competitive edge in a rapidly evolving consumer electronics and safety gear hybrid market.

- AI-enabled automatic emergency crash detection and notification systems (AEDNS).

- Machine learning algorithms optimizing MIPS layer performance based on impact simulation data.

- Personalized helmet sizing and internal padding geometry generated via 3D scanning and predictive modeling.

- Predictive supply chain management analyzing global cycling trends, urban growth, and seasonal demand.

- Biometric data analysis (via integrated sensors) to monitor rider fatigue and alert potential risk conditions.

- Optimization of ventilation patterns using computational fluid dynamics (CFD) informed by AI analysis of typical commuting speeds.

DRO & Impact Forces Of Commuter Road Bike Helmets Market

The market dynamics are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the direction and velocity of market growth. A primary Driver is the increasing awareness and adoption of cycling safety standards, often reinforced by governmental legislation mandating helmet use, particularly for minors and in certain urban zones. Opportunities are heavily concentrated in smart technology integration, offering enhanced value through features like advanced lighting, connectivity, and integrated communication systems, aligning the helmet with the growing Internet of Things (IoT) ecosystem within smart cities. Restraints primarily involve the relatively high initial cost associated with premium smart helmets compared to basic models, along with aesthetic resistance from some consumer segments who perceive helmets as bulky or unattractive.

Key Drivers include the global health and wellness trend encouraging physical activity, sustained investment in cycling infrastructure (e.g., protected bike lanes), and the rising popularity of high-speed e-bikes and speed pedelecs which require helmets designed for enhanced impact protection and often necessitate NTA 8776 certification in Europe. The shift towards sustainable urban mobility solutions also plays a critical role, as city planners actively promote cycling to reduce carbon emissions and traffic congestion. This favorable regulatory and infrastructural environment creates a substantial underlying demand base for standardized and advanced commuter helmets, ensuring continuous market volume growth across developed and developing economies.

Restraints are not insignificant; they include the lack of universal helmet laws in some major markets, which dampens overall mandatory adoption rates. Furthermore, the inherent need to replace helmets after significant impact or every few years due to material degradation (especially EPS foam) can represent a high lifetime cost for consumers. Opportunities, conversely, lie in material science innovation, focusing on bio-based or recycled polymers to address sustainability concerns, and in creating highly modular designs that allow users to upgrade smart components without replacing the entire helmet. The critical Impact Forces driving the market include competitive intensity among manufacturers (pushing for innovation), supplier bargaining power (especially for specialized materials like MIPS liners), and the persistent threat of substitutes (though low due to safety mandates), all reinforcing the necessity for continuous product enhancement and robust safety testing.

Segmentation Analysis

The Commuter Road Bike Helmets Market is broadly segmented based on Product Type (Traditional vs. Smart Helmets), Technology Used (MIPS, Wavecel, Standard EPS), Material (Polycarbonate, ABS, Carbon Fiber), End-User (Adult, Youth), and Distribution Channel (Online, Offline Retail). This granular segmentation is essential for manufacturers to tailor product development and marketing strategies, recognizing that the needs of an adult e-bike commuter in Northern Europe differ significantly from those of a casual rider utilizing bike-sharing services in Southeast Asia. The increasing differentiation in product features, especially concerning visibility and connectivity, underscores the shift towards value-added premium segments.

The segmentation by Technology Used is arguably the most dynamic, driven by relentless pursuit of superior impact protection. Helmets incorporating rotational energy management systems (like MIPS) are rapidly becoming the market benchmark, often commanding a premium price but offering certified enhanced safety. The rise of Smart Helmets, integrating features such as indicators, brake lights, bone conduction audio, and automatic crash notification, represents a burgeoning segment that appeals to tech-savvy urban professionals who prioritize integration and active safety features. This technological segmentation is expected to accelerate product obsolescence rates in traditional helmet categories.

- Product Type:

- Traditional Helmets (Standard EPS)

- Smart Helmets (Integrated Connectivity and Lighting)

- Technology Used:

- MIPS-Equipped Helmets

- Wavecel/Other Rotational Management Systems

- Standard Impact Absorption Helmets

- Material:

- Polycarbonate Shell

- ABS Plastic

- Carbon Fiber Composites

- End-User:

- Adults (18+)

- Youth and Children

- Distribution Channel:

- Offline Retail (Specialty Bike Shops, Sporting Goods Stores)

- Online Sales (E-commerce Platforms, Direct-to-Consumer Websites)

Value Chain Analysis For Commuter Road Bike Helmets Market

The value chain for commuter road bike helmets begins with upstream activities focused on raw material sourcing, predominantly involving specialized suppliers for expanded polystyrene (EPS) foam, polycarbonate or ABS plastics for the outer shell, and highly specialized components for smart features (e.g., sensor arrays, micro-batteries, LED lights). The quality and consistency of EPS are crucial, as it dictates the primary impact absorption capability. Upstream analysis highlights increasing pressure on raw material suppliers due to volatility in petrochemical markets and growing demand for specialized, sustainable, or recycled polymer inputs, driving material innovation and supplier relationship management importance.

The core manufacturing and assembly stage involves complex processes, including injection molding of the shell, precision foam molding, integration of rotational protection layers (like MIPS liners), and sophisticated electronic assembly for smart helmets. Manufacturing complexity significantly increases for high-end commuter helmets that require advanced ventilation structures and seamless integration of battery packs and communication modules. Direct distribution channels, primarily through e-commerce platforms and brand-owned websites (DTC), allow manufacturers greater control over branding and pricing, while indirect distribution relies heavily on specialty cycling retailers and large sporting goods chains, which provide crucial fitting and expert advice services to consumers.

Downstream analysis centers on retail strategies, aftermarket services, and consumer education. Effective marketing must emphasize safety ratings, comfort features, and aesthetic design to capture the discerning urban commuter. Aftermarket services, particularly for smart helmets, involve firmware updates, battery replacement, and handling warranty claims related to integrated electronics. The distribution channel choice is often segmented: basic models rely on broad retail availability (indirect), while high-end smart helmets frequently utilize DTC or specialty bike shops (direct/semi-direct) to ensure adequate product education and specialized customer support, optimizing profitability and brand image.

Commuter Road Bike Helmets Market Potential Customers

Potential customers for commuter road bike helmets primarily fall into distinct categories based on their cycling intent, demographic profile, and technology adoption behavior. The largest segment comprises daily urban commuters who use bicycles or e-bikes as their primary means of transport to work or school. This group prioritizes safety certification, visibility features (integrated lights, reflective accents), comfort for extended wear, and a professional aesthetic that complements business attire. They are often willing to invest in premium features like MIPS and high-quality ventilation systems to enhance their daily experience.

A second crucial segment includes recreational riders and casual users of bike-sharing programs who cycle periodically for leisure, errands, or fitness. This segment is highly price-sensitive but increasingly values standard safety features. Manufacturers target this group with competitively priced, aesthetically pleasing, and easy-to-use helmets that meet basic safety compliance without excessive smart technology complexity. The adoption rate in this segment is strongly influenced by public service announcements and local safety campaigns.

A rapidly expanding customer base is the e-bike user demographic, which includes both younger professionals and older adults seeking low-impact mobility. E-bike users require specialized helmets that often adhere to higher impact standards (e.g., NTA 8776), are optimized for slightly higher average speeds, and often seek seamless integration of communication or navigation systems. Finally, institutional buyers, such as corporate wellness programs, municipal bike-share operators, and delivery service companies (food and parcel delivery cyclists), represent significant bulk procurement opportunities, focusing on durability, low maintenance, and standardized fleet safety compliance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,500 Million |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Trek Bicycle Corporation (Bontrager), Bell Sports, Giro Sport Design, Kask S.p.A., Abus August Bremicker Söhne KG, Lazer Sport NV (Shimano), POC Sweden AB, Sena Technologies, Inc., Coros Global Inc., Lumos Helmet, Inc., Smith Optics, Thousand Helmets, Bern Unlimited, MET Helmets. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Commuter Road Bike Helmets Market Key Technology Landscape

The technological landscape of the commuter road bike helmets market is rapidly advancing, moving beyond simple foam and shell construction toward integrated, multi-functional safety systems. A core technological focus is kinetic energy management systems (KEMS), which are crucial for minimizing rotational forces transmitted to the brain during oblique impacts. MIPS (Multi-directional Impact Protection System) and competitive technologies like Wavecel or Spin continue to dominate the premium segment, utilizing low-friction layers or cellular structures placed between the head and the helmet shell to redirect impact energy. Manufacturers are investing heavily in reducing the profile and weight of these systems while maximizing their efficacy, driving up the safety standards across the entire market spectrum.

Another significant technological pillar involves the seamless integration of electronics to enhance visibility and connectivity, defining the 'Smart Helmet' category. This includes ultra-bright, rechargeable LED lighting (front and rear) integrated directly into the helmet structure, often utilizing proximity sensors and accelerometers to function as automatic brake lights or turn signals controllable via handlebar remotes or gesture controls. Connectivity features frequently involve Bluetooth integration for music, hands-free communication, and critical safety functions such as GPS tracking and automatic crash detection systems that alert pre-designated emergency contacts. The challenge in this area lies in maximizing battery life and ensuring water resistance and durability without compromising the helmet’s primary structural integrity.

Furthermore, material science and manufacturing innovations are paramount. There is continuous research into advanced composite materials, such as specific blends of polycarbonate and fiberglass, or even limited application of carbon fiber in ultra-lightweight, high-strength commuter models. Ventilation systems are becoming increasingly sophisticated, utilizing internal channeling and large, strategically placed vents to maintain rider comfort during extended urban rides, especially in hot and humid climates. The utilization of 3D printing technologies is also beginning to penetrate prototyping and customized padding production, enabling faster iteration and more personalized product offerings, further cementing the role of technology as a primary differentiator in this competitive market space.

Regional Highlights

- North America (USA and Canada): North America is a mature market characterized by high consumer spending power and stringent safety regulations (CPSC certification). Growth is fueled by the growing acceptance of e-bikes and significant urban investment in dedicated bike lanes. The US market, particularly in metropolitan areas like New York, San Francisco, and Portland, shows high adoption rates for premium, tech-integrated helmets.

- Europe (Germany, UK, Netherlands, France): Europe, particularly the Netherlands and Denmark, represents the global heartland of cycling culture and sustainable urban transport. This region exhibits high market penetration, driven by mandatory safety standards and a strong preference for high-quality, durable, and highly visible commuter gear. Germany and the UK are leading adopters of NTA 8776 certified helmets due to the popularity of speed pedelecs.

- Asia Pacific (China, Japan, South Korea, India): APAC is projected to be the fastest-growing region, dominated by mass adoption of two-wheelers and e-bikes, particularly in China and Southeast Asian megacities. Market growth here is stimulated by high population density and traffic congestion, making cycling a practical alternative. The focus is often on affordability, though rapidly growing middle classes in Japan and South Korea show increasing demand for smart, safety-certified imported models.

- Latin America (Brazil, Mexico): This region is a developing market, highly sensitive to price but demonstrating promising growth fueled by government initiatives promoting cycling in major cities to combat pollution and improve public health. The market is primarily dominated by basic and mid-range helmet segments, with growing opportunities for low-cost, high-visibility options.

- Middle East and Africa (MEA): MEA is the smallest but evolving market. Growth is localized in areas with favorable cycling infrastructure and expatriate communities. High temperatures necessitate helmets with superior ventilation technology, while market development is dependent on urbanization rates and safety awareness campaigns.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Commuter Road Bike Helmets Market.- Specialized Bicycle Components

- Trek Bicycle Corporation (Bontrager)

- Bell Sports

- Giro Sport Design

- Kask S.p.A.

- Abus August Bremicker Söhne KG

- Lazer Sport NV (Shimano)

- POC Sweden AB

- Sena Technologies, Inc.

- Coros Global Inc.

- Lumos Helmet, Inc.

- Smith Optics

- Thousand Helmets

- Bern Unlimited

- MET Helmets

- Limar Srl

- Uvex Sports Group

- Kali Protectives

- Sweet Protection

- Rudy Project

Frequently Asked Questions

Analyze common user questions about the Commuter Road Bike Helmets market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Commuter Road Bike Helmets Market?

The market is projected to expand at a Compound Annual Growth Rate (CAGR) of 8.5% between the forecast years of 2026 and 2033, driven primarily by increased global cycling participation and advanced safety technology adoption.

What are the primary safety features consumers look for in modern commuter helmets?

Consumers prioritize rotational impact protection systems, such as MIPS or Wavecel, robust safety certifications (CPSC/EN 1078), high visibility features (integrated LED lights and reflective decals), and enhanced ventilation for comfort during daily urban use.

How is the rise of e-bikes affecting the demand for commuter helmets?

The increasing popularity of e-bikes, particularly speed pedelecs, necessitates higher safety standards. This demand drives growth in the premium segment for helmets that meet specialized certifications like NTA 8776, designed for higher speeds and enhanced impact absorption capabilities.

What role does Artificial Intelligence (AI) play in the development of new commuter helmets?

AI is crucial in enabling automatic crash detection and emergency notification systems (AEDNS), optimizing helmet design through simulating complex impact scenarios, and personalizing fit via 3D scanning and machine learning algorithms to improve safety and comfort.

Which geographical region is expected to exhibit the fastest growth in this market?

The Asia Pacific (APAC) region is forecasted to experience the highest growth velocity, attributed to rapid urbanization, increasing traffic congestion driving alternative transport adoption, and rising disposable incomes leading to greater acceptance of safety gear, especially in China and Southeast Asia.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager